By Ray Rivers By Ray Rivers

April 18th, 2024

BURLINGTON, ON

Pouring over the 400 page federal 2024 budget document, one can’t help but be impressed with the breadth and scope of federal involvement in almost every facet of the lives of Canadians. It is a lot of money that gets spent by your federal government each year. This year that list of expenses is even longer thanks to the NDP demanding their pound of flesh for propping up the Liberal government.

The photo op reminds one of two students turning in their homework. Prime Minister Justin Trudeau and Finance Minister Freeland The federal government has been forced to use the power of the purse to buy its way into areas which were once exclusively provincial. That is because the premiers of provinces like Alberta, Saskatchewan and Ontario are not meeting the needs and wants of their electorate. And the public doesn’t know, or even care, which government is responsible, but blame the feds if they don’t get what they want and need.”

So the feds have found their way into having to develop their own health care, dental care, pharmacare, education and child care programs. Provincial governments are involved in some of these but none of these new initiatives would be happening without federal leadership or funding. And now there is a billion dollar school food program, filling a void left open by most provinces and some parents.

The federal government was late in getting to the point where they would play a direct role in getting housing built. The provinces left them no other option. Housing has taken a front seat in this budget as the feds have plunged headlong into dealing directly with municipalities to meet the hugely unmet demand for accommodation spaces across the country. The provinces may resent the federal intrusion into their back yard, but Canadians feel it is a federal responsibility. So it’s in the budget. Of course, cutting the bank rate, which is driving up mortgages across the country, and limiting immigration would also help solve the housing crisis.

Justin Trudeau came to power, unlike his political opponents, arguing for even more deficit financing to grow the economy. And it’s been a spotty growth record, marred by the pandemic and the acute inflationary supply shortages immediately following. Still, Canada posted one of the highest growth rates over the past couple years among the G7, though not on a per capita basis thanks to the flood of new immigration we’ve seen.

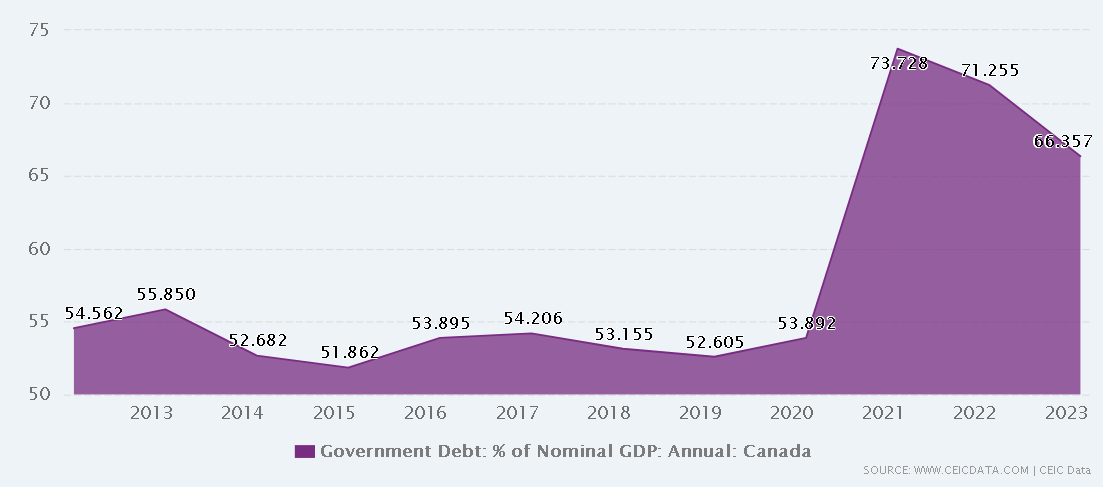

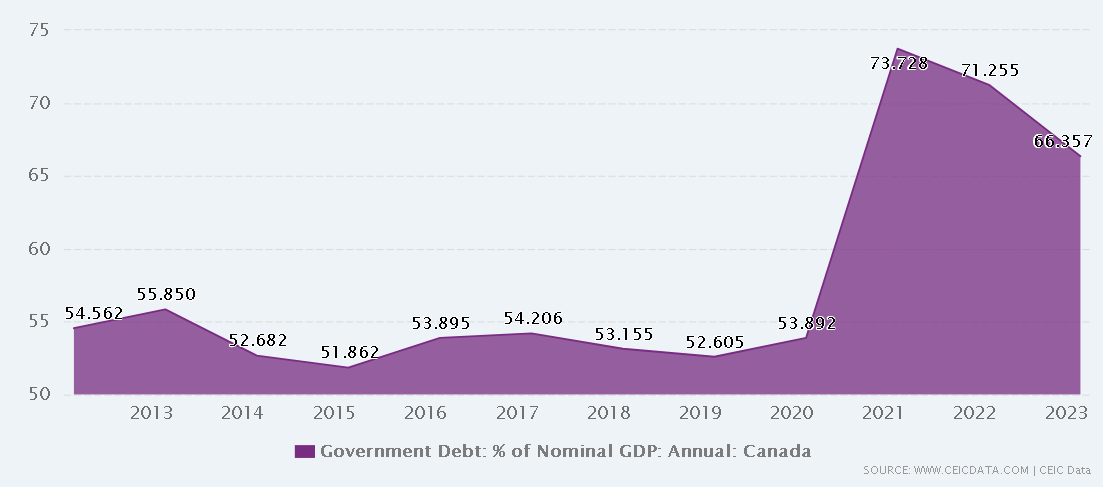

Economists these days prefer to talk about debt as a percentage of the GDP. Still, when the cost of financing the debt is more costly than what the government contributes to health care, that is troubling. Canada’s debt to GDP ratio, which is about half of that of our southern neighbours, had been slowly declining until Covid came knocking at our door. The budget predicts that ratio will get back to where it left off and continue its downward trajectory.

That will be helped by the big news in this budget that taxes are finally going up for those who can most afford them. There are about 40,000 Canadians who earn over $250,000 in capital gains and only pay income tax on half of that. The capital gains tax for those folks is rising from 50% to 67%. That is still well below the 75% rate once imposed by former PM Mulroney.

A younger Justin Trudeau made it clear from the beginning – he was going to work for the middle class – more votes in that demographic. And why would capital gains be treated any differently from employment income – why shouldn’t it be taxed at 100% like other earned income? Capital gains, much like an inheritance or casino winnings are windfalls but they are spent and saved just like earned income. Why do we treat them as a free lunch?

Income tax rates have not been touched in this or other recent budgets. One of the first acts of the Trudeau administration was to cut taxes for the middle class, which the PM claims helped lift more than one million Canadians out of poverty. And to pay for that he created a new top federal income tax bracket of thirty three percent.

But Canada, with its publicly financed health care is still a relative tax bargain for its citizens. We still have the lowest marginal tax rate in the G7. For example, the richest Americans are taxed at 37%. Also, Canada’s corporate income tax rate is the 4th lowest in the G7 at 26.2%. And taxation of new business investment at 13%, compared to the USA at 17.8%, is the lowest in the G7.

Unquestionably this is a progressive budget and those who don’t believe in government playing a bigger support role in our lives will disapprove. Still we know from our experience with the Canada Health Act that universal publicly funding universal programs are less costly to society overall. It’s a known fact that Canadians pay something like half what Americans do for a health care system with better outcomes, despite some access issues.

So those naysayers are on the wrong side of history. As we are forced into the age of fighting to save the planet from the potential ravages of climate change we need to get used to governments playing an even bigger role. But we need to pay for what we are demanding. And making the wealthiest Canadians pay a fairer share by raising the inclusion rate on capital gains is just a start.

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Background links:

Budget – Debt – Highlights – More Canada – Not Less –

By Eric Stern By Eric Stern

April 19th, 2024

BURLINGTON, ON

On April 16th the federal government introduced its eighth budget. Using the term “fiscal guardrails” to describe their approach to deficit spending the Liberals plan to add another $39.8 billion to the national debt.

We have wonderful social programs and it is amazing to see this government adding to them. Canada is the only country in the world with healthcare coverage but no prescription medication coverage for people under 65 (outside of hospitals). The budget takes a tentative first step towards correcting this.

The problem with adding new social programs is that we need a fair way, for every generation, to pay for these programs.

Debt and Deficit

Federal debt The federal debt load, the sum of all unpaid government deficits, is now around $1.2 trillion. These numbers are so big they become meaningless. Dividing $1.2 trillion by the population of the country, 40 million, we get something more meaningful. The federal government has borrowed, on behalf of each person in Canada, about $30,000. Using the same line of calculation and a population of 16 million, the Ontario government has borrowed, on behalf of each person in Ontario, about $26,850.

Adding the two totals together, a baby born today, in Ontario, owes $56,850. Is this fair to the newborn generation?

Another way to look at this problem is to compare healthcare dollars with the interest payments on the $1.2 trillion debt. The federal government will transfer, to the provinces, $49 billion for healthcare and will pay $54 billion in interest payments on the debt. If the current government, and previous governments, had actually had any fiscal guardrails, far more money would be going to healthcare, something the current generation of seniors might see as fair.

Trudeau has added more money to the total debt than all previous prime ministers combined going back to 1867. This burden will be transferred to future generations, once again calling into question the statement “Fairness for every generation”.

The federal government has added 100,000 employees to the payroll. In 2015 there were 257,034 employees, in 2023 there were 357,247 employees. Healthcare is a provincial responsibility; the growth didn’t take place in healthcare. In spite of Trudeau promising, in 2015, to reduce the use of consultants, consulting fees have increased 60% (2015 to 2023). The federal government has added 100,000 employees to the payroll. In 2015 there were 257,034 employees, in 2023 there were 357,247 employees. Healthcare is a provincial responsibility; the growth didn’t take place in healthcare. In spite of Trudeau promising, in 2015, to reduce the use of consultants, consulting fees have increased 60% (2015 to 2023).

The Liberals have failed to make the civil service more productive either through the use of technology or other means, and have failed to control the size of the civil service. Arrivecan is just one example. With such massive growth in both public sector employment, and in the use of consultants, there must be opportunities to reduce government spending to pay for new social programs offering true fairness for every generation.

Tax the Wealthy

In 1990 there were twelve countries in Europe with a wealth tax, today there are three. In France, between 2000 and 2012, an estimated 42,000 millionaires left the country. Over time, as wealthy people leave, tax revenues decline. France repealed their wealth tax in 2018.

While the Liberals play checkers, Canada’s millionaires and billionaires have accountants and lawyers who play chess. Can a billionaire move to the Caymen Islands, a tax haven, and fly their private jet to Toronto for meetings? Why not, Trudeau hops in a plane with less thought than the rest of put into taking an Uber.

The Fraser Institute, a conservative think tank estimates that the top 20% of Canadian income earners pay more than half of total taxes. Statements like “the wealthy must pay their fair share” may already be true. Link to the report HERE.

The 2024 Forbes list of billionaires shows there are 67 billionaires in Canada with a combined wealth of $314 billion. This is a very small number of people, I bet all 67 can fit in the Prime Minister’s jet. A tax system that encourages and allows more people to become billionaires will generate more tax revenue for all Canadians.

The change in the capital gains inclusion rate will cause real and long-term damage to our economy. Tobi Lutke, one of our billionaires and a cofounder of Shopify, posted this on “X” immediately after the budget was released. “Canada has heard rumours about innovation and is determined to leave no stone unturned in deterring it”.

Tech companies, in particular, need venture capital funding to grow. The changes in capital gains taxation will deter venture capitalists from investing in Canada. In the US, the tax rate on capital gains is a flat 21%. We are simply not competitive. Small and medium sized businesses, in every sector, now have one more difficulty to overcome when trying to attract capital to grow. How many Canadian venture capital firms will relocate to the US and simply stop investing in Canada? Tech companies, in particular, need venture capital funding to grow. The changes in capital gains taxation will deter venture capitalists from investing in Canada. In the US, the tax rate on capital gains is a flat 21%. We are simply not competitive. Small and medium sized businesses, in every sector, now have one more difficulty to overcome when trying to attract capital to grow. How many Canadian venture capital firms will relocate to the US and simply stop investing in Canada?

Housing Costs

Someone in the federal Liberal government fell asleep at the switch, the result is that Canada’s rate of immigration is unsustainable. Immigration is wonderful but schools, healthcare, roads, and housing need to keep up.

Oval Court: A high rise development planned for Burlington The budget completely ignores the fact that the Liberal government created the housing shortage.

Now that the opinion polls have forced the government to wake up the Liberals really have no choice but to spend tax dollars, collected from all Canadians, to create more housing. Burlington has already received $21 million in federal housing funding and the money has gone into processes, not physical housing. I really hope this new round of federal money goes into homes instead of more photo ops to boost the Liberal party’s sagging popularity.

Is this article almost finished?

Almost.

There are many budget details still to be released. The government expects to raise $6 billion with a new digital services tax. Will this be just another tax along the lines of charging HST on top of the carbon tax? We’ll have to wait and find out.

The Liberal government has forgotten that Canada needs a vibrant and growing private sector that can be taxed, fairly, to pay for our social programs. Companies in Canada need to compete against companies around the world, employee housing costs, personal tax rates, and corporate tax rates are major factors in this competition.

Inflation is a problem for everyone, the Bank of Canada has asked all levels of government to reign in their deficit spending so that interest rates can come down. Borrowing $40 billion just pours gasoline on the inflation fire. Here’s a new slogan: Budget 2024: Un-Fairness for every generation.

I sometimes wonder if Trudeau understands the difference between a million, a billion, or a trazillion.

Eric Stern is a Burlington resident, a retired businessman in the private sector and said to handle a pool stick better than most of the people he plays with. Eric Stern is a Burlington resident, a retired businessman in the private sector and said to handle a pool stick better than most of the people he plays with.

By Pepper Parr By Pepper Parr

April 18th, 2024

BURLINGTON, ON

Hassaan Basit is busy tidying up last minute tasks, the Conservation Halton as staff prepare to say goodbye to the best leader they have had in decades. His replacement has some pretty big shoes to fill.

Haassan Basit becomes the City Manager Monday of next week. Meanwhile staff at City Hall get ready to welcome Hassaan as their new city manager on Monday. The public doesn’t know much about Hassaan – one reader labelled him the Mayor’s sock puppet. They couldn’t be further from the truth.

City Manager Tim Commisso. One wonders if Tim Cammisso will leave a letter in the bottom drawer of his desk setting out for Hassaan what he has in front of him

Commisso told City Council at his last meeting earlier this week that he had been working with Haassan for a number of months during which he had introduced him to some of the senior staff.

People need to understand that Hassaan Basit and Marianne Meed Ward have worked together for a number of years.

She was a city representative on the Conservation Authority as far back as 2014. They each have a good measure of each other. He knows what he is getting into and she knows what she has.

Councillor Sharman put it very well when he described Hassaan as both strategic and good with numbers.

The Gazette has worked with five different City Managers – each had their own style. Some understood media and worked with us; others didn’t understand media and didn’t like media. You can imagine how those relationships worked out.

Hassaan Basit did not grow and mature as an executive in a municipal environment.

My experience during the 12 years the I have covered Burlington and the years prior to that when I covered municipal governments in Bradford and Barrie Ontario was that they were not interested in giving clear, direct answers to the public.

The culture within municipal governments is set by people who spend their careers at different municipalities. They work and interact with each other on a regular basis. Using Tim Commisso as an example: he started with Burlington and stayed in different jobs as he was promoted from department to department for 20 years; left Burlington to become the City Manager in Thunder Bay, spent a few years in the private sector and returned to Burlington as City Manager.

In those years he formed a very solid network of senior level people within the municipal sector. Very few move from the municipal sector to the province where they might work with Municipal Affairs and Housing. Municipal people rarely move to the private sector.

Some may take exception with the “not interested in giving clear, direct answers” statement. Let me give you two examples – there are many. Every city has reserve funds – some of them are mandated. We once published the complete list. There was a point when Commisso decided that rather than make the complete list available he would group the reserve funds and give totals for the group – meaning the public didn’t have the full picture.

The floating docks at LaSalle Park Marina Many were stunned when the city sucked $4 million out of the Hydro Reserve Account to fund the LaSalle Marina upgrade to the floating docks.

Earlier this week a delegator had some questions about the tax bills that were going to be sent out. Councillor Sharman admitted that he didn’t understand much of the language on a tax bill. Sharman asked if perhaps a note could be included with the tax bill. There was no interest from any other Councillor in letting the public know what the numbers on their tax bill meant.

Hassaan hasn’t been infected with that municipal virus. He walks his talk.

A number of years ago he came to the conclusion that if he was going to manage to make any changes at Conservation Halton he needed more revenue. The fees for using the conservation properties were decent and were seen as a place where revenue could be improved.

In the municipal world staff figure out what they need and they raise prices.

He walks his talk, he is direct and doesn’t fudge his answers – at least not when I knew him. Hassaan took a different approach. He met with different groups and asked what they liked and what they didn’t like and how they would feel if fees were put in place for things that were free.

He listed and because there was a strong trust relationship he had people telling him they would accept a fee just as long as it was reasonable.

Bringing that approach to a municipality is a challenge, one that Hassaan Basit was fully aware of when he applied for the job.

It would be unreasonable to expect much in the way of visible changes in the first six months. Hassaan will listen, use those opportunities when staff ask for some direction to quietly make suggestions. He is politically astute – has no problem reaching out.

By October 2026 we will have a clear sense as to what kind of a City Manager he has turned out to be and the direction he will take the city.

Everyone will have advice for him and I am no different.

My advice to Hassaan Bait is to be in touch with Lori Jivan at the Finance department and ask her how he he accesses the Loaves and Fishes account.

By Pepper Parr By Pepper Parr

April 18th, 2024

BURLINGTON, ON

Which former politician is in this picture?

Do the legs give you a hint? The tag line was Turks and Caicos

The date was 20 hours ago.

By Staff By Staff

April 18th, 2024

BURLINGTON, ON

Are you coming to Congress?

Volunteer Halton is pleased to present, along with the City of Burlington, Town of Milton, Town of Oakville, and Town of Halton Hills, the 2nd Halton Non-Profit Congress on Saturday April 27, 2024. Event takes place at the Town Hall, Oakville; a transformative event tailored to non-profit leaders and changemakers in arts, culture, heritage, recreation, and sports.

The facilitators have put together a strong lineup of speakers for this event, including key-note speaker Rosita Hall, education session leaders Erin Spink of spinktank, Devan Seebarren of the Halton Equity Diversity Roundtable, Heather Kaufmann from the Town of Halton Hills, Sammy Feilchenfeld of Volunteer Toronto, Shaminda Perera of Volunteer Canada and Candice Zhang from the Ontario NonProfit Network

In addition, there will be a Funder Panel Discussion featuring speakers from KidSport Ontario, the Region of Halton, Oakville Community Foundation, and the Burlington Foundation to share information about funding opportunities for your organization. In addition, there will be a Funder Panel Discussion featuring speakers from KidSport Ontario, the Region of Halton, Oakville Community Foundation, and the Burlington Foundation to share information about funding opportunities for your organization.

Registration closes April 23 at 12:00pm!

THE HALTON NON-PROFIT CONGRESS

Saturday April 27, 2024

8:30am – 4:30pm

Town Hall, Oakville: 1225 Trafalgar Road, Oakville

Registration is now open! REGISTER TODAY – space is limited!

By Jack Tomer By Jack Tomer

April 17th, 2024

BURLINGTON, ON

Breathtaking landscapes, and exquisite cuisine, offering an endless array of destinations to explore. Italy is a land of rich history, breathtaking landscapes, and exquisite cuisine, offering an endless array of destinations to explore. While Naples itself is a city bursting with culture and charm, venturing beyond its borders unveils a world of treasures waiting to be discovered.

From ancient ruins to picturesque coastal towns, here are some weekend trips from Naples that promise unforgettable experiences. Naples, with its winding streets, vibrant culture, and mouthwatering cuisine, is a destination that captures the heart of every traveller. But beyond the bustling streets and historic landmarks of this captivating city lies a world of treasures waiting to be discovered. As you peel back the layers of Naples, you’ll find yourself drawn to the allure of nearby destinations, each offering its own unique blend of history, natural beauty, and Mediterranean charm.

Whether you’re a history buff, a nature lover, or simply seeking a taste of la dolce vita, these weekend trips offer something for everyone. Join us as we uncover the treasures of Italy waiting to be explored, just a stone’s throw away from the vibrant streets of Naples.

Pompeii: A Journey Through Time

Just a short drive from Naples lies Pompeii, an ancient city frozen in time by the eruption of Mount Vesuvius in 79 AD. Walking through its streets feels like stepping back in time as you explore remarkably preserved buildings, intricate mosaics, and haunting plaster casts of the city’s residents. Pompeii offers a fascinating glimpse into Roman life, making it a must-visit destination for history enthusiasts and curious travelers alike.

Amalfi Coast is renowned for its dramatic cliffs, colourful villages, and crystal-clear waters. A scenic drive along the winding coastal road offers breathtaking views at every turn. The Amalfi Coast: A Coastal Paradise

Stretching along the southern edge of the Sorrentine Peninsula, the Amalfi Coast is renowned for its dramatic cliffs, colorful villages, and crystal-clear waters. A scenic drive along the winding coastal road offers breathtaking views at every turn, with charming towns like Positano, Amalfi, and Ravello waiting to be explored. Whether you spend your time lounging on sun-drenched beaches, wandering through narrow alleyways, or savoring fresh seafood at seaside trattorias, the Amalfi Coast promises a truly enchanting escape.

A tour of the caves at the Isle of Capri are an adventure. Guides will tell you the history of these unique destinations. Capri: Island of Dreams

Just a short ferry ride from Naples or the Amalfi Coast, the island of Capri beckons with its rugged coastline, chic boutiques, and glamorous atmosphere. From the iconic Blue Grotto to the stunning views from Monte Solaro, Capri boasts a wealth of natural beauty and cultural treasures. Explore the charming town of Anacapri, take a leisurely stroll through the Gardens of Augustus, or simply relax on one of the island’s many pristine beaches. With its irresistible blend of luxury and charm, Capri is the perfect destination for a weekend getaway.

Sorrento: Gateway to the Amalfi Coast

Nestled atop dramatic cliffs overlooking the Bay of Naples, Sorrento is a picturesque town famed for its sweeping views, fragrant lemon groves, and vibrant street life. Stroll along the bustling Corso Italia, sample limoncello at a local distillery, or simply soak up the Mediterranean sunshine at Marina Grande beach. Sorrento also serves as the perfect base for exploring the surrounding area, with easy access to the Amalfi Coast, Pompeii, and the island of Capri. Whether you’re seeking relaxation or adventure, Sorrento offers the ideal blend of culture, scenery, and hospitality.

Weekend Trips from Naples: Exploring Italy’s Treasures

While Naples itself offers a wealth of attractions, venturing beyond the city limits unveils a world of wonders just waiting to be discovered. Whether you’re exploring the ancient ruins of Pompeii, soaking up the sun along the Amalfi Coast, or indulging in the luxury of Capri, each destination offers its own unique charm and allure. With convenient transportation options and a wealth of accommodation choices, weekend trips from Naples are easily accessible and endlessly rewarding. So why not pack your bags, hit the road, and embark on an unforgettable journey through Italy’s most enchanting treasures? Whether you have just a few days to spare or a whole weekend to explore, the wonders of Italy await.

The ancient city of Pompeii, preserved under a blanket of ash and smoke from the Mount Vesuvius volcano eruption in 79 A.D. Conclusion

Naples serves as an excellent starting point for exploring the diverse wonders of Italy. While the city itself is brimming with history, culture, and culinary delights, the surrounding region offers a wealth of treasures waiting to be discovered. From the ancient ruins of Pompeii to the glamorous island of Capri, each destination offers its own unique blend of beauty and charm.

Whether you’re drawn to the rich history of ancient civilizations, the stunning landscapes of the Amalfi Coast, or the vibrant atmosphere of coastal towns, weekend trips from Naples promise unforgettable experiences. With convenient transportation options and a plethora of accommodation choices, embarking on a journey to explore Italy’s treasures has never been easier.

So, why not escape the hustle and bustle of daily life, and immerse yourself in the magic of Italy? Whether you have just a few days to spare or a whole weekend to explore, the possibilities for adventure and discovery are endless. Pack your bags, set out on the open road, and let the beauty of Italy captivate your senses. After all, the journey is just as enchanting as the destination. Buon viaggio!

By Daniela Quaglio By Daniela Quaglio

April 18th, 2024

BURLINGTON, ON

A friendly safe city on the edge of Lake Ontario with a diverse population. Some might argue that Toronto is Canada’s most exciting city—and for good reason. No matter the season, the city comes alive to offer a long list of exciting events and programs for its residents. As summer approaches, the focus is on getting outside and enjoying the warm weather.

Picnic in a park where wine can be enjoyed. From heading to picnics in the park to chomping your way through food festivals, the atmosphere is perfect for unwinding outdoors. But not all residents in areas like Hamilton and Burlington are looking to head into nature or hit the streets in the summer sun. In fact, some keep their focus on life’s flashier opportunities.

One of the latest trends in Ontario is to head to a virtual casino with your crew. The province recently launched its virtual market, which means players have access to games like roulette, blackjack, and slots. While some prefer to head to a brick-and-mortar casino like Casino Woodbine, others are staying in to throw gaming parties with friends. From a remote device like a computer or even a tablet, players can spin the roulette wheel or try to hit blackjack – all while dressed to the nines in their more luxurious gear.

But if you’re looking to hit the town, then we’ve got a few more suggestions. Consider penciling in some of these experiences on your agenda, all of which offer a taste of extravagance.

High Tea at the Omni King Edward

High Tea at one of the most elegant hotels in Toronto The Omni King Edward is one of the swankiest hotels in the Downtown Toronto area. Though you might be imagining relaxing in one of its plush, high-thread-count beds, there’s a more unique experience on offer: afternoon tea. Whether or not you regularly enjoy a cup of Earl Grey, it’s an experience you won’t forget.

That’s because the concept of afternoon tea fits beautifully with the Omni King Edward’s opulent design, transporting you into the fancy days of European yore. Toss in some bite-sized cakes and sandwiches and you’ll feel like bona fide royalty in no time.

Spa Treatment at Sweetgrass Spa

A luxurious pastime If classy afternoon tea isn’t quite your thing, then consider unwinding with an even more luxurious pastime: a visit to the spa. Toronto’s Sweetgrass Spa (for women only) is one of the most well-known in North America thanks to its range of holistic treatments, products, and services.

The spa offers a spa lounge, water therapies, facials, body treatments, massages, and much more. Products are from leading brands like Tata Harper and SkinCeuticals. There’s even an acclaimed in-house restaurant that crafts unique lunches for the day’s guest list. Just be sure to book ahead of time, as Sweetgrass is a highly popular destination.

Countryside seats are possible – the vibe is electric VIP with the Raptors

Pickering offers a solid concert venue—but what about the more famous Scotiabank Arena, home of the NBA’s Toronto Raptors? If you’ve got a sports lover in your life, then the ultimate flashy experience might simply have to do with watching the team’s biggest matches of the year—or even meeting them.

The Raptors offer a few different meet-and-greet packages as part of their VIP program. Keep in mind that meet-and-greet packages aren’t always tacked onto seats, which means you can buy tickets for any part of the arena and still get to meet some of the team’s top players.

The Ultimate Option: Private Helicopter Tour

Ever dreamed of seeing Toronto from a bird’s eye view? You now have this option thanks to the growing popularity of helicopter tours. You can choose from multiple companies that offer a range of options. Most revolve around the time and depth of the tour; some are designed to see the skyline at a certain time while others are designed to offer an in-depth tour of the city from above.

If you want to turn this into a special adventure with a loved one, look for companies that offer a romantic getaway package. These are particularly popular for anyone thinking about how to pop the question in a truly unforgettable way—just in case you or anyone in your life needs any inspiration.

By Pepper Parr By Pepper Parr

April 17th, 2024

BURLINGTON, ON

We don’t think the Mayor expects those Councillors who are opposed to her grasp on the Strong Mayor powers to go away quietly.

Lisa Kearns has made it clear she has more to say – for example:

It is true, Council did unanimously accept a petition with 633 signatures and growing, 71+ correspondence supporting the petition and heard three delegations in support of the petition “Restoration of Democracy at Burlington City Council.”

Councillor Kearns goes after the Mayor. BUT…despite that, the mayor doubled down on her ‘rationale’ for retaining arguably the most crushing power – full decision-making regarding the City Manager/CAO stays with the Mayor. That means the highest corporate position in the City can be hired or fired by the highest elected position. Power is centralized in the city between two positions – shedding the governance board (Council by majority vote), through to the corporate lead (City Manager/CAO), and then duly through to Staff.

A new and concerning element has been introduced via Strong Mayor Legislation – influence. The introduction of an invisible threat is confusing to staff and harmful to elected officials. Strong Mayor powers create an element of influence which democracy should be free of. The question is raised, when a CAO owns a decision, is it free of influence in the absence of a council decision? The majority of council holds that all decisions and directions of council should be grounded in majority decision. A new and concerning element has been introduced via Strong Mayor Legislation – influence. The introduction of an invisible threat is confusing to staff and harmful to elected officials. Strong Mayor powers create an element of influence which democracy should be free of. The question is raised, when a CAO owns a decision, is it free of influence in the absence of a council decision? The majority of council holds that all decisions and directions of council should be grounded in majority decision.

The majority of Council is not okay with this. Yet, the mayor has “had many discussions with residents, community leaders, staff and other mayors and heard a wide diversity of views.” A recent post states, “it is truly unfortunate that our discussions have been marred by misinformation and misunderstanding of the legislation.”

Maybe we should question where the misinformation is coming from? Let’s see some receipts. Nothing shared with Council, nothing in the public record (save one correspondence drawn on heavily in remarks), no counter petition, no supportive delegations…so where then does this justification come from if not from Council or Constituency?

It is even more deceptive that the mayor’s account posted that “Burlington Council Unanimously Approves Receiving Petition Related to Democracy”, as if to signal that the case is closed and all is well. In fact, nothing could be further from the truth. Misinformation.

The ‘Open Letter’ by the mayor, viewed by 1700 people doesn’t hold water. A recent interview that purports two of the powers have been shed, with silence on the remaining power is misinformation by omission. Lofty accusations that “for the most part” Councillors haven’t violated the Code of Good Governance regarding the roles of “Council to Govern” (the irony) is accusatory and unfounded – the reader assumes that ‘for the other part’ they have. Now the reader is misled into believing that there is a Council in violation of Good Governance afoot – how convenient, despite being false. This then supports that the retention of this remaining super power in the hands of the mayor is the only way to save the incoming CAO from any unadjudicated violations between management and governance.

I am certain that if there was a chance to launch an integrity complaint against any Councillor for breaching the Code of Good Governance that it would be on blast already – in fact – I invite an investigation just to prove this accusation wrong.

After council yesterday, all that the community, majority of council, delegates, engaged citizens and perhaps the media are left with is more peddling of weak rationale and a strong signal that any strong mayor that cannot listen continues to be a danger to our democracy. Hiding behind compliance with terrible provincial legislation does not dismiss the informed voice of the community. Posting decisions after they are made is not transparency. Telling those who challenge that they “might not understand it yet” is not accountability. And, holding a minority position on a critical matter is not democracy.

Keep pushing folks, if you want a Better Burlington, looks like you are going to have to demand it.

Mayor Meed Ward is using every communications tool she has to get her story out on the decisions she has made on how she will use her Strong Mayor powers. Meed Ward once said that she has 17 platforms on which she can communicate. She also has a Communication specialist on staff.

By Staff By Staff

April 17th, 2024

BURLINGTON, ON

We reported earlier today that we had heard nothing from Burlington MP KArina Gould on the federal budget.

Ms Gould sent out the following moments ago:

Dear Neighbour,

Yesterday, Minister Freeland released the 2024 Budget, Fairness for Every Generation.

This year’s budget is focused on giving every Canadian a fair chance to build a good middle class life, to realize the promise of Canada.

Budget 2024 achieves this by putting forward a blueprint for building more homes, making life cost less and growing our economy in a way that is shared by all.

Key initiatives include:

Our government believes in a country where everyone has a fair shot at success. Budget 2024 is another step towards greater fairness in Canada. To learn more about Budget 2024, click here.

Along with the brief statement Gould provided some supplementary information on a number of government programs – we will do our best to get that data published today.

By Pepper Parr By Pepper Parr

April 17th, 2024

BURLINGTON, ON

Councillor was pleased to serve with the Speakers Series the Mayor had sponsored. When the Mayor’s Speaker series was being debated at a Council meeting earlier she was given a rough ride.

Ward 4 Councillor Shawna Stolte loved the idea saying the first speaker Jennifer Keesmatt, former City of Toronto was a good fit for the first speaker in the planned two speakers each year.

Several days later Councillor Stolte had a change of heart and said she was withdrawing her endorsement of the Speaker series .

Stolte issued a statement to “clarify the facts in case there is any confusion regarding the discontinuation of my involvement with the Mayors event.

“Originally, in my role as Deputy Mayor of Housing for the City of Burlington, I had begun the planning process for a 2024 City Wide Housing Symposium as well as a “ward by ward” series of Housing Information Meetings with a focus of addressing the housing supply and affordability crisis in Burlington.

“The Mayor then decided to choose this model and subject as the first of her Mayors Speakers Series in May, so I agreed to join in the planning process in an effort to collaborate on the event.

Ward 4 Councillor Shawna Stolte did a superb job pressing the Mayor to tell Council when she was going to let them know what her response was going to be to the request that she relinquish her Strong Mayor powers. Stolte did get a date – Meed Ward published her decision that was posted on her web site. Councillor Stolte seems to be conflicted with on just how supportive she is of the Mayor. “After deep consideration, I have concluded that Mayor Meed Ward and I have fundamental differences in how we choose to communicate critical information with the public and I have decided to resign my participation in the Mayor’s Speakers Series and resume my focus, time and efforts on planning for these smaller, interactive “ward by ward” resident meetings across the City.

“In an effort to connect with and ensure all Burlington residents’ concerns can be heard, I encourage the residents of Burlington to stay up to date on their Ward Councillor monthly newsletters for the dates and times of these upcoming Housing Information Meetings.”

City Council is getting to be a very uncomfortable place to work.

By Staff By Staff

April 17th, 2024

BURLINGTON, ON

TEASING GRAVITY is a thrilling adventure in movement featuring contemporary dance by some of North America’s fastest rising choreographers. From Hanna Kiel’s exuberant physicality and Jennifer Archibald’s awe-inspiring imagery, to the hyper-kinetic jazz dance of Rodney Diverlus, TEASING GRAVITY will leave audiences breathless with the art form’s endless possibilities.

“a national treasure…among the ranks of Toronto’s top dance companies” – the Globe and Mail

The group will be at the Performing Arts Centre Thursday May 2, 2024 at 7pm. The group will be at the Performing Arts Centre Thursday May 2, 2024 at 7pm.

Canadian Contemporary Dance Theatre: Dances for the Young and Fearless.

Regular: $35.00 – $55.00 (All-in)

Member: $30.00 – $50.00 (All-in)

Tickets – click HERE

View 2024 Season

By Pepper Parr By Pepper Parr

April 17th, 2024

BURLINGTON, ON

Karina Gould released her budget statement later in the day.

Link to that statement is HERE

When a major federal government decision is made every MP sends out a newsletter to the people on their email list.

Oakville North Burlington MP Pam Damof Yesterday, Oakville Burlington North MP Pam Damof sent out the following:

This is our plan to make Canada fair for every generation. One where younger Canadians can get ahead, where young families can find an affordable place to call home; where seniors can age with dignity – where everyone can succeed.

Karina Gould with her second child. She is currently on maternity leave. Nothing so far from Burlington MP Karina Gould – and that is unusual. This budget is critical for the Liberals who are in trouble and need to attract the voters that elected them in 2015 but didn’t vote for them in 2019.

Gould is a member of Cabinet and is expected to be at the front of the parade. She is on maternity leave – but a budget is a big big deal, something you show up for or at least have your office send something out.

No word on why we have not heard from the Burlington Member of Parliament.

By Pepper Parr By Pepper Parr

April 17th, 2029

BURLINGTON, ON

The relevant thing about a democracy is that citizens decide who is going to lead the government.

We do that by holding elections – some politicians take the position that you elected me and I can do the job as I see it.

Modern democracies have governments that listen to their constituents on a regular basis. In Burlington we have people delegating to their city council. For an unfortunate period of time there were very few delegations. The people who did the delegating began to feel they were not being heard

That has changed. Delegators know that they are not being heard and have decided that, nevertheless, they are going to speak and on Tuesday they did speak.

The Council Chamber was far from full. That smiling face at center right is former ward 3 Councillor John Taylor who was busy taking notes. Two delegators: Ann Marsden and Lynn Crosby did a superb job of reminding Mayor Meed Ward of just what her job was and what it wasn’t.

There is little doubt that they had any impact on the Mayor. She is too committed to the Strong Mayor powers she has – the public is going to have to wait it out until October of 2026 – 30 months away – when they can elect a different Mayor. Who the other candidates for the Office of Mayor will be is unknown at this point – what was important today is what Marsden and Crosby had to say.

Read on – they were both right on.

Ward 2 resident Lynn Crosby delegating before Council. She was a significant part of Meed Ward’s election team. Crosby was there to present the Petition for Restoration of Democracy at Burlington City Council and Opposing the Strong Mayor Powers.

“It is truly sad to find myself feeling the need to delegate to ask my own mayor and council to stand up for democracy and its basic tenet of majority rule and that I’m doing it for a second time because it seems the Mayor may need more convincing.

“I understand that in filing the petition last Friday, we were too late. We erred. As a result, we needed a 2/3’s majority vote today to allow the petition to be received. I thank you all for voting to approve the receipt of the petition. It is certainly ironic that our protocols could ever block a peoples’ petition, the sole subject of which is the return of democracy to council. I note that our rules require 2/3’s of you to bypass a procedural filing deadline but only one of you, the Mayor, can hire and fire the CAO or overrule the elected representatives of almost 200,000 people.

“The petition was started on March 26 and as of this morning there are over over 600 signatures. The petition is in support of the Motion by Councillors Nisan, Stolte and Galbraith in which they asked the Mayor to delegate to Council the powers and duties assigned to the head of council with respect to the City Manager, as well as asking her to delegate other powers and duties to council as outlined in that Motion. We intend to keep the petition active until such time as the Mayor agrees to all of council’s requests.

“We are both disappointed and surprised by the Mayor’s decision, as expressed late last week in her ‘open letter’, which some residents may have seen. When all her supporting verbiage is stripped away, what remains, the single end result, is the fact that she is willing to surrender only one of the Strong Mayor powers and this one only to the City Manager and CAO – an unelected official who reports only to her rather than to Council as a whole.

“Without conceding to the council request in its entirety, and instead cherry picking one power only, the Mayor has made things worse. One main intent of the Council motion was that our elected Councillors should have equal say in the hiring and firing of senior staff, including the City Manager. Allowing the Mayor alone to have this power, or her now giving it to the City Manager while the Mayor retains sole authority over he or she effectively concentrates all the power with the Mayor. There is no change. For all practical purposes, you have the Mayor and an unelected official selected by the Mayor running the organization.

As Councillor Nisan recently opined in the Hamilton Spectator, “whether used or sheathed, the mere presence of this weapon can wreak havoc on a municipal administration like Burlington’s. It not only undermines local democratic institutions, but potentially also creates a municipal administration rife with the opportunity for dysfunction as staff may be in constant fear of the strong mayor and being “next.””.

Speaking of the Mayor ward 2 resident Lynn Crosby said “she’s heard from us now.” “This doesn’t change at all with the Mayor retaining her power to hire and fire the City Manager and then delegating to him the power to potentially do her bidding in regard to the hiring and firing of senior staff. I also suggest that council look at the current version of the petition – some of the most recent names may interest you when pondering Councillor Nisan’s words regarding staff, particularly recent exits.

“The Mayor has said in the past that she hadn’t heard directly from the public that they were opposed to the strong mayor powers. While I respectfully suggest that if that is what she thought, she wasn’t paying attention to the commentary that was circulating out in the community, the fact is, she’s heard from us now.

“I ask council to accept the petition today as valuable feedback received from hundreds of Burlington residents; read the comments on it and Mayor please return all powers that you can as requested by the majority of your council.”

Marsden:

Ann Marsden took a slightly different tack saying “The most important part of the request that Nisan, Galbraith and Stolte was that the Mayor delegate to Council the powers and duties assigned to the head of council under the Municipal Act, with respect to the City Manager.

Thursday April 11, 2024 Mayor Meed Ward publicly made it clear she was not going to give up that power.

What is even more troubling with the Burlington Mayor’s position is the statement she made to Grant Lafleche of the Hamilton Spectator published on April 11, 2024.

“She said (the Mayor) having these powers (to hire the CAO) protects the CAO from “undue pressure behind the scenes by any member of council.” According to Lafleche Mayor Meed Ward refused to say if she believed Councillors were manipulating City Manager Tim Commisso. . “She said (the Mayor) having these powers (to hire the CAO) protects the CAO from “undue pressure behind the scenes by any member of council.” According to Lafleche Mayor Meed Ward refused to say if she believed Councillors were manipulating City Manager Tim Commisso. .

“Further, Mayor Meed Ward claimed in the LaFleche article that it was important that the CAO and the Mayor, were compatible. Compatibility with the Mayor and indeed all members of Council is something that can never be decided until time proves it is so. More important than compatibility with the Mayor, however, is the ability of CAO to be free to take a stand at Council when the Mayor or indeed any member of council is promoting a path that will see them acting outside any legislation and thereby putting the City at immense risk.

“Besides raising the issue publicly that Mayor Meed Ward believes she needs to protect a very experienced and talented CAO from her fellow Councillors she has, in our minds, spoken publicly about fellow members of Council in a manner that our Code of Governance and “Respect in the Workplace Policy” prohibits.

We believe there is only one way Mayor Meed Ward can fix this. Publish a decision immediately after this Council meeting that reverses her decision and delegates the powers to hire the CAO to council with a majority rule and commit not to undelegate this power.

Sadly the chances of that happening are the same as Anne running a 20 yard dash.

“For the Mayor to make the changes four of the seven member Council asked her to do would mean she had listened to what constituents had to say.”

By Pepper Parr By Pepper Parr

April 16th, 2024

BURLINGTON, ON

Drawing attention to myself is not one of my strengths said Tim Commisso as he spoke to Council for the last time.

He had a 20 year career with the city, then a good stretch of time in Thunder Bay, his home town and returned to serve as the City Manager for five years “which has been the culmination of everything” he said.

“If you’d told me I’d be the city manager for the best city in Canada, I’d never believed you.

I grew up in a small northern Ontario town, Pickle Lake and that’s at the end of the road.

He went on to say “thank you to my counsel” with more emotion one has come to expect from Tim

I respect the fact that you had discussions today with me that were obviously near and dear to my heart. One of the principles I adhere to is to make the tough decisions, have the tough debates in open session at counsel.”

“The suggestion that something should be named in my honour – I’m not interested in naming anything – there may be a rumour going around that I might get a temporary naming of the parking lot, which in two years, you can rip out because it’s going to be redeveloped.

Tim fondly remembers Lisa Kearns calling him the big cheese in front of some sixty people.

“I want to thank Council for facilitating a seamless transition for a new city manager. “I want to thank Council for facilitating a seamless transition for a new city manager.

“A lot of times you’ll see acting or interim City Manager. I want to talk about a bit about next Monday when Hasaan will be sitting in this seat whenever you guys meet again. I am really impressed quite frankly with the decision you made to have him come on.

“I’ve been working with him for a couple of months. He’s given me his time and met with senior staff. We’ve spent a lot of time going through transition items. He will do very well and I wish him nothing but the best moving forward.

Tim closed with a remark I didn’t expect. “After 42 years, I’ll quote Neil Young’s “Comes a time”. I don’t like saying I live my life through rock and roll but that song kind of epitomizes everything for me.

Comes a time when you’re driftin’

Comes a time when you settle down

Comes a light, feelings liftin’

Lift that baby right up off the ground

Oh, this old world keeps spinnin’ ’round

It’s a wonder, tall trees ain’t layin’ down

There comes a time

You and I, we were captured

We took our souls and we flew away

We were right, we were giving

That’s how we kept what we gave away.

No, Tim didn’t sing those lyrics but he was clearly feeling them as he spoke to a Council that he guided and in five cases mentored and help them grow into the job.

Tim Commisso: His practice was to think it through. Tim wanted the public to understand that everybody on the leadership team, compared to five years ago is new. “That’s 19 people. I want that to resonate with you because it is a reflection of the fact that we’ve been able to attract or promote the senior leadership team.”

“It’s the reality of my era, everyone has probably retired, but you’ve got a very strong team; a group of about 70 staff. A lot of them, I would say 85% of them, are new in their roles over the last five years. People like Emilie Cote who was here today: you know, five years ago, she was maybe a supervisor. What you’ve got is really a talented team. The reason I’ve really enjoyed working with all of you is it really comes down to two reasons.

Adieu! “One is their passion and compassion. Passion is the unrelenting desire to fulfill your own wishes that drives you. And I always look at it as drive in the context of doing better for the city?

“The other one, and this is as important for me, is your desire to help others. That, quite frankly, has been the primary motivating thing people ask sometimes, like, how do you do this job? It’s because you align yourself with people that have both compassion, and passion. And ultimately, the outcome is building a great community.

“I think I’ve covered the bases here. I just want to say this is pretty surreal, but it is real. So thank you very much. I will leave it at that Mayor.

Council began to applaud and then as a group they stood and continued to applaud.

I’ve had my issues with Tim and he has had his with me. He has served the people of Burlington very well. Much of his work is evident today – what people will realize a decade from now is that he was right, very right, far more often than he was wrong.

By Staff By Staff

April 16th, 2024

BURLINGTON, ON

There are dozens of organizations in the city that will celebrate the volunteers who make what they do possible.

Food for Life is holding a meeting on Friday, April 19th at 1:30 pm to celebrate impact of an Ontario Trillium Foundation grant at a volunteer appreciation event. Food for Life is holding a meeting on Friday, April 19th at 1:30 pm to celebrate impact of an Ontario Trillium Foundation grant at a volunteer appreciation event.

There are 565 volunteers who show up regularly to pack the food that comes in into packages that are distributed to the more than 4000 people who are served each week

There are an additional 200 people in the community who volunteer in different ways.

Those are impressive number and well worth celebrating.

Related news story:

How Food for Life makes delivering fresh food to 4000 families happen

By Staff By Staff

April 15th, 2024

BURLINGTON, ON

With news like this – you now know why Bonnie Crombie took a pass on running for the Milton seat in the Legislature.

The Ontario government is moving ahead with the largest GO train service expansion in more than a decade, adding more than 300 trips per week on the Milton, Lakeshore West, Lakeshore East, Kitchener and Stouffville lines. The 15 per cent increase in weekly trips will give commuters more choice to get where they need to go faster. The Ontario government is moving ahead with the largest GO train service expansion in more than a decade, adding more than 300 trips per week on the Milton, Lakeshore West, Lakeshore East, Kitchener and Stouffville lines. The 15 per cent increase in weekly trips will give commuters more choice to get where they need to go faster.

“As part of our work to get it done on the largest public transit expansion in North America, our government is adding hundreds of additional GO train trips each week for communities across the GTA,” said Premier Doug Ford. “Today’s announcement, along with our recent introduction of free transfers between different transit systems through One Fare, will help get people across the region where they need to go faster, while saving the average transit rider $1,600 every year.”

Starting April 28, 2024, weekend train service will increase from every 30 minutes to every 15 minutes in the afternoon and evening on the Lakeshore West and Lakeshore East lines between Oakville GO Station, Union Station and Durham College Oshawa GO Station. For the first time, riders on the Kitchener line will also benefit from new 30-minute weekday service during midday and evenings between Bramalea and Union Station.

| “As Ontario’s population continues to grow, our government is investing in a world-class transit network that connects communities and people to good jobs and affordable housing,” said Prabmeet Sarkaria, Minister of Transportation. “We’re delivering on our plan to bring more reliable, convenient two-way, all-day GO train service to commuters in the Greater Golden Horseshoe.”

The province is also adding evening train service seven days a week on the Stouffville line, as well as an additional morning rush hour trip to Union Station for commuters in Milton and an afternoon rush hour trip from Union Station to Milton GO.

“Investing in GO rail service and infrastructure is critical to advancing Milton’s long-term complete community vision,” said Mayor Gordon Krantz, Town of Milton. “Additional GO rail service trips in Milton further connects people to jobs, students to learning, stimulates our economy, fosters housing builds in our transit corridors and improves connections to other transit services. We thank the Government of Ontario for this investment, demonstrating a positive step forward in the shared two-way all-day GO service vision for 2031.” |

By Staff By Staff

April 15th, 2024

BURLINGTON, ON

The City rarely sends out media releases on the hiring of new staff. Those that they do send out have, to date, been about very senior people.

The following came from the city this morning:

The City of Burlington is announcing the hiring of two new directors to Burlington Digital Services – Richard Liu, Director of Information Technology, and Chinelo Okereke, Director of Digital Strategy and User-Centric Services. These appointments support the delivery of the City’s Digital Business Strategy, designed to prepare and shift the organization for transformational changes in digital approaches and architecture.

In announcing the two new hires the city wants the public to know that people really do want to work for Burlington.

Chinelo (Chinny) Okereke and Richard Liu Richard Liu

Mr. Liu has been appointed as the City’s Director of Information Technology, effective April 8, 2024. He joined the City of Burlington in November 2022 as the Principal of Digital Enterprise Architecture. Mr. Liu brings over 20 years of experience in technology leadership roles to the City. Prior to his most recent role at the City, he held senior leadership positions with the Government of Nova Scotia’s Digital Services, mostly notably as the Director of Enterprise Architecture for over 10 years. He has also held positions in the private sector at CGI Consulting, and CARIS Inc.

With a commitment to digital transformation, strategy, and enterprise architecture, Mr. Liu has been instrumental in spearheading major digital initiatives, including the implementation of public cloud strategies and migrations, artificial intelligence (AI) solutions, and the modernization of legacy technology systems.

Mr. Liu holds a Master of Computer Science from the University of New Brunswick and a Bachelor of Science in Computer Science from Southwest Jiaotong University in China. His professional certifications include a COBIT 2019 Foundation certificate, an Information Technology Infrastructure Library (ITIL) certificate, and designations as a Business Relationship Management Professional (BRMP), and TOGAF 9 Certified Enterprise Architecture Practitioner.

Chinelo (Chinny) Okereke

Ms. Okereke joined the City of Burlington as the new Director of Digital Strategy and User-Centric Services on March 25, 2024. Ms. Okereke is an accomplished senior technology transformation leader. Prior to joining the City, she was the Enablement, Transformation and Operations Lead for Walmart Canada’s Insights & Analytics Centre of Excellence, created to accelerate the organization’s digital transformation agenda. She has also held positions at the Royal Bank of Canada including driving the strategic enablement of the technology function, and program managing RBC’s global innovation accelerator for employees.

Throughout her career, Ms. Okereke has acquired extensive experience in driving large transformation programs and leading successful digital initiatives that increase customer satisfaction, user engagement and employee experience. She has also led the development of user-friendly digital platforms to transform customer interactions.

Ms. Okereke holds a Master of Management Sciences (Technology) from Waterloo University, and a Bachelor of Science, Economics from the University of Toronto. She has certifications in product management, change management and Agile Project Management. She has also served as a part-time instructor for colleges, teaching innovation, change management and business management.

In their roles at the City of Burlington, Mr. Liu, Ms. Okereke, and their teams will be responsible for helping to execute aspects of the City’s Digital Business Strategy. The strategy outlines actions and investments that take advantage of technology and data to optimize and transform the way City services are delivered. The strategy will guide the delivery of services and ensure they meet the needs of the community, are easy to use, and cost efficient.

By Staff By Staff

April 15th, 2024

BURLINGTON, ON

This is National Volunteer Week (NVW) – a dedicated week to celebrate the importance and contributions volunteers make in

shaping and impacting our community.

The theme Every Moment Matters, highlighting that the sharing of time, skills, empathy, and creativity is vital to all our organizations and builds inclusivity, strength, and wellbeing in our communities.

The staff at Community Development Halton (CDH) and Volunteer Halton extend their heartfelt thanks to each volunteer in our community as well as to those who lead volunteers, in paid and unpaid roles. Volunteers are fundamental to meeting this challenging moment.

Volunteers across Halton Region, committing their support to increase our collective efforts and impact, help contribute exponentially to quality of life we all strive for.

This week, CDH and Volunteer Halton will honour some amazing volunteers at events in Burlington and Milton. Today please join us in celebrating the contributions This week, CDH and Volunteer Halton will honour some amazing volunteers at events in Burlington and Milton. Today please join us in celebrating the contributions

of volunteers who are receiving a Cheers to Volunteers award!

Cheers to Volunteers Award Recipients: This award recognizes the contributions of volunteers making a difference in our communities. A total of 12 volunteers

from across the Region are receiving Cheers to Volunteers awards this year!

HALTON HILLS

Diane Fullerton: Links2Care

Ruth Taylor: Town of Halton Hills

Matthew Key: Halton Healthcare, Georgetown Hospital

OAKVILLE

Luisa Reyes: Acclaim Health

Claudia Cortes: Community Living Oakville

Daniel Nash: Kerr Street Mission

MILTON

Freda Patterson: Town of Milton

Cathie Heirman: Milton Place Adult Day Centre

Brittany Marcijus: Halton Food for Thought

BURLINGTON

Nancy Williams: Acclaim Health

Sharon Collins: Joseph Brant Hospital

Melanie Daley: Halton Regional Police Victims Services Unit

By Staff By Staff

April 15th, 2024

BURLINGTON, ON

St. Matthew on-the-Plains is hosting its annual plant sale.

Geraniums are available in red, salmon, pink, fuschia and white for $34 per flat of 10 or $3.40 per single.

There are also hanging baskets available in red, salmon, pink, fuschia for $34 each. There are also hanging baskets available in red, salmon, pink, fuschia for $34 each.

Orders must be received Friday, May 10.

Pick up is Saturday, May 25, in Parish Hall between 9 and noon.

For more information contact 905-632-1233 or office@stmatthewburlington.ca.

By Pepper Parr By Pepper Parr

April 15th, 2024

BURLINGTON, ON

This is a long article intended for those who want to understand how the city is going to grow and the changes that will take place

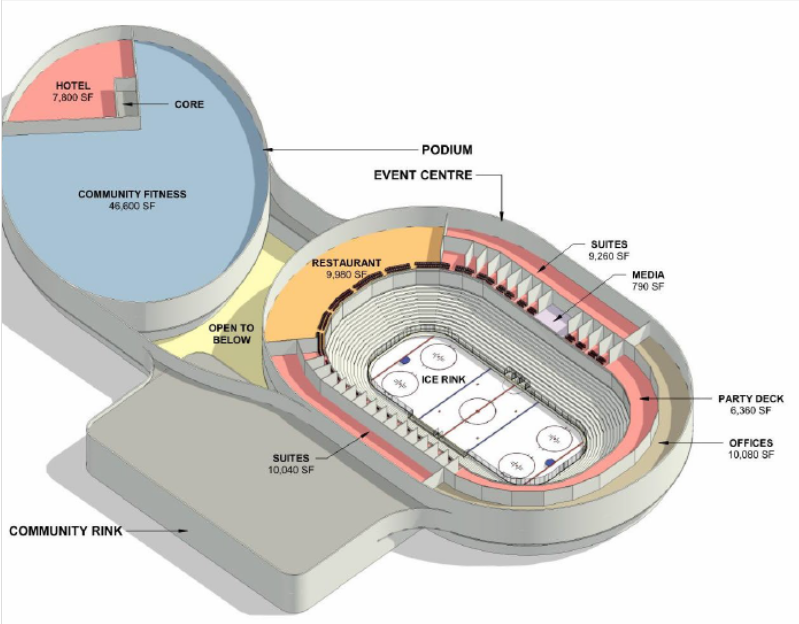

There are three development projects that will set a new approach to how the city works with developers and at the same time result in significant development that will change the way the city is seen as a community.

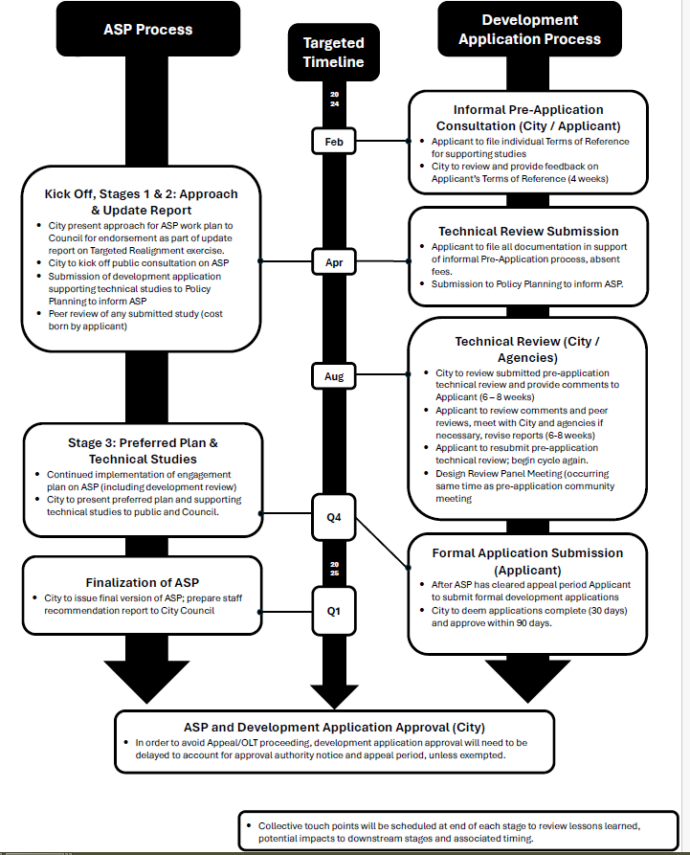

This was presented to Council earlier in the month and started with:

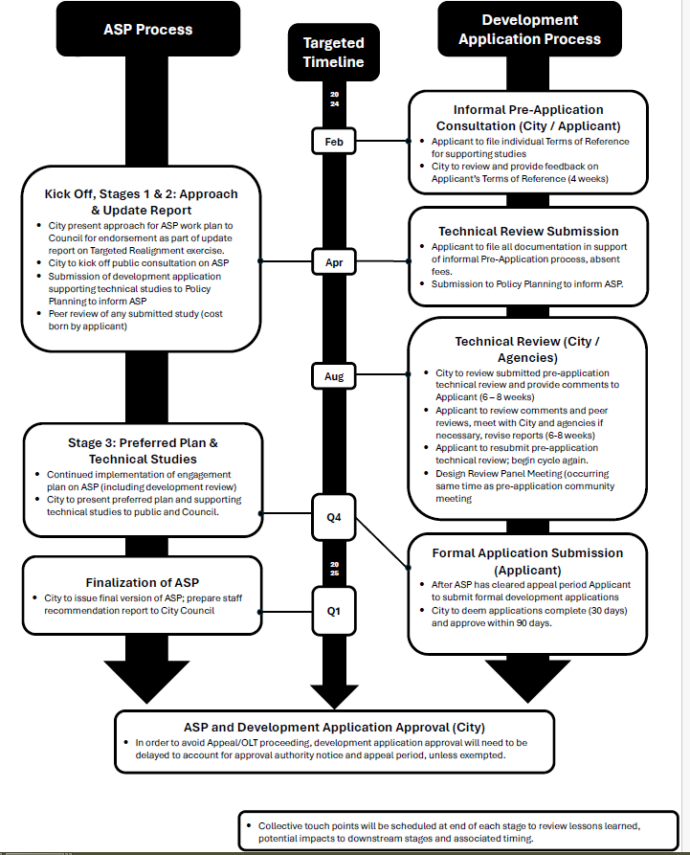

Direct the Director of Community Planning to implement the targeted timeline set out in a of community planning department report to support the development of an Area Specific Plan informed by City objectives, inputs from the landowner/applicant information and City-led public engagement, to define the Urban Structure role, the Growth Framework prioritization and the land use policies for Bronte Creek Meadows.

Direct the Director to engage with all ROPA 49 landowners as one input into the development of the City’s population and employment work and to inform the development of the revisions to the Urban Structure, Growth Framework and preparing supporting timeline and approach to initiate the development of area specific plans or their equivalent.

Alison Enns: Manager of Policy and Community Planning. The ball carrier in this instance was Alison Enns, Manager of Policy and Community who was very specific, direct and detailed. This is a whopper of a task.

None of these properties have been considered in the Official Plan, other Master Plans or the City or Regional Development Charges and all have been supported by City Council to form part of the Region’s 2023 Allocation Program.

In December 2023 the city set out four key areas of focus.

Focus Area 1 is: Designing and delivering complete communities. Specifically, the work discussed in this report responds, in part to G:

Deliver on the City’s Official Plan 2020 with an update to reflect growth and needs of complete communities. This update will include the transfer of all Official Plan policies from Halton Region to the City of Burlington, confirmation of additional strategic growth areas (e.g., ROPA 49 decision – Oct 2022), and Burlington’s 2031 Housing Pledge target of 29,000 units. This update will be supported by a proactive communication and engagement plan.

Some background:

After a period of turbulence Bill 162, which is currently referred to a provincial Standing Committee, will, if passed, will reinstate four significant changes with impacts on the BOP, 2020 Urban Structure, Growth Framework and Land Use policies. BOP = Burlington Official Plan

Staff wanted to confirm with Council the approach to planning for three key future growth areas and believe the approach presented can be a model for understanding the role of all of these new areas.

Background and Discussion:

In June, 2023 a number of issues resulted in a need to develop an initial work plan to undertake the necessary work to bring the BOP,2020 into “alignment with the updated Regional and Provincial policy framework”

The overall workplan acknowledged the role for both modifications to the BOP, 2020 at the OLT and statutory official plan amendments (OPAs) to develop a local vision for growth and development to address the range of changes to the planning framework.

While the initial workplan identified a wide range of changes in play some have not been realized as set out in recent Targeted Realignment Update reports.

“The targeted realignment exercise was introduced to Council in mid-2023, and was set out as an initial work plan to advance the Burlington Official Plan, 2020 (BOP, 2020) in a way that ensured alignment with the updated Regional and Provincial policy framework.

“The overall legal strategy acknowledges the role for both modifications through the Ontario Land Tribunal (OLT) as well as statutory official plan amendments (OPAs) in order to develop a local vision for growth and development to address the range of changes to the planning framework since the 2020 Regional approval of the Burlington Official Plan.

“Despite continued uncertainty staff have initiated work on the development of City specific population and employment growth forecasts.”

Regional Structure and Regional Urban Structure Changes

Several land use assumptions of the BOP, 2020 and the work prepared to support the Regional Official Plan Review have changed. The BOP, 2020 established a refined Urban Structure, Growth Framework and revised Land Use policies that together set out the long-term growth management strategy for a largely intensifying municipality.

That long-term growth management strategy did not anticipate the new areas (introduced either through the addition of new community areas within the urban area or through employment conversion).

It was an on, off and then on again process that made it very difficult for the Planning department. With the Executive Director of Community Planning nolonger with the city there is some scrambling taking place.

On April 22 Hassaan Basit former President and Chief Executive Officer at Conservation Halton will arrive at City Hall and serve as the City Manager. Hassaan started his career as an evolutionary biologist. Add to that a new City Manager joining the city and you get a sense as to the environment staff are working within.

Initially, the Minister’s modifications to Regional Council approved Regional Official Plan Amendment 49 (ROPA 49) converted several employment areas, and added several new urban areas within the City of Burlington.

Next, legislation through Bill 150 was introduced to rescind almost all of the Minister’s modifications. Subsequently, in response to feedback from the Mayor, with Council support, the initial Minister’s modifications may soon be reinstated almost in their entirety if Bill 162 is passed in the Provincial legislature.

While the effect of Bill 162, if passed would automatically incorporate the physical changes to the Regional Official Plan it is important to note as recently set out in Region of Halton Staff report

… ROPA 49 as adopted by Regional Council in June 2022 directed growth to 2041 to the existing Regional Urban Boundary and identified a framework that would be used to plan for future growth between 2041 and 2051. The Minister’s November 2022 decision modified ROPA 49 to extend its growth strategy to 2051 and to revise the population and employment forecasts for each municipality. The Minister’s modifications related to the planning horizon and growth forecasts were rescinded through Bill 150, but are now proposed to be reinstated through Bill 162. The population and employment distribution to 2051 for Halton Region and the Local Municipalities in the Regional Official Plan is as follows:

Upper Middle Road looking east towards Burloak is now land that becomes part of the planning domain. A Ministerial order converted it from Employment to mixed use. The City has determined it is critical and timely to initiate its own population and employment growth analysis, in advance of Royal Proclamation of Bill 23. In order to prepare this study best information is required to support this analysis, including determining the role and function of several new community areas including new urban areas.

The Local Growth Management Update will require best information and assumptions as inputs as it relates to the new areas, at a minimum the following issues must be considered:

-

-

- How will the newly converted employment areas and new urban areas fit within the City’s Urban Structure;

- How will the newly converted employment areas and new urban areas bereflected in the Growth Framework in light of the City’s focus on growth within existing Strategic Growth Areas within the built boundary; and

-

-

- What the vision, role and function of the newly converted employment areas and new urban areas reflected through the creation of area-specific plans or policies for major growth areas.

The answers to these three questions will be assessed against:

-

-

- Updated Regional and Provincial plans, policies and legislation,

- Burlington’s Strategic Plan and From Vision to Focus,

- Burlington Official Plan, 2020,

- Burlington’s Housing Strategy,

- Burlington’s Housing Pledge, and

- Other City objectives

The outcome of the work will be to determine how the City of Burlington will be planning to 2051 and beyond for:

-

-

- Employment, jobs and economic development,

- New population growth,

- The creation of diverse housing options and opportunities to welcome new residents to the City,

- The development of these three key areas from all

Bound by Hwy 403 and the rail lines the land will change how Burlington relates to Hamilton. King Road is at the bottom of the photograph. Some of the landowners noted above currently hold broad appeals to the Burlington Official Plan, 2020. A critical early priority of working with any of these landowners should be a request to scope appeals to the BOP, 2020 to site-specific appeal. This is an important request as staff have continuously noted that the wide-ranging broad appeals to the BOP, 2020 are impacting non-appellant landowners and developers from moving forward with the creation of new homes and new development. Staff believe this approach to be reasonable as the individual landowners retain their appeal, albeit at a site-specific level.

The three “future” areas have single owners, none have been considered in the Official Plan, other Master Plans or the City or Regional Development Charges and all have been supported by City Council to form part of the Region’s 2023 Allocation Program.

A partnership with the City, landowners and the public to guide the planning work for these areas presents an opportunity to demonstrate, in action, community responsive growth and the opportunity to create vibrant, mixed use, people-oriented communities.More broadly, new assumptions and new population and employment growth along with new policy directions will drive new considerations and requirements that will need to be captured in a whole range of other plans and strategies. As has been previously noted there will be additional costs related to updating critical local master plans and other key documents to appropriately plan for the whole range of local services (in addition to Regional Services). As with all new growth there will be long term costs as well as benefits related to new growth that will be considered in the coming years.

Rendering of some of the development ideas the Alinea Group had for their 1200 King Road property. Other Resource Impacts

There are significant demands on staff time given critical deadlines, and other associated efforts underway or about to be initiated. Staff will continue to monitor staff and work plans and proactively identify means of addressing any gaps.There may be a need to supplement staff complement to continue to make progress on a wide range of issues.

|

|

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers