By Staff By Staff

December 10th, 2024

BURLINGTON, ON

Bev Kingdon has been with the Trumpeter Swan Coalition Restoration project since its earliest days.

Bev Kingdon with Trumpeter swans on the beach at the LaSalle Park Marina where the boaters have learned to share the space with the swans. At a meeting that had nothing to do with Swans last night, she told us that saving the trumpeter swans have moved from being a Restoration project to being a Sustaining project and that sometime in February the group that deserves the gratitude of people across the province for saving the swans is going to do a province-wide count of the number of swans there are now.

The magnificent birds were on the very edge of extinction. The Coalition now wants to know just how many Trumpeter Swans there are. “We have to do the count across the province in a single day” said Kingdon “because the swans move from place to place and we want to ensure there is no double counting.”

People will be assigned a space and asked to report on the number of swans they see in a single day – and that is going to require hundreds of people to do the counting on a specific day that has yet to be determined.

Grace and Beauty – photograph by Amada Kerr If the Swans mean anything to you – be in touch with the Trumpeter Swan Coalition and let them know where you live.

This count initiative is in the very early stages – so be patient.

Related news story:

Winner of the Gazette Trumpeter Swan photo contest

By Staff By Staff

December 10th, 2024

BURLINGTON, ON, ON

Support Burlington Public Library’s

Kids Learning Fund this holiday season

Give a gift that inspires a lifetime of learning! By donating to BPL’s Kids Learning Fund, you’re directly supporting literacy, creativity, and discovery for children in our community. A $30 donation can purchase up to four books for our children’s collection. A $100 donation can buy supplies for a STEAM programming session. And a $200 donation can help replace aging play equipment!

Click HERE to donate online or in any BPL branch from now until December 31. Tax receipts are provided for all donations over $20.

Shopping for someone who has everything? Honour their love of books and learning with a truly meaningful gift! Your contribution in their name is a gift that keeps giving.

Your donation helps us enhance our children’s book and tech collections, fund free programs that ignite a passion for reading, science, and art, and create welcoming library spaces with engaging toys, furnishings, and technology.

By Staff By Staff

December 10th, 2024

BURLINGTON, ON

The Mayors Chamber of Commerce luncheon took place on Monday at the Burlington Convention Centre.

The crowd was decent enough.

The Mayor made her comments, insisting again that the tax increase was going to be 5.76, which is true, but also very misleading and really poor communications policy on the part of the City.

That 5.76 represented all the taxes: Boards of Education, the Regional levy (which has yet to be determined), the Police Services expense – which is included with the Regional levy.

The Mayor and her council members are responsible for what Burlington spends and what it needs in the way of a tax levy. The residents of the city deserve to know what the city is doing to them financially.

At this point, the tax increase over last year is expected to be 7.83%. The city uses the words “deemed to have been approved” in statements they issue these days.

The Regional Council will determine what their tax levy is going to be on Wednesday – at that point, the city will be able to set its tax levy.

The City CAO Hassaan Basit used the same 4.97% number.

This was not the picture we used in the first version of this story. Shortly after it was published Councillor Kearns advised me that my zipper had come undone. I asked her for suggestions on what could be done. We ended up agreeing that photo-shopping the picture and putting in a fig leaf would do the trick. At Chamber of Commerce events a table is usually set aside for media. In the past CHCH has had cameras, Cogeco had a crew and a number of print media sent a representative.

This year there were just two media people: Hunter Lawson from Burlington Today and Pepper Parr from the Burlington Gazette.

There was no table, there was no lunch. We did get a glass of water.

By John Best By John Best

December 10th, 2024

BURLINGTON, ON

The Ombudsman for the city of Burlington has ruled that it cannot involve itself in political decisions and for that reason is unable to act on a complaint lodged by the Bay Observer about the communication process surrounding the Bateman School Project. The Bay Observer launched a complaint against Burlington City Council in November of 2023, alleging that Burlington Council had misled the public about the real financial scope of the Bateman project when it was first floated with the public, and throughout the election year 2022, engaged in a public consultation process that had participants providing comments and buy-in with no idea of the financial implications of the project.

The Ombudsman found in his conclusion: “I am satisfied from the evidence that the City’s Communications staff followed City policies, and professional practices in the communications field. I further accept that City staff can only publish information they are authorized to share (Our emphasis). I interpret that the remainder (and bulk, frankly) of Mr. Best’s concerns are directed to the City’s political processes or decision-making – which isn’t appropriately within this Office’s jurisdiction.” The Bay Observer had not directed its criticism towards communication staff, understanding their role is to carry out council communications.

What got the Bay Observer interested in the Bateman project was when members of council initiated an integrity commissioner complaint into comments made by Councillor Shawna Stolte at a meeting in late 2021 where she referred to the cost of the project saying, “the reality is that the final cost will be well above $50M.” That figure had earlier only been presented to council in closed session. The Integrity Commissioner ruled that her comments were a clear violation of procedure and Stolte was sanctioned.

Mayor Marianne Meed Ward What seemed unusual was Mayor Marianne Meed Ward’s release of a 2,300-word statement the day after the Integrity Commissioners report was approved by council, that had the feel of overkill. Among many other statements, the Mayor wrote, “Any breach of the Code is a breach of public trust. The community loses; The breach related to the purchase of Robert Bateman High School, as the Integrity Commissioner has noted, had incorrect information that risks misleading the public. In addition, while the dollar amount disclosed was incorrect, it could have seriously damaged negotiations as the seller could have interpreted that number as indicative of the City’s price point.” (The mayor rightly pointed out the $50 million figure was incorrect, as the final figure at last estimate is now more than double that.) What struck us then was the force with which the mayor and councillors came down on Stolte, leading a reporter to wonder if the urgency of sanctioning Stolte was really the breach of confidentiality itself or the fact that through Stolte’s actions the size of the project was now in the public domain.

Publisher’s note. During the kerfuffle surrounding the sanctioning of Stolte, the Mayor attempted to force Stolte to make a public apology to a city Staff member. The attempt was made by the Mayor during a virtual Council meeting. The Gazette published the rant which can be reviewed HERE

With the Stolte matter behind it, council throughout 2022 developed a public consultation plan that in our view was misleading to participants, and formed the basis of the complaint to the Ombudsman. Both in our reporting, and in our complaint to the Ombudsman, the Bay Observer stated that the complaint, “relates to the genesis of the Bateman project, specifically the failure by council to provide the public with any sense of the size and scope of a plan to spend tens of millions of dollars on renovations to the former Robert Bateman School for use as a community centre as they were conducting public consultation throughout 2022. In fact, I submit that the city engaged in deliberate obfuscation of the financial scope of the project, as they engaged in public consultation. Indeed, those members of the public who participated in surveys and town halls had no idea for what they were actually providing buy-in, making the public consultation piece a sham. The project was essentially presented to the public as a simple land swap, with the end goal providing space for a Brock University satellite campus, a city economic division known as Tech Place and the Library.

A development project that included everyone except the public. The (cost and scope of the) community centre aspect was only alluded to in the most vague terms throughout the public consultation period, when in fact every member of council had known it was a major capital project costing at least $50 million (December 2021). As soon as the election was over the price was announced at $80 Million and has now grown to $100 Million. A decision to embark on a project of this magnitude while giving the public at least a ballpark sense of the cost would not have frustrated subsequent tendering. The fact that this communication process was followed in an election year is particularly concerning as it was a legitimate item for public discussion. Large municipal projects are frequently presented to the public for comment with an approximate price tag attached, in fact plebiscites (on significant public works projects) are often framed with this information.”

The full Ombudsman report runs to 24 pages. You can read it in the Bay Observer.

John Best is the Editor of the Bay Observer

By Pepper Parr By Pepper Parr

December 9th, 2024

BURLINGTON, ON

The comment that caught my attention was made by David Shepherd when he said: “we would just like to see it go away”, referring to the $95,000 that was owed to the city for various services provided to the Sound of Music (SoM) in the past.

The Staff report discussed at the December meeting said: “During the Committee of the Whole Meeting on December 2, 2024, the above report was discussed. It was noted that a private foundation had expressed interest in offering financial support to Sound of Music to help ensure the success of the 2025 festival. This new information led to a deferral of the report to the December 10, 2024, Council Meeting. Since then, staff have had the opportunity to meet with the foundation and the Board Chair of Sound of Music to continue discussions.”

Looks like they will be back. That’s not quite the way this happened either. Ward 1 Councillor Galbraith said he had been approached by an individual who expressed an interest in helping out financially.

We learned today that the Burlington Foundation has been advised that one of the private foundations they administer has directed the Foundation to apply some of their funds to the SoM.

The funds are not coming from the Foundation; they are coming from an individual who has a personal foundation (it could be corporate) and they have directed the Foundation to use some of the funds to the benefit of SoM.

The public may never know who actually put up the money.

“Staff are pleased to share that the private foundation intends to make a significant donation to the festival. This contribution will be applied to Sound of Music’s outstanding debt owing to the city from previous years, as well as the city’s loan to Sound of Music that is not expected to be repaid when it is due on December 11, 2024. As of that date, Sound of Music’s total outstanding debt to the city will be $220,000. Any remaining balance after this donation is applied to Sound of Music’s debt will be due to the city following the 2025 festival, with full repayment required no later than September 1, 2025. If the debt is not fully repaid by that time, future city grants may be impacted.

“As outlined in RCC-19-24, the city will be moving forward with a detailed service level agreement with Sound of Music, incorporating elements from the recently endorsed Accountability Framework to ensure clear expectations and effective collaboration. This agreement will also depend on the Sound of Music Board’s commitment to strong governance and ensuring sufficient resources for the successful execution of the 2025 festival. In addition, Sound of Music will be required to submit a comprehensive business plan for the 2026 festival, which will need to be approved by the Commissioner of Community Services, the Commissioner of Legal and Legislative Services, and the Chief Financial Officer. This plan will be due no later than June 1, 2025, to guide future funding decisions.”

This is a badly needed element. In the past, the SoM has been a kind of Wild West show. Transparency didn’t exist, governance was something they either didn’t understand or didn’t want to have to comply with.

There will have to be a change in the culture of the organization if they are to succeed financailly going forward.

The music industry is to a considerable degree a cash operation; hard to create a paper trail when cash is involved.

Aretha Franklin, known as the “Queen of Soul”, was a female musician who insisted on being paid in cash for her performances. She would collect her payment on the spot or refuse to sing. She would sometimes keep her cash in her purse, give it to her security guards, or leave it on top of the piano while she sang.

This is a happy camper. A revised report will be presented to Council on Tuesday for their consideration:

Authorize the Director of Recreation, Community and Culture to negotiate and execute any necessary agreements with Sound of Music related to the City’s 2025 grant to Sound of Music Inc., with the content satisfactory to the Director of Recreation, Community and Culture and in a form satisfactory to the Commissioner of Legal and Legislative Services.

Authorize the Director of Recreation, Community and Culture to negotiate and execute any agreements with Sound of Music related to the extension of the repayment of the Sound of Music Inc’s debts with a repayment deadline up to September 1, 2025 with the content satisfactory to the Director of Recreation, Community and Culture and in a form satisfactory to the Commissioner of Legal and Legislative Services.

“In closing, it is clear that the Burlington community deeply values this important festival and wishes to see it continue. However, for the festival to remain sustainable in the long term, it is vital that the Board of Directors carefully consider the financial health of the organization and plan for both the 2025 festival and the years that follow. We appreciate the continued collaboration and commitment to this valued community event.”

Chief Administration Officer Hassaan Basit, is tough tough on transparency – he will deliver some hard lessons to the SoM that is currently an operational board. They need to add some governance to the mix – soon.

Related news story:

Burlington Foundation distributes more than $300,000 – a record for the 25-year-old organization.

By James Porthouse By James Porthouse

December 9th, 2024

BURLINGTON, ON

This information is not professional investment advice. Investors are advised to do their own research into individual stocks before making an investment decision.

The five stocks with the largest dollar value of insider acquisitions in the public market are:

|

| Peyto Exploration & Development Corp —–Buy Quantity: 10,000 Average cost: $16.16 Total: $161,600.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Lachance, Jean-Paul Henri |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-06-24 |

10,000 |

$16.16 |

$161,600.00 |

|

| Morguard Real Estate Investment Trust —–Buy Quantity: 8,300 Average cost: $5.50 Total: $45,650.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Morguard Corporation |

3 – 10% Security Holder of Issuer |

10 – Acquisition or disposition in the public market |

12-05-24 |

8,300 |

$5.50 |

$45,650.00 |

|

| Canso Select Opportunities Corporation —–Buy Quantity: 14,700 Average cost: $2.70 Total: $39,727.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Morin, Joseph Patrick |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

12-05-24 |

13,800 |

$2.70 |

$37,276.00 |

| Morin, Joseph Patrick |

4 – Director of Issuer |

10 – Acquisition or disposition in the public market |

12-04-24 |

900 |

$2.72 |

$2,451.00 |

|

| ACT Energy Technologies Ltd —–Buy Quantity: 5,000 Average cost: $6.40 Total: $32,000.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| MAXWELL, RODERICK DONALD |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-06-24 |

5,000 |

$6.40 |

$32,000.00 |

|

| Cathedra Bitcoin Inc —–Buy Quantity: 293,818 Average cost: $0.08 Total: $24,920.47 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Armstrong, Thomas |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-06-24 |

81,818 |

$0.08 |

$6,939.48 |

| Armstrong, Thomas |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-04-24 |

50,000 |

$0.08 |

$4,240.80 |

| Armstrong, Thomas |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-03-24 |

162,000 |

$0.08 |

$13,740.19 |

The five stocks with the largest dollar value of insider dispositions in the public market are:

|

| Bombardier Inc —–Sell Quantity: -19,676 Average cost: $101.17 Total: -$1,990,650.43 Options Issued: 19,676 Average cost: $26.75 Total: $526,333.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Brennan, Daniel |

5 – Senior Officer of Issuer |

51 – Exercise of options |

12-05-24 |

19,676 |

$26.75 |

$526,333.00 |

| Brennan, Daniel |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-05-24 |

-19,676 |

$101.17 |

-$1,990,650.43 |

|

| Kinross Gold Corporation —–Sell Quantity: -101,000 Average cost: $14.13 Total: -$1,426,946.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Gold, Geoffrey Peters |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-04-24 |

-100,000 |

$14.13 |

-$1,412,840.00 |

| Gold, Geoffrey Peters |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-05-24 |

-1,000 |

$14.11 |

-$14,106.00 |

|

| Agnico Eagle Mines Limited —–Sell Quantity: -10,000 Average cost: $122.00 Total: -$1,220,000.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Robitaille, Jean |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-04-24 |

-10,000 |

$122.00 |

-$1,220,000.00 |

|

| NUVISTA ENERGY LTD —–Sell Quantity: -74,874 Average cost: $13.47 Total: -$1,008,552.78 Options Issued: 74,874 Average cost: $1.70 Total: $127,660.17 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Wright, Jonathan Andrew |

5 – Senior Officer of Issuer |

51 – Exercise of options |

12-04-24 |

74,874 |

$1.70 |

$127,660.17 |

| Wright, Jonathan Andrew |

5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-04-24 |

-74,874 |

$13.47 |

-$1,008,552.78 |

|

| TransAlta Corporation —–Sell Quantity: -45,000 Average cost: $17.67 Total: -$795,150.00 Options Issued: 45,000 Average cost: $5.59 Total: $251,550.00 |

| Insider |

Relationship |

Transaction |

Date |

Quantity |

Price |

Total |

| Kousinioris, John Harry |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

51 – Exercise of options |

12-05-24 |

45,000 |

$5.59 |

$251,550.00 |

| Kousinioris, John Harry |

4 – Director of Issuer, 5 – Senior Officer of Issuer |

10 – Acquisition or disposition in the public market |

12-05-24 |

-45,000 |

$17.67 |

-$795,150.00 |

| TransAlta Corporation |

1 – Issuer |

38 – Redemption, retraction, cancellation, repurchase |

12-06-24 |

-47,600 |

$0.00 |

$0.00 |

What is Insider Trading?

How Insider Trading works.

By Staff By Staff

December 9th, 2024

BURLINGTON, ON

Four-in-five say seniors, people with disability should be eligible for one-time cheque

Prime Minister Justin Trudeau and the Liberal federal government were hoping that two new proposals aimed at those struggling with the cost of living would earn them some holiday goodwill with Canadians. And while some are merry about the prospects of a forthcoming GST/HST holiday and a (now uncertain) one-time $250 cheque, many are greeting what is viewed as an “entirely political” move with a “bah humbug”.

New data from the non-profit Angus Reid Institute finds that 45 per cent of Canadians believe the announced tax holiday, set to take effect on Dec. 14, will help them at least a little over the next two months. Fewer, approximately one-in-three (36%), say the same of a one-time $250 cheque from the government, an idea that was initially a part of the Liberal plan for Canadians but has now evidently been shelved like an elf, facing criticism from the NDP.

The lack of support from leader Jagmeet Singh and the NDP is due to the criteria for eligibility to receive a cheque. The federal government announced The Working Canadians Rebate for those who worked in 2023 and earned less than $150,000. Singh argues that new graduates, people with disabilities, and seniors should be included. These new data suggest that lower-income people are the least likely to say they are eligible for the rebate. Two-in-five (38%) with incomes lower than $25,000 and 35 per cent of those earning between $25,000 and $49,999 say they would not be eligible. So, while lower-income Canadians are most likely to say a payment would benefit them, they are also most likely to say the offering would miss them entirely. The lack of support from leader Jagmeet Singh and the NDP is due to the criteria for eligibility to receive a cheque. The federal government announced The Working Canadians Rebate for those who worked in 2023 and earned less than $150,000. Singh argues that new graduates, people with disabilities, and seniors should be included. These new data suggest that lower-income people are the least likely to say they are eligible for the rebate. Two-in-five (38%) with incomes lower than $25,000 and 35 per cent of those earning between $25,000 and $49,999 say they would not be eligible. So, while lower-income Canadians are most likely to say a payment would benefit them, they are also most likely to say the offering would miss them entirely.

For their part, 84 per cent of Canadians believe these policies are politically motivated, while far fewer (7%) say the government genuinely wants to help people.

By Pepper Parr By Pepper Parr

December 9th, 2024

BURLINGTON, ON

Few would describe Burlington as a significant part of the marine industry – most would see that as part of what Hamilton is.

There are two organizations in Burlington that are major players in the marine industry – they work together. One makes things that sea going ships use and the other owns ships that ply the Great Lakes.

Thordon Bearings staff with the products they manufacture. Thordon Bearings has delivered COMPAC water-lubricated propeller shaft and SXL rudder bearings to replace oil- and grease- lubricated bearings onboard McKeil Marine’s bulk carrier Northern Venture as part of a major refurbishment project.

Established in 1956, Canada-based McKeil Marine provides marine transportation along the St. Lawrence Seaway, the East Coast, and Canadian Arctic with its diversified fleet of tugs, barges, workboats and vessels, including bunkers, cement carriers, and tankers.

The shipowner acquired the 155m (508.5ft), 19,651dwt Northern Venture in 2022. The self-discharging River Class vessel has a forward mounted discharge boom and a single point loading system which allows all four holds to be loaded via shuttle conveyors from a single deck-mounted hopper.

The Northern Venture, part of the McKeil Marine fleet of ships. The conversion to water-lubricated propeller shaft and grease-free rudder bearings was made to ensure the vessel does not discharge oil or grease into the Great Lakes, said Andy Vary, Director of Technical Operations at McKeil Marine. “It’s part of our continuous commitment to our people, our customers and the communities in which we operate.”

The retrofit included COMPAC bearings for the vessel’s 409mm (16.1in) diameter propeller shaft along Thordon’s Water Quality Package to ensure a clean water supply to the bearings. Thordon grease-free SXL rudder bearings were also supplied for the bulker. This installation was undertaken in summer 2023 at COSCO’s Nantong Shipyard in China, with the vessel operational on the Great Lakes in December 2023.

The world’s first Thordon water-lubricated propeller shaft bearing was installed on a Great Lakes tug owned by McKeil Marine in the late 1970s. McKeil Marine is a returning customer for Thordon Bearings. The world’s first Thordon water-lubricated propeller shaft bearing was installed on a Great Lakes tug owned by McKeil Marine in the late 1970s.

Following this conversion, many other Great Lakes operating vessels converted to Thordon, helping to raise the profile of the Burlington, Ontario-headquartered company across the global shipping industry.

Thordon’s COMPAC propeller shaft bearing is constructed from a cross-linked polymer alloy that offers a low breakaway friction resulting in quiet and smooth operation. The material’s abrasive resistance is much greater than traditional laminated materials. The visco-elastic nature of the material also improves the hydrodynamic performance of the bearing leading to longer wear life, and as the material is homogenous, it provides consistent low wear and friction properties.

To promote early formation of a hydrodynamic film between the propeller shaft and bearing, the lower (loaded) portion of the bearing is smooth, while the upper half of the bearing incorporates grooves to allow water lubricant/coolant to flow. A key benefit of the water-lubricated propeller shaft system is that it negates the need for a damage-prone aft seal.

José Duarte, Marine Business Development Manager – North America, Thordon Bearings, said: “As an added environmental benefit, Thordon’s COMPAC system has been shown to lead to fuel savings and reduced emissions. Compared to oil-lubricated bearings, at rated shaft speeds viscous friction is lower with water.”

The Thordon Water Quality Package is designed to supply sea or lake water to the propeller shaft bearings for lubrication and cooling and to condition the water by removing suspended solids.

Thordon’s SXL rudder bearings operate without grease above and below the waterline, offer high abrasion resistance and can also withstand high shock loads, improving the wear life of the bearing.

Thordon has been actively supporting shipowners such as McKeil Marine, Algoma Central, American Steamship, CSL, Lower Lakes Towing and Interlake Steamship for over three decades. More than 120 vessels sailing the Great Lakes have Thordon’s water-lubricated components.

Related news story:

Thordon celebrates

By Pepper Parr By Pepper Parr

December 7th, 2024

BURLINGTON, ON

Ontario Auditor General Shirley Spence “They just do whatever they want with no consideration for the rules, for accountability, for transparency and frankly, for what the data and science are telling them. This is a government that’s off the rails and they’re doing whatever they want at enormous expense to the people of Ontario.” So said the Auditor General for the province.

For the most recent fiscal year ending March 31, 2024, the Ontario government spent $103.5 million on advertising. This was over three times as much as what was spent in the previous fiscal year, $33.7 million, and the most the government has ever spent on advertising in a year.

Figure 1 shows the trend in government advertising expenditures over the past 10 fiscal years. As shown, spending follows a wave-like pattern that correlates with Ontario’s provincial elections. Spending climbed to peak in 2017/18 and again in 2021/22, the years immediately preceding provincial elections (held in June 2018 and June 2022). Spending dipped significantly in 2018/19 and 2022/23, the years immediately following those elections. The trend in expenditures was also impacted by higher costs in 2020/21 for health-related advertising about the COVID-19 pandemic.

Figure 2 lists the top 10 advertising campaigns by expenditure. These 10 campaigns accounted for $95.2 million (or 92%) of the total amount spent on advertisements in 2023/24. The expenditure amounts include both the cost to create and/or produce the advertisement and to distribute it in the media. Figure 2 lists the top 10 advertising campaigns by expenditure. These 10 campaigns accounted for $95.2 million (or 92%) of the total amount spent on advertisements in 2023/24. The expenditure amounts include both the cost to create and/or produce the advertisement and to distribute it in the media.

The Act applies only to advertisements published by “government offices,” namely provincial ministries, the Cabinet Office and the Office of the Premier. We do not review advertising by government agencies, such as Metrolinx or LCBO, or institutions in the broader public sector that receive government funding, like hospitals or colleges.

Under a 2005 agreement, we have the authority to review third-party advertising when an independent organization is funded by the government to promote something. If a government office funded the item, approved the content and permitted the party to use the Ontario logo, then the Auditor General is required to review the advertisement.

Second, certain kinds of ads that government offices purchase are exempted from our review. For example, job advertisements for specific roles are not considered eligible for review, as well as public notices required by law or for urgent matters affecting public health or safety.

Digital Advertising

This is the area that raises eyebrows.

Following Regulation 143/15 of the Act, our Office does not review some kinds of digital advertising engaged in by government offices. We do not review ad items that run on social media platforms, for example, advertisements on Meta, X or Instagram. We also do not review spending on search marketing services such as Google ads or search engine optimization.

Although we do not review these kinds of digital advertising items, we are empowered to report how much the government has spent on them.

Figure 4 compares what was spent by the provincial government on reviewable and non-reviewable digital advertisements (social media and search marketing services) in 2023/24. Figure 4 compares what was spent by the provincial government on reviewable and non-reviewable digital advertisements (social media and search marketing services) in 2023/24.

In the past fiscal year, the government spent a total of $12.8 million on digital ads and services that were excluded from our review. This marked an increase of more than 250% from the year prior, when $4.9 million was spent.

The majority of social media advertisements were run as part of larger, reviewable campaigns that used different delivery channels. For example, the Ministry of Transportation’s “Winter Safe Driving” campaign cost approximately $873,000 of which $156,000 was spent on social media advertising.

Some advertising campaigns were distributed solely via social media, such as the Ministry of Finance’s campaign about the Fall Economic Statement that cost $92,600.

Figure 4 shows the annual amounts spent by the government on social media and search marketing services over the last eight fiscal years. Non-reviewable search marketing services and social media buys are only a fraction of the digital media landscape.

The Auditor General cannot force the government to do anything. The reports issued are public and frequently result in strong public reaction – something some governments are known to respond to.

Her recommendations and the government response.

By Pepper Parr By Pepper Parr

December 6th, 2024

BURLINGTON, ON

“They just do whatever they want with no consideration for the rules, for accountability, for transparency and frankly, for what the data and science are telling them. This is a government that’s off the rails and they’re doing whatever they want at enormous expense to the people of Ontario.”

Who said that: The Auditor General for the province.

How does the Auditor General get the job?

The Legislative Assembly of Ontario appoints the Auditor General for a 10-year term. The appointment is made by Order of the Legislative Assembly after a bi-partisan panel of MPPs unanimously recommends a candidate. The legislature must also approve any removal of the Auditor General.

The Auditor General is an independent officer of the Legislative Assembly who is responsible for:

Shelley Spence: Ontario Auditor General Ensuring financial transparency

Holding public-sector organizations accountable

Examining the province’s Public Accounts

Auditing the accounts and financial transactions of Crown agencies

Carrying out performance audits of government activities and programs

Assessing compliance with legislation and government directives

Reporting on their examination in an annual report

Shelly Spence, the Ontario Auditor General had a lot more to say about the Ford government.

Tune in tomorrow – we will have more for you.

By Staff By Staff

December 6, 2024

BURLINGTON, ON

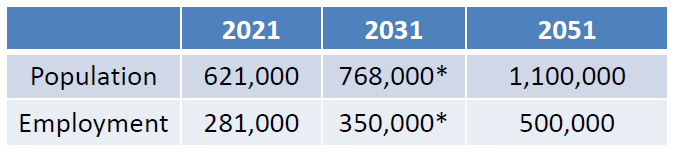

Unless things dramatically change, the Ontario government’s much-touted target of building at least 1.5 million homes across the province by 2031 won’t happen. It’s that simple, according to several industry experts – and basic math.

The reality, driven home by everyone from politicians and housing advocates to urban planners, is that we need new homes built now – or we won’t be able to accommodate our growing population and the relentless housing crisis will worsen. Ontario’s current climate, however, isn’t exactly one that facilitates the widespread construction of new homes. And the obstacles are plenty.

In the wake of recent eyebrow-raising reports that reveal slowing housing starts and disheartening projections, the big question is: Will Ontario actually reach its target? For many, it’s already more of, “Just how far off will it be from hitting it?”

The Perfect Storm For Slow Builds

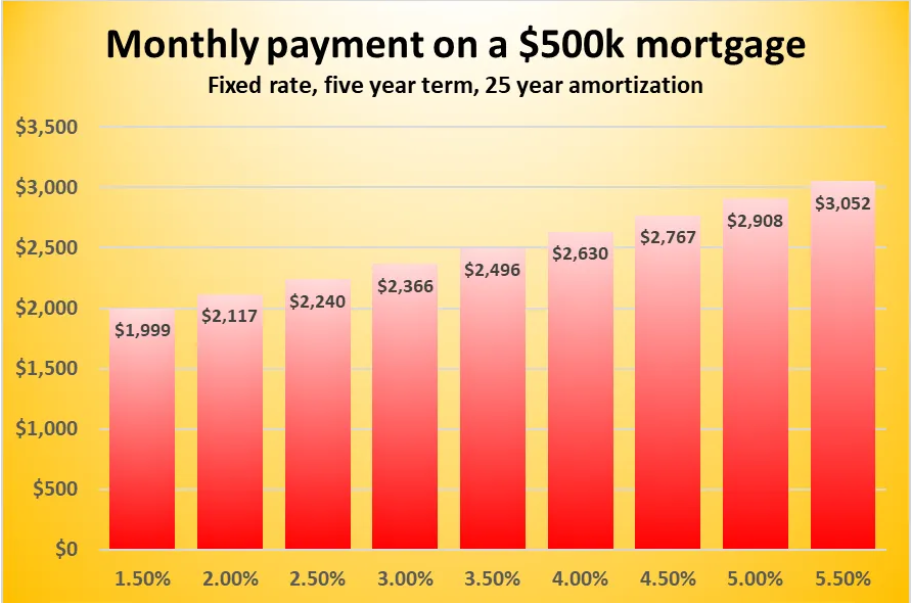

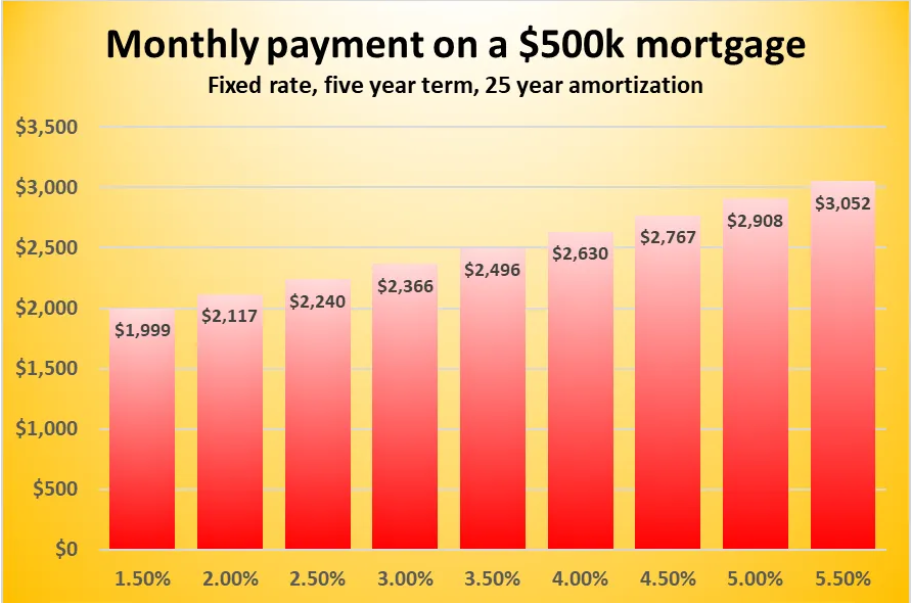

Before we jump into it, it’s important to consider how we got here in the first place. Factors include a combo of high and rising land costs, heightened interest rates, rising development fees, construction costs, and bureaucratic delays that have slowed development activity across the province. “The greatest contributors to the province’s slow speed of new home construction has been the increase of development charges, the continued problem of too much red tape, and federal sales taxes,” Residential Construction Council of Ontario (RESCON) president Richard Lyall tells STOREYS.

Of course, high interest rates and inflation don’t help either. “For the last year and a half, the biggest barrier is the cost to build at a rate that the market can absorb,” says Justin Sherwood, senior vice president, communications and stakeholder relations for Building Industry and Land Development Association (BILD). “The last five years has seen a significant increase in the cost of construction from both a labour and material perspective. Construction inflation in the GTA has resulted in nearly an 80% increase in the cost to build a condominium and 98% in the cost to build a single family home since Q4 2019.”

Paired with high land values and sky-high municipal fees to build and the result is a cost structure that is out of line with the market’s ability to absorb, says Sherwood. “As a result, pre-construction sales have plummeted since mid-2022, new projects are not financially viable and starts are following a similar trajectory to sales,” he says. “This is why BILD has been advocating that governments of all levels do something to address the taxes, fees, and charges they put on new homes that adds 25% to the cost of an average new home in the GTA.”

CMHC housing outlook, housing starts data

CMHC Sees No Return to Pre-Pandemic Price Levels in Annual Housing Forecast CMHC Sees No Return to Pre-Pandemic Price Levels in Annual Housing Forecast

The Provincial Government’s Tough Target

To achieve its ambitious goal, Ford’s government has set housing targets for the province’s 50 largest municipalities. They’ve also established a $1.2 billion Building Faster Fund to incentivize municipalities to meet these targets. Municipalities that achieve at least 80% of their annual target receive funding, with additional bonuses for those that exceed their targets.

Late last month, however, the Ford government revealed that housing starts had declined since the last budget… but still said they’d meet target goals. While the province needs at least 100,000 new homes built per year to achieve the target, their fall economic statement reveals that Ontario is not on track to make this a reality between 2024 and 2027. In fact, projected housing starts fall in each of these years. The fall economic statement revised the 2024 housing starts projection from 87,900 to 81,300. This comes significantly short of the Ontario government’s goal of 125,000 new homes in 2024, as outlined in the statement.

Despite passionate voices from opposition parties, the provincial government says it’s doing just fine in the new home-building department, thank you very much. On its website, a tracker boldly reveals the province’s housing supply progress, based on monthly housing starts and ARUs data provided by the Canadian Mortgage and Housing Corporation (CMHC). Figures show that the Province reached 99% of its housing start target of 110,000 new homes completed in 2023 – with 109,011. Meanwhile, the province saw 89,217 starts in 2023, as well as the addition of 9,879 residential units, which includes non-residential space that is converted to residential units and residential to residential conversions.

“Ontario has achieved the highest housing starts the province has seen in over three decades,” wrote Justine Teplycky, director of communications for provincial housing minister Paul Calandra, in an email to STOREYS. “However, as a result of high interest rates caused by the federal government’s runaway tax-and-spend policies, including the federal carbon tax, homebuilders across the province face a challenging economic environment that is impacting the pace of new home construction.”

As a result, Teplycky says the government is taking proactive measures to address everything from legislation delays to filling the missing middle. “Our government is redoubling our efforts to support the building of even more homes faster by cutting red tape and streamlining approvals,” says Teplycky. “We’ve introduced a new Provincial Planning Statement to provide municipalities with greater flexibility to build more housing. We’ve introduced common sense rules to help encourage the construction of garden, laneway, and basement suites. And we’re investing over $3 billion to address what municipalities have identified as the number one obstacle to building housing, critically needed housing-enabling infrastructure.”

In true Ford government form, Teplycky says these initiatives are more impactful than proposed solutions from other political parties. “In contrast, the NDP wants to double down on inflationary spending with a $150 billion dollar scheme that proposes to build only a fraction of the homes we need, and the Liberals are proposing to copy the federal government with a retail sales tax that will make everything we buy more expensive,” says Teplycky.

A report published on November 14 from the Financial Accountability Office of Ontario drove home the reality that Ontario’s new home construction wasn’t looking as promising for 2024 as it (sort of) was for 2023. According to the report, the province saw a total of 20,600 housing starts in Ontario in 2024 from April to September – a 16.9% decline from the 24,800 starts in Q3 of 2023. Most notably, the construction of single-family homes has dramatically dropped. In 2024 Q3, 77% of total housing starts were multiple dwelling units, while 23% were single detached homes. In fact, the construction of single detached homes is on track for the lowest level of annual starts since 1955.

The report cites “affordability challenges, changes in household preferences, and planning efforts aimed at increasing density” as reasons for this declining share of single-family homes. Indeed, in places like Toronto’s core, single-family homes – especially new ones – are becoming an increasingly rare sight.

The report outlines that, to meet its goal of 1.5 million homes by the end of 2031, it would require an average of 34,100 units per quarter, beginning in 2021 Q1 – and that’s not currently happening. From 2021 Q1 to 2024 Q3, Ontario has started an average of 22,900 units per quarter. “To reach the government’s target by the end of 2031, an average of 39,900 units would need to be started per quarter beginning in 2024 Q4,” reads the report. “This represents a 74% increase in the pace of units started since 2021 and about 5,500 above the highest number of starts ever recorded of 34,400 in 1973 Q3.”

Yikes.

To say this seems like a pretty challenging prospect – for housing starts to nearly double – given the current state of things, would be a vast understatement.

When it comes to the future of housing starts, a new report from RESCON isn’t exactly a hopeful one, indicating a predicted decline in housing starts in the upcoming years. Inevitably, this decrease is expected to worsen the current housing shortage throughout the province.

In Housing Market Outlooks in Ontario, RESCON’s analysis underscores the mix of factors that are negatively impacting the construction of new homes across Ontario. A relentless culprit is climbing construction costs. The report highlights that the rising cost of land and government-imposed fees, such as development charges, are the primary factors driving up housing prices. Due to these increased costs, constructing new low-rise housing, in particular, is becoming financially unviable.

This is particularly true in the infamously pricey Greater Toronto Area (GTA) region. Here, municipal fees for single-family homes have jumped $42,000 from last year to a head-shaking average of $164,920. Meanwhile, apartment fees have climbed $32,000 to $122,387. Adding insult to injury when it comes to prices, the report found that approval delays cost developers between $2,672 and $5,576 per month, depending on the municipality. This can raise the cost per unit by up to $90,000.

The report’s long-term outlook presents two scenarios, with both anticipating a continued decrease in housing starts and employment until 2025. A gradual recovery is projected between 2026 and 2028. By the end of 2028, however, conditions will not have fully recovered. As a result, housing availability is expected to remain limited, keeping prices elevated.

Ontario Lags Behind Other Provinces In The Race To Build Homes

Figures released recently from the Canadian Mortgage and Housing Corporation (CMHC) reveal that Ontario housing starts fell significantly behind the national trend between January and October 2024. While the rest of Canada saw an average increase of 14,000 housing starts, the province initiated 13,000 fewer homes during the same period compared to the previous year.

Meanwhile, a new Smart Prosperity Institute (SPI) report authored by Mike Moffat, Economist and Senior Director of Policy and Innovation at SPI, shows that Ontario has lagged behind the other provinces when it comes to new homes for quite some time now.

According to the report, data for 2024 suggests that Ontario’s homebuilding rate per capita is worsening. The province has consistently ranked in the lower half nationally over the past six years. While British Columbia had eight communities and Quebec had four in the top 20, only three Ontario communities — Pickering, Oakville, and Kitchener — reached this level. In fact, Ontario’s cities and towns accounted for 13 of the 20 lowest spots in per-capita homebuilding. These included Aurora, Brampton, Peterborough, St. Catharines, Ajax, Windsor, Burlington, Halton Hills, Sarnia, Sault Ste. Marie, Sudbury, Thunder Bay, and North Bay.

“If we can identify what jurisdictions and municipalities are doing well, then we can start to identify why they’re doing well and adopt the best practices that they’re doing,” says Moffatt. “Kitchener, for example, has done a good job in allowing for density and their official plan has been quite helpful zoning-wise when it comes to welcoming diversity of housing types.”

While every province is obviously dealing with the same aforementioned high interest rates, things like provincial differences in approval times influence the outcome. “Why can a municipality like Edmonton return an approval in six months, but it takes on average 20 months in the GTA?,” asks Sherwood. Tellingly, Alberta has seen record-breaking numbers of housing starts in the first half of the year.

It’s Everyone’s Problem

The housing supply crisis is an issue for all Ontario residents – even those who own appreciating houses with manageable mortgage payments. “Housing affordability is at an unprecedented level which is having a broader impact on the economy and lowering quality of life for many,” says Lyall.

In his report, Moffat outlines the consequences of six years of slow growth on the homebuilding front. In no uncertain terms, he highlights how Ontario’s inability to build new housing has resulted in record-low vacancy rates, sky-high rents, record food bank use, and an unofficial estimate of 234,000 Ontario residents experiencing homelessness.

“Today’s housing starts are the housing supply of tomorrow,” says Sherwood. “If ‘starts’ are the lowest level now since 1955, then over the next few years the new supply coming to the market will be the lowest level since 1955. This will mean price appreciation, when the objective of the entire exercise of expanding supply is intended to increase affordability. But this isn’t just about putting roofs over people’s heads – it’s about the socio-economic wellbeing of the economic engine of Canada. What happens when young families and workers leave the region in pursuit of housing choices and prices they can afford?”

The SPI report highlights how inadequate housing has contributed to a “brain drain” in Ontario. Over the past four years, the province has seen a net outflow of over 100,000 people to other provinces, says Moffat. This migration pattern suggests that a significant number of educated and professional individuals are leaving Ontario in favour of better housing options and improved living conditions (and, perhaps, remote work culture).

Recent record-breaking immigration won’t fill all the holes, either. “It’s a question of who is leaving, and we are losing a lot of talented young people just starting out their careers,” says Moffatt. “It doesn’t help out society if people go to school here but realize that they can’t afford to live here and move out to Edmonton, where wages are the same and home prices are half as much. We desperately need these people – the ones most likely to leave – in our province.” Our cities only work if we have a robust middle class, says Moffatt. “We need to have nurses, teachers, doctors, and electricians live within the city,” he says. “There’s no point being an aging person in the city if you can’t find a personal support worker or all of the services you need.”

As for the fortunate set who already own their homes, they should care too. “On one hand, I live in a single-family, detached home, so some may think people like me benefit from housing scarcity and high prices,” says Moffatt. “But, I want my daughter to also be able to afford a home and she won’t be able to do that if housing is scarce. You may like housing scarcity as a homeowner, but you’d probably like to have a teacher at your kids’ school and nurses in the hospital. So, we can’t price the middle class out of our cities.”

Furthermore, as highlighted in RESCON’s report, employment in new residential construction has peaked and will likely fall further in the years ahead. The slowing construction of new homes could lead to widespread job losses both in the housing sector and industries linked to construction.

What needs to be done? Clearly, something. Experts agree that it comes down to cutting development charges, speeding up the permitting process, zoning reform, and better land use planning to accommodate our growing population.

“With a critical need for new housing, it is imperative that all levels of government take immediate action to boost construction by lowering taxes, fees, and levies and reducing the red tape and bureaucracy which slows the industry and adds to the cost of housing,” says Lyall. “To spur the market, we need conditions that allow builders to build houses that people can afford. Otherwise, we may be in dire straits as new home construction stalls and unemployment in the industry rises.”

RESCON’s report states that for new home sales to rebound, affordability must be restored to previous levels. This can be achieved through a combination of lower interest rates and reductions in government-imposed costs and land prices. However, both scenarios are unlikely. The report also highlights other challenges that need to be addressed, including delays in land use approvals and infrastructure development, the limited availability of developable land for builders, and stricter mortgage regulations that have reduced the borrowing capacity of buyers.

“If we lower fees, we can lower costs, more people can afford to purchase pre-construction, we get more housing starts and we increase supply,” says Sherwood.

Lyall tells STOREYS new actions could have a positive impact. “For example, the recent plan floated by the federal Conservatives to remove the sales taxes on new housing sold for under $1 million, the recent announcement that Vaughan would dramatically cut its development charges back to 2018 levels, and new efforts by the Province to further reduce red tape could all help,” he says.

The City of Toronto recently passed a package of measures to offset the cost to build crisis by reducing development costs and property taxes for a defined period — but Lyall and Sherwood say it falls short.

“This package recognized the problem, but defined the solution so narrowly that only a handful of projects could qualify – specifically the city’s own Housing Now projects,” says Sherwood. “If those projects were finding it challenging to proceed, on city donated lands with federal financial support, is it no wonder that market-rate projects for the average resident are struggling. While BILD applauds the City for taking a small step forward, we are calling for a much more comprehensive package to jump-start the estimated 30,000 stalled units in the City of Toronto alone. Addressing stalled out residential construction requires a package that delivers development charge and property tax relief for stalled purpose built rental projects and development charge relief for stalled condo projects.”

If immediate action isn’t taken, the grim reality is that we will have a serious shortage on our hands, with the crisis worsening, in the near future. There is room for optimism, however. “We have a dynamic, vibrant, and innovative homegrown residential construction sector in the GTA,” says Sherwood. “They have literally built the communities, towns, and cities of where we all live and work, and many local home builders are now some of the largest home builders across North America, building across Canada and the United States. In the right environment, with the right supportive policy framework today’s challenges are solvable and our industry can deliver.”

By Staff By Staff

December 6th, 2024

BURLINGTON, ON

Earlier this week we celebrated Giving Tuesday

Thousands of organizations were asking for help.

Some made the target they had set out – others may not have done as well.

That doesn’t mean they aren’t worthy.

Eagles Nest, an NGA that serves Burlington and parts of Hamilton – they will help anyone who knocks on their door is looking for support. Eagles Nest, an NGA that serves Burlington and parts of Hamilton – they will help anyone who knocks on their door is looking for support.

Real Life Isn’t Perfect

Counselling and mental health support is expensive. Eagles Nest provides low cost financially supported help. Why is mental health so important? Because, unlike a holiday movie, real life isn’t always picture perfect.

Statistics tell us that one in five Canadians experience mental health issues. Anxiety, depression, trauma and difficult relationships are unwanted guests around many dinner tables.

Mental health issues affect not only the person, but spill out to affect relationships, families and communities.

Eagles Nest Makes Getting Help Easier

Finding affordable, local mental health services can be difficult. Eagles Nest is a registered charity that helps people care for their mental health, understand themselves and learn new tools for healthy relationships.

We provide counselling, coaching and support programs to adults, youth and children. All our services are fully subsidized or low cost because we think everyone should be able to care for their mental health.

Will You Help?

To help sustain our existing mental health services, our goal is to raise $35,000. Every $50 donated provides one hour of mental health services. A donation of $200 provides someone with a month of service.

Your donation will be appreciated. Click HERE to help

HOPE RESTORED, LIVES CHANGED

By Staff By Staff

December 4th, 2024

BURLINGTON, ON

Hard to go wrong with an event that is labeled Art with Heart.

The event takes place December 11th, from 12:30 to 7:00 pm in the Holland Room at the Burlington Public Library The event takes place December 11th, from 12:30 to 7:00 pm in the Holland Room at the Burlington Public Library

Described as a powerful and inspiring showcase celebrating creativity, resilience, and the profound connection between art and mental wellness that came out of a five-week program designed to foster self-awareness, personal growth, and empowerment through expressive arts, mindfulness practices, and reflective journaling.

Guests will have the opportunity to view powerful pieces. The displayed works, ranging from vivid paintings to intricate mixed-media pieces, provide an intimate glimpse into the participants’ journeys of self-expression and wellness. Reflecting their creative journeys, the series empowered local residents and fostered greater self-awareness, mental wellness, and resilience. Each work is a testament to the transformative impact of combining creativity and mindfulness.

By Pepper Parr By Pepper Parr

December 5th, 2024

BURLINGTON, ON

Committed is the word I came away with after a lengthy interview with Paul Paletta, the President of Alinea, the developers that are moving forward with plans for the 120-acre King Road site, the three hundred plus acre Bronte Creek property and other notable development projects in the region. Given the magnitude of their development projects and their impact on the city over the next several decades I felt it important to sit down with Alinea’s CEO to better understand his history and vision.

Paul Anthony Paletta, the third son in a family of four boys, attended high school in Aurora and chose McGill University for his post-secondary education beginning in 1987. He graduated four years later with a Bachelor of Commerce. He wanted to study law but his father wouldn’t hear of it and so he returned to the family business. When back in the family business his father put him to work on the management of a significant part of the sales and marketing operation.

His Father put him to work on the management of a significant part of the sales and marketing operation. While at McGill he was invited to apply for the job of running the computer centre in the business school, an operation that employed forty students. The first sign of management skills was evident. Paul is the only one of the four boys in the family to complete a university degree.

“My Dad would call me a couple of times a week when I was at McGill asking when I was coming home – I had to explain to him that a university degree was a four-year undertaking.”

Paul is what they used to refer to as ‘a company man’ – the only organizations he has ever worked for are his family’s business. Beginning with Paletta Bros Meat Products Ltd. where he started as a nine year old boy answering the phone on Saturdays.

“They didn’t ring very often said Paul, “sometimes they didn’t ring at all and at times when they rang it was a wrong number.”

Pasquale Paletta, Pat, the name that everyone used, insisted that his children work for the company.

Pat was born in Spezzano dela Sila, Cosenza, in the very south of Italy. Like most of Europe, in 1949, Italy was struggling to recover from the Second World War. The family decided to emigrate to Canada and landed in Thunder Bay. Pat Paletta was then 18 years old; penniless, he worked at the local hospital, grain elevators and a Safeway store.

In 1951 the family moved to Hamilton where he worked in several of the local meat stores.

In 1953 Pat purchased his first cow: it was the beginning of what eventually became the largest privately owned meat packing company in eastern Canada. The first plant was in Hannon; in 1963 the family purchased property at Appleby Line and QEW in Burlington and opened a federally inspected meat packing plant in 1964.

In 1967 Pat started the real estate division which grew to become the largest employment and residential capacity in the Region and is now the single largest catalyst of economic activity in the region for the foreseeable future.

Paul was born in 1968.

The meat packing business was the foundation that allowed the Paletta’s to begin buying up property. Pat had the capacity to see over the horizon and had learned the art of identifying property that was a good long term prospect.

The Paletta’s were a Hamilton family; that is where Pat met his wife Anita; they married in 1961. The four boys, Angelo, Remi, Paul, and Michael – their sister, Gloria, who died at a very young age were raised in Burlington.

They moved to Burlington in 1964 and lived in south Burlington before eventually moving to north Burlington in 1979.

I asked Paul Paletta when he first realized his father was moving out of the meat processing business and into full-time land development.

From the left: Michael, Remi, Anita, Pat, Angelo and Paul “It wasn’t a sudden decision, my father had decided many years before that land was where the growth was; the meat and poultry businesses were what created the profits that allowed us to buy land.”

And buy land they did. The organization is the largest land owner in the Region.

The first serious job with the company had Paul involved in the costing of cattle for the beef processing business. “This was the point in my career where I learned from the mistakes I made and learned that hard work and reputation mattered.

“I learned from my father the importance of knowing your client and meeting their needs.”

Paul Paletta – everything has to be thought through before he makes a decision. In 2000 Paul was made President of Tender Choice Foods after serving as vice president for a period of time.

Tender Choice was originally a partnership known as Stoney Creek Foods . “We were silent partners at the start in 1984 and bought out the partners in 1985. The company added poultry to its product line in 1988.

Tender Choice Foods Inc. was sold to a private equity group in 2016. They did not purchase the buildings. The operated Tender Choice Foods rented space. Paletta International kept their administration offices in the building.

The company was now out of the meat and poultry business.

The offices and poultry production facilities on Paletta Court, then owned and operated by a third party, but which included the Paletta administration offices in adjacent space were totally destroyed in a December 2017 fire.

With nothing in the way of space to operate the poultry business the new owners of Tender Choice Foods declared bankruptcy.

Pat Paletta died in February of 2019

It was at this point that the direction of Paletta was in the hands of the four boys with Angelo and Paul leading; at the time Angelo was seen as the voice of the company

Differences cropped up and it became evident that a reorganization would have to take place. Paul and his brother Michael assumed ownership and control of the family business in 2021, rebranding it as Alinea with a new resolve to develop the family’s land holdings bringing new investment to Burlington.

Bound by the rail line to the south and Hwy 403 on the north – running from King Road to the Aldershot GO station – it is the largest piece of undeveloped property in Burlington. Much of the land the Paletta’s owned within the urban boundary was zoned as employment lands. Burlington wasn’t building all that much in the way of factories or high-rise office towers at the time.

But when changes were made to the Ontario Planning Act that changed the definition of employment lands to permit much-needed residential development, the 120 acres at King Road and at its development site off Burloak could now be fully developed. Paul and his team, and it is very much a team with a significantly different operational approach to development than his brother Angelo, knew what they wanted to do but before they made any decisions they sought the opinion of the mayor and City Council, and a wide range of other potential stakeholders. They also travelled and looked at everything they could to see what worked and what didn’t work.

Paul and his team travelled to Europe, the Middle East and throughout North America to investigate other notable mixed-use communities; particularly those with an educational component. Paul and the members of his team wanted to see what had been done to create a Live, Work, Play community – a relatively new concept to the development world – it would become a focal point for the Alinea Land Corporation.

The development of the 120 acres at 1200 King Road will, in time, shift the focus from the downtown core of Burlington to the west – closer to Hamilton.

In advancing this project Alinea took a significantly different approach. Instead of making a development application Paul and his team met with the city and asked what they would they like to see; what did they think was needed?

The City had created the Burlington Land Partnership with the intention of working with the development community going forward.

Stakeholders, organizations that might become a part of how 1200 King Road was developed toured the site. There were numerous tours of the 120-acre property. Groups from the Planning department toured the site; stakeholders and public interest groups walked through the property.

There are very solid working relationships with Mohawk College to look at post-secondary school opportunities.

I toured the site with Dave Pitblado, the Director, Real Estate Development – Alinea Land Corporation, and saw potential that was far beyond anything Burlington had ever seen before.

The Official Plan changes and the zoning issues had been resolved.

Alina and the city are at the Memorandum of Understanding (MOU) and Letters of Intent stage.

I asked Paul where the Bronte and King Road developments would be in a decade.

Paul Paletta is quick to say that decisions have not yet been made – they wan to listen and have created some renderings to get the conversation started. “I think it is realistic to think we could have shovels in the ground in 2026. Build out will take 10 plus years.”

“The rate at which buildings are constructed will be determined to a significant degree by market conditions.”

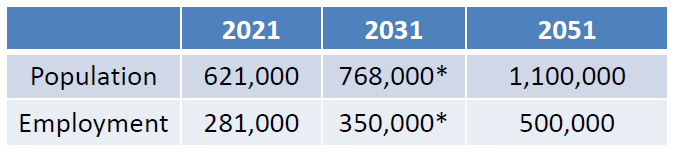

Burlington is committed to creating 29,000 homes by 2030 Paul expects that there will be something in the order of 9,000 residential units at King Road site ultimately, which will have a different name at some point in the future.

Paul said he could see purpose-built rental housing on the site – again dependent on market demand. If the demand for housing is not evident then we are not going to be building.

Alinea expects there will be something in the order of 9,000 residential units at King Road site ultimately. The market will determine the rate at which construction will take place. Paul makes a strong point when he says he is concerned that the people who are going to benefit the most from the development are not at the table – today’s high school, community college and university students.

Alinea rests on a solid foundation: the mission is to create a more xxx perception of what the corporation will be doing in the decades ahead. Paul is very aware of the Paletta public perception. He knows too that the past cannot be changed – but the future is going to be much different.

The ownership and leadership changes of the Paletta family business, with Angelo taking a share of the holdings and going off on his own while Paul and his brothers creating Alinea and making Alinea the kind of company Pat had always wanted is well on its way.

The legacy is important said Paul. The family has been an instrumental part of what Burlington has become and with the 1200 King Road site getting to the point where decisions will be made public Burlington will enter a new phase of its growth.

Whatever happens with the King Road site it will bind Burlington even more tightly with Hamilton, a city that has shed some, certainly not all, of its steel-making past.

The port of Hamilton reaches out to the world which opens up huge potential for the landowners in the Region.

I closed the interview asking Paul if the hockey arenas shown in the architectural renderings suggested that an NHL level team might be part of the long-range plan. Paul had little to say other than that he is a shareholder in the Ottawa Senators, which makes it a little difficult because Paul has been a Boston Bruins fan for as long as he has been interested in the game.

He sits on several of the Senator’s corporate committees and its Board and has a working relationship with NHL Commissioner Gary Bettman. He is in touch with Bill Daly, deputy commissioner and chief legal officer of the league on a regular basis. Make what you will of those connections.

It’s going to be both an interesting and exciting time for the Alinea operation.

Paul Anthony Paletta is totally committed to taking the deliberate yet cautious steps to making it happen.

Pasquale Paletta would be pleased

By Staff By Staff

December 5th, 2024

BURLINGTON, ON

On the president-elect’s musings over Canada as 51st U.S. state, a mere 5% of Canadians are interested.

From Truth Social posts deriding the U.S. trade deficit with Canada, to this country’s fentanyl production and the resources allocated to monitoring what was once hailed as the globe’s “longest undefended border”, to dinners at Mar-a-Lago, followed by yet more Truth Social posts, this time featuring the Maple Leaf and … the Matterhorn … it has been a month of whiplash in the world of Canada-U.S. relations.

Immigrants crossing the border into Canada with police officer watching. Pillar is the International Boundary marker The common denominator, of course, is American president-elect Donald Trump, and his threats of a whopping 25% tariff on all Canadian exports into the U.S, tied to various complaints about this country’s actions, or perceived lacks thereof, on defense spending, border security and the drug trade.

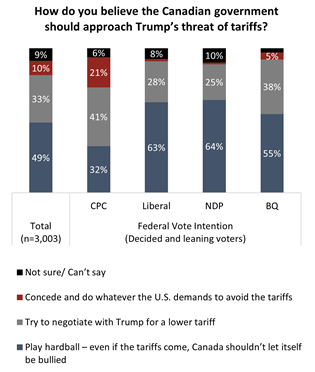

New data from the non-profit Angus Reid Institute finds a high level of anxiety within the Canadian public when it comes to the threat and potential consequences. But Canadians stop short of asking the federal government to roll over and do entirely as Trump demands.

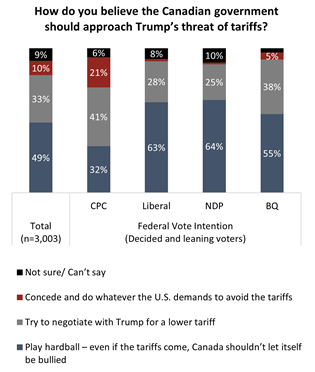

Overall, 86% say they’re concerned (44% “very concerned”) about the threat of tariffs from Trump. Asked how they feel the Trudeau government should approach these threats, however, half of Canadians say they prefer a hardline approach – that is, even if the tariffs are ultimately implemented, they do not feel Canada should let itself be bullied.

One in three would take a cautious approach to negotiations (33%), while one-in-10 would do whatever the U.S. demands to avoid being hit with the 25% tax on goods. Notably, the vast majority of that latter group is comprised of those who would support the Conservative Party if an election were held. One in three would take a cautious approach to negotiations (33%), while one-in-10 would do whatever the U.S. demands to avoid being hit with the 25% tax on goods. Notably, the vast majority of that latter group is comprised of those who would support the Conservative Party if an election were held.

After Trudeau made his first trip to visit with Trump in his second go-round as president (though he won’t be inaugurated until January), Canadians are offering lower levels of confidence in his government than they did in 2017. At that time, 60% said they had confidence in the Trudeau government to handle Trump. Now 42% say the same.

One item spoken about by Trump and Trudeau,whether a joke or not, it is not something Canadians are willing to entertain. After Trump quipped that Canada could simply become the 51st American state to avoid any negatively impacting U.S. policies, just 5% of Canadians say they would like to see this country join the U.S.

Gordie Howe Bridge crossing the Detroit River. Maybe it shouldn’t be completed?

By Staff By Staff

December 5th, 2024

BURLINGTON, ON

Starting on Saturday, December 7, Lakeshore West rail service will be temporarily modified every weekend until end of service on Sunday, December 22 to allow for critical track work along the corridor.

As trackwork continues, Lakeshore West service will be adjusted on the following weekends:

December 7 and 8, 2024. December 7 and 8, 2024.

December 14 and 15, 2024.

December 21 and 22, 2024.

During the weekends listed, Lakeshore West trains will operate hourly between Union Station and West Harbour GO stations. Please check schedules before you travel as trip times on the Lakeshore West Line will be adjusted.

GO Bus connection times will also be adjusted, there may be longer than usual wait times.

- Customers connecting to GO buses on Routes 12, 15 and 18 may experience connection times from eight minutes earlier to up to 49 minutes later. Please check schedules in advance and plan your trip ahead.

More information about Lakeshore West service adjustments and alternate route options is available HERE.

By Pepper Parr By Pepper Parr

December 5th, 2024

BURLINGTON, ON

The item was on the consent agenda, which meant it wasn’t supposed to get any attention.

No one asked the CAO to speak to his report. And not a single member of Council asked a single question of CAO Hassaan Basit. It was, unfortunately, a missed opportunity

Burlington’s growing and evolving economic and tourism landscapes necessitate a critical examination of how the City delivers and governs these services. Currently managed by independent boards, as part of the City’s Agencies, Boards and Commissions (ABCs), Burlington Economic Development (BED) and Tourism Burlington have historically provided adequate flexibility and autonomy to respond to local business and tourism needs.

However, changes in legislation over the years, increased economic complexity, a growing and changing population, and evolving City priorities present an opportunity to assess whether the current model continues to serve the community optimally.

A recent announcement from Halton Region indicates a shift of its economic development services to local municipalities which means a reevaluation of Burlington’s current approach. This presents both challenges and opportunities.

A periodic review of this nature helps ensure the City remains competitive, accountable, and capable of meeting stakeholder expectations.

Staff will be undertaking a review to evaluate the current structure, effectiveness, and potential integration of BED and Tourism Burlington into the City’s governance framework. This review will consider alignment with City goals, operational efficiencies, stakeholder needs, and transparency. Three potential pathways are outlined: Staff will be undertaking a review to evaluate the current structure, effectiveness, and potential integration of BED and Tourism Burlington into the City’s governance framework. This review will consider alignment with City goals, operational efficiencies, stakeholder needs, and transparency. Three potential pathways are outlined:

maintaining the status quo,

conducting a third-party review,

or proceeding with integration.

The ABC model was adopted historically to navigate restrictive legislation under the Municipal Act, which limited municipal involvement in economic development activities. These limitations included restricting the ability of municipalities to engage in certain activities that could be seen as business-related, including offering direct incentives or engaging directly in economic development activities that competed with the private sector.

These restrictions made it necessary for municipalities to operate their economic development arms externally through separate entities and, specifically to economic activities at the time, this structure offered several advantages:

- Operational Flexibility: ABCs could move more freely in responding to business needs and economic opportunities without being bound by the rigid constraints of municipal governance processes.

- Governance Autonomy: By being arm’s-length from the municipality, ABCs were seen as more able to work closely with private-sector partners and advocate for economic opportunities.

- Avoiding Legal Restrictions: The Municipal Act at the time limited municipalities from engaging in what was deemed “commercial enterprises” or providing certain types of financial incentives to businesses. ABCs provided a legal workaround by being separate entities, not directly bound by these restrictions.

Over time, legislative changes have allowed municipalities greater leeway in managing their own economic development. In particular, changes to the Municipal Act and the introduction of new regulations such as the Ontario Regulation 599/06 (Municipal Services Corporations) enabled municipalities to directly take on economic development activities.

In 2023, the City of Burlington initiated a comprehensive review to enhance its relationships with ABCs and Joint Ventures (JVs), with a focus on accountability, governance, and alignment with City objectives.

A sleepy little office with a collection of brochures. A significant development during this period was the proposed merger of Tourism Burlington and BED into a single independent ABC. This merger, was guided by the Joint Board Governance Steering Committee formed in late 2023. Milestones included a September 2023 Letter of Intent between TB and EcDev to explore governance integration, Council’s November 2023 receipt of an updated strategy report, and February 2024 discussions on shared operations and marketing.

There was also a Council directive in March 2024 to expedite the merger by January 2025 in order to deliver the Municipal Accommodation Tax (MAT) program (Local Board Governance – Merger of Tourism ).