By Staff

By Staff

March 31, 2014

BURLINGTON, ON.

Each year the province requires municipalities to publish a list of all those who earn more than $100,00 annually. The data is presented as the salary paid and benefits given that are taxable.

Burlington civil servants were given a 1% salary increase in the 2014 budget.

Councillor Marianne Meed Ward brought a motion to Council that was approved asking the city manager to look into the free parking and free transit passes that are given city employees. Meed Ward is of the view that this benefit is taxable and should be treated as such.

The first figure shown after each name is the annual salary, the second is the taxable benefit.

ADCOCK ALAN Firefighter $102,172.28 $487.27

ALDHAM JUDY Field Services Supervisor $104,070.38 $2,225.26

ALLDRIDGE BRIAN Platoon Chief $124,140.31 $649.80

ANTONIOW PHIL Manager of Program Development, Budgets and Contracts $112,680.32 $622.77

AXIAK ROB Manager Facility Operations and Special Projects $105,876.99 $552.03

BAKOS MICHAEL Captain $108,247.81 $571.12

BARRY PHILIP Captain $108,610.77 $573.86

BAVOTA ANTHONY Fire Chief $157,572.65 $1,906.95

BAYLOR MARK Captain $110,816.79 $570.96

BAYNTON STEVE T. Captain $111,727.68 $586.64

BEATTY DAVID N. Fire Chief $105,836.89 $3,409.68

BEDINI CHRIS District Supervisor $105,298.61 $662.70

BENNETT RANDY Manager of Information Technology Infrastructure and Operations $117,305.77 $640.34

BENNITT JAMES District Supervisor $101,209.87 $764.12

BERDAN MICHAEL Transit Supervisor $103,954.97 $456.07

BIELSKI BIANCA Manager of Development Planning $131,198.38 $739.08

BIRCH CHARLES T. Captain $112,490.88 $585.12

BLACK JEFFREY Manager of Field Services $105,641.57 $3,398.73

BOYD LAURA Human Resource Manager $106,215.06 $590.76

BRILLON SYLVAIN Firefighter $100,870.86 $484.09

CAUGHLIN DEBORAH Manager of Council Services $104,747.58 $582.24

CHOLEWKA CHRIS Captain $107,542.24 $564.00

CLARK CARY Manager of Development and Environmental Engineering $109,618.58 $550.80

COULSON ANN MARIE Manager of Financial Planning and Taxation $133,138.56 $702.66

CRASS JOHN Manager of Traffic Services $106,854.96 $599.16

DI PIETRO ITALO Manager of Infrastructure and Data Management $118,340.36 $655.44

DONATI DERRICK Firefighter $101,799.93 $495.31

DOWD TIMOTHY Captain $117,192.97 $585.12

DUNCAN JOHN Transit Manager $120,963.15 $1,069.52

EALES MARK Captain $106,407.96 $559.95

EICHENBAUM TOOMAS Director of Engineering $165,413.29 $877.56

EVANS FRANCES Manager Halton Court Administration $104,071.88 $575.45

FIELDING JEFF City Manager $249,940.24 $8,898.60

FIORAVANTI LEANNE Solicitor $105,949.26 $510.32

FORD JOAN Director of Finance $153,457.30 $838.93

FRYER E. TODD Firefighter $101,929.55 $519.12

GLENN CHRISTOPHER Director of Parks and Recreation $132,997.91 $731.28

GLOBE DARREN Captain $107,508.37 $573.49

GOLDRING PATRICK Mayor $168,155.78 $2,511.56

GRISON GREGORY J. Captain $111,727.66 $585.74

HAMILTON SCOTT Manager Design and Construction $111,514.22 $618.78

HAMMER CHAD Firefighter $101,951.54 $493.89

HAMMOND BILL Fire Training Supervisor $107,840.61 $562.56

HART TIMOTHY Firefighter $103,027.20 $492.49

HAYES DENNIS M. Platoon Chief $127,478.73 $617.46

HEBNER PETER B. Captain $114,146.11 $585.12

HURLEY BLAKE Assistant City Solicitor $134,557.07 $644.83

JAMES MICHAEL Training Officer – Fire $102,489.52 $570.96

JONES SHEILA City Auditor $123,574.30 $664.26

JONES STEPHEN Captain $107,384.25 $550.83

JURK ROBERT Senior Project Leader $105,261.62 $581.57

KEANEY THOMAS Firefighter $100,775.57 $486.09

KELL DONNA Manager of Public Affairs $114,486.31 $630.35

KELLY JOHN Captain $110,246.84 $579.30

KIPPEN MARK Firefighter $100,628.48 $496.85

KOEVOETS MATT District Supervisor $106,906.64 $1,394.19

KRUSHELNICKI BRUCE Director Planning and Building $160,581.87 $891.60

KUBOTA ERIKA Assistant City Solicitor $134,346.99 $644.86

LAING BRUCE K. Captain $111,727.68 $585.12

LAPORTE N. JASON Captain $109,433.52 $571.25

LASELVA JOHN Supervisor Building Permits $103,581.39 $578.01

LONG MARK Captain $114,237.26 $591.85

MACDONALD GARY F. Captain $111,727.68 $585.12

MACKAY MICHAEL J. Captain $111,727.68 $587.71

MAGI ALLAN Executive Director of Corporate Strategic Initiatives $172,840.24 $967.56

MALE ROY E. Executive Director of Human Resources $182,946.28 $1,012.56

MARTIN CHRISTOPHER Captain $108,414.44 $553.46

MATHESON JAMIE Firefighter $100,671.68 $492.84

MCNAMARA MICHAEL J. Captain $112,644.56 $585.12

MERCANTI CINDY Manager of Recreation Services $113,175.87 $568.20

MINAJI ROSALIND Coordinator Development Review $100,370.93 $560.67

MONTEITH ROSS A. Deputy Fire Chief $136,019.93 $1,601.85

MORGAN ANGELA City Clerk $140,406.98 $753.15

MYERS PETER R. Captain $111,727.67 $593.09

NICELIU KENNETH Firefighter $104,681.45 $514.61

NICHOLSON J. ALAN Captain $111,727.68 $585.12

O’REILLY SANDRA Controller and Manager of Financial Services $113,228.22 $591.60

PEACHEY ROBERT Manager Parks and Open Space $111,558.40 $623.32

PHILLIPS KIMBERLEY General Manager $212,612.61 $8,730.36

POLIZIANI MATTHEW Captain $107,950.52 $557.81

REILLY PETER Captain $114,474.01 $589.90

ROBERTSON CATHARINE Director of Roads and Parks Maintenance $146,163.10 $1,304.38

SCHMIDT-SHOUKRI JASON Manager of Building Permit Services and Chief Building Official $135,620.24 $738.61

SHAHZAD ARIF Senior Environmental Engineer $100,995.97 $560.26

SHEA NICOL NANCY City Solicitor $168,958.55 $814.29

SHIELDS LISA Assistant City Solicitor $134,626.43 $638.32

SLACK CRAIG D. Platoon Chief $128,234.10 $649.80

SMITH CLINT Platoon Chief $127,352.17 $649.80

SMITH SIMON Firefighter $100,129.68 $498.05

SPICER MIKE Director of Transit $134,021.48 $708.84

STEIGINGA RON Manager of Realty Services $113,120.85 $618.84

STEVENS CRAIG Senior Project Manager $101,835.28 $570.98

STEWART SCOTT General Manager $217,635.03 $10,462.48

SWANCE JEFFREY W. Captain $111,727.67 $585.12

SWENOR CHRISTINE Director Information Technology Services $163,040.20 $861.42

TAGGART DAVID Manager Facility Assets $111,045.99 $610.32

THANDI JAZZ Manager Procurement Services $101,688.67 $561.61

VRAKELA STEVE Field Services Supervisor $101,325.60 $1,691.68

WEBER JEFF Deputy Fire Chief $139,961.19 $5,933.10

WHEATLEY RYAN Captain $110,407.44 $570.96

WIGNALL T. MARK Firefighter $102,867.06 $512.74

WINTAR JOSEPH Chief Fire Prevention Officer $110,934.32 $621.60

WOODS DOUGLAS S. Captain $112,106.48 $585.12

ZORBAS STEVE General Manager $167,678.00 $923.12

ZVANIGA BRUCE Director of Transportation Services $145,292.33 $775.86

By Staff

By Staff Registrations must be received by the clerks department no later than noon on Feb. 10, 2015.

Registrations must be received by the clerks department no later than noon on Feb. 10, 2015.

By Pepper Parr

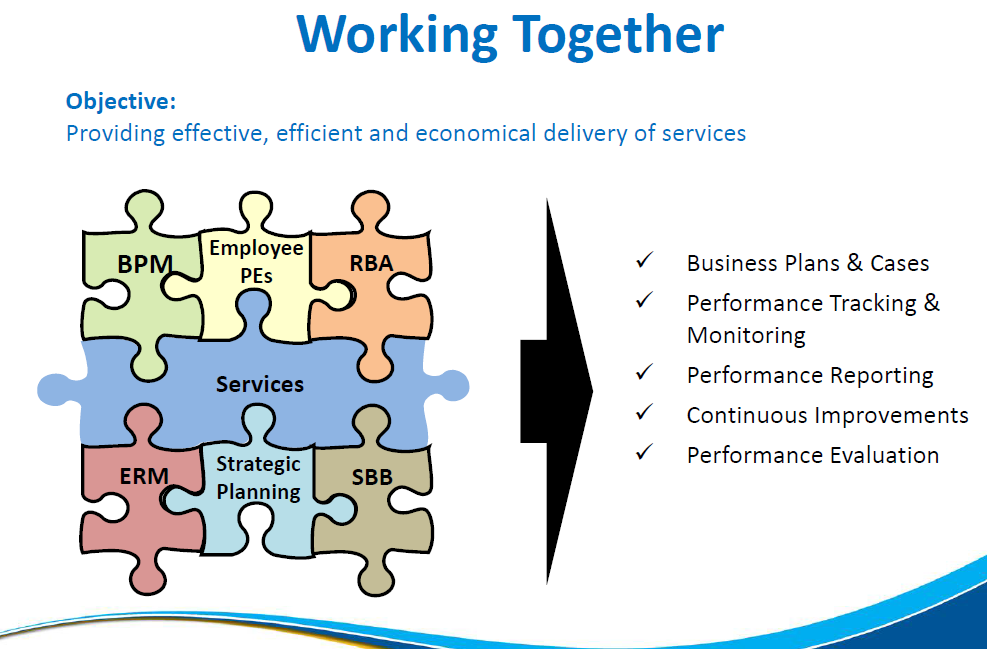

By Pepper Parr There are a number of Business Cases made for increased funding, which is included in the draft budget.

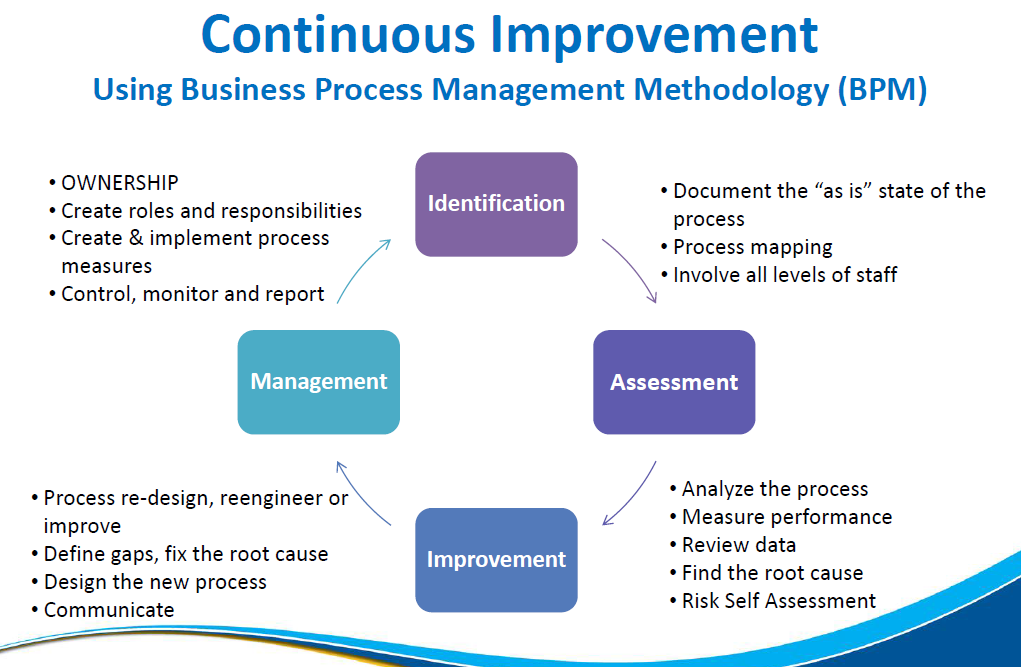

There are a number of Business Cases made for increased funding, which is included in the draft budget. Giving the obstreperous tone at the last Council meeting – the budget deliberations could be tense. Councillor Taylor who referred to members of Council as the “gang of four” will chair the budget deliberations which begin on January 12th with a Community and Corporate Services Committee meeting where an Overview and a review of the 2015 proposed current budget.

Giving the obstreperous tone at the last Council meeting – the budget deliberations could be tense. Councillor Taylor who referred to members of Council as the “gang of four” will chair the budget deliberations which begin on January 12th with a Community and Corporate Services Committee meeting where an Overview and a review of the 2015 proposed current budget.

The Panel will meet over two full Saturdays on January 17 and January 31. The Panel will also meet on the evening of Wednesday, January 21 for a special Public Roundtable Meeting to which all Halton residents are invited.

The Panel will meet over two full Saturdays on January 17 and January 31. The Panel will also meet on the evening of Wednesday, January 21 for a special Public Roundtable Meeting to which all Halton residents are invited.  Starting in 2015, the city is using a new system to budget and has 24 public services and 13 internal services to help provide efficient, effective services to the community. Those services include road and sidewalk maintenance, fire protection and transit.

Starting in 2015, the city is using a new system to budget and has 24 public services and 13 internal services to help provide efficient, effective services to the community. Those services include road and sidewalk maintenance, fire protection and transit.

Councillor Sharman was both direct and blunt.

Councillor Sharman was both direct and blunt. Susan Lewis a consistent transit user, she doesn’t drive, was asked to join the Transit Advisory committee and headed downtown in January

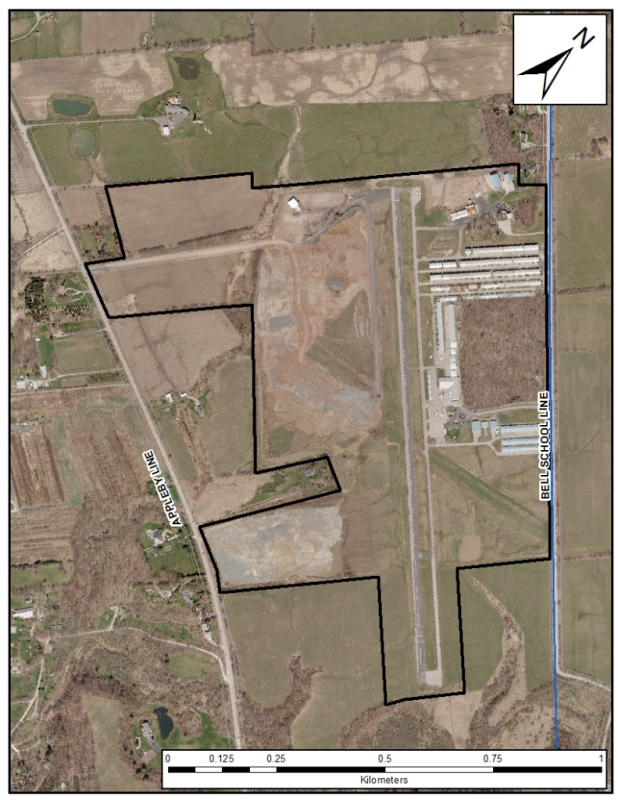

Susan Lewis a consistent transit user, she doesn’t drive, was asked to join the Transit Advisory committee and headed downtown in January  Back to those mobility hubs and the John Street terminal.

Back to those mobility hubs and the John Street terminal.

The number represents an increase of 3.5% which over the term of this council totals 10.13% over the four-year term – slightly higher than the 10% the Mayor went on record with.

The number represents an increase of 3.5% which over the term of this council totals 10.13% over the four-year term – slightly higher than the 10% the Mayor went on record with. This year there was very little, if any, mention of “shave and pave” that process we use to keep the cost of maintaining our roads manageable.

This year there was very little, if any, mention of “shave and pave” that process we use to keep the cost of maintaining our roads manageable.