By Julia Borg By Julia Borg

May 16th, 2025

BURLINGTON, ON

The OLG (Ontario Lottery and Gaming Corporation) revealed in April that it made a whopping CA$27 million in the fourth and final quarter of the 24/25 financial year. This came from gaming revenue and will be paid out in installments to 29 different Ontario communities that host gaming facilities. The most came from Casino Woodbines municipality in Q4 as they returned just over CA$4 million back to the community.

These payments are paid back into community programmes and support local programs and infrastructure as part of the Canadian government’s scheme for returning money into the communities that it earns from land-based casinos. Winnings from online and offshore betting companies are not part of this scheme yet, but it could be worth checking out the best crypto casinos Canada list to see where’s best for your next online wager, regardless. These sites accept cryptocurrency as a payment method, which holds such benefits as anonymity, fast transaction speeds, and security.

For land-based casinos in Canada, however, the boom continues to be very much present for them. Whilst the return in Q4 is smaller than Q3’s massive CA$33.5 million return, there continues to be strong returns made to the community through the casino’s scheme. Indeed, since 1994, host communities have received more than CA$2.5 billion in non-tax gaming revenue. It seems Canada have found a good model that allows the casinos to work in tandem with the local communities to provide a source of entertainment and prizepots yet still allow for their chance to give back through this scheme and help out locals in the community with the total payouts to municipalities during the 24/25 financial year returning around CA$142 million.

The OLG advised that the host gaming communities are made a lot stronger through these payments and seems to be a good model of symbioticism in the community. Stan Cho, the Ontario Minister of Tourism, Culture and Gaming advised that ‘Gaming sites continue to provide good local jobs and other positive impacts across the province’ and was pleased to see the revenue being invested.

The revenue is based on a set percentile return of revenue made on slot machines, table games and sportsbooks and puts a positive spin on an often stigmatised section of society.

The news of these returns comes in tandem with the reports made in February that the iGaming industry in Ontario had seen continued year-on-year growth once again. February 2025 saw around CA$7 billion worth of bets made, which marks a 26.9% increase on the previous year. The market performance report seems to show that it is traditional online casino games that are thrusting the majority of this increase, generating around CA$6 billion of the reported increase and marking a 30% increase in this section of the industry from Februrary 2024, whilst sports betting markets were not reflecting quite as large a boom. It is believed that the implementation of Gigadat online transactions has really helped with this boost. The news of these returns comes in tandem with the reports made in February that the iGaming industry in Ontario had seen continued year-on-year growth once again. February 2025 saw around CA$7 billion worth of bets made, which marks a 26.9% increase on the previous year. The market performance report seems to show that it is traditional online casino games that are thrusting the majority of this increase, generating around CA$6 billion of the reported increase and marking a 30% increase in this section of the industry from Februrary 2024, whilst sports betting markets were not reflecting quite as large a boom. It is believed that the implementation of Gigadat online transactions has really helped with this boost.

One thing is for sure, and clear to see. Ontario remains one of the most lucrative markets in North America for betting both with land-based casinos and in the iGaming industry. Competitive markets and strict regulations do not seem to have hampered the industry which continues to see huge growth.

By Staff By Staff

May 15th, 2025

BURLINGTON, ON

Burlington’s very first coffee party—Private Coffee Sessions Vol. 1—happening this Sunday, May 18 at Hola Café & Market. Burlington’s very first coffee party—Private Coffee Sessions Vol. 1—happening this Sunday, May 18 at Hola Café & Market.

The event drops May 18th, at Hola Café & Market: Latin beats, specialty brews, and the city’s best vibes, turning your Sunday plans into something unforgettable. —one Sunday only.

In collaboration with Montañeros Coffee Corp and DJ collective MXJ, the first-ever coffee party in Burlington taking place Sunday, May 18th from 1:00 PM to 5:00 PM at Hola Café, 2156 Mountain Grove Ave, this RSVP-only event is free to the public (with limited capacity) and promises an afternoon full of soul, sabor, and seriously good coffee.

Here’s the brew:

- Burlington’s first-ever coffee party

- Official Listening Party for MXJ’s latest project

- Live DJ sets by MXJ and 2 special guest DJs

- Specialty coffee by Montañeros Coffee Corp

- Latin snacks like empanadas and tequeños available for purchase

- Giveaways for the fastest guests:

First 15 – unlimited coffee

Next 15 – one free cup

PLUS – we’ll be announcing the winner of our online giveaway live at the party.

To enter, follow us on Instagram and join the celebration: @holacafemarket, @musicbymxj, @montaneroscoffee

Food and drink will be available throughout the party, and if you’re craving a full meal, head over to the restaurant side patio (open 10 AM – 5 PM) to enjoy full service and our special weekend dish: lechona, a traditional slow-roasted pork feast from Latin America. “At Hola, we believe food and music are the two most powerful ways to bring people together. Private Coffee Sessions is our way of inviting the community into that magic—natural flavors, Latin rhythms, and a space that feels like home,” says the Hola Café team. Food and drink will be available throughout the party, and if you’re craving a full meal, head over to the restaurant side patio (open 10 AM – 5 PM) to enjoy full service and our special weekend dish: lechona, a traditional slow-roasted pork feast from Latin America. “At Hola, we believe food and music are the two most powerful ways to bring people together. Private Coffee Sessions is our way of inviting the community into that magic—natural flavors, Latin rhythms, and a space that feels like home,” says the Hola Café team.

This promises to be a new tradition for Burlington—an intimate, music-infused coffee party that blends community, culture, and curated vibes. It’s free, but once we hit capacity, doors close. Be early, be ready, be part of the story.

Location: Hola Café & Market, 2156 Mountain Grove Ave, Burlington, ON Date & Time: Sunday, May 18th, 1:00 PM–5:00 PM

By Tom Parkin By Tom Parkin

May 15th, 2025

BURLINGTON, ON

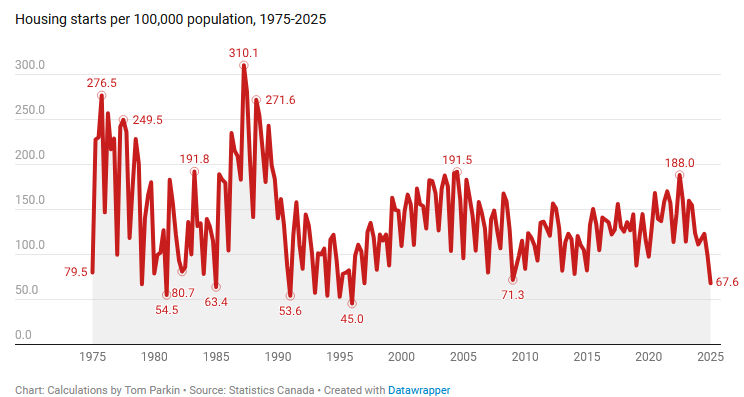

Ontario needs a significant plan to reverse the trend in housing construction and today’s Ontario budget is unlikely to deliver it.

Only 67.6 new housing units per 100,000 population were built in the first quarter of 2025, the lowest level since the Q1 of 1996, according to Statistics Canada.

Thousands of Ontario residential construction workers are unemployed in a province where the need for housing has never been greater. Ontario unemployment now stands at 7.8 per cent with significant construction sector job losses in April. Construction unions and real builders can only remain complacent about this for so long.

Yet, the province’s most recent legislation, Bill 17, introduced Monday, offers no reason to believe it will succeed where the many earlier iterations of the same approach have so evidently failed.

The legislation continues to play with development charges and approvals processes. Streamlining approvals is fine, but off-target in a province where very few are seeking project approvals.

Two-thirds of Canadians choose to buy their housing and many more would like to own. Construction of single-family housing, typically owner occupied, has collapsed due to a lack of demand under current unaffordable prices. The average price of a benchmark home in the Greater Toronto Area rose from $757,000 in Jun 2018 to $1,313,000 in June 2022. Prices are since down, but financing costs are up from the low levels of 2020-2022.

The result has been a market stand-off with investors holding back supply, trying to maintain price levels, and buyers unable to pay the prices being demanded.

The condominium sector is in utter collapse not because there’s a lack of housing demand but because developers built for demand from owner-investors, not owner-residents.

An investor buying a “dog crate” condo of less than 500 or 600 square feet could churn enough tenants through at high rents to pay a low finance cost mortgage. But with higher finance costs and falling asking rents, demand from owner-investors has evaporated.

Now the Toronto condo model premised on investor-ownership no longer makes financial sense. The result is a massive supply of terrible quality housing on the market at distressed prices. They make no sense an as investment and few people want to buy one for occupancy.

The result of market failures has been that perhaps the only housing sector holding up has been apartment buildings construction for corporate ownership. While Ontario needs all the housing it can get, more corporate rental units do not provide the same benefits as housing ownership, either of a house or condo.

Security of tenure, the possibility of one day living both rent- and mortgage-free, the end of dependance on unreliable maintenance — there are many good reasons two-thirds of Canadians choose to buy their housing and many more would like to own. They are not wrong.

Home ownership shouldn’t be a get-rich plan, but it should be a reasonable and attainable goal for far more people. While focusing on the rights of tenants and protecting affordable rents is critical, Ontarians want political leadership that helps them meet their dreams.

The Ford PCs and their federal Liberal allies have crushed those dreams. The NDP in Ontario and federally have mostly ignored them. Perhaps the social democrats should consider that protecting renters while rekindling the home ownership dream is not a sell-out or contradiction.

By Staff By Staff

May 13th, 2025

BURLINGTON, ON

Unlock Tax-Smart Strategies for Your Business

Sun Life, Trillium District and supported by the Burlington Chamber of Commerce

Join the Burlington Chamber of Commerce at the Burlington Golf & Country Club for a free, in-person seminar designed specifically for business owners. Join the Burlington Chamber of Commerce at the Burlington Golf & Country Club for a free, in-person seminar designed specifically for business owners.

Led by Paul Thorne & Katelyn Culliton, Directors of Advanced Planning at Sun Life, this session will explore the latest tax-efficient planning opportunities to help you: Led by Paul Thorne & Katelyn Culliton, Directors of Advanced Planning at Sun Life, this session will explore the latest tax-efficient planning opportunities to help you:

- Keep more of what you earn

- Make smart decisions for the future

- Navigate evolving financial landscapes with confidence

You’ll walk away with real-world strategies and the chance to connect with other local entrepreneurs who share your drive for growth.

Location: Burlington Golf & Country Club – Banquet Room

Date: Thursday, June 12, 2025

Choose from two FREE sessions:

Session 1: 8:00 AM – 10:00 AM

Session 2: 10:30 AM – 12:30 PM

Space is limited, so register now to secure your preferred time.

By Gabriela Pelayes By Gabriela Pelayes

May 12th, 2025

BURLINGTON, ON

You can improve your experience when you play slots. One of the best ways is to use promotions at casinos like AllySpin casino. Bonuses guarantee different advantages like more spins or balance, but you must know how to use them wisely.

Always read the rules, choose slots with beneficial conditions, and complete the wagering requirement quickly. This article explains approaches to using promotions to your advantage.

Types of Promotions for Slots

Purely a game of chance. But read the terms to determine whether you get a bonus. You can use different types of promotions to play slots without spending too much of your own money. Here’s a list that explains the most popular types of slot bonuses:

- Free spins. Casinos like AllySpin give a set of spins on specific slots. You can win real money, but you must complete the wagering requirement to withdraw it. Most free spins have a fixed value per spin.

- Reload bonuses. You get a promotion on your payments after a welcome bonus. This gift increases your balance, so you can play longer.

- No deposit promotions. You get a promo without a condition to spend money. These bonuses have wagering requirements, and they’re rare.

Other potential bonuses are available at sites like AllySpin, but these are more common. All of them have conditions.

Terms and Conditions of Promotions

You must read the requirements and rules for bonuses at casinos like AllySpin before you claim them. It’s the most important part, as these terms determine whether you get a bonus and can withdraw funds. These are some of the conditions in general:

- Wagering requirements. Users must wager the amount they get a specified number of times. For example, 20, 25, 30 and so on.

- The minimum deposit unlocks the bonus, which you can get if you invest a lower amount.

- There are restrictions on titles. You should check if some slots are excluded, as they won’t count toward wagering.

- Maximum winning limits. Some gifts have maximum amounts on how much you can win. It can be a sum, like €200, or a multiplier, like x10.

- Expiration dates. The length of time you can use a promo, for example, is limited to 1 to 30 days.

- A maximum bet limit. Most bonuses often have limits on wagers. You can’t make larger bets to complete wagering requirements.

Read the rules in detail before you use the promotion. You may want to skip bonuses at casinos if they’re not for your favorite slots.

Guide to Select a Slot and Use Bonuses

You should select slots that you like, but also that are compatible with the bonus. Here’s a list of tips that help you use promotions to your benefit:

Plan every session when you use bonuses. Choose the right game, follow the rules, and play responsibly.

By Leonard Fergus By Leonard Fergus

May 4, 2025

BURLINGTON, ON

A reliable internet connection is essential for everything these days, be it work, school, entertainment, socializing, or staying connected with loved ones. With so many internet providers and plans available out there, it can be difficult for an average user to choose the right one. The right provider can make your online experience seamless and allow you to enjoy the internet hassle-free, while the wrong one can leave you frustrated and annoyed all the time.

So, if you are in a situation where you have to choose an internet provider, then you must consider these factors before choosing a provider, as these are the most important factors to judge how good or bad a provider is.

Fibre optic cable has improved the speed at which data runs through the internet – it will continue to get better and better Internet Speed and Bandwidth

Internet speed is usually measured in megabits per second (Mbps) and it is a measure of how quickly the data can be downloaded or uploaded. The higher the Mbps or Gbps, the faster your internet connection is. While choosing an internet provider, make sure that you choose an internet speed that can handle most of your internet needs. Here is a quick breakdown of different internet speeds required for different activities:

- 10–25 Mbps: Suitable for basic browsing, email, and streaming in standard definition.

- 50–100 Mbps: Ideal for HD streaming, online gaming, and working from home.

- 200+ Mbps: Perfect for 4K streaming, large file downloads, and multiple devices.

You should look for an internet provider like Rogers that offers internet speeds that match your usage requirements. Don’t go for the cheapest plan, instead make sure that the plan you are choosing has enough speed and bandwidth to handle your internet needs.

Reliability and Uptime

There is nothing more frustrating and annoying than having an unreliable internet connection that experiences frequent disconnections, outages, and slowdowns, as these can disrupt your work, studies, and entertainment. Committing to an internet provider that provides a reliable internet connection with 99.99% uptime guarantee is what you should opt for.

Although every internet provider will promote itself by promising reliability and maximum uptime, you should check customer reviews and ratings on the internet to get better insights into how reliable an internet provider is.

Coverage and Availability

The price might be right – but the coverage your getting might be terrible. Not all internet service providers provide their internet coverage in every area throughout the country. Although there are some internet providers, such as Bell, which provide coverage over a wide range of areas, most internet providers have limited internet coverage and you should check the coverage and availability in your area to ensure that the provider provides coverage in your area. Along with coverage, make sure to assess available internet connection types, as choosing a fiber internet connection is much better than sticking with a slower connection like DSL or satellite internet.

Pricing and Contracts

As an average internet consumer, you should be aware of the fact that many internet providers often advertise low promotional rates and increase the rates significantly once the initial promotional period is over. Before committing to any provider, make sure that you check the long-term costs. Along with this, also check for additional and hidden charges like installation fees, equipment rentals, early termination fees, etc.

Some internet providers may require you to sign a long-term contract with them, while others may offer flexibility and month-to-month plans. If you are not sure about a long-term commitment, then look for an internet provider that has more flexible terms.

Customer Service and Support

Service is often spotty – ask around and listen to what others customers tell you. Good customer service and support are very important to assess how good an internet provider is because when something goes wrong, you want to have an internet provider with a proactive, responsive, and helpful customer support team that can resolve the issue. Poor customer service can turn a minor issue into a major one, and it is what you should try to avoid at all costs.

Look for feedback on the customer support of the internet providers that you have shortlisted. Pay special attention to how they handle complaints and resolve issues, and whether they have 24/7 support available or not.

Additional Features and Services

Lastly, you should not forget about additional features. Because of the increasing competition, internet service providers are offering additional features and services. Many providers offer bundles that include TV, phone, and mobile services that are usually cost-effective if you need multiple services. Make sure to assess for additional features and the equipment provided by the provider. If the provider is offering equipment of subpar quality, then consider investing in your own.

Additional services and bundles provided by internet providers are usually cost-effective, but ensure that you are not being overcharged before committing to a provider.

By Staff By Staff

May 5th, 2025

BURLINGTON, ON

Kelly’s Bake Shop; opened in 2012 and became a reason to visit Burlongton.

Owners Kelly and Erinn closed their downtown Burlington location after 13 years. It wasn’t a decision they made – the property owner made it for them – giving them sixty days to vacate the premises.

Planning a day – when the days were good. Kelly and Erinn

Rendering of the proposed development. Interesting to note that the Bake Shop is included in the rendering which suggest that the developer was open to the idea of the Bake Shop being part of the development. No word from the developers as to when the demolition of the site will begin. Most recent information was that a development application has yet to be approved. Property taxes will be lower once the site has been levelled.

The site is bound by Brant, John and James with the southern end the parkette.

Proposed Development

To modify the Zoning for the previously approved development as follows:

- Reduce the parking rate to 0.74 parking spaces per residential unit (overall number of parking spaces),

- Reduce the parking stall dimensions,

- Reduce the second-floor height from 3.8 metres to 3.7 metres,

- Reduce setbacks to the parking structure and

- Increase the overall building height from 65m to 66 m to make room for a mechanical penthouse.”

Statutory public meeting and recommendation report

May 13, 2025

9:30 a.m.

Virtual Meeting held in hybrid format

By Fiona Stein By Fiona Stein

May 3rd, 2025

BURLINGTON, ON

Ontario has always dominated the gambling scene – big, bold, and buzzing with energy. From glitzy slot machines to poker tables, betting has long been a go-to activity for Ontarians. But the rise of technology has changed this scenario now. Now, you don’t need to get into your car, steer through traffic, find a parking spot, and then step into a physical casino. Just open your laptop from the comfort of your home, the casino is there. What’s driving this shift? How it’s shaking up the way you play? Let’s have a look.

A New Era Kicked Off in 2022

Things changed on April 4th, 2022, when Ontario launched its iGaming market. Before the iGaming market, OLG was the only site regulated by the Alcohol and Gaming Commission of Ontario (AGCO), and online gambling was a grey market. Offshore sites were making it possible, but they weren’t well-regulated. But, with iGaming Ontario, the province took charge of overlooking this industry. It wasn’t just a bureaucratic flex but a pivotal move for local bettors. Suddenly, running gambling sites in Ontario wasn’t a shady operation. It was a legit, licensed, and well-regulated industry. This change lets people place safer bets, lesser risks, better odds, and a lot less guesswork. Things changed on April 4th, 2022, when Ontario launched its iGaming market. Before the iGaming market, OLG was the only site regulated by the Alcohol and Gaming Commission of Ontario (AGCO), and online gambling was a grey market. Offshore sites were making it possible, but they weren’t well-regulated. But, with iGaming Ontario, the province took charge of overlooking this industry. It wasn’t just a bureaucratic flex but a pivotal move for local bettors. Suddenly, running gambling sites in Ontario wasn’t a shady operation. It was a legit, licensed, and well-regulated industry. This change lets people place safer bets, lesser risks, better odds, and a lot less guesswork.

Convenience That’s Hard to Beat

People are busy. They usually don’t have time to go to a casino on the weekends when their family wants to spend some quality time with them. Online casinos have cracked this problem. Not feeling like driving? Sitting in a remote location? Or chilling in your living room? You can access these virtual casinos. Just open your smartphone or laptop, and you’ll be spinning slots in no time.

Who doesn’t need such convenience? And it’s this convenience that’s rewriting the Ontario gambling rules. Obviously, why would you wear a suit if you can play poker in your shorts and favorite hoodie from your living room?

Banking That Keeps Up with the Times

Land-based casinos require cash. And cash withdrawals bring sketchy ATM fees and other stress. But those days are fading fast. That’s because online gambling sites offer payment options you already use every day. One such method is Interac e-transfers—quick, local, and trusted. Land-based casinos require cash. And cash withdrawals bring sketchy ATM fees and other stress. But those days are fading fast. That’s because online gambling sites offer payment options you already use every day. One such method is Interac e-transfers—quick, local, and trusted.

Not a fan of Interac? Or just don’t want to use it for your online gambling transactions? There are e-wallets like Skrill and Neteller to deposit money with ease, without linking it to their bank accounts.

And that’s not the end. For the tech-savvy, Crypto is the option. Bitcoin and Ethereum are popping up on many gambling platforms, providing a safe, secure, and futuristic transaction vibe. And for those preferring old-school methods, credit card options aren’t going anywhere.

So, where physical casinos stick with a few payment options, virtual ones offer you a bunch of them for flexibility.

More Than Just Slots and Poker

This is the interesting part. Casinos usually conjure a picture of slot machines and basic blackjack tables in your mind. But that’s not the case with online gambling sites. These virtual playing spots can offer thousands of games, catering to different individuals with different preferences. This is the interesting part. Casinos usually conjure a picture of slot machines and basic blackjack tables in your mind. But that’s not the case with online gambling sites. These virtual playing spots can offer thousands of games, catering to different individuals with different preferences.

Not a fan of those old-school poker or blackjack? No problem. You have thousands of other games on the list. Table games, card games, slots, roulettes, wheel of fortune, arcade games, specialty games, there’s a lot to keep you entertained for an eternity.

Safety Nets That Actually Work

That’s where things get in their favour. Responsible gambling has always been a talking point when it comes to gambling. And just a while ago, this virtual area felt like the Wild West. But iGaming Ontario with AGCO changed this scenario. Now, online sites have to adhere to some strict gambling rules.

Mandatory age checks for casinos (19+) and lotteries (18), spending limits, and easy access to physical and mental health services are a must. You can’t say that’s flawless; nothing is. But that’s way better than those old unregulated days.

The Bottom Line

The way online gambling sites are thriving, the digital shift is not at all going to slow down. In fact, in the future, we might witness more complex technologies like VR, etc., integrating with gaming, making the experience more exciting and fun. So, what’s the verdict? Ontario’s online gambling scene is upgrading, and people are embracing it quite well. It’s safe, secure, and flexible, and who wouldn’t love such an experience?

By Anton Lucanus By Anton Lucanus

May 3rd, 2025

BURLINGTON, ON

Finding casinos that offer the best payouts is vital because it boosts your returns and heightens the excitement of playing your favourite casino games. Casino brands like Golden Tiger Casino, Yukon Gold Casino, Zodiac Casino, Luxury Casino, and Captain Cooks Casino also provide top casino payouts through their carefully curated list of games and partnerships with the best software providers.

Top Canadian Casinos with the Best Payouts

Yukon Gold Casino is a trusted Canadian casino which has maintained an outstanding payout record over the last two decades. Players have also endorsed it as a reliable and transparent gaming partner and platform where they can enjoy the best payouts due to its top casino payouts.

Zodiac Casino provides a consistent payment structure and high RTP rates for all its games so that players can enjoy the best winning outcomes. The casino also ensures player satisfaction by making all its games available on its mobile app and using customer service agents who are always available to assist players or answer their questions.

Golden Tiger Casino is one of the best high RTP online casinos with a unique selection of table, slot, and live dealer games. It has EXCELLENT reviews on Trustpilot and other platforms, making it a credible option for many players. Golden Tiger Casino is one of the best high RTP online casinos with a unique selection of table, slot, and live dealer games. It has EXCELLENT reviews on Trustpilot and other platforms, making it a credible option for many players.

Luxury Casino blends premium offerings through its Casino Rewards loyalty program and high payments through its high RTP games. It is also one of the most profitable casinos for players due to offering additional opportunities to increase payouts through its additional bonuses and regular promotions.

Captain Cooks Casino provides the best return to player and win rates alongside secure payment options. Its generous payment providers charge the lowest fees and ensure the lowest withdrawal times so players can receive the highest percentage of their winnings promptly.

Bigger Returns with the Highest Win Rate Guarantee

Each Casino Rewards group brand offers a HIGHEST WIN RATE GUARANTEE. This guarantee assures players that all games on their platforms have the best Return to Player and win rates.

It optimizes player returns on Golden Tiger Casino by providing the biggest wins more frequently. It also makes sure that players preserve their bankrolls.

Players who can do this can play many more rounds or hands of their favourite casino games, which translates into longer play times and better player experiences.

The highest win rate guarantee also improves player experiences by making choosing casino games simple. Instead of researching different games to see which offer the best payout rates, players can pick any game on these casinos’ platforms and know they will enjoy significant earnings due to their guaranteed casino payouts. The highest win rate guarantee also improves player experiences by making choosing casino games simple. Instead of researching different games to see which offer the best payout rates, players can pick any game on these casinos’ platforms and know they will enjoy significant earnings due to their guaranteed casino payouts.

These guaranteed casino payouts also benefit players who prefer progressive slot games. These games have the highest payouts, typically in the hundreds of thousands to millions of dollars range. Casinos with the highest win rate guarantee optimise their win frequencies so players have an increased chance of landing the biggest wins.

Trust Factors in High-Payout Casinos

Players should always consider trust factors like casino ratings and reviews when choosing the casino brands to engage with. Trustpilot ratings and reviews are so important because they represent the unfiltered and raw views and opinions players have about the specific casinos they have experience with.

Players can leverage these trusted casino reviews to make better decisions, verify the best return on casinos with payout guarantee, and ensure a better gaming experience. They can check if a casino has a long history of consistent and reliable casino returns, secure casino payments, and great player experiences.

You can also use Luxury Casino reviews to see that the casino has passed third-party audits. Player-favoured casinos that are registered with and licensed by various bodies including eCOGRA allow regular audits that check their systems and processes to verify that they keep player data safe, guarantee fair outcomes, and provide consistent casino returns.

These audits also check that the casinos use verified, secure, and trusted processors to guarantee secure casino payments, including efficient casino withdrawals and deposits. By passing payment checks, players can trust that they will receive their winnings without issue and that they will be charged favourable fees after making a withdrawal request.

Strategies to Increase Your Casino Payouts

The best strategies for increasing casino payouts include choosing games with high Return to Player and win rates and using available casino bonuses effectively.

High RTP online casinos post the return and win rates of all games on their websites. These platforms become an essential research tool for players deciding which games to pick that will ensure the best winning outcomes.

You can also check review websites to find out information about specific games. These players tell you everything you need to know, including which games have the highest payouts, the best bonuses, and fast payout times.

Casino Rewards Group brands offer welcome and deposit bonuses as well as additional in-game bonuses. You can take advantage of welcome and deposit bonuses by spreading out your deposits to leverage bonus matches.

Captain Cooks Casino, for example, provides a 100% match for the second and fifth deposits. Spreading out your money can help you leverage all five of its deposits to increase your bankroll soon after signing up. Captain Cooks Casino, for example, provides a 100% match for the second and fifth deposits. Spreading out your money can help you leverage all five of its deposits to increase your bankroll soon after signing up.

You should also use your bonuses as soon as possible to avoid losing your casino bonus opportunities. As you do this, you pick games with favourable wagering requirements that fulfil your requirements much faster. Slot games are the best option for minimizing the impact of wagering requirements on your bonus, but credible casinos like Captain Cooks Casino will tell you which games give you the best odds of withdrawing the largest winnings.

Key Takeaways – Selecting the Best Casino for Maximum Payouts

The best payout casinos give you access to fast wins and have enhanced Return to Player and win rates to increase your winnings significantly. Each of them has numerous positive reviews and EXCELLENT ratings on Trustpilot and other platforms, making them credible options for enjoying high-earning casino games.

The casino brands Yukon Gold Casino, Zodiac Casino, Golden Tiger Casino, Luxury Casino, and Captain Cooks Casino offer unparalleled payout and gaming experiences. With their high rankings and credibility, why would you play anywhere else?

By Shireen T. Singh By Shireen T. Singh

April 28th, 2025

BURLINGTON, ON

The world of fintech has gained a lot of attention since 2018, and for good reason. Simply looking at the numbers, you can just tell that the industry is growing rapidly. At the end of 2023, the F-Prime Fintech Index, which tracks the industry’s growth, estimated the market cap of the industry to be $573 billion. And that’s double what it was in 2019!

Trade with a firm’s money for profit from the comfort of their home. Today, financial services are becoming more efficient and user-friendly than ever, making fintech a mainstay in today’s economic climate. One area where fintech’s relevance is growing significantly is proprietary trading. So, let’s examine how fintech is transforming prop trading and what its future is shaping up to be.

Understanding Prop Trading

When a financial institution, like a bank or hedge fund, trades with its own money in the forex market, stock market, or other financial markets, that’s called proprietary trading. These financial companies typically make trades on behalf of their clients and earn a commission, but prop trading is a little different. Instead of using a client’s money to invest, they use their own capital, which means they can take on more risk and have a shot at higher rewards.

Thanks to advancements in fintech, this form of trading has become more accessible and advanced, opening up new opportunities to companies and traders globally. CFD brokers and prop trading firms now provide retail traders with access to institutional-grade trading environments, allowing them to leverage cutting-edge trading tools. For example, platforms like OANDA now allow traders (with no capital) to trade with a firm’s money for profit from the comfort of their home.

It is also important to note that financial corporations involved in prop trading do this for one major reason, and that is to make more profit. In order to keep things fair and focused, they have special sections of the company dedicated to these kinds of trades — referred to as the prop trading desk. This desk operates separately from client-focused areas and sometimes even acts as “market makers,” meaning they step in to buy or sell large amounts of security when there isn’t enough movement in the market. This keeps things flowing and adds increased stability to the market, even when things get rocky.

Evolution of Prop Trading

In the 1980s, before the internet, prop trading started as a way for retail traders who weren’t wealthy investors or big institutions to get a chance to join in on the stock market action. This was possible when financial corporations created “pool accounts” that allowed these smaller traders to access real-time data and trading tools they couldn’t get on their own.

These people were skilled traders who worked directly from these firms’ offices to help grow the company’s capital. These people were skilled traders who worked directly from these firms’ offices to help grow the company’s capital. They then earned part of the profits they garnered for these financial institutions. This is the foundational setup that structures today’s prop trading model, where firms still partner with individual traders.

Thanks to the internet, the world of prop trading has become so advanced that it is somewhat unrecognizable. However, the concept remains the same: traders pay a fee to be evaluated, and if they pass, they get access to the firm’s capital, sharing any profits that they make. Technological advancements have made prop trading easily accessible to every trader willing to fulfill requirements stipulated by prop trading firms.

Currently, well over 100 online prop trading firms offer evaluation programs for anyone who wants to try trading. While most traders might not make it past the evaluation, the few who succeed stand to earn significantly by trading with more funds than they would have had on their own.

Three Key Fintech Innovations Transforming Prop Trading

The trading methods and tools used to carry out innovative and competitive trades have changed significantly owing to the advancement in the fintech industry. With the advantage of fintech, prop trading has become faster, smarter, and more adaptable to market changes. Here are three key fintech innovations that are transforming the world of prop trading that are available through these solutions.

High-Frequency Trading (HFT)

Today, it is much easier to use high-frequency trading in prop trading. HFT is a technological advancement that allows thousands of trades to be carried out in fractions of a second. When used together with algorithmic trading, it can boost trade volume and speed, helping traders react instantly to market changes and increase profits. This advancement has given traders and firms an upper hand in the markets but also poses a risk of increased market volatility, especially when trades are executed at high speeds in sensitive conditions.

By Anthony Lucas” By Anthony Lucas”

April 25th, 2025

BURLINGTON, ON

To ensure the best experience and winning outcomes, players should opt for the best-paying online casinos that guarantee the best payouts and biggest win rates. Casino brands like Yukon Gold, Golden Tiger, Zodiac Casino, Luxury Casino, and Captain Cooks Casino all provide the highest slot payouts in Canada, making them ideal choices.

Where Can You Find the Highest Paying Slots in Canada?

Players can find the highest paying slots in Canada by visiting casino sites that are known to provide the best RTP slots. These include brands like Yukon Gold Casino, Captain Cooks Casino, Luxury Casino, Zodiac Casino, and Golden Tiger Casino. Players can find the highest paying slots in Canada by visiting casino sites that are known to provide the best RTP slots. These include brands like Yukon Gold Casino, Captain Cooks Casino, Luxury Casino, Zodiac Casino, and Golden Tiger Casino.

Yukon Gold Casino is a player-favorite since it provides the best slot returns. It selects all the online casino games on its platform carefully and works with the best software provider so each game has the best win and payout rates.

The casino is also highly trusted due to its reputation for timely payouts. It ensures players can receive their winnings from its quick payouts and fastest payout slots by working with trusted and secure payment methods that players are familiar with.

Zodiac Casino is known for its large selection of online slots and Progressive jackpot slots. It ensures high payouts for each game through its highest rate guarantee. The “Highest Win Rate Guarantee” promises to deliver the most favorable win rates or Return to Player (RTP) percentages from the games provided by the casino’s software suppliers.

Players can choose from hundreds of video poker games with unique gameplay, features, bonuses, and payouts available through the casino’s website and mobile app.

Golden Tiger Casino aims to provide players with the largest game collection of high return slot machines. Players can choose from slot games they can find at other casinos or unique titles only found on this casino’s website. Golden Tiger Casino maintains a rotation of high payout slot games to ensure a unique gaming experience for its players.

Luxury Casino also offers high paying slot games, but it improves the player experience by providing unique bonuses and running various promotions regularly. Upon signing up, players can access hundreds of unique slot games where bets start at a few cents.

Once they start playing, players get access to bonuses like free spins, winning boosts, and mini games that increase their earnings significantly.

Captain Cooks Casino aims to replicate a similar experience to the one players get when playing slots in physical casinos. It has an easy-to-use platform that categorizes its games so players can find their favorites easily. The casino also participates in the Casino Rewards highest win rate guarantee where it ensures all the slot games on its platform provide the highest win rates.

Why Is Trust Important When Choosing a Casino?

When choosing a casino, it is crucial to pick a trustworthy one. Such casinos ensure player safety, responsible gambling tools, fantastic customer support, and fair gameplay.

The best way to know if a casino is trustworthy is to check user reviews. Players leave reviews of the various casinos they have experience with on review websites, and checking them can inform readers what they think of specific casinos.

Platforms like Trustpilot make it easy for players to leave such reviews and provide ratings for different casinos.

Players can go through reviews of trusted Canadian casinos to see what others are saying about specific casinos and if they recommend any player-approved slots before making a choice. They should only pick casinos with consistently high praise for their payouts, customer support, transparency, and gaming experience. Players can go through reviews of trusted Canadian casinos to see what others are saying about specific casinos and if they recommend any player-approved slots before making a choice. They should only pick casinos with consistently high praise for their payouts, customer support, transparency, and gaming experience.

Players should also check for mentions of payouts. These should be positive statements about how trustworthy a casino is regarding paying out winnings and its use of secure payment methods.

How Do RTP and Slot Payouts Work?

The RTP or Return to Player rate is a casino payout percentage that indicates how much of a player’s bet the casino returns as winnings. It is an average rate calculated over millions of slot rounds. The top slot casinos have very high RTPs, with their rates typically a few points higher than those at other casinos.

Since the RTP is the percentage of a bet that a casino returns, higher rates are better because they lead to bigger wins. RTPs also determine the house edge, the amount a casino keeps as its profit for each dollar players wager.

With higher RTPs, casinos that provide big win slots Canada keep less of a player’s bet, which means a larger amount goes to the bet and leads to better payouts.

Tips for Maximizing Slot Payouts

Players can leverage several strategies to maximize slot payouts. The easiest one is choosing high paying slot games with the highest win and RTP rates. They should also stick to casinos that provide a highest win rate guarantee so they can be assured of the best rates regardless of the slot game they choose.

To choose the right slots, players should check different casino platforms and User reviews websites. Casino websites display all the information players need to find high paying slot games.

Review websites also post information about these games and are an incredible source of reviews that tell players whether they should register and play at specific casinos.

Choosing the Best Canadian Casinos for Slot Payouts

Top slot payout casinos all provide games with the highest RTPs and win rates to ensure the biggest wins for their players. These casinos also use secure payment methods to ensure fast payouts and player data security.

The best casinos provide excellent customer service so players can find the assistance they need when they need it. Brands like Yukon Gold Casino, Zodiac Casino, Golden Tiger Casino, Luxury Casino, and Captain Cooks Casino stand out due to their exceptional slot gaming experiences beyond their high payouts.

By Staff By Staff

April 25th, 2025

BURLINGTON, ON

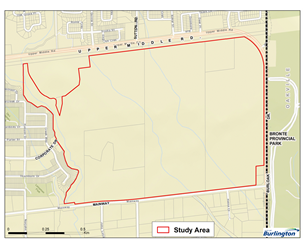

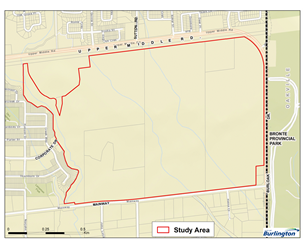

On March 4, 2025, staff presented proposed Official Plan Amendment (OPA) No.4 to a Committee of the Whole Statutory Public Meeting through staff report DGM-13-25 Bronte Creek Meadows Proposed Official Plan Amendment No.4,in order to hear comments and questions from members of Council and the public. Staff continued to accept questions, comments and recommendations until March 18, 2025.

City staff have reviewed and considered the feedback received, and are targeting bringing forward a Recommendation Report to Council for adoption of the OPA in May 2025. City staff have reviewed and considered the feedback received, and are targeting bringing forward a Recommendation Report to Council for adoption of the OPA in May 2025.

Staff continue to be available to answer any questions about the project. Email newop@burlington.ca if you have any questions or would like to Talk to a Planner.

By Olivia Sabell By Olivia Sabell

April 23rd, 2025

BURLINGTON. ON

Online casinos have been a revelation in the gambling world since the beginning of the 21st century. Canada has been one of the strongest global economies throughout this period. Still, it wasn’t until recently that Canadian provinces warmed to regulating and taxing online casinos.

In Canada casinos are regulated by the province they are located in with Ontario having the best regulations. It has been a global surge that has pulled many countries along with it. Unlike the UK, which was one of the first countries to regulate online casinos nationally, Canada’s provincial and fractured regulatory landscape meant that the rise of online casinos has taken a different trajectory.

It’s essential to distinguish between the federal regulations in Canada and the provincial bodies that oversee gambling competitions, including online casinos, but also encompass other gambling games, such as lotteries and sports betting.

Over the last decade, this has shaped the casino market in neighboring America rather than their European counterparts. Today, we will look at some nuances in the Canadian casino market and how they have affected the current market.

A changing landscape

In the late 1980s, Canada created a new landscape for land-based casinos. The first land-based casino opened in Winnipeg and became an entertainment venue featuring restaurants, hotels and other amenities.

A few years later, Montreal got in on the action. Although the first online casino emerged just a year after that, many within the casino industry were skeptical that the internet had a lasting place in the gambling world.

In the 1990s, few people had home PCs, and internet connections were slow and extremely expensive. It was a digital world of message boards and bookshops – the internet wasn’t the ubiquitous presence we see today in modern society.

Online casinos, of course, quickly proved to be a challenging, disruptive market for the traditional industry. The cost of accessing the internet decreased dramatically and the speed of connectivity soared, bringing tens of millions of people online within just a few years.

The global market’s interconnectivity meant that the best online casinos in Canada were companies establishing a presence in several other international markets. It became such a crowded and competitive market that experts started compiling reviews and assessments of the sites they believed stood out in this growing, saturated market.

Navigating local regulation in a global market

While the internet has introduced a range of innovations, it has proved to be a regulatory headache for governing bodies that look to provide oversight. Instrumental social media companies have shown just how difficult it can be to provide broad policing and taxation to markets that span dozens of countries, and online casinos have faced a similar fate.

By the early 2010s, propped up by the success of the online gambling market that had emerged in the UK, lobbyists and influential figures in online gambling were tirelessly searching for ways to get online casinos into the North American market, the biggest continental market.

Although the federal laws oversee the gambling market and its legality, they have devolved the regulatory powers to 13 different provincial governing bodies. While most of them are similar, it’s always a good idea to check the legality of online gambling in your province before you decide to sit down and play a casino game.

A rise in convenience

As soon as online casinos proved to be an alternative that was just as secure and as reliable as a land-based provider, interest in this new form of gambling soared. There was a time before the advent of the internet when Canadian casino gamers would have to pack a bag, head down to the airport and fly to the US to scratch their gambling itch. However, online casinos meant Canadians could do this without leaving their homes. As soon as online casinos proved to be an alternative that was just as secure and as reliable as a land-based provider, interest in this new form of gambling soared..

Generally speaking, though, Canadians have only been able to access legal and regulated online gambling markets since this century, when regulatory changes allowed some of the world’s biggest sports betting companies to set up shop on Canada’s digital shores.

However, in the mid-2000s, a black market emerged in Canada, with millions of dollars’ worth of bets placed with offshore companies. This market forced the hand of regulators to some extent, as it was simply too difficult to police. Regulating, taxing and cycling these funds into community development projects became the only viable route.

The smartphone era

If online casinos weren’t convenient enough, the mid-2010s saw the rise of gaming apps and mobile gaming. Those who played at online casinos on their home PCs or laptops now had an even more convenient option: playing on the move via their iPads, tablets or smartphones.

This rise wasn’t unique to the Canadian market. Smartphones have transformed everything about our lives; we’re sure you don’t need us to tell you that. Online casinos simply surfed the crest of the wave that presented a fresh opportunity for their casinos to expand, and the rise in usage among Canadian customers was a microcosm of what was happening in the global iGaming market.

As the competition heated up, online casinos searched for ways to incentivize these promotions, offering free spins, matched deposits and other cost-effective promotions to get people to their sites ahead of the competition.

Final thoughts

VR gaming could well be the next technological advance that takes the sport to new heights. Although Canada opted for a provincial and localized approach to regulation, many trends that resulted in the rise of online casinos are attributed to the broader pull of the global market. Countries like the UK pioneered their digital legislation in the early 2000s, creating a foundation whereby online casinos could launch their brands into the international market.

The UK tax base soared, generating tens of billions of pounds over the subsequent decade. Canada is a little behind in this curve, but the numbers are equally promising, especially if we combine online casinos with sportsbooks and lotteries as part of the complete market.

This trend will likely continue to adapt to technology over the next decade. It may take the form of VR gaming, further integration of AI, or casinos focusing on the rise of digital payment options; it could also be a combination of any of these aspects.

However, now that the sector has an appropriate regulatory framework and the number of Canadians accessing online casinos continues to rise, expect to see quick changes and serious growth over the next decade as it begins to take shape in a legal market.

By Julieta Belen Correa By Julieta Belen Correa

April 21st, 2025

BURLINGTON, ON

Online casinos in Canada provide something that brick-and-mortar establishments don’t: bonuses. Some land-based casinos offer special treatment, but it’s often reserved for high-rollers.

Online gambling websites have promotions for all types of players. For example, you can check out AllySpin and see that this casino provides bonuses not just for gamblers, but also for bettors. Here’s an important factor: these promotions have wagering requirements.

This article explains with examples what is a wagering requirement and other crucial factors.

What is a Wagering Requirement?

It’s a term that explains how many times you must wager the bonus amount. Usually, a wagering requirement is a multiplier, like x20, x30, and so on. You must multiply the amount of funds you get by that number. It’s a term that explains how many times you must wager the bonus amount. Usually, a wagering requirement is a multiplier, like x20, x30, and so on. You must multiply the amount of funds you get by that number.

Suppose you received CAD 200 with a x25 requirement. You must spend CAD 200 x 25 = CAD 5,000. You can use gifted funds and the deposit amount to complete this requirement.

Players can’t withdraw funds without completing this requirement.

Reasons Why Casinos Implement Them

In the past, when online casinos only starting to gain popularity, companies had to compete for the attention of clients. Some users abused this system and kept claiming bonuses without playing at casinos like AllySpin.

That’s why now we have wagering requirements and other conditions. These are all other reasons:

- Prevent cash-outs without playing.

- Guarantee for profitability.

- Encouragement for longer gameplay.

- Balance of promotional attractiveness and risk.

So, wagering requirements are a strategic tool. Promotions attract users, but they can’ just cash out without gambling.

Other Important Aspects

Most promotions have excluded games on the list. This means they won’t contribute to the wagering requirement. Moreover, some games do contribute, but not as much as slot machines.

So, here’s a table with contribution percentages:

| Game type |

Contribution to wagering requirements |

Notes |

| Slots |

100% |

Most bonuses are designed with slot players in mind. |

| Blackjack |

15–25% |

Varies by casino; often lower due to skill element. |

| Video poker |

10% |

Strategic game, so contributes less. |

| Table/card games |

0–10% |

Generally low contribution. |

| Live dealers |

0–10% |

Live games are limited due to higher payout potential. |

You should also understand that all bonuses at casinos like AllySpin have time limits. They start from 48 hours to 30 days. For example, you must wager winnings from free spins within 48 hours.

Tips to Complete Wagering Requirements

Here’s a list of a few tips that should be helpful: Here’s a list of a few tips that should be helpful:

- Opt for offers with wagering requirements between x20 and x40 for a better chance of complying.

- Games with a higher Return to Player (RTP) percentage are statistically more likely to result in wins. This means you get more funds to wager without additional spending.

- Play low-volatility games for smaller, but more regular winnings. Hgh-volatility games may offer huge wins, but they are rare.

To conclude, you should carefully read and understand the rules. You have a better chance to not prevent overspending when you select bonuses with reasonable requirements, and play games that contribute more.

By Lyall Gillies By Lyall Gillies

April 21st, 2025

BURLINGTON, ON

Bank transfer is one of the oldest and most reliable payment methods. For players who value security, trust, and no-nonsense banking, bank transfers offer a dependable way to move money in and out of online casinos. Backed by major financial institutions, this method provides peace of mind that your hard-earned cash is handled carefully. It’s a go-to choice for players who prefer the stability of traditional banking over the uncertainty of newer, trendier options.

The Benefits of Using Bank Transfers at Online Casinos

Bank transfers are processed by established financial institutions with strict regulations and built-in protections. Bank transfers have various advantages, making them an appealing option for many Canadian players. Here’s why they continue to hold their ground in the online casino world:

Security You Can Rely On

Bank transfers are processed by established financial institutions with strict regulations and built-in protections. This makes them one of the most secure ways to deposit and withdraw money from your casino account.

Clear Financial Tracking

Since all transactions go through your personal bank account, you’ll have a clear record of every deposit and withdrawal. This level of transparency helps players control their spending and manage their bankroll more effectively.

No Need for Third-Party Accounts

Unlike e-wallets or payment apps, bank transfers don’t require setting up and maintaining an extra account. Everything is done through your bank, making the process more straightforward and familiar.

Great for High-Value Transactions

Many casinos allow higher withdrawal limits when using bank transfers, making this method ideal for players who plan on cashing out larger sums.

Do All Canadian Casinos Accept Bank Transfers?

While bank transfers are a reliable and secure payment method, they’re not as widely supported at Canadian online casinos as one might expect. The main reason is that many Canadian casinos use payment intermediaries like Interac, iDebit, and Instadebit, which serve a similar function as bank transfers but are faster, more user-friendly, and built specifically for the Canadian market.

Because of these alternatives, casinos have less incentive to offer traditional direct bank transfers. Interac, for example, is already connected to most Canadian banks and allows players to deposit and withdraw funds directly from their bank accounts, making it a smoother and more integrated option. From the casino’s perspective, supporting these local services is easier and more aligned with what most Canadian players already use.

Additionally, bank transfers can require manual processing, especially for withdrawals, which adds time and complexity on the casino’s end. In a market where players value speed and convenience, this makes traditional bank transfers a lower priority for many operators.

Still, some casinos support them—especially those that aim to give players more choices and cater to those who prefer traditional banking. The best way to find them is to use Canada-specific affiliate sites, such as OnlineCasinoCanada and Bojoko. The latter is a powerful resource, as they have created a list of bank transfer casinos operating in Canada. The options are limited, but you can get a good grasp of what is out there and choose the best casino for you.

Alternatives to Bank Transfers for Canadian Players

There are several strong alternatives to traditional bank transfers for Canadian players looking for faster or more convenient payment options. These methods are widely accepted at most Canadian online casinos and are designed to make deposits and withdrawals easier and quicker while maintaining high-security standards.

1. Interac

Purely Canadian Interac is by far the most popular payment method in Canada. It’s directly linked to your bank account, just like a bank transfer, but offers faster processing times and a more seamless user experience. Both Interac e-Transfer and Interac Online are commonly supported, making it easy to deposit and withdraw without setting up a separate account.

2. iDebit and Instadebit

Instadebit works more like a wallet you can fund from your bank account. These two services also connect directly to your bank, but they act as intermediaries, allowing instant deposits and faster withdrawals than traditional transfers. The main difference is that iDebit allows one-time payments directly from your bank, while Instadebit works more like a wallet you can fund from your bank account.

3. Credit and Debit Cards

Visa and Mastercard are accepted at most Canadian casinos. They’re fast and convenient for deposits, though not always available for withdrawals. Remember that some banks may block gambling-related transactions, which means that availability can vary depending on your bank.

4. E-wallets (e.g., Trustly, Skrill, Neteller)

E-wallets offer an extra layer of privacy by letting you fund your casino account without sharing your banking details directly. They also typically have fast withdrawal times. However, not all Canadian casinos support them—especially PayPal, which is more limited in Canada.

5. Prepaid Cards and Vouchers

Options like Paysafecard allow you to deposit without using a bank account at all. These are great for players who want added privacy or control over their spending, although they generally don’t support withdrawals.

6. Cryptocurrencies

Cryptocurrencies: They offer fast, anonymous transactions but come with added volatility and a learning curve. While still not adopted by most Canadian casinos, the number of Crypto casinos that accept Canadian players has skyrocketed. They offer fast, anonymous transactions but come with added volatility and a learning curve. There are also a number of hybrid casinos offering Canadians the ability to gamble in both crypto and FIAT currencies.

Why Bank Transfers Remain a Reliable Payment Option for Canadian Players

Despite the growing popularity of new payment methods, bank transfers continue to offer security, simplicity, and direct connection to your bank account, making them a trusted choice for many players.

While newer payment methods may be faster, bank transfers still have a strong market presence due to their security, simplicity, and transparency.

By Pepper Parr By Pepper Parr

April 19th, 2025

BURLINGTON, ON

Fences are up; surveillance is installed. Trees could be coming down soon. The developer is setting the stage to get started on building as soon as they complete the conditions of the OLT decision from June 2024. He is already crossing the finish line, hoping we have given up.

We are not giving up!

Call to Action: Join us on Saturday, April 26 from 11:30 am to 12:30 pm for a Community Assembly

We are asking Doug Ford and the Minister of Housing to come to Millcroft to and see what is at stake.

·

This is not just a Millcroft issue – if this development isn’t stopped – there are other large pieces of land that will be the next target.

We need you and your family to RSVP (select the link or reply to this email) because the media will be joining us to support our final, collective call for leadership and accountability. Your presence matters!

Date: Saturday April 26, 2025

Time: 11:30 am – 12:30 pm

Location: In front of Hole 7

BYOBB: Bring Your Own Bristol Board

MYOM: Make Your Own Message – * Please review friendly suggestions below *

Parking: Millcroft Park (for those outside of our community) 4250 Millcroft Park

We are gathering — in a friendly, neighbourly way. This is not a protest. This is a community gathering.

Please keep messaging friendly, positive, and professional.

This Is Our Last Call

Protect Millcroft, Protect Burlington

This Is the End of the Millcroft Golf Course, Unless We Act Now

Focus on Nature & Greenspace

Greenspace Is Not Replaceable

Once It’s Gone, It’s Gone

Focus on Greenspace & Future Generations

Smart Growth, Green Future

Preserve the Green, Protect the Future

Our Community Needs Greenspace — Now and Tomorrow

Our Community Deserves a Say; Premier Ford, Come Walk With Us

Unaffordable Homes Won’t Fix the Housing Crisis

Greenspace Can’t Be Rebuilt

Golf Course Closure / Slippery Slope Messaging

· Today 92 Homes. Tomorrow, the Rest of the Course

· We’re Not Just Losing Land — We’re Losing a Legacy

By Staff By Staff

April 17th, 2025

BURLINGTON, ON

Election systems need to be protected against cyber attacks so that voters can choose their leaders. Cyber attacks can steal data from election systems, change results, and affect the whole process and public trust. So, the government must take the right steps to protect these systems.

In this article, we will discuss some effective ways for government officials to protect election systems from cyber attacks. Let’s have a look!

Prevent Suspicious Activity

Identity theft is the first step for hackers. You can prevent it by being very very careful if you see something suspicious. One of the best ways to protect election systems is to prevent any suspicious activity. You should carefully monitor the systems for strange activity and take action fast if you notice anything suspicious.

For example, if you see a sudden increase in traffic, this can also be a sign of a cyber attack. So, you must stay alert and stop threats before they cause damage.

Implement Network Segmentation

Network segmentation is another good way to protect election systems. For this, divide the network into smaller and separate parts and ensure good security for each part.

By dividing the network into smaller segments, you can ensure effective protection. Moreover, the attacker cannot easily access other parts if one part is attacked.

Moreover, checking your IP address is also important for keeping networks safe. Knowing what is my IP address will help you find any unauthorized access and possible cyber security threats to your network. You can protect your network from hackers by regularly checking your IP address.

Credential Management

Proper credential management is also important for securing election systems. So, make sure to use strong, unique passwords for all accounts and change them often.

Also, use multi-factor authentication (MFA) as it adds extra security by requiring an additional verification code. This makes it much harder for attackers to access the system.

Software Updates and Patch Management

Install the updates when they become available. Software update and patch management fix any problems in the system and make it harder for attackers to get into your system.

So, regularly update the software and apply patches to increase the security and reliability of election systems. This not only reduces the cyber attack risks but also improves the system’s functioning.

Log Management

Last but not least, log management provides information about network activity and can help find any security threats.

By managing logs, you can find out about any suspicious activities and respond quickly to fix the issues.

By Rivers By Rivers

April 16, 2025

BURLINGTON, ON

Ross Perot Ross Perot, who ran for president in 1992 had it right when he called NAFTA a ‘giant sucking sound’. NAFTA has not been a great deal for America, or Canada, especially when it comes to the automobile. Between 1994 and 2004 Canada’s share of North American auto production tumbled from almost 15% to just over 8%. The US lost significant market share as well. And Mexico became the big winner – rocketing from barely 7% to over a quarter of all the cars built in this continent.

Donald Trump had ranted but done little in his first term to correct that trade imbalance, ultimately endorsing the USMCA which replaced NAFTA. But once re-elected he armed himself with ‘yes men’ and set out to change the way America operates. And in the on-and-off world of Trump’s import tariffs he has now whacked the auto sector with 25%.

Canada has a long history of auto production. Ford Motors started operations here in 1904, and by 1923 Canada became the second largest auto producer in the world and a major exporter of autos and auto parts. Today we’re not even in the top ten.

So, those autoworkers who are being laid off in Windsor and Ingersoll have more than Mr. Trump’s 25% tariffs to blame. But the tariff threat has put a chill in everyone working upstream and downstream in the auto industry. The mere suggestion of plant closures at Honda put all of Ontario on edge, for example.

Brian Mulroney It was Mr. Mulroney who killed the Canada-US auto trade pact in favour of his multi-sectoral trade deal with the Americans (NTA). He wrote off the auto pact which had ensured that the big three auto companies would build at least one car for every one they sold here. And then Mr. Chretien brought Mexico into our trade deal and the three amigos created NAFTA…and that giant sucking sound.

Not everyone is crying doom and gloom about Trump’s automobile tariffs. A recent article in ‘Driving’ magazine (see links) in fact, is rather upbeat about the prospects for the Canadian auto industry. To a large extent that is because of the way the Carney government has responded with our own counter tariffs and the provision of support for the Canadian auto makers to minimize the impacts.

Mark Carney Mark Carney has spoken about re-imaging Canada’s manufacturing sector, and re-engineering our economy. He has referenced the need for public involvement, public-private partnerships and greater foreign investment in rebuilding our manufacturing sector, and especially the auto and defence industries. And he (if he’s still PM) and Trump have agreed to start negotiations next month on sectoral trade arrangements, which will form the backbone of our future trading relationship with the US.

In the meantime Canadians need to focus on our own future. That means doing more of what we have started doing even in the brief moment since Trump’s tariffs were announced – building Canadian, growing Canadian and buying Canadian.

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Background links:

Giant Sucking Sound – More Perot –

Trump on Trade – Global Car Production – Auto Decline – Upbeat –

By Pepper Parr By Pepper Parr

April 10th, 2025

BURLINGTON, ON

I became aware of the change when I was at Costco with a chum on Wednesday. “ There are actually parking spaces” he said as we drove in.

The number of people in the massive shopping space was quite a bit thinner than my chum was used to seeing.

On Thursday I was having a late breakfast at a well-known spot at New Street and Guelph. There was just the one person having breakfast.

When I left, there was a booth with four people.

The waitress said that it had been slow for several days. “People just aren’t spending – they’ve decided they want to keep that twenty dollars in their wallets.

“The customers will come back – I just don’t know when – not until things change in the States.”

Restaurants are feeling the pain – “people are keeping their money in their wallets”. New data from the non-profit Angus Reid Institute finds nine-in-10 Canadians (91%) are concerned about the prospect of a recession in the coming year. Indeed, during this federal election campaign, this is one of the few questions that unify all potential voters, with at least 85 per cent of all partisans sharing in this concern.

With markets tanking, recovering, tanking, and then recovering again, and job losses mounting, Canadians are also concerned about how their own finances will endure this period. Four-in-five (83%) are wary of their household finances taking a hit (83%). Fully half (50%) say that they or someone in their household are at risk of losing a job should this economic turmoil persist.

The weather today certainly didn’t help retail or the hospitality sector.

Uncertainty infects everything.

By Stephen Atcheler By Stephen Atcheler

April 10th, 2025

BURLINGTON, ON

As of 2025, dating apps have over 360 million users around the world. This figure includes platforms of all types, ranging from casual swiping apps to those focused on building long-term connections. Despite a slight decrease in downloads, usage remains high. Tinder, for example, saw $1.91 billion in earnings during 2023, growing nearly 7% from the year before. Match Group alone accounted for $3.5 billion of the total $6.18 billion market revenue in 2024.

There are around 25 million people using data apps each month. The market continues to grow. By 2030, estimates place industry revenue at over $17 billion. This comes with an expected increase in both paid users and geographic reach. Users are also spending more, with around 25 million paying for features each month.

What’s Working—and Why

Dating apps work for many users. In a 2021 report from The Knot, one out of every four engaged couples met online. Apps like Hinge are gaining more attention for targeting users looking for lasting connections instead of casual flings.

About 57% of online daters report having a good time on these apps overall. Women and men approach the apps differently, and this shapes how matches are formed. For example, users often favor traits like emotional availability and open communication.

Still, the increasing number of options can be hard to manage. Studies describe a phenomenon called the paradox of choice—more options can actually lead to less satisfaction. Users, especially women, have also set higher filters, preferring partners aligned with their values.

Picking Your Path: Relationship Types Aren’t One-Size-Fits-All

Dating app users now make more specific choices about what kind of relationships they want. Some seek marriage, others prefer casual dating, while many explore grey areas in between. Apps like Hinge focus on long-term commitment, while others support different lifestyles or connections based on goals or compatibility. Secret Benefits is one of several platforms contributing to this range of choices, supporting matches based on clarity and purpose.

This flexibility means users can match with those who share not only similar interests but also aligned timelines or relationship expectations. It’s less about fitting into old patterns and more about choosing what works personally.

New Trends in the Mix

2025 is seeing more users taking a direct approach. This is called “Loud Looking.” About 70% of singles using dating apps now declare their intentions early. They list clear relationship goals, expectations, and dealbreakers upfront.

Interest-based dating is also becoming common. Some platforms now form micro-communities around shared hobbies or beliefs. These changes are especially noticeable among younger age groups, including users under 30.

These trends peak during certain times of the year. One of the busiest days for dating apps is “Dating Sunday,” which falls on the first Sunday in January. For example, on Tinder, user likes rise by 15% on this day. Hinge reports nearly 30% more messages sent compared to regular Sundays.

How AI Is Changing the Apps

More apps are now using artificial intelligence to suggest better matches. This includes analyzing behaviors, profiles, and chat patterns. Apps using AI now show a 14% increase in user engagement, likely due to more relevant suggestions and fewer unwanted messages.