By Staff By Staff

December 23rd, 2019

BURLINGTON, ON

On December 20, 2019, members of the Halton Regional Police Service’s Child Abuse and Sexual Assault (CASA) Unit, with support from the Emergency Services Unit (including Tactical and Canine officers) and additional investigative officers, arrested a 58 year-old male for multiple offences, including human trafficking, sexual assault, and assault.

These offences are alleged to have taken place in the City of Burlington and the Town of Milton between January 2006 and December 2019, and involved more than one victim. These offences are alleged to have taken place in the City of Burlington and the Town of Milton between January 2006 and December 2019, and involved more than one victim.

Accused:

Mohan “Jarry” AHLOWALIA (58) of Burlington is charged with the following:

• Assault x7

• Assault with a Weapon

• Sexual Assault

• Uttering Threats

• Extortion

• Trafficking in Persons (Forced Labour)

• Receive a Material Benefit from Trafficking in Persons (Forced Labour)

• Unsafe Storage/ Transportation of a Firearm

• Contravention of a Storage of a Firearm

• Possession of a Firearm Knowing its Possession is Unauthorized

• Firearm in a Vehicle

• Possession of a Prohibited Firearm

• Possession of a Prohibited Weapon without a Licence

The accused is known to use a number of aliases, including: Gerry AHOLOWALIA, Jarry Mohan AHLOWALIA, Jarry AWALIA, Mohan J. WALIA, M.J. AWALIA, Jarry AHLUWALIA, Mohan AHUWALIA, Jarry A’WALIA, and Jarry WALIA.

Investigators believe there are community members who may have any additional information pertaining to this investigation and they are asked to contact the Child Abuse and Sexual Assault (CASA) Unit at 905-825-4747 ext. 8970.

Be reminded that all persons charged are presumed innocent until proven guilty in a court of law.

Due to the fact this investigation is ongoing, no further details will be provided regarding this investigation.

Every person has the right to feel safe in our community.

Victims of violence and/or sexual assault and witnesses are encouraged to contact the Halton Regional Police Service. The following is a list of valuable support services and resources in Halton region for victims of violence and/or sexual assault:

• Halton Regional Police Service Victim Services Unit 905-825-4777

• Nina’s Place Sexual Assault and Domestic Assault Care Centre 905-336-4116 or 905-681-4880

• Sexual Assault and Violence Intervention Services (SAVIS) 905-875-1555 (24-hour crisis line)

• Radius Child & Youth Services 905-825-3242 (Oakville) or 1-855-744-9001

• Kid’s Help Phone 1-800-668-6868 (24-hour crisis line)

• THRIVE Counselling 905-845-3811 or 905-637-5256

Traffickers need customers – some attention needs to be paid to the people who deal with human traffickers.

By Pepper Parr By Pepper Parr

December 23rd, 2019

BURLINGTON, ON

Gift sent to the Office of the Mayor Mayor Marianne Meed Ward received a number of Christmas gift baskets from several developers. She sent them along to different community organizations with a note suggesting that a Christmas card was more acceptable.

One Gazette reader asked if members of City Council received gift baskets.

We don’t know – so to members of City Council: Did you receive a gift basket from any developer – and if you did what did you do with the gift

Ward 1 Councillor, Kelvin Galbraith

Ward 2 Councillor, Lisa Kearns

Ward 3 Councillor, Rory Nisan

Ward 4 Councillor, Shawna Stolte

Ward 5 Councillor, Paul Sharman

Ward 6 Councillor, Angelo Bentivegna

We will let you know what we learn.

By Pepper Parr By Pepper Parr

December 23rd, 2019

BURLINGTON, ON

It is a common business practice to send a gift to the people one does business with at Christmas. In my errant youth while working in the financial sector the practice was to send along a case of Single Malt. Those days are long gone.

The development community maintains the practice but uses gift Baskets to convey their season’s wishes.

A social media moment indeed. Mayor Marianne Meed Ward’s office received a number and posted her policy about gifts on her Facebook page and in a Tweet she sent out.

Mayor’s Office got several holiday gift baskets from developers.

“My personal policy is not to accept gifts from this with current/pending before city council.

“Baskets found a good home Halton women’s Place and Welling Square Friday Community Dinner.

“In future a Christmas card suffices to spread holiday and Christmas cheer.

She suggested that in future gifts be directed to people in need.

One Gazette reader commented: Pretty empty gesture, however, when you’re giving the downtown away. Nice photos though – and another social media moment.

Yet another pointed out that Provincially, you aren’t permitted to accept any gift. Keeps things very simple and very clean.

Another asked if the other members of council were favoured – and if they were what did they do with anything they might have received.

Good question. Let’s ask them

Provincially, you aren’t permitted to accept any gift. Keeps things very simple and very clean.

By Staff By Staff

December 23rd, 2019

BURLINGTON, ON

The Halton District School Board is hosting several Pathways Information Evenings in January 2020 to allow Grade 7 – 12 students and their families to explore program opportunities offered at high schools in Halton.

The Board offers more than 80 regional Pathways Programs designed to meet individual needs and help students succeed after high school, whether they are pursuing a pathway toward apprenticeship, college, community, university or the workplace. The Information Evenings help students to be better prepared for a rapidly changing world while receiving a relevant and engaging education.

All are welcome to attend and registration is not required.

The meetings will be held at the following locations from 6 – 8 p.m.:

Tuesday, Jan. 14, 2020: Georgetown District High School, 70 Guelph Street, Georgetown

Thursday, Jan. 16, 2020: Craig Kielburger Secondary School, 1151 Ferguson Drive, Milton

Tuesday, Jan. 21, 2020: Garth Webb Secondary School, 2820 Westoak Trails, Oakville

Tuesday, Jan. 23, 2020: M.M. Robinson High School, 2425 Upper Middle Road, Burlington

Pathways Programs include the Specialist High Skills Major programs, Ontario Youth Apprenticeship programs, Specialty School to Career programs, the Employability Skills Certificate program, Dual Credit college programs, Grade 8 – 9 Transition programs, and more.

Agenda for Pathways Information Evenings:

6 – 6:30 p.m. – Pathways displays and meet the Pathways Program teachers

6:30 – 7 p.m. – Pathways presentation (programs and planning for post-secondary)

7 – 8 p.m. – Teacher displays and elementary transition to high school workshop

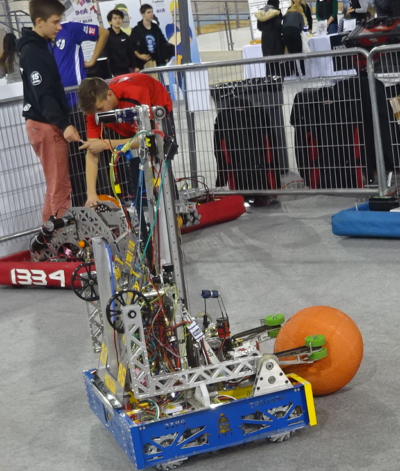

High school show that they have been able to do with robotics. The piece of business was built to be able to , find, pick up and throw a basketball. The Halton District School Board recently held a Find the Fit event at the Mattamy Velodrome in Milton where more than 1500 students from within the Region spent two hours talking to people from institutions offering different academic programs and getting a sense of what was out there in terms of post high school programs.

Superintendent of Education Julie Hunt Gibbons Superintendent of Education Julie Hunt Gibbons is responsible for for Secondary curriculum and school program, Student success and Pathways destinations, Elementary schools: Brookdale, Eastview, Gladys Speers, Oakwood, Pine Grove, WH Morden and TA Blakelock High School.

She said that preparing students for high school is a much different challenge than it was a decade ago. The world these students are going to work within is a lot more complex and ever changing than anything their parents took part in.

Many of the jobs that exist today will not exist when they graduate from high school – education for them is going to be a lifelong task.

By Pepper Parr By Pepper Parr

December 23rd, 2019

BURLINGTON, ON

Getting your name in the news.

The Burlington Foundation last week announced the establishment of the Pasquale (Pat) and Anita Paletta Foundation Fund through a generous gift of $500,000.

Recently unveiled at Burlington Foundation’s 20th anniversary celebration, the gift was announced by businessman and philanthropist Angelo Paletta on behalf of the Paletta family. Honoured as Burlington’s 2019 Distinguished Philanthropist, Angelo was joined by family members including mother Anita, and brothers Michael, Paul and Remi as together, they also shared in receiving a posthumous honour awarded to their family patriarch, Pasquale (Pat) Paletta, for his lifetime of community giving.

The Paletta family’s generosity to community has been evident since the early 1970’s. Since immigrating to Canada in 1949, the Paletta family have established many successful business enterprises across meat packing, real estate development and the entertainment industry, achieving local and national success. Through their achievements, the Paletta family have demonstrated a generous commitment to many local charitable needs and causes including notable contributions to Joseph Brant Hospital, Carpenter Hospice, Paletta Lakefront Park and Mansion, and the Tansley Woods Community Centre.

The Paletta Family at the Burlington Foundation event honouring the $500,000 Leadership endowment. “By establishing this foundation fund, we’re proud to honour the long-term commitment of giving generously to the community in which we live and work, that has been modelled by my father and mother,” says Angelo Paletta. “Through partnering with Burlington Foundation to establish this endowment, we are thrilled that our family’s community legacy will continue to grow for generations beyond.”

“It is an honour for Burlington Foundation to further our long-standing partnership with the Paletta Family and support their desire of continuing to make an ongoing impact in our community,” says Colleen Mulholland, President and CEO, Burlington Foundation. “We look forward to building upon their dedication to philanthropy for many years to come.”

The second news item was different in tone and much different in the number of dollars involved.

A Canadian Tax Court ruling, Paletta v. The Queen, the taxpayers’ attempt to break into the Hollywood movie business was a flop.

In this case, the Tax Court of Canada (TCC) held that the taxpayers’ contractual arrangement was nothing more than an attempt to claim tax losses and so the TCC confirmed the Canada Revenue Agency’s (CRA) decision to disallow US$96 million in partnership losses. The TCC’s basis for its decision was that option agreements – which were key elements of the transactions under appeal – were a sham.

The TCC also considered the government’s alternative argument should the sham doctrine not apply. In that regard, the TCC held that, if the option agreements were not a sham, the TCC would have dismissed the appeal on the basis that the property the appellants purchased was an unregistered tax shelter.

This tax alert focuses on the TCC’s sham analysis, as this was the primary basis for dismissing the appeal.

Relevant facts

Secret of the Tomb grossed over $363 million at the box office. One of the appellants was Paletta International Inc. (Paletta International), a corporation that operated several businesses including real estate and farming businesses. In 2006, Paletta International borrowed US$212 million from the Royal Bank of Canada (RBC) and invested the borrowed funds, along with US$8 million of its own funds, into a limited partnership (LP). Paletta International was the sole limited partner of the LP. The LP used US$128 million of the capital investment it received from Paletta International to purchase a worldwide perpetual copyright for the movie ‘Night at the Museum’ (the Film) from Twentieth Century Fox Film Corporation (Fox). The Film had not yet been released in theatres.

The LP then used US$82 million of the capital investment it received from Paletta International to pay for the print and advertising expenses related to the Film. As a result, the LP reported non-capital losses of US$82 million from the print and advertising expenses, the majority of which were allocated to the limited partner, Paletta International. As part of these transactions, the parties agreed that Fox would have the option to reacquire the Film at essentially the cost of the Film plus 97 percent of the print and advertising expenses incurred by the LP (the Option Agreement). Fox exercised its option to reacquire the Film shortly before the Film was set to be released in theatres.

Angelo Paletta (Mr. Paletta), the other appellant, completed identical transactions with RBC and Fox for a second movie, ‘The Day the Earth Stood Still’, and similarly claimed non-capital losses in respect of the second movie. Due to the identical nature of the transactions, the TCC focused its analysis on the transactions related to the Film and applied the decision to both series of transactions.

The sham doctrine

The TCC set out the relevant jurisprudence and principles related to the sham doctrine. In particular, sham documents are ones that “give to third parties or to the court the appearance of creating between the parties’ legal rights and obligations different than the actual legal rights and obligations”. Furthermore, The TCC cited that for tax, “the Court will arrive at a finding of sham when the evidence shows that the parties misrepresented their arrangements in a bid to achieve a tax benefit that would be denied if the nature of their arrangements was properly disclosed”.

The government’s position was that the transactions were a sham because Fox “never truly transferred” the Film to the LP. Simply put, the government argued that the LP never owned the copyright to the Film, had no right to earn income from the Film and did not incur expenses for the purpose of earning income.

The TCC’s analysis regarding sham

To determine whether the transactions constituted a sham, the TCC first looked to the conduct of the appellants. Testifying on behalf of the appellants, Mr. Paletta stated that he entered into these transactions to earn revenue from the distribution of the Film. He stated that, although he was aware of the Option Agreement, he hoped Fox would not exercise its option. Mr. Paletta testified that he had estimated the likelihood of Fox exercising its option was 50 percent and he was confident that if Fox did not exercise the option, the appellants could earn a substantial return from the distribution of the Film.

No one from Fox testified as to why Fox entered into these transactions. Based on the evidence, the TCC determined that Fox’s purpose for entering into the transactions was to save three percent on the print and advertising costs that it was going to incur related to the Film. In other words, the TCC held that Fox did not have any intention to sell the Film and that Fox’s benefit from taking part in these transactions was to offset some of its expenses related to the Film.

Finally, the TCC believed that the transaction documents would have resulted in unintended consequences for the parties if Fox did not exercise the options. For example, the distribution agreement (pursuant to which Fox retained distribution rights to the Film) provided that Fox would pay a percentage of the profits from the distribution of the Film to the LP for 15 years. However, the security agreements permitted Fox to hold payments owing to the LP in its collateral account until the expiry of the distribution agreement. In other words, Fox, in its sole discretion, could withhold all payments to the LP for 15 years. When the TCC raised this issue to Mr. Paletta, he stated that he would not have entered into the agreements if he had known that Fox could withhold the profit payments for 15 years.

TCC’s conclusion on sham doctrine

The film grossed $79,366,978 domestically and $153,726,881 in foreign markets, a total of $233,093,859. The TCC held that the Option Agreement was a sham because, based on the circumstantial evidence, the LP never intended to earn income from the Film due to the TCC’s finding that the parties agreed that Fox was going to reacquire the Film before it was released in theatres. Therefore, the TCC concluded that the LP (and, by extension, the appellants) did not incur the print and advertising expenses for the purpose of earning income. Instead, the appellants entered into the transactions “solely to avail themselves of the tax savings that the promoters led them to believe they could expect and that they felt secure in the knowledge that Fox had agreed to reacquire the films prior to their commercial release”.

In summary, the TCC held that the Option Agreement was a sham because (1) the appellants entered into the transactions to obtain the partnership losses, (2) the appellants expected that Fox would exercise its option to reacquire the Film and (3) Fox had agreed in advance to exercise its option. Interestingly, the TCC’s basis for finding that a sham existed was different than the government’s basis for alleging sham. As set out above, the government’s position was that, notwithstanding the transactions and agreements, Fox did not relinquish the Film and the LP never acquired the Film. The TCC did not find that the LP’s acquisition of the Film was a sham that was designed to misrepresent the parties’ agreement. Instead, the TCC held that the Option Agreement was a sham because it was not, in fact, an option, but a pre-arranged agreement pursuant to which Fox would reacquire the Film. Furthermore, only one element of the Option Agreement was a sham: the purported option element. The TCC therefore treated the Option Agreement as a “reacquisition agreement”.

Will Paletta cause the CRA to increase the use of sham as an assessing basis?

It will be interesting to see if the CRA uses Paletta as a precedent to reassess taxpayers under sham more frequently. Based on the TCC’s application of the sham doctrine in Paletta, the CRA may look to apply the sham doctrine to specific elements of agreements between taxpayers rather than simply applying it to whole transactions. The appellants have appealed the TCC’s decision to the Federal Court of Appeal, so some clarity on the sham doctrine may be obtained in the near future.

The Gazette will report on any decision from the Federal Appeal Court.

The bulk of the information on the tax court case came from RSM: Audit, Tax and Consulting Services to Help Middle Market Leaders Succeed media release.

By Staff By Staff

December 22, 2019

BURLINGTON, ON

For those who don’t believe in honest work – the chance to scam someone is something they can’t resist. This message came to us from:

Amazon <noreply-in-support.d79tqzglfbf90awhp@app.mailbox.com

The following came our way.

There is something unusual in your account, you are trying to buy a gift card with no known security and avoid a danger.

We inform your account on the close. We request information that this is you. account.amazon.com.

T33o36 88d46a11t61e12,25 57A85m42a79z74o35n73S78m70i25l41e16 83h16a28s35 72d90o32n64a25t22e75d48 48a64 85t50o25t87a65l73 72o98f53:47

• Device : Mozilla/5.0 (Windows NT 6.1; WOW64; rv:50.0)

• IP : 184.154.83.119

• Date : 12/21/2019 04:48:55 am

The scammers never stop. Be vigilant. If it looks fishy – it is.

By Staff By Staff

December 22, 2019

BURLINGTON, ON

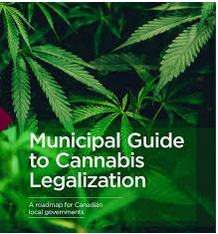

The application for a cannabis retail store at 3007 New St. is now up for public comment. Once approved it will be the fifth retail store in Burlington. It will be called Corner Cannabis – New Street.

Written comments about the proposed location will be received by the AGCO until Jan. 3 and may be submitted online at www.agco.ca/iAGCO. The AGCO will accept submissions from: Written comments about the proposed location will be received by the AGCO until Jan. 3 and may be submitted online at www.agco.ca/iAGCO. The AGCO will accept submissions from:

• A resident of the municipality in which the proposed store is located

• The municipality representing the area in which the proposed store is located and/or its upper-tier municipality.

Comments submitted to the AGCO should relate to the following matters of public interest:

• Protecting public health and safety

• Protecting youth and restricting their access to cannabis

• Preventing illicit activities in relation to cannabis

After Jan. 3, the AGCO will consider all written comments and available information to decide whether the application for the proposed store location will be approved.

On Jan. 14, 2019, Burlington City Council voted to allow the operation of retail cannabis stores in Burlington.

By Staff By Staff

December 20th, 2019

BURLINGTON, ON

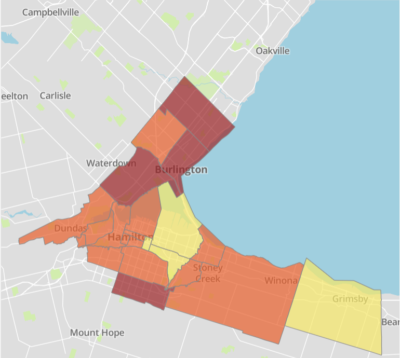

Click on the link to the left – highlighted in red and learn what housing costs in different parts of the country. This is the time of year when “home” is the most important place for everyone.

Most people know more than enough about the cost of housing in Burlington but there isn’t much in the way of data on the cost of rental properties.

The Canadian Centre for Policy Alternatives published a number of reports in 2019 that set out an interactive graphic that allowed you to dive into the data.

Give it a go – surprising how much the different communities cost out.

The data highlights the need for a minimum wage that is higher than $14 an hour and the need for accommodations that are actually affordable.

By Staff By Staff

December 20th, 2019

BURLINGTON, ON

A drab looking city hall – were it not for the poinsettia you’d never know it was Christmas. There is a small Christmas tree to the left of the Security Desk The ground floor of city hall might be a little drab looking but there is nothing drab about the Mayor’s office and the Christmas get up she and her staff wore.

This is the team that gets the Mayor through a day. We don’t see the eggnog container – but there has to be one for that crew to behave this way. A Santa wasn’t seen in the lobby area – that might be due to the cancellation of the Santa Claus parade.

The Karma is amazing.

By Staff By Staff

December 20th, 2019

BURLINGTON, ON

Taxes to keep the city operating. City hall released the following:

City tax increase of 3.99%

The Gazette reported that yesterday.

The approved tax increase of 3.99% includes:

Investments to maintain City services

1.33% to ensure the continued delivery of high-quality services

Investments in infrastructure renewal

1.25% dedicated to the renewal of existing city infrastructure.

Major capital projects in 2020 include:

• Revitalization of the Skyway Community Recreation Complex

• Resurfacing of New Street, between Walkers Line and Burloak Drive

• Repair and renewal of assets at numerous community centres and pool facilities

• Minor reconstruction of Canterbury Drive.

Investments to address climate change impacts

0.82% dedicated to assets and initiatives that support sustainable infrastructure and a resilient environment, including:

Another Handi-van added to the fleet • Four new conventional buses and eight additional drivers, plus a new specialized transit vehicle (Handi-Van) and driver

• Free transit for children age 12 and under

• New electric vehicle charging stations at City facilities such as arenas and community centres

• A new private tree bylaw program

• Updates to the Urban Forestry Management Plan and a new tree planting initiative

• Funding to complete a Climate Change Adaptation Plan, support for the Bay Area Climate Change Partnership, and resources to implement the Climate Action Plan.

Investments to address risk management and other corporate priorities

0.59% dedicated to enhancing customer service and supporting the implementation of Burlington City Council’s four-year work plan, Vision to Focus, including:

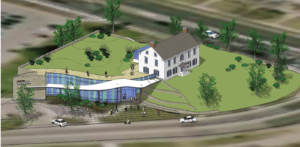

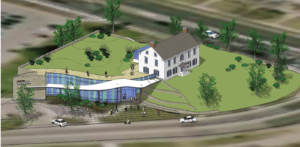

Staffing needed for the re-vitalized Museum. • Enhanced parks and winter maintenance operations, including sidewalk snow removal

• Four years of the Home Fire Safety program

• Improvements to cyber security resilience

• Temporary staffing to operate the newly expanded Joseph Brant Museum

• Programming at the Burlington Performing Arts Centre that celebrates all cultures.

Burlington Mayor Marianne Meed Ward said: “Council and our community should be proud of this budget that focuses on transit, trees, and green infrastructure, among other needs. We had to whittle down requests from Council that would have put us at a 7.5% city-tax increase if they had all been approved. We aimed for enhancing services, renewing aging infrastructure and responding to the needs of a growing community, while keeping your pocketbooks in mind. We made some tough, but strategic decisions for the 2020 budget, and the priorities reflect those of our community.”

Joan Ford, Chief Financial Officer added that: “The 2020 budget focuses on providing strategic investments aligned to the City’s four-year work plan, Vision to Focus, and Burlington’s 25-year Strategic Plan. At the same time, it provides investments to ensure the continued delivery of high-quality services, renewal of Burlington’s aging infrastructure, and funding for new community programs and initiatives.”

The total annual increase to property taxes for a home assessed at $500,000 is $96.70.

By Pepper Parr By Pepper Parr

December 20th, 2019

BURLINGTON, ON

When Myles Rusak appeared before a Council Standing Committee last week he set out some of the Sound of Music (SOM) longer term thinking and the objectives they had in mind. He was short about $40,000 of the budget he needed to accomplish the bigger plan.

Myles Rusak, Sound of Music Executive Director pitching City Council for financial support. He explained to Council that it was going to take the SoM a couple of years to get some realistic lift-off and asked Council for the $40,000 + each a year for three years needed to meet the SoM long term plan. Rusak said that he thought the funds could come from the Municipal Accommodation Tax that is expected to come into force early in 2020.

Mayor Marianne Meed Ward didn’t see it quite that way. She commented that council will decide where any MAT money goes.

Rusak had suggested that the SoM might get attached to the Municipal Accommodation Tax (MAT) that municipalities can now impose.

This new tax would apply to hotel and motel rentals. The first serious look at the tax suggested that an estimated $750,000 – $1 million of annual revenues in Burlington. 50% of that would go to Tourism Burlington – the balance would go to the city to be distributed as they saw fit. Sound of Music wants to be on that gravy train.

The tourism people are certainly onside. In March the Tourism Burlington Board of Directors unanimously approved the feedback received during stakeholder consultations. Those recommendations include:

The Board of Directors supported the adoption of a 4% Municipal Accommodation Tax on the assumption that the core funding support from the City of Burlington for Tourism Burlington remains in place and that the MAT funding be considered incremental.

From 2007-2010 the Burlington Hotel Association collected a voluntary Destination Marketing Fee (DMF) with the goal of increasing visitation to the city and overnight stays.

The City has a Tourism Service Agreement with Tourism Burlington that was put in place in 2015:

The goal of Tourism is to reduce its dependence on funding from the City. All acknowledge that the receipt of funding from the City is essential to the performance of the business and responsibilities of Tourism provided for under the Agreement.

Tourism Burlington has an Information Centre with all kinds of material and staff that will answer questions. Tourism works independently and co-operatively with the City to reduce its dependence on funding from the City and secure its own revenues by way of soliciting sponsorships and donations to provide and support the tourism undertakings and responsibilities herein.

The annual operating grant provided by the City to Tourism will not be reduced as a result of any participation by Tourism in any destination marketing program implemented in Burlington which may provide funds to Tourism for any new or enhanced initiatives beyond the scope of services provided hereunder.

A continued commitment by Municipal Council to a sustainable and predictable source of core operating funds for Tourism Burlington will enable Burlington to become a more significant participant in a very competitive tourism sector. By continuing to provide core funding, monies generated through the Municipal Accommodation Tax would bolster tourism promotion and development opportunities that would not otherwise be possible if Tourism Burlington was restrained by its existing annual operating budget.

Replacing Tourism Burlington’s core funding allocation from the City of Burlington with the revenues generated from the Municipal Accommodation Tax would merely maintain the status quo and would not achieve the intended purpose of the legislation which is to grow the tourism sector in the municipalities that adopt the accommodation tax.

The municipal portion of the MAT would be allocated to destination development initiatives that will be beneficial to visitors and residents.

The provincial legislation allows the remaining MAT funds can be retained by the municipality. Since this money is generated through accommodation room revenue, the remaining funding should be set up as some type of reserve fund to assist with destination development/ tourism capital projects and initiatives.

Tourism Burlington publishes a Guide for Visitors to the city. Economic development stakeholders and the City would work together to develop fund parameters and criteria to ensure return on investment and community benefits. The accommodations interviewed strongly support this approach. It is imperative to see growth in hotel occupancy and revenue particularly with new properties opening in the area over the next few years increasing competition.

The Bridgewater will at some point actually open and the hotel that is part of the development will want to be very active in promotions.

The Waterfront Hotel has plans to demolish the existing structure and build something much bigger and much higher. These two hotels will add significant capacity to the city and will add to what is collected in the way of the Accommodation tax.

Short-term rental (STR) accommodations such as Airbnb, HomeAway, will also collect the MAT.

During discussions with the local accommodaters they unanimously recommended that all accommodations be included so that it would level the playing field. It is recommended that short-term rentals be Phase 2 of the MAT plan as it will take time to negotiate agreements with the various companies. At a recent industry forum on MAT it was suggested that before agreements are established with STR that municipalities consider updating their by-laws. For example, some cities have restricted short-term rentals to principle residences.

The Bridgewater development includes a hotel – that will at some point will open. Tourism Burlington will develop an integrated strategy for the MAT funds that will include the development of guiding principles, identification of target audiences, performance measures and strategic partnerships to ensure return on investment for the local tourism industry.

Tourism Burlington worked in conjunction with the Hotel Association, the Marketing Committee and Board to develop a comprehensive DMF marketing plan which included campaigns, sales missions and incentives.

Burlington’s parking meters are a challenge for any visitor Regional data sets out the extent of tourism in Burlington.

Total visitor spending $303.5M ($101M Burlington)

Total person visits 4.3M (1.4M Burlington)

25% are overnight visitors

87% of overnight stays are with friends/relative

Purpose of trip

64% are visiting friends & relatives

22% pleasure trip

6% business/conferences

5% shopping

Average nights stayed 2.1

Average age: 44.8 years

Burlington at one point had a Visitor Information Booth in Spencer Smith Park – 1970. In 1985 the city worked with local tourism partners to formally strike a Visitor & Convention Centre Board. This non-profit organization evolved to become Tourism Burlington (TB) which was incorporated in 2005 and is overseen by a volunteer board of directors.

Waterfront hotel – due to be demolished and replaced with something a lot taller. TB is funded by and has a service agreement with the City of Burlington. Other sources of revenue include federal and provincial grants primarily for summer students, cooperative marketing initiatives such as their guide, maps and sale of souvenirs.

TB has 3 FTE’s who are supplemented with part time weekend and summer travel counselors and over 1,000 volunteer hours. There are 1,889 tourism businesses and 24,491 tourism jobs in Burlington.

There is an opportunity to grow tourism in the city – it will be interesting to learn what Tourism Burlington plans to do going forward – they are going to have close to half a million dollars to spend so the problem will not be funding. To bring about real tourism growth the TB will have to be very creative – something we have not seen all that much of from the tourism people.

City Council did give the Sound of Music the $40,000 + they needed for 2020, but the funding was just for the one year. They will have to come back next year with their hands out.

By Pepper Parr By Pepper Parr

December 20th, 2019

BURLINGTON, ON

More than eight years ago during a conversation with then Mayor Rick Goldring he remarked on how surprised he was when people would approach him in the supermarket or at some event and chat him up. It wasn’t something he expected when he was elected Mayor.

There were different views on Rick Golding’s effectiveness as a Mayor – but there was never any doubt that he cared passionately about his city. See him in a Santa Claus parade collecting loonies and twonies in a sock. But it is what people expected of their elected representatives. In Burlington people want to keep that small town feel and know that they can approach their member of city council to talk about a problem or a concern. The practice then, for many of the council members, was to give the citizen their business cards and ask them to call their assistant, explain the problem and the Councillor would follow up and make sure it was taken care of.

Then something changed. Not sure where the change came from. We recall conversations a number of years ago from a General Manager (when Burlington had General Managers) about installing a CSR (Customer Service Response) system – this was supposed to handle all the communications problems.

The Gazette is in touch with members of Council frequently – the level of response varies, most get back quite quickly. There is one who said he had been told “not to talk to you” when we approached and asked a question.

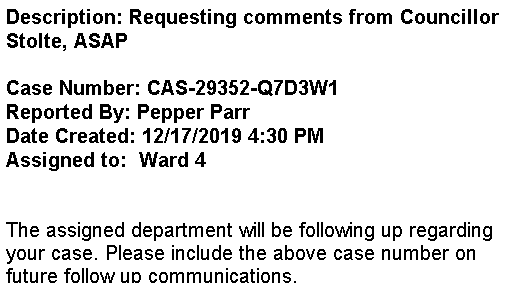

We recently sent a note to a member of Council and used the new system – the one where you enter the ward number – ward4@burlington.ca – if you wanted to reach Shawna Stolte.

Here is what came back to us:

Being referred to as a “case number” didn’t strike me as all that customer friendly.

Maybe times are changing and it will all come down to each of us being a “case” with a number from which all our questions will be answered.

How much did the city spend on the system that assigns me my case number and are we getting value for those dollars?

Perhaps the problem is the Councillors just don’t have the time needed to respond to all the calls.

There is a solution to that problem – add more Councillors. But that is not likely to happen for one reason – it would impact on the financial interests of the current members of Council.

Burlington has seven seats on the Regional government Council. If we added Council member they would not get a seat at the Regional level and not earn the $50,000 +/-

Oakville solved that problem by having members of Council that are Regional Councillors as well as town Councillors and some who are just town Councillors.

There are seven members of council in Burlington – are they able to meet the needs of the people they represent? It is a direction Burlington should at least be looking at – soon, so they can be in a position to approach the electors in the 2022 municipal election with a council structure that meets the needs of the citizens.

Don’t expect the current council to put that kind of initiative on the table.

Salt with Pepper is the musings, reflections and opinions of the publisher of the Burlington Gazette, an online newspaper that was formed in 2010 and is a member of the National Newsmedia Council.

By Pepper Parr By Pepper Parr

December 19th, 2019

BURLINGTON, ON

The good news is that the Interim Control Bylaw (ICBL) Land-Use Study was produced within the one year time frame Heather MacDonald, Executive Director of Community Planning, Regulation and Mobility, said it would be done in.

It will be formally presented to Council at a Statutory meeting on January 14th. In the meantime the report – 135 pages long – will be closely read and re-read by the development community, their advisors and their legal counsel. All those billable hours will be racked up and billed before the end of the year.

Too early to say whether or not this is a gift to anyone.

Heather MacDonald, Executive Director of Community Planning, Regulation and Mobility In a statement released by the city, Heather MacDonald, Executive Director of Community Planning, Regulation and Mobility said: “The recommendation to implement an ICBL was brought forward by City staff in response to two primary concerns, including growth pressures that continue to emerge for the lands in the study area and a need to review the role and function of the John Street Bus Terminal as a Major Transit Station Area (MTSA).

Is this John Street Bus Terminal a Major Transit Station Area or just a place where you can buy a bus ticket? With the findings of the study in hand, City staff will come back to City Council on Jan. 14 with proposed amendments to the current in-force-and-effect Official Plan and Zoning Bylaw that will make it possible for new development in the identified study area to be better informed by the City’s transit, transportation and land use vision.”

The staff recommendation report and proposed amendments can be viewed online.

The full Dillon report is HERE

The purpose of the proposed Official Plan and Zoning Bylaw amendments is to:

• strengthen the integration between land use and transit by introducing policies related to transit-supportive development

• introduce the concept of Major Transit Station Areas and a policy framework

• introduce development criteria for development applications within the study area

• update or add definitions to the Official Plan to align with Provincial policy documents and/or assist in the interpretation of Official Plan policies

• introduce additional permitted uses and heights on lands near the Burlington GO Station.

A review of the Land Use study will follow – soon.

By Ray Rivers By Ray Rivers

December 19th, 2019

BURLINGTON, ON

“President Donald Trump, Florida Gov. Rick Scott, Florida Sen. Marco Rubio, and others who oppose action to address human-induced climate change should be held accountable for climate crimes against humanity.” (Jeffrey David Sachs- special adviser to the UN)

He had no idea what he was doing to his body. Have we learned anything from the tobacco companies? For decades they understood the consequences of smoking and second hand smoke. But rather than changing their product, or at a minimum, informing the public, they lied – hiding the truth about the dangers, sowing confusion and misleading the public about the health hazard of their products. It was deliberate and it was manslaughter – a crime against humanity.

So now we find out that the oil companies did the same thing. Their research as far back as the fifties pointed to today’s evolving climate change. And they too established a program of disinformation and outright lies, enabling climate deniers like GW Bush and Stephen Harper to employ the uncertainty they created as an excuse to resist climate action.

Greta Thunberg Alberta’s latest enabler Jason Kenney has just opened his energy war room, furthering the notion that Alberta is under attack by the environmentalists. And he’s poured $30 million to make himself battle ready for the fight to the finish against the 16 year young Greta Thunberg and those other fearsome greenies. And the chest pounding, hype and propaganda are working.

Albertans were motivated to donate more than anyone else in the last federal election, hoping to get the pro-oil Conservatives elected. And now Kenney’s blind defence of big oil has even spilled over into the classroom. Parents at one Alberta school have threatened a teacher not to use a balanced approach, pros and cons, when it comes to teaching about the oil sands. According to the oil zealots there can be no discussion of a downside to Alberta’s biggest industry.

A few days ago Mr. Kenney rode into Ottawa to shake hands with Mr. Trudeau and pretend he wanted to mend fences, offering him one heck of a Faustian bargain. Green light another monster oil sands project and reap some kind of political peace in exchange. It was an offer he thought Trudeau couldn’t refuse. But chances are pretty good he will.

The Teck Resources proposed Frontier mine oil sands project would convert 24,000 hectares of mostly northern Alberta wetland into two massive open mine pits, a bitumen processing plant and a tailing pond for the toxic waste residue. And it would likely need another pipeline to move the estimated 260,000 barrels of bitumen a day the project will produce.

Four million tonnes of greenhouse gases (GHG) a year will be pumped into the atmosphere every year for the next 41 years. The project would last over a decade beyond the PM’s commitment to achieve net zero emissions. And that does not account for the GHG emissions resulting from burning all that oil.

Kenney did eventually shake the Prime Ministers hand. And is Kenney serious? How would Trudeau square approving this massive carbon emitting project with his 2030 emissions target. He would lose any credibility he has on the climate change file and with it the support of the third parties, whose support he is counting on for this current mandate. Mr. Kenney may not be the devil but he came to Ottawa to steal Justin’s soul and then to damn the rest of us to an ever faster and more aggressive global warming.

Look at Australia which has just experienced its hottest day ever amid the worst bush fires in the nation’s history. The massive area of scorched earth will take decades before it can be rehabilitated, its wine industry has been dealt a blow and a toxic cloud has blanketed its largest city and drifted across the Tasman Sea as far as New Zealand. The fires have emitted half of the annual GHG national contribution of carbon, and they are still burning.

Australia is the world’s largest exporter of coal, mainly to Asia. Much like Canada it has an obscene carbon footprint, not even counting the emissions from the coal it exports. It once dabbled with a carbon tax, but like we did in Ontario the Aussies booted out their environmentally conscious government for one led by a series of right wing climate action deniers.

And speaking of Ontario, premier Doug Ford is as busy as ever eliminating every single climate change mitigation program the previous government had initiated – as if somehow the climate is a partisan issue. And the provincial auditor general has warned that Ford will not come anywhere near the provincial 2030 emission reduction target. But nobody, including his environment minister, expects him to, anyway.

He means every word in the sign before him – unfortunately. So far he has cancelled the provincial cap and trade carbon pricing system, eliminated rebates for home energy conservation and electric vehicle (EV) purchases, cancelled plans for high speed rail travel, ended the provincial EV charging station program and the requirement for charging to be available in new housing. He has shut down almost 800 renewable energy projects, is fighting the federal carbon tax up to the Supreme Court, and has just canceled Hamilton’s light rail transit system.

Transitioning to a zero carbon society is unlikely to be accomplished at zero cost. But as we have already seen, the consequences of climate change will be much more costly. Just ask the Australians. And the fact is that the cost for many of the transitional changes can be phased in as existing infrastructure gets replaced. Or the costs can be redistributed and shared, like the carbon tax, to avoid major impacts for those in need.

Pennywise and pound foolish are those who would avoid transitioning as quickly as possible to a lower carbon footprint. Financial debt can be paid off, but restoring the earth’s climate and the life it supports, once we have passed a tipping point will be impossible. Which do we think future generations would object to the most? And who do you think they will blame for these climate crimes against humanity?

Ray Rivers writes weekly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was a candidate for provincial office in Burlington where he ran against Cam Jackson in 1995, the year Mike Harris and the Common Sense Revolution swept the province. He developed the current policy process for the Ontario Liberal Party. Ray Rivers writes weekly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was a candidate for provincial office in Burlington where he ran against Cam Jackson in 1995, the year Mike Harris and the Common Sense Revolution swept the province. He developed the current policy process for the Ontario Liberal Party.

Background links:

Crimes Against Humanity – Tobacco Crimes – COP 25 Madrid –

Australia – Alberta Political Donations – Teacher Threatened –

Kenney – Natural Gas – Oil Sands – Alberta War Room –

Oil Deception – More Australia – Hamilton –

By Staff By Staff

December 19th, 2019

BURLINGTON, ON

Pick the slope you want. Glen Eden will be opening the hill and spinning the lifts on Friday, December 20, 2019!

Lifts will be running from 8:30 am to 9:30 pm, which are the regular hours of operation during the season, weather permitting. Glen Eden will be closed on Wednesday, December 25 for Christmas Day but will be open on Boxing Day.

It is anticipated that Updraft Chair and Ridge Chair will be running and that Twister, Challenger, Sidewinder, Slow and Easy and Nighthawk, as well as both Learning Centres, will be open.

Another devotee who will be at Glen Eden on opening day is Travis Gerrits, former Olympic freestyle skier from Milton. Gerrits wants to be there for first tracks but he won’t be taking that first chair. Instead, he will be walking up the hill, carrying his skis, as inspired by the “earn your turns” philosophy on skiing and snowboarding.

One of the most popular spots to ski and snowboard at Glen Eden are the terrain parks, located on Nighthawk and Falcon.

There’s no better place to hang out after school or work and you won’t find a community like the Glen Eden terrain park at any other hill. This season, there will be some brand new features in the terrain park, many of which will be available on opening day.

Staff working to have as many lifts as possible running and as much terrain as possible for opening day “The team at Glen Eden has been working around the clock to make sure we can have as many lifts running and as much terrain open as possible for opening day,” says Craig Machan, Senior Manager, Kelso/Glen Eden. “We are so excited for opening day, the upcoming season and the opportunity to provide a great skiing and snowboarding experience for everyone who visits!”

“We are so proud to be able to offer an opportunity for the members of our community to ski and snowboard with their families at a hill that is affordable, approachable and close to home,” says Hassaan Basit, CAO, Conservation Halton. “The team at Glen Eden always works so hard to make each season the best that it can be, so I know that this is going to be another great season!”

Promo Cards

New this year, Glen Eden has introduced four Promo Cards to their offerings. Off-Peak is loaded with 5 lift tickets, Prime Time is loaded with 3 lift tickets, Youth Triple Play is loaded with 3 lift tickets for youth and Stay Tuned is loaded with 5 ski or snowboard tunes. (Season pass holders receive a discount on Promo Cards, so members can buy them for friends and family.) Click here for more information.

It’s a little like learning to walk – once she gets the hang of it there will be no stopping her. Lesson Programs

For those that are new to skiing or snowboarding, Glen Eden is a great place to get your start with lesson programs for all ages and skill levels. There are a number of options, including Christmas Camps, Group Lessons, Semi-Private Lessons and Private Lessons. Click here for more information, or call Visitor Services at 905-878-5011 (ext. 1221).

Glen Eden also offers a beginner lesson program, known as Discover Skiing and Snowboarding, which teaches the basics of stopping and turning. Discover is available at the beginner hills on a “first-come, first-serve basis” but bookings should be arranged for larger groups. For groups of 20 or more people, please call 905-878-5011 (ext. 1278) at least one week in advance.

By Staff By Staff

December 19th, 2019

BURLINGTON, ON

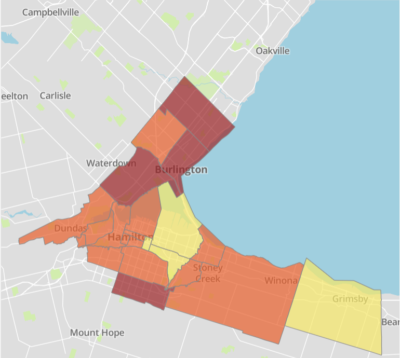

If you want to know what the growth of residential housing is going to look like for 2020 – have a look at what the Regional government approved in November.

New houses in the Alton community on the North side of Dundas Street added to the construction industry numbers. Regional Council approved Allocation Program Option #1 of up to 19,329 Single Detached Equivalents (SDEs).

This includes up to 8,716 SDEs to be allocated to the Town of Milton,

7,118 SDEs to be allocated to the Town of Oakville,

3,000 SDEs to be allocated to the Town of Halton Hills, and

495 SDEs to be allocated to the City of Burlington.

Of course single detached equivalents are not condominiums.

By Pepper Parr By Pepper Parr

December 18th, 2019

BURLINGTON, ON

The announcement that the police had a warrant to arrest Sean Baird may have had a number of people putting in calls to their lawyers.

Baird created a number of Ontario Corporations that were registered as Third Party advertisers during the 2018 municipal election that made Marianne Meed Ward the Mayor.

The Gazette was unable to elicit any comment from Sean Baird during that election – he basically said he had nothing to say.

Posters, reminding people to consider anonymously reporting criminal activity are being posted in Burlington bars and restaurants in a joint initiative between Crime Stoppers of Halton and the Burlington Restaurant Association. Taking part in the program’s launch are: front row from left, Const. Lad Butkovic, Karla Madge, Det. Const. Paul Proteau, Barry Glazier, Crime Stoppers of Halton Executive Director Dianne Hartwick and Mike Marcolin; back row from left, Ted Kindos, Sean Baird, Brian Dean, Burlington Restaurant Association President Craig Kowalchuk, Gene Quondamatteo, Mike Coles and Andrea Dodd. Baird is circled in red. The election, one of the messiest Burlington has seen in some time, pitted a lot of vested interests against a public that wanted to retain the look and feel of the city, especially the downtown core where high rise condominium development applications were flooding the city’s Planning Department.

Police react to complaints – in Ontario they don’t go looking for infractions that might have taken place during an election.

Someone has to put information before them – then they take action.

Other than a concerned citizen – there were just three people who would have taken a complaint to the police.

We do know that the Halton Regional Police Service received a complaint and that they turned to the Ontario Provincial Police for help.

The charges that were laid came out of an investigation by the OPP Anti-Rackets Branch, with the assistance of investigators from Halton Regional Police. The Regional Police would not have a lot of experience or depth with this type of criminal offence.

The Provincial Police were asked to, in the language the police use, take carriage of the complaint.

The charges laid include:

Uttering a Forged Document – Contrary to section 368(1) of the Criminal Code of Canada

Fraud over $5000 – Contrary to section 380(1) of the Criminal Code of Canada

Corrupt Practice (four counts) – Contrary to the Municipal Elections Act.

The question on the minds of many is: Who took the complaint to the police and what were the police given in the way of information or evidence?

The Gazette published the names of the Third Party advertisers – they were all numbered companies, registered by Sean Baird. It was the Gazette that brought that information to the public.

Baird wasn’t running for public office –is it reasonable to assume that he was acting on behalf of someone ? Who?

When the police eventually locate and arrest Baird (at last report the police were still looking for him), he will be interrogated and then arraigned in Court at which point everything is public.

It will be interesting to learn who will defend Baird.

Related news stories:

The numbered companies

Arrest warrant issued for Sean Baird

Hanky panky during the 2018 election campaign.

The Baird numbered companies.

By Staff By Staff

December 18th, 2019

BURLINGTON, ON

It has been a contentious issue for close to a decade.

It was impossible to find a consensus – positions were deeply divided. The environmentalists had a view point and they believe they are right; the property rights people know the environmentalists are wrong and have all kinds of documentation to show the law is on their side.

Positions taken by King George III were brought up by the property rights people who argue that the municipality don’t have the right to tell the owner of a tree what they can and cannot do with or to that tree.

City Council did get to vote on the bylaw that has several sections of which have been deferred to a January Council meeting.

The bylaw will not come into force until April 1st, 2020.

The fear amongst many in the city is that those who have trees on their property may choose to cut them down before the bylaw is in force.

Albert Facenda, a frequent council delegator. Albert Facenda, a frequent council delegator said in a Gazette comment: “Arborist’s, Start your Chainsaws and Chippers!! Between now and April 2020 tree service companies will be going crazy to get ahead of the deadline.”

Before the vote took place Councillor Paul Sharman tabled 12 amendments to the bylaw. Some were deferred but there was nothing of substance that was approved as an amendment.

Councillor Sharman: “”This Council couldn’t wait for Roseland pilot project to complete.” In his closing comments Sharman said:

“This Council couldn’t wait for Roseland pilot project to complete.

“This Council couldn’t wait for the forestry management plan.

“This Council doesn’t even know the capacity of the built area was even designed to hold a bigger UTC than 15%, this whole thing may be a wild goose chase.

“As Arborist, Thomas Wright, says, this Council does not even know whether the City has a significant loss of tree canopy happening.

“So, it is proposed that the City of Burlington impose heavy fees, possibly significant fines and replanting costs on potentially 10’s of thousands of home owners in the next 10 years all with the single ideological goal of stopping them from cutting trees down that will die in any event.

“This bylaw may trigger a number of unintended consequences, including:

1) Providing home owners, the incentive of selling their land to assemblers who will convert single family home neighbourhoods into blocks of townhomes, especially south of the QEW. All because this Council has made it prohibitively expensive to improve their homes.

2) Disincentivizing home owners from ever planting trees on their own property because when they grow to be over 20cm’s they represent a significant financial risk in the event they wish to reorganize their property.

“People will not be allowed to manage their own property without paying huge, punitive fees to the City all to protect someone’s good idea.

There were times during the private tree bylaw debate when Councillor Sharman was distracted. “The reason the Urban Tree Canopy (UTC) in the urban area is only 15% is precisely because it was developed with homes. But no one in City Hall has checked that out.

“This whole rushed and ill-conceived bylaw is premised on the desire to sustain and increase the UTC significantly, but no one in the city has bothered to check how feasible that lofty goal is. All that is being done here is a huge penalty on anyone who wishes to improve their property. The property they have worked hard to own. The city is going extort huge sums of money to satisfy an idealistic fantasy.

“I cannot support this decision Council is about to make in the complete absence of evidence. I repeat myself again, this bylaw is rushed and ill-conceived.

Councillor Stolte: “As a community …we are playing “catch up” to other more progressive municipalities. Councillor Shawna Stolte responded saying: “I by no means see this Bylaw as being “rushed and ill-conceived” as presented by my colleague on Council.

“Staff have worked very hard on this policy framework and members of the Forestry Department have worked towards this goal for nearly a decade.

“As a community we are not leading the way…we are playing “catch up” to other more progressive municipalities that enacted tree protection bylaws years ago. If these policies had not been effective, those communities would have repealed them long ago.

“One silver lining of the City of Burlington taking so long to enact our own tree protection bylaw is that we have benefited not only from the research conducted by other municipalities but also from the benefit of their lived experiences. This does not mean however that we should merely replicate another municipality’s solutions.

“We are unique, we are special and we have worked hard to collaborate and come up with an initial framework that fits our unique community.

“There remains some details to finalize, especially with the financial impact to the residents, but the purpose and objective of the bylaw is clear and I am proud to support this proactive, positive step forward for our community.”

Having seconded the 12 amendments to the Private Tree Bylaw Councillor Bentivegna had questions about many of them. The 12 amendments Councillor Sharman put forward (they were seconded by Councillor Angelo Bentivegna who at times wasn’t certain where Sharman was going).

Council Meeting December 16, 2019

1. Direct staff to prepare a Forestry Management Plan equally as comprehensive as the Oakville Urban Forest Strategic Management Plan Town of Oakville, 2008 – 2027 by Q1 2021

2. Direct staff to update the Burlington Private Tree By-Law relative to the Burlington Forestry Management Plan when complete by Q2 2021

3. Direct staff to a) compare the Burlington Private Tree By-Law to Oakville’s 2017 By-Law and explain differences, and whether to modify Burlington’s b) update the Burlington Private Tree By-Law for review at March Committee Meetings

4. Amend the Burlington Private Tree By-Law to forego replanting or cash in lieu and planting of 1st 20 cm of any tree cut down under the tree by-law application process.

5. Amend the Burlington Private Tree By-Law to revise the aggregate planting policy and replace it with the Modified Oakville replanting requirement Attachment 1 and include adjustment for tree condition.

6. Amend Burlington Private Tree By-Law to increase 2mtrs set back from house allowance (whereby no application fees or replacement is required) to equal drip distance line or 4mtrs, whichever is less

7. Amend the Burlington Private Tree By-Law to include the following clause from the Oakville 2017 By-Law “5. The provisions of this By-law do not apply to the removal of trees: (g) to permit the construction of a building or structure, where the removal, injury or destruction is required under a building permit.”

8. Amend the Burlington Private Tree By-Law to require replacement tree diameter of 30mm instead of 50mm and adjust the associated cash in lieu accordingly

9. Amend Burlington Private Tree By-Law to exclude invasive species e.g. Norway Maple from application and tree replacement

10. Direct staff to develop firm policies for the Burlington Private Tree By-Law to define forestry assessment standards in order to allow citizens to clearly understand the basis of all City arborist’s assessments, decisions and ruling to ensure transparency and accountability for the February 2020 meeting cycle

11. Amend the Burlington Private Tree By-Law to exclude rural farm property other than up to 4 acres that are used for residential purposes. Exclude all wood lots that are subject to existing municipal by laws.

12. Direct staff to return of cash in-lieu funds to applicants if not used to plant trees on private property within 3 years proportional to contribution and actual plantings accomplished

By Pepper Parr By Pepper Parr

December 17th, 2019

BURLINGTON, ON

Is anyone doing a staff compliment count?

How many people have been added to the number of people who are, or will be, on the city payroll ?

There will be eight more bus drivers by the end of next year; three are to be added to the Forestry department – that number could go to five.

The Municipal Accommodation Tax will put dollars into the Tourism budget – that money will have to be spent. The Customer Service unit is being created, which means finding a new city Clerk. Will it also mean additional staff for the Customer Service Unit that the current city Clerk is going to head up?

The Museum is going to need more staff if they are to function effectively.

Burlington has been in this situation before. Sharman, Bentivegna and Galbraith understand what a balance sheet looks like – that’s just three votes. Four are needed to put a stop to anything.

A little too early to be certain but this might turn into a tax and spend council.

By Pepper Parr By Pepper Parr

December 17th, 2019

BURLINGTON, ON

They did it.

City Council passed a private tree bylaw during debates that got close to rancorous.

A number of items that are to be in the bylaw that will become effective April 1st, 2020 were deferred to a meeting in January.

There were 12 amendments put forward by Councillor Sharman – Bentivegna seconded the amendments.

The vote was 5-2 for with Councillors Sharman and Bentivegna opposed.

The tree was cut down to make way for a development – nothing has replaced it.  A Private Tree bylaw would have saved this tree or put some serious cash in city coffers if it had been cut down. There was no bylaw in place at the time this tree came down. There is a lot that has to be adjusted before this bylaw will actually work.

Mayor Meed Ward was challenged twice on rulings she made as Chair of the Council meeting.

There were a number of delegations, two that brought solid information to the discussion.

The decision is historic for the city – will it bring about the results that this council wants? Only time will tell.

The fear amongst some is that residents will begin cutting down trees to ensure that they don’t find themselves needing permits to cut down trees – permits that could cost tens of thousands.

This is a controversial bylaw – it is going to take some very deft management on the part of the Forestry department to convince people that there is a better solution than cutting down a perfectly good tree just because, as one resident put it, “it had become a nuisance”.

This by-law has the potential to come back and bite the city, this council and the Mayor.

|

|

These offences are alleged to have taken place in the City of Burlington and the Town of Milton between January 2006 and December 2019, and involved more than one victim.

These offences are alleged to have taken place in the City of Burlington and the Town of Milton between January 2006 and December 2019, and involved more than one victim.