By Ian Allen By Ian Allen

December 10th, 2021

BURLINGTON, ON

As the decade progresses, we will look back at 2020 as the year that changed everything. The COVID-19 pandemic triggered a massive digital revolution, which saw unprecedented growth in various sectors.

The internet has turned our worlds upside down. Most of us can’t even imagine a single day without our smartphones and a stable wifi connection. It has revolutionized communication to such an extent that it has become the preferred medium of everyday communication.

The point of reference much much of our communication now. As the internet has evolved, our daily lives have become easier. You can make a restaurant reservation using your phone, order coffee, keep yourself updated with news, gamble, book flights and hotels, attend meetings, get a degree, and so on. The list is never-ending, and the online world is all-encompassing.

Here are 10 ways in which the digital transformation of everyday life has occurred!

10 ways in which the internet changed everyday life

1. Research

From AltaVista in the mid-90s to the present-day search engines like Google, Microsoft Edge, Yahoo, Bing, etc., the internet has revolutionized how we obtain information. As the internet has become the primary source of accessing information, nothing you won’t find there.

The number of queries being processed every day is massive, with Google being the web’s number one search engine.

2. Social Media and Communication

Can you recall the last time you wrote a letter to someone? Probably not. The internet has radically transformed how we routinely communicate with others. Social media networks have made it easy for us to connect with people spread across the world. Especially during the pandemic crisis, the importance of digital communication was realized. Now you can attend a meeting in Canada while being thousands of miles away.

3. E-commerce

The positive response of online marketplaces like Amazon, eBay, Flipkart, and Alibaba has made the physical location of a store almost redundant. You can order anything off the internet. With a clear voice command, you will be presented with thousands of options for the product or service you’re looking for. You can even compare the prices across the different platforms, make an online purchase, and get the best deal.

4. Entertainment

Canada, especially Ontario, has a vibrant sports scene. Canadians love their sports and place bets on their favorite team- whether lacrosse or ice hockey. There is a certain feeling of community and camaraderie during sporting events, and the rivalry between opposite teams is always competitive. So, with Covid forcing social distancing and lockdown norms, people had to be happy with whatever sporting entertainment they could find online.

From placing friendly wagers on your favorite team to trying your hand on popular casino games like blackjack, poker, or slots- it is available with a simple click on the mouse, and now you can bet on sports online in Canada! In Ontario, the sportsbook and betting industry has become one of the fastest-growing segments.

5. Streaming

Remember when you had to visit a DVD store or rent a VHS to see the latest movie? That was the past. The use of DVDs, VHS tapes, and other tangible forms of physical media is rapidly declining as the online world has taken over. Streaming apps like Netflix, Amazon Prime, AppleTV+, Lionsgate, Hulu, and so on, has made content accessible to anyone.

In fact, Netflix has more than 100 million regular subscribers at the moment. So, if you’re planning on watching the latest James Bond movie, all you need is a stable internet connection and a streaming subscription!

Dating is a different game – a lot of places – some that need to be avoided. 6. Relationships

Online dating is one of the most popular aspects of the online world. Finding love has never been so easy. The internet has helped transform how people look for and find love. There are enhanced algorithms that people are increasingly using to match their criteria and find “the one”.

In a fragmented world like ours, this has made dating easier for a lot of people. Besides, you don’t need to feel any pressure to make a move when you’re not ready. And, if you’re not looking for love, you can always find great friends on these apps!

7. Healthcare

While no one should trust medical advice on the internet, it is undeniable that the digital world has transformed the medical experience for both doctors and patients. There are wearable technologies like smartwatches that let you track your vitals. You can order medicines online from your local pharmacy or even book an early appointment with your doctor just by using the smartphone.

Mental health has become more accessible and affordable for people as you can chat with your therapist on the go or drop a text whenever you’re feeling anxious.

8. Travel

Travel planning has never been so easy or cheap. There are multiple websites for travel information, apps offering crazy discounts, Airbnb for affordable stays, Google Maps to help you navigate, and more! You can find out all about a place, from its restaurants to local sights, before you are required to board your flight.

9. Education

Even though some people may argue that the cons outweigh the pros, the internet has rapidly reconstructed the education sector. When lockdowns were declared worldwide, the internet became the only respite for students looking to advance their education. As schools started becoming online, more and more students could invest time in studying from home.

This made education more approachable for most and convenient for those who have day jobs or part-time jobs. Even for adults, it’s never been easier to go back to school and take a few classes.

However, students are indeed missing out on the school experience, proms, and graduation ceremonies.

10. Financial Services

Once upon a time, you had to visit a bank to make money transfers, pay bills, or perform the most basic financial actions. With online banking, you can send and receive money from across the world in seconds. By setting up regular payments online, you will seldom have to go to the bank.

Transactions have become hassle-free and a great advantage for those with busy schedules. These online financial services value the customer experience and are always looking for ways to innovate and personalize.

By Staff By Staff

December 10th, 2021

BURLINGTON, ON

Get there before 3 on the 13th. The Service Burlington counter at City Hall (426 Brant St.) will be closing at 3 p.m. on Monday, Dec. 13, 2021.

The counter will re-open at 8:30 a.m. on Dec. 14, 2021.

Residents can visit burlington.ca/onlineservices to access a variety of City services online.

By Pepper Parr By Pepper Parr

December 10th, 2021

BURLINGTON, ON

This is a multi part story. The first part is about what the Hamilton Commonwealth Games Bid Committee is setting out to do and the part they think Burlington can play .

The second part is about what they are planning on putting together in terms of both a site location and how other stakeholders will be involved.

The third part is the discussion that took place with members of Council and the Bid Committee.

All three parts are very enlightening. Commonwealth Games are not Olympic Games but they aren’t all that much different. This is a big deal

Get ready to hear a lot about the Commonwealth Games – there are plans in the works to have them take place in Hamilton in 2030 which will mark the 100th anniversary of the games – which first took place in Hamilton in 1930

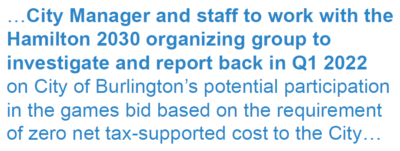

City Manager Tim Commisso met informally with the group preparing the bid. At the December 9th Standing Committee there was a delegation from Hamilton 2030 Commonwealth Games Bid committee which city manager Tim Commisso introduced and set up why they were talking to Council.

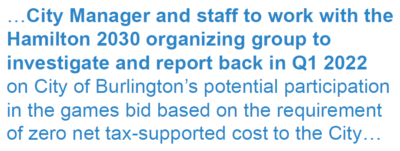

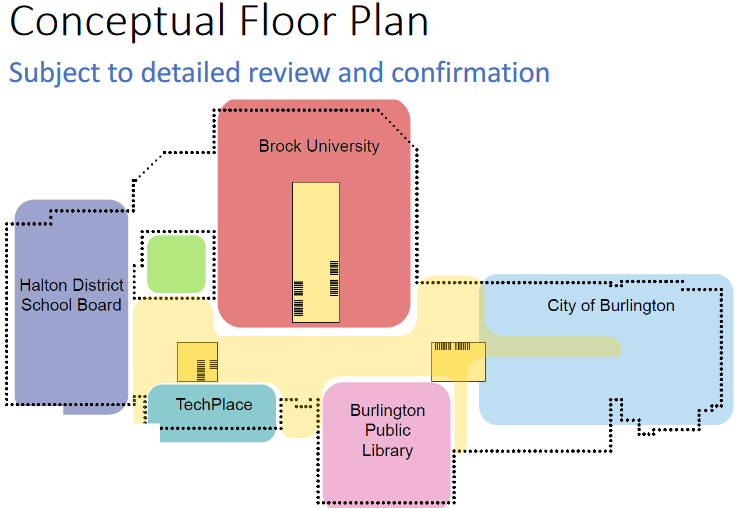

Commisso provided a bit of a context and a more in depth look at an opportunity and that is potential participation in the Commonwealth Games bid which would actually be centered in Burlington on the Paletta King Road property that fronts on Highway 401.

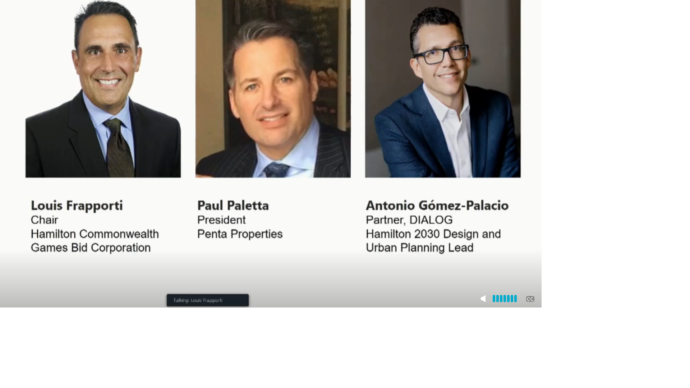

Louis Frapporti is the chair of the committee that Commisso and senior staff have had some informal discussions adding that at this point “we want to bring it forward to council to formalize a direction with respect to looking at this further by the end of March 2022 which is a relatively short turnaround.”

The team that is driving the Hamilton bid for the 2030 Commonwealth Games Frapporti then took Council through a detailed presentation during which the small lead group was introduced. It was at this point that the public learned that Paul Paletta had been made President of Penta Properties and that the Penta holdings on King Road would be the local site of the Games.

Palleta, now the President of Penta Properties spoke at length about their role in the initiative.

The King Road site was once the focus of an initiative to build a stadium for the Hamilton Tiger Cats. That idea didn’t go very far – Burlington City Council did a quick scan of what it would cost and moved away from the idea real quick. Link to that story set out below.

Antonio Gomez -Palacio CEO of Dialogue design took part in the presentation. He was engaged by the Commonwealth Games bid effort to act as the lead design curator around concept planning for infrastructure for the games. Antonio was also engaged by Penta in relation to the planning around the King Road. site.

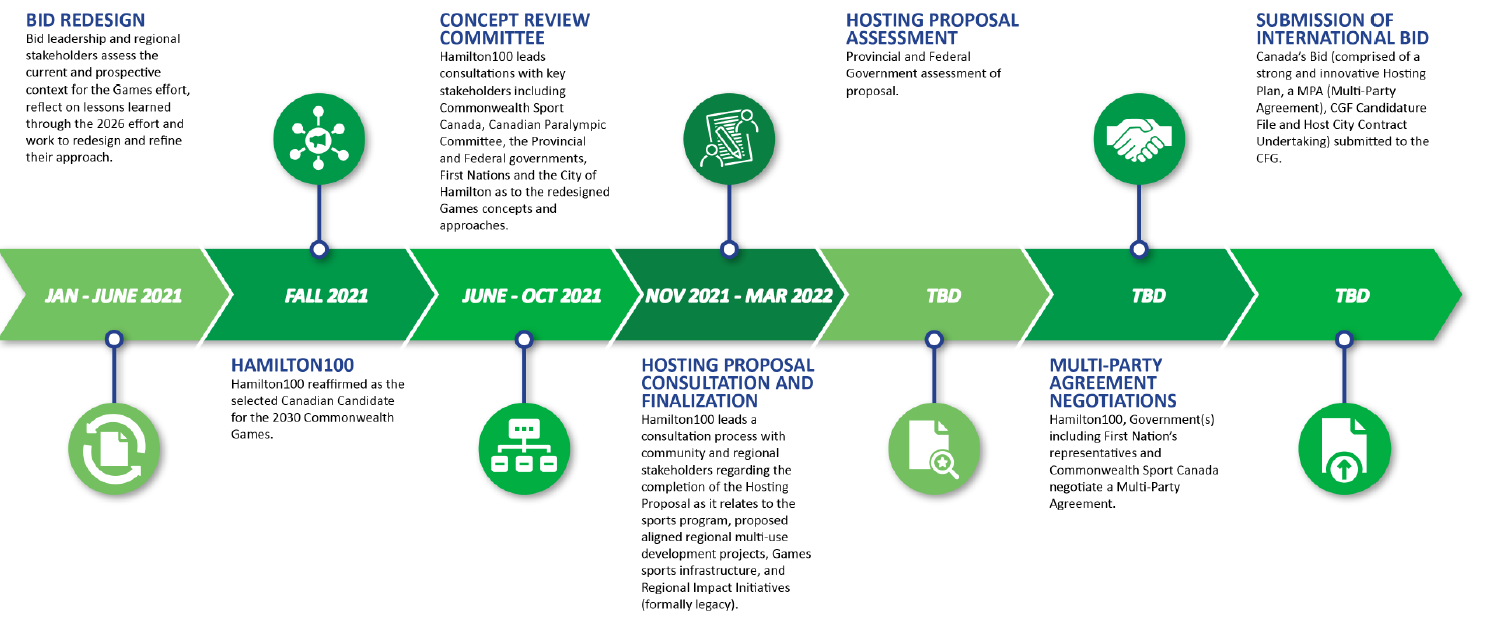

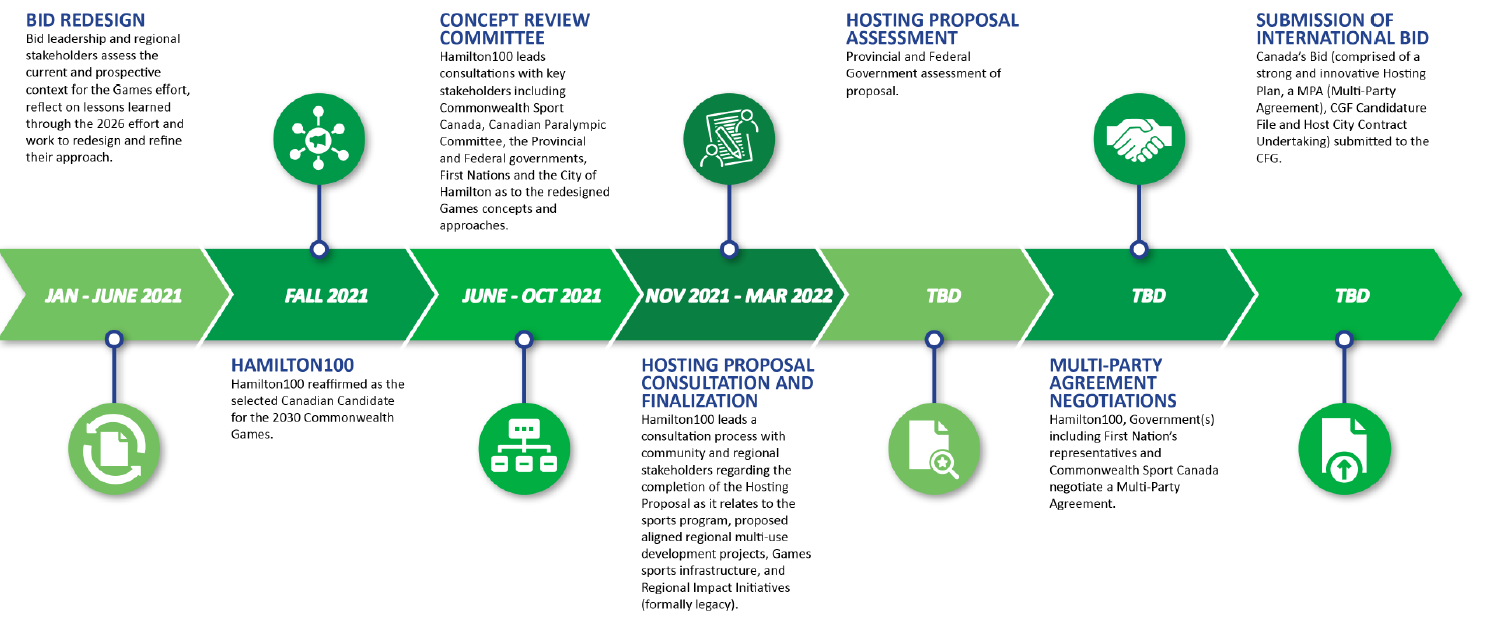

The Hamilton Commonwealth Games Bid Committee (HCGBC) has been working on bringing back the games to Ontario for over three years. The Commonwealth Games authority in Canada and the CGF in the UK, have selected and approved our community bid in relation to 2030 for international submission. The Hamilton Commonwealth Games Bid Committee (HCGBC) has been working on bringing back the games to Ontario for over three years. The Commonwealth Games authority in Canada and the CGF in the UK, have selected and approved our community bid in relation to 2030 for international submission.

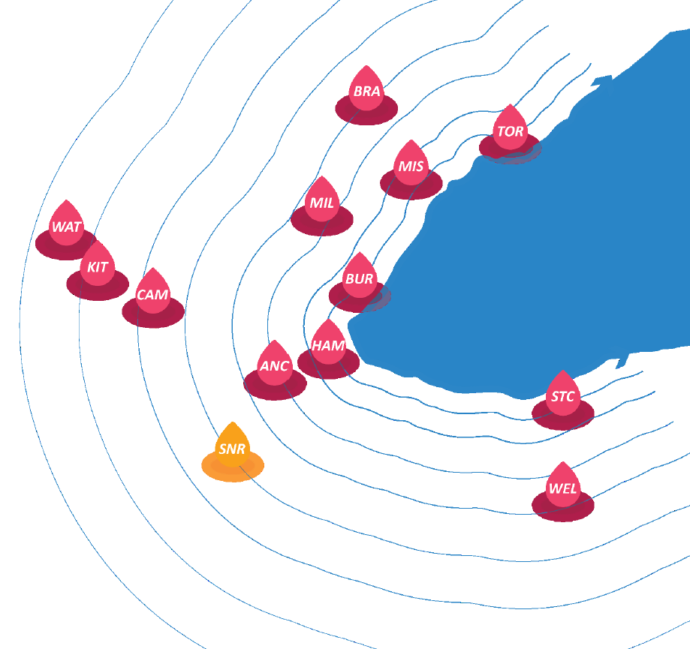

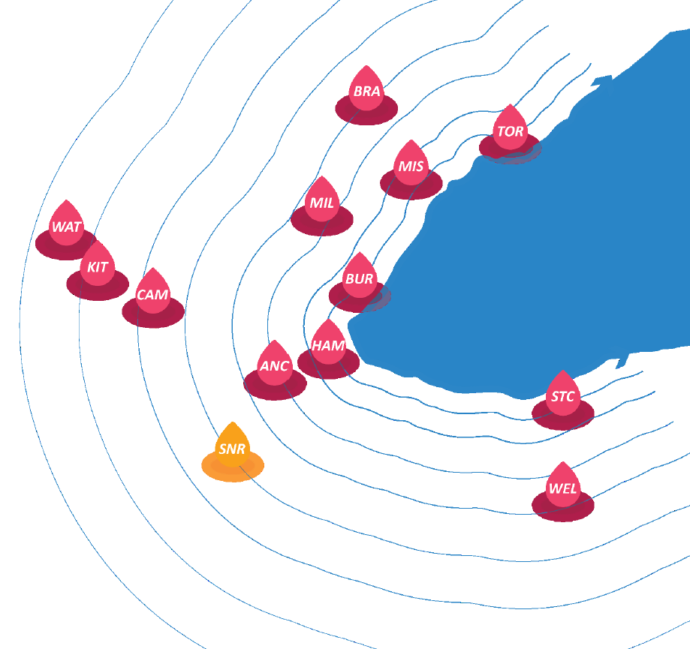

The process began years ago with 16 Canadian communities showing an interest; that was whittled down to the Hamilton bid that is now a regional bid which includes a number of municipalities.

The stakeholder group that is advancing the bid isn’t just a municipal stakeholder group; It is comprised of a variety of different types of stakeholders, including two First Nations, the Mississauga as of the Credit and Six Nations in Brampton as well as a significant array of educational institutions, Not for Profit groups, charities, private sector leaders and others who feel that this these games with their focus on social impact would be a fitting way of marking the centenary of the return of the games to Ontario and leaving a lasting legacy for the region.

The Hamilton Bid Committee is heading into the final stages of the creation of an international submission and was before Council to explain its relevance to the city of Burlington. They are working with a number of regional municipalities including the province of Ontario and the federal government to finalize this process.

“The uniqueness of this bid, said Frapporti “is an attempt at really redesigning multi sport events to make them more relevant to their communities generally and to avoid some of the challenges and concerns regarding costs, and to accelerate their impact in the region so that the citizens of Burlington and all of the adjoining regions that are part of the games bid catchment area can enjoy the benefit of its impacts immediately.

“That’s going to be done in this case by an unusual and very innovative effort to combine private sector partners into the creation and the funding of the games bid upfront, which is an innovation that we have been working to bring to the games. “

“First of all, we’re not proposing, and this is very unique in the history of games in Canada, that any municipality be obligated to provide any funding for any aspect of games infrastructure. One of the innovative elements in our effort is that private sector partners are invited and incented to work with the partner municipalities around delivery of assets that can be used by the games at private sector expense. What we’d like to do, and this is a commitment we’ve made with every municipality, and as a function of our discussions with the province and federal government is to actually use the games to advance your municipal priorities.

The site has a lot going for it – access to the site by GO services. Interestingly the Bid Committee has yet to have a conversation with Metrolinx. “We’ve had the opportunity to review your strategic planning priorities and over the course of the next few months, if we’re fortunate enough to work with you in Penta properties around the King Road site, we would look to be very deliberate in our approach to using this opportunity to address a variety of your current strategic priorities. And notably, and this again is the real innovation in efforts around bids, is to bring P3 or private sector partners into these opportunities from a development perspective, so that development opportunities can get activated immediately inspired by the games, but not dependent upon the award of the games.

“One of the things that we would have you understand in the uniqueness of the Commonwealth Games beyond their having been born in Canada in 1930, is that their value and mission statement is the beginning of building or creating peaceful, sustainable and prosperous communities.

“When I got into this effort, I began to appreciate that this wasn’t primarily about a sporting event. It was about a vision and a set of values that the Commonwealth Games and Commonwealth nations propound that we want to integrate in every aspect of the work that we’re doing. It’s, traditionally, at a very high level, the economic assessments of the games themselves as an event; please understand that this is about the event specifically, rather than the work leading up to the event, which we hope to commence with the private sector in a variety of municipalities almost immediately: Insofar as the event is concerned, the measurable impacts from the games have historically produced about one and a half billion dollars in regional GDP between 15,000 to 23,000 hours in full time equivalent jobs.

“There are and will be much in excess of 10,000 volunteers trained in a variety of disciplines for the purposes of conducting the games. The games themselves for a variety of reasons become critical magnet for attracting incremental funding. And this is important from not only senior levels of government, but the private sector. To what extent can we use the game’s opportunity with private sector partners to incent them to make commitments and investments.

“There is a timeline and critical path for the games. We’ve been at this for a number of years, the beginning of the completion of the International things is a bid and at the moment we’re working with the province and federal government and other municipalities to finalize a concept plan, which the province and federal government will then use to determine whether they wish to commence what is referred to as multi party agreement negotiations for the finalization of the bid.

“This process will take the next eight to 12 months.

Time line at this point. “We hope to have that done by the fall of this year immediately after the 2022 Birmingham games. The announcement of the 2030 host city is expected to be made in November of 2023.

“Appreciate that the work we’re doing, which is very novel, is intended to activate private sector development.

“The big concepts for our bid are not what you might expect – they don’t primarily relate to sports or sporting events. In our case consistent with the CGS priority and focus on building prosperous, sustainable and healthy communities. We are using the UN 17 Sustainable Development Goals as our design rubric.

“As Antonio will explain, are working with Dialogue and the Conference Board of Canada to integrate specific initiatives centered on sustainability and wellness as the focus of our efforts in designing the bid and we hope to activate these sustainability priorities.

“As part of all of the private sector development projects that will be part of the game’s footprint.

“As a result of two years of work looking to redesign the approach to games we came up with a number of core concepts that are important for you to understand. First of all, we acknowledge the concern by many internationally that games are overly reliant on government funding. And so we worked very hard to create a structure that prioritize private sector funding for infrastructure in relation to the games further, we created a structure which anticipates that there is no demand or expectation of prescribed municipal financial support for infrastructure. It’s not that we’re precluding municipalities from making commitments or adding value to specific initiatives that are primarily funded by the private sector.

“But we’re not mandating them as part of the bids.

“This is part of a process that we see unfolding when disability in discussions with a private sector partner work to create something in relation to a development project that would be used as a site for the games that makes sense. But there is no requirement. Notably, in all of this work, and in the inclusion of private sector partners around specific development projects, we wanted to get away from the idea of the games as an event in time that is something that happens every four years, but to create a movement that in this case, is centered on healthy, sustainable and prosperous communities.

“And in doing that to create a framework by which all of the stakeholders including municipalities, First Nations, private sector partners, educational institutions, and so on, continue to consult and work together, not just in the completion of the bid, but in all the subsequent years from the delivery of the projects and sites and the creation of the programming related to the effort actually important to understand that this is not a single city that not only is it not a municipal baby, it’s not even a local bed.

The catchment area is wide – if the Games take place they will be a huge draw. “What we have done is to expand very significantly the catchment area for the games, in consultation with the province of Ontario and federal government to make the games regional. This adds value to the games expands the impact area for the games, it differentiates the games internationally, it reduces and mitigates the risks of the game to sitting on or being primarily related to one community because we are really focused on expanding the the experience of these impacts and their measurement over time.

“Expanding the games to all of these municipalities has been the work that we’ve been engaged in over the course of the last three years, which has accelerated meaningfully recently. The question of the City of Burlington involvement will be entirely a function of your interest in the interest of private sector partners like Penta and your willingness in the next few months to come up with an approach as to what opportunities the city would like to engage in and have them included.

“So I’m going to turn it over to Antonio here to explain his role and to speak to you from his perspective.”

Part 2 will be Antionio Gomez -Palacio explaining what he will be doing and why.

City Manager Commisso said the time frame given to prepare a response was tight but he felt it could be done.

The promise. Related news stories:

Moving the Tiger Cats to the Paletta King Road site

By Staff By Staff

December 10th, 2021

BURLINGTON, ON

OFFICIAL Congratulations are in order. !!!!!

Finalist award  The photograph was created by a women taking part in a Muslim Call to Prayer that took place in Spencer Smith Park last July. The Canadian Online Publishers Association (COPA) announced that the Burlington Gazette 2015 Inc has been named a finalist in one category for the 2021 COPAs.

The selection was for Media in the Best Photo Journalism category.

The photograph was taken by Denis Gibbons who was on assignment for the Gazette covering a Muslin Call to Prayer that took place in Spencer Smith Park on June 11th, 2021

That story is HERE

By Ryan O’Dowd By Ryan O’Dowd

December 10th, 2021

BURLINGTON, ON

Burlington’s first annual Holiday Market kicked off Thursday evening running from 4 pm to 9 pm downtown Burlington and will showcase local Burlington businesses all weekend.

The market’s first night started slowly, traffic on the Elgin Promenade was scarce until crowds slowly began to funnel in around 6 pm. Still, the mood around the festivities was positive. Shop owners were excited to showcase their wares in the outdoor marketplace, happy to be free of the rigid pandemic restrictions that have limited capacity for the better part of two years.

Back by Bees. Aimee(right) Chrissie (left) The local Burlington business owners set up tents along the snow-swept promenade beneath strings of lights shining red, green, and gold. The temperatures were low on the windy winter evening but customers could ease the chill with drinks from a booth in the Poacher parking lot, operated by the restaurant.

Many of the vendors used this opportunity to craft holiday-specific items for purchase at the market while raising brand awareness. The eponymous owner of Joseph Tassoni sold designer Christmas Holiday Trees as opposed to his award-winning parkas and other fashion items, which were showcased in the background. Tassoni said he was proud to showcase his products made right there in downtown Burlington and is filling what he sees as a void in mid-priced fashion.

Joseph Tassoni with examples of what ‘made in downtown Burlington’ actually is. “What I wanted to do is kind of engage into as many markets as possible to interact with the community again, and kind of give them an example as to what ‘made in downtown Burlington’ actually is. Often brands claim to be made in Canada, when the majority of the time it’s made overseas, and they just flip it here. So it’s kind of wonderful to show people what we are capable of in our crafts.”

The Odd Spot is following suit with seasonal original items in the form of “mystery boxes.” You don’t know what you’re buying with the boxes but they feature 10 items from the store and a gift card. It’s an approach Rich from the Odd Spot thinks will make for a great gift.

“We’ve jammed all kinds of stuff in there, there’s a t-shirt in there and a bunch of servers over 30 bucks with the stuff in there. And then we also threw a $5 to $10 denomination gift card inside. Just kind of as a gift. So you pay 20 bucks to give someone a gift but you don’t even know what it is. And then they open it. And then there’s a gift card inside. If they like the stuff they come back.”

That the market was a celebration of all things local became a familiar refrain throughout the evening. Aimee with Backed by Bees discussed the focus on sustainability and using local Ontario goods.

“We’re looking for sustainability products. So everything that you see is local to Ontario. Made by us by small vendors in the area. We do local produce, farm fresh eggs, and dairy. We specialize in raw honey which is unprocessed and pasteurized. We do all kinds of different flavors but specialize in raw honey, and with that honey we make our mead. So it’s a circular process and we have a whole lot of ways to try to do our best for these sustainability efforts.”

Gift Baskets: The contributing artists must live within an hour of Burlington. Lindsay with the Handmade House was showcasing local artists’ works with gift baskets at the event. The contributing artists must live within an hour of Burlington. Tomorrow the Handmade House will feature “build your own gift boxes”

“And then what we’re doing tonight is just a selection of gift baskets because we can’t possibly showcase all the thousands of beautiful things we have. So our vendors have put together some gift boxes to show everybody what we can offer there for sale and then we’d like to send people up to the storefront.”

The crowd, small in numbers on the first evening, did not lack for enthusiasm.

“It’s great to see things like this, it just feels like things are back to normal,” said Jessica, a woman browsing in the market.

“Burlington always does a good job with markets, it’s a fun atmosphere,” said Martha, who tries to make it out every time Burlington hosts an event like this.

The Burlington Holiday Market has promised fun, family friendly activities including concerts and choirs, interactive community art features, and advent-style community displays. These were not showcased on the first evening of the event so expect them over the weekend. Thursday featured 13 vendors, lower than the announced 20+, perhaps more will arrive as the weekend progresses.

After a rough couple of years for retail, participating vendors are certainly hoping the buzz around the market will build throughout the weekend. The market will run with much longer hours over the coming days: 11 am to 9 pm on Friday, Saturday, and Sunday.

By Staff By Staff

December 9th, 2021

BURLINGTON, ON

Will the State of Emergency be lifted soon?

And if it is – what difference will it make to the lives we live each day.

Definition and Authority

An emergency is defined under the Emergency Management and Civil Protection Act as “a situation, or an impending situation that constitutes a danger of major proportions that could result in serious harm to persons or substantial damage to property and that is caused by the forces of nature, a disease or other health risk, an accident or an act whether intentional or otherwise”

Under the Emergency Management and Civil Protection Act, only the head of council of a municipality (or his or her designate) and the Lieutenant Governor in Council or the Premier have the authority to declare an emergency. The Premier, the head of council, as well as a municipal council, have the authority to terminate an emergency declaration

Criteria

established to assist the Mayor/Council in determining if/when our existing state of emergency should be terminated.

When considering whether to terminate a declaration of emergency, a positive response to one or more of the following criteria may indicate that a situation, warrants the termination of declaration of emergency.

City Staff are thinking through what will have to be clanged if the State of Emergency is lifted – but we aren’t there yet.

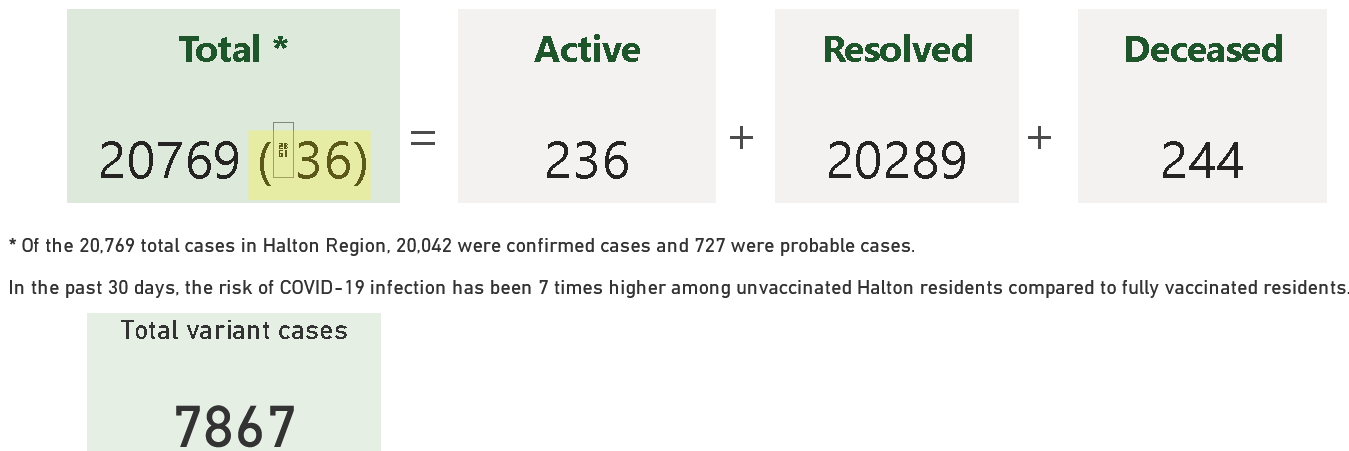

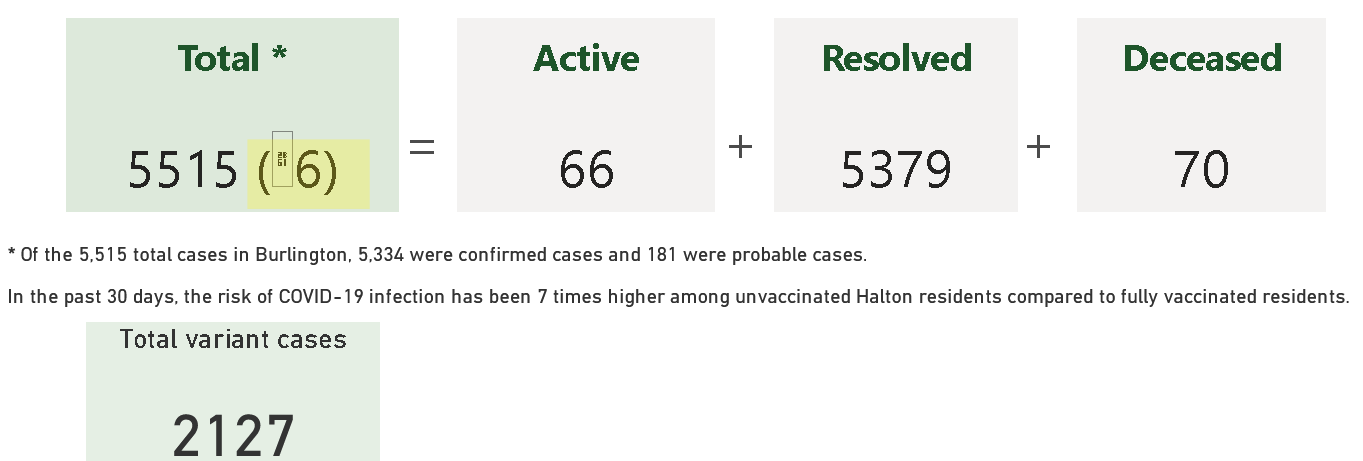

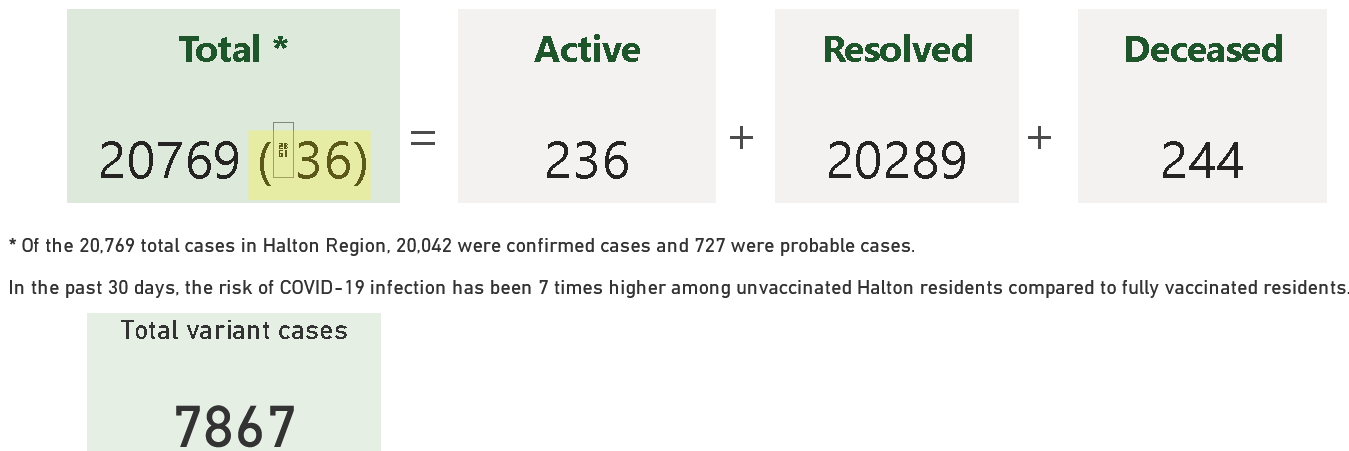

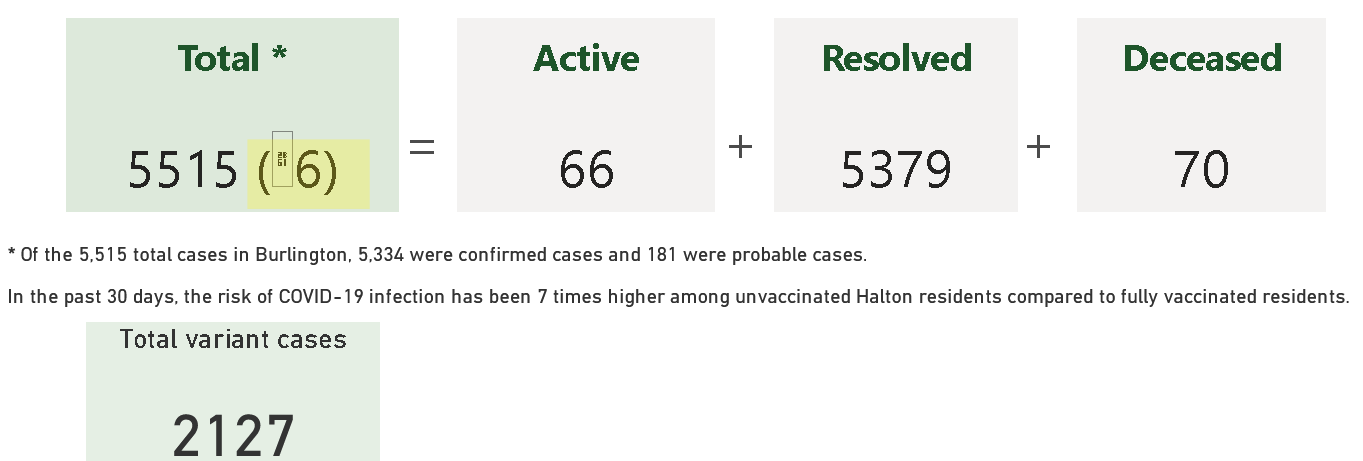

The Covid infection numbers for the day – province, Region and Burlington,

Regional Covid19 infections as of December 8th

Burlington Covid19 infections as of December 8th

By Staff By Staff

December 9th, 2021

BURLINGTON, ON

Just a reminder that the Sound of Music our Silent (Night) Holiday Auction is LIVE on their website until Friday, Dec 10 @ 4pm. Get your bids in soon!

That is an impressive list of items. When they say Silent Bids – you get one chance to bid and hope that yours was the offer. Remember – bidding is BLIND – be sure to enter your best offer as you will not be notified if you are out bid. Good Luck!

Click HERE to bid

By Pepper Parr By Pepper Parr

December 8th, 2021

BURLINGTON, ON

Without information technology the city could not open the doors each day.

A lot of very smart people make the technology do what it is expected to do – and making it work is a challenge.

Chad MacDonald: Chief Information Officer Different computer applications have to learn to “talk” to each other and feed information to each other so that senior staff and council can have an up to date (sometimes up to the minute) information on which to make decisions.

The other given for the technology, the people is money – this stuff is wickedly expensive and the people who work in Information Technology are not cheap – and there aren’t enough of them to go around.

Municipalities will poach from each other to get people who can make it all come together.

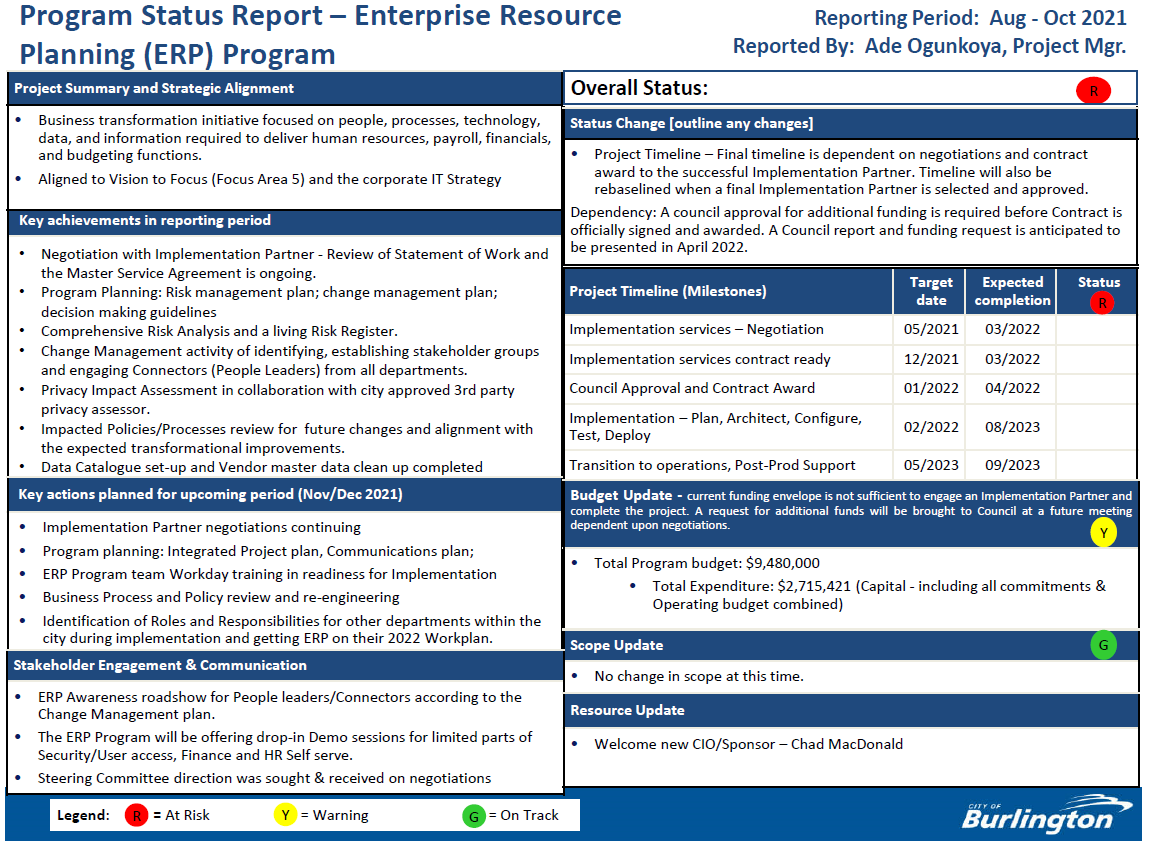

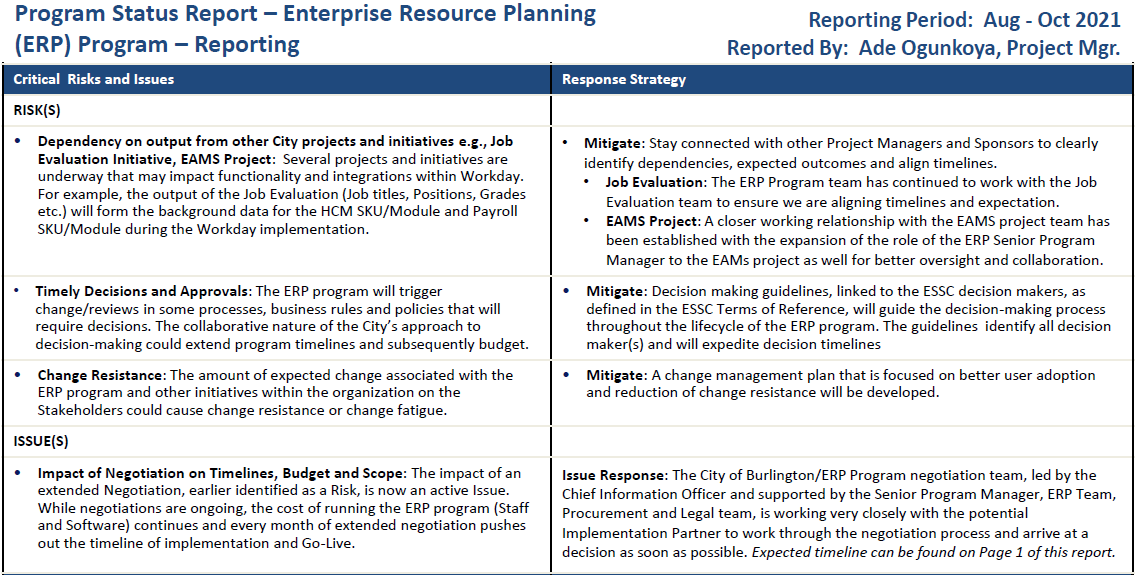

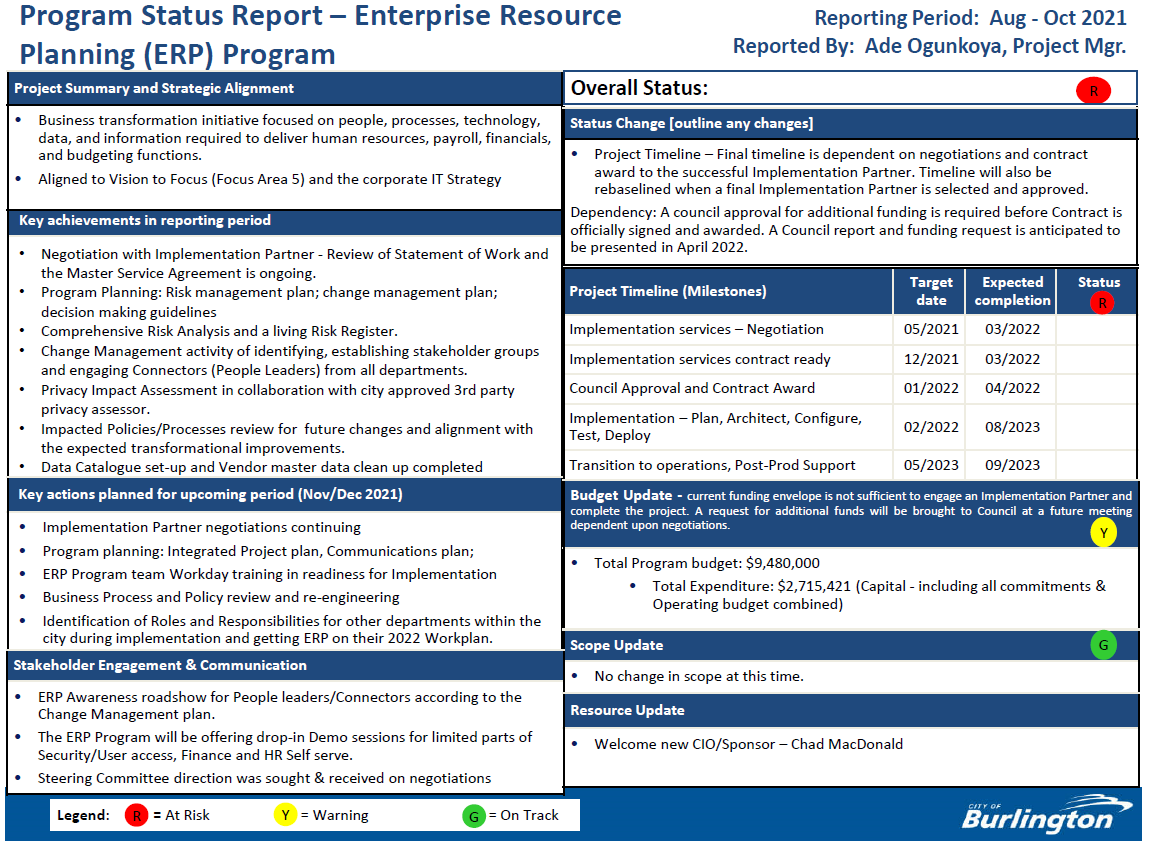

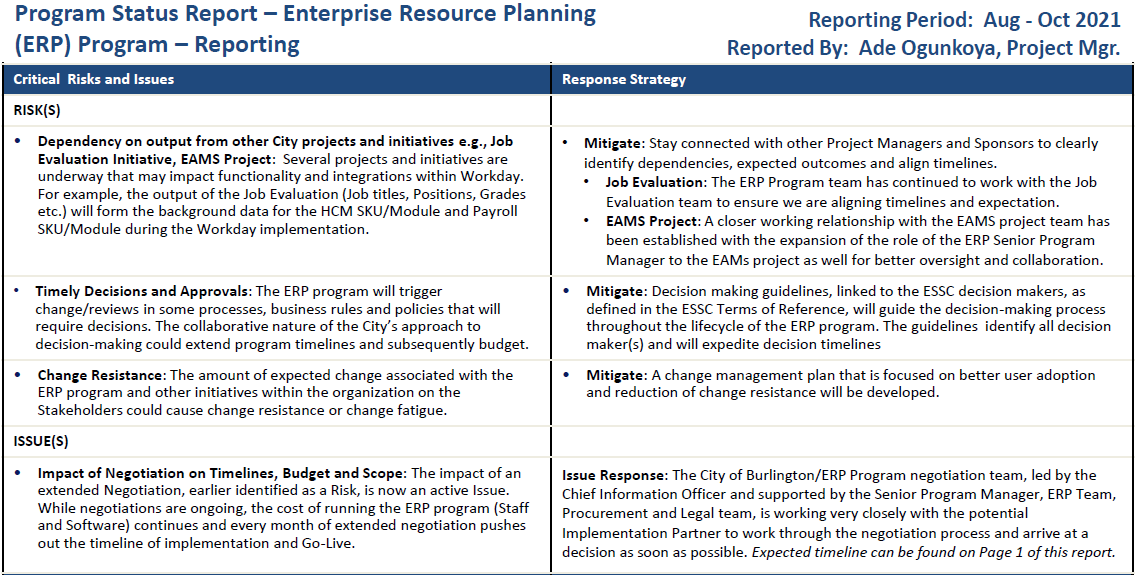

Earlier in the week Council got a Status Report on some of the projects for the period August to October.

It wasn’t all bad news – but there wasn’t a lot of really really good news for Council.

The program budget for the Enterprise Resource Planning program is $9,480,000 with more required in the near future. A Council report and funding request will be presented in April of 2022. The ask then is in the $3 million range.

One of the problems with keeping on top of these essential but very essential programs is that few of the seven members have much in the way of an understanding of what is involved. Councillors Sharman and Kearns have a good grip on the subject: Kearns is the sharper of the two.

Sharman is good at holding senior Staff to account. There was an “iconic” Council session last year when Sheila Jones went toe to toe with Councillor Sharman with Jones reminding the Councillor that the approach for members of Council was “noses in – fingers out”.

Councillor Sharman does, from time to time get down into the weeds – the Senior staff in place now are quite good at curbing that Sharman habit.

Burlington has a number of projects delivering customer centric services with a focus on efficiency and technology transformation. Specifically, Enterprise Resource Planning (ERP), Enterprise Asset Management Software (EAMS), Customer Relationship Management (CRM) and Business Intelligence (BI) have a corporate designation reflecting the breadth and depth of the scope of these projects and their contribution to achieving customer first approach and digital transformation.

This report also provided information on the theory of status reporting and the key elements of status reports in the City of Burlington including:

Overall project status that considers scope, budget, and schedule and where clear criteria is established to objectively assess the status within each area.

A brief description of the project and alignment to strategic goals.

Highlights of key achievements since the last reporting period and key tasks planned for the upcoming period.

Highlights of critical risks and challenges that form part of the risk management plan.

Key tasks that address communications and engagement and information related to staff resourcing.

Links to documents or tools and other information that may be relevant based on the project status.

In keeping with open communication and engagement, the report provides Committee and Council with an update on each of the three corporate initiatives including overall status, key milestones, critical risks, and other relevant information with the goal of providing assurance that project governance is working effectively.

While the criteria and guidance for assessing a project’s health status have recently been amended within the context of overall project management practices with Information Technology Services, we are deferring its use until 2023. This deferral will provide us with an opportunity to take a refreshed look at the report template to enhance the information reported to council. In addition, we are reviewing our inventory of corporate- wide projects to appropriate status reporting is provided to Council.

The most critical computer application that is being worked up has too many serious risk points. It is too late to go back. The CRM application should be dropped. Hydro installed one that works just fine – borrow from them. Councillors Nisan, Bentivegna, Stolte and to a considerable degree Councillor Galbraith are lost when technology is the issue. They are easily snowed by Staff. Burlington has a mix of computer applications that have reached the end of their life cycle and are no longer being supported; other applications have to be revised or replaced in order to communicate with the larger more robust applications that are being used now.

Some budget items can baffle people because of their complexity. It becomes very difficult to hold Staff accountable.  Understanding complex integrated information technology matters is beyond most Councillors. To understand the size of the challenge calls for some literacy which most of the Councillors don’t have. The Mayor tends to take what she hears on faith knowing that she can collar the city manager during their weekly meetings that are not on the record.

Sometime ago the city began integrating a Customer Response Management (CRM) program – the first step did not go well. Members of Council were livid and demanded that the city administration not get in between the Councillors and the voters.

There were solid reasons for putting a CRM program in place when it went kaflooey the Councillors were in a position to demand immediate changes. That dynamic is unlikely to apply to other situations.

It is generally realized and understood that data is needed to make decisions and that for the most part the data is “in there somewhere” Isolating the data and setting it up so that it is accessible by other applications is the expensive challenge the city faces.

The Business Information reviews have been completed; they gave the Information Technology people a deep understanding of their operational needs. Chad MacDonland, Chief Information Officer told Council that the work has gone so well that his team has been able to show staff demonstration version of what the completed integration will look like.

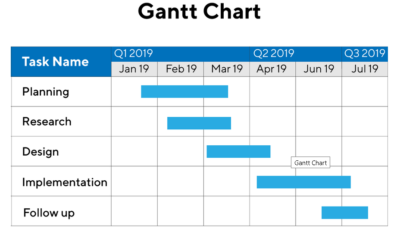

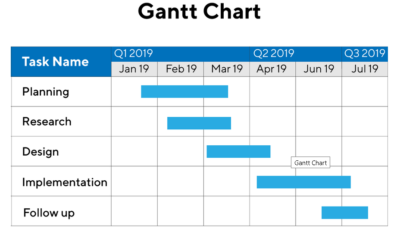

Is this the kind of thing a Council member would lust over However, all the information requirements were not met. Councillor Sharman said that he “lusts after the sense of confidence” he would get from seeing Gantt Charts – and asked if they existed and if they existed were they available.

Executive Director Jones reminded Sharman that the Councillors role was: “noses in, fingers out”.

The Gantt charts exist – no assurance that Sharman will get to see them.

By Pepper Parr By Pepper Parr

December 8th, 2021

BURLINGTON, ON

When a book store closes there is a tear in the social fabric that is hard to repair. Something that was – isn’t anymore.

Scheduled to close at the end of January. At the end of January Fly By Night – Antiques and Books will close its doors for the last time. Personal health reasons are such that Michael Cowan, who has been running the store for more than 20 years, can’t do the work anymore.

The focus is on used books with every imaginable title in a store that is a collection of shelves that go to the ceiling and packed in stacks on the floor as well.

Cowan started with just books but developed a personal interest in antique items and began stocking things that appealed to him. It grew into a strong part of his business.

The books are sourced by a person called a “picker” who gets called when there is a household that might be moving and wants to get rid of the books.

People managing an estate will call the picker and ask him to just please pick up everything and get rid of it.

Row upon row of shelves that were a destination for those who were looking for something new to read. For book lovers these stores are paradise – a place to spend hours glancing over titles.

Bob “G”, was uncomfortable having his last name used, said he is “out of the picking business, too old to do the running around and lugging heavy boxes of books.”

He tells the story of once picking a guitar that he paid $20 for and then learned it was an antique Gibson that he resold for $22.000

“The last time Michael and I counted the inventory there were more than 20,000 titles on the shelves.”

The bookstore has a small but very loyal customer base that drops in regularly; they are in the 60 to 85 age range and each as their own interest area. The store has customers who read Westerns; other who like everything they can find on the two World Wars and others that look for romance or mystery titles.

Michael Cowan – books and people are the two things he knows. Cowan started with operating a bookstore in Oakville and moved to Burlington which has always been seen as a good book market.

Bob adds that there are fewer buyers; the younger people aren’t readers and they aren’t nearly as many true book lovers.

Mike was a generous person, he helped the down and out; he wasn’t in the business to make money. He loved books and he loved people.

Store closes at the end of January. Michael’s brother Rick is handling the closing.

Why a bookstore named Fly By Night. Not exactly the name one would put on the lease application. Has to do with owls.

In 1921, the Oskee Wee Wee cheer was first used at a Hamilton Tigers football game. Back then, there were two teams in Hamilton — the Tigers and the Wildcats. They merged in 1950 to become the Hamilton Tiger-Cats.

Three Interesting facts about the Grey Cup Trophy Three Interesting facts about the Grey Cup Trophy

It may not be the usual month that Canadians are treated to all that this tournament has to offer, but the 108th Grey Cup is just around the corner. With all of the action kicking off on 12th December, we thought that it would be a great time to reflect on the history of this Cup.

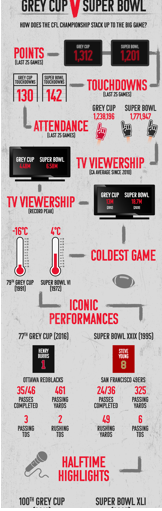

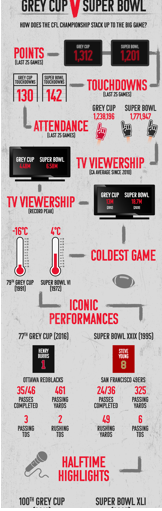

While the Grey Cup may not be quite as popular as the NFL, it is still big business in Canada. According to research by Betway Insider, the Grey Cup still stacks up well against the NFL Super Bowl and brings Canadians the same thrill that their US counterparts experience. So much so that even Burlington residents were behind getting the Grey Cup game to Hamilton in 2021. Some of the draw of the Grey Cup is down to its history and some of the interesting facts that can be attributed to it. Let’s take a look at the top three:

Fire struck the 35th Grey Cup

It was back in 1947 that the Toronto Argonauts rowing club building caught fire. It didn’t just catch fire – the building was burnt down in its entirety. Inside this building was no other than the Grey Cup and there was real concern that this could spell the end of the tournament for that year with no cup to award. Fate, however, had different ideas.

The shelf that was home to the cup had collapsed during the fire. Every trophy on that shelf had fallen to the ground and been destroyed. All except for one. By some miracle, the Grey Cup fell but found itself caught in a nail. This saved the cup from the engulfing fire.

The Grey Cup sees more points being scored than the Super Bowl

What makes a game exciting and the ultimate in entertainment is the number of points that are scored. The more points the bigger the thrill and the more intense a game becomes. When you compare the Grey Cup to the NFL Super Bowl, the way in which points are awarded is almost the same. There is, however, a difference.

The CFL provides a wider field, extra receiver, and unlimited movement before the snap. The result? A fast-paced and higher-scoring game. Research from Betway Insider has shown that the last 25 Grey Cups have seen 1,312 points being scored compared to 1,201 at the Super Bowl.

The Grey Cup has been stolen three times – so far!

The RCMP keep the Grey Cup safe. The Grey Cup is clearly an attractive trophy. So attractive that thieves have targeted it three times. The first time was back in 1967 with the cup being stolen from the Hamilton Tiger-cats. It appeared that this was more about a prank than a real ambition to keep the cup as it was found abandoned some three days later.

1969 saw the Grey Cup being stolen for the second time. This time it was taken from the Ottawa Rough Riders only to turn up in a hotel locker. The most recent occasion came in 1997 when Toronto kicker Mike Vanderjagt had it stolen from him in a bar. Fortunately, it was recovered the very next day.

By Staff By Staff

December 8th, 2021

BURLINGTON, ON

It all starts late Thursday afternoon.

The first annual Holiday Market for Burlington; an event patterned after the very successful markets that have taken place in Europe for decades.

The vendor list is acceptable, the locations are close to each other.

Now we wait for the actual roll out and see how it works.

Will it be filled with people Thursday night and through the weekend?

By Pepper Parr By Pepper Parr

December 7th, 2021

BURLINGTON, ON

The City Hall communications people put out a media release on the taxi situation in the city.

With the Public Vehicle By-law amendments providing a temporary solution to replace lost taxi service, the City of Burlington is sharing that Blue Line Taxi company has been issued a new taxi licence. Blue Line Taxi will start to service Burlington residents today. To book taxi service, Burlington residents can call Blue Line Taxi by phone (905) 525-0000 or book online at 525blue.com.

905-525-0000 will bring one of these cabs to your door The by-law that governs the issuance of new taxi licences was written to meet the needs of the taxi business model that existed in 2009. To allow new business to enter the Burlington transportation market, City staff recommended interim by-law amendments. These amendments provide flexibility in the application process to meet the demands of current business models.

Quick Facts

- Burlington’s main taxi service provider Burlington Taxi ceased operation on Nov.26, 2021

- At the Nov. 30, 2021 Special Council meeting, City Council approved amending the Public Vehicle By-law to allow exemptions to existing licensing requirements so other taxi services could apply to provide service for Burlington residents

- The by-law amendments allowed applications for new taxi owner licences/plates to open on Dec. 2, 2021 until all spaces are full

- The by-law amendments are intended to provide a temporary solution. City staff are aiming to undertake a comprehensive review and consultation and have a new by-law created prior to December 31, 2023.

- Further review is required not only to determine appropriate taxi licensing requirements, but to investigate the ‘rideshare’ businesses and options for regulating that market.

Mayor Marianne Meed Ward Mayor Marianne Meed Ward said: “I know we all welcome the news that taxi service can resume in our community as early as today, and in time for the holidays. I want to thank the successful applicant for coming forward, and I’m grateful to City staff and my Council colleagues for working quickly to find a temporary solution to restore taxi service in Burlington immediately. I also thank staff for their ongoing efforts to bring forward a permanent solution to this issue. As well, thank you to Burlington Taxi for their 53 years of dedicated service to our community.”

Ward 4 Councillor Shawna Stolte Ward 4 Councillor Shawna Stolte said: “As we learned earlier this morning, amendments to our Vehicle/Taxi Bylaw will allow us to welcome 13 new taxi vehicles onto to our streets as of today, Tuesday, December 7, 2021. Staff are open and eager to review additional licenses to increase this number of available taxi vehicles as multiple companies in the taxi industry continue to come forward with applications. It was unfortunate that these changes and amendments were not considered before the closure of Burlington Taxi as this could have avoided the subsequent transportation crisis for many Burlington residents, but I am relieved that an expedient way forward was sought by staff and I look forward to the renewed commitment to this valuable mode of transportation for Burlington residents in the future.”

There is some “shame on you” to be spread around on this one.

Related new stories:

Scott Wallace Talks Back

Burlington Taxi announces the need to close

By Pepper Parr By Pepper Parr

December 7th, 2021

BURLINGTON, ON

The Town of Milton bit the bullet and accepted a 5.47tax increase last night is there a message for Burlington Marianne Meed Ward? The Town of Milton bit the bullet and accepted a 5.47tax increase last night is there a message for Burlington Marianne Meed Ward?

Milton Mayor Gord Krantz has been saying for some time that Burlington is going to have to get used to higher buildings and higher taxes.

The antics at city Council last week look like an attempt to stem the tide.

With the budget being debated at 4.95% perhaps council should quite while they are ahead.

By Pepper Parr By Pepper Parr

December 7th, 2021

BURLINGTON, ON

There is taxi service- city hall is issuing temporary licenses to drivers who can be on the road by the end of the day.

Blue Line of Hamilton will be offering the service.

The number to call is on the cab – 525-0000 Add the 905

Calls for service will go to the Blue Line dispatch which is described as very robust.

Taxi rates are determined by the municipality. Blue Line rates are lower than what Burlington taxi was asking for – so there will be cars and drivers on the road and it will cost you less.

Blue Line has taken up 40 of the 51 driver/car slots that were available.

If you want a cab – call Blue Line.

They have an App – and they offer a number of services.

Blue Line is working with the Boards of Education and the hospital.

More detail is expected from the city soon.

Wondering how Scott Wallace is feeling about all this.

By Pepper Parr By Pepper Parr

December 7th, 2021

BURLINGTON, ON

Did you ever had a puppy that you had to train not to piddle on the floor? I had one and when he did his business where he wasn’t supposed to I’d give him a stern look and call him a bad dog and put him in his business box. Did you ever had a puppy that you had to train not to piddle on the floor? I had one and when he did his business where he wasn’t supposed to I’d give him a stern look and call him a bad dog and put him in his business box.

Scott Wallace did just that, gave Mayor Meed Ward a couple of paragraphs of some strong language when he wrote the following letter:

Our response to the Mayor’s statement on November 24th has not come easily. We must speak to the facts that outline our last few years urging for change in our local taxi industry. We could not be more proud of our Burlington Taxi team for their hard work and dedication over the last 53 years.

With all due respect, we take strong exception to our Mayor’s statement that asserts, “the Taxi By-Laws were written to protect Burlington Taxi” and that our “closure was unrelated to the by-law review request in 2018.”

We ask, what exactly has the By-Law protected? Did the By-Law protect the taxi drivers now out of work since November 2021? Did the By-Law protect Burlington Taxi from having to shut down its operations? Did the By-law protect taxi companies from unregulated competition; ride share companies that have enjoyed the luxury of no city license fees, no federal taxes, no commercial insurance, no vulnerable sector criminal checks, nor an obligation to support wheelchair accessible transportation?

Former Ward 6 Councillor Blair Lancaster talks with Scott Wallace, proprietor of Burlington Taxi. Lancaster was on the Council that Wallace had taken his concerns about the taxi industry in 2018. It gives us no pleasure to say that the city’s process failed to support its business community, taking little notice of our repeated pleas over the years for comprehensive change.

We saw the tsunami coming (Uber/Lyft drivers, the pandemic, a severe labour shortage, a spike in insurance rates). What we missed was the acknowledgement that our By-law request in November was one small part of a fulsome City By-law review initiated in 2018.

For the record, our final plea in November was to allow our drivers to continue working as employees under new Burlington Taxi ownership, and further give them the ability to align themselves with other Cab companies of their choice as independent operators, as every other city does in North America.

Facts don’t lie. The last time the City of Burlington reviewed its taxi by-laws was in 2009, which was written based on the recommendations of a consulting firm hired by the city of Burlington, not the taxi industry.

In 2016, the City was urged to review the new unregulated ride share service (Uber). Council and staff agreed to complete a review of these services. Our industry concern had little to do with Uber itself, but everything to do with regulation of the Uber business model. Regulation is what keeps people safe and ensures fair play among businesses. In Burlington’s case, the ride share industry has no responsibility to anyone – not to the city, not to its drivers, and definitely not to its customers. As a rider, if you experience an unsafe ride, or are a victim of excessive surge pricing, there is no one to call. The city has not regulated ride share companies, perhaps a way to absolve its responsibility, but it certainly doesn’t solve the problem.

Our former council, recognized that our Taxi By-Law was antiquated and in desperate need of comprehensive review. That is why, in early 2018, the former Mayor directed the City to commence a comprehensive review. Public record shows the details surrounding this direction. Nothing came of this.

Not liking the sound of that letter. Was it even read? We thank our current Mayor for her recognition and issuing her statement on December 2nd regarding taxi, that, “In 2019, city staff formed a small team to look into the by-law review and removed the motion from the regular reporting list, with a plan to report back to council on progress. That report didn’t happen… We acknowledge that the review should have occurred. It didn’t, and for that, we take responsibility.”

“Facts don’t lie. The last time the City of Burlington reviewed its taxi by-laws was in 2009, which was written based on the recommendations of a consulting firm hired by the city of Burlington, not the taxi industry.” It should not go without mention that we have reached out at regular intervals to the city, each time trusting in their reassurance that the by-laws would be changed.

The election of new city representatives unfortunately sidelined the former Council’s directive for a comprehensive review of the taxi industry and our hope for actual change.

Following our closure last month, Council has re-committed the City to reviewing and updating the Taxi By-Law.

Our hope is that the City will NOW actually follow through with meaningful change.

Our thanks to Ward 4 Councillor, Shawna Stolte, for taking up the torch and advocating for change.

Our City deserves it.

One small ray of hope. There will be a Verbal Update on Licensing of New Taxi Businesses in Burlington at a Standing Committee on Tuesday.

By Pepper Parr By Pepper Parr

December 6th, 2021

BURLINGTON, ON

Fifty million – and not enough information in the hands of the public.

City Council agreed this afternoon to make a formal offer to purchase the Bateman High School property for $50 million.

Council agrees to make an Offer to purchase the Bateman site Mayor Meed Ward said the site will become the biggest facility in the city –more than twice the size of Tansley Woods which is the largest at this point.

To the surprise of this reporter we learned that the pool is not owned by the city – Halton District School Board (HDSB) appears to be the owner.

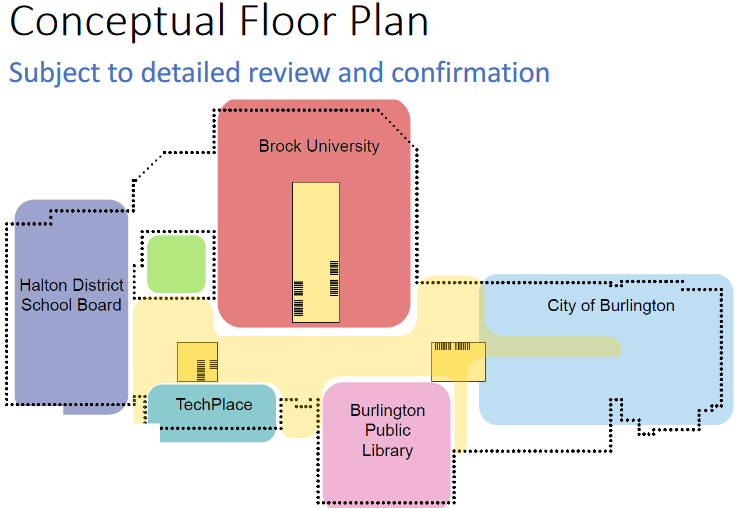

It will be a shared space with plenty of space for community events There are all kinds of details that are not known; the HDSB will retain some of the space, Brock University is in talks with the city to rent space, Tech Place is going to need an affordable place to operate and has eyes on the Bateman location and the Library might become a tenant as well.

Councillors Stolte and Kearns hold off on fully agreeing to the decision to purchase; they want much more information in the hands of the public. Councillor Sharman put is quite clearly when he said this was not an agreement to purchase – this was an agreement to continue discussions with the vendor.

The task now he said “ is to figure out how to pay for it.”

The matter comes up again in March of next year.

At the Special meeting of City Council this afternoon two of the seven members of Council voted not to approve the decision to make a formal offer: Councillor Kearns and Stolte took a pass on putting their thumbprint on this one.

By DENIS GIBBONS By DENIS GIBBONS

December 6th, 2021

BURLINGTON, ON

Frosty the Snowman and more than 100 of his brothers and sisters have made an early Christmas visit to Burlington’s Lockhart community.

The plastic, blow-up images of the Yuletide characters dot the lawns of almost every home in the area, behind the old John A Lockhart School.

It’s all part of the Frosty’s Village program, organized by several mothers, to spur donations to the Burlington Foodbank.

Campbell Court was alive with Christmas music On Saturday night a selection of musicians from various bands in the city gathered at the end of Campbell Court to entertain folks, who accompanied them by singing Christmas carols.

The concert was organized by Marg MacVinnie, who now is retired from her job on the Waterfront Project for the City of Burlington, with the help of Jan Boomgardt, Sue Hall, Cathy Hall and Phyllis Wallen.

The volunteers were able to secure a grant of $1,500 from the City’s Community Support Fund to organize the concert and another one, which will be held this Saturday night at 7 on the promenade of Spencer Smith Park.

76 trombones led the big parade. Children will be able to learn bucket-drumming on metal pails then follow Burlington’s Junior Redcoats as the march along the edge of Lake Ontario.

Purpose of the fund was to encourage neighbourhoods, arts, recreation, sports and culture groups to create new ways of connecting with each other.

Three mothers came up with the idea for the blow-up Frosty’s.

Three-year-old Quinn McMahon watches the concert from the shoulders of her granddaddy Alan Sharkey. Frosty’s Village has brought in hundreds of food donations for the local food bank.

They collected about 900 pounds of food last year, and are hoping to double the donations after formally partnering with the Burlington Food Bank.

The Lockhart Community is named after the late John A Lockhart, who served as Principal of Central Elementary School for 26 years, then as Mayor of Burlington from 1957 to 1961 after completing his education career.

By Staff By Staff

December 5th, 2021

BURLINGTON, ON

Council is expected to recommend the standing committee Chair and Vice-Chair appointments for 2022, and the appointments to the Licensing Committee, as follows:

Councillor Galbraith will back up Lisa Kearns as Chair of the Budget Committee. It will be a quieter year for this Committee EICS: Environment, Infrastructure & Community Services Committee

Chair: Councillor Kelvin Galbraith Vice Chair: Councillor Shawna Stolte

CPRM: Community Planning, Regulation & Mobility Committee

Chair: Councillor Shawna Stolte Vice Chair: Councillor Rory Nisan

CSSRA: Corporate Services, Strategy, Risk and Accountability Committee

Chair: Councillor Rory Nisan

Vice Chair: Councillor Paul Sharman

Councillor Angelo Bentivegna remains chair of workshops. Council Workshop

Chair: Councillor Angelo Bentivegna (remains the same) Vice-Chair: Councillor Lisa Kearns

Budget

Chair: Councillor Lisa Kearns (Moves from Vice Chair to Chair) Vice-Chair: Kelvin Galbraith

License and Appeals Committee

Chair: Paul Sharman

Council Representatives (2 required):

Councillor Kelvin Galbraith Councillor Lisa Kearns

Each year, the mayor recommends for council approval appointments of Chair and Vice Chair for standing committees.

There are two notable changes from 2021. There is no longer a separate chair for Community Planning Regulation and Mobility Statutory Public Meeting. These meetings will be chaired by the Chair of the regular CPRM. There is a new License and Appeals Committee and the clerk has requested a chair and two members of council to be appointed to serve.

In making my recommendations to Council said Mayor Meed Ward the guiding principles include attempting to accommodate specific requests where received, providing accommodations for specific personal circumstances as needed, providing opportunity to serve on different committees, and offering fairness, balance and equity of opportunity for each member to serve as chair of one of the three standing committees within a two-year period.

Normal practice to achieve this equity is for the Vice Chair to move into the Chair position the following year. There are six committees, so all members of council will have an opportunity to serve as Chair of a committee and Vice Chair of a committee in 2022. Audit committee selects their own Chair and Vice Chair by a vote of the membership.

As 2022 is an election year, the term of Chair/Vice Chair will end with the council term. A new slate of Chairs/Vice Chairs for the balance of 2022 and 2023 will be chosen in November once the new council takes office.

By Pepper Parr By Pepper Parr

December 4th, 2021

BURLINGTON, ON

Photo by DENIS GIBBONS

It wasn’t a parade but Santa did manage t get around town with the aide of Fire department volunteers on Saturday.

Small groups gathered at intersections to watch Santa in a Fire truck drive by. They will be back out on the streets of the city on Sunday.

He isn’t really sure what’s coming his way.  Taking it all in as best they can during a pandemic

Santa Drive By

By Denis Gibbons By Denis Gibbons

December 5th, 2021

BURLINGTON, ON

Staff from Hospital’s Labour and Delivery Unit handing out Christmas packages. Photo by DENIS GIBBONS Burlingtonians, who purchased Join the Joy gift boxes to support Joseph Brant Hospital’s Labour and Delivery Unit, were able to pick up their gift boxes in the parking lot of Access Storage on Fairview St. on Saturday.

The boxes contained fun items like a family-friendly game, hot chocolate, magical reindeer dust and holiday crafts.

Retired fire fighters keeping an eye on an antique fire truck. Photo by DENIS GIBBONS

Veteran Burlington firefighters had their 1922 fire truck, which is housed in Kilbride, on display as they handed out candy canes to children

Tasty pastries were handed out by employees of COBS Bread Bakery, representatives of FastSigns accepted letters to Santa and Paladin Security had its cars and men on hand to act as Santa’s secret service.

|

|

By Ian Allen

By Ian Allen

By Staff

By Staff

By Pepper Parr

By Pepper Parr

The Hamilton Commonwealth Games Bid Committee (HCGBC) has been working on bringing back the games to Ontario for over three years. The Commonwealth Games authority in Canada and the CGF in the UK, have selected and approved our community bid in relation to 2030 for international submission.

The Hamilton Commonwealth Games Bid Committee (HCGBC) has been working on bringing back the games to Ontario for over three years. The Commonwealth Games authority in Canada and the CGF in the UK, have selected and approved our community bid in relation to 2030 for international submission.

By Staff

By Staff

By Ryan O’Dowd

By Ryan O’Dowd

By Pepper Parr

By Pepper Parr

By Pepper Parr

By Pepper Parr

Three Interesting facts about the Grey Cup Trophy

Three Interesting facts about the Grey Cup Trophy

By Staff

By Staff

The Town of Milton bit the bullet and accepted a 5.47tax increase last night is there a message for Burlington Marianne Meed Ward?

The Town of Milton bit the bullet and accepted a 5.47tax increase last night is there a message for Burlington Marianne Meed Ward? By Pepper Parr

By Pepper Parr By Pepper Parr

By Pepper Parr Did you ever had a puppy that you had to train not to piddle on the floor? I had one and when he did his business where he wasn’t supposed to I’d give him a stern look and call him a bad dog and put him in his business box.

Did you ever had a puppy that you had to train not to piddle on the floor? I had one and when he did his business where he wasn’t supposed to I’d give him a stern look and call him a bad dog and put him in his business box.

By Pepper Parr

By Pepper Parr