By Pepper Parr By Pepper Parr

March 21st, 2023

BURLINGTON, ON

The pushing, the delegations, the email and the consistent public comment on not hearing anywhere near enough about that was actually happening with the former Bateman High School site finally got some results.

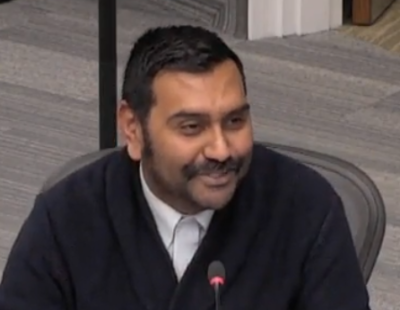

Kwab Ako-Adjei, Director of Communications and Engagement Council had Kwab Ako-Adjei, Director of Communications and Engagement, in the Council Chamber telling Council what was in the works.

Kwab has been a busy man – he just wasn’t sharing was being done by his team. They were in fact meeting that very afternoon to suss out some of the plans.

One is a mail out to every taxpayer in the city (it might be every household) that wasn’t very clear.

Ward 2 Councillor Lisa Kearns, supported by ward 4 Councillor Shawna Stolte put forward amendments that look is as if they were going to pass – Council recessed for about an hour after which they will continue with what Kwab has to say.

Parks, Recreation and Culture are going to be involved with what will be done outside the building and what would be done inside what Councillor Kearns is calling a Community Hub.

Mention was made of possibly meeting with people during the Under the Stars, community film nights that take place in the summer and asking people what they thought.

Kwab assured Council that he would have a fully developed Engagement Plan for Council in May and that he thought there would be both in person public events is as well is as virtual events.

Jim Thomson delegating on what he would like to see done with the football pitch at the rear of the former Bateman High School site. Ward 5 Councillor Paul Sharman pressed the point that what was planned for both Phase 1 and Phase 2 of the development be included.

All the Councillors wanted everything that was being thought about on the table where the public could read and be aware of and then have an opportunity to delegate and comment.

Kearns, who is the Deputy Mayor for Engagement, made the point that the purchase of the Bateman school property was the biggest thing council was doing – but that the public wasn’t being given a chance to speak.

While Kearns wasn’t wearing the Deputy Mayor Engagement badge quite yet – she was certainly doing the “giddy up” council dance today.

About time.

By Pepper Parr By Pepper Parr

March 21st, 2023

BURLINGTON, ON

OPINION

After a full day of discussion and debate City Council agreed on how the work they did on Procedural Bylaw revisions will come back for REVIEW. They will:

Direct the City Clerk to bring an amended Procedure By-law to the Corporate Services, Strategy, Risk and Accountability Committee by the end of Q3 2023, incorporating feedback from the February 27, 2023, Council Workshop Committee meeting;

Lisa Kearns doing her daily photo op at a Regional Council meeting, was not able to attend the Workshop at which her role as Deputy Mayor for Citizen Engagement was discussed. That could be as late as September.

How Deputy Mayors will do their work will come back by the end of June.

Direct the City Clerk to report back to the Corporate Services, Strategy, Risk and Accountability Committee with proposed Deputy Mayor with Portfolio guidelines by the end of Q2 2023.

There has yet to be any public discussion on either of these initiatives. While they aren’t exactly interesting or subjects that are easily understood they are important.

The do pale when compared with the cost of food and what home owners are having to cope with when their mortgages come up for renewal.

One wonders if this council is relying on a lack of public interest.

What is on the agenda has to be passed by this Council today. Changes do get made but not that often.

It will be interesting to hear what ward 2 Councillor Lisa Kearns has to say. She was not able to take part in the Workshop for personal reasons. She has the capacity to spot the weak spots in an argument and will no doubt put forward trenchant remarks. Word is that she has amendments she wants to put forward at the Council meeting today.

The unfortunate part is this council has lost the ability to work together in a meaningful, useful way.

The Mayor chairs Council meetings and has the ability to do some agenda management. The last time she did that it blew up in her face.

Salt with Pepper is the musings, reflections and opinions of the publisher of the Burlington Gazette, an online newspaper that was formed in 2010 and is a member of the National Newsmedia Council.

By Staff By Staff

March 22nd, 2023

BURLINGTON, ON

You may have a vacation planned already for 2023, but don’t forget there is so much to see and do right here in Burlington! We believe it is more important than ever before to support our local businesses and pay a visit to some of the incredible entertainment venues, restaurants and bars right here in the city. There’s a seriously thriving entertainment scene in Burlington, so whether you’re a local resident or a brand-new visitor – let’s dive into some of the best local spots!

Entertainment is Everywhere

In today’s fast-moving society, it is easier than ever before to access entertainment wherever you are in the world.

Ontario recently regulated the online gambling industry, meaning that you can enjoy yourself at an online casino as you make your way around Burlington. If Burlington is just one stop on your trip around Canada, you can still enjoy yourself at a Canadian instant withdrawal casino as you travel. There’s never been a better time to start playing, as some of the top Canadian sites have a massive range of games, and there’s something to suit everyone.”

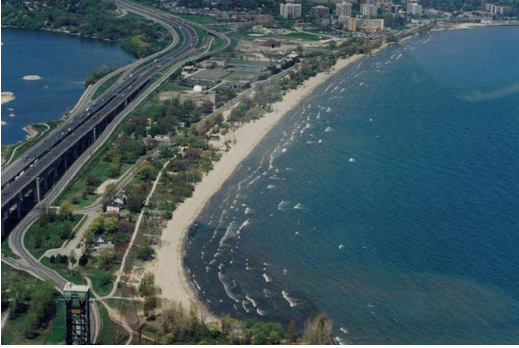

Burlington has an extensive stretch of public beach that is a five minute drive from the downtown core. Great walking trails. You can also find your own entertainment by spending time in some of Burlington’s beautiful local beauty spots – the Lake Ontario shoreline is a stunning place to relax or play games with friends. Entertainment is all around us here in Burlington, and local businesses have been working hard to provide a range of different options to those looking for fun.

For those who enjoy the arts, Burlington is home to a thriving cultural scene. The Burlington Performing Arts Centre hosts an eclectic variety of performances throughout the year, including theatre productions, concerts, and dance performances. The centre also offers educational programs and workshops for people of all ages, making it a treasured hub for creativity and learning in the community.

Downtown Is The Place to Be

We have to give an honourable mention to the beating heart of our city – downtown Burlington. After spending a morning on the natural lakefront beach at Beachway Park, there are so many amazing local businesses here on the stunning waterfront which can satisfy all your shopping and dining cravings.

Paradiso Restaurant for a Mediterranean feast, For a classic lunch, we’re huge fans of Downtown Bistro & Grill for their unmissable burgers and charred calamari. For an evening meal, there is a huge range of local restauranteurs here serving up incredible global food – head to Paradiso Restaurant for a Mediterranean feast, to Rayhoon Persian Eatery for a family-friendly experience, or to Mikado for arguably the best, most authentic sushi in town.

The downtown area is now also very pedestrian-friendly, making it easy to explore on foot and enjoy the buzzy atmosphere at your own pace. From boutique shops to trendy restaurants, there is something for everyone in downtown Burlington. For more information, check out the Burlington Downtown Business Association – a local non-profit organization which promotes our thriving business community in downtown Burlington.

Small Business Shopping

The Village Square – unique setting with shops and good restaurants. Whether you’re looking for a unique, hand-crafted gift for a friend or are simply on the market for a little personal retail therapy – there are countless creative and independent local shops to choose from when shopping in Burlington. Pay a visit to the Village Square in Downtown Burlington, and you’ll find a whole host of independent shops and even a regular farmer’s market for fresh local produce.

Burlington After Dark

It’s never been a better time for Burlington’s nightlife. Now that our best-loved bars and nightclubs are thriving again, there are so many fantastic spots to choose from. There’s something for everyone here in Burlington – whatever your style. One of the city’s most treasured and iconic pubs, The Dickens on Elizabeth Street, is a great choice for those seeking that traditional British pub experience. The venue is well-loved for regularly hosting local bands every Friday and Saturday night, and it also has a weekly trivia night on Tuesdays for those who prefer their entertainment to be a little more intellectually challenging!

When it comes to partying in Burlington, we have seriously got to celebrate many of our incredible local businesses and bars.

Walk out to the end of the Pier and just while away half an hour. The Queen’s Head next door to city hall is one you don’t want to miss – fine traditional British food and a great crowd at the bar. Another spot, minutes away is the Pearle Hotel and Spa with a fine selection of places to eat and the best view of the lake from the Outdoor Patio where you can walk over to the Pier and out to the end where you can sit and relax and just while away half an hour.

Festivals and Events

These days, there is a wide range of public events, themed days and festivals in Burlington all year round – there’s something for everyone! On July 1, there are some pretty exciting Canada Day celebrations held right here in Burlington – last year’s celebrations hosted a range of activities, local stalls and food vendors, and the day ended with an awesome fireworks display. The festive season here in Burlington means the annual Santa Claus Parade, which showcases local businesses on its floats and has become a firm family favourite for that fuzzy festive feeling. The Sound of Music Festival is one of the most popular cultural events in Burlington – this thrilling festival takes place every June and features live music from both local and international artists.

Annual Antique Car Show takes place on Brant Street – the main thoroughfare. We’ve only really scratched the surface of the thriving entertainment scene here in Burlington today. There are so many awesome small businesses and projects to celebrate – Burlington’s bars, restaurants, shops, and entertainment venues have so much to offer, whether you’re a local resident or just passing through. In our fast-paced modern world, it is so important to remember to slow down and support local businesses, so we hope you’ve found some new favourites today. So get out there, and enjoy everything Burlington has to offer!

By Janis Viksne By Janis Viksne

March 21st, 2023

BURLINGTON, ON

In recent years, the popularity of online poker in Canada has skyrocketed. This is partly due to the COVID-19 pandemic, throughout which Canadians have looked for new ways to entertain themselves. But this surge in popularity can also be attributed to the wide range of options available to poker players on virtual platforms.

Canadians have access to many different variations of poker. While Texas Hold’em is recognized all of the world as the most popular variation of the game, there are many other ways to play poker. Most online casino sites also offer other variations of poker, including Omaha, Razz and Stud, as an option to players.

Poker is a simple game to learn these days. There are several websites and forums that encourage communication amongst poker players and have amassed a wealth of poker information over time. The whole online poker community gives players access to useful information as well as a welcoming setting where they may meet others who share their interests and create enduring relationships. Players of all skill levels can progress together in forums like TwoPlusTwo by staying informed about new advancements and exchanging strategies with other players.

Steely eyed and very focused – attributes of winning poker players. Yet, eventually, learning the fundamentals of the game is a requirement for anyone hoping to break out on the professional poker scene. This includes the ability to explore winning poker hands and understand the various strategies employed in winning a game of poker. Anyone who is persistent enough could boost their chances of success by studying the strategies used by more skilled poker players. Nevertheless, maintaining consistent strategies and advancing your skills are more powerful than just beating other players.

While understanding the principles of online poker is a key requirement for success, players should also consider the security of their financial transactions. This is where cryptocurrencies prove useful.

The Rise of Cryptocurrencies in Online Poker

Getting involved in online poker has never been simpler, in part because of cryptocurrencies. The pandemic significantly altered a number of businesses, including the gaming sector.

A number of websites have now embraced cryptocurrencies as a way to simplify financial transactions for their player base. Online poker players utilise cryptocurrencies as a convenient way to deposit and withdraw funds on their accounts.

For players of online poker, cryptocurrency provide a number of advantages. For starters, players may transfer money between accounts quickly and securely thanks to cryptocurrencies. For people who respect their privacy and prefer to stay anonymous, cryptocurrency also provides anonymity, which is crucial.

The ability to play from any location in the world is also made easier by cryptocurrencies since they are not bound by any one particular legal system. In short, they are quick, provide anonymity, and lower transaction costs, benefits valued by players and online poker venues alike.

Mobile Gaming and AI in Online Poker

Mobile gaming is already a staple in the gambling industry, with many online casinos offering their services through mobile applications. The majority of Canadians own smartphones so mobile applications are a convenient way for these players to enjoy the game of poker on the move. In 2020 alone, the mobile gaming market generated over $98 billion in revenue worldwide. The industry has only grown since then, with further growth project for the years ahead.

Online poker rooms are increasingly taking payments made in crypto currencies. Future developments in online poker are predicted to involve a significant amount of artificial intelligence (AI). Numerous other businesses now use AI technology to increase efficiency and accuracy, and the online poker community may soon follow suit.

Analyzing gameplay data with AI might be an intriguing use. The ability to uncover trends in player behaviour using insights from AI analysis could greatly enhance decision-making. AI might also swiftly offer players recommendations for enhancing their methods, which would be helpful for newer players who might not yet have a firm grasp of the game.

The Future of Online Poker in Canada

Online gambling in Canada appears to have a promising future. Online poker rooms are increasingly taking payments made in cryptocurrencies. A growing need for simple and secure payment options in the online gaming business is one factor driving this trend. Furthermore, players can now access their preferred games whenever and wherever they want thanks to the development of mobile poker apps within a thriving mobile gaming market. New opportunities and difficulties will arise in the game as cryptocurrency adoption and AI technology progress.

The way Texas Holdem is played online. The best and most successful poker players today are thought to be Canadians. The capacity to continually strive for success by Canadians like Mike McDonald, Jonathan Duhamel, and Daniel Negreanu has made them household names all over the world. This has led to an increase in the game’s popularity throughout Canada. Poker played online is here to stay. As more and more Canadians turn to online poker as a convenient way to socialize and engage with others, the number of active players hoping to follow in the footsteps of their countrymen is only growing.

Looking ahead, Canadians’ favourite pastime and competitive sport will undoubtedly be online poker for a very long time.

By Pepper Parr By Pepper Parr

March 20th, 2023

BURLINGTON, ON

The silence has been deafening.

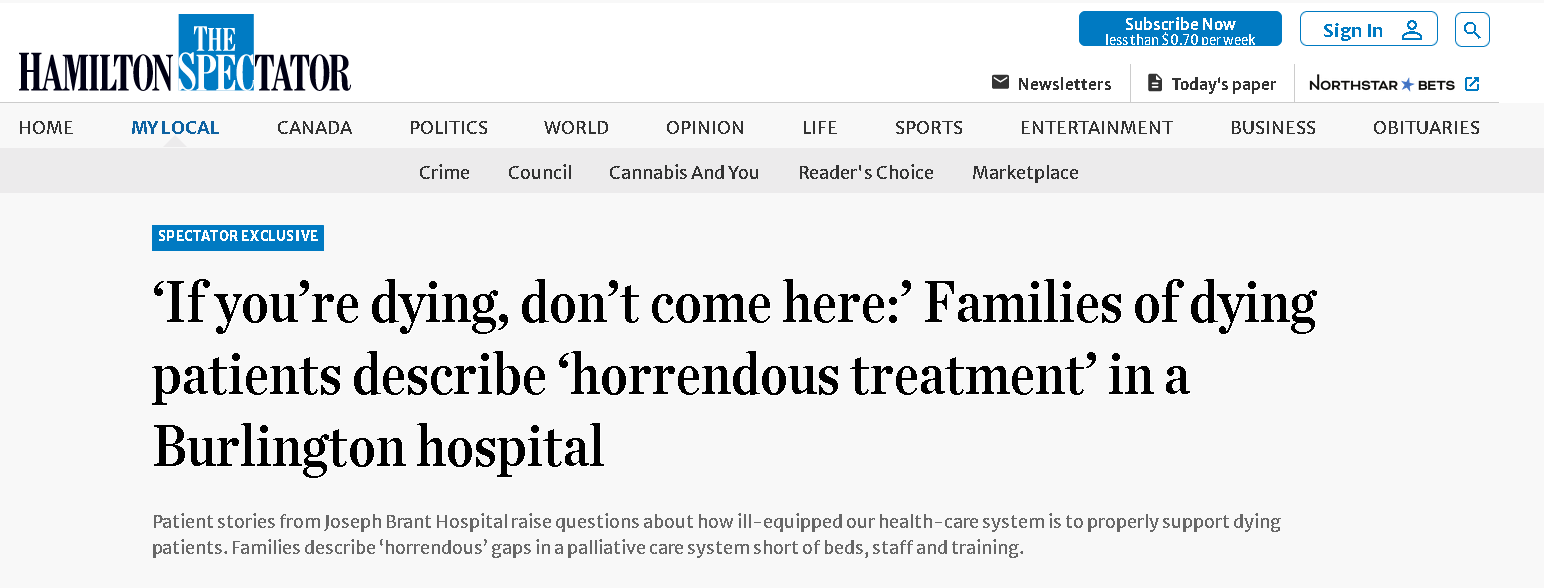

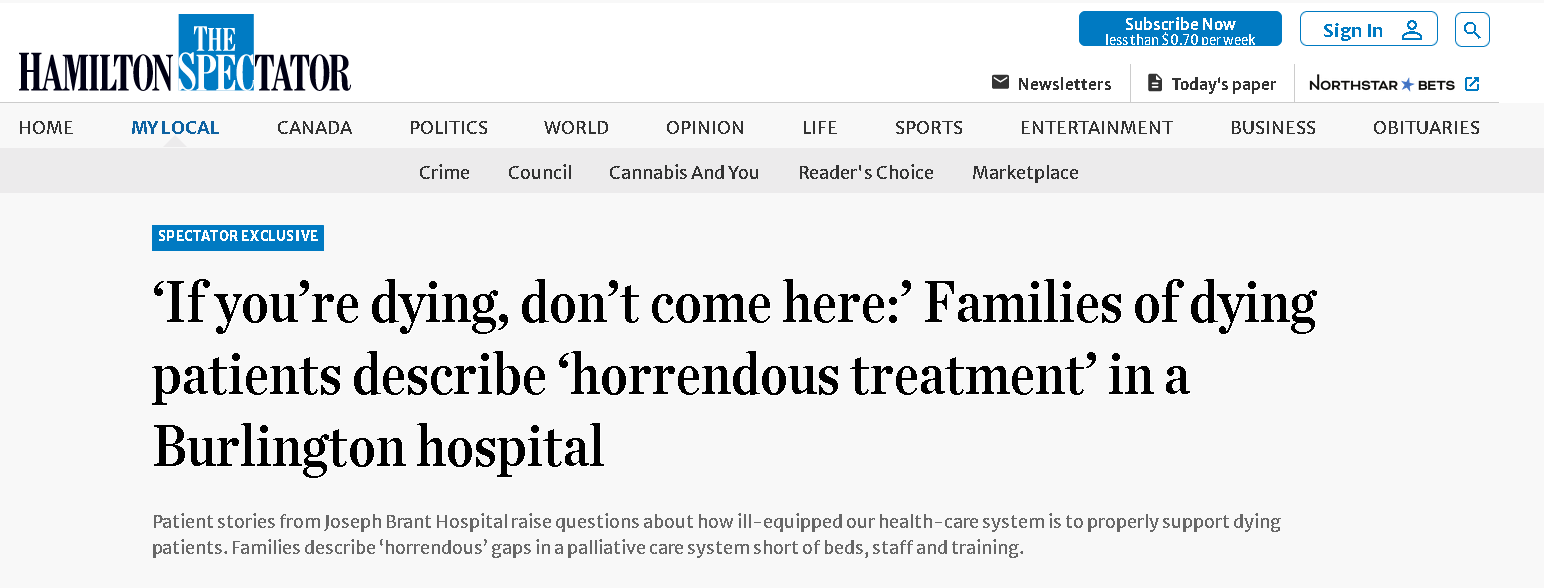

The Saturday issue of the Hamilton Spectator published a four page feature on problems at the Joseph Brant Hospital. It was not a pretty picture and it isn’t the first time that the hospital has been the object of seriously negative news.

There was no comment that I am aware of from the hospital; there was no comment from the Mayor; we did ask for one early this morning.

Mayor doing a photo-op a three minute walk from the hospital – not a word on the problems at JBH The Mayor spent part of the day viewing the Indigenous art that was on display at Spencer Smith Park. She later took part in a photo-op in front of the Joseph Brant Museum; all she had to do was look over her shoulder to see the hospital.

Angelo Bentivegna: Fresh cut lawn and displaying my favourite lawn sign from Joseph Brant Hospital . Order yours lawn sign Joseph Brant Hospital Foundation jointhej.ca! Ward 6 Councillor Angelo Bentivegna places a Support the Hospital sign on his lawn. Good. But a lawn sign doesn’t cut it when there is a serious concern within the community about the Spectator news feature.

I don’t expect the Mayor, or ward Councillor Bentivegna, who is the city’s representative on the hospital Board, to solve the problem.

But could we not expect the Mayor to make a statement that she has asked Bentivegna to report to Council on what the hospital response has been to the news feature in the Spectator ?

Council meets on Tuesday. Perhaps the Mayor will make a statement

The public expects its political leadership to be aware and respond to citizen concerns

Related news story:

Spectator publishes a four page feature on hospital problems

Salt with Pepper is the musings, reflections and opinions of the publisher of the Burlington Gazette, an online newspaper that was formed in 2010 and is a member of the National Newsmedia Council.

By Pepper Parr By Pepper Parr

March 20, 2023

BURLINGTON, ON

City Clerk Kevin Arjoon City Council is in the midst of reviewing the Procedural Bylaw. Dry is as dust to most people – except the city clerk – he gets excited about the document.

He is, for the most part, well versed in its contents – however he is often slow to ensure that it is acted upon and enforced.

There are a number of elements in the draft revised version being discussed that do not appear to be in the best interest of the public. There are discussions about not permitting people to delegate because they are deemed to be disruptive. They haven’t done something like that – but they did try to keep a candidate – Keith Demoe – from delegating.

We heard that it was not possible to find the current Procedural Bylaw on the city web site and learned there were others who could not find the document.

We sent a note to the City Clerk asking:

Where on the city web site can a citizen find a copy of the Procedural Bylaw that is in force now – March 20th, 2023.

We are fully aware that you are in the process of amending that bylaw – but where can people find and read the existing bylaw.

We would like to know exactly where it can be found.

Here is the answer we got:

At present, folks need to use the by-law manager. We have by-law 31-22 posted under agendas and minutes, but it does not include the three amendments, these can be found using the bylaw manager.

That is close to inexcusable. There is no good reason for making it difficult for people to access the document – especially when it is the subject of much concern and interest.

For you your interest HERE is the link to the document

By Staff By Staff

March 20th, 2023

BURLINGTON, ON

After months of interviews, meetings and deliberations, the Burlington Chamber of Commerce has announced the finalists for its 2023 Business Excellence Awards, presented by RBC. After months of interviews, meetings and deliberations, the Burlington Chamber of Commerce has announced the finalists for its 2023 Business Excellence Awards, presented by RBC.

The Chamber has named 24 local organizations as potential winners of awards in a variety of categories. Award nominations are based on overall business excellence and the criteria include excellence in business leadership, community contributions, entrepreneurship, environment, employee welfare, innovation, and market growth.

The finalists are:

Employer of the Year Award

• Ritestart Limited

• LJM Developments

• Continuum II Inc.

Food, Beverage & Tourism Award Food, Beverage & Tourism Award

• Backed By Bees

• Boston Pizza Burlington North

• Mandarin Burlington

Heritage Award

• Winner To Be Announced

Not-For-Profit Award

• Burlington Public Library

• Burlington Soccer Club

• Drury Lane Theatrical Productions

Retail & Wholesale Award

• Bocana Boutique

• glamjulz

• She’s Got Leggz

Service – Small Award

• Bartimaeus Inc.

• Hearing Well Matters! • Hearing Well Matters!

• Oakstone Wealth

• Shifra Homes Inc.

• The Dance Station

Service – Large Award

• Baumer Canada

• Carson Law Office Professional Corporation

• Spectrum Airways

• The Healing Path Chiropractic and Wellness Centre

By Pepper Parr By Pepper Parr

March 20th, 2023

BURLINGTON, ON

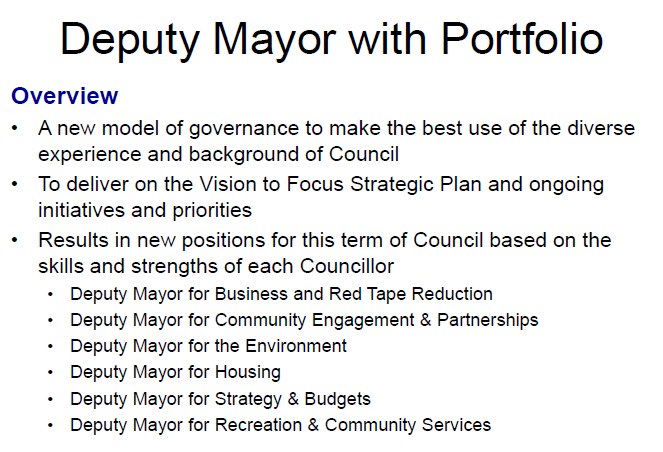

This is a multi-part series on what members of Council thought about becoming Deputy Mayors with a Portfolio.

Late in February members of city council and some city staff took part in a day long review of the Procedural Bylaw – the document that sets out how Councillors have to manage themselves and work with each other as municipal politicians.

They used an hour and a half of the day to talk about just what being named a Deputy Mayor – something Mayor Meed Ward did earlier in the year.

Ward 3 Councillor Rory Nisan seemed to have a different understanding of just what the role was about.

Ward 3 Councillor on one of the few days he actually attended a Council meeting in person. His practice has been to attend virtually. Nisan said:

“I do agree with the mayor and think her response was good. I’m glad we’re talking about it. I think the parts that I would highlight would be the authority that comes with the title because after all, we are talking about a title right?

“We’re not really talking about a different function. per se, but the title so the title is authoritative so when you’re with staff or with the community, people will understand that the title of Deputy Mayor holds some authority to it that would allow your voice to be highlighted in a way that it wouldn’t be if it was a council lead.”

Nisan added that “leads to the second one, which is the intuition around the title. So it’s intuitive that a deputy mayor has authority that a council lead or a councillor may not have to the same degree. So if I’m the Deputy Mayor for the environment, then I go to an Environmental Conference … people understand Oh, okay, so he’s kind of the second in charge for environmental issues. He’s got that leadership role.”

He further added that he didn’t think a lot more explanation would be required and people wouldn’t necessarily understand the authority.

Nisan then said: “And then the last piece which hasn’t been mentioned, although I do agree with the other points is a degree of retention. I think the mayor is in many respects devolving degree of her power to the rest of us by allowing some elevation of our positions, which will make the role more desirable for future candidates, which would in the long term, improve the quality of the councillor around the table.”

Mayor Meed Ward then made it very clear – there is no power, there is no veto. She said: “I am pretty invested in that title, I think it conveys the kind of stature and authority whilst I think it elevates you … you are acting for the whole city, not just in your councillor role.

“So there’s there’s a certain responsibility that comes with the with the title of Mayor and also deputy mayor that when you are acting in that role you are acting with the city’s interests in mind the community’s interest in mind. And that means putting aside a little bit of your own personal agenda for lack of another word to think about what has council approved as a whole.

“Each of us still retain an independent voice as an individual member of council but when we act in those roles with those titles, it carries a whole different responsibility.

Ward 4 Councillor Shawna Stolte preferred stature over authority. Ward 4 Councillor Shawna Stolte didn’t see the role of a Deputy Mayor is as one with much in the way of authority.

She said: “I’d like the opportunity to see if we could embed some of the wording that the mayor used because I really liked taking out the word authority and putting in stature and responsibility. I think that sounds more appropriate.”

Ward 5 Councillor Paul Sharman – talking about stature versus authority. Quite a bit later ward 5 Councillor Paul Sharman said: “I want to start off by talking about stature versus authority. This is my fourth term. And the first three terms. I felt like I didn’t know what was going on.

Because something would be going on and staff would be talking to the mayor who either told us or not. And so that was debilitating. Because we’d find out things that we might have known about earlier.

“I see the value here of the stature, that suddenly I have that staff want to talk to me. You know, they always would but it was more kind of we better talk to each of these individual councillors, these people who make up this panel, but we have talked to them on an equal kind of way.

“And so what that allows us then as deputy to have some stature that deserves some sort of engagement in something that is pertinent to the role they’ve been given.

“With respect to authority, I think authority is well defined by the municipal act. So I’m not concerned about that at all. In fact, I think the way this has been spelled out is actually completely correct.”

Related news stories:

Part 1 – What the Mayor was setting out to do.

Part 2: Figuring out what the job was

By Staff By Staff

March 20th, 2023

BURLINGTON, ON

It is an event that makes the city part of what it is – people getting out and helping clean up and Green Up their community.

Burlington residents, groups, schools and businesses are already signing up to participate in this impactful city-wide opportunity.

Get involved today and help us achieve our goal of 15,000 participants this year to celebrate 15 years of making a difference with BurlingtonGreen.

Register your event HERE

By Pepper Parr By Pepper Parr

March 20th, 2023

BURLINGTON, ON

How does a city respond to a front page story on the local hospital that takes up an additional four pages of news – none of it good?

What do you do with a headline that reads: “If you’re dying don’t come here”?

Burlington’s Mayor is usually one of the first to respond when there is an issue. Before becoming Mayor Marianne Meed Ward served as the city’s representative on the hospital board and spoke very positively about the way the hospital board worked – at one point saying that they were a model she wished Burlington could follow. Burlington’s Mayor is usually one of the first to respond when there is an issue. Before becoming Mayor Marianne Meed Ward served as the city’s representative on the hospital board and spoke very positively about the way the hospital board worked – at one point saying that they were a model she wished Burlington could follow.

No response from the Mayor so far on the Spectator reporting.

By Staff By Staff

March 19th, 2023

BURLINGTON, ON

From a reader who keeps an eye on the restaurant scene in the city:

Does the T shirt tell us what direction Craig Craig Kowalchuk will be going in? Love your digital magazine. I keep looking for updates to Burlington’s restaurant scene, but nothing recently.

I note that a new Greek restaurant, NISI Greek Taverne has replaced Lock Side, and a new Black Swan will replace Wendel Clark’s on Brant.

Also, Di Mario’s Italian restaurant is under new management.

Finally, Emma’s Back Porch is supposed to open this summer.

Emma’s Back Porch to reopen? Who will manage the place. Is Craig going to be behind the bar. Not if the T shirt he is wearing is any indication.

By Pepper Parr By Pepper Parr

March 19th, 2023

BURLINGTON, ON

This is a multi-part series on what members of Council thought about becoming Deputy Mayors with a Portfolio.

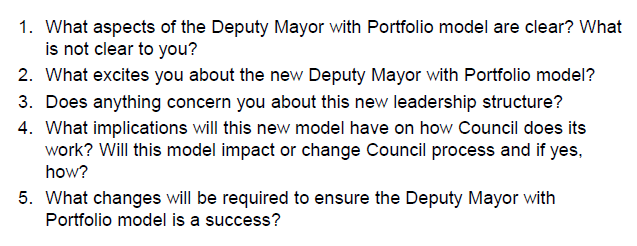

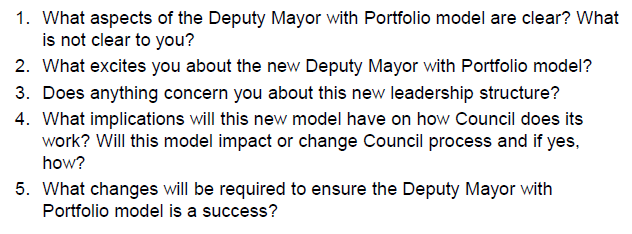

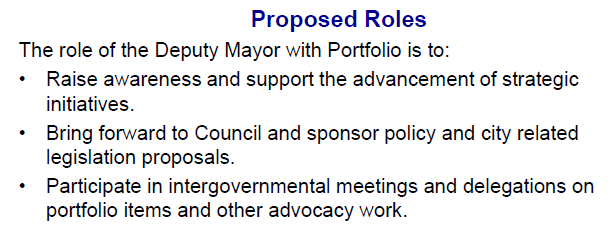

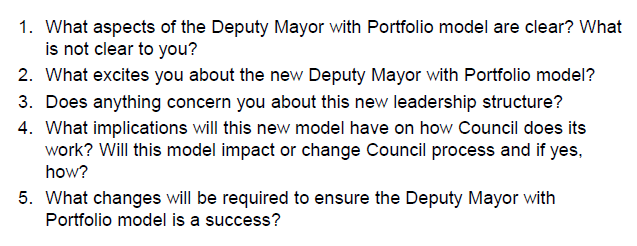

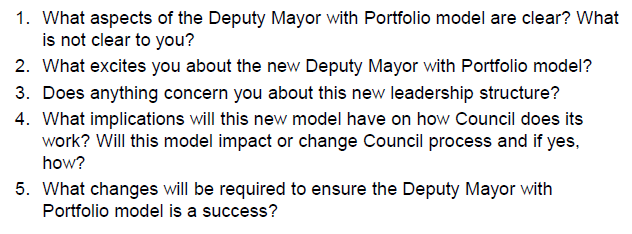

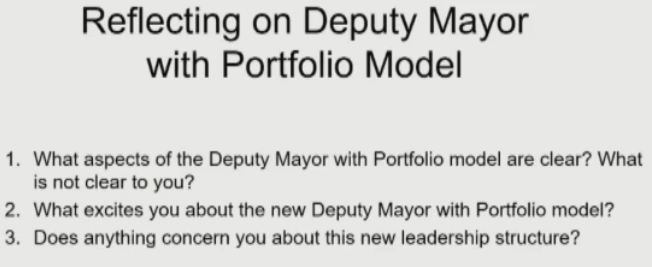

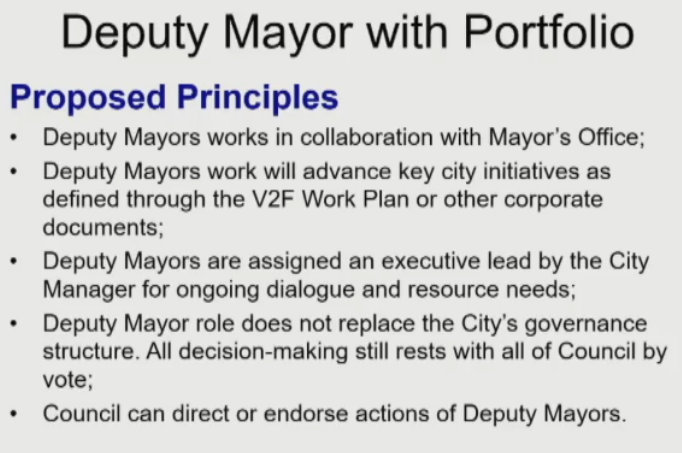

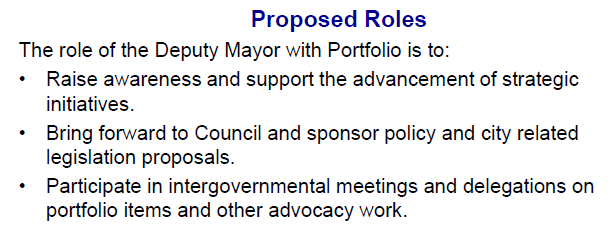

In part 1 of this ongoing series about the six members of Council being made Deputy Mayors, facilitator Suzanne Gibson had five questions:

Suzanne Gibson guiding members of Council through an understanding of what they would so as Deputy Mayors Gibson explained that the “intention behind those five questions is to get you to dig into the into the new model, to think about the implications, to share your concerns, to share what excites you.

“We’re going to dig into these a bit and see if we want to add more clarity because you know you’re starting with something new. The more clarity around principles and roles, the more effective and efficient the process will work. So I’m going to let you speak to how these came up both the principles and the roles.”

Each member of Council was given an opportunity to talk about the role was as they saw it and how they would serve as Deputy Mayors.

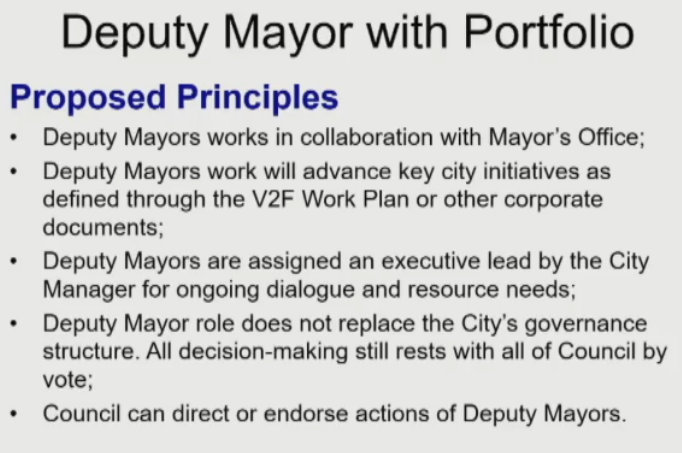

Meed Ward had explained earlier that serving as Deputy Mayors meant they would be focused on the interests of the city and not just their ward, using the lens of their portfolio is as a guide.

The questions they were asked to reflect on was – just what does it mean to you to be a Deputy Mayor ? During my discussions with two of the newly elected Council members in their term in office they talked about how they saw their future in municipal politics: both said they could see themselves serving as Mayor at some point.

How would council members, working as Deputy Mayors, determine what they could and could not do? Those principles were set out and debated.. This “bigger picture” role for Deputy Mayors will be interpreted differently based on their individual past experiences and their levels of sophistication. Expect some unintended consequences as this goes forward. .

City Clerk Kevin Arjoon and his staff were taking notes that would be used in the report they would bring back to Council later in the year.

It did sound somewhat complicated but as the council members worked their way through the hour and a half they had it began to come together. It did sound somewhat complicated but as the council members worked their way through the hour and a half they had it began to come together.

An added objective was a commitment Council members would make to each other.

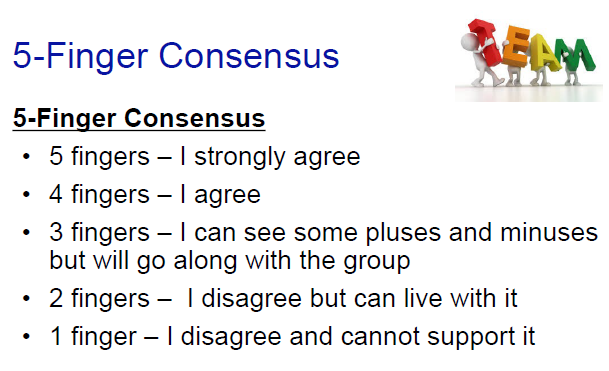

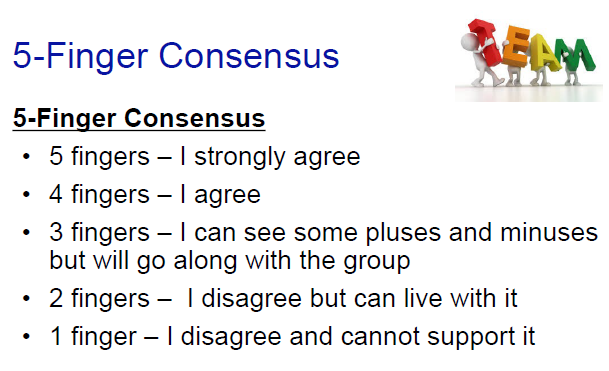

Suzanne Gibson directing council members through a complicated process. She managed to keep them on topic – most of the time. How were the council members to work out their differences as they went through each part of the process Gibson had put in place ? She introduced a five finger vote approach to get a sense as to just where each member of council stood on working through the proposed roles and principles.

Gibson wanted to steer clear of majority votes and used the five fingers to see where some change in position might be possible – and for the most part it worked.

It sounded complex but as the conversations continued one could get a pretty good idea as to how each member of Council was going to carry out the role of Deputy Mayor.

Ward 6 Councillor Angelo Bentivegna: No magic wand It was clear that each Council member had taken to the idea of being a Deputy Mayor. Ward 6 Councillor Angelo Bentivegna said he found that many people he talked to thought all a Council member had to do was wave a magic wand and what they wanted would be done. “I had to explain to people that that wasn’t the way this was going to work”. he said

Ward 1 Councillor Kelvin Galbraith was pumped about the new role and commented that he was already talking to people about issues that were city wide.

The next step in this series is to look at what each member of Council had to say as they worked through what their portfolio was, what the principles were, what the proposed roles would require of them and how well they handled the commitment they were making to each other.

Using the five finger vote had a caution – when it was a one finger vote – which finger would they be using.

Next we will cover what Councillors Nisan and Galbraith had to say, followed by Sharman and Bentivegna and then Kearns and Stolte

It was quite an exercise – we heard more about how the Councillors see themselves performing than was heard during the election that put every one of them back in office for a second term.

Some people will say: If I only knew then what I know now.

Indeed.

Related stories:

Part 1 – What the Mayor was setting out to do.

By Pepper Parr By Pepper Parr

March 18th, 2023

BURLINGTON, ON

The Burlington Teen Tour Band marched through the streets of Dublin on St. Patrick’s day, part of a twelve day tour the band is on in Ireland.

The TV footage Is impressive – the Irish certainly know how to put on a parade.

Watching the parade and seeing young people from Burlington with vert serious looks on their faces was quite something.  Six big tubas with the name Burlington in red letters – the Irish certainly know who we are now. Content is courtesy of Ward 2 Council member Lisa Kearns – was she up watching the event? Didn’t think she was Irish.

You can watch the parade by clicking HERE

By Joe Gaetan By Joe Gaetan

March 18th, 2023

BURLINGTON, ON

To The Honourable Karina Gould

In 2015 Prime Minister Justin Trudeau said,

“2015 will be the last federal election conducted under the first-past-the-post voting system.”

Then Minister of Democratic Institutions and Burlington MP Karina Gould. As Minister of Democratic Institutions, you were once tasked with leading the charge to change Canada’s 150-year-old voting system. When the Prime Minister not surprisingly did an about face on his promise, the message was clear, winning elections was more important than our democratic institutions.

A link to the CBC broadcast during which Gould announced that changing the way the public elects their government was not in her mandate is HERE It is 15 minutes in length. The part where she makes the announcement is at minute 2:51. The media give her a rough ride,

As a result of what I believe is interference in our electoral process by the Chinese Communist Party (CCP) I have lost what little confidence I had in our electoral process and your government. I frankly do not know who to believe in anymore.

Bloc Québécois Leader Yves-François Blanchet said that while he has “nothing against” Johnston personally, the prime minister “should pick someone who is not notably and admittedly a friend of the family.” Blanchet called the role a superfluous waste of time since opposition parties will still demand a public inquiry.

NDP Leader Jagmeet Singh said he believes Johnston is a “non-partisan” person of “integrity” and that he trusts him to do the work. He maintained, however, that Johnston’s mandate as special rapporteur should include answering “the fundamental questions that Canadians have.”

“What did the prime minister know, when did he know about it and what did he do about it, when it comes to foreign interference?” he said. Singh said again that he believes the government should launch a public and independent inquiry into election interference.

Not a good look…

With the backing of NDP and Bloc Québécois members, the Conservatives have the votes to pass a motion to summon Katie Telford to testify before the House procedures committee. But Liberal MPs have staged a multi-day filibuster to keep the motion from going to a vote.

According to Andre Coyne, “David Johnston is a man of high integrity. But as rapporteur? We should be in high dudgeon.”

I am in high dudgeon, as should you be as well.

Nothing less than full, formal non-partisan public inquiry will satisfy my concerns.

Regards,

Joseph A. Gaetan BGS

Burlington ON

By Pepper Parr By Pepper Parr

March 13th, 2023

BURLINGTON, ON

This is a multi-part series on what members of Council thought about becoming Deputy Mayors with a Portfolio.

In most Canadian municipalities the Mayor appoints a Deputy to fill in for them when they are not available. It is usually for a flag raising or a ribbon cutting.

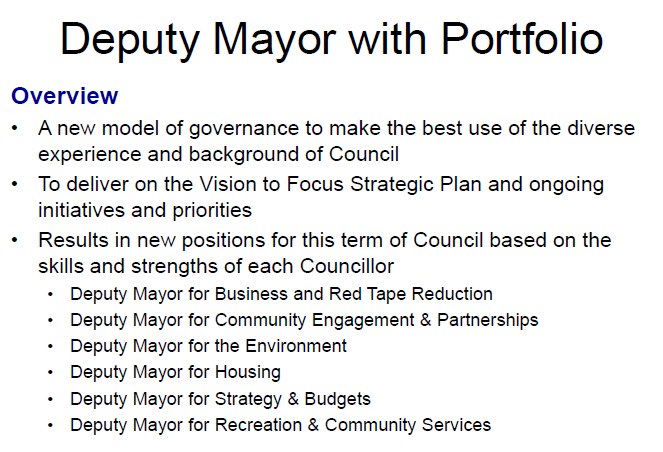

When Mayor Marianne Meed Ward put forward an idea that appears to be unique to the world of municipalities – she made every member of Council a Deputy and then assigned them a portfolio.

The discussion as to just how this would work and how the members of Council felt about the addition to their workload took place at a Workshop late in February.

Workshop facilitator Stephanie Gibbons, Stephanie Gibbons, the Workshop facilitator who for reasons that are hard to determine, frequently referred to Meed Ward as “.Our illustrious mayor”, started out by explaining the structure she would use – which consisted of five questions each member of Council would be asked.

The Workshop started off with Mayor Meed Ward explaining how and why she did what she did.

Mayor Marianne Meed Ward talking about why she proposed making every member of Councillor a Deputy Mayor. “It really started with my own journey as mayor – when I started I thought it would be essentially a counselor for six wards instead of one and a lot of ceremonial duties – the role is nothing like that. Plus the municipal act bestows upon you some fairly significant titles that come with responsibility and there’s zero definition. One is the head of Council, the other is the CEO of the Corporation. A Mayor doesn’t get to choose who you work with. The public chooses who you work with.

“Then we had a pandemic in the middle of the last term of council – and I had to figure out how to deal with that.

“I found myself thinking what if I got sick What if I couldn’t do the job anymore? Who could step ?

“I didn’t want anyone to feel the way I did – having to figure it out as you go along.

“That was part of the thinking. The other part was that there’s such unique skills and talents around the table and every single person on this council wants to contribute.

“As I looked at the skills that each council member brought, I realized that the universe knew what it was doing when it delivered us all to the council.

“This council is aligned with the things that we are trying to achieve for our community. We have a recreation and culture review to plan for the future. We are trying to tackle red tape red carpet, we always need to focus on budgets and Strategic Planning and Performance metrics.

“Housing has emerged as a huge huge issue. Our state of the emergency around the environment. And then of course our desire that we all share to ensure that we’re properly representing and communicating and involving our community.

“Instead of sort of hand picking in a way that was not transparent or clear, who would work with me on those things, it just became really clear that the best way to do that was to ask council members if they would like to assume some additional roles and responsibilities around the areas that I had seen council members investing time and attention in.

“This also goes to the heart of what I think we all really care about fostering collaboration. You could even say it forces collaboration. In the past when I was working on something in my role as the mayor with the city wide perspective, if I knew there was a council member interested in something I might tap them on the on the shoulder, but I didn’t always think of it. It wasn’t always top of mind. It was very ad hoc, very random.

“Now I don’t move without thinking – is there a deputy mayor that could help me with this or who might want to take a lead on this?

“It shares the responsibility but it also brings council along to get that city wide perspective.

“I won’t be around forever; I think a lot about succession planning.

“I’ve been absolutely thrilled over how well received this this has been not only among the seven of us, but the way the community has really embraced it. I’ve started to see constituents with a concern start to loop in the deputy mayors.

“The collaboration is really coming to the fore so I’ve been so proud of this council how you’ve all embraced this role that you are and you will make it your own. And you know, I think it’s a great governance model, and we’ll figure out the parts that we haven’t figured out yet. And that is an exciting conversation to have.

So to sum up it’s really it’s about collaboration. It’s about a city wide focus. It’s about succession planning, and it’s about leveraging the skills in a in an open, transparent and very intentional way that each council member brings to the table.”

By Staff By Staff

March 18th, 2023

BURLINGTON, ON

Help is available for low income households filing Income Tax returns

The tax season upon us.

The tax forms can be daunting – people often need help.

Burlington MP Karina Gould will be running a Community Volunteer Income Tax Program (CVITP) in the Burlington Centre on Tuesdays from 10-2 and Thursdays from 1- 4 beginning on March 2nd through to April 27th. The CVITP office will be located on the first floor near the elevator (entrance by door 1).

If you are in a lower income tax bracket it might be something you will want to look into.

To be eligible for this year’s free tax clinic you must have a modest income and a simple tax situation. A modest income is considered $35,000 in annual income for one person, and no more than $45,000 per couple.

Your tax situation is not simple if you:

· Are self-employed or have employment expenses

· Have business or rental income and expenses

· Have capital gains or losses

· Filed for bankruptcy

· Are completing a tax return for a deceased person

What to bring:

If you are eligible to take part in a CVITP, make sure to bring:

· Tax information slip

· Receipts (rent, property tax, donations, transportation, etc)

· Social Insurance number

· Photo Identification

The Burlington Central Library will be holding their in person CVITP from March 6th until May 1st on Mondays from 9:30 – 3:30.

If you are unable to come in to the tax sessions The MP has teamed up with the volunteers at the Burlington Central Library Tax Clinic to host a virtual CVITP.

Should you be eligible for this free service and wish to have your taxes completed over the phone please leave a voicemail at 289-427-6209 and a volunteer will contact you.

By Staff By Staff

March 17th, 2023

BURLINGTON, ON

The Ontario government is providing up to $1.25 billion to long-term care homes this year to hire and retain thousands more long-term care staff across the province, to continue increasing the amount of direct care time provided to residents.

This is part of the government’s historic four-year, $4.9 billion commitment to hire and retain more than 27,000 registered nurses, registered practical nurses and personal support workers over four years and ensure residents receive, on average, four hours of direct care per day by March 31, 2025.

This is the reality for many seniors – it aint gonna be home sweet home. “In 2018, we inherited a broken long-term care system and status quo that was no longer working so we introduced a historic plan to fix long-term care,” said Paul Calandra, Minister of Long-Term Care. “With the largest investment in long-term care in Ontario’s history, we’re hiring more staff to increase daily direct care for residents to ensure they can continue to connect to the care they need in the comfort of their long-term care home.”

This is the third and largest annual funding increase to date that long-term care homes are receiving to reach the system-level average direct care targets set out in the Fixing Long-Term Care Act, 2021. Direct care is hands-on care that includes personal care, such as help with dining, bathing and dressing, as well as other important tasks such as helping residents move and providing medication.

As a result of the government’s ambitious plan, more people are working in long-term care than ever before. This year’s funding will help achieve targets of an average of three hours and 42 minutes of daily direct care for residents as well as increasing hours of care from allied health professionals such as resident support aides, physiotherapists and social workers to 36 minutes per resident, per day.

The government is fixing long-term care to ensure Ontario’s seniors get the quality of care and quality of life they need and deserve both now and in the future. This work is built on four pillars: staffing and care; quality and enforcement; building modern, safe and comfortable homes; and providing seniors with faster, more convenient access to the services they need.

This is the image governments are using – but what is the reality? Quick Facts:

The government provided the following:

Achieving the system-level average target of four hours of direct hands-on care per resident, per day is being made possible by annual funding increases to long-term care homes:

$270 million in 2021-22

$673 million in 2022-23

$1.25 billion in 2023-24

$1.82 billion in 2024-25

What it did not provide was – where are the people who are going to be hired going to come from?

When they are found – who is going to train them?

Will they be certified and will there be a program that ensures they are given upgrades regularly?

And finally – what will they be paid.

By Pepper Parr By Pepper Parr

March 17th, 2022

BURLINGTON, ON

Rendering of the revised development application In an announcement from city hall today we learn that the ADI applications to amend the Official Plan and Zoning By-law to permit a mixed-use development comprising three tall buildings with retail uses at ground level and residential uses above in properties east of Waterdown Road and south of the GO railway tracks near the Aldershot GO station have been revised.

In the original proposal (2022):

Building A (northwest corner of site) was 36 storeys tall including a 4-storey podium.

Building B (southeast) was 26 storeys tall.

Building C (southwest) was 36 storeys tall. Buildings B and C shared a three-storey podium.

The proposed buildings contained a total of 1,139 residential units and 231m2 of ground-level retail at the corner of Masonry Court and Cooke Blvd. 1,031 parking spaces were proposed within five levels of underground parking.

In the revised proposal (2023):

Building A (northwest) is 33 storeys tall including a 12-storey podium.

Building B (southeast) is 29 storeys including a six-storey podium that steps down to three storeys on the north side.

Building C (southwest) is 31 storeys including a six-storey podium. The buildings are no longer connected to each other, and a plaza has been introduced at the ground level between Buildings B and C.

The total number of residential units has increased from 1,139 to 1,165.

The total amount of retail floor area has increased from 231m2 to 495m2.

The total number of parking spaces has increased from 1,031 to 1,145 spaces within 6 underground parking levels.

Those are the hard facts.

This is the eastern boundary of the property ADI has developed since it bought the land from Paletta International; a Paletta is said to now regret. What is absolutely amazing is how this development has evolved and found a way to not even mention space for parks.

The patch of land, and it really isn’t much more than that, was originally going to have three building and some parkland space. ADI was prepared at one point to talk to the public about where parkland would be within the site.

This part of the development has to be seen in context with what has already been built. The pictures below tell that story.

Mid rise units are part of the development. The problem with getting involvement from the public is that the community ADI has created hasn’t had a chance to come together and talk about what has happened. Covid19 kept people indoors and then when people were ready to be outside more there was no place for people to gather.

The overall neighbourhood has resigned themselves to the fact that everything north of Masonry road is high rise. This by the way was the part of the city where Marianne Meed Ward launched her 2018 campaign to become Mayor. While it was never her ward (she did run in the ward prior to 2010 and was soundly trounced) she hasn’t done much to help the people in that community.

Town houses are part of the mix in the very large development. The current ward councillor hasn’t done all that much either – other than to advise one of the better community activists that the ward Councillor’s office would no longer communicate with him.

There was a slight ray of sunshine on how the city distributed the news. Changes in development applications don’t usually get include in what the city sends out. Even though it came out during the afternoon of a Friday – it was at least more public than in the past. Kudos to whoever made that decision.

By Pepper Parr By Pepper Parr

Match 17th, 2023

BURLINGTON, ON

Does anyone remember when Council held Committee of the Whole meetings?

Jack Dennison on the day he sold his health club When they were held Jack Dennison always served as Chair – he did the job very well – it didn’t require much in the way of prep – as long as you were familiar with the issues you could get by; and Dennison had been there long enough to know all the issues – sometimes too well

One of the things you were able to do at Committee of the Whole was delegate.

Which some people believe is why this Council has moved to using Workshops – no delegations are permitted.

That puts the lie to a transparent and engaged council.

By Pepper Parr By Pepper Parr

March 17th, 2023

BURLINGTON, ON

Marit Stiles Leader of the Opposition The complaints sent to the provincial Integrity Commissioner by Marit Stiles Leader of the Opposition (there are two of them) are keeping the Commissioner busy. So much so that he has decided to put one in abeyance while he works on the other.

J. David Wake , the Integrity Commissioner said he is not prepared to dismiss Stiles’ second complaint “since there is an overlap to some extent with the issue being determined in her first request. Therefore I am placing it in abeyance until I have completed the investigation on the first.”

The second complaint was related to donations that were made to the “stag and doe” event for the Premier’s daughter.

The first complaint is related to the land swaps that were made in the Greenbelt area where there was a concern that developers were made aware of government plans before they were public.

Premier with Steve Clarke, Minister of Municipal Affairs in the Legislature. In a newspaper report Wake said he has requested documents from government and non-government sources and is reviewing the material gathered so far. His final report will be made public, he said.

As long as the work being done isn’t dragged out for months the public interest will be met.

As for the first complaint the Integrity Commissioner has already said that “the gift rule … is very specific. It applies only to the member who receives the gift. It does not apply to gifts received from third parties to an adult child of the member or her spouse. Even the definition of ‘family’ in the act is restricted to the member, the member’s spouse and minor children.”

|

|

By Pepper Parr

By Pepper Parr

After months of interviews, meetings and deliberations, the Burlington Chamber of Commerce has announced the finalists for its 2023 Business Excellence Awards, presented by RBC.

After months of interviews, meetings and deliberations, the Burlington Chamber of Commerce has announced the finalists for its 2023 Business Excellence Awards, presented by RBC. Food, Beverage & Tourism Award

Food, Beverage & Tourism Award • Hearing Well Matters!

• Hearing Well Matters!

Burlington’s Mayor is usually one of the first to respond when there is an issue. Before becoming Mayor Marianne Meed Ward served as the city’s representative on the hospital board and spoke very positively about the way the hospital board worked – at one point saying that they were a model she wished Burlington could follow.

Burlington’s Mayor is usually one of the first to respond when there is an issue. Before becoming Mayor Marianne Meed Ward served as the city’s representative on the hospital board and spoke very positively about the way the hospital board worked – at one point saying that they were a model she wished Burlington could follow.

It did sound somewhat complicated but as the council members worked their way through the hour and a half they had it began to come together.

It did sound somewhat complicated but as the council members worked their way through the hour and a half they had it began to come together.