By Pepper Parr By Pepper Parr

November 21st, 2019

Burlington, ON

There is one thing you can be absolutely certain about with the current city council: when Councillor Sharman is upset – you will hear from him and his words will be very precise.

Councillor Sharman asked the Mayor for the floor to make some comments on November the 18th.

He said:

Let me begin by making the following statements:

a) The consulting report is the subject of my discontent in these notes, it is not personal towards any person or staff.

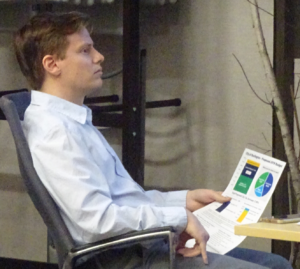

Councillor Sharman: “Let me begin by acknowledging …” b) My business background coupled with my consulting and professional accounting career lead me to hold reasonable expectations of consultants when it comes to them guiding investment decisions, especially using hard tax dollars, which must be performed with sincere concern for the public trust.

c) I fully support the concept of increasing the modal split in the City of Burlington and the Region of Halton.

Let me begin by acknowledging that my analysis of the business plan, as already communicated to you by Tom Muir, (via the Burlington Gazette) is correctly reported. I will confirm and add to what has already been reported:

1. There was no assessment of the actual Burlington market, its operations, long term history or projected short, medium, and long-term rider demand.

2. There was no analysis or forecast of demographic and related ridership changes in coming years even though we already have a reasonable expectation of what is likely.

3. I will add a new point. Most people are bothered by the huge level of congestion on Burlington streets at peak hours.

This is probably the most significant motivator of increasing modal split. A few considerations:

a. Peak hour traffic will only be reduced by the amount of automobile traffic that can be redirected to GO transit. However, since most of the peak hour traffic relates to people coming into the City from outside (70% according to Transportation staff) or travelling from outside and exiting through the City (30% according to Transportation staff) are most likely not well served by GO transit. Then the probability of those people continuing to use their cars is high. But we have no analysis.

b. Given that the City is still growing, and new residential communities continue to grow to the north, west and south of Hamilton, the number of vehicles on Burlington roads will increase for the foreseeable future. But we have no analysis.

c. Since Burlington Transit essentially serves only the trips of those who travel within the boundaries of the City, increased service cannot be expected to have any material impact on ridership growth in terms of re-directed commuter trips.

4. Halton modal split numbers are theoretical. Our purpose should be to figure out in realistic terms if, how and when they can be accomplished.

5. Our consultant used Canadian Urban Transit Association standards to determine what that meant in terms of how many more buses, drivers, maintenance staff, overhead staff and facilities we will need to add to the budget in each year going forward. CUTA standards are aspirational goals that have been demonstrated to not actually represent any Burlington peer municipality (Jeff Casello, Waterloo University 2012). They are more representative of highly intensified big city circumstances, which we are not… not for a long time anyway.

Ward 5 Councillor Paul Sharman does know how to drill down into the data and look for results. 6. When you look at the numbers in the tables provided, they are all premised on a 23% average ridership growth that is required to achieve theoretical modal split goals. For some reason it was assumed that growth will somehow occur in a way that is highly front end loaded with a 36.5% growth in year 1 of the plan, i.e. from 2,000,000 riders in 2019 to 2,730,000 in 2020, with no explanation of how.

7. The critical concern is not so much the report per se, but that the 2020 budget for the City of Burlington includes funding to purchase 4 new buses and hire 8 new drivers. The report proposes that the City should do that in each of the following four years at a cost of millions of dollars each year.

8. The risk is that that the City is about to pour all sorts of real hard dollars into a plan that is completely devoid of any substantive assessment of ridership projections or a realism.

9. Keep in mind that a 1% increase in the City of Burlington budget equals a $1.6m spending increase. Further, that transit revenue, presently, represents less than 25% of the transit operating cost. This is at a time when the City is built out and new sources of property tax increases are drying up. Remember the 2019 budget use of reserves to keep tax rate increases low. This is not going to get any easier.

10. My concern is that costs will go up way more rapidly than ridership… so will taxes in a period of low tax growth, therefore increasing taxes by perhaps 10 to15% in total just for extra transit spending over the next 5 years. What does that mean giving up?

11. We can agree that “more bus users” would be good, but we do not agree to getting there by any means or a hope and a prayer.

So, what should we do, you might ask? Well:

1. Hold off a year to see what happens in 2020 with the new grid network;

2. Hold off a year to see what happens when the new buses and drivers approved in the 2019 budget actually come on line in the next month;

3. Use 2020 to remedy the concerns I have advised you of above;

4. Use 2020 to plan acquisition of electric buses instead of traditional diesel fueled vehicles;

5. Use 2020 to plan a complete transition of Burlington Transit to a 100% electric service;

6. Use 2020 to plan the implementation of on-demand service to undeserved neighbourhoods

I hereby move that we refer this to staff

Related news stories:

Muir on the transit problems.

Council doesn’t like what the consultant had to say – neither did the Director of Transit

By Pepper Parr By Pepper Parr

November 18th, 2019

BURLINGTON, ON

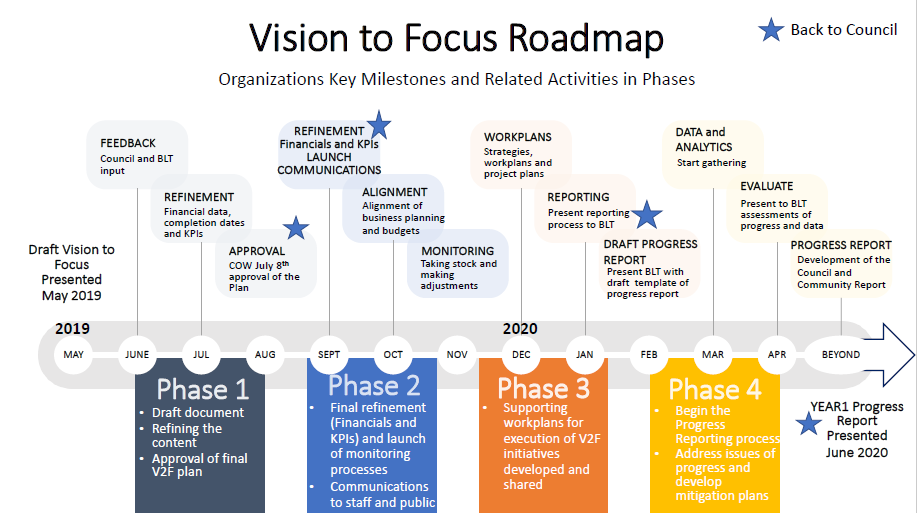

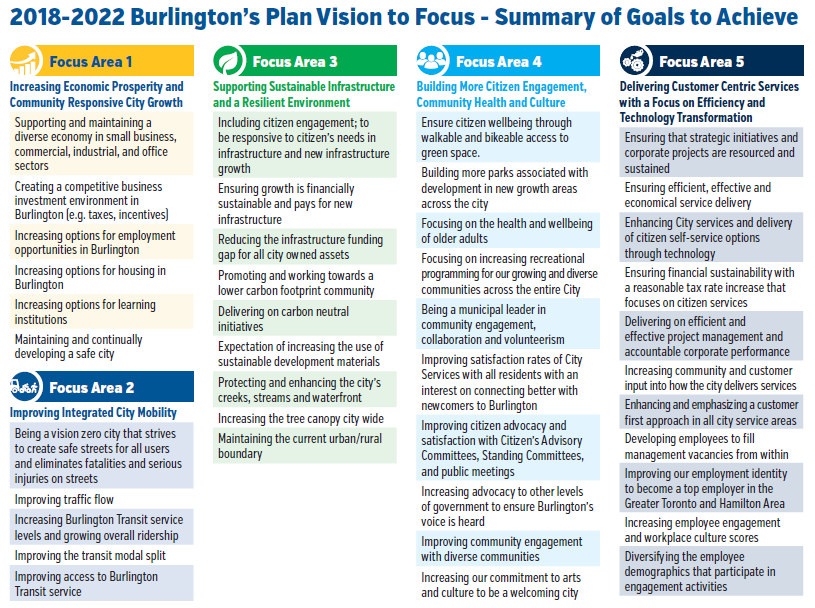

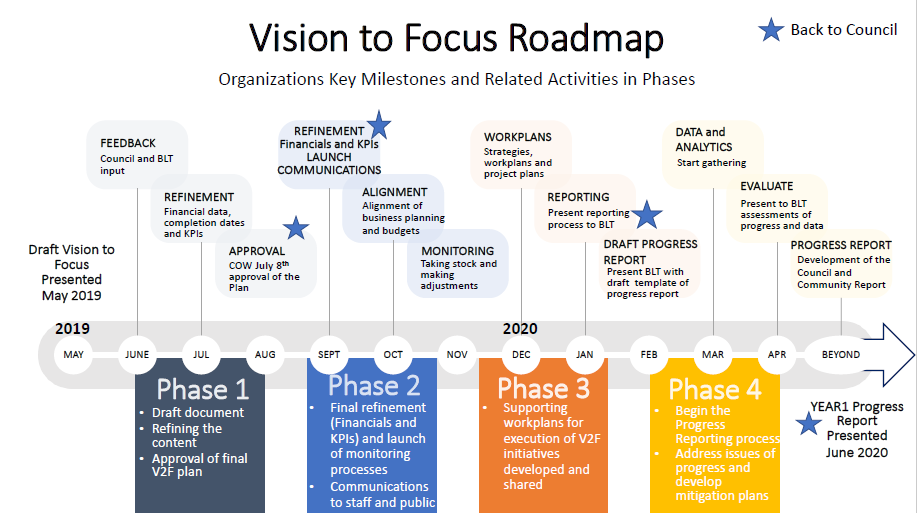

The 2018-2022 Vision to Focus Financial Plan is complex, expensive and a different approach for Burlington.

The meeting was to receive the Financial Plan for the implementation of the strategic initiatives as defined in the 2018-2022 Burlington’s Plan: From Vision to Focus (V2F).

The portions of that vision that were to be tackled by council and Staff were:

Promoting Economic Growth

Intensification

Focused Population Growth

Increased Transportation Flows and Connectivity

Healthy Lifestyles

Environmental and Energy Leadership

Good Governance

Community Building through Arts and Culture via Community Activities

On April 11, 2016 Council approved the city’s 2015-2040 Strategic Plan; transforming the Strategic plan into a central policy document and guiding the community’s key activities, investments and actions. Realize that the city council we had in 2016 is not the city council we have today. Nevertheless the Strategic Plan created then is still in place.

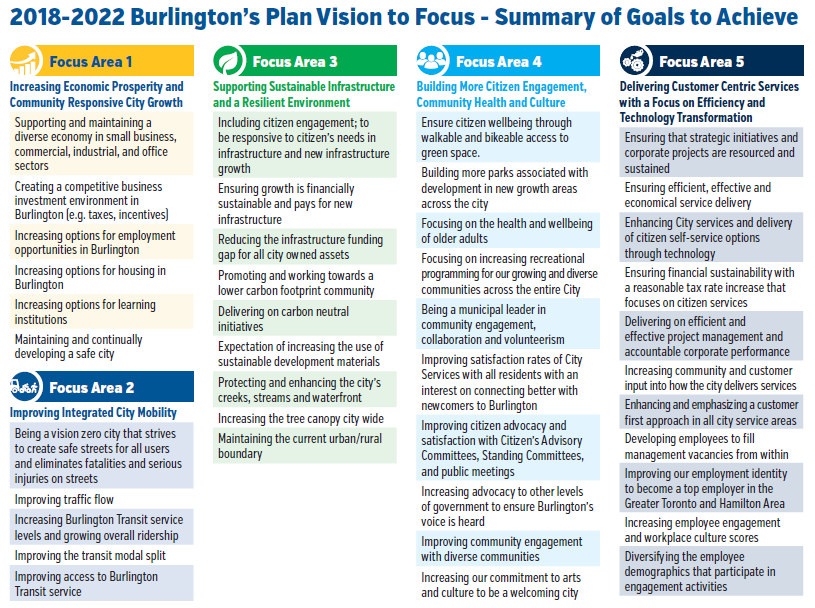

What city council has done is approve the creation of a Business Plan that has been named Vision to Focus (V2F) which sets out what Council and the Burlington Leadership team have identified as the key priorities for the balance of this term of office. This document establishes the strategic actions and initiatives that will focus the city’s efforts over the next four years.

The V2F work plan intends to deliver on five focus areas, with a total of 75 initiatives which are aligned to the 25-year Strategic plan.

The five focus areas are as follows:

• Focus Area 1 – Increasing Economic Prosperity and Community Responsive Growth Management

• Focus Area 2 – Improving Integrated City Mobility

• Focus Area 3 – Supporting Sustainable Infrastructure and a Resilient Environment

• Focus Area 4 – Building more Citizen Engagement, Community Health and Culture

• Focus Area 5 – Delivering Customer Centric Services with a Focus on Efficiency and Technology Transformation

It’s a solid plan – can the city deliver on council’s expectations? And do enough of the city Councillors fully understand what it is about? They are at phase two and have hit some speed bumps. The trick is to ensure that the five focus areas and the initiatives within them are aligned with the budget – that translates into – are we sure the money to do all these things is going to be in the bank.

Phase 1 of the Financial Plan for the 2015-2040 Strategic Plan was approved in July 2016 and provided a long-term financial plan to build for the long-term implications that would be realized with a 25-year vision.

None of this is going to be cheap.

A Strategic Plan Reserve Fund was established to hold funds to administer and deliver the initiatives laid out in the plan. Any unspent dollars from the annual strategic plan base budget funding is allocated to the reserve fund.

Retained Savings: Minimum of $500,000 towards the Strategic Plan reserve fund provided the city’s retained savings is $1 million or greater. Retained Savings is what most of us know as the surplus – money that was budgeted but not spent or revenue projections that turned out to be better than expected.

Base Budget Funding: The following is a list of annual base budget funding that will be used for strategic plan implementation;

Strategic plan implementation $150,000

Policy initiatives reserve fund for planning initiatives $100,000

Culture reserve fund for cultural initiatives $50,000

Community Investment reserve fund for community engagement and empowerment initiatives $80,000

That’s a cumulative total of $380,000 – before any goodies that might come from Burlington Hydro. Policy is to allocate future special dividends received from Burlington Hydro towards the strategic plan

The following financial plan was approved by Council to meet the funding requirements at that time and plan for future requirements.

This is to cover “much of the core planning and policy work associated with achieving the implementation of the 25-year vision of the city’s Strategic plan. Also, there are certain distinct initiatives that begin to directly deliver some of the plan commitments. Incorporated within the Focus Areas are references to many other important documents, such as the

Official Plan,

Zoning By-Law Review,

Integrated Mobility Plan,

Transit Business Plan, and Mobility Hub Plans, to name a few.

These documents will represent a holistic approach to planning ahead and form the foundation for the future success of many of the initiatives laid out in the V2F work plan and the overall strategic plan.

Type is small – if you can read it – is this what you want your city to do for you? All this planning got Mayor Meed Ward “fussed” as she put it.

The Urban Forestry Management Plan has her asking why trees could not be planted while the planning was being done. We know we are going to be planting trees – so let’s start doing just that, said the Mayor.

With the Staff report read into the record the meeting moved on to asking questions of Satff

The Mayor was not impressed – she describes council as nimble and agile and wants that reflected in the work that gets delivered to them. Meed Ward had had enough.

She said that what we have here are plans to develop plans.

We will be spending a lot of money without seeing any change happen.

This council has shown itself to be very action oriented

Can we not reduce the time frame or the cost for all this – preferably both.

Can we not go outside and get some of the help we need?

Meed Ward said she understood that Planning and implementation are joined at the hip but we need to see changes on the ground.

So what can we do she asked.

City manager Tim Commisso responded saying he understood and that the report was a snapshot of where we are.

We are starting so that we have something to measure; we want to be able to nail down the numbers. Meed Ward still wasn’t happy.

She said she wanted to see “expedited” and added that she gets a little jaded about plans and added to that that in her time on council she has seen four or five different master plans.

Trees are something we can measure while we plant.

We want to be a nimble, agile council; can we act and plan at the same time ?

City manager Commisso said “yes we can”.

That was the best the Mayor was going to get out of staff that evening.

The report was moved as received and filed.

But a message had been delivered.

Council was told that “Following the quick wins and initiatives that are transitioned to operations, 51 initiatives remain.

Of these, 19 initiatives are well defined, financial resources are clearly identified and the target for completion is within the four-year time-frame.

The other 32 initiatives are multi-faceted. Multi-faceted initiatives have a foundational and an implementation component. The foundational aspect of the initiatives represents comprehensive planning that needs to occur in order to lay the foundation for future work and decision making. This planning period will occur over a four-year time-frame (2019-2022) and the resulting documents will collectively assist in guiding the City through critical decision points on executing the completion of the initiatives. The implementation component will extend beyond the four-year time frame and the required costing and timing will become available once the planning work associated with it is complete.

The following plans/ reports (not a comprehensive list) are scheduled for completion and/or initiated within the next four years;

• Adopted Official Plan

• Audit and Accountability Report

• Mobility Hub Plans

• Transit Business Plan

• Integrated Mobility Plan

• Climate Change Action Plan

• Green Fleet Strategy

• Fire Master Plan

It was close to mind boggling. The challenge is to determine if the Staff are available to do the work and if the funds are there to pay for the consulting that is going to be needed.

There will be more on this file in the months ahead.

By Staff By Staff

November 12th, 2019

BURLINGTON, ON

Leaf collection has been suspended until the snow has been cleared.

Schedule adjustments, if any, will be posted on the city web site and in the Gazette

Clearing the snow of the streets has those heavy trucks pushing a snow plow.

Depending on the need heavy duty trucks can be used to plow snow. The city’s snow fighting team was ready for the forecasted early blast of winter and snow. Once that snow is no longer an issue and the temperatures warm up to seasonal norms the leaves will get any attention they need.

The forecast was for 15 cm of snow for Burlington. It came in at closer to 20+; as a result, the City is declaring a significant snow event as of 6 p.m. this evening. All parking exemptions are cancelled and there is no on-street parking after 6 p.m. tonight and until the city declares the significant snow event has ended.

Many of the leaves on the streets might get taken up with the snow – a possible savings for the leaf collection budget.

Now it is used for leaf collection. Residents wanting to remove their leaves can either use them as mulch on their lawn or garden or bag them for Halton Region’s yard waste pick-up.

During the winter season, the City of Burlington maintains 1,900 lane kilometres of roads and 850 kilometres of sidewalks.

• If a snow event is announced, all parking exemptions are cancelled and there is no on-street parking until the snow event has been cancelled.

‘• Do not leave vehicles parked over the sidewalk while in your driveway as this can prevent the sidewalk plow from completing its work.

• Do not shovel, plow or blow snow from residential or commercial properties onto the road. This poses a hazard to motorists and is prohibited by the Ontario Highway Traffic Act and City bylaw.

• Snow plows need room to clear the ice and snow. Please stay back 70 feet as sand and salt may be dropping from the trucks. This also gives you room to stop safely.

• Give snow plows plenty of space at intersections. The snow plow may need two or more lanes to turn or to get through the intersection. If a snow plow is waiting to turn left at an intersection, do not pull up and stop underneath or in front of the wing plow (the plow attached to the right side of the truck). Your vehicle could be struck by the plow when the truck pulls forward.

Mark Adam, Manager of Road Operations said: “Snow removal will always take priority over loose leaf removal. When the snow comes, all available resources are focused on making the roads and sidewalks safe. The cold weather is expected to last several days. We will be watching the weather and will announce when the loose leaf collection will resume.”

By Pepper Parr By Pepper Parr

November 1st, 2019

BURLINGTON, ON

During the federal election we heard members of the Liberal government comment frequently that people want to see something done on climate change but were not prepared to pay that much to bring about a change.

They certainly weren’t prepared to give up the gas guzzling pickup trucks.

The 2020 proposed budget attempts to strike a balance between identifying efficiencies, leveraging non-tax based revenue sources, revising service levels, and continuing to build towards long-term financial sustainability through additional investment in infrastructure renewal.

That’s what comes from the bureaucrats. The politicians have their agenda and for the current council climate change is a big issue – is it THE issue? The Mayor would like to think so but she may not have enough of her council colleagues on side with her.

Ward 5 Councillor Paul Sharman is usually very direct, tends to want to see data that is verifiable and expects to get his way. Councillor Sharman read a well prepared statement into the record. He said:

1. I love trees and do not want to see them cut down unnecessarily

2. The people of Burlington feel the same way; based on the statistically accurate survey prepared by Forum Research in June 2013 for the City Burlington the evidence is clear:

I. The people of Burlington love trees and do not wish to remove them

II. Many Ward 5 and 6 residents felt there are insufficient trees, so do I

III. People agree that City oversight of the tree canopy is desirable

IV. Two out of three respondents also agreed that “a landowner should be able to remove a healthy tree if it is no longer wanted by the property owner without permission from the city.”

a) The big question in 2013 was and remains, is there a significant tree loss problem?

Staff reported at the time:

A total of 21 tree care companies were contacted. The following are key findings of the

survey:

I. In 2012, approximately 1,813 trees were removed by all tree care companies combined.

II. 78% of trees removed were dead, diseased or dying, followed by natural death due to age. 1414 trees

III. 17% of trees were removed due to landscaping modifications (presumably development), poor planting location or damage to property caused by the tree. 308 trees

IV. 5% of removals were a result of home improvements (e.g. additions, decks, etc.) 91 trees

b) What we believe is that the Urban tree canopy is insufficient and at, 15-17% coverage falls short of the 30-40% recommended.

c) What we know today:

These trees were on private property. I. The City is going to cut down about 15,000 Ash Trees on municipal property in 2019. That suggests the number of diseased trees on private property is multiple times greater.

I have heard that it could be in the order of 300,000 trees in the City. Disease is the single biggest cause of canopy loss and will continue to be so for several years to come.

II. Trees on property subject to site plan approval in the development application process do not need to comply with a municipal private tree bylaw.

III. That clear cutting of development sites is known to happen, but it is not known how many.

IV. Roseland has had perhaps 4 applicable tree cutting permits issued under the bylaw

V. The suggested City private tree bylaw will not actually stop trees from being cut down, it is only designed to create a 2nd thought

VI. Trees do not provide significant climate change mitigation. Trees provide us with significant benefits, including carbon sequestration (storage), however, net carbon neutral can be achieved only by reducing dependence on fossil fuels. **

d) What we do not know today:

I. We do not know how many trees are cut down on private property

II. We do not know how many sites are clear cut by developers to avoid site plan control.

III. We do not know if trees are being cutting down unnecessarily*

IV. We do not know how many trees are needed to increase the urban tree canopy to 30 or 40%

V. We do not have a tree inventory of Burlington

VI. We have not identified alternative costed strategies that might be more effective than the Roseland bylaw or a derivative thereof.

e) Conclusions:

Will the city create working parties to plant the tens of thousands of trees needed? • As much as I would like to support a valid and properly justified extended tree protection bylaw, we are not ready to have one because we have no adequate information to suggest we should.

• The data we do have suggests that we need to plant trees, a lot of them. I am told that we need in the order of 300,000 trees to increase the canopy to 40%. In the scheme of things, spending $100,000’s to stop people cutting down a very small number of trees, according to the 2013 research, is not the best use of money.

• I would rather use a carrot than a stick by providing a $250 grant to property owners for every tree they plant on their own property.

• Finally, for now and until we have a properly thought out tree strategy based on real supportable data, I will continue to only support the option to continue the existing Roseland private tree bylaw.

• Let’s plant 10,000 5cm trees a year, that could be 20-30cm in 20 years time, in order to recover the canopy. Of course, we need to make sure they are watered. That will give us the best ROI.

There is a reason for calling Councillor Sharman Dr. Data.

• His after thoughts:

Councillor Sharman: Data. data, data – there is never enough! o I appreciate that some people think that people who willingly cut trees for their own reasons should be caused to pay for the greater good of the community. Considering that the larger community loss is due to disease and simple old age (78% in 2013, possibly 95% currently re Emerald Ash Borer). It would be more equitable for all home owners to pay a progressive tax to pay for administration and execution of a properly justified and constructed tree strategy.

o Surely, we can figure out another way to get the few people to report that they are cutting trees than charge them in excess of $1000 per tree.

o Surely, we can figure out how to ensure that when trees are cut to facilitate development that the applicant ends up complying with site plan regulations.

o We need to figure out what the real problem is that is being addressed in this discussion?

* Note, we asked the Town of Oakville for data on how many trees were cut down and for what reasons since they introduced their bylaw. Oakville staff were not able to provide the data. The Oakville Green website does not have relevant statistics. City of Burlington staff acknowledge they have no data.

These trees are in ward 5. They will probably have to come down if a high rise residential tower goes up. ** Climate change mitigation impact of trees. There are a wide range of sequestration rates in Canadian urban forests, from 0.2 to 1.2 Mg (megagrams; 1 Mg = tonne) of C per hectare per year. It likely depends on tree species and health of trees. If we planted trees across the whole land mass of Burlington (18,200 ha), it would only sequester around 79,000 tonnes of CO2e. Burlington’s community emissions are currently estimated at 1.2 million tonnes of CO2e.

This is based on using the highest rate of 1.2 tonnes of C per hectare per year (very high). (1 tonne of carbon = 3.67 tonnes of C02e; 3.67 x 1.2 = 4.4 tonnes of CO2e/ha) 4.4 tonnes of CO2e/ha x 18,200 = 79,000 tonnes.

Perhaps, if we replaced buildings, roads and traffic with trees, we wouldn’t have a carbon problem anymore.

Trees provide us with significant benefits, particularly to improve community resilience by providing cooling for the urban area and reducing the urban heat island effect, as well as reducing erosion with flooding events. However, we will only achieve our goal of being a net carbon neutral community by reducing our dependence on fossil fuels. We will put more emphasis on the benefits of urban forestry in part 2 of the Climate Action Plan (the climate adaptation strategy

Councilor Nisan was less verbose but was clear – “it is about the climate” was the position he took.

The basics of the 2020-2021 budget are:

a proposed base amount of $172,060,655 plus recommended business cases of $1,574,524 for a total proposed net tax levy of $173,635,179.

This net tax levy represents 65.5% of total operating revenues in 2020. The 2020 proposed capital projects are approximately $85.8 million, with a ten-year program of $809.7 million.

The budget review process included:

• A line-by-line review of the base operating budget by the Chief Financial Officer and Service Owners (budget reductions of $1.02 million).

• The Corporate Infrastructure Committee conducted an in-depth review of the 10- year capital program.

• A corporate / strategic review by the Operating Budget Leadership Team. This team is comprised of the City Manager, Chief Financial Officer, Executive Director of Human Resources, Chief Information Officer (rotating member) and the Director of Transit (rotating member).

• A corporate / strategic review by the Capital Budget Leadership Team. This team is comprised of the Executive Director of Environmental, Infrastructure and Community Services, Chief Financial Officer, Director of Roads, Parks and Forestry (rotating member) and the Executive Director of Community Planning, Regulation and Mobility (rotating member).

• Alignment to strategic objectives and review of operating business cases.

Joan Ford, the city’s Director of Finance knows where every dollar comes from and where every dollar gets spent. The recommendation?

Receive and file the proposed 2020 budget book; and Direct staff to present the recommendations, that is what is going to occupy much of the months of November and December.

The city Finance department hopes to have this budget wrapped up before the end of the year. That is probably not something you want to be very much money on.

An added note. The Director of Human Resources has a report suggesting to Council that they might want to increase what they are paying the non-union staff – Burlington is no longer competitive and we are not getting the staffing quality we need.

How much higher will the 2020 tax increase be over what it was in 2019? Council is going to struggle to keep it below 5%. That isn’t going to be easy.

Related news stories.

The 2019 budget

How much was that tax increase?

By Staff By Staff

October 1, 2019

BURLINGTON, ON

It won’t begin until after Halloween has come and gone – the details of the 2020 budget, while not cast in stone, are basically worked out by Staff.

City manager Tim Commisso does not have much of an appetite for raiding the reserve funds. Councillor Sharman shares that view. Some changes take place – but not all that much – unless, like last year, funds were pulled out of various reserve funds.

Proposed meeting dates for the 2020 budget include:

Nov. 4, 2019

Meeting of Committee of the Whole: Budget overview report

Nov. 19, 2019

2020 Budget Telephone Town Hall

Dec. 10 and 12, 2019

Meeting of Committee of the Whole: Budget review and approval

Dec. 16, 2019

Meeting of Burlington City Council: City Council to consider approval of proposed 2020 budget.

For a city that has a department working on how they are going to engage the citizens – holding a Town Hall meeting is the equivalent to the cake the French nobility fed its citizens.

Previous councils held public meetings that were exceptionally well attended – not all but more than several.

Burlington has always had a small group of citizens who get out to public meetings to review budgets, policy proposals and share ideas.  On a number of occasions the meeting hall has been packed. Proper preparation and a genuine commitment to engage does produce results. During the settling of the budget last year city manager Tim Commisso said that he wanted to do some work on putting the various reserve funds into groups rather than literally scores of them being listed. Some reserve funds are mandatory while others sit there with no clear purpose. There is certainly an opportunity to do some tidying up at that level.

No word on when the city manager is going to let everyone in on what he has managed to get done.

By Staff By Staff

October 1st, 2019

BURLINGTON, ON

In the weeks ahead city council will begin crafting the budget for the 2020 year. It will be the second budget this team has done – but this time around they have a much better grip on just what they are spending and where the money is coming from.

Mayor Meed Ward and Councillor Sharman were the only two members of council who, at the time, had a full understanding of what putting together a municipal budget meant. It was a steep learning curve for the five new members of Council.

In 2018 the Mayor was determined to bring in a budget under a 3% increase. Councillor Sharman wanted to ensure that there was some money left in the reserve funds.

The budget increase was kept under 3%

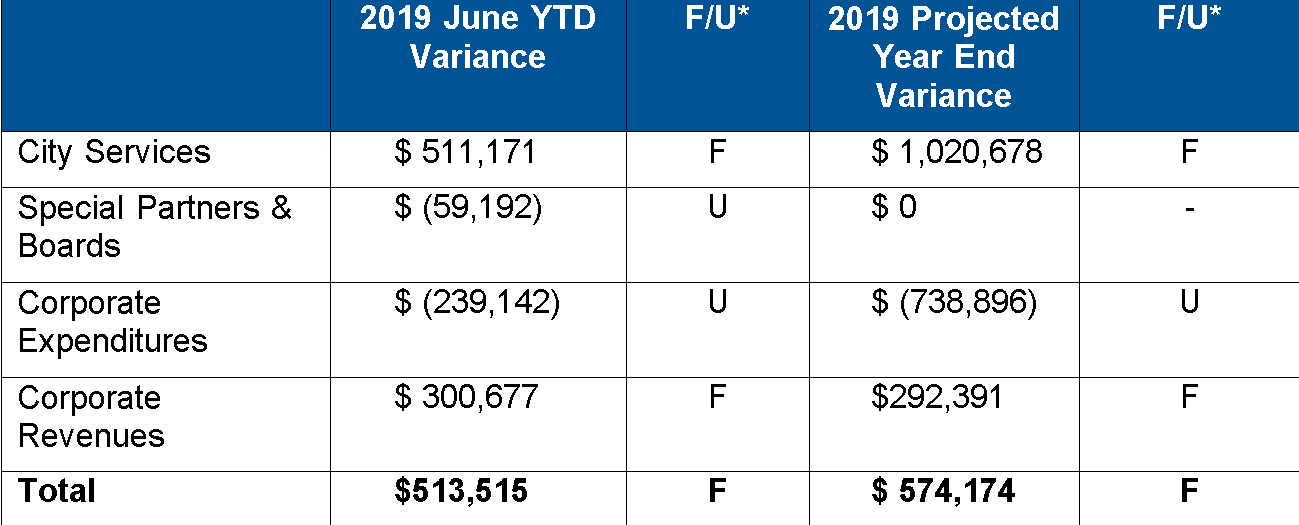

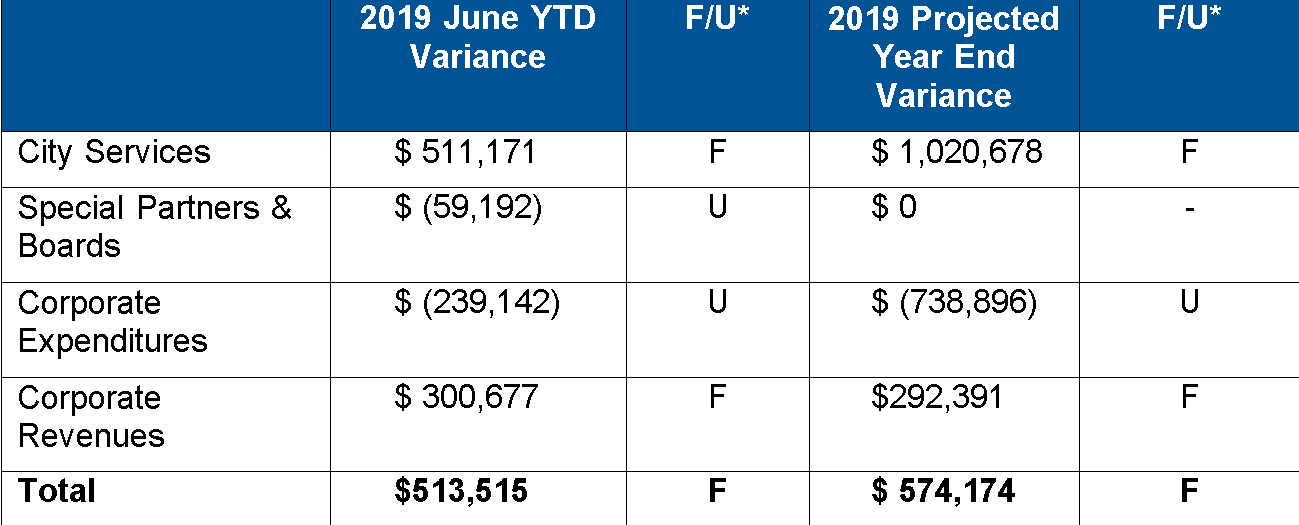

Director of Finance, Joan Ford At the city council meeting last week the Director of Finance, Joan Ford, brought people up to date on where things stood at the end of June. Most people who work on budget refer to having either a surplus or a deficit – the municipal world talks in terms of variances from what they budgeted as either favourable or unfavourable.

Set out below is the position at the end of June. Any surplus (oops favourable variance) doesn’t get returned to the citizens. It gets spread around and into reserve funds and anything they don’t know what to do with gets dropped into the tax stabilization fund. At least that was the practice from 2010 to 2018.

Mayor Meed Ward is going to break a lot of the rules as she works to refashion the way city hall operates. Having a council that is more informed on financial matters it should be interesting to see what they decide to do with one of those favorable variances.

They decided to:

Direct the Director of Finance to report back on the city’s retained savings strategy upon confirmation of the 2019 year-end actual.

If the variance holds at $574,174 it will cover the $503,000 that got scooped from the city’s bank account. Year-end projections will be refined by staff in order to improve their degree of precision. Services will also continue to exercise due diligence when authorizing large expenditures.

Any savings are viewed as “one-time” revenue. From a multi-year budgeting perspective, the use of “one-time” revenues should be tied directly to “one-time expenditure priorities that may include transfers to reserve funds. To do otherwise results in the reliance on “one-time” revenues for funding ongoing expenditures and is contrary to multi-year budgeting principles.

Staff will report to Council in the New Year with a specific recommendation once the year end savings are quantified. Staff continue to recommend contributions to Reserve and Reserve Funds to allow the city the financial flexibility to respond to uncontrollable factors (such as economic cycles, revenue fluctuations, and severe weather events plus short term and one-time needs, and sustainability to plan for today and the future.

The monitoring of corporate and service expenditures and revenues is part of the Operating Budget Performance policy which exists as a key component of the City’s financial management control system. The monitoring of corporate and service expenditures and revenues is part of the Operating Budget Performance policy which exists as a key component of the City’s financial management control system.

It will be interesting to see how the Finance department handles that $503,000 that slipped out of an account and is never likely to return.

By Pepper Parr By Pepper Parr

August 20th, 2019

BURLINGTON, ON

When the Premier tried to download the costs of a number of services onto the municipalities some time ago, there was an uproar – they had already set their budgets and their tax rates – wasn’t possible to change at that point.

The Ford government relented; everyone knew they would be introducing the plans again – and they did – yesterday at the AMO conference taking place in Ottawa.

Child-care and health-care advocates are slamming the provincial government’s plan to go ahead with some of its controversial municipal funding cuts next year.

Despite some extra time before funding is slashed, the news was not welcome.

The cuts are real and they create “uncertainty, stress for families and sort of chaos at the municipal level across the province as they try to scramble to figure out what’s happening.”

Premier Doug Ford addressing the municipal sector on Monday. Ford said some of this year’s planned cuts — to public health, child care and land ambulance funding — will take effect Jan. 1.

“We recognize our government moved quickly when we came into office to address our inherited challenges. But we’ve listened to you.”

Moody’s, the bond rating service, said the cuts will blow $2-billion hole in municipal budgets which will raise the cost of borrowing. Halton Regional Carr might not be able to brag about having the great credit rating the Region has had for more than a decade.

Prior to the changes announced by the Ford government last spring, municipalities had varying public health cost-sharing arrangements with the province — with Ontario paying 100 per cent or 75 per cent in some cases.

The new plan will see all municipalities pay 30 per cent of public health care costs.

The chair of Toronto’s board of health, said “officials are trying to figure out what the full financial impact of the cuts will be — but he was adamant that the cuts would amount to tens of millions of dollars annually for the city.”

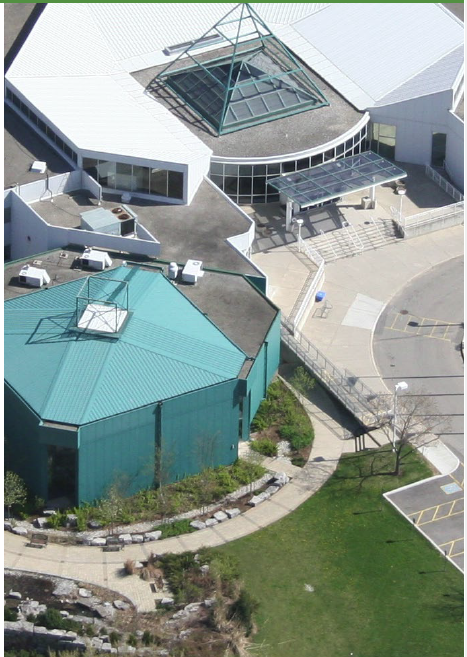

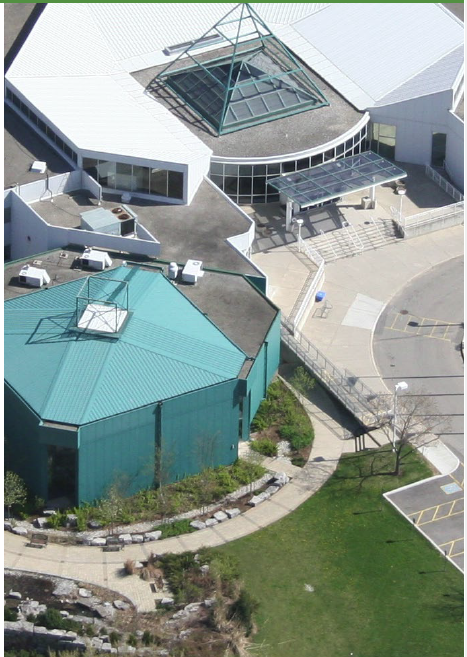

Aerial view of the Regional offices located in Oakville. Commissioners at the Region will be running their numbers when they get back to their offices – it is not going to be a pretty picture.

“As is too often the case with this provincial government, they make announcements first and provide details later.”

Starting on Jan. 1, municipalities will also have to pay 20 per cent of the cost of creating new child-care spaces, which the province previously fully funded.

Some cuts to funding for administrative child-care costs are being delayed until 2021 and others are being delayed to 2022.

Ford also said land ambulance funding will increase by four per cent.

The province is dealing with an $11 billion deficit, the highest sovereign debt of any government.

Just about all the Mayors “recognize and appreciate the challenges the government of Ontario faces in getting its deficit under control”. However, this must be done in a prudent, collaborative manner that does not impact the services that people rely on each and every day.”

A former city of Toronto Councillor said: “Make no mistake, these cuts will hurt people. They are short-sighted and they are wrong.”

Regional Chair and the CAO are going to have to confer with their commissioners to figure out how to deal with the funding cuts announced by the Ford government.

Regional Chair Gary Carr  Regional CAO Jane MacCaskill For weeks, the premier and his cabinet ministers had defended the cuts as necessary to tackle an urgent financial situation and said municipalities needed to do their part, as the recipients of a large share of provincial dollars. The government is trying to eliminate an $11.7 billion deficit.

AMO president Jamie McGarvey, who introduced Ford at the event Monday, said municipalities understand the province’s goals and urged the government to work with civic leaders.

“We cannot achieve these things with abrupt, unilateral changes and it will take more than simple belt tightening to make things better,” McGarvey said. “Working together, we can avoid unnecessary turmoil, and respect the essential front line-services that our governments deliver.”

The services that are going to be hit by funding cuts are for the most part delivered by the Regional government.

The tax rate that is set by a municipality includes taxes levied by the Region and the Boards of Education.

By Pepper Parr By Pepper Parr

July 11, 2019

BURLINGTON, ON

An early look at what the 2020 municipal budget is going to look like had a couple of gulps and let the public see what the city council sense of humour looks like.

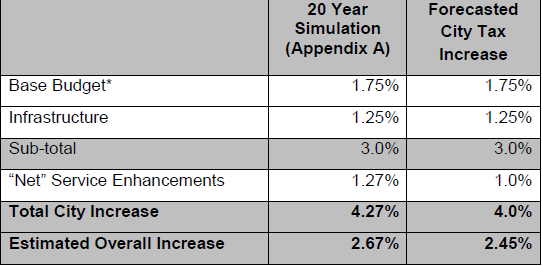

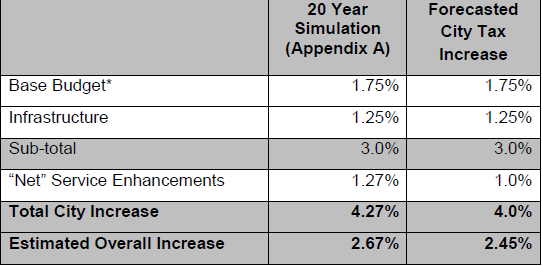

Director of Finance Joan Ford told Council that she was hoping to deliver a budget that will require a tax levy lower than last year. The early projection for the city is 4.27 over last year with the actual impact on the tax bill amounting to 2.67 which City treasurer Joan Ford said that her staff were working on getting that down to 2.45 – which would get the number under the 2.92 for 2019

Mayor Meed Ward wanted to see several lines added to the tax bill and had a line saying “Ford Levy” showing which increases were the results of changes by the Ford government that are going to whack us in the wallet. Mayor Meed Ward wanted to see several lines added to the tax bill and had a line saying “Ford Levy” showing which increases were the results of changes by the Ford government that are going to whack us in the wallet.

Couple of problems there – Ford said that she was running out of space on the tax bill and then told us that the province determines what the tax bill must look like.

These are early days in the budget process – we can see what is coming.

Meed Ward proudly tells anyone who asks that the council in place from 2010 to 2018 was never able to lower taxes.

This council expect to bring in a lower tax levy – despite what the provincial government has done to make life at the municipal level as tough as it can get.

By Staff By Staff

May 28th, 2019

BURLINGTON, ON

The following Statement was issued by the Mayor of Burlington.

Today I am pleased to acknowledge the Provincial government’s announcement that they will be cancelling the recently announced retroactive in-year cuts to municipalities and maintaining the pre-budget funding levels for public health, child care and ground ambulance.

Ontario’s big-city mayors met in Guelph on Friday (May 24) at a meeting of LUMCO (Large Urban Mayors Caucus of Ontario) along with Mayor John Tory of Toronto, to discuss a joint strategy to respond to the previously announced Provincial budget cuts and downloading on municipalities, after our budgets had already been passed. We were grateful to have the Minister of Municipal Affairs and Housing, The Honourable Steve Clark, also join us for part of that meeting.

He heard our concerns and took our unanimously passed joint statement back to the Premier. The key messages from the mayors meeting as LUMCO were:

• We want to be at the table with the Province to work together to address their fiscal challenges in ways that minimize impacts on our residents.

• If the Province does not change course, or even delay implementation until 2020 so that we can adjust for our next budget cycle, municipalities will be forced to consider tax increases, service cuts, or raiding reserves.

Mayor Marianne Meed Ward with Premier Doug Ford. On behalf of the City of Burlington, I commend Ontario Premier Doug Ford and Minister Steve Clark for listening to the concerns raised by mayors on behalf of our residents across the province.

The cuts, as originally announced, were poised to hurt local communities and put cities’ finances at risk. They were also made without prior consultation with municipal leaders, leaving no time to plan for what was coming and leaving a collaboration gap between our two levels of government. Today’s news shows what can be accomplished when different levels of government listen to one another and work together.

But we are not out of the woods yet.

The delay in these cuts is helpful, but some of these cuts continue to be inappropriate to download to the municipal tax base. The Province cannot balance its own books on the backs of municipal property taxes, especially when they will negatively impact front-line services. Municipalities only receive 9 cents on every tax dollar collected by our governments. We will only make substantial fiscal progress by ensuring savings are found by the levels of government that spend the most (federal and provincial). We encourage the Province to look at their own administrative efficiencies rather than cutting front line services delivered at the municipal level.

On a related note, the Province has asked municipalities to help find additional savings and efficiencies, recently announcing an “Audit and Accountability Fund” to support line-by-line third-party reviews of their operations.

Mayor Meed Ward advises that “we are not out of the woods yet”. My fellow LUMCO Mayors and I are fully supportive of balancing our budgets, reviewing all expenditures to look for efficiencies, and supporting the Province in reducing their deficit and debt.

The City of Burlington completed a line-by-line review as part of our 2019 budget process, as we do every year. Unlike the federal and provincial governments, municipalities cannot run a deficit. We must not only balance our books annually, but also share them transparently with our constituents.

As a result of our line-by-line review, our approved 2019 budget saw an initial reduction of $1.15M, with City Council trimming an additional $1.6M while still investing in our infrastructure, local transit, tree planting and community services. The end result was our ability to pass the lowest tax increase at the city level in eight years. We would be more than happy to share our best practices with the Province.

Even with all these savings already found, we are always willing to have an independent review of our books to verify what we already know.

More detail on our commitment to finding efficiencies and managing our budget effectively can be found on my blog at mariannemeedward.ca/finding-municipal-budget-efficiencies.

While we welcome today’s announcement, changes in other pieces of legislation will negatively affect our ability to be financially sustainable and provide for community services. Bill 108 includes proposed changes that would hurt cities’ ability to provide parkland, community facilities and adequate public engagement to inform the planning of our neighborhoods. Changes to Development Charges, paid by developers to offset the cost of growth, could put parkland and community centres in jeopardy. The changes will mean either a reduction in community services or an increase in property tax to cover the shortfall. These changes do nothing to reduce provincial costs but do increase the costs to municipalities at a time we are all trying to find efficiencies.

Additionally, a return to the old OMB (Ontario Municipal Board) rules for planning appeals means that planning matters will once again be taken out of the hands of local municipal councils. There is no evidence to support that these changes would actually increase the supply of affordable housing.

Furthermore, reverting to the old rules will add costs and time to planning approvals and require municipalities to spend more in legal fees defending our planning decisions. Again, these changes do nothing to reduce provincial costs but do increase the costs to municipalities at a time we are all trying to find efficiencies.

Mayor offers to share Burlington budget practices with the province. We are heartened by the willingness of the Province to listen to municipalities and reverse course, and we look forward to additional conversations on the outstanding matters that have yet to be addressed by today’s announcement that create costs without benefits to municipalities and our residents.

By Pepper Parr By Pepper Parr

March 4th, 2019

BURLINGTON, ON

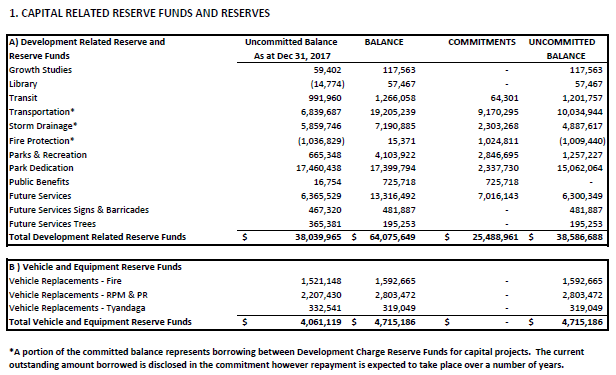

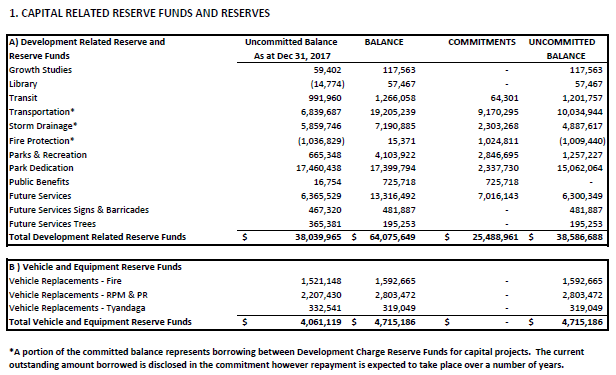

The city of Burlington has tonnes of money squirreled away in bank accounts. Some of the money is ear marked for specific purposes. Other reserve funds are there to be used for almost any purpose.

The city’s reserves got a lot of attention during the recent budget deliberations. In a number of instances funds from a reserve fund were brought in to the 2019 budget to cover an project expense.

That there is now a bit of a struggle for control of those reserve funds became evident during the budget debates where sharp differences from the Interim city manager, the Director of Finance, Councillor Sharman and the Mayor. That debate ended with the chair of the budget committee promising not to raid the reserve accounts in the future.

In a document from the Finance department they explain that “Reserve Fund Assets are segregated and restricted to meet the purpose of the reserve fund. Investment income must be accumulated in the reserve fund and be accounted as part of it.

“There are two types of reserve funds: obligatory reserve funds and discretionary reserve funds. The following table provides a summary of our reserve funds and their purpose,”

Development Related Reserve Funds:

Development Charges against land to pay for increased capital costs required because of increased needs for services arising from development of the area to which the By-law applies. – (By-Law No. 46-2014)

Central Park Park Dedication

For funding parkland acquisition and other recreational purposes in accordance with governing legislation and municipal policy. (By-Law Nos. 147-1993, 57-2005, 70-2005)

Public Benefits

Funding to be utilized only for facilities, services and other matters specified in the policies of the official plan and Sec. 34 regulations as enacted and as more particularly set forth in the signed agreement between the City and developer. – (By-Law No. 15-2017)

Vehicle Depreciation and Replacements

To accumulate funds to be used for the purpose of funding replacement requirements and/or purchase of vehicles, equipment, accessories through the Capital Budget process. – (By-Law Nos. 140-2002, 141-2002 & 142-2002)

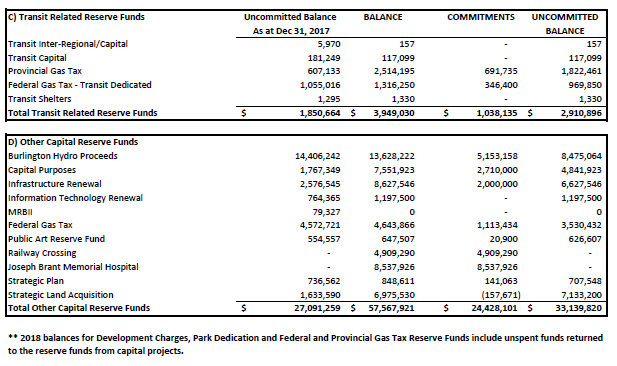

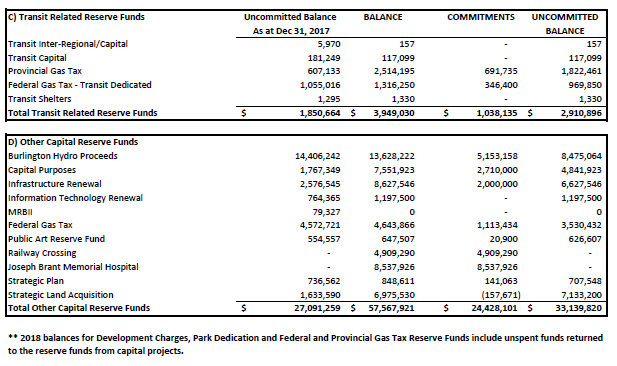

Transit Related Reserve Funds Transit Related Reserve Funds

Transit Inter-Regional/Capital to accumulate funds to be utilized for Transit Inter-Regional Capital Projects or other Transit related capital requirements as approved by City Council. – (By-Law No. 62-2002)

For the accumulation of monies to finance future transit capital requirements.

(By-Law No. 61-2002)

Transit Capital

For the transfer of funds from the Provincial Fall Economic Statement (2007) Funds for municipal transit capital expenditures. – (By-Law No. 33-2008)

Gas tax funds cover the cost of new vehicles. Provincial Gas Tax

For the accumulation of monies received from the Provincial government under the Dedicated Gas Tax Funds for Public Transportation Programs. – (By-Law No. 123-2004)

Federal Gas Tax – Transit Dedicated

To accumulate funds to be used according to guidelines established within the Municipal Funding Agreement. – (By-Law No. 149-2006)

Transit Shelters Funds for use in the construction of Bus Shelters. – (By-Law No. 72-1992)

Burlington Hydro Proceeds

Used to capture interest and dividend payments to the City as the sole shareholder. The funds are used for capital renewal projects as well as provide funding to the Current Budget. – (By-Law No. 34-2001)

Capital Purposes

Contributions from the Current Budget are held in this fund before they are required in the capital program. Provisions to Capital from Current are made annually. (By-Law No. 2-1991)

Infrastructure Renewal

For funding minor reconstruction of roads, creek work, facility or building retrofit and repairs and technology replacement. Provisions from the Current Budget are made annually. (By-Law No. 116-1996)

Information Technology Renewal

For funding capital renewal of the City’s information technology Systems and infrastructure. (By-Law No. 109-2015)

Federal Gas Tax

To execute the Municipal Funding Agreement for the Transfer of Federal Gas Tax Revenue under the New Deal for Cities and Communities between the Association of Municipalities of Ontario and the Corporation of the City of Burlington. (By-Law No. 109-2005)

Public art on Plains Road Public Art

To fund future expenditures related to the acquisition, installation, deaccessioning, maintenance, preservation, restoration, and collection management of the City’s Public Art Program. (By-Law No. 89-2004)

Railway Crossing

For funding future railway crossing improvements and possible new grade separations budgeted in the Capital Budget. (By-Law No. 33-1997)

Joseph Brant Hospital

In December 2009 Council approved a municipal contribution of not more than $60 million toward the JBH Phase I Redevelopment plan. (By-Law No. 28-2010)

Strategic Plan

For funding the delivery of the initiatives identified in the City’s 2015-2040 Strategic Plan. (By-Law No. 46-2016)

Strategic Land Acquisition

The accumulation of funds for the acquisition of land. (By-Law No. 56-2008)

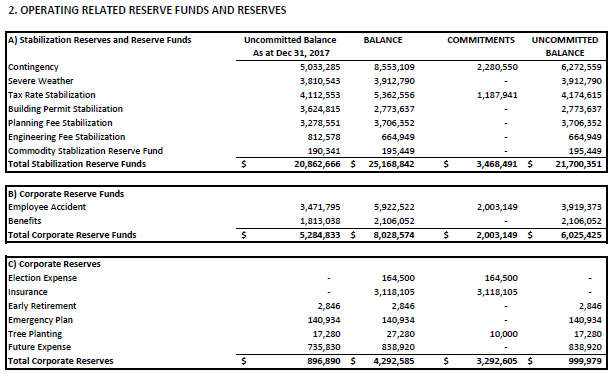

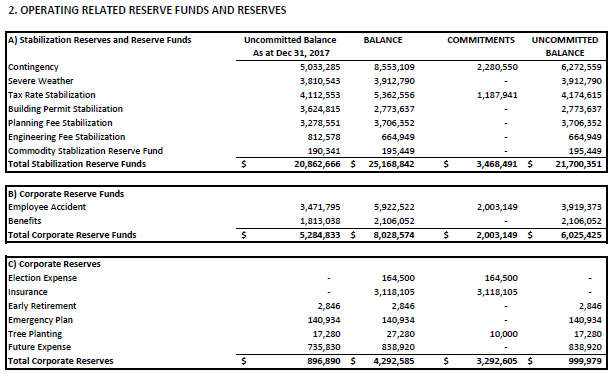

Severe Weather

To accumulate funds primarily for the purpose of alleviating the fiscal impact of unforeseen or uncontrollable fluctuations in costs associated with severe weather events. (By-Law No. 60-2010)

Tax Rate Stabilization Tax Rate Stabilization

To alleviate the fiscal impact on the city’s budget and tax rate as a result of unforeseen or uncontrollable fluctuations in budget expenditures and revenues. (By-Law No. 35-1994)

Building Permit Stabilization

For the accumulation of monies to stabilize building permit revenues. (By-Law No. 27-2005)

Planning Fee Stabilization

For the accumulation of monies to stabilize planning and development revenues. (By-Law No. 29-2005)

Engineering Fee Stabilization

For the accumulation of monies to stabilize engineering revenues. (By-Law No. 28-2005)

Commodity Stabilization

To alleviate the impact of unforeseen or uncontrollable fluctuations in commodity costs. (By-Law No. 06-2016)

Employee Accident

Required by agreement for funding Workers’ Compensation Board (WCB) claims and related expenses incurred by the City as a Schedule 2 employer. (By-Law No. 25-1994)

Benefits

Fund consists of premium rebates from the insurance carrier, used to make various payments relating to the provision of benefits to staff. (By-Law No. 26-1993)

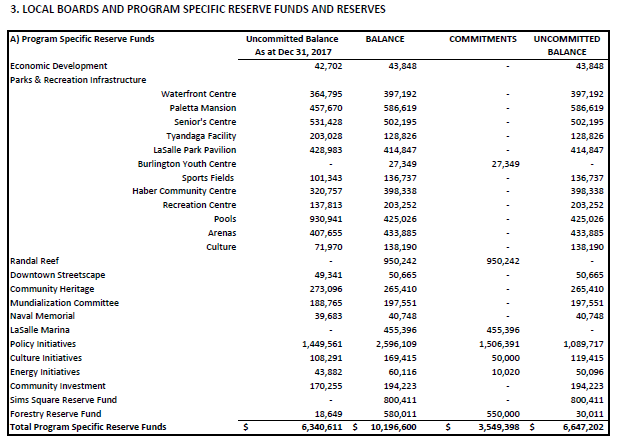

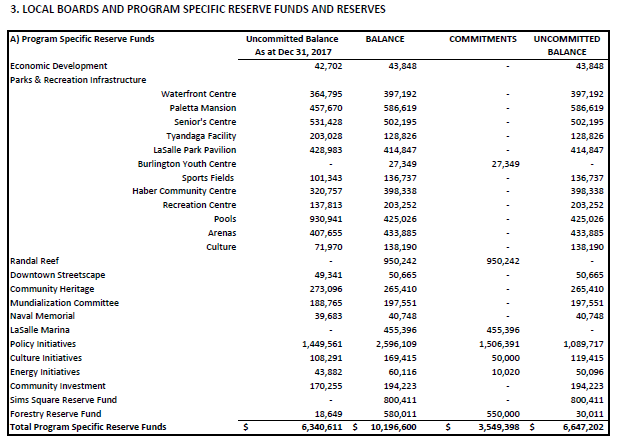

Economic Development

Used to fund economic development initiatives designed to capitalize on significant business recruitment opportunities. (By-Law No. 26-1998)

Waterfront Centre

For the accumulation of monies received from net surplus from the indoor operations of the Waterfront Centre as well as the net surplus revenues from the waterfront parking lots parking program for the capital renewal, capital enhancement and debt repayment of the Waterfront Centre. (By-Law No. 66-2015)

Paletta mansion Paletta Mansion

For the accumulation of monies received from the net operations of the Paletta Mansion for the capital renewal and capital enhancement of the Paletta Mansion. (By-Law No. 64-2015)

Tyandaga Facility

For funding capital improvements to the municipally owned Tyandaga Golf Facility. (By-Law No. 4-1991)

LaSalle Park Pavilion

For the accumulation of monies received from the net operations of the LaSalle Park Pavilion for the capital renewal and capital enhancement of the LaSalle Park Pavilion. (By-Law No. 63-2015)

Senior’s Centre

For the accumulation of monies received by way of surcharge from facility rentals, program registrations, memberships and/or donations at the Burlington Senior’s Centre to support the capital renewal of the Burlington Senior’s Centre. (By-Law No. 65-2015)

Sports fields

For the accumulation of monies received by way of surcharge from facility rentals and/or unrestricted donations at Artificial Turf Fields, Sports Fields and Passive Parks (“Sports Fields”) to support the capital renewal and capital enhancement of these Sports Fields. (By-Law No. 61-2015)

Haber Community Centre

For the accumulation of monies received from the naming rights to Haber Recreations Centre to support the capital renewal and capital enhancement of the Haber Recreation Centre. (By-Law No. 67-2015)

One of several gymnasiums at the Haber recreation centre. Recreation Centre

For the accumulation of monies received by way of surcharge from facility rentals, program registrations, memberships and/or unrestricted donations at Brant Hills Recreation Centre, Haber Recreation Centre, Mountainside Recreation Centre Community Rooms, Rotary Youth Centre, Tansley Woods Community Centre Gyms and Community Rooms, Sherwood Forest, Ella Foote Hall, Lowville School House (“Recreation Centres”) to support the capital renewal and capital enhancement of these Recreation Centres and the related program amenities. (By-Law No. 58-2015)

Pools

Swimming pool. When the Nelson pool equipment failed funds to replace everything came from a reserve fund. For the accumulation of monies received by way of surcharge from facility rentals, program registrations, memberships and/or unrestricted donations at Aldershot pool, Angela Coughlan Pool, Centennial Pool, LaSalle Pool, Mountainside Pool, Nelson Pool and Tansley Woods Pool (“Pools”) to support the capital renewal and capital enhancement of these Pools and the related program amenities. (By-Law No. 60-2015)

Arenas

For the accumulation of monies received by way of debt repayment from ice and room rentals at Aldershot Arena, Appleby Arena, Central Arena, Mainway Arena, Mountainside Arena, Nelson Arena and Skyway Arena (“Arenas”) for the debt repayment of Appleby Ice Centre. (By-Law No. 62-2015)

Culture

For the accumulation of monies received by way of surcharge from facility rentals, program registrations, memberships and/or unrestricted donations at Music Centre and Student Theatre (“Cultural Facilities”) to support the capital renewal and capital enhancement of these Cultural Facilities and the related program amenities. (By-Law No. 59-2015)

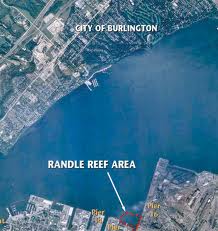

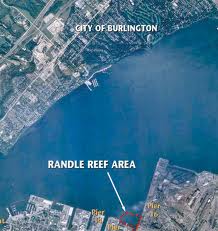

Funds for the Burlington share ($2.3million) for Randall Reef that had to be built to encase years of toxic waste in Hamilton Harbour we kept in a reserve fund. Randal Reef

For the accumulation of monies for the purpose of providing the City’s and Region’s contribution to ensuring the successful implementation of sediment remediation efforts for Randle Reef, by way of agreement with Environment Canada, Ontario Ministry of Environment, City of Hamilton, Hamilton Port Authority and US Steel Canada Inc. (By-Law No. 25-2013)

Downtown Streetscape

Funds for use in improving streetscaping in the downtown core area. (By-Law No. 108-1994)

Community Heritage

Funds provided by the Ministry of Culture and the City to provide financial assistance to owners of designated properties. (By-Law Nos. 128-1985 & 16-1993)

Mundialization Committee

To provide funding for reciprocal gifts for the City of Burlington’s twin, Itabashi, Japan. (By-Law No. 89-1995)

Naval Memorial

The Naval Memorial; a prominent part of Spencer Smith Park. Fund provided for the purpose of funding future expenditures related to the maintenance, preservation, restoration and management of the Naval Memorial Monument. (By-Law No. 81-2009)

LaSalle Marina

Funds collected from the sale of slips to be used for the capital replacement of the LaSalle Park Marina. (By-Law No. 17-2005)

Policy Initiatives

For funding corporate and departmental policy initiatives. (By-Law No. 106-2015)

Culture Initiatives

For funding expenditures to facilitate opportunities for enhancing city-initiated cultural programs. (By-Law No. 107-2015)

Energy Initiatives

For funding energy initiatives deemed to be feasible and in line with City objectives relating to energy conservation. (By-Law No. 108-2015)

Community Investment

For funding solely towards supporting future community initiatives approved through the Community Investment Policy. (By-Law No. 115-2015)

Sims Square

For the accumulation of monies received from the net operations of Sims Square for the capital renewal and capital enhancement of Sims Square.

Forestry

For Funding expenditures related to the preservation of City of Burlington’s tree canopy from invasive species and diseases such as Emerald Ash Borer, Gypsy Moth and Dutch Elm. This includes treatment programs, removal and replacement of impacted trees, and related coordination and communication costs. (By-Law No. 105-2015)

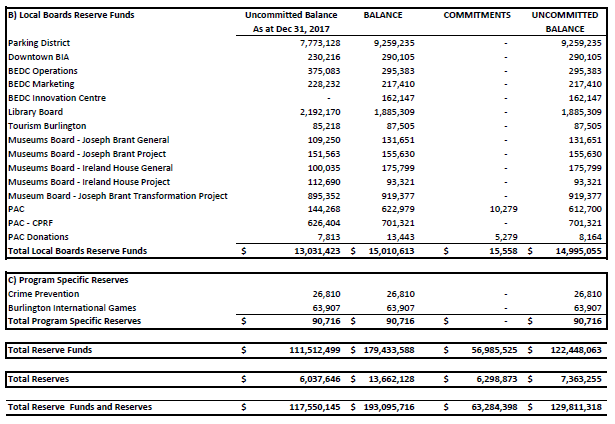

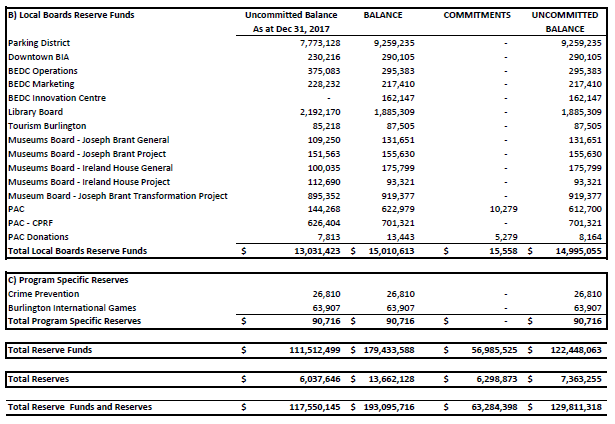

Parking District

For funding capital improvements to parking lots within the City. (By-Law No. 3-2007)

Downtown BIA

For the purpose of funding future capital projects and future tax rate stabilization. (By-Law Nos. 39-1997 & 99-1999)

BEDC Operations & Marketing

Funding for programs relating to the Downtown Partnership and the Burlington Economic Development Corporation. (By-Law No. 161-1993)

BEDC Innovation Centre

Funding to be used to alleviate the impact of unforeseen operating expenses or for capital purposes such as for renovations, improvement and equipment that will benefit users of the centre and most be approved by the Burlington Economic Development Corporation Board of Directors, or otherwise approved by Council. (By-Law No. 32-2018)

Library Board Library Board

Contributions from the Current Budget are held in this fund before being required in the capital program for Library purposes. (By-Law No. 70-2003)

Tourism Burlington

For the accumulation of monies to be used to cover Current Budget shortfalls and for special projects after the Current Budget has been expended. (By-Law No. 69-2006)

Museums Board

Funds for use in the acquisition of artifacts and for capital improvements to the Joseph Brant and Ireland House Museums. (By-Law Nos. 20-1990, 21-1990, 22-1990 & 143-1991)

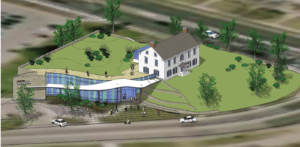

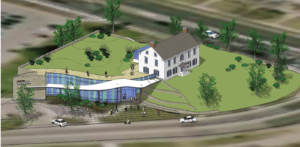

The transformed Brant museum is scheduled to open in July. Museum Board – Joseph Brant Transformation Project

Funds to be used solely for the purpose of funding the Joseph Brant Museum Transformation Project. (By-Law No. 56-2014)

Burlington Performing Arts Centre

For the accumulation of monies received from net surplus revenues from the operations of the Burlington Performing Arts Centre. (By-Law No. 55-2015)

Burlington Performing Arts Centre – donations

For donations contributed to the Burlington Performing Arts Centre. (By-Law No. 54-2015)

Burlington Performing Arts Centre – capital

For capital repairs, rehabilitation and renewal of the Burlington Performing Arts Centre. (By-Law No. 50-2015)

By Pepper Parr By Pepper Parr

March 1st, 2019

BURLINGTON, ON

The shift that has taken place in the way city council works now is almost seismic.

Burlington voted for five new council members in October. Two of the five were the result of former councillors who decided not to run again. The other two were defeated at the polls.

The Mayor lost his chain of office – Marianne Med Ward now wears that symbol of office.

The 2010 to 2018 Council was almost always mean spirited – the Mayor was not able to change the culture of that Council. Meed Ward’s relationship with then ward 1 councillor Rick Craven was close to toxic; Meed Ward often felt her personal safety was at risk. The Gazette didn’t see it that way, however they certainly didn’t get along.

The 2019 city council – seven people quite pleased with themselves – they have every reason to be proud of what they ave done so far. Ward 5 Councillor Paul Sharman was almost as bad as Rick Craven – they seemed to feed off each other with former Councillor Lancaster following along and former Councillor Dennison, who should have known better, let them get away with it.

Marianne Meed Ward was determined that this was not the way the city council she was to lead would work. She made that abundantly clear during the final meeting of the 2010 – 2018 city Council.

The question was: Could she pull it off?

Too early to be definitive but if what we are seeing so far – it is and will continue to be a much more collegial and effective city council.

Meed Ward gets to laugh from time to time. Meed Ward gets to laugh from time to time.

When she realizes after hearing what staff and other Councillors have to say that her opinion needs to change – she is direct and forthright – and changes her mind.

She is also challenging staff in a way they have not been challenged for the past ten years. This is really healthy. There is certainly some chatter amongst the Directors as to how she inserts herself into a situation – they will get over it and come to realize that they are fortunate to have a Mayor who will actually lead.

Meed Ward still has some work to do on getting her council members onside. In an important vote related to the Randall Reef work being done in Hamilton, Meed Ward said she wanted her colleagues with her on this one. The motion passed but it was one of those 4-3 votes Burlington used to see every council meeting.

Councillors Lisa Kearns, Paul Sharman and Kelvin Galbraith did not vote with her on the item which had to do with using reserve funds money for a short period of time.

Randall Reef – The second worst environmental waste deposit in the country had to be cleaned up: Burlington paid $2.3 million over ten years. Randall Reef is a three government level undertaking to bury tonnes of toxic sludge in Hamilton Harbour. Burlington is in for $2.3 million, Hamilton $6 million – the Region and federal government in for the balance.

The most socially liberal spend came from Councillor Sharman who said free transit for people who do not have enough money to live on “is the biggest gift we can give them” put the expense in the base now.

The Region uses a formula that is made up of LICO + 15%. The low income cut-offs (LICOs) are income thresholds below which a family will likely devote a larger share of its income on the necessities of food, shelter and clothing than the average family.

Thus a household with one person will be eligible for the free transit if their income is below $29,139.

The cut off point for larger households is set out below.

1 person 29,139

2 persons 36,276

3 persons 44,597

4 persons 54,147

5 persons 61,412

6 persons 69,262

7 persons or more 77,113

There were some extraordinary decisions made at the Standing Committee meetings this week. They should hold up at the Council meeting at the end of the month.

Related news stories:

Meed Ward – final 2018 Council meeting.

Randall Reef

Salt with Pepper is the musings, reflections and opinions of the publisher of the Burlington Gazette

By Pepper Parr By Pepper Parr

February 28th, 2019

BURLINGTON, ON

The tax increase for the 2019 budget will be 2.99%.

They did it.

Marianne Meed Ward – just sworn in as Mayor. And today she got her first budget approved. The Operations budget is set at $165,960,609.

The Fire Chief didn’t get his $50,000 drone but the Manager/Supervisor of the bylaw enforcement team did get $35,000 for a car.

There were some incredible decisions made – those people who live below the poverty line are going to be able to get bus passes that will allow them to use transit totally free of charge.

More detail later today – council is getting ready to wind up – talking through some Staff Directions they would like staff to work at and think about.

We have a Mayor who worked hard to bring her colleagues with her and challenged staff to look at the way funds are used differently.

The decision made at the Standing Committee is just a recommendation – it can be changed at the city council meeting at the end of March.

A new council produced a budget that will surprise man.

By Pepper Parr By Pepper Parr

February 28th, 2019

BURLINGTON, ON

The first part (Capital) of the 2019 budget has been approved;city council now moves on to completing the debate on the Operations part of the budget.

This city council has shown that it is ready to do things differently. The capital focus has been on infrastructure and transit. Spending for 2019 will amount to $96.4 million with a 10-year program of $819 million.

Seventy two per cent of the 10-year capital budget will be invested in renewing Burlington’s aging infrastructure.

A breakdown of spending for the 2019 capital budget of $96.4 million includes:

Burlington has to do a major upgrade of its information technology systems – some of it is urgently needed. • $49.5 million, the largest component, for roadways

• $10.1 million for facilities and buildings

• $8.4 million for parks and open spaces

• $6.3 million in storm water management

• $10.6 million towards fleet vehicles and equipment

• $9.5 million for information technology

• $0.9 million for local boards (Burlington Public Library, Burlington Performing Arts Centre, Art Gallery of Burlington, Burlington Museums)

• $1.1 in parking.

Some highlights of the 2019 capital budget include:

Burlington Transit getting new buses – to deliver less service. • $1.9 million in funding to improve public transit with the purchase of three new conventional buses

• $234,000 in funding to purchase one new para-transit bus

• $550,000 in funding to build a new splash pad in Brant Hills Community Park

• $450,000 in funding for a new sports lighting system for the ball diamond and pathways at Maple Park

• $600,000 in funding for new amenities at Tansley Woods Park.

Council was able to whittle away some of the Finance department recommendation of $96.8 million down to $96.4 million.

By Pepper Parr By Pepper Parr

February 26th, 2019

BURLINGTON, ON

It has been chop, chop, chop at the Operational budget review meeting that started this morning.

City staff came in with a proposed tax increase of 3.99% – Mayor Meed Ward said she liked the look of 2.99% – and at noon this council had the amount whittled down to 3.1%

This new Council is looking to the reserve funds for the dollars that are needed to pay for some of the new asks. They actually debated on whether or not they would hire new bus drivers for the new buses they approved of last night.

Brant Museum Executive Director left the Standing Committee meeting before getting the wording on the Staff Direction that was prepared for her. The Brant Museum got a close close look – and had its funding request handled as a one time expense – council wants to see what the Museum staff can do on the revenue side.

Councillors Galbraith, Bentevegna and Mayor Meed Ward worked at lessening the new spending and using reserve funds to pay for new services. This is a different council – one that talks openly about how big an advocate ward 4 Councillor Shawna Stolte has become for the fire department. There is a ride on a fire truck in the works for her. Mayor Meed Ward seems intent on being on that fire truck as well.

Good work so far for this council.

By Staff By Staff

February 21st, 2019

BURLINGTON, ON

It looks as if the Interim is still the Interim and not the Acting.

During the Capital Budget Standing Committee meeting today Tim Commisso was addressed as the Interim City Manager. A couple of chuckles were heard from the Staff Section of the council seating. During the Capital Budget Standing Committee meeting today Tim Commisso was addressed as the Interim City Manager. A couple of chuckles were heard from the Staff Section of the council seating.

No one has said anything about how the title “Acting” got attached to Commisso’s name – clerical error perhaps?

The budget meeting went exceptionally well. The performance put in by Ward 4 Councillor Shawna Stolte on handling two very complex financial issues – Information and Technology and the Fire department, were lengthy but very well done.

The financial requirement for Information Technology was in the millions and brought to light some serious issues that were not known or discussed at anything length at previous budget meetings. The financial requirement for Information Technology was in the millions and brought to light some serious issues that were not known or discussed at anything length at previous budget meetings.

This council is made up of younger people who are not afraid to ask questions and id they aren’t comfortable they ask a follow up question.

Budget Committee Chair Lisa Kearns Budget Committee Chair Lisa Kearns was able to match the staff member explaining the technology word for word – she has been down that road before. They also managed to take a decent amount of money out of the Capital budget – they are determined to get any tax increase below 3% – given the rate at which they moved today – you can think in terms of something well below that 2.99% Mayor Meed Ward put on the table.

There is a different tone from this council.

By Pepper Parr By Pepper Parr

February 21st, 2019

BURLINGTON, ON

Just how does the city budget get created and passed and what do the members of council do to ensure that tax payers are getting value for money?

Staff in the Finance department present a draft budget to city council

That draft is the result of a process that has each department putting together their budgets which gets vetted by a team that consists of senior staff, the Director of Finance and the city manager.

The public get to delegate on the draft budget.There was email feedback, there was a telephone town hall, the city made use of its Get Involved service that lets people say what they think on various issues. And then there was that button-holing that politicians have to live with from residents who want something for their special interest or community.

Members of Council inevitably have questions – with the current five new members of Council there is not only a steep learning curve but also a lot of questions that are often specific to their wards.

The following is a list of some of the questions individual council members asked. The name of the council member who posed the question is not provided – unfortunately.

Service: Recreation

Question: Securing Sponsorship Funds by Naming Corporate Assets

Who is responsible for generating sponsorship funds through the naming of corporate assets?

The Haber Law Group got naming rights to the Recreation Centre in Alton for 20 years – paid millions. Response: To date, naming opportunities have been done on a project by project basis with Parks and Recreation staff usually taking the lead. A sponsorship package is approved by council and potential sponsors are sought. Most recently the city was successful in securing a naming opportunity for the Haber Recreation Center; unsuccessful in securing a sponsor for the renovated Nelson Outdoor Pool.

Funds secured are placed in a reserve to support future capital renewal of the asset that was named. There have been differences of opinion on whether the city should secure sponsorship for the overall name of an asset, with there being more comfort with naming components within an asset.

A review of the corporate sponsorship policy will be undertaken later in 2019, early 2020

It was Regional budget dollars that paid for the re-build of New Street. Infrastructure no matter who pays – in the end it is coming out of your pocket. Question: What would be the impact on the overall 20-year asset management plan if the increase in the infrastructure renewal levy was decreased to 1% instead of 1.25% for this year, and what is that amount worth?

Response: A 0.25% decrease would reduce $400,000 of funding to the capital program in 2019 and $8 million of funding over the next 20 years ($24 million over the 60-year Asset Management Plan). $4 million of projects would need to be removed from the 10-year capital budget and forecast.

The capital projects impacted by the reduction risk higher costs in the future to complete and additional costs by the way of minor maintenance expenditures until the work can be done. The projects timing in the capital program is based on assessed condition, warranting the required work, deferring work can impact the resident’s experience and derived quality with the asset.

Question: Provide a list of statutory and discretionary development charge exemptions and a list of ineligible services.

Response: List of statutory and discretionary development charge exemptions and list of ineligible services:

The Development Charges Act along with regulation O.Reg. 82/98 provides legislated statutory development charge exemptions for the following:

• Industrial building expansions up to 50% of the gross floor area

• Intensification within existing residential developments with up to 2 additional dwelling units permitted within existing low-density dwellings and 1 additional dwelling unit permitted within medium and high-density dwellings

• Municipalities (City and Region)

• Board of Education and local board, as defined in the Education Act

The City’s existing DC by-law (46-2014) also provides non-statutory exemptions from payment of development charges with respect to:

• Hospital, excluding any portion of the lands, building or structures occupied by the tenant of the hospital

• A place of worship

• Conservation authority

• Seasonal structure and temporary venues

• Parking garages

• Agricultural uses

• Canopy (structure with one or no walls, ie. Gas pump islands)

Ineligible services:

In accordance with the Development Charges Act and O. Reg 82/98, a development charge by-law may not impose development charges to pay for increased capital costs, prescribed as ineligible service listed below:

• Cultural or entertainment facilities, including museums, theatres and art galleries

• Tourism facilities, including convention centres,

• Acquisition of land for parks, including woodlots

• Hospitals, as defined in the Public Hospitals Act

• Landfill sites and services

• Facilities and services for the incineration of waste

• Headquarters for general administration of municipalities and local boards

• Lands for parks, includes land for woodlots and land because it is environmentally sensitive

Project: Funding for Capital Projects from Parks and Recreation Reserve Funds

Question: How are the reserve funds managed and what amount of funding is coming from them for capital projects?

Response: The Parks and Recreation Department utilizes reserve funds to partially support capital initiatives for the repair and renewal of facilities and associated program amenities/enhancements in the Organized Sport Support, Recreation and Culture service areas.

Angela Coughlan Pool Reserve Funds related to facilities and programs are funded by a 5% surcharge place on user fees. Funds from these Reserve Funds are used to offset a portion of capital costs related to repair, renewal and enhancement of facilities and programs in the asset type, for example; surcharges collected at Angela Coughlan Pool would be placed in the “Pools” Reserve Fund and used for pools asset renewal projects.

Projects presented through the capital budget that are funded or partially funded through Reserve Funds illustrate details as such under the budget summary.

Service: Municipal Law Enforcement (additional By-law Enforcement

Question: Bylaw: getting from 6 (proposed budget) to 8: I understand Parks and Recreation have a parks enforcement office, and parking enforcement is also separate from bylaw. Can we redeploy a parks and rec, and a parking officer to bylaw to bring the total bylaw complement to 8 officers? Or redeploy one officer from animal control to bylaw to achieve one of the 2.

Response: Parks and Recreation have Park Ambassadors who work with sports groups on proper park etiquette and problem-solving issues (lights on, lights off etc). These are part- time staff who work in summer months.

Parking Enforcement is contracted out to a 3rd party provider (Core Commissionaires) and the enforcement officers are not City employees.

Moving an animal enforcement officer would result in service reductions to customers and Animal Control Enforcement overall. This would impact the work the animal enforcement officers do on investigations, ticketing, and coyote management (as examples).

Service: Road and Sidewalk Maintenance

Would this stretch of sidewalk qualify? Question: What would be the cost of plowing the pathway at Brant Hills Community Centre? Are there any other locations not currently maintained in the winter?

Response: The additional cost to maintain this pathway is minimal and could be accommodated however there are significant safety concerns during freeze/thaw conditions given the hilly nature of the pathway.