By Diane Furlong By Diane Furlong

July 22nd, 2024

BURLINGTON, ON

The buying and selling of stocks, shares and bonds between financial traders has been a fundamental facet of our societies for centuries, with the concept of financial exchanges dating back to the Venetian golden age of the late Middle Ages. As history has progressed, stock exchanges have played an increasingly vital role in global mechanics, operating as the backbone of our global economy. However, despite the obvious importance of stocks, many of us know very little about what they are, how they work, and their real money value. Let’s take a more comprehensive look at these powerful economic entities.

What Are Stocks?

A share certificate in the Ford Motor Company which is a public corporation whose shares are traded on the NYSE. Simply put, stocks represent the ownership of a fraction of a company. Otherwise known as shares or equity, the purchase of a stock provides the buyer a piece of that company. This allows the owner of the stock to claim a portion of any assets or earnings resulting from the company’s success. For the company, issuing stocks helps to raise capital for their operations allowing them to grow. This symbiotic relationship between company and stockholder is fundamental to our global economic model. Stocks can be divided into two distinct types, common and preferred. Common stocks are the most widely held stocks, providing the owner a vote in shareholder meetings as well as a portion of company dividends. Contrastingly, preferred stocks provide the owner a greater share of the dividends but without any voting rights. The procurement of stocks is seen by many as an opportunity for financial gain, hoping to sell their stocks for a higher price over time while taking in the dividends in the meantime.

What Affects Stock Value?

Firstly, there are a number of different ways in which stocks can be valued. A stock can be valued based on the value of the company using its financial accounts – this is referred to as its book value. However, when purchasing stock many brokers use the market value which is driven by supply and demand and is the actual price of the stock on the market. Alternatively, some may use the intrinsic value which is seen as the true value of the stock based upon detailed financial analysis. Depending on the procurement in play, brokers may take all three valuations into account.

The floor of the New York Stock exchange where the public value of a company is determined. Traders do the actual trading between the different brokerages. You as an investor work with your broker. These values are determined by a number of different factors. The economic performance of the company is a key factor in determining the value of its stocks. High sales, new product launches or increased brand exposure can lead to improved financial health of a company which in turn improves its market value. External factors can also significantly affect stock value. Global events such as the COVID-19 pandemic, international conflicts and natural disasters all have an effect on the markets which can results in stocks values to rise or fall. Periods of recession often lead to stock prices to fall while periods of economic recovery can see prices rise again.

Calculating the Real Money Value

Considering this, how do investors determine the real money value of different stocks? By using certain financial ratios, they are able to make informed decisions on where and when to put their money on the table. The price-to-earnings (P/E) ratio, compares the company’s current share price to its earnings per share (EPS). A high P/E ratio indicates that investors expect a high growth potential from the stock in the future even if current earnings are low. The price-to-book ratio (P/B) compares a company’s market value to its book value and is a conservative approach often used in mature industries with a reduced growth potential. This ratio essentially assesses the market value of the company based on its actual worth, making it a useful method for understanding whether a company is under or overvalued. An alternative way of assessing the value of a stock is its dividend yield. While the other two ratios are ideal for assessing potential profits from sales of stocks, understanding how much in dividends you will receive for the price of the stock is a great tool if you want to keep hold of stocks for regular payments. When looking at dividend yields, ensuring the long-term sustainability of their output is key.

Buying and Selling Stocks

Once a stock has been valued using the above methods, investors must then purchase these stocks at centralized locations known as stock exchanges. Stock exchanges such as the NASDAQ and S&P 500 provide investors with a platform to buy and sell stocks in some of the largest companies across all sectors including healthcare, entertainment and technology. While anyone can buy stocks, they must first open a brokerage account in order to access the various stock exchanges. Once the account is set up, funds can be added to the account and orders on stocks can be placed.

Remember the Risk

Every investor needs to understand their own risk tolerance. How much risk are you prepared to take? It is a very personal number you need to think about. It is important to understand that buying stocks is not a guaranteed money maker and so being aware of the risks involved is vital. Buying stocks can be likened to placing bets on online casinos, with the best real money online casinos in Canada available at Onlinecasino.ca. Stocks with a high probability of success will often provide a low return, while volatile stocks with a low probability of success could provide huge profits – although the chance of losses is also higher. Ultimately, purchasing stocks is a gamble, so significant research should be done to ensure that the right stocks are bought at the right price. Additionally, there is also a risk of a total market collapse such as that seen during the 2008 financial disaster. This effects the value of all stocks and can lead to severe losses from investments.

Understanding stocks is a great way to both increase your financial situation and to better understand the cogs that the run the world that we live in. A combination of knowledge, research and strategy is essential for success in the stock exchange however the details of this article are only the tip of the iceberg. It is vital to be aware of the complexities of our economic system and remember where there is reward, there is risk.

By Justin Weinger By Justin Weinger

March 20th, 2020

BURLINGTON, ON

The way we make a living is changing, but too few people realize that. If you want to survive, you must stop thinking of yourself as an employee and start considering yourself to be an independent contractor. You can either sell your skills and time to a company (an employer) or use them to cobble together sources of income to fund the life you want to live.

One can buy and sell foreign currencies. Ideally you would buy when you felt a currency was undervalued relative to some other currency and sell when the values changes. Complex – but very rewarding when you learn the process. In this article, I’m going to talk a little bit about making money with investments, and with Forex trading in particular. Admittedly, I’m not very good with investing, so this article will only get you started. You are better off having someone with a good amount of experience in this field mentor you in how to make money with Forex trading.

What is Forex?

Forex (a portmanteau of foreign exchange) trading is the art of using money to make money. Literally, you are exchanging one form of currency for another and pocketing the difference. Its just like trading shares on the stock market. You purchase currency at a certain exchange rate and then sell it at a preferably higher rate. For example, I would buy $9 worth of British Pounds (GBP) when the exchange rate was 1.5 (1 GBP = $1.50) and then sell it when the rate went up to 1.75 (1 GBP = $1.75). My profit from the exchange would be $3.25.

The Basics of Forex Trading

Currency has been bought and sold since it was invented. In fact, if you have ever traveled to another country and exchanged your currency for the currency used in that country then you have participated in forex trading, albeit on a very small scale (and you probably lost money).

Forex trading is done on a larger scale. There are some companies that allow traders to trade in small amounts. For the most part, though, you will need an initial investment of at least $1,000 to get started. Additionally, you won’t start making the big bucks until you begin buying and selling currency in the tens of thousands of dollars.

If you don’t have that kind of cash on hand, you can do what is called margin trading. Basically, you trade with money borrowed from the broker. The broker will require you to front a small percentage of the loan. For instance, to borrow $150,000 you would need to put up $3,000 or 2%. Each forex brokerage firm is different. Some allow investors to open accounts with as little as $25 while others won’t even talk to you unless you have $10,000 in the bank.

Currency is purchased in lots, with the smallest being 1,000 units (micro). The other sizes are mini (10,000 units) and standard (100,000). In general, you cannot break lots. You must purchase currency in the established increments. There are a few retail Forex brokers, though, that will allow account holders to trade in custom lots. So if you want to trade 1,511 units, you will need to find a company that will let you do that.

Lots must be purchased or sold by the end of the trading day (usually 5pm E.S.T); otherwise you will earn or pay interest on any open positions. All profits and losses are added or deducted from your brokerage account each time you buy or sell currency. Additionally, the brokerage firm may charge trading fees. You can check the typical trading conditions at Friedberg Direct site.

Can You Make Money with Forex Trading?

The short answer is yes, you can make money Forex trading. The slightly longer answer is you have to know what you are doing. You must be able to correctly predict what the currency exchange rates are going to do because making money depends on buying low and selling high. You could potentially wipe out your account if you misjudge the activity. At the same time, you could become a gazillionaire.

Like I said before, the best thing to do is find a person who has made money with forex and convince them to show you how. If you like the thrill and excitement of trading on the stock market or you have money to burn, then it may be worth it to experiment with this money making opportunity. Like I said before, the best thing to do is find a person who has made money with forex and convince them to show you how. If you like the thrill and excitement of trading on the stock market or you have money to burn, then it may be worth it to experiment with this money making opportunity.

Justin Weinger is a free lance writer who digs out opportunities and situations that can be very profitable.

By Staff By Staff

December 6th, 2017

BURLINGTON, ON

This could be fun.

Former ward 4 candidate for the public Board of Education seat Margot Horne Shuttleworth has gone public with in a Facebook message to her wine loving friends.

Holiday Wine Exchange – forget the cookies — who wants 36 bottles of wine?! 🍷🍷

The weather outside is frightful, but the wine is so delightful…

Who wants to participate?

I need a MINIMUM of 6 participants to join in a holiday wine exchange. Buy ONE bottle of wine valued at $20.00 or more and deliver it to one person. That’s it! I need a MINIMUM of 6 participants to join in a holiday wine exchange. Buy ONE bottle of wine valued at $20.00 or more and deliver it to one person. That’s it!

I will PM you the name/address and in return you will receive 6 – 36 bottles of wine!! (# of bottles depends on the number of participants).

Let me know if you are interested and I will PM you the information. Please comment on this post if you’re in. Just keep in mind, you only have to buy ONE bottle valued at a minimum of $20.00 and, if everyone participates, you can receive up to 36 bottles of wine!!!

Only comment if you are really going to participate. If you say you will and don’t, it doesn’t work for everyone else. Give it a try. It could be fun and you could stock up for the holiday season with the purchase of only ONE bottle!!….. you need to be local…. but should be fun!!

Margo Horne- Shuttleworth on Facebook at –

https://www.facebook.com/margo.shuttleworth/

By Harry Wilson By Harry Wilson

August 11, 2024

Burlington, ON

Yazan al Homsi Provides Insights Into Investment Trends in ESG and Technological Innovations: A Venture Capital Perspective.

Environmental, Social, and Governance: It is the way business is now being done. In recent years, Environmental, Social, and Governance (ESG) investments have become a significant focus for venture capitalists. ESG investing refers to the practice of incorporating these three crucial factors into investment decisions, aiming to generate sustainable and ethical returns. This shift reflects a broader societal move towards more responsible and impactful business practices. The growing awareness of climate change, social equity, and corporate governance has spurred investors to look beyond mere financial returns, considering the broader impact of their investments.

The venture capital landscape has seen a notable rise in ESG investments. This is driven by a combination of regulatory changes, increasing consumer demand for sustainable products, and a genuine concern for the planet’s future. Governments worldwide are implementing stricter environmental regulations, and companies are under pressure to comply with these standards. At the same time, consumers are becoming more conscious of their purchasing choices, favouring brands that demonstrate a commitment to sustainability and ethical practices.

Yazan al Homsi, a renowned expert in the venture capital space, highlights the topicality of ESG investments, stating, “Everyone wants something that’s topical. So whether it’s the plastic upscaling or plastic pollution, green hydrogen, or AI for health tech, these are very topical topics.” This reflects the market’s appetite for innovations that address pressing global issues. Investors are not just looking for profitable ventures; they are seeking opportunities that align with their values and can make a significant positive impact.

The integration of ESG factors into investment strategies is not just a trend but a strategic imperative. Companies that prioritize ESG are often better positioned to manage risks and capitalize on opportunities in the evolving market landscape. This holistic approach to investing helps mitigate potential risks associated with environmental regulations, social unrest, or governance failures. Moreover, ESG-focused companies tend to attract a loyal customer base, enhancing their long-term profitability and resilience.

ESG is a growing trend – bears keeping an eye on. In conclusion, the rise of ESG investments in venture capital signifies a profound shift towards more responsible and sustainable investing. This trend is expected to continue as regulatory pressures increase, consumer preferences evolve, and the global community becomes more attuned to the urgent need for sustainable practices. Investors like Yazan al Homsi are at the forefront of this movement, recognizing the dual potential for financial returns and positive societal impact.

Technological Innovations Driving Green Energy and Plastic Recycling

The push towards sustainability has spurred remarkable technological innovations in green energy and plastic recycling. These sectors are witnessing a surge in venture capital investments, driven by the urgent need to address environmental challenges and the potential for substantial returns. Innovations in these areas are transforming the landscape, offering solutions that are not only eco-friendly but also economically viable.

Green energy, encompassing renewable sources like solar, wind, and green hydrogen, is at the forefront of this technological revolution. Startups in the green energy sector are developing cutting-edge technologies to harness these renewable sources more efficiently. For instance, advancements in solar panel efficiency, wind turbine designs, and energy storage systems are making renewable energy more accessible and affordable. These innovations are crucial for reducing our reliance on fossil fuels and mitigating the impacts of climate change.

Recycling plastic is one of the most challenging environmental issues. The venture capital community is interested. Plastic recycling is another area where technological advancements are making a significant impact. Traditional recycling methods have often been criticized for their inefficiency and limited scope. However, new technologies are emerging that can recycle a broader range of plastics and do so more effectively. Techniques such as chemical recycling break down plastics into their molecular components, allowing for infinite recycling without degradation of quality. This not only addresses the issue of plastic waste but also reduces the demand for virgin plastic production.

Despite the promise of these technologies, ventures in green energy and plastic recycling face several challenges. Scalability remains a significant hurdle. Many innovative solutions work well on a small scale but encounter difficulties when scaled up to meet global demands. Financial viability is another critical issue. While these technologies are advancing, they often require substantial initial investments, and the path to profitability can be uncertain.

Yazan al Homsi provides a nuanced view of the financial aspects of these sectors, noting, “People want things that are a bit more mature in the sense that they have revenue and are closer to profitability. My argument to that would be, well, there are not many companies in these spaces that are actually in revenue and profitable.” This highlights the balance that investors must strike between supporting groundbreaking innovations and ensuring financial returns.

Success stories in green energy and plastic recycling serve as inspirations and proof of concept for these sectors. Startups that have managed to scale their operations and achieve profitability demonstrate the potential of these technologies. For example, companies developing advanced recycling methods are securing partnerships with major corporations, showcasing the commercial viability of their innovations. Similarly, green energy startups are entering into large-scale projects and receiving government support, further validating their business models.

In summary, technological innovations in green energy and plastic recycling are driving significant changes in the venture capital landscape. These sectors offer immense potential for environmental impact and financial returns. However, investors must navigate the challenges of scalability and profitability to realize these benefits. As Yazan al Homsi suggests, the maturity of these ventures plays a crucial role in attracting investment and achieving sustainable growth.

The Health Tech Boom: Balancing Innovation with Financial Viability

The health tech sector is experiencing an unprecedented boom, driven by technological advancements and the growing demand for innovative healthcare solutions. From artificial intelligence (AI) to remote patient monitoring, health tech startups are transforming the healthcare landscape, offering improved patient outcomes and operational efficiencies. Venture capitalists are keenly investing in this sector, recognizing its potential to revolutionize healthcare delivery.

AI in health tech is one of the most promising areas, with applications ranging from diagnostic tools to personalized treatment plans. Machine learning algorithms can analyze vast amounts of medical data, providing insights that were previously unattainable. This not only enhances diagnostic accuracy but also allows for more tailored treatments. Startups focusing on AI-driven health solutions are attracting significant venture capital funding, reflecting the sector’s potential.

Remote patient monitoring is another rapidly growing area within health tech. The COVID-19 pandemic accelerated the adoption of telehealth and remote monitoring solutions, enabling patients to receive care from the comfort of their homes. These technologies reduce the burden on healthcare facilities and offer continuous monitoring, which is particularly beneficial for managing chronic conditions. Investors are supporting startups that develop wearable devices and telehealth platforms, anticipating long-term growth in this space.

Generating revenue and achieving profitability are two different things. However, the financial viability of health tech startups remains a critical consideration for venture capitalists. While the potential for innovation is high, these ventures often face challenges in generating revenue and achieving profitability. The development and deployment of advanced technologies require substantial capital, and the path to financial sustainability can be fraught with obstacles.

Yazan al Homsi emphasizes the importance of robust management in navigating these challenges: “The key in my career has always been management. You always have to check management has to be on top of the ball. The three companies I’d say that all of them share that in them.” Effective management teams are crucial for steering health tech startups through the complexities of the market, ensuring that innovative solutions are translated into viable business models.

Moreover, the early-stage nature of many health tech ventures means that they often lack immediate revenue streams. This can be a deterrent for investors seeking quicker returns. Al Homsi points out, “The issue is like a lot of plastic recycling or healthcare for AI, there has not been real… There’s been a lot of talk and actual companies that execute on talk are far and few.” This highlights the need for thorough due diligence and a focus on companies with strong execution capabilities.

In conclusion, the health tech sector offers immense potential for transformative innovations and significant returns on investment. However, achieving financial viability remains a challenge. Investors must prioritize effective management and be prepared for a longer-term commitment to realize the benefits of their investments.

The Future Outlook: Security, Management, and Market Opportunities

As venture capital continues to flow into ESG and technological innovations, the future outlook for these sectors appears promising. However, several factors will influence the trajectory of investments, including security, effective management, and market opportunities. Understanding these dynamics is essential for investors seeking to capitalize on emerging trends.

Security is a paramount concern in the venture capital landscape. The volatility of financial markets and the unpredictability of technological advancements necessitate a focus on risk management. Yazan al Homsi underscores the importance of security, stating, “The benefit that we have is that in our industry people want more security. But the benefit that we have is you don’t know when interest rates are going to get cut, but the minute they get cut, all these growth stock names are going to get a lot of attention.” This highlights the need for investors to balance the potential for high returns with the inherent risks of innovative ventures.

Effective management remains a cornerstone of successful investments. Startups with strong leadership are better equipped to navigate the challenges of scaling operations and achieving profitability. Al Homsi’s experience demonstrates that companies with robust management teams are more likely to succeed: “A lot of people got cleaned out during the last two years because a lot of people could not sustain. They already had investments in other spaces e-gaming and growth companies just can’t turn from a growth phase to ‘We want to focus on revenue and profitability.'” This insight underscores the importance of selecting ventures with capable and adaptable leadership.

Market opportunities in ESG and technological innovations continue to expand, driven by ongoing advancements and increasing societal awareness. Investors are particularly interested in companies that can either be acquired by larger firms or transition to major stock exchanges. Al Homsi explains, “The ultimate game is you want to be involved in companies that ultimately are going to be either bought out by a major or they’re going to be moving to major exchanges. Those are the two ways to make meaningful alpha.” This strategic approach highlights the importance of identifying companies with clear exit strategies and significant growth potential.

Additionally, the perception and reception of recycling and other green technologies play a crucial role in their market success. Al Homsi notes, “People still look at the, especially when there’s been so much negative media about recycling, people think that the only thing… I think there was a segment by CBS that said the only thing that got recycled is them recycling the lie of recycling.” Overcoming such skepticism requires transparent communication and demonstrable results from green tech companies. Additionally, the perception and reception of recycling and other green technologies play a crucial role in their market success. Al Homsi notes, “People still look at the, especially when there’s been so much negative media about recycling, people think that the only thing… I think there was a segment by CBS that said the only thing that got recycled is them recycling the lie of recycling.” Overcoming such skepticism requires transparent communication and demonstrable results from green tech companies.

In summary, the future of venture capital investments in ESG and technological innovations is shaped by security, effective management, and strategic market opportunities. Investors must remain vigilant and adaptable, focusing on companies with strong leadership and clear paths to profitability. By doing so, they can navigate the complexities of these sectors and achieve substantial returns while contributing to sustainable and impactful innovations.

By Staff By Staff

May 30th, 2024

BURLINGTON, ON

The Minister of Education has announced that in order to graduate students will have to pass a financial literacy assessment – and will need a mark of at least 70% or higher on the assessment, which will be tied to the Grade 10 math course.

Education Minister Stephen Lecce Education Minister Stephen Lecce also includes the return of home economics to a Back to Basic approach to what is taught in classrooms.

Changes of this nature have been long overdue. In his announcement Lecce added that “By elevating life skills in the classroom, along with better career education and higher math standards on educators, we are setting up every student for lifelong success.”

“The new financial literacy requirement, covering practical skills, will include a lesson module as well as an assessment that Lecce said “ensure students have the skills and knowledge to create and manage a household budget, save for a home, learn to invest wisely, and protect themselves from financial fraud.”

Lecce, who rang the opening bell at the Toronto Stock Exchange before unveiling the province’s plans, said the secondary reforms are the first in 25 years and that parents and educators will be consulted.

“Too many parents, employers and students themselves tell me that students are graduating without sufficient financial literacy and basic life skills,” said Lecce in a written statement. “Too many parents, employers and students themselves tell me that students are graduating without sufficient financial literacy and basic life skills,” said Lecce in a written statement.

Lecce also said that a math competency test for new teachers — which was challenged in court by a group of students but ultimately upheld — will resume in February 2025 and be mandatory before graduates can be certified to work in classrooms.

By Soloman Smithers By Soloman Smithers

January 24th, 2024

BURLINGTON, ON

The Canadian stock market, a key component of the global financial system, is a dynamic arena where retail and institutional traders buy and sell stocks. In this market, companies list shares to garner capital, predominantly through stock exchanges like the Toronto Stock Exchange (TSX). Investors can buy and sell these stocks to profit in the long run.

When a company goes public, it sells shares through an Initial Public Offering (IPO) on the primary market. Post-IPO, these shares are traded on the secondary market, allowing for public trading and investment diversification. The stock market typically refers to this secondary market where most trading occurs.

Before cell phones or fax machines trading was done between individual traders representing stock brokerage firms. It was hectic, noisy – busy as all get it. Exciting as well. The Evolution of Stock Trading

Traditionally, stock trading was a physical, raucous affair with traders using hand signals and shouts. Now, it’s predominantly electronic. Opening an online self-directed brokerage account allows individuals to start trading within minutes. Alternatively, investors can seek the expertise of stockbrokers or financial advisors, offering guidance and execution of trades, albeit at a cost.

The stock market’s core is driven by supply and demand. Sellers set their “ask” price, while buyers have their “bid.” The difference, known as the spread, influences the stock’s trading activity. Modern trading largely relies on computer algorithms for price-setting, streamlining the process significantly.

Stock Market vs. Stock Exchange

While often interchangeable, ‘stock market’ and ‘stock exchange’ are distinct. A stock exchange is a part of the broader stock market, which can encompass multiple exchanges. Exchanges are crucial in managing orders, matching prices for trades, and ensuring transparency and fairness.

Canadian Stock Exchanges

Canada boasts five primary stock exchanges:

- Montreal Exchange

- TSX Venture Exchange

- Aequitas NEO Exchange

- Toronto Stock Exchange (TSX)

- Canadian National Stock Exchange (Canadian Securities Exchange)

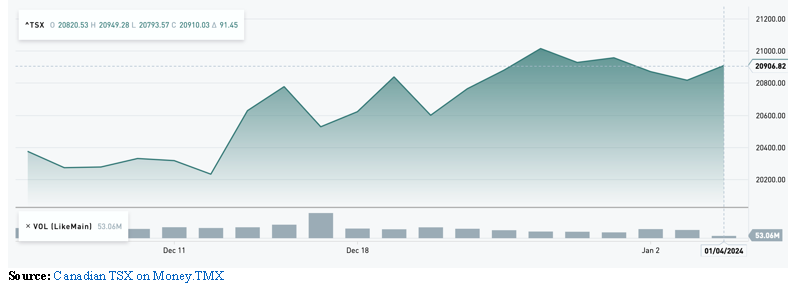

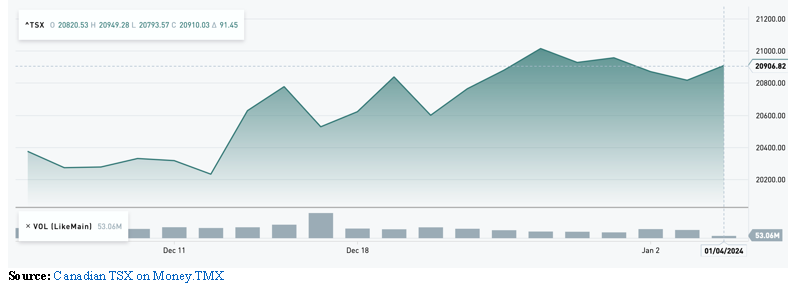

The TSX, one of the largest globally, reflects Canada’s robust economic health and strategic role in international trade.

Global Trading for Canadian Investors

Canadian investors are not limited to domestic exchanges. Trading can occur on any global exchange accessible through brokerage accounts. The New York Stock Exchange (NYSE), with a market capitalization exceeding $32 trillion, leads the global list. In contrast, the TSX ranks within the top 10 worldwide.

Apart from stocks, various financial instruments find their markets. The money market caters to short-term investments, the bond market to government and corporate bonds, and the derivatives market to contracts linked to underlying assets like stocks. The forex market, where currencies are traded, is another significant sector.

Stock markets today are all digital with trades taking place digitally. A trader could be active in several market at the same time. Market Volatility and Performance

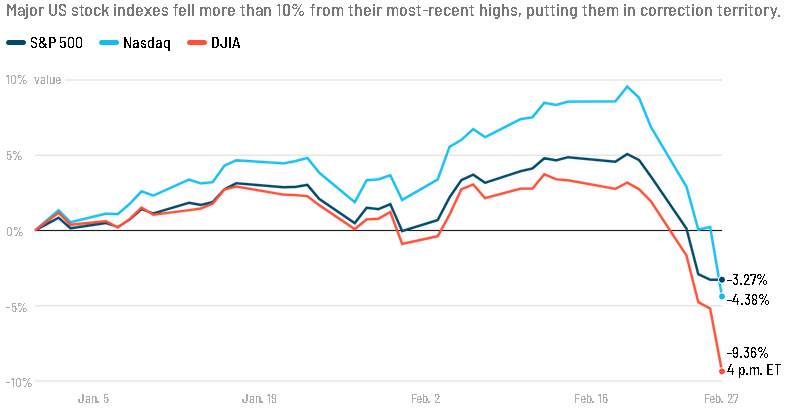

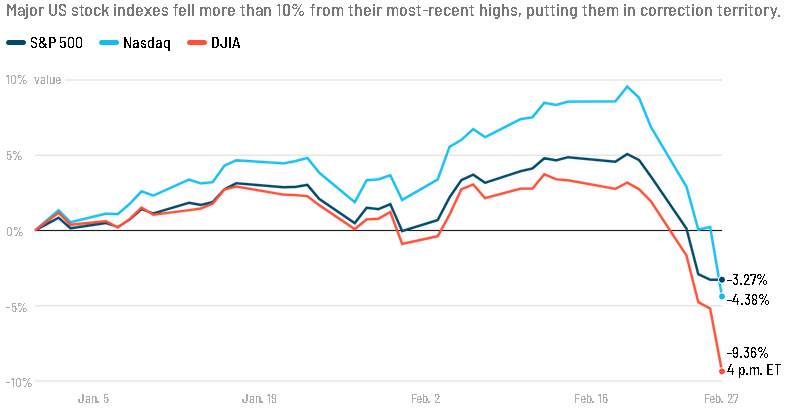

Stock markets are inherently volatile. Indices like the S&P 500, comprising the 500 largest U.S. companies, serve as performance barometers. Historical trends, like the 2008 financial crisis or the COVID-19 pandemic, demonstrate the market’s fluctuating nature, underscoring the importance of strategic investment.

Investors typically follow day trading or long-term investing strategies. Day trading focuses on short-term gains from daily price fluctuations, requiring time and expertise. Long-term investing, on the other hand, focuses on sustained growth and earnings over time, a strategy exemplified by investors like Warren Buffet.

Navigating the Canadian Market with Advanced Trading Platforms

In the intricate Canadian stock market, platforms like MetaTrader 5 are invaluable. This advanced trading platform caters to the diverse needs of modern traders, offering functionalities like auto trading systems, a wide range of asset classes, and detailed analytical tools. It facilitates informed decision-making in a market influenced by global and domestic trends.

In Canada, products like Contracts for Differences (CFDs) are relatively new and primarily unknown to investors. These instruments don’t have specific regulatory margin requirements or leverage restrictions, representing a unique aspect of the Canadian financial regulatory environment.

Within the unique financial landscape of Canada, Contracts for Differences (CFDs) are emerging as an intriguing and accessible instrument for traders of all skill levels. These derivative products allow traders to speculate on the price movement of assets without actually owning them.

There are two primary positions in CFD trading: long and short. A long position involves buying an asset with the expectation that its value will increase. In contrast, a short position is taken when a trader anticipates a decrease in the asset’s value. CFD trading is versatile, offering various strategies like day trading, swing trading, and scalping, each with its distinct approach and risk profile.

Moreover, CFD trading is cost-effective and facilitates hedging, making it an attractive option for Canadian traders looking to diversify their trading strategies and manage risks effectively.

A bull market! The Canadian e-commerce sector, pivotal to the nation’s economy, is experiencing rapid growth. By 2025, it’s projected to double from 2021 levels, surpassing $90 billion. This surge is driven by an increasingly digital consumer base and a shift towards online shopping, highlighting the evolving nature of retail and investment opportunities in Canada.

Concluding Remarks

The Canadian economy, marked by robust stock exchanges and a burgeoning e-commerce sector, presents diverse opportunities for investors and traders. Understanding the intricacies of stock trading, the role of advanced platforms like MetaTrader 5, and the burgeoning e-commerce landscape are essential for navigating Canada’s dynamic market.

This perspective is crucial for anyone looking to maximize their financial opportunities in Canada’s evolving economic landscape.

By Staff By Staff

October 4th, 2023

BURLINGTON, ON

An Indigenous Student Bursary fund reaches a $150,000 milestone in its third year providing support for indigenous students pursuing post-secondary education.

Teach for Tomorrow encourages and supports First Nations, Inuit and Métis students to fulfill their ambition to become teachers and provides a seamless approach for students to transition though high school into university. Launched in 2021 in partnership with Indspire as part of Wolseley Canada’s recognition of Truth and Reconciliation Day, the Indigenous Student Bursary is part of the Building Brighter Futures program. It. provides funding for individual First Nation, Inuit and Metis students enrolled in full- and part-time studies in college, university, skilled trades, apprenticeships and technology programs.

“It is important to Wolseley Canada that we give back to the communities where we work and live,” says Kim Forgues, Vice President of Human Resources at Wolseley Canada. “We feel strongly that it is our corporate responsibility to help build stronger communities, and a key part of that is creating opportunities for young people to start a career. With this bursary program, we reflect on history and consider how we can better support Indigenous youth for a brighter future.”

Wolseley Canada annually contributes $25,000 to the fund, which the Government of Canada matches for a total of $50,000 each year.

For more information about the Wolseley Canada Indigenous Student Bursary or to apply, visit indspirefunding.ca. Applications deadlines are November 1, 2023, and February 1, 2024.

About Wolseley Canada

Wolseley Canada is a market leader in the wholesale distribution of plumbing, heating, ventilation, air conditioning, refrigeration, waterworks, fire protection, pipes, valves and fittings and industrial products.

With its head office in Burlington, Ontario, the company has approximately 2,500 employees and more than 220 locations coast to coast. Wolseley’s team of sales and service specialists, an industry-leading e-business platform, Wolseley Express, and relationships with the best vendors and brands in the business, make Wolseley the professional’s choice across the country.

Wolseley Canada’s parent company, Ferguson plc is the world’s largest trade distributor of plumbing and heating products and a leading supplier of building materials. Ferguson plc is listed on the New York Stock Exchange (NYSE: FERG) and the London Stock Exchange (LSE: FERG).

By Staff By Staff

October 1st, 2021

BURLINGTON, ON

Wolseley Canada announced the Canada Indigenous Bursary, to help Indigenous students across Canada reach their full potential with funding for post-secondary education.

In partnership with Indspire, Wolseley has donated $25,000, which will be matched by the Government of Canada for a total of $50,000.

Sebastien Laforge, President, Wolseley Canada. “This is an important day to reflect on history, and to consider how we can better support Indigenous communities,” says Sebastien Laforge, President, Wolseley Canada.

The Wolseley Canada Indigenous Bursary is part of the Building Brighter Futures program, and provides funding for individual First Nation, Inuit and Metis students enrolled in full and part time studies in college, university, skilled trades, apprenticeships, and technology programs.

For more information about the scholarship, or to apply, visit https://indspire.ca/programs/students/bursaries-scholarships/.

Wolseley Canada is a market leader in the wholesale distribution of plumbing, heating, ventilation, air conditioning, refrigeration, waterworks, fire protection, pipes, valves and fittings and industrial products. With its head office in Burlington, Ontario, the company has approximately 2,500 employees and more than 220 locations coast to coast. Wolseley’s team of sales and service specialists, an industry-leading e-business platform, Wolseley Express, and relationships with the best vendors and brands in the business, make Wolseley the professional’s choice across the country. Wolseley Canada is a market leader in the wholesale distribution of plumbing, heating, ventilation, air conditioning, refrigeration, waterworks, fire protection, pipes, valves and fittings and industrial products. With its head office in Burlington, Ontario, the company has approximately 2,500 employees and more than 220 locations coast to coast. Wolseley’s team of sales and service specialists, an industry-leading e-business platform, Wolseley Express, and relationships with the best vendors and brands in the business, make Wolseley the professional’s choice across the country.

Wolseley Canada’s parent company, Ferguson plc is the world’s largest trade distributor of plumbing and heating products and a leading supplier of building materials. Ferguson plc is listed on the London Stock Exchange (LSE: FERG) and on the FTSE 100 index of listed companies.

-30-

By Pepper Parr By Pepper Parr

March 1st, 2020

BURLINGTON, ON

The coronavirus disease (COVID-19) has been found in 47 countries.

We may be be close to declaring a pandemic, which is when a whole country or the world is infected. China, Iran and Italy are struggling to control the spread of the disease. The disease is now being spread in the United States.

Ontario has now found 19 people who are infected.

There is much that is not yet known by this virus. It appears that most people do recover from an infection.

The damage to the economy has been significant; the New York Stock Exchange recorded the largest drop in its history.

Biggest one day drop of New York Stock Exchange prices in its history. “The game has changed with Italy and also with the new case in California,” People have every reason to be concerned – deeply concerned.

Japan has closed all its schools.

It has been suggested that the Tokyo Olympics might be cancelled.

None of this is said to be alarmist – however we do have a serious problem on our hands.

Ontario learned a lot from the SARS outbreak – those lessons are serving us well.

The provincial Medical Officer of Health and the Ministry of Health has a constant flow of information – we are informed at the federal level and the provincial level.

We are not informed at the Regional level.

The disease is now in Canada. It is being passed from person to person. That does not mean the ravages of the 1918 Spanish flu is about to overcome us – but it does mean things have changed and public behavior has to change.

The public expects leadership from the people who we have put in place to lead. The Medical Officer of Health is a critical part of protecting us. Saying nothing is just not acceptable.

In the event that the virus gets completely out of control what does the average uninfected person do?

What does a person who suspects they might be infected do?

What does a person who is infected do?

If there are say 100 people in the Region infected – what do we do?

Is there a plan in place?

We have plans for people to use recreational centers when the weather is sub-zero and dangerous to be out in.

The public is advised when there is a West Nile virus concern – the Gazette publishes those notices regularly as we do with an outbreak of measles.

Dr. Hamidah Meghani, Halton’s Medical Officer of Heath. The public has not heard a word from the Regional Medical Officer of Health on the COVID19 virus.

The public deserves better.

The Medical Officer of Health for the Wellington-Dufferin-Guelph Public Health board told a local newspaper in that community that “It’s more of a communication event than a medical event for us.”

The communications advisors at the Region said the Medical Officer of Health had no comment when the Gazette asked for a comment.

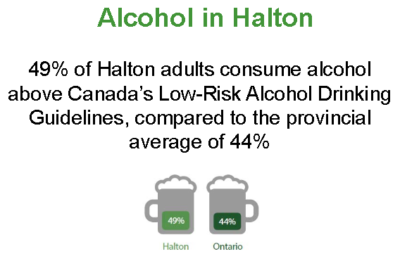

A report on Halton’s alcohol consumption took up more than 45 minutes during a Regional Council meeting The Regional Medical Officer of Health did advise Regional Council recently that Halton could well have a alcohol problem; the Regional rate of consumption is 5% higher than the provincial rate.

There is something wrong with the priorities.

Salt with Pepper is the musings, reflections and opinions of the publisher of the Burlington Gazette, an online newspaper that was formed in 2010 and is a member of the National Newsmedia Council.

By Ray Rivers By Ray Rivers

December 7th, 2018

BURLINGTON, ON

Our American neighbours tend to see Canada as that socialist state on their northern border. We do have single-payer health care in each province and there is a national broadcaster partially funded by the federal government. But we are a lot less socialist than we used to be back when our federal government used to run a national railway, our biggest airline and our very own oil company, Petro-Canada.

Today Canadian governments of all political persuasion agree that oil production is best left to the private sector. Except, we don’t leave it alone. Federal and provincial governments annually subsidize the oil sector by almost three and a half billion dollars – just under a hundred dollars for every man woman and child in the country. And that doesn’t include Mr. Trudeau’s recent purchase of the Trans Mountain pipeline. Today Canadian governments of all political persuasion agree that oil production is best left to the private sector. Except, we don’t leave it alone. Federal and provincial governments annually subsidize the oil sector by almost three and a half billion dollars – just under a hundred dollars for every man woman and child in the country. And that doesn’t include Mr. Trudeau’s recent purchase of the Trans Mountain pipeline.

Of course the governments spend tax dollars on a lot of things, like defence, education and health care, but mostly for services which are not for-profit. But business is supposed to be business, and no commodity is more market oriented than oil – just watch the daily fluctuation at the gas pumps. And note that, with annual profits into the billions, PetroCan and its partner Suncor are one of the biggest items on the Toronto Stock Exchange.

But the markets are telling us that the cost of producing oil in Alberta exceeds the value of that resource in the marketplace. Of course there is a glut of the stuff globally today and it’s now a buyers’ market. But while the best quality crude has dropped to as much as a third of its peak value of only a couple of years ago, oil sands bitumen is bottoming out at $10 a barrel.

Leasing rail cars – a lot of them are made in Hamilton. And even though a new pipeline or another 7000 rail cars would help move that oil to Asian markets where the price might be better, it’s still low quality oil and some of the most expensive to produce. So neither another pipeline nor more rail cars make economic sense as an investment. If they did wouldn’t industry have already taken care of that? In fact wasn’t lack of profitability behind Kinder Morgan blackmailing the federal government into buying its old pipeline.

Mr. Trudeau had no choice, politically, you might say but to buy that last pipe dream politicians east of the Rockies sleep on. He had to be seen helping an Alberta whose premier had embraced a carbon tax, among other things. Rachel Notley is acquiring some 7000 new rail cars for the same political reason. It’s something we call corporate welfare.

There is panic in the oil patch. So Notley, acting on a proposal from the non-socialist opposition parties, is also intervening in the market by winding down oil production, hoping for a better match with market demand and improved oil prices. It is probably a political set-up, staged by her opponents, hoping she’ll pay a price at the polls come next year’s provincial election. Then the odds are against her anyway.

Only zero emitting cars will be sold in B.C. after 2040. But the odds are also against the oil sands enduring. General Motors just closed its largest assembly plant in Canada, in Oshawa, claiming it’s crossed over to building electric vehicles. And that is a common theme by auto execs everywhere as they enter the growing movement to end the reign of guzzler. Only zero emitting cars will be sold in B.C. after 2040.

Long the target of the greenies everywhere, Barclays Bank shareholders have now demanded it pull its investments out of the ‘tar sands’. The plastics industry, the other main user of petroleum, is also under attack, particularly for single uses and packaging . There is this island of waste plastic the size of France in the middle of the Pacific ocean. And even in our once pristine Great Lakes plastic residue can be found in just about every fish species.

Of course prices will go up again before they go down again, and so on. Then, there are still millions of gasoline powered cars, gas heating appliances and so on. So the petroleum industry will not disappear over night, nor forever, as has Quebec’s deadly asbestos industry. But only a fool should want to put more money into expansion of the oil sands.

And guess what? The carbon tax is not to blame for the current crisis. Though Alberta has one, which is even more progressive that the one the feds will be implementing in most of the rest of Canada early next year. But then Rachel Notley gets it – unlike her fellow premiers immediately to the east of her. Besides she’s seen how Canada’s first carbon tax has worked out for her neighbour just across the Rockies.

BC has had its carbon tax for a decade now. But it hasn’t stifling the economy as Ontario’s Mr. Ford would mislead all the people of his own province. Quite the contrary, because or in spite of its carbon tax B.C.’s economy has been growing at a rate of 3.5% for the last four years. And the federal carbon tax is modeled on the one that pioneered in Lotus Land. Imagine what it might do for Ontario’s economy Mr. Ford!

Ray Rivers writes regularly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers Ray Rivers writes regularly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Background links:

Alberta Oil Crisis – Canada’s Fossil Fuel Subsidies – Buying Rail Cars –

Oil Cuts – Plastic Bags – Pipelines? –

Barclays – BC Zero Emissions –

By Staff By Staff

July 4th, 2018

BURLINGTON, ON

Wolseley Canada, a Burlington based leader in the wholesale distribution of plumbing, heating, ventilation, air conditioning, refrigeration, waterworks, fire protection, pipes, valves and fittings and industrial products has acquired AMRE Supply Company Limited (“AMRE”), a market leading supplier of plumbing, HVAC, appliance, electrical and property maintenance parts, equipment and supplies required by tradespeople, homeowners, service contractors and professional property operators.

Kevin Fancey, President of Wolseley Canada Inc. announced the acquisition of AMRE yesterday.

Kevin Fancey and Doug Swane cementing the Wolseley acquisition of – AMRE Wolseley has approximately 2,500 employees and over 220 locations coast to coast; their commitment to good corporate citizenship is reflected in their national sponsorship of Special Olympics Canada. The company has donated more than $3.1 million through corporate sponsorship and employee fundraising.

They are an active supporter of Habitat for Humanity.

Kevin Fancey, president Wolseley Canada Wolseley Canada’s parent company, Ferguson plc is the world’s largest trade distributor of plumbing and heating products and a leading supplier of building materials. Ferguson plc is listed on the London Stock Exchange (LSE: FERG) and on the FTSE 100 index of listed companies.

The AMRE operation is headquartered in Edmonton and has 12 “Property Performance Centre” locations across Canada in Richmond, Surrey, Edmonton, Calgary, Saskatoon, Winnipeg, London, Windsor, Hamilton, Mississauga and Scarborough.

AMRE celebrated 50 years of operation this year; over 200 AMRE employees will join Wolseley. AMRE president, Doug Swane, will join Wolseley as divisional president, AMRE Supply, and will lead the business.

AMRE and its branches will continue to operate under the “AMRE Supply” brand for the foreseeable future.

AMRE will build on 220 Wolseley locations across the country. AMRE president Doug Swane said “this , will enable us to expand our market reach and product offerings. Wolseley represents an excellent fit for all aspects of AMRE’s business, including a company culture with similar values and guiding principles.”

Wolseley got their name in the news last year when they annonced the signing of an agreement to collaborate with Vaughan, Ontario-based Drone Delivery Canada (DDC) on the potential implementation of a drone delivery solution focused on a customized depot-to-depot delivery as well as a depot-to-customer solution in Wolseley Canada’s supply chain. Wolseley got their name in the news last year when they annonced the signing of an agreement to collaborate with Vaughan, Ontario-based Drone Delivery Canada (DDC) on the potential implementation of a drone delivery solution focused on a customized depot-to-depot delivery as well as a depot-to-customer solution in Wolseley Canada’s supply chain.

If the testing and development are successful to the satisfaction of both parties, negotiations will proceed to form a definitive agreement once applicable government legislation is enacted.

Wolseley expects to be able to radically improve on-time delivery using a drone to make what is known as Beyond Visual Line of Sight deliveries

By Staff By Staff

December 7th, 2016

BURLINGTON, ON

Cogeco, the cable TV provider for Burlington, has had a two week run of good news.

They were recognized as a Community Builder at the Ontario Business Achievement Awards (OBAA) in Toronto.

That award celebrates large businesses whose community investments have yielded the greatest social return on investment. The Ontario Chamber of Commerce thus recognized the company’s good practices and its commitment to supporting the communities of the greater Ontario region.

Cogeco Connexion’s leadership in community engagement has been highlighted on numerous occasions in recent years. “So much so, that our community focus is now part of our DNA,” said Cogeco Connexion President, Ken Smithard.

Cogeco Cable live the Gala Opening of the Burlington Performing Arts Centre. Host Mark Carr and Mayor Rick Goldring prepare to go on camera. “We believe it’s a privilege and a responsibility to invest in the communities we serve. Cogeco Connexion has been part of Ontario’s and Canada’s economic landscape for nearly 60 years, contributing to key sectors of their economies. Today’s nomination by the Ontario Chamber of Commerce only confirms the importance of our organization in Ontario and reinforces our desire to exert and maintain a positive impact on the communities in which we operate,” added Mr. Smithard.

Community engagement is not a short-term commitment and with major yearly investments of

$2.5 million in Ontario alone, Cogeco Connexion continues to support numerous worthy community endeavours in the areas we serve. Through employee community engagement, direct investment, sponsorships and donations, Cogeco Connexion’s leadership team is driven by the desire to prove it’s possible to sustain economic viability while helping those in need. “And we do so while continually innovating and offering amazing experiences that are developed and delivered locally by our talented and dedicated employees,” concluded Mr. Smithard.

Parks and Recreation Manager Denise Beard tapes a program for Cogeco TV. For over 30 years, the OBAAs have recognized and celebrated Ontario’s business success stories. As one of the most prestigious business awards in Ontario, the OBAAs recognize the achievements in innovation, entrepreneurship, integrity and hard work of businesses operating in Ontario.

Getting a prestigious award was good positive news – launching its UltraFibre 1Gig service, that will allow its customers in Oakville and Burlington to benefit from speeds of up to 1 gigabit per second is good news for their customer base.

This announcement is the result of a series of investments in infrastructure upgrades carried out by Cogeco over the past months. Starting in several areas in Burlington and Oakville, Cogeco Connexion will continue expanding its ultra-high speed offering in successive phases in the Ontario and Québec markets where it provides services.

“Today, Cogeco Connexion is making a commitment to the communities it serves, enhancing its high-speed Internet offering to help power economic growth and development for businesses and residents,” stated Ken Smithard, President, Cogeco Connexion. “As we have always made our customers’ needs the primary focus of our priorities and decision-making process, today’s announcement is also further evidence of our unwavering commitment to offering our clients an amazing experience and helping them navigate evolving technology.”

Cogeco’s popular At Issue program features Host Mark Carr, Casey Cosgrove, Che Marville, former Burlington Mayor Walter Mulkewich and Burlington lawyer Brian Heagle “With online entertainment usage growing exponentially, the proliferation of connected devices and increased home office broadband needs, our Internet customers’ current appetite for speed is definitely trending upward,” asserted Daniel Boisvert, Vice President, Marketing & Innovation. “Demand for ultra-high speeds represents a market with considerable potential, and we’ve chosen to respond to it. We are proud to enhance our customers’ online entertainment and to offer them a suite of ultra-high speed Internet services with our new UltraFibre 1Gig service.”

Cogeco Connexion is launching this service to prepare for the ultra-connected homes and businesses of the future, thanks to a powerful hybrid network consisting of coaxial cable (HFC) and 11,000 km of linear fibre running from Windsor, Ontario to Gaspé in Québec.

“Upgrading our current broadband network to enable speeds well beyond 1 gigabit is possible with the DOCSIS Evolution path and Cogeco Connexion Fibre-to-the-Home (FTTH)/EPON technology,” explained Michel Blais, Vice President, Engineering and Operations. “As we continue to leverage our networks, we will keep pace with our customers’ needs. We will see to it that our customers have the right bandwidth speed and equipment, wireless technologies and service to optimize their online enjoyment.”

Mayor Rick Goldring and Cogeco TV host Mark Carr prepare for a live broadcast from city hall’s Council Chamber Cogeco now has 2,550 employees and is the third largest employer in Burlington. The company offers video, high-speed Internet, telephony, fibre-based data and voice transmission, and cloud-based applications for businesses.

They have 11,000 km of linear optical fibre between Windsor, Ontario and Gaspé, Québec

COGECO TV is operated in Quebec where there are 15 stations and 22 in Ontario, with close to 1,000 volunteers)

Cogeco is the second largest cable operator in Ontario and Québec in terms of the number of basic cable service customers served.

In the United States Cogeco operates through its subsidiary Atlantic Broadband in western Pennsylvania, south Florida, Maryland/Delaware, South Carolina and eastern Connecticut.

Through Cogeco Peer 1, Cogeco Communications Inc. provides its business customers with a suite of information technology services (colocation, network connectivity, hosting, cloud and managed services), through its 17 data centres, extensive FastFiber Network® and more than 50 points of presence in North America and Europe. Cogeco Communications Inc.’s subordinate voting shares are listed on the Toronto Stock Exchange (TSX: CCA).

By Pepper Parr By Pepper Parr

April 7, 2015

BURLINGTON, ON

Our interview with Dave McPhail took a little longer than we expected – McPhail was hunched over his keyboard “developing his relationship” with Cisco in a conference call.

Dave McPhail walking past some of his commercial peers as he prepares to show off the technology his firm markets. Throughout the conversation phrases like “tribal knowledge” and “the “embedded data dictionary” were tossed around. McPhail talked about “product aggregation” and how he was taking data and information from the shop floor and putting it in front of senior management in real time – when there was a problem, management knew about the problem when it was happening.

Instead of the engineering department in a large manufacturing operation having to wait until reports that got to them the following day or at the end of the shift – they were now able to head out to the shop floor and fix the problem immediately.

Memex, a company that McPhail bought out of receivership and brought in John Rattray as an operating partner along with two silent partners who have since been bought out. They set out to first create a product that didn’t exist before and then market it by establishing partnerships with corporations that had clout and brand recognition which would give Memex a lead that would be hard to catch up to.

Memex isn’t disrupting an existing market – they are creating something that didn’t exist before

McPhail isn’t giving his clients all that much in the way product – what he is doing is giving them tools that allow them to capture data in real time and put it to use immediately.

This says McPhail is a significant cultural shift in manufacturing. McPhail claims to be able to give his clients a return on capital in three to four months – a time frame that astounds many and they don’t take the time to listen to us. The hope for McPhail and the rest of the Memex team is that there are enough early adopters to keep them alive. At some point we will become the standard.

McPhail doesn’t have an MBA, isn’t a university graduate. He earned a diploma from Humber College and set out to do what every entrepreneur does – create wealth.

Memmex president Dave McPhail explains what Merlin, an electronic device can do for manufacturing operations. The Gazette first met McPhail when he was playing host to MP Mike Wallace who was announcing an $800,000 loan to the company as part of the federal government program.

Memex is a public company traded on the Venture side of the Toronto stock Exchange. Senior management recently issued 1.25 million options to its five member senior management team.

The company refers to the M2M (machine to machine) productivity software they provide as Merlin; it is used by a number of leading manufacturers. The market we are creating is worldwide said McPhail

One of the pleasures for McPhail is the McMaster University DeGroote campus on the south Service Road – a five minute drive from McPhail’s operation on Harvester Road. The plans to create a technological hub on campus where products can be shown to clients is a real plus for McPhail.

We have all kinds of case studies but when someone can see in real time what we do – that’s a big plus and if McMaster can make this idea of theirs work – we are with them.

Memmex announced half a million in sales during the first quarter of 2015 – they have a stock price that ranges between five to twenty cents a share – always well above a dime a share.

Dave McPhail with a version of Merlin in his hands – the device that captures data real time and delivers it to senior management who can make instant decisions. Memex was founded in 1992 with a vision to improve the way automated machine tools work and connect on the factory floor. McPhail bought it out of receivership and has brought it to the point where they are at least contenders in the market they are working.

The company started manufacturing electronic circuit boards for memory and connectivity and evolved into Memex Automation. The vision has expanded to include the networking of all machine tools so that they can communicate with the computers in the administration office. At some point the network may be extended to the Internet, allowing productivity and other statistics to be emailed to a device, or computer anywhere in the world.

Getting to the point where they can issues stock options to the senior management team was not easy. McPhail gives the Niagara One Angel Investors group a huge thanks for their early support and tells you what every entrepreneur says: Canadians don’t take out their cheque books as easily as Americans – we are a risk adverse country and McPhail thinks we are paying a price for our complacency. Getting to the point where they can issues stock options to the senior management team was not easy. McPhail gives the Niagara One Angel Investors group a huge thanks for their early support and tells you what every entrepreneur says: Canadians don’t take out their cheque books as easily as Americans – we are a risk adverse country and McPhail thinks we are paying a price for our complacency.

Meanwhile McPhail plugs away at what he loves doing – improving the way manufacturing operations can access and use the data that is sitting out there on the shop floor and put in the hands of people who know what to do with that information.

Machine learning: taking the data that is collected from a machine and running it through an algorithm is the next step in the manufacturing learning curve that McPhail sees as part of the Memex product service offering.

The federal loan is going to allow Memex to hire an additional 16 people. We have very good working relationships with Mohawk College and the University of Waterloo – we bring in students from their co-op program said McPhail – most of them work out very well.

85% of the market Memex is outside Canadian borders – and not just south of the border – this is a worldwide manufacturing opportunity. We intend to own the market before others realize just what we are doing” said McPhail. The words of a committed serial entrepreneur.

The Burlington Performing Arts Centre will appear before a Council committee next week and detail their budget projections for the next fiscal year and explain their business plan for the next few years as well.

The BPAC, a project that is the pride of many in the city or one of those “nice to have but not necessary” for others, depending on which side of the cultural divide you have chosen to sit on, is getting close to Opening Day. The staffing compliment is growing as they get ready to market and promote programs for the fall season and at the same time keep public anticipation as high as possible.

This is the look the Performing Arts Centre wants to take to the community in its branding, advertising and promotional material.

This is the look the Performing Arts Centre wants to take to the community in its branding, advertising and promotional material.

As part of the pre-launch process the centre released a new “brand” that will be used in all its marketing initiatives. Graphics are thing you either like or don’t like – here is what the Centre is going forward with.

Past chair Keith Strong has explained that the Centre is going to go for what he calls a “soft opening’ which will have the community able to tour the building and get a sense of what has been built and showcase the opportunities and the potential.

Almost a little too much resemblance between the Mental Health Association logo and that chosen by the Performing Arts Centre. Is there a hidden intention here?

Almost a little too much resemblance between the Mental Health Association logo and that chosen by the Performing Arts Centre. Is there a hidden intention here?

The decision was made not to open with a loud, expensive boffo event but to let the community warm up to the space with events that are low key and not all that expensive.

The 12 member Board for the Centre (with the Mayor as an Ex officio member) is in place and is made up of:

[box type=”shadow”]

Chairman Allan Pearson

Allan was born in Hamilton and has lived in Burlington for most of his life, having grown up in the downtown core. He has been in the automobile business since 1976 and is President of Discovery Ford Sales in Burlington.

Allan has served on the Ford of Canada Roundtable, is a former Board member and past Chair of the Board at Wellington Square United Church and currently sits on the Board of Trustees. Allan is a past Board member and Board Chair of the Burlington Community Foundation. He is current Vice-Chair of the Canadian Ford Dealer Pension Board of Trustees, and sits on the Board of Directors for the Carpenter Hospice. Allan has completed the DeGroote School of Business/United Way not-for-profit governance workshop.

Vice Chair Rick Burgess

Rick is a business lawyer based in downtown Burlington. He is an Instructor-Business and Labour Law, Niagara and Sheridan Colleges; Mediator & Group Facilitator; Instructor-Negotiation / Mediation / Dispute Resolution. From 1980 to 1989 Rick was a business lawyer in Toronto. He has been a member of Ontario & California bar associations since 1980.

Rick’s community involvement includes:

- Past Chair, Burlington Community Foundation Board (2009-2010)

- Past Vice-Chair and Member, Halton Regional Police Services Board (2005-2010)

- Past Chair, Burlington Chamber of Commerce

- Past President, Creative Burlington (2008-2009)

- Past President, Burlington Art Centre (2002-2004)

- Burlington Art Centre Foundation Board (2004-2005)

Rick has lived in Burlington since 1992 with his wife, Brenda Bowlby, who is also a lawyer, and their daughter Lindsay, who attends university.

Keith Strong

Keith has resided in Burlington for the last 42 years. He moved to Burlington as an employee of Windsor Salt which later resulted in being employed by Metasurf Canada. In 1970 Keith purchased a small mobile wash in Hamilton and has been self employed from that time. In 1985 Keith designed and built the first totally enclosed hazardous waste transfer site and instituted the first permanent household hazardous waste location in Ontario. In the late 80’s Keith sold his business to Laidlaw. Over the last 15 years Keith has helped small business to grow and expand. The remaining of his time has been spent giving back to the Burlington community. Keith has a daughter Terra and a son Scott both married, living in Oakville raising their families.

Philippe Pango

Dr. Philippe Pango’s inventions and technologies have been successfully implemented in millions of wireless Bluetooth headsets, hearing-aids and ground penetrating radars throughout the world. A long time resident of Burlington, Dr. Pango’s career started as a Senior Design Engineer for Gennum Corporation, where he was instrumental in the company’s transition to digital hearing aid technology. In 2006 he launched his first start up, CAYCe, in partnership with McMaster University. Dr. Pango is currently the Chief Technology Officer of Vitasound Audio Inc., where he oversees the research and development of advanced audio processing technologies, including hearing aids and hearing protection devices. An avid musician, Dr. Pango understands the importance of arts in a perfectly balanced life, and its positive impact on a community. He plays electric and acoustic guitar, five-string bass, piano, organ, djembé percussion, sings in a choir that promotes the African culture throughout the Halton region, has authored two novels, and claims to be unbeatable at tennis.

Mary-Ellen Heiman

Mary-Ellen’s professional background includes skills in building strong relationship amongst volunteers, staff, major donors and business partners. She has held positions in the direction of the performing arts sector as Chair of the Board, and board member, for the St. Lawrence Performing Arts Centre in Toronto, with direct reporting to the City of Toronto. She has also been a consultant to various music, drama and heritage organizations. Mary-Ellen has also worked in the visual arts sector as Executive Director of a public non-profit art gallery. Through these roles she has distinguished herself as a strategic planner and partnership builder with strong Board of Joseph Brant Hospital.

Presently, Mary-Ellen is the Director of Development and funding for the Canadian Centre of Emergency Preparedness. In her previous consulting career, she was a consultant in needs analysis, strategic planning, promotional enhancement, program design and board development. Mary-Ellen’s skills include partnership building, workflow analysis, communication methodology and organizational change, with direct experience in marketing, governance, sponsorship and grant funding, financial and event management. Mary-Ellen has completed the DeGroote School of Business/United Way not-for-profit governance workshop.

Dominic Mercuri

Dominic is a leader in financial services marketing and is currently the Executive Vice President and Chief Marketing Officer for TD Bank Financial Group. In this capacity Dominic leads a global marketing team and is responsible for the bank’s overall market positioning, and oversees the development and execution of TD’s global marketing and brand strategy. Dominic, his wife Carol, and their children Jennifer and Frank have lived in Burlington since 1995. He is also a member of the Joseph Brant Memorial Hospital Foundation Board.

Ed Hannah

Ed Hannah was born in Collingwood, raised in Hamilton and has lived for the past 18 years in Burlington. Ed is a graduate of Yale University (B.A.); York University (M.B.A.); Osgoode Hall Law School (LL.B.); and Harvard Law School (LL. M.).

Ed has spent 22 years of his 27-year professional career as a lawyer at Davies Ward Phillips & Vineberg, LLP (Toronto) where he currently practices law, specializing in Corporate/Commercial Law, Mergers and Acquisitions, Structured Finance and Corporate Governance.

Ed has also been a Senior Vice-President of Score Media Inc., a Toronto Stock Exchange-listed public company, and Executive Vice-President, Corporate Development and General Counsel for Magna Entertainment Corp. and its parent corporation, MI Developments Inc., both public companies cross-listed on U.S. and Canadian stock exchanges. Ed has served on several public company and charitable boards of directors.

Ilene Elkaim

Ilene Elkaim, a Burlington resident since 1994, recognized for a distinguished career in Logistics and Information Systems for Retail Administration and Operations, founded Six Dynamix in 2005. Six Dynamix partners with small to mid-sized retail or wholesale organizations enabling them to improve efficiencies in their business processes. She has developed an effective process of working collaboratively with their clients to optimize administration and operations during all economic times, including software selection and implementation.

Ilene is also an active thespian within the Hamilton/Halton area since 1996. Her involvement includes acting, back stage activities as well as having been an active participant on various Boards, including The Aldershot Players and Performing Arts Burlington (now known as Creative Burlington).

Ilene looks forward to joining forces with her fellow board members and management to make constructive, progressive contributions for the Burlington Theatre Board Inc.

Mayor Rick Goldring (Ex-officio)

On December 1, 2010 Rick Goldring was sworn into office as the City of Burlington’s 28th Mayor, after serving four years as Ward 5 City & Regional Councillor. A lifelong Burlington resident, Rick went to Nelson High School and earned his BA (Economics) from McMaster. He lives here with his wife, Cheryl, and they have a combined total of seven daughters.

Having been in business locally for 30 years, most recently as a senior financial advisor with Assante Financial Management Ltd., Rick has always been actively involved in community affairs. In addition to co-hosting Taking Care of Your Future on TV Cogeco, Rick is a member and past president of the Hamilton Chapter of Advocis – Canada’s largest association of financial advisors. Rick is a Rotarian, and has also been on the Board of the Ron Edwards (Burlington) Family YMCA and the Burlington Chamber of Commerce. As City and Regional Councillor for Ward 5 in Burlington, he chaired both the Budget and Strategic Planning and the Community Services Committees.

Rick is passionate about his community and plans to address major concerns during his term including sustainable development, environmental issues and fiscal responsibility.

Peter Ashmore

Peter Ashmore has lived in Burlington for over 20 years with his wife Marla and their two children both who are now attending university. He is a principal in MLA Enterprises Inc. an investment holding company. Peter is a member of the Burlington Theatre Board and Chair of its Finance Committee. He has been involved with the Fundraising Campaign Cabinet for The Burlington Performing Arts Centre and the Performing Arts Centre Board Development Task Force. Peter is currently President of the HoliMont Ski Club: a 1400 member not for profit club located in Ellicottville, New York. He has served on the Joseph Brant Memorial Hospital Foundation Board where he held the position of Treasurer. He was also active in the development of the Triathlon Club of Burlington were he remains as director.

Denise Walker

Denise Walker has been an entrepreneur for the past twenty-five years. She started High-Q Computer Education where she taught various software applications to small businesses. Her business has evolved into doing contract work, which includes event planning, client appreciation, business data analysis and marketing support. She is currently working at Lakeshore Clinic and CIBC Wood Gundy in Burlington. Denise started as a member of the Burlington Performing Arts Centre Fundraising Campaign Cabinet for more than 5 years, and is now a member of the Burlington Theatre Board Inc. Denise is also currently the Fundraising Chair.

Denise is passionate about the project and is currently working on completing the 11 million dollar Capital Campaign.

Denise is a Wilfrid Laurier Graduate with a degree in Economics.

She was born in Montreal, but has been a Burlington resident for 41 years. Denise and her husband Kevin have three children; one doing postgraduate studies and two in university. Denise has completed the DeGroote School of Business/United Way not-for-profit governance workshop.

Steve Zorbas

Steve Zorbas is currently Acting General Manager of Development and Infrastructure for the City of Burlington, Ontario, Canada. At the City of Burlington he has also held the positions of Acting Director of the Parks and Recreation Department and Executive Director of the Finance Department. He has over 27 years financial experience within local government, which have included the Town of Richmond Hill and the City of Mississauga. Prior to entering local government he also worked in the private sector in various financial positions in both the retail and manufacturing environments.