By Tina S. Singh By Tina S. Singh

November 26th, 2024

BURLINGTON, ON

Artwork in various forms has the power to grab attention, inspire, and stir emotions. That said, whether it’s a bespoke painting, a sculpture, or a precious photograph, such items must be safeguarded and preserved for future art enthusiasts to enjoy. Without proper care, water damage or heat can severely impair valuable art items you’ve spent considerable time collecting.

Understand the Risk of Water Damage and Heat

If this was your home – the flooding would have damaged some of your art beyond repair. Extreme heat and water damage can wreak havoc on art items. Water can permeate delicate materials, causing warping, ballooning, and color distortion. Such a threat can accelerate mold growth issues, compromise artwork appearance, and pose health concerns. Intense heat conditions ultimately lead to fading, flaking, and degradation of art mediums, including canvas, paint, and paper.

In this guide, let’s discuss expert tips to help you protect your precious collection from potential dangers.

- Climate Control

In other words, maintain a stable environment. Keeping your artwork in a controlled setting (ideally 68-720F and 40-50% humidity) is critical to preserving art. Install temperature and humidity monitors to ensure the parameters remain within the desired range, especially within storage spaces like galleries and studios. In other words, maintain a stable environment. Keeping your artwork in a controlled setting (ideally 68-720F and 40-50% humidity) is critical to preserving art. Install temperature and humidity monitors to ensure the parameters remain within the desired range, especially within storage spaces like galleries and studios.

- Ample Ventilation

Adequate ventilation limits excessive moisture buildup and curbs the risk of mildew and mold growth. Do not store or exhibit your art pieces in damp, poorly ventilated spaces like basements or attics. If you store your art items in storage boxes, ensure the containers are moisture-resistant and boast adequate airflow.

- Disaster-Proof Storage

Preparing a solid disaster plan to cater to extreme weather conditions is a good idea. Neglected drain pipes, lapses in inspection, and blocked grates are among the leading causes of flooding, triggering substantial damage with financial implications to homeowners. Consider elevating your artwork storage racks—such a move limits direct contact with the floor in the event of flooding. Investing in waterproof and fire-resistant safes adds an extra protective measure.

A solander box, a drop-spine box, or a clamshell is an excellent storage idea to protect your valuable artwork. Thanks to its solid case with a hinged lid, a solander box design allows it to open flat, allowing you easy access to your valuables. It shields enclosed items from the weather elements, ensuring longevity.

To build a solander box, you will need:

Very very hard to recover art work that has been damaged by water from flooding. Procedure:

- Fold upwards along the sides of the base and lid pieces, including the corners, to form a box shape. Glue the triangular corners to the inner adjacent walls. Here, use the best types of glue for household use. Hold the pieces together using a clip temporarily.

- Spread out your fabric and place the two cover pieces with the spine positioned in the middle (allow for a few millimeters gap between them). Use scissors to cut the material diagonally across its corners (as far as the cover pieces allow).

- Glue the cardboard pieces to the fabric as currently positioned.

- Fold the ends of the fabric up and around the pieces and apply glue—use paper clips to keep everything in place.

- Glue the two strips of ribbon midway down the outer edges of the covers, allowing for adequate free ribbon to tie in a bow together after completing the project.

- Glue the smaller box onto the right cover.

- Fit the larger box over the smaller one—leaving a gap at the turn close to the spine.

- Apply glue to the upside-down cardboard box and lift the covered card as if closing a book. Next, press down gently until the two surfaces stick.

- Once the glue dries, place your taonga inside. For extra protection, you can opt to wrap it in tissue paper.

If your house had been flooded – your art work may have ended up in a pile like this. Now’s the Time to Disaster-Proof Your Precious Artwork

Protecting your artwork from adverse environmental elements requires a mix of skill, care, and proactive measures. Pick the correct display methods, invest in proper storage, and you can be sure your cherished artwork will retain its vibrant appeal.

ByAlina Jovia ByAlina Jovia

November 26th, 2024

BURLINGTON, ON

Many consumers have considered gambling online because the activity is convenient, inexpensive, and fun.

The online experience is different than at a casino. Gambling online provides consumers with quick and easy access to their favorite gambling titles, including slots, roulette, blackjack, and more. Furthermore, gambling online means the consumer can access these titles without leaving home. Nevertheless, consumers must understand that gambling online is far different than gambling in person.

It is vital to adjust to the switch. Otherwise, the gambler may run into a variety of issues, including lost money and a stolen identity. Just make sure that you consider the information at GamblingInformation before moving forward.

Why Online?

Online gambling is not suitable for all consumers. For instance, some consumers may prefer mingling with other gamblers. Online casinos offer some degree of social features, but it’ll never be enough for some. Furthermore, some gamers may prefer playing in person with friends and relatives. For these individuals, it is best to visit a local casino. However, online gambling provides numerous perks that aren’t available elsewhere.

Consumers can play from home so they’ll save money and they’ll be much safer. They also won’t have to adhere to the casino’s schedule. After all, online casinos are open around the clock. Online gambling in Canada has grown in popularity because online sites offer so many benefits.

New Risks

Do your homework – know what you are getting into – there are shady operators out there. When gambling online, the risks are going to be significantly different. With in-person gambling, you have to worry about someone mugging you when you leave. You’ll also need to worry about theft and other issues. However, online gambling tends to be much safer since you don’t have to leave home. Still, there are risks involved. In particular, consumers must avoid signing up for shady sites.

Each player should carefully research the site in question to ensure that they’re making the right decision. Otherwise, they could lose everything. More about this will be explored below.

Research Each Site

Consumers have to be concerned about signing up for a bad website. Doing so could lead to issues, including a stolen identity. When choosing an online gambling site, the consumer must perform extensive research. Some sites pose as legitimate gambling sites even though they’re scams. You don’t want to fall for one of these traps. Instead, you should do your best to avoid such problems. Make sure that the site you choose is reliable and safe. The gambling site should use the latest safety protocols to protect your information.

Promotions

Bonuses are a big part of the fun when you gamble online. Experts in the industry providing trustable information recommend taking advantage of bonuses, including free spins. However, some casinos may provide more generous bonuses. For instance, some will deliver a deposit bonus to new and existing customers. If you deposit a specific amount, you should receive a specific amount. Each casino establishment will have unique rules. Still, it is important to consider these things because bonuses are very beneficial.

Bonuses can keep you playing for longer without depositing more money.

Games Available

It is also pertinent to consider the selection of games. Some casinos are better about this than others. For instance, some online casinos only offer three or four games. Others provide access to conventional gambling titles as well as innovative ones. It is wise to consider your options. Make sure that you’ll have access to the hottest titles.

When it comes to online gambling in Canada, it is always best to pick a diverse platform.

Social Features

GamblingInformation.com provides consumers with access to gambling resources, reviews, and more. One thing to remember when digesting such information is that online gambling can also be social. It’s not as social as in-person gambling, but you can still interact with others. Usually, online gambling platforms provide players with chat features. You can use these features to interact with other players. Doing so will undoubtedly make the experience more exciting.

Player Protection

Online casinos offer player protection, such as secure checkouts. It is up to players to maintain a responsible gambling protocol. Temptations are the worst in the gambling industry. People addicted to gambling struggle to stop, even after they have depleted their bankroll.

Experts insist all consumers read the casino’s policies fully before an initial wager. Be sure to focus on the fine print because it is vital information about the casino operations.

By Ray Rivers By Ray Rivers

November 25th, 2024

BURLINGTON, ON

OPINION

The annual Climate Change Congress of the Parties (COP 29) held this year in Azerbaijan has concluded in uncertainty, discontent and pessimism. Pessimism is what every single one of those delegates should be feeling about the future of the planet we are leaving for our offspring. The global community has completely failed to halt the advance of global climate warming and with it the ravages of climate change.

Climate Change Congress of the Parties (COP 29) It’s the fossil fuels and, like an addict on heroin, we are unable to put down the syringe. And the rush from this drug, fossil fuels, will continue for almost a millennium. The worlds largest producer of oil, the USA, emits just over 10% of global annual GHG emissions but accounts historically for the majority of all that stuff still up there. That unfortunate record is due to be broken one day soon by the world’s second largest economy and its most significant polluter.

China is still using coal China, currently at 30% of global GHG annual emissions, is still building coal burning plants. In fact it had initiated 95% of all global coal plant construction in 2023. Ironically, it is also the leader in renewable technologies and electric vehicles. The country is claiming it’ll be carbon neutral by 2060. But only a blind optimist would buy that given its GHG emissions increased almost 5% last year, 15% faster than the rest of the world.

There is discontent among the smaller nations, including those island states which will eventually disappear into the ever rising oceans. Many of these less developed countries (LDC) are relatively small contributors to global emissions, certainly compared to China the US and Europe. But they are at the table, though it seems more like a trough. If money is for the taking, they want in – the only reason they used all those carbon credits getting there.

The COP process used to be about reducing emission reductions with a little cash on the side to help those LDCs in need. But it has morphed into an income redistribution exercise and a money grab. $100 billion was promised in 2009 and this year the ante was upped to $300 billion. Still the ask was for two or three trillion big ones. Delegates from less developed nations are calling it a paltry sum, but nobody is leaving money on the table. And how does India, with the fifth largest global economy and fourth largest military have the nerve to claim access to that COP money?

COP has lost its way. The 1990’s Kyoto protocol was the best chance to get global cooperation and action on reductions. COP has lost its way. The 1990’s Kyoto protocol was the best chance to get global cooperation and action on reductions. But then GW Bush, the oil president, pulled the rug out and it was drill baby drill. Obama helped create the voluntary Paris Agreement in a faint hope to limit the earth’s temperature increase to below 1.5 degrees. But then the 2016 Donald took his baseball and went home. Though he is coming back and now threatening to take the ball diamond as well.

In any case it is probably too late for incremental emissions reductions, emission targets and all that bureaucratic stuff. Many have already decided we’re at the 10th stage of grief – acceptance. The oil companies may have lost the battle to discredit climate scientists since their predictions are ringing in close to home. But big oil appears to have won the war anyway. That 1.5 degree tipping point is now within sight – possibly as early as next year. And so the Paris Agreement will also have failed.

The demographic that is going to have to live with the results of COP29 So the discussion at these annual mega-groupies has turned to something else – welfare for those less developed nations in their struggle to adapt. COP is not really about emissions reductions for LDCs since if they can afford fossil energy they can easily afford the less costly renewable energy option. And these less developed nations typically are not the heavy polluters anyway. Even Canada, which has the tenth largest global economy and is the fourth largest oil producer, still only contributes less than 2% to the problem.

Russia has decided to ignore the world and fall back to it’s nasty environmentally dirty old imperial ways. The holy land has become one big carbon emitting battlefield. And China, already the world’s dirtiest polluter will continue to pollute, as we in North America continue to buy their manufactured goods, thus making ourselves complicit. The USA will once again face a neoconservative ideological agenda promising “drill baby drill” and an end to new renewables. Canada is almost certainly to follow if the opinion polls are right – Ontario already has.

Humble beggar 40% of India’s installed electrical power capacity came from non-fossil fuel sources in 2021. It already has among the lowest emissions per capita in the world. And perhaps that alone, reducing its carbon footprint when wealthier nations are floundering, is a good enough reason to reward India by letting it dine at the beggar’s banquet. And, no humble beggar, the Indian delegation was one of the loudest voices demanding more money at this COP.

It was symbolic that the last two annual COP meetings were hosted by nations heavily dependant on oil revenues for their GDP. This year the host was the autocratic and highly repressive former Soviet republic of Azerbaijan which obtains 90% of its foreign income from the black gold. That country’s president kicked off the COP by setting the tone. He lectured that oil was a gift from God.

The head of France’s delegation went home after the Azerbaijani president insulted France and Holland over their colonial policies. The Argentine president brought his entire delegation home after only three days, probably as a symbol to please his new pal the American president-elect. It was chaos and there were also reports of others leaving in droves like rats abandoning a sinking ship. And no one should wonder why.

Background links:

Climate Not Improving – Greenwash Conference –

UNFCCC – Poilievre and Paris –

Time to Rethink COP –

Stages of Grief –

Ray Rivers has worked on the climate change challenge since 1992. In addition to private consulting and heading the international emissions trading company Clean Air Canada, Rivers also assisted the federal and provincial governments in developing emissions trading and reduction programs. He attended COP 4 in Buenos Aires and COP 9 in Milan. Ray Rivers has worked on the climate change challenge since 1992. In addition to private consulting and heading the international emissions trading company Clean Air Canada, Rivers also assisted the federal and provincial governments in developing emissions trading and reduction programs. He attended COP 4 in Buenos Aires and COP 9 in Milan.

By James Portside By James Portside

November 25th, 2024

BURLINGTON, ON

This information is not professional investment advice. Investors are advised to do their own research into individual stocks before making an investment decision.

The five stocks with the largest dollar value of insider acquisitions in the public market are:

|

| Sol Strategies Inc. (formerly, Cypherpunk Holdings Inc.) —–Buy Quantity: 100,000 Average cost: $1.21 Total: $121,250.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Guoga, Antanas (Tony) |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-22-24 |

100,000 |

$1.21 |

$121,250.00 |

|

| Vecima Networks Inc —–Buy Quantity: 6,000 Average cost: $17.08 Total: $102,456.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Kumar, Saket |

8 – Deemed Insider – 6 Months before becoming Insider, 6 – Director or Senior Officer of 10% Security Holder, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

1,000 |

$17.44 |

$17,440.00 |

| Kumar, Sumit |

8 – Deemed Insider – 6 Months before becoming Insider, 4 – Director of Issuer, 6 – Director or Senior Officer of 10% Security Holder, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

1,000 |

$17.44 |

$17,440.00 |

| Kumar, Surinder Ghai |

3 – 10% Security Holder of Issuer, 4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

1,000 |

$17.44 |

$17,440.00 |

| Kumar, Saket |

8 – Deemed Insider – 6 Months before becoming Insider, 6 – Director or Senior Officer of 10% Security Holder, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

1,000 |

$16.71 |

$16,712.00 |

| Kumar, Sumit |

8 – Deemed Insider – 6 Months before becoming Insider, 4 – Director of Issuer, 6 – Director or Senior Officer of 10% Security Holder, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

1,000 |

$16.71 |

$16,712.00 |

| Kumar, Surinder Ghai |

3 – 10% Security Holder of Issuer, 4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

1,000 |

$16.71 |

$16,712.00 |

|

| Martinrea International Inc —–Buy Quantity: 7,000 Average cost: $10.02 Total: $70,140.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Martinrea International Inc. |

1 – Issuer |

38 – Redemption, retraction, cancellation, repurchase |

11-22-24 |

-322,300 |

$0.00 |

$0.00 |

| Wildeboer, Robert Peter Edward |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-22-24 |

7,000 |

$10.02 |

$70,140.00 |

| Martinrea International Inc. |

1 – Issuer |

38 – Redemption, retraction, cancellation, repurchase |

11-21-24 |

322,300 |

$16.71 |

$5,386,412.42 |

|

| Aurion Resources Ltd —–Buy Quantity: 100,000 Average cost: $0.56 Total: $56,470.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Lotan Holdings Inc. |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-22-24 |

30,000 |

$0.56 |

$16,820.00 |

| Lotan Holdings Inc. |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

5,000 |

$0.57 |

$2,850.00 |

| Lotan Holdings Inc. |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

34,000 |

$0.57 |

$19,240.00 |

| Lotan Holdings Inc. |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

31,000 |

$0.57 |

$17,560.00 |

|

| Andrew Peller Limited (formerly Andrés Wines Ltd.) —–Buy Quantity: 9,100 Average cost: $5.05 Total: $45,955.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Tsiofas, Chris |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-22-24 |

4,600 |

$5.05 |

$23,230.00 |

| Tsiofas, Chris |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

4,500 |

$5.05 |

$22,725.00 |

The five stocks with the largest dollar value of insider dispositions in the public market are:

|

| Quebec Innovative Materials Corp. (formerly Quebec Silica Resources Corp.) —–Sell Quantity: -910,000 Average cost: $1,048.92 Total: -$954,520,973.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Inwentash, Sheldon |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

140,000 |

$0.17 |

$24,472.00 |

| Inwentash, Sheldon |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-525,000 |

$1,818.00 |

-$954,450,000.00 |

| ThreeD Capital Inc. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-525,000 |

$0.18 |

-$95,445.00 |

|

| Secure Energy Services Inc —–Sell Quantity: -2,005,532 Average cost: $16.63 Total: -$33,353,243.73 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Bonderman, David |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

-112,500 |

$16.74 |

-$1,883,362.50 |

| Bonderman, David |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

-75,283 |

$16.67 |

-$1,255,042.89 |

| Bonderman, David |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-250,000 |

$16.64 |

-$4,161,250.00 |

| Bonderman, David |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-22-24 |

-63,600 |

$16.34 |

-$1,039,048.96 |

| Coulter, James G. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

-112,500 |

$16.74 |

-$1,883,362.50 |

| Coulter, James G. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

-75,283 |

$16.67 |

-$1,255,042.89 |

| Coulter, James G. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-250,000 |

$16.64 |

-$4,161,250.00 |

| Coulter, James G. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-22-24 |

-63,600 |

$16.33 |

-$1,038,524.40 |

| TPG GP A, LLC |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

-112,500 |

$16.74 |

-$1,883,362.50 |

| TPG GP A, LLC |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

-75,283 |

$16.67 |

-$1,255,042.89 |

| TPG GP A, LLC |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-250,000 |

$16.64 |

-$4,161,250.00 |

| TPG GP A, LLC |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-22-24 |

-63,600 |

$16.33 |

-$1,038,524.40 |

| Winkelried, Jon |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

-112,500 |

$16.74 |

-$1,883,362.50 |

| Winkelried, Jon |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

-75,283 |

$16.67 |

-$1,255,042.89 |

| Winkelried, Jon |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-250,000 |

$16.64 |

-$4,161,250.00 |

| Winkelried, Jon |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-22-24 |

-63,600 |

$16.33 |

-$1,038,524.40 |

|

| Great-West Lifeco Inc —–Sell Quantity: -146,826 Average cost: $49.88 Total: -$7,323,842.39 Options Issued: 181,800 Average cost: $35.62 Total: $6,475,716.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Mahon, Paul |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

51 – Exercise of options |

11-21-24 |

181,800 |

$35.62 |

$6,475,716.00 |

| Mahon, Paul |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-146,826 |

$49.88 |

-$7,323,842.39 |

|

| CGI Inc —–Sell Quantity: -26,130 Average cost: $154.82 Total: -$4,045,498.65 Options Issued: 13,955 Average cost: $85.62 Total: $1,194,827.10 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Boyajian, Mark |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-21-24 |

13,955 |

$85.62 |

$1,194,827.10 |

| Boyajian, Mark |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-13,955 |

$155.00 |

-$2,163,025.00 |

| Henderson, Dave |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

-4,000 |

$153.84 |

-$615,355.58 |

| Hurlebaus, Timothy |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

-8,175 |

$155.00 |

-$1,267,118.07 |

| Hurlebaus, Timothy |

5 – Senior Officer of Issuer |

30 – Acquisition or disposition under a purchase/ownership plan |

11-20-24 |

-6,614 |

$155.07 |

-$1,025,657.75 |

|

| NUVISTA ENERGY LTD —–Sell Quantity: -230,253 Average cost: $13.16 Total: -$3,029,036.83 Options Issued: 11,000 Average cost: $1.62 Total: $17,840.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Asman, Kevin Garth |

5 – Senior Officer of Issuer |

57 – Exercise of rights |

11-21-24 |

32,024 |

$0.00 |

$0.00 |

| Asman, Kevin Garth |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-42,024 |

$13.27 |

-$557,534.64 |

| Lawford, Michael |

5 – Senior Officer of Issuer |

57 – Exercise of rights |

11-21-24 |

42,064 |

$0.00 |

$0.00 |

| Lawford, Michael |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-21-24 |

5,000 |

$2.62 |

$13,100.00 |

| Lawford, Michael |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-47,064 |

$13.21 |

-$621,609.04 |

| Paulgaard, Ryan Daniel |

5 – Senior Officer of Issuer |

57 – Exercise of rights |

11-21-24 |

31,411 |

$0.00 |

$0.00 |

| Paulgaard, Ryan Daniel |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-31,411 |

$13.11 |

-$411,798.21 |

| Truba, Joshua Thomas |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-20-24 |

6,000 |

$0.79 |

$4,740.00 |

| Truba, Joshua Thomas |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-20-24 |

-6,000 |

$12.98 |

-$77,880.00 |

| Truba, Joshua Thomas |

5 – Senior Officer of Issuer |

57 – Exercise of rights |

11-21-24 |

28,456 |

$0.00 |

$0.00 |

| Truba, Joshua Thomas |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-28,456 |

$13.11 |

-$373,058.16 |

| Wright, Jonathan Andrew |

5 – Senior Officer of Issuer |

57 – Exercise of rights |

11-21-24 |

75,298 |

$0.00 |

$0.00 |

| Wright, Jonathan Andrew |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-21-24 |

-75,298 |

$13.11 |

-$987,156.78 |

What is Insider Trading?

How Insider Trading works.

By Harry Randall-Wooden By Harry Randall-Wooden

November 25, 2024

BURLINGTON, ON

Since iGaming Ontario took up the reins and the challenges of the new online gambling scene in Ontario, there has been a prominent spike in the sector’s popularity. In the first couple of years of operation, online gambling has seen plenty of positive growth in the province, but that of course is just one small drop in terms of what the country produces.

Unlike places such as the UK and Ireland, the Great White North as a whole is not governed by the same gambling framework. That’s because things are left to the provinces as to how they handle things, and therefore there are great variations between one and the next.

Things for example are tighter in Quebec, whereas the modern online gambling scene in Ontario has delivered a fresh, well-regulated and yet open platform for those interested. Legalized gambling can be an important part of a province’s economy, and proof of that comes from financial reports posted by iGaming Ontario, which may make other provinces sit up and take notice. The demand is there, can it be tapped into? Things for example are tighter in Quebec, whereas the modern online gambling scene in Ontario has delivered a fresh, well-regulated and yet open platform for those interested. Legalized gambling can be an important part of a province’s economy, and proof of that comes from financial reports posted by iGaming Ontario, which may make other provinces sit up and take notice. The demand is there, can it be tapped into?

What’s Going on in Ontario?

Starting in April 2022, iGaming Ontario (different from the Ontario Lottery and Gaming Corporation) delivered a new, secure and regulated online gambling system to the province. Working in conjunction with the Government of Ontario, the overseeing body is the one that hands out and maintains licensing for any online operators.

That was a big step towards a safer gaming experience for Ontarians, because picking from the list of regulated providers from iGaming Ontario, gives players peace of mind over things like the security of payments and fair gaming. That is a massive boost for igaming and as reported in the article Ontario iGaming Expected to Triple by 2032, Written by Anthony Odiase, Published by gambleontario.ca1, popularity is soaring.

With players having already previously found offshore sources at which to do their online gambling, Ontario took the fresh approach of standardising the market for willing providers in the province. That was designed to bring some advantages to the economy as well, and numbers from the first two years of iGaming Ontario show the value of their approach.

Growth In Ontario

The total gaming revenue from online gambling in Ontario in 2023 was $1.4 billion. That number had jumped significantly to $2.4 billion in the second year since iGaming Ontario started running the show2. The growth has been outstanding not only for the operators in the sector but for locals as well.

There are now a reported 12,000 full-time equivalent jobs running in Ontario because of the online gambling scene, a number which is expected to add another 10,000 by 20323. So big things are still expected from this market, which contributed $1.6 billion to Ontario’s GDP during its first year of operation, and that’s a number expected to surpass $2 billion in revenue by 2032. There are now a reported 12,000 full-time equivalent jobs running in Ontario because of the online gambling scene, a number which is expected to add another 10,000 by 20323. So big things are still expected from this market, which contributed $1.6 billion to Ontario’s GDP during its first year of operation, and that’s a number expected to surpass $2 billion in revenue by 2032.

The overall projection is that the potential annual GDP contribution from online gambling is going to almost triple by 2032. Current figures report that more than $900 million has gone to employee compensation in Ontario’s iGaming sector with the average salary running at $103,000.

There have been clear signs that there is a big demand for online gambling and the numbers across the country are supporting that.

Year-on-Year Growth

It’s reported that there are over 19 million active online gamblers in Canada4 and across the country, the federal revenue garnered from it is around $3.1 billion. So there is a lot that is going back into the economy and the advances in Ontario in the last couple of years have certainly added to it, considering that it contributed $1.4 in revenue in 2023.

The average online gambler in Canada spends around $7 per month. But again, dialing in the focus to the progressive setup in Ontario, there have been noticeable increases in how much players gamble on average. In 2022 it was around $70 per month and that had jumped to $200 per month in 2023, significantly higher than the national average.

This isn’t a surprise since Ontario has a more open, regulated industry, which means that access to provincially-backed sites is easy. Accessibility is a big factor in more money being gambled per person. Other people in the country may have to take risks at offshore platforms to do their gambling and are less likely to risk greater funds going to places like that. This isn’t a surprise since Ontario has a more open, regulated industry, which means that access to provincially-backed sites is easy. Accessibility is a big factor in more money being gambled per person. Other people in the country may have to take risks at offshore platforms to do their gambling and are less likely to risk greater funds going to places like that.

The increase in betting averages comes with concerns that there will be a rise in problem gambling, due to the players more easily accessing platforms. As part of the ongoing campaigning for the safety of players, iGaming Ontario for example has a strong approach to responsible gambling, by providing knowledge and tools to make things safer for players. That includes a coordinated and centralized self-exclusion problem from all gambling websites operating in Ontario.

Demand And Supply or Supply And Demand?

Ontario has more than 50 licensed operators providing gambling platforms in the province. That number will likely grow as the industry is still fairly new and existing operators are likely to face competition not only between themselves but from newly licensed ones down the line.

The demand for legalized gambling in Ontario appears to be there because if it wasn’t popular then the growth would not have been as strong. Or has it been a case of “build it and they will come” within the province? Has the user-friendly, legalized gambling market thrown the doors wide to give people access to something that they may well have left alone had it never been there?

There’s no way to answer that speculation of course, but in 2022, after iGaming Ontario launched the new system, around 30% of people gambling in Ontario reported back in a survey by Ipsos5, as being registered to an online gambling site as the new market fired up.

But to think that gambling wasn’t in demand before iGaming Ontario regulated it, is folly. In 2022, it was reported that around 70% of all online gambling from Canada was done on offshore platforms. A large volume of people were already finding ways to gamble before things were regulated.

Why The Discrepancy?

Why, in the new age of being able to play at fully regulated sites, would players still take chances at offshore unregulated ones? The main answer to that will come down to knowledge, not even knowing that there is now a list of regulated online gambling sites provided by iGaming Canada which are safe to use.

Ontario Lottery & Gaming – OLG.ca, which is the official Ontario Lottery website is tightly regulated and hugely popular, was even regulated To further press that home, another Ipsos report found that more than 70% of respondents were completely unaware that OLG.ca, which is the official Ontario Lottery website, was even regulated and were under the assumption that other major online gambling providers were also unregulated.

But biases also play into this, because players who have used or are still using an unregulated platform are likely unaware that it is not regulated, and even if they did know, they would be more prone to believing that it was a regulated one.

So perhaps the message from iGaming Ontario has not been quite as far-reaching as it could be and has some work to do. Still, from a previous 70% of Ontario gamblers using offshore platforms to around 85% now using province-regulated ones, that is a sizable shift and a positive for player safety.

The Rest Of Canada

Ontario gets a lot of attention thanks to its positive approach to getting its online gambling sector regulated within its border and remains the only province that is fully regulated for private operators. Because of that open and competitive market, it is why the province stands alone because of the pioneering approach to things. But what is going on within the rest of the provinces?

Legal and Regulated

British Columbia, Alberta, Saskatchewan, Manitoba, Quebec and New Brunswick offer legal and regulated online gambling. That is all done, however, through government-run platforms that provide a range of options including sports betting, casino games and lottery. BC, Manitoba and Saskatchewan are all linked together on BC’s prominent, government-run PlayNow.com platform.

Legal and Limited

Nova Scotia, Prince Edward Island and Newfoundland and Labrador have far more limited options in terms of what online gambling is accessible, with most of them limiting sports betting. What is available in each of the territories is provided by the respective provincial government. Things are also fairly limited In the Territories where options are mostly for lottery products only.

What About Offshore?

Access to offshore gambling sites is still available across the country. It happens, and understandably so, when people’s options for legal and regulated gambling within their home province are limited. However, the danger with unregulated platforms is that they come with some extremely grey areas over things like providing any kind of customer protection and responsible gambling.

In Conclusion

With figures from online gambling expected to triple in Ontario alone within the next eight years, online gambling is going to continue to rise in popularity across the country. There may well be envious eyes being cast over to Ontario where things have shaped up nicely, and the industry there has grown competitively and strongly in the last couple of years.

Ontario’s stance has been much lauded for offering approved platforms to play at because if gamblers are going to gamble, it’s better for it to be done somewhere that’s safe and regulated without being locked into just one government-controlled platform. It is also a proven model for providing jobs and a boost to overall GDP. Ontario’s stance has been much lauded for offering approved platforms to play at because if gamblers are going to gamble, it’s better for it to be done somewhere that’s safe and regulated without being locked into just one government-controlled platform. It is also a proven model for providing jobs and a boost to overall GDP.

- Ontario iGaming Expected to Triple by 2032, Written by Anthony Odiase, Published by gambleontario.ca

- iGaming Ontario’s FY 2023-24 Full Year Market Performance Report, Written by iGaming Ontario, Published by igamingontario.ca

- Deloitte: Economic Contribution of Ontario’s Regulated iGaming Market, written by iGaming Ontario, Published by igamingontario.ca

- Gambling Statistics in Canada, Written by Olivia Bush, Published by madeinca.ca

- Thirty Percent of Canadians Report Being Registered on an Online Gambling Website, Written by Ipsos, Published by ipsos.com

By Staff By Staff

November 22nd, 2024

BURLINGTON, ON

There are tough times all around – and the development industry is hurting like many others.

The number of developments that have been put on hold; facing foreclosure by their lenders or being sold to a group that can complete what someone else started is quite long.

These financial bumps impact people looking to buy property – there is still a lot of speculation in the small-unit condo market. Money to be made for sure – but the speculation isn’t helping people who need housing with two and three-bedroom homes – with a decent park reasonably close.

Storey, an online news source focused on the development industry provides the details.

It’s been a hot minute since we heard anything about The One. But it turns out no news doesn’t mean good news, as the latest buzz is about a potential lawsuit that’s been brewing and could end up halting construction. It’s been a hot minute since we heard anything about The One. But it turns out no news doesn’t mean good news, as the latest buzz is about a potential lawsuit that’s been brewing and could end up halting construction.

Three years after the condo project was first placed under receivership, a buyer has been found for Central Park Ajax, bringing an end to a saga that included legal action involving the Town. Three years after the condo project was first placed under receivership, a buyer has been found for Central Park Ajax, bringing an end to a saga that included legal action involving the Town.

Meanwhile, Chacon Developments is facing a quadruple-whammy, including two receiverships and two powers of sale over properties in Brampton and Caledon.

On a brighter note, leading purpose-built rental developer Fitzrovia has dipped into a new $1.1-billion fund to acquire the rights to redevelop a 24-storey office building in midtown Toronto.

In a move that’s being applauded by industry stakeholders, the City of Vaughan has slashed their sky-high DCs. In particular, charges on low-rise residential have been decreased by over $44,000.

You’ve probably heard of office-to-residential conversions, but have you heard of prison-to-residential conversions? That’s a separate story.

By the numbers:

This week’s real estate news, according to the numbers.

240,761

—

The number of housing starts in October, marking an 8% annual rise. Even so, starts remain “well below” what is needed to restore affordability in Canada’s urban centres. |

2%

—

The year-over-year rise in the Consumer Price Index in October – a “minor setback” for the BoC and future rate cuts, but not enough to completely derail the chance of a 50-bps cut in December.

$1.8B

—

The investment sales volume of multi-suite rental properties in the third quarter, marking the highest quarterly total since the first quarter of 2022.

35%

—

The percentage of Canadian renters searching for more than two weeks for their rental as of November, down from 57% as of March.

60%

—

The year-over-year decline in GTA new home sales in October, with 765 transactions recorded.

624 Acres

—

The size of a Greenbelt property in Caledon that Ontario students are being invited to submit creative design concepts for as part of a $100,000 competition.

QUOTE OF THE WEEK

CIBC Economist Katherine Judge had this to say about the economy: “Although this report will be a disappointment for the Bank of Canada, it follows a string of reports that showed more progress than expected. While that makes the December meeting a closer call in terms of a 25bp or 50bp cut, the slack in the Canadian economy that we expect to be confirmed in upcoming labour market and GDP reports has us retaining our call for a 50bp cut in December for now.”

By James Portside By James Portside

November 20th, 2024

BURLINGTON, ON

This information is not professional investment advice. Investors are advised to do their own research into individual stocks before making an investment decision.

The five stocks with the largest dollar value of insider acquisitions in the public market are:

|

| LIONS GATE ENTERTAINMENT CORP —–Buy Quantity: 2,056,075 Average cost: $9.31 Total: $19,149,746.83 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Liberty 77 Capital L.P. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

32,897 |

$9.59 |

$315,490.86 |

| Liberty 77 Fund International L.P. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

25,771 |

$9.59 |

$247,150.71 |

| Liberty 77 Capital L.P. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-18-24 |

1,111,949 |

$9.30 |

$10,337,867.16 |

| Liberty 77 Fund International L.P. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-18-24 |

871,059 |

$9.30 |

$8,098,296.07 |

| Liberty 77 Capital L.P. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-15-24 |

8,074 |

$10.48 |

$84,638.24 |

| Liberty 77 Fund International L.P. |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-15-24 |

6,325 |

$10.48 |

$66,303.80 |

|

| Altus Group Limited —–Buy Quantity: 26,000 Average cost: $56.01 Total: $1,456,260.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Brennan, William |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-18-24 |

26,000 |

$56.01 |

$1,456,260.00 |

|

| i-80 Gold Corp —–Buy Quantity: 621,000 Average cost: $0.68 Total: $423,340.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Savarie, David Roger |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

60,000 |

$0.72 |

$43,100.00 |

| Young, Richard Scott |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

561,000 |

$0.68 |

$380,240.00 |

|

| TELUS International (Cda) Inc —–Buy Quantity: 94,396 Average cost: $3.43 Total: $323,857.63 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Dengel, Tobias |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6), 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-18-24 |

100,000 |

$3.55 |

$355,000.00 |

| Hannon, Brian |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6), 5 – Senior Officer of Issuer |

57 – Exercise of rights |

11-15-24 |

10,776 |

$5.56 |

$59,884.04 |

| Hannon, Brian |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6), 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-15-24 |

-5,604 |

$5.56 |

-$31,142.37 |

|

| Spanish Mountain Gold Ltd —–Buy Quantity: 1,355,500 Average cost: $0.12 Total: $160,442.50 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Janes, Lembit |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-18-24 |

1,355,500 |

$0.12 |

$160,442.50 |

| MAH, GEORGE PETER |

4 – Director of Issuer |

16 – Acquisition or disposition under a prospectus exemption |

11-15-24 |

150,444 |

$0.14 |

$20,309.94 |

| Ruus, Mark Adrian |

5 – Senior Officer of Issuer |

16 – Acquisition or disposition under a prospectus exemption |

11-15-24 |

300,952 |

$0.14 |

$41,887.56 |

The five stocks with the largest dollar value of insider dispositions in the public market are:

|

| Suncor Energy Inc —–Sell Quantity: -100,000 Average cost: $57.10 Total: -$5,709,545.00 Options Issued: 105,000 Average cost: $42.99 Total: $4,513,950.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Ferguson, Kent Donald |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-18-24 |

5,000 |

$57.13 |

$285,640.00 |

| Smith, Kristopher Peter |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-18-24 |

105,000 |

$42.99 |

$4,513,950.00 |

| Smith, Kristopher Peter |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-18-24 |

-105,000 |

$57.10 |

-$5,995,185.00 |

|

| Great-West Lifeco Inc —–Sell Quantity: -27,225 Average cost: $49.49 Total: -$1,347,315.75 Options Issued: 26,400 Average cost: $34.21 Total: $903,107.04 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Bailey Moffitt, Colleen Nancy |

5 – Senior Officer of Issuer |

30 – Acquisition or disposition under a purchase/ownership plan |

11-19-24 |

119 |

$46.54 |

$5,537.75 |

| Bailey Moffitt, Colleen Nancy |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

-825 |

$49.11 |

-$40,515.75 |

| Henaire, Charles Donald Harvey |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6) |

51 – Exercise of options |

11-19-24 |

26,400 |

$34.21 |

$903,107.04 |

| Henaire, Charles Donald Harvey |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6) |

10 – Acquisition or disposition in the public market |

11-19-24 |

-26,400 |

$49.50 |

-$1,306,800.00 |

|

| Propel Holdings Inc —–Sell Quantity: -30,859 Average cost: $38.66 Total: -$1,193,020.70 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Stein, Michael |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

-30,000 |

$38.67 |

-$1,160,121.00 |

| Usprech, Cindy |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-18-24 |

-859 |

$38.30 |

-$32,899.70 |

|

| Cameco Corporation —–Sell Quantity: -14,062 Average cost: $79.98 Total: -$1,124,678.76 Options Issued: 14,062 Average cost: $15.27 Total: $214,726.74 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Reilly, Brian Arthur |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-19-24 |

14,062 |

$15.27 |

$214,726.74 |

| Reilly, Brian Arthur |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

-14,062 |

$79.98 |

-$1,124,678.76 |

|

| Peyto Exploration & Development Corp —–Sell Quantity: -55,000 Average cost: $15.68 Total: -$862,653.00 Options Issued: 55,000 Average cost: $13.44 Total: $739,130.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Frame, Riley Millar |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-19-24 |

55,000 |

$13.44 |

$739,130.00 |

| Frame, Riley Millar |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-19-24 |

-55,000 |

$15.68 |

-$862,653.00 |

What is Insider Trading?

How Insider Trading works.

By Tom Parkin By Tom Parkin

November 20th, 2024

BURLINGTON, ON

Manufacturing jobs are down 13,000 from June 2018, Trump election adds uncertainty to massive public EV supply chain investments, premier focusing voters on bike lanes

Manufacturing shipments haven’t been lower since January 2022. Ontario manufacturing shipments continued their decline in September, falling to $30.1 billion, according to seasonally adjusted data from Statistics Canada released Friday.

From a peak of $33.4 billion in May, 2023, Ontario manufacturing shipments are down $2.9 billion, or 8.9 per cent.

Manufacturing is important to Ontario’s export-driven economic growth. Shipments haven’t been lower since January 2022.

Auto and steel lead manufacturing decline

The biggest hit has come in the auto industry. Motor vehicle manufacturing is down 27 per cent from a $5.4 billion peak in July 2023 to $4.0 billion in September.

Auto parts manufacturing has fallen 16 per cent, from a $3.1 billion peak in July 2023 to $2.6 billion in September 2024.

Canada was the world’s sixteenth-largest steel producer, by volume Steel manufacturing has also recently tumbled, falling 34 per cent from a peak of $1.5 billion in June 2022 to $970 million in September 2024. However, steel remains higher than in more of the 20 years before the 2022 peak (see chart, below).

Canada was the world’s sixteenth largest steel producer, by volume, in 2023 and the fourteenth largest vehicle manufacturer in 2022. according to international industry associations.

Trump’s impact on Ontario EV investments unclear

Ontario has lost over 13,000 manufacturing jobs since the June 2018 election, when premier Doug Ford gave a “guarantee” he’d create 300,000 manufacturing jobs.

And now the sector, and the billions of public dollars spent rebuilding auto supply chains around electric vehicle production, faces more uncertainty due to the re-election of US President Trump, who opposed EV purchase incentives during his campaign.

Some have argued the influence of Elon Musk, owner of EV manufacturer Tesla, could cause Trump to reverse course and keep EV incentives. But others believe ending the incentive plan would help Tesla, already profitable, secure dominance over the American EV market by increasing the investment required by his EV competitors to reach profitability.

Telsa share price is up 60 per cent However the situation turns, investors are betting Tesla will come out a winner. Telsa share price is up 60 per cent since Labour Day, rising from $210 USD on September 3, 2024 to $336 USD yesterday.

None of Canada’s EV battery production appears to be currently tied into Tesla’s supply chain. Tesla’s biggest battery partner, South Korea’s LG, has received billions to set up production in Ontario. But the protect is in partnership with Stellantis, owner of big car brands Chrysler, Dodge, Jeep, Fiat, Alfa Romeo, Maserati, Renault, Citroën, Peugeot and others competitors to Tesla.

Ontario premier focusing attention elsewhere

Ontario’s manufacturing decline and new uncertainty comes as the province’s approach to housing fails to spur construction starts, costing jobs and increasing the costs for renters and house-seekers.

Retail sales are below a 2022 peak, the average wage has fallen the last two months and unemployment has been higher than the national rate for most of the past five years.

Bicycle lanes Ford wants to remove from some Toronto streets. On each metric, Ontario is heading in a different, and worse, direction than the rest of Canada.

While economic clouds continue to gather over Ontario, the province’s premier appears to believe he will win a third term by misdirecting voters onto controversy he has created about removing bicycle lanes from some Toronto streets.

Tom Parkin is a social democratic commentator and the publisher of the Data Shows newsletter.

By Tom Parkin By Tom Parkin

November 19th, 2024

BURLINGTON, ON

OPINION

So many Ontario economic indicators are pointing down, and the failure to build housing could be the key to understanding why

Month after month the Ontario PC ‘s approach has absolutely failed to spur housing construction, and October was no different, according to data released by the Canada Mortgage and Housing Corporation this morning.

There were under 5,500 Ontario housing starts last month. There were under 5,500 Ontario housing starts last month. That’s only 44 per cent of the 12,500 per month pace needed to meet to hit the target of 1.5 million units by 2031 set by the Housing Affordability Task Force and accepted by the Ford PC government.

Housing data can bounce around month to month. But this isn’t statistical noise. Mark up a big F for fail because in four of the last five months Ontario housing starts have been less than 50 per cent of target. This government hasn’t hit a single target since they adopted them in June, 2022.

Twenty-nine months later, 211,980 new units have been started, 150,520 homes less than needed. The shortage that has been added by this government is enough to housing perhaps 300,000 to 500,000 people — a significant-sized city.

Broader economic impacts going unexamined

Housing scarcity increases renting and buying prices. It costs jobs in the residential construction industry. In May, Data Shows research showed BC’s big housing push was paying off with jobs and paycheques while Ontario slumped.

But there seems to be almost zero media attention on how this self-inflicted housing crisis hurts Ontario’s broader economy.

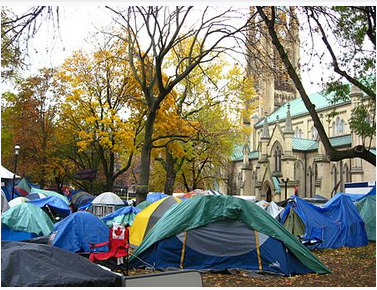

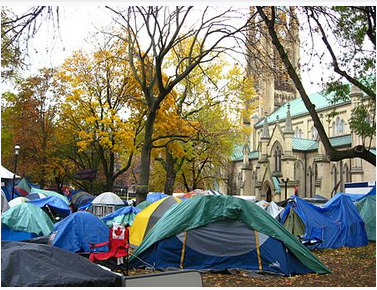

There is occasional acknowledgement that while Ford’s policies aren’t building much housing, they are spurring the growth of tent cities. Workers who can’t pay for a home become homeless. And for those unable to work because of disability, living on under $16,500 a year on Ontario Disability Support Program, the housing crisis is a complete catastrophe. There is occasional acknowledgement that while Ford’s policies aren’t building much housing, they are spurring the growth of tent cities. Workers who can’t pay for a home become homeless. And for those unable to work because of disability, living on under $16,500 a year on Ontario Disability Support Program, the housing crisis is a complete catastrophe.

But with the asking price of a Toronto one bedroom apartment now at almost $2,400 a month or nearly $30,000 a year, it’s not just those relying on social assistance who can’t make ends meet. A worker earning $25 an hour and working 40 hours a week takes home just over $40,000 a year after source deductions.

Rising costs means an increasing number of people have nothing left after paying for food and rent. The rising housing crisis has combined with food inflation to become a general affordability crisis for many. And when fewer people have money to spend, it’s a problem for everyone, not just a few.

Consumer spending drives the economy, particularly the services sector. In most developed economies, consumer spending generates about two-thirds of GDP.

Ontario’s affordability crisis goes a long way to explaining why August retail sales in Ontario were lower than May 2022 though, outside Ontario, they are at a new peak.

Low consumer spending drags down everything else. Ontario’s unemployment rate is worse than the national rate. Ontario’s average wage is falling while rising elsewhere. Unionization is in decline.

There’s only so much housing failure an economy can survive. There’s only so much economic failure a good society can survive.

Fixing Ontario’s economic challenges not the priority

Added to the retail sales problem, the province’s manufacturing is declining, affecting jobs and reducing income from export sales (Data Shows will take a closer look at sales data tomorrow). Added to the retail sales problem, the province’s manufacturing is declining, affecting jobs and reducing income from export sales (Data Shows will take a closer look at sales data tomorrow).

But despite these overlapping challenges, the top priority of a premier elected to “get it done” on housing and jobs is ripping up bicycle lanes in downtown Toronto.

Tom Parkin is a social democratic commentator and the publisher of the Data Shows newsletter.

John Portside John Portside

November 13th, 2024

BURLINGTON, ON

This information is not professional investment advice. Investors are advised to do their own research into individual stocks before making an investment decision.

The five stocks with the largest dollar value of insider acquisitions in the public market are:

|

| Premium Brands Holdings Corporation —–Buy Quantity: 57,820 Average cost: $77.84 Total: $4,500,468.09 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| DEA, THOMAS PHILIP |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

52,820 |

$77.87 |

$4,113,118.09 |

| PALEOLOGOU, GEORGE |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

5,000 |

$77.47 |

$387,350.00 |

|

| South Bow Corporation —–Buy Quantity: 85,865 Average cost: $33.24 Total: $2,854,110.22 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Dafoe, P. Van R. |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

18,000 |

$33.17 |

$597,060.00 |

| Lewis, Melville George |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

30,000 |

$33.25 |

$997,500.00 |

| Palazzo, Marc |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

4,189 |

$33.30 |

$139,486.46 |

| Wirzba, Bevin Mark |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

33,676 |

$33.26 |

$1,120,063.76 |

|

| Sol Strategies Inc. (formerly, Cypherpunk Holdings Inc.) —–Buy Quantity: 975,000 Average cost: $1.18 Total: $1,153,347.25 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Guoga, Antanas (Tony) |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-12-24 |

281,900 |

$1.25 |

$352,375.00 |

| Guoga, Antanas (Tony) |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-11-24 |

718,100 |

$1.17 |

$841,972.25 |

| Harris, Douglas Andrew |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-07-24 |

-25,000 |

$1.64 |

-$41,000.00 |

|

| Savaria Corporation —–Buy Quantity: 19,545 Average cost: $22.96 Total: $448,753.20 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| De Montigny, Jean-Philippe |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-11-24 |

19,545 |

$22.96 |

$448,753.20 |

|

| Cardinal Energy Ltd —–Buy Quantity: 60,000 Average cost: $6.24 Total: $374,500.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Brussa, John Albert |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-12-24 |

10,000 |

$6.25 |

$62,500.00 |

| Ratushny, M. Scott |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-12-24 |

50,000 |

$6.24 |

$312,000.00 |

The five stocks with the largest dollar value of insider dispositions in the public market are:

|

| Ivanhoe Mines Ltd —–Sell Quantity: -300,000 Average cost: $18.63 Total: -$5,587,730.00 Options Issued: 300,000 Average cost: $3.95 Total: $1,183,950.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Cloete, Martie |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6), 5 – Senior Officer of Issuer |

51 – Exercise of options |

11-08-24 |

300,000 |

$3.95 |

$1,183,950.00 |

| Cloete, Martie |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6), 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

-300,000 |

$18.63 |

-$5,587,730.00 |

|

| Capstone Copper Corp —–Sell Quantity: -500,000 Average cost: $10.50 Total: -$5,249,450.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Pylot, Darren Murvin |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

-500,000 |

$10.50 |

-$5,249,450.00 |

|

| Fortis Inc —–Sell Quantity: -21,266 Average cost: $61.45 Total: -$1,306,821.68 Options Issued: 21,716 Average cost: $37.30 Total: $810,006.80 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Glitch, Keri Linda |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

450 |

$61.60 |

$27,722.07 |

| Smith, Gary Joseph |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6) |

51 – Exercise of options |

11-08-24 |

21,716 |

$37.30 |

$810,006.80 |

| Smith, Gary Joseph |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6) |

10 – Acquisition or disposition in the public market |

11-08-24 |

-21,716 |

$61.45 |

-$1,334,543.75 |

|

| TC Energy Corporation —–Sell Quantity: -16,076 Average cost: $68.37 Total: -$1,099,117.27 Options Issued: 16,076 Average cost: $55.89 Total: $898,513.06 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Ebl, Trevor |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6) |

51 – Exercise of options |

11-08-24 |

9,554 |

$53.97 |

$515,629.38 |

| Ebl, Trevor |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6) |

10 – Acquisition or disposition in the public market |

11-08-24 |

-9,554 |

$68.48 |

-$654,219.70 |

| Johnson, Nancy Angenita |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-08-24 |

3,328 |

$54.01 |

$179,745.28 |

| Johnson, Nancy Angenita |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

-3,328 |

$67.75 |

-$225,472.00 |

| Lindley, Colin |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6) |

51 – Exercise of options |

11-11-24 |

3,194 |

$63.60 |

$203,138.40 |

| Lindley, Colin |

7 – Director or Senior Officer of Insider or Subsidiary of Issuer (other than in 4,5,6) |

10 – Acquisition or disposition in the public market |

11-11-24 |

-3,194 |

$68.70 |

-$219,425.56 |

|

| iA Financial Corporation Inc —–Sell Quantity: -5,550 Average cost: $130.45 Total: -$724,025.00 Options Issued: 5,550 Average cost: $69.73 Total: $387,022.50 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Bergeron, Alain |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-11-24 |

2,750 |

$83.87 |

$230,642.50 |

| Bergeron, Alain |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-11-24 |

-2,750 |

$129.90 |

-$357,225.00 |

| Ricard, Denis |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

51 – Exercise of options |

11-11-24 |

2,800 |

$55.85 |

$156,380.00 |

| Ricard, Denis |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-11-24 |

-2,800 |

$131.00 |

-$366,800.00 |

What is Insider Trading?

How Insider Trading works.

By Staff By Staff

November 13th, 2024

BURLINGTON, ON

6 Years in Office

Premier Ford: Glad handing has become close to a full time job. -234,000 Homeless

-1400 Encampments

-2 Years after announcing the attainable housing program

Conservatives still working on the definition of “attainable housing ”

Keep all this in mind when it comes time to vote – don’t be swayed by the $200 the Ford government plans to give you early in the new year.

By James Portside By James Portside

November 12th, 2024

BURLINGTON, ON

This information is not professional investment advice. Investors are advised to do their own research into individual stocks before making an investment decision.

The five stocks with the largest dollar value of insider acquisitions in the public market are:

|

| Ayr Wellness Inc —–Buy Quantity: 1,450,000 Average cost: $1.46 Total: $2,109,948.19 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Millstreet Credit Fund LP |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

450,000 |

$1.27 |

$573,118.21 |

| Millstreet Credit Fund LP |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-06-24 |

1,000,000 |

$1.54 |

$1,536,829.98 |

|

| Superior Plus Corp —–Buy Quantity: 100,000 Average cost: $6.37 Total: $637,326.70 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Gottschalk, Patrick Edward |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

100,000 |

$6.37 |

$637,326.70 |

|

| Sol Strategies Inc. (formerly, Cypherpunk Holdings Inc.) —–Buy Quantity: 500,000 Average cost: $1.13 Total: $565,250.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Guoga, Antanas (Tony) |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-11-24 |

500,000 |

$1.13 |

$565,250.00 |

|

| Cardinal Energy Ltd —–Buy Quantity: 90,050 Average cost: $6.20 Total: $558,298.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Brussa, John Albert |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-11-24 |

40,000 |

$6.20 |

$247,988.00 |

| FESTIVAL, JOHN |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

11-11-24 |

50,050 |

$6.20 |

$310,310.00 |

|

| Total Energy Services Inc —–Buy Quantity: 10,000 Average cost: $10.45 Total: $104,500.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Halyk, Daniel Kim |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-11-24 |

10,000 |

$10.45 |

$104,500.00 |

The five stocks with the largest dollar value of insider dispositions in the public market are:

|

| WSP Global Inc —–Sell Quantity: -2,100,000 Average cost: $242.55 Total: -$509,355,000.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Canada Pension Plan Investment Board |

3 – 10% Security Holder of Issuer |

90 – Change in the nature of ownership |

11-08-24 |

0 |

$0.00 |

$0.00 |

| Canada Pension Plan Investment Board |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

11-07-24 |

-2,100,000 |

$242.55 |

-$509,355,000.00 |

|

| TFI International Inc —–Sell Quantity: -25,000 Average cost: $203.32 Total: -$5,083,072.50 Options Issued: 25,000 Average cost: $40.36 Total: $1,009,000.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Bédard, Alain |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

51 – Exercise of options |

11-08-24 |

25,000 |

$40.36 |

$1,009,000.00 |

| Bédard, Alain |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

-25,000 |

$203.32 |

-$5,083,072.50 |

|

| COLLIERS INTERNATIONAL GROUP INC —–Sell Quantity: -20,000 Average cost: $209.21 Total: -$4,184,238.00 Options Issued: 30,000 Average cost: $103.94 Total: $3,118,320.69 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Mayer, Christian |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-07-24 |

30,000 |

$103.94 |

$3,118,320.69 |

| Mayer, Christian |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-07-24 |

-20,000 |

$209.21 |

-$4,184,238.00 |

|

| iA Financial Corporation Inc —–Sell Quantity: -25,000 Average cost: $128.88 Total: -$3,221,951.50 Options Issued: 25,000 Average cost: $48.29 Total: $1,207,220.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Jobin, Éric |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-08-24 |

3,000 |

$57.87 |

$173,610.00 |

| Jobin, Éric |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

11-08-24 |

-3,000 |

$128.11 |

-$384,324.00 |

| Miron, Pierre |

5 – Senior Officer of Issuer |

51 – Exercise of options |

11-11-24 |

15,000 |

$48.82 |

$732,300.00 |

| Miron, Pierre |

5 – Senior Officer of Issuer |