By Pepper Parr By Pepper Parr

November 2nd, 2021

BURLINGTON, ON

Taxes are about politics – good government service comes after that.

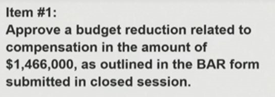

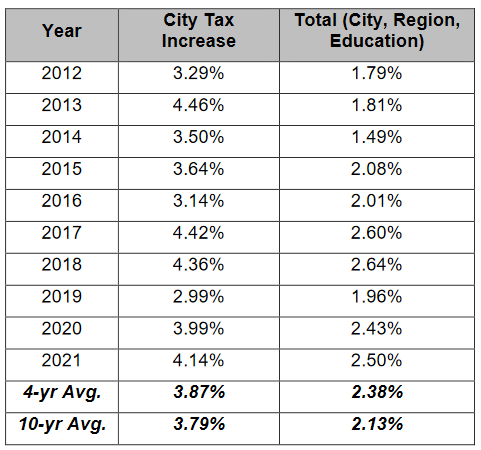

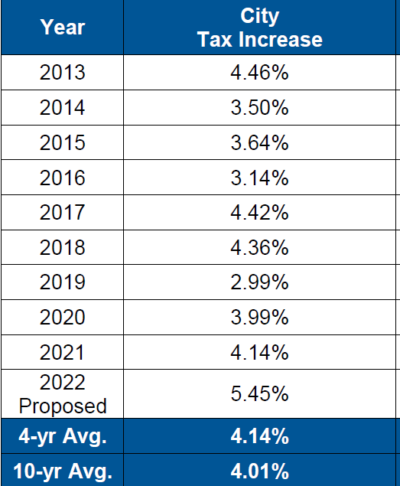

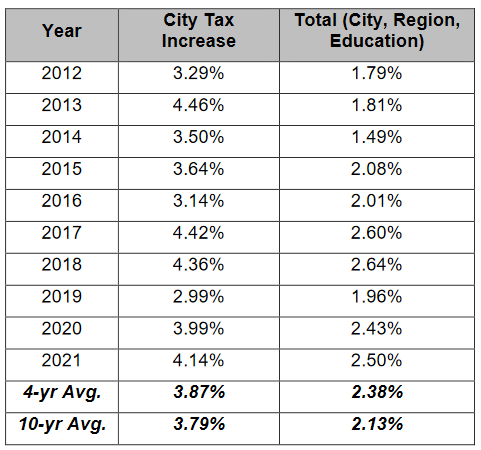

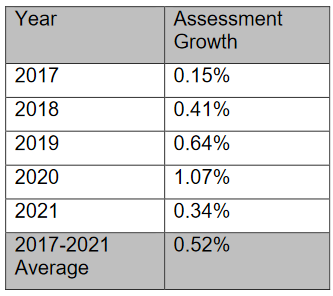

The four year average amounts to 4.14% – nothing to brag about but with inflation hitting that level – might it be acceptable? You get elected when you lower taxes and fake the delivering of service as best you can.

Burlington changed the way and frequency that it collects leaves and then citizens fight like crazy with those who want to cut down the trees so they don’t have to rake them up or they want to put in a swimming pool.

In the fourth year of a term of office the practice is to lower taxes just enough to show that you care and add a service or two that doesn’t cost all that much,

Some will argue that COVID19 changed those practices.

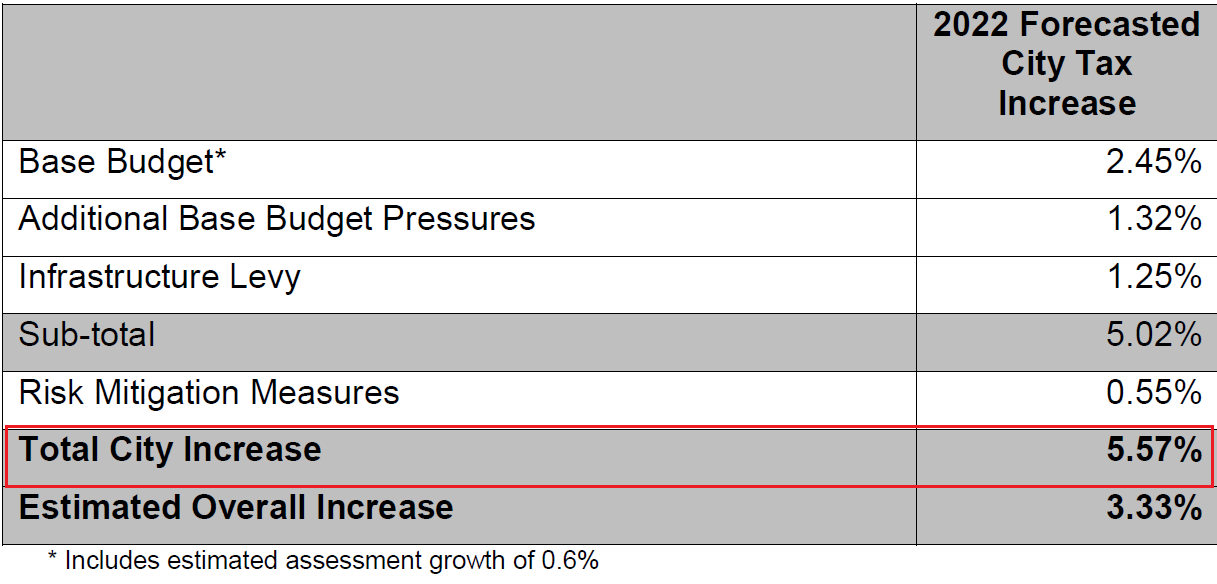

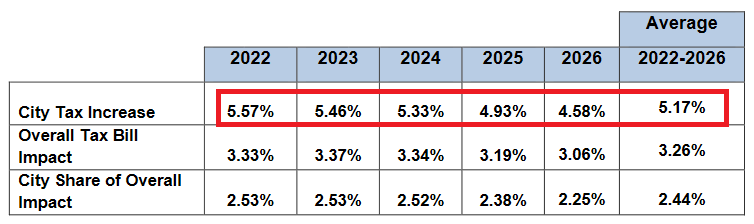

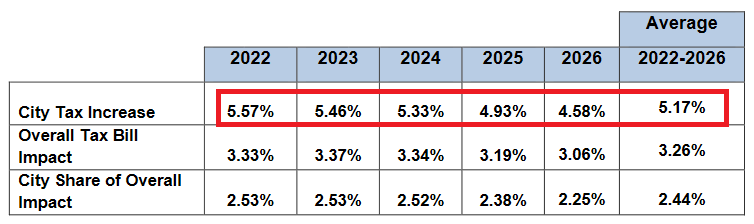

When the public sees just how much money the city got from the federal and provincial governments they will wonder why taxes are predicted to increase by 5.45% over last year.

The four year tax run for the current council is not encouraging. Is this a tax and spend government?

Too early to tell.

Sharman will experience some indigestion … Mayor in waiting Paul Sharman will tell you, even if you don’t ask, that during his first year as a member of Council he pushed for a 0% increase – and got it.

Sharman will experience some indigestion over the Mayor in Waiting title; he’s not modest – just strategic.

How the rest of council are going to explain the increase will be interesting to watch.

Mayor Marianne Meed Ward. was seen as unbeatable when she ran for Mayor the first time – has the music changed? Will a budget be her undoing? The Mayor has already staked out her position – the budget they will be looking at on Wednesday is a “staff wish list” – that’s what the Mayor is reported to have said during her CMHL 15 minutes of fame bit last week.

During this four-year period, the city’s budget included the 1.25% infrastructure levy to direct towards the growing infrastructure funding gap while at the same time provided significant investments in Transit, By-law Enforcement and Forestry.

Add to the mix interest former Mayor Rick Goldring has shown in matters civic. This could be very interesting.

By Pepper Parr By Pepper Parr

November 2nd, 2021

BURLINGTON, ON

Work to determine the City of Burlington’s 2022 budget continues. An overview of the budget will be presented to Council at a virtual Corporate Services, Strategy, Risk and Accountability Committee meeting on Wednesday, Nov. 3 at 9:30 a.m. The overview will include a look at the proposed 2022 operating budget as well as the 2022 capital budget and forecast.

Key areas of focus for the proposed 2022 budget

Each year, during the City’s budget process, decisions are made to ensure an appropriate balance between affordability, maintaining service levels and financial sustainability over the long term.

The proposed 2022 budget focuses on:

- Mitigating the financial impacts of COVID-19

- maintaining service levels

- ensuring city assets are maintained in a good state of repair

- continuing to provide strategic investments aligned to the City’s work plan, 2018 to 2022: Vision to Focus

- upholding legislative requirements while ensuring competitive property taxes.

Proposed capital budget

The proposed 2022 capital budget is $77.3 million, with a ten-year program of $829.5 million. From this total:

- 68.5% is for infrastructure renewal

- 15.1% goes towards growth-related projects

- 12.8% is for new/enhanced projects

- 3.6% goes towards green projects which support the City’s climate goals.

Proposed operating budget

The proposed 2022 operating budget is $284.8 million and includes new funding to support:

- Sustaining city services ($685,333)

- Additional funding for on-going recreation facility maintenance to meet lifecycle requirements and reduce risk

- One-time funding to support a Gypsy Moth spraying program in 2022

- One-time funding to extend the contracts of two bylaw officers

- Enhancing services ($199,130)

- Funding to make the free transit for seniors pilot a permanent program

- Operating expenses to support the new Orchard Community Hub

- Modifications to services to address COVID-19 ($332,733)

- Funding to make the bus cleaning pilot program permanent

- Dedicated operations space for building inspection and bylaw enforcement staff.

There was a time when citizens met and discussed the budget options – COVID19 is being used as the reason for not being able to do that this year. Proposed tax increase

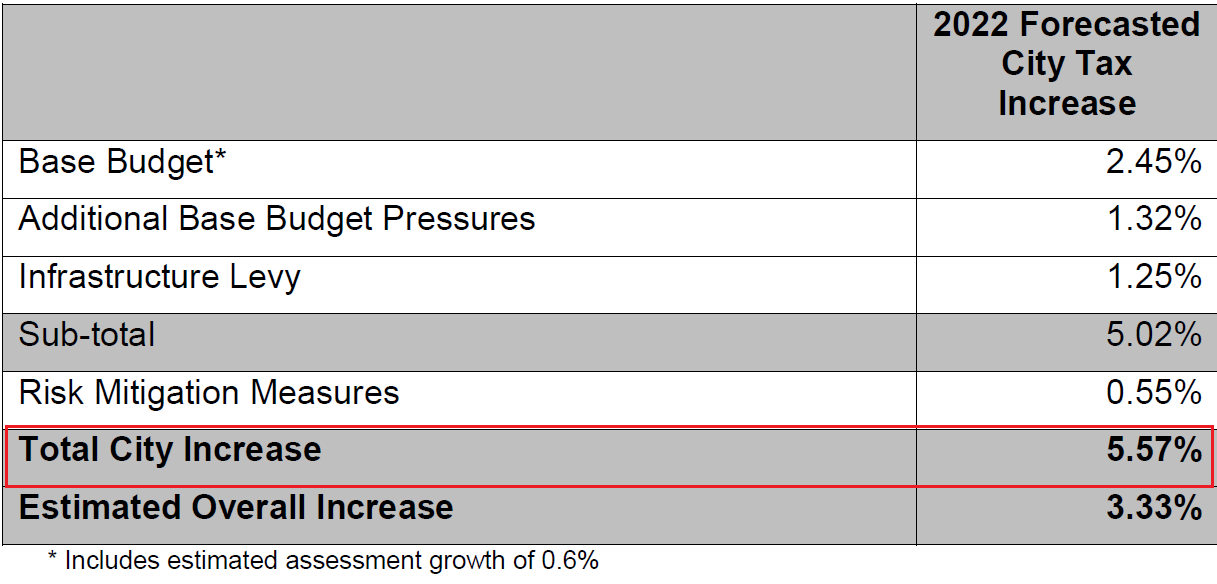

When combined with the estimated regional and education tax levies, the overall projected tax increase for a Burlington homeowner in 2022 is 3.18% or $24.76 per $100,000 of assessment. For example, homeowners with a home assessed at $500,000 would pay an additional $123.80 per year or $2.38 per week. This represents a 5.45% increase to the City’s portion of the tax bill.

In a statement reported to have been made by Mayor Meed Ward last week the budget and its tax increase was described as a Staff wish list and would not be passed. Staff do not appar to have gotten that memo.

A copy of the proposed budget for 2022 will be available online.

Public Input

To gather feedback from residents about how municipal services are valued and which ones are a priority for residents, the City hosted an online budget survey from July 5 to Sept. 30, 2021. A total of 539 responses were received.

Survey results:

- 71.7% indicated they are satisfied with the services provided by the City of Burlington

- 64.5% rated the value they receive for their tax investment as good or very good

- 70.3% said it is important to them for funding to be put aside for infrastructure renewal

- 86.3% said it is important to them to set aside additional funding to address potential future emergencies like a pandemic or natural disaster.

Get Involved Burlington also features an interactive budget simulation tool where residents and taxpayers can show the City how they would balance the budget. Users can increase and decrease funding for different City service areas as they see fit while still maintaining a balanced budget.

Virtual 2022 Budget Town Hall – Nov. 22 at 7 p.m. – Save the Date

An additional opportunity for public input on the 2022 budget will be held on Monday, Nov. 22, from 7 to 8:30 p.m. during a virtual town hall hosted by Mayor Marianne Meed Ward. The live, online meeting provides residents an opportunity to learn more and ask questions to City staff about the proposed 2022 budget priorities.

By Pepper Parr By Pepper Parr

October 28th, 2021

BURLINGTON, ON

Tom Muir, a regular Gazette reader and commentator said he “ saw the Mayor on CHCH TV this morning and the budget was covered. She said 5.45% is a wish list, is too much, and will not be approved.”

In the budget discussions we have heard so far not a peep from the Mayor on what she thought was an appropriate level of tax increase Council could accept.

Mayor Marianne Meed Ward reported to have described the 5.45% budget increase as a “staff wish list” that would not be passed. To say publicly that the budget is a “Staff wish list” is disrespectful and condescending in the extreme.

Joan Ford and her crew work hard on the budgets and they look for ways to trim costs where they can.

Ford, who fully understands how municipal budgets work, struggles to get this Mayor to understand that reserves are in place for a reason and they are to be respected.

How Meed Ward convinced herself that more than $4 million could be taken from the Hydro Reserve fund and used to pay for a wave break at the LaSalle Marina. The decision was so egregious that City Manager Tim Commisso said aloud that he would begin looking for ways to group the Reserve funds so that it wasn’t so evident just how much money was kept for extreme situations.

There are still those recovering from the flood of 2014. The city had reserves in place then that allowed immediate spending to clear up the creek beds and repair the bridges that had been damaged.

Staff takes their lead from Council. To have people in the finance department working their tails off only to learn that their efforts are seen as a “wish list” hurts.

An apology might be in order.

By Staff By Staff

October 25th, 2021

BURLINGTON, ON

Shaping Burlington’s 2022 budget: key meeting dates coming up, including a virtual town hall with Mayor Marianne Meed Ward on Nov. 22

Work to determine the 2022 budget continues. An overview of the budget will be presented to Burlington City Council at a virtual Corporate Services, Strategy, Risk and Accountability Committee meeting on Wednesday, Nov. 3 at 9:30 a.m. The overview will include a look at the proposed 2022 operating budget as well as the 2022 capital budget and forecast.

Key areas of focus for the proposed 2022 budget

Each year, during the City’s budget process, decisions are made to ensure an appropriate balance between affordability, maintaining service levels and financial sustainability over the long term.

The proposed 2022 budget focuses on:

- Mitigating the financial impacts of COVID-19

- maintaining service levels

- ensuring city assets are maintained in a good state of repair

- continuing to provide strategic investments aligned to the City’s work plan, 2018 to 2022: Vision to Focus

- upholding legislative requirements while ensuring competitive property taxes.

City plans to add more bylaw enforcement officers. Proposed capital budget

The proposed 2022 capital budget is $77.3 million, with a ten-year program of $829.5 million. From this total:

- 68.5% is for infrastructure renewal

- 15.1% goes towards growth-related projects

- 12.8% is for new/enhanced projects

- 3.6% goes towards green projects which support the City’s climate goals.

Proposed operating budget

The proposed 2022 operating budget is $284.8 million and includes new funding to support:

- Sustaining city services ($685,333)

- Additional funding for on-going recreation facility maintenance to meet lifecycle requirements and reduce risk

- One-time funding to support a Gypsy Moth spraying program in 2022

- One-time funding to extend the contracts of two bylaw officers

- Modifications to services to address COVID-19 ($332,733)

- Funding to make the bus cleaning pilot program permanent

- Dedicated operations space for building inspection and bylaw enforcement staff.

Proposed tax increase

This represents a 5.45% increase to the City’s portion of the tax bill.

When combined with the estimated regional and education tax levies, the overall projected tax increase for a Burlington homeowner in 2022 is 3.18% or $24.76 per $100,000 of assessment. For example, homeowners with a home assessed at $500,000 would pay an additional $123.80 per year or $2.38 per week.

A copy of the proposed budget for 2022 will be available online at burlington.ca/budget.

Pre Covid19 there were meetings with staff where questions could be asked. Now it’s all virtual. Public Input

To gather feedback from residents about how municipal services are valued and which ones are a priority for residents, the City hosted an online budget survey from July 5 to Sept. 30, 2021, at getinvolvedburlington.ca. A total of 539 responses were received.

Survey results:

- 71.7% indicated they are satisfied with the services provided by the City of Burlington

- 64.5% rated the value they receive for their tax investment as good or very good

- 70.3% said it is important to them for funding to be put aside for infrastructure renewal

- 86.3% said it is important to them to set aside additional funding to address potential future emergencies like a pandemic or natural disaster.

Get Involved Burlington also features an interactive budget simulation tool where residents and taxpayers can show the City how they would balance the budget. Users can increase and decrease funding for different City service areas as they see fit while still maintaining a balanced budget.

Virtual 2022 Budget Town Hall – Nov. 22 at 7 p.m.

An additional opportunity for public input on the 2022 budget will be held on Monday, Nov. 22, from 7 to 8:30 p.m. during a virtual town hall hosted by Mayor Marianne Meed Ward. The live, online meeting provides residents an opportunity to learn more and ask questions to City staff about the proposed 2022 budget priorities. More details about the link to join the virtual meeting will be available on getinvolvedburlington.ca in the coming days.

Marianne Meed Ward has never shied away from budget increases. Her approach reflects the Red Liberal in her. Mayor Marianne Meed Ward explains: “The budget process is one of the most important exercises the city undertakes each year. Determining key spending priorities in the face of the ongoing COVID-19 pandemic is challenging as COVID continues to present significant financial impacts.

“To assist City Council in the budget process, we want residents and taxpayers to share their input and tell us what services are important to them. Please join in the conversation at the Nov. 22 virtual town hall that I will be hosting. We know our citizens expect us to maintain a high quality of services as our city continues to grow and evolve and we want everyone to share their feedback with us, so we can continue to deliver on their expectations.”

Joan Ford knows her numbers inside out. She gives council the facts and advice when they ask. They don’t ask very often. Joan Ford, Director of Finance gives her side of the budget story: “The City’s annual budget process provides an opportunity to review existing operations and make investments in key City programs and services. While the COVID-19 pandemic continues to provide significant financial challenges for the City, the 2022 budget process will focus on maintaining the city’s financial position, addressing corporate risks, and ensuring residents continue to receive the programs and services that provide a high quality of life in Burlington.”

By Staff By Staff

July 21, 2021

BURLINGTON, ON

Budget time – and this is going to be a defining period of time for this council.

Traditionally politicians put forward a budget that lowers taxes in an election year.

That is going to be very very difficult for this Mayor; she has yet to learn budget discipline.

Will the Mayor learn to listen to and hear what some of her council members and the public are saying. The Finance department will do their best to make a case for some fiscal prudence. Her council will learn to clamp down – when staff finishes telling them what the city is really up against fiscal prudence will kick in.

Insurance costs have sky-rocketed. Repairing the covid19 damage to the local economy is going to take time.

Burlington is fortunate in having a Finance department that knows what they are facing – and while council lauds their efforts they don’t pay enough attention to the advice that Treasurer Joan Ford puts forward.

The city will be doing another survey – that’s all part of the process. The complexity of municipal budgets is difficult for people to get a grip on. There isn’t a balance sheet or a profit and loss statement – municipalities are not in place to make money – they are there to deliver services and hold funds for those unforeseen situations.

Take the budget survey and tell the finance people s which City services are important to you.

You are encouraged to complete an online survey at www.getinvolvedburlington.ca. All the feedback captured through the survey will be shared with Burlington City Council. The survey will remain open until Sept. 30, 2021.

Key meeting dates for the 2022 budget include:

Sept 22, 23, 28, and 30

City Council workshops with presentations from each City service area

There used to be public budget meetings that filled the main room at the Art Gallery Nov. 3

Corporate Services, Strategy, Risk and Accountability Committee Meeting: 2022 Budget overview report

Nov. 4

2022 Budget Virtual Town Hall

Nov. 30 and Dec. 2

Corporate Services, Strategy, Risk and Accountability Committee Meeting: 2022 Budget review and approval

Dec. 14

Meeting of Burlington City Council: City Council to consider approval of the proposed 2022 budget

Changes in how Council meetings will take place as the Region works its way through Step 3 of the Re-Open Plan. It might be possible to hold real public meetings with perhaps limited public participation.

Does this Council really want the public in the room looking them in the eye and asking some hard questions?

By Pepper Parr By Pepper Parr

July 15th, 2021

BURLINGTON, ON

On July 14, 2021, Regional Council approved Halton’s 2022 Budget Directions Report. The Report provides guidelines to staff to maintain existing service levels for Regional programs while supporting the community’s recovery from the COVID-19 pandemic. It also establishes a target property tax increase at or below the rate of inflation (2.0 per cent). On July 14, 2021, Regional Council approved Halton’s 2022 Budget Directions Report. The Report provides guidelines to staff to maintain existing service levels for Regional programs while supporting the community’s recovery from the COVID-19 pandemic. It also establishes a target property tax increase at or below the rate of inflation (2.0 per cent).

“The 2022 Budget Directions Report is an important step in the development of our next Budget and Business Plan,” said Halton Regional Chair Gary Carr. “It lays a foundation to help us preserve our strong financial position, keep property taxes low and support our community as more residents get vaccinated and Halton gradually reopens.”

The Report identifies priorities for Regional investments in 2022 to ensure residents have access to essential services while providing for critical program enhancements to address community growth. It also ensures next year’s Budget aligns with the strategic themes, objectives and outcomes outlined in the 2019–2022 Strategic Business Plan.

Seven of those smiling faces represent Burlington – if they voted to hold the 2022 tax increase to 2% for the Region – can’t they do that for the City? Financial pressures related to the COVID-19 pandemic and vaccine rollout are also identified in the Report. Staff are closely monitoring current and potential fiscal impacts as they develop plans for 2022. The Region will continue to address program pressures, reallocate resources to priority areas and maintain service levels to help achieve a property tax rate increases at or below the rate of inflation.

By Pepper Parr By Pepper Parr

July 14th, 2021

BURLINGTON, ON

Council is on their summer break until September 6th.

The city will wake up each day – do the things a city does and hope that the wheels don’t fall off.

The City is still in a declared State of Emergency which puts the day to day running of the city in the hands of the Emergency Control Group (ECG).

What if they have to do something quickly – really quickly to deliver the services council has approved?

Council found a solution for that – they gave the city manager delegated authority to spend $250,000 without referring to council before getting the cheque signed.

Pretty decent amount in terms of pocket change for city manager Tim Commisso to carry around. That kind of cash could certainly burn a hole in one’s pocket.

City manager Tim Commisso To be serious this is just prudent management that allows the City Manager and his delegate (when the City Manager is absent) to make the decisions normally deemed to be decisions of Council. Such decisions would be limited in dollar value to $250,000 at a maximum per individual decision. In making these decisions, the City Manager and his delegate will have the support of Burlington Leadership Team and Emergency Control Group.

This authority begins on July 14 and stays in place until September 6.

The City Manager and the Mayor will stay in touch and if a situation crops up that is more than critical the Mayor can call a Special Meeting of Council and do the necessaries.

The City Manager is required to report any and all decisions made under this delegated authority to Council in the September Corporate Services, Strategy, Risk and Accountability committee meeting.

In addition, the City’s Corporate Continuity of Governance & Operations Plan describes the importance of the succession of leadership, particularly when involved in an emergency situation, to ensure the City of Burlington can carry out mandated responsibilities. In the case of the ECG, this succession is clear between the City Manager and his alternate, namely the Executive Director, Environment, Infrastructure & Community Service.

It was a relatively light downpour – it just lasted a long, long time. Many will remember the crisis that occurred when during a Sunday in August 2014 rain began to fall and it kept falling. When it was all over the city had to deal with the 191 mm of rain that flooded basements, underpasses and large open areas.

The preparations in place at the time taught city council that things had to change.

In May 2020, the City’s service re-design strategy outlined a responsive and highly measured approach to resuming delivery of City services and operations. This strategy included a framework for governance and decision making, clearly outlining those decisions to be made by Council and those that could be made directly by the Burlington Leadership Team/ECG/Service Leads.

The decisions of Council are in accordance with the following approved framework:

There are five question the City Manager and his leadership have to ask when they are making a decision about the delivery of services. City staff looked at a number of options before arriving at a recommendation:

1. Hold decisions until the resumption of committee and Council meetings in September – NOT RECOMMENDED

This option would hinder the City’s ability to respond to changes in the Provincial re-opening regulations and orders in a timely manner resulting in further financial impacts, potential loss of service and significant reputational damage.

2. Seek approval of Council to delegate decisions up to $250,000 per individual decision to the City Manager (or his delegate in his absence) –RECOMMENDED

This option is consistent with the application of all formal delegated authority decision making by the City whereby authority transcends from Council to an identifiable staff member. In discussion with the City Clerk, delegating most COVID re-opening activities to the City Manager through the Council break would be most appropriate. The City’s current policy framework, with the Delegated Authority By-law and Procurement By-law have Council established approval limits that will be respected throughout this time. In September, a report to CSSRA as an addendum would report the COVID-related activities during the break. When the dollar threshold is expected to exceed $250,000, the City Manager and City Clerk will confer with the Mayor on the need for a special council meeting.

3. Seek approval of Council to delegate decisions to the Mayor – NOT RECOMMENDED

This option is not consistent with the application of all formal delegated authority decision making by the City. Delegation of authority, as is the case with all areas under the existing Council approved Delegated Authority by-law, sees the authority transcend from Council to an identifiable staff member.

4. If and as required, Mayor to call a special meeting of City Council to consider and approve COVID related service redesign decisions – NOT RECOMMENDED

This option is contrary to Council’s prior approval of the annual Council Meeting Calendar which specifically sought to re-establish an extended break during July and August. In so doing, both Council and staff are

afforded the opportunity to “lead by example” and support measures that address ongoing fatigue and stress caused by many months of COVID emergency response. However, there is a provision in the recommendation for the City Manager and City Clerk to confer with the Mayor on a call of a special council meeting should the $250,000 per individual decision threshold be exceeded.

Joan Ford, the city’s Chief Financial Officer is on top of every financial decision made – her counsel is sought and respected by the City Manager. The Chief Financial Officer continues to have corporate oversight of all COVID-19 service re-design decision impacts and reporting to Council. The City Finance team, working closely with other staff, have applied extraordinary due diligence in securing COVID related funding (approximately $20 million in total). As a result, the City is very well positioned financially to address any impacts arising from additional service redesign decisions in July and August.

As long as it doesn’t rain in August and assuming that the vast majority of the public act responsibly and get their vaccinations – we could be in for a decent summer.

The announcement yesterday by the Chief Medical Officer for the province that he expected a wave of infections in September is certainly a bummer.

By Pepper Parr By Pepper Parr

July 5th, 2021

BURLINGTON, ON

It is that time of year again – setting the budget for 2022 and, from a Council member perspective, keeping an eye on what the budget will do to their re-election prospects.

Expect every member of Council to seek re-election with a maybe not for ward 2 Councillor Lisa Kearns (who has told one of her supporters that she will not run again) and possibly ward 6 Councillor Angelo Bentivegna who may find that the work load is not something he wants to take on for four more years. However, he has said publicly that he is planning on running again.

In a Staff report that will be discussed at a city Standing Committee meeting Monday July 5th timelines for the 2022 budget are set out.

Council Workshops –Service Presentations

The budget projections for each of the 38 services the city provides will be reviewed on September 22, 23, 28 & 30, 2021

Budget Overview November 3, 2021

Budget Virtual Town hall November, 2021(TBC)

2022Budget Review & Approval – November 30 &December 2, 2021

Council –2022 Budget Approval December 14, 2021

Council Workshop sessions have been scheduled over 4 days to allow the 38 City Services to present overviews of their business plans to Council. Each of the City Services have been grouped into the 8 sessions by themes somewhat aligned to the Strategic Plan.

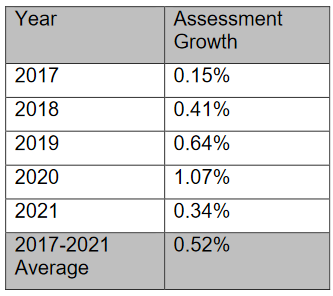

With a projection for a tax increase of more than 5% the historical record looks a little dismal. These workshop presentations will include:

A summary of current financial investment by service

An overview of current service delivery including known financial gaps and service needs

An overview of the asset investment required for service delivery

Key Performance Indicators (KPIs)

An overview of service goals and objectives

A portion of the presentation on the first day (Session 1) will be set aside to provide an overview of the incremental budget investments including staffing that have been made during this term of Council (2019-2021).

In addition, a portion of the presentation during the last day (Session 8) will include an update on the overall Designing and Evolving Our Organization (DEOO) process.

Reckoning and future direction:

Some of the spending done in the past few years is now going to have to be reckoned with.

This budget is going to be a turning point for the city. The impact of the Interim Control bylaw that stopped approval of projects for a year (it has extended now to whenever the LPAT hearings resolve the appeals made), the creation of an approved but not yet in force Official Plan and the significant number of high rise tower development applications that are challenging the Planning departments ability to do its work on a timely basis.

The growth of properties that go on the tax base is too low – all the development that has people worried about what their city is going to look like does pay some of the bills. Right now those hi-rise towers are holes in the ground. The success Mayor Meed Ward has had in getting the Urban Growth Boundaries moved well north of the downtown core and getting the province to realize that a bus terminal was not a Major Transit Service Area are wins for which she is not getting the credit she deserves.

The focus on getting high rise housing around the GO stations was aptly described by the Mayor as the creation of the new small cities. Five years from now there will be a number of new city councillors to accommodate the new wards that will have to be created to accommodate the population growth.

While the fight isn’t over yet the desire on the part of the developers to put up tall buildings in the downtown core, especially in that football shaped piece of property between Old Lakeshore Road and Lakeshore Road, is no longer the slam dunk it looked like when the 2014 city council held its last meeting.

Coping with all these changes brings with it challenges that have to be dealt with – they all show up in a budget that also has to cope with the costs of a pandemic.

Fortunately the province has created funding sources that leave Burlington in pretty good financial shape in terms as to what the pandemic has cost the city.

The cost to the hospitality sector has been brutal and a number of operations in that sector will not survive. Retail has also taken a hit.

It all adds up. The financial fundamentals for Burlington are pretty good; the leadership on the administrative side has been what was needed to get us through the pandemic. Going forward city manager Tim Commisso may not want to continue to handle the day to day grind. He has found his future leadership within the organization and appears to have done a good job of nurturing and developing the administrative talent.

There are a number of senior level retirements coming up – legal and human resources come to mind. The legal department has had difficulty finding talent with an understanding of the way the municipal sector works – it is a world unto itself.

Treasurer Joan Ford should be given medals for the job she has done. Along with a superb level of service Ford has grown the talent within the department to ensure that the financial side continues delivering.

Managing the changes the pandemic has brought about has critically impacted on the way citizens who pay attention to what gets done at city hall are able to participate.

A simulation based on the available data shows hefty tax rates for the last year in the current term of council and for the first three years of the next term of office. Can they be elected on this platform? Having to go virtual has almost put an end to the kind of delegations citizens would provide. Not being able to be in the room, actually see all the members of council and react to their body language, facial expressions severally limits genuine participation.

We all pay for the lack of thoughtful response from concerned citizens.

This is your city council in a virtual session. There were no delegations at this meeting. The view does not include all the participants. The Public Board of Education manages to have some of the trustees take part in the meeting by being in the room. Burlington’s city council is close to being at the point where limited public participation could begin – there has been no signal from the members of council that this might be in the offing.

Life is easier when you don’t have to respond to criticism from someone right in front of you – looking you in the eye,

Kind of convenient for them.

By Pepper Parr By Pepper Parr

May 19th, 2021

BURLINGTON, ON

Every once in a while ward 6 Councillor Angelo Bentivegna casts a vote intended to make a point.

Councillor Angelo Bentivegna: thinking it through. This time he was asking what impact changing the business model for the Tyandaga Golf Club would have on the 2022 budget – and then reminded his colleagues that the projected tax rate for 2022 was 5.25%

Council was about to pass the item as part of a collection of issues that had been pulled together as a consent item, which is council’s way of voting on a number of decisions at the same time.

Any member of Council can ask to have an item pulled from the consent list so that it can be voted separately.

Bentivegna wanted more information on just what the change in the business model would have on the tax rate.

He was told that it would likely be between .07% or .08% – which would put the 5.25% projection over 6%

Staff did their best to assure Bentivegna that the public wouldn’t see any increase in 2022 and probably not in 2023 either. Any funds the golf course needed would be for capital items and would go on a list to be considered by the Capital expense people.

Ward 6 Councillor Angelo Bentivegna making a point at a council meeting. Bentivegna’s point was that – yes it would be going on a list and at some point the public would be asked to pay.

When it came to a vote on the item Bentivegna asked that it be a recorded vote. He was going on the record and wanted his colleagues to do the same thing.

The vote was 6-1: Bentivegna had made his point with his “no” vote.

The public will at some point be asked to pay for capital items at the golf course. The fear in the minds of many is that the public might be asked to pay for some of the operating costs as well.

By Staff By Staff

May 6th, 2021

BURLINGTON, ON

City Council approved the 2021 Tax Levy Bylaw at its meeting on May 5, 2021.

The bylaw allows the City to bill 2021 property taxes and set payment due dates for final tax bills on June 22 and Sept. 22, 2021. Final tax bills will be mailed in late May.

The 2021 Tax Levy Bylaw reflects the budget processes of both the City and Halton Region. The province provides the education tax rates.

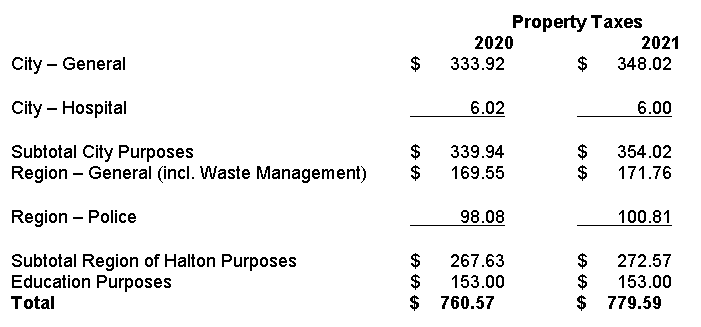

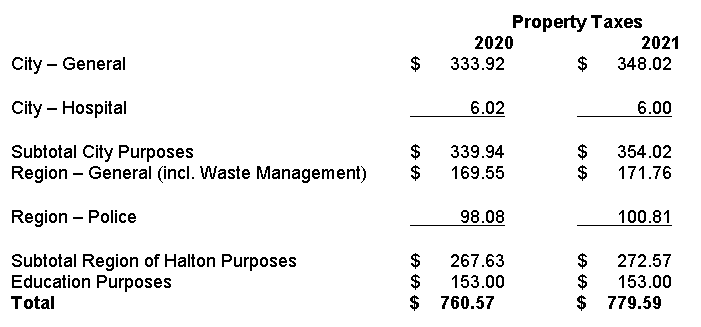

City of Burlington 2020 and 2021 Urban Residential Property Taxes per $100,000 Current Value Assessment (CVA) COVID-19 Property Tax Relief

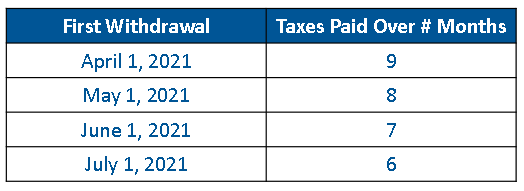

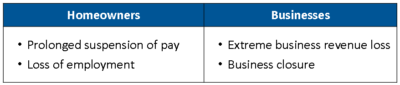

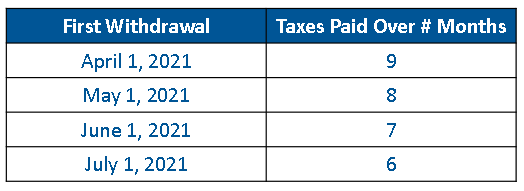

In response to the ongoing COVID-19 pandemic and the resulting economic impact, on March 3, 2021 Burlington City Council approved a 2021 COVID-19 Property Tax Deferral Payment Plan program. The application-based program provides relief to residents and businesses that continue to face financial hardship due to the pandemic.

Eligible property owners who are unable to pay property taxes by the regularly scheduled tax due dates can apply to defer taxes under a pre-authorized payment plan. Those eligible may include unpaid balances from March 1, 2020 onward in the deferral plan and can choose which month they would like to start the monthly payments. The remaining options for start dates are June 1, or July 1. Equal monthly withdrawals will be made that will allow for the property taxes to be paid in full by Dec. 1, 2021. Eligible property owners who are unable to pay property taxes by the regularly scheduled tax due dates can apply to defer taxes under a pre-authorized payment plan. Those eligible may include unpaid balances from March 1, 2020 onward in the deferral plan and can choose which month they would like to start the monthly payments. The remaining options for start dates are June 1, or July 1. Equal monthly withdrawals will be made that will allow for the property taxes to be paid in full by Dec. 1, 2021.

Property owners enrolled in this payment plan will not be subject to penalty and interest charges as long as payments are made.

Please visit Burlington.ca/property tax for more information or email pap@burlington.ca to register.

Quick Facts

• The City of Burlington collects property taxes for the city, Halton Region and the Halton district school boards. The total combined tax levy for all three entities is approximately $439 million.

The city’s levy is $182 million; the city collects $141 million on behalf of Halton Region; and $116 million on behalf of the Halton district school boards. The taxes levied for Halton Region and the Halton district school boards are remitted to them.

• Burlington City Council approved an increase to the Low-Income Seniors Property Tax Rebate. For eligible property owners, the rebate has increased from $525 to $550 for the 2021 tax year.

By Pepper Parr By Pepper Parr

May3rd, 2021

BURLINGTON, ON

A very solid look at what the citizens of Burlington get for the money they pay Councillor Paul Sharman to serve as a city councilor is on the Council agenda this week.

Paul is a bean counter – an accountant with years of experience managing some tricky corporate budget issues. He was once on the payroll at Nortel, a once thriving Canadian corporation in the communications equipment sector.

When it comes to numbers and process he knows whereof he speaks – and this week he is going to speak quite bluntly to his colleagues about some serious problems related to the way budgets are prepared by staff and handled by council members when they are submitted for debate and discussion.

Joan Ford, the city’s Treasurer knows where every dollar comes from and where every dollar gets spent. Finance is and has been for some time the best run department in the city. This past 15 months have pushed them beyond the limit – but they never faltered. Joan Ford, the treasurer, has been with the city for more than 30 years (33 I think) and has a cottage that she is said to want to spend more time. She has a fine staff – but it will be very hard to replace Joan Ford. That is not to suggest that she is leaving – we have no idea what her personal plans are.

Councilor Sharman has put forward a Staff Direction to:

Direct the Chief Financial Officer to report back in July 2021 as part of the budget framework report on process changes reflecting a coordinated corporate integrated business planning, measurement, budget and performance management process.

“Based on my experience and observations, as a Councillor,” said Sharman, “I believe we are experiencing increasingly difficult challenges with the alignment of the City’s annual budget process with strategic decision making.

Sharman has spent a lot of time explaining the finer points of budget matters to Councillor Bentivegna. “In addition, Council has very limited routine knowledge about how well City operations are performing other than when we receive complaints from citizens. Key performance measurement indicators are not routinely provided to Council. Overall, I very much appreciate and value the efforts of staff, including the Finance Budget team, however a discussion on this matter by Council, is both timely and critically important to reduce performance risks of the type Burlington has experienced in recent years.

One year the finance staff gave members of Council the complete budget on a memory stick with a feature that allowed them to make changes in the budget and see instantly the impact on the tax rate. That memory stick was never made available to the public. “While we have enhanced our efforts related to multi-year strategic planning, service planning/resource needs and operational risk management, the unrealistic expectations placed on the budget process is increasingly apparent. A few key considerations:

the culture of requiring Council to provide budget directions in July, inclusive of a staff recommended city tax rate change target, without in depth and disciplined understanding of the business performance issues contribute to our service and operating risks.

“After the “budget direction report” is approved, staff undertakes significant work to prepare a budget in which the majority of the Council discussion revolves around department cost centers and services where all recommendations are developed relative to the prior year’s budget (or base case), which is adjusted for inflation, employee compensation increases and other known increases.

“Following the Chief Financial Officer’s line by line review where base case adjustments are completed, staff assess what other additions might be acceptable based on Council sensitivity to a perceived tax increase target rather than a complete understanding of the business needs of the City. All of this leads to the completion of a proposed budget prepared by staff and presented to Council for review, modification, and approval in the absence of adequate understanding of current operational performance measures, issues, and risk.

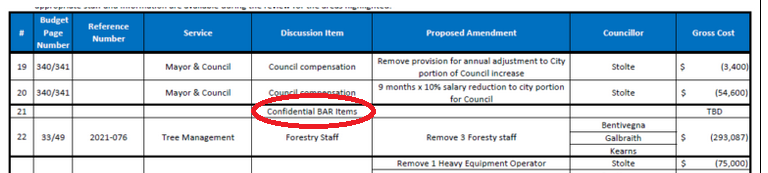

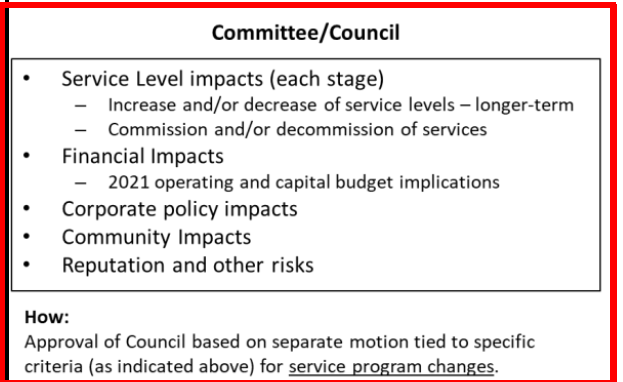

“Formal Council Budget review and approval is accomplished through a “horse trading” process that revolves around a form called “Budget Action Request” (BAR), which is a list of items to be amended and tabled by each member of Council based on their review of the draft budget. Each item is discussed by Councilors and then voted on. Items that are approved have the effect of modifying the budget and lead to budget approval. The BAR form process is essentially short term focused and not suitable for dealing with longer term operational or strategic goals of the organization. Meanwhile, history tells us that departments are often struggling because there has been no continuous dialogue with Council about the extent to which operational needs exist in the City.

‘Some recent examples where Council had inadequate or no prior awareness of critical incidents that might have been avoided had what is being proposed been in effect, include:

Laura Boyd once produced a report that set out all to clearly where the problems were in making the best use of the staff compliment. • Transit staff working extended hours beyond legislative limits and service goals not being met due to inadequate budget.

• Incidents in Recreation Community and Culture related to facility preventative maintenance standards.

• Community Planning department seriously under-resourced to address existing and forecasted workload i.e., development applications.

• Roads Parks and Forestry seriously under-resourced to meet Council approved service standards and community expectations.

• By-Law Enforcement/Animal Control under resourced

• Human resources stretched particularly given the unprecedented impact on staff workload.

“Strategy formulation is the most important mechanism for prioritizing resource allocation for the long term, sustainable, benefit of the community we serve. That allows us to consider critical long term funding requirements, as was accomplished in previous terms of Council for a) JB Hospital expansion, b) Infrastructure renewal including new annual dedicated levy.

“With regard to strategy alignment with the budget process, the following should be in place recognizing it will not all happen in one year. There should be distinct business plans for each key strategic direction embedded in our 25 yr Strategic Plan and V2F 4yr Action Plan, even if only rudimentary, initially.

Councillor Sharman has always been very direct with his comments – he can be withering at times. “These plans should be reviewed in depth every 5 years and consulted every year as part of a rolling 5-year Operating Plan. The first year of the Operating Plan would be approved as the budget for the subsequent year. The operating plan/1st year budget should be based on real, unvarnished, in depth reviews of a 5-year business plan for each service. The service business plans should be brought to Council for review before “budget directions” are provided.

“Council’s Strategic Plan and approved Operating Plan/Budget need to transcend elections and provide useful guidance to future Councils as part of the preparation of both documents (not a commitment). These plans will be subject to change, as all plans are. The premise of this suggested model is to place a focus on long term planning with short term adjustments. The approach is designed to shift the organization focus to the future rather than on the past, and to the business of the organization rather than vague and poorly informed assessments of community sentiment.

“Here is what I propose, recognizing that staff will need to report back:

1) Staff report back in July 2021 with a framework and proposed timing for the budget process enhancements related to alignment with strategic planning and ongoing service planning. Please note staff were already planning to come to Council in July, comments/guidance from council today will be helpful.

Sharman: Waiting for the wisdom he has just sprinkled on council to settle in? 2) In September, real, unvarnished, in depth reviews of 5-year business plans for each service be held with Council in preparation for budget with short, midterm key metrics. Integrated into this reporting, the City Manager should include an update on multi-year resource needs in keeping with the recent Designing and Evolving the Organization (DEOO) initiative.

3) Staff to prepare summary report of service reviews to identify issues raised, risks, opportunities, priorities and recommendations. Service priority directions to be sought from Council.

4) A distinct business plan be prepared for each strategic direction for the full planning horizon that estimates key activity milestones and resource requirements complete with short-, mid- and long-term key metrics.

5) A 5-year business plan be brought to council that reflects the combination of items 2,3&4 above. This represents the basis for budget decision making.

6) The consequent 1st year of the budget is to be presented in both perspectives of

a) Service budget, operational measures, and performance targets b) Department budgets reflecting the service budgets, multi-year resource needs, KPI measures, and targets.

7) Covid-19 verbal updates to be replaced in future by a City Service Operations Review Update “Ops Review.”

“What is proposed represents a huge change culturally and work wise. It is possible that all aspects mentioned exist already to some degree, but refinement is required. They require time to be accomplished. Burlington staff and Council have worked to implement all of the pieces over the last ten years. Now it is time to integrate and align them…it is now time to complete the work.

Ever the advocate – Sharman during the 2018 election – there was a period of time when his seat was at risk “Doing so should simplify and massively improve Council knowledge, planning, budget preparation and approval. That said, I recognize that to introduce it all in one year is not feasible. Aspects can be implemented for the 2022 budget process, and that we consider doing what is possible, without creating massive disruption. The rest can be phased over the next year and perhaps beyond.”

Council is going to spend a lot of time on this one. The subject is as dry as toast and as important as whatever you have in your wallet.

By Pepper Parr By Pepper Parr

April 24th, 2021

BURLINGTON, ON

The week was a media bonanza for ward 2 Councillor Lisa Kearns.

Ward 2 Councillor Lisa Kearns On Wednesday she handled a two hour webcast on what is known now as Fairview LP, the gigantic development that will rise on the 8.5 acre property to the east of the Burlington GO station; on Thursday she held a ward meeting in which she jammed in everything she could possibly tell you about what she is achieving at city hall.

There was one item of significant interest in the city hall recap – that was what appears to be a new and very welcome approach to creating budgets.

Kearns first explained that the 4.14% increase on the city portion of your tax bill was really necessary – that can be argued at some future date.

Kearns also explained how hard council had worked to get a budget in place before the end of March.

The Finance department prefers to get a budget in place before the end of a calendar year but Covid19 has screwed up everything everyone is trying to get done.

The practice in the past was to invite the public to “review” the budget that had already been decided upon. It was community engagement at its worst – getting public input before city departments did their work would be classic community engagement. The plan, if we heard to ward Councillor correctly, was to start budget thinking in June and ask the public what they would like to see before having the various departments submit their first cut on a budget.

The Gazette has been advocating this for years – maybe, just maybe, they will ask the public how they would like to see their money spent.

Done properly this could be very effective.

Time will tell.

Salt with Pepper is the musings, reflections and opinions of the publisher of the Burlington Gazette, an online newspaper that was formed in 2010 and is a member of the National Newsmedia Council.

By Ray Rivers By Ray Rivers

April 22, 2021

BURLINGTON, ON

Just like that it was over! Presentation of a budget with no real surprises, unlike the almost alarmist complaining by the opposition parties that it had been two years in coming. And it’s a huge budget document with spending to match. There was relatively little post-budget fuss except for the habitual Tory complaints about the mounting size of the deficit and the debt.

Minister of Finance and Deputy Prime Minister Chrystia Freeland preparing to speak to her budget which Prime Minister Justin Trudeau leafs through. None of the opposition leaders want an election right now, so they are behaving very gingerly to avoid an excuse for an election. The polls show the Liberals would win again and maybe with a majority this time. And the Libs would love to take advantage of that, but we’re in probably the worst phase of the pandemic now and the voters resent it when opportunistic governments call inconvenient and untimely elections. So it’ll come but not just yet.

The pundits are calling this an election budget anyway. And it is loaded with goodies for just about everyone. A chicken in everyone’s pot. In any case it’s all borrowed money – so more like the government borrowing your chicken to give it back to you. The biggest goodies are climate related initiatives, creating a million jobs this year, and a ten dollar a day national child care program. But everyone gets some kind of handout, be it farmers, householders, green energy start ups, existing oil companies, and even seniors.

The $10 a day pre-school plan is long overdue for a society which values social interdependence as Canadians like to think we do. Quebec’s successful program is the template which the feds are looking at. The results from la Belle Province include better early education, increased female participation in the labour force and economic growth.

We too might have already had this program. But Jack Layton’s NDP’s pulled the plug on Paul Martin’s minority government in 2006 and with it died a unique federal provincial agreement to establish a national child care program. Stephen Harper’s, supported by Layton, killed the initiative and gave parents some cash instead, which as one Liberal partisan noted, would likely buy beer and chips instead. So Mr. Singh is on shaky ground when he claims this has been a long term NDP policy.

Federal civil servant handing over a cheque to a Quebec civil servant. Having showed their hand Mr Trudeau and his finance minister have got their job cut out for them getting the current field of cash strapped premiers to ante up and sign on to a new plan. And the feds have weakened their negotiating position by saying they would be picking up half of the bill. Quebec has signaled that it would be happy to get a cheque instead, since it already has a program.

Not every good idea made it to the budget however. Rank and file Liberals who paid their money to participate in the recent policy convention must be disappointed that their highest priorities seem to have got lost. Pharmacare, a priority also for the NDP, seems to have been overlooked, though another NDP policy, a federal minimum wage of $15 per hour, has been included.

Universal basic income (UBI) didn’t even get a mention though about 90% of voting delegates supported it at their convention. That is probably because a UBI would make it more difficult to justify the kind of piecemeal pork that get handed out with this kind of budget – discretionary top-ups and the continuation of COVID emergency programs, most of which are poorly thought out, like the problematic federal sick leave.

And then there is the mother of all wasteful programs – the COVID wage subsidy. At about $100 billion the wage subsidy is the most costly federal COVID-19 program, and one of the most expensive short-term government programs in Canadian history. Companies get taxpayer money so they can keep people on the payroll when they don’t have enough work for them. Isn’t that what we used to call Soviet-style socialism?

Canadian Football League wants to get its snout into the trough as well But it turns out that is a great way to put more money into the pockets of shareholders and to fatten the bonuses and salaries of senior executives, while regular workers are given the boot anyway. Apparently even the big three telecoms are sucking up wage subsidy money, even at a time when internet usage is up 70-90%. And telecom rates haven’t declined that I’ve noticed, so how do they qualify? And how does the CFL (Canadian Football League) get to dip its pigskin in the trough as well?

Who would approve such a wasteful program? Turns out it was a unanimous decision of all the patties. And, this has to be a conflict of interest because all four national political parties have also applied for a wage subsidy from this program. So the next time Erin O’Toole complains about the mounting cost of the deficit, someone should remind him that he and his party are also a big part of the problem.

Ray Rivers, born in Ontario earned an economics degree at the University of Western Ontario and a Master’s degree in economics at the University of Ottawa. His 25 year stint with the federal government included time with Environment, Fisheries and Oceans, Agriculture and the Post office. Rivers is active in his community; has run for municipal and provincial office. Ray Rivers, born in Ontario earned an economics degree at the University of Western Ontario and a Master’s degree in economics at the University of Ottawa. His 25 year stint with the federal government included time with Environment, Fisheries and Oceans, Agriculture and the Post office. Rivers is active in his community; has run for municipal and provincial office.

Background links:

Budget – Wage Subsidy – Political Parties at the Trough –

Cost of Wage Subsidy – The Rip Off Crowd – Sealing the Deal –

By Staff By Staff

March 24th, 2021

BURLINGTON, ON

City Council met yesterday for a meeting that was expensive.

The biggest spend was the approval given to Burlington Hydro to borrow up to $15 million (TD Bank will be the lender).

No mention as to what the line of credit will be used for.

Other long term borrowing:

Angela Coughlan Pool A bylaw to authorize a request for the issuing of debentures by the Regional Municipality of Halton for Angela Coughlan Pool Revitalization

A bylaw to authorize a request for the issuing of debentures by the Regional Municipality of Halton for Fairview Street Bus Bays – Teen Tour Way Shelters

A bylaw to authorize a request for the issuing of debentures by the Regional Municipality of Halton for the Sinclair Circle and Autumn Hill work

A bylaw to authorize a request for the issuing of debentures by the Regional Municipality of Halton for the Ester Drive area Reconstruction, Water Main and Wastewater Main

A bylaw to authorize a request for the issuing of debentures by the Regional Municipality of Halton for Ghent and Hager Avenue Minor Reconstruction.

When Burlington needs to borrow longer term funds they don’t go to the bank – they arrange for the Regional government to issue debentures.

All four Halton municipalities take their longer term financial needs to the Region. Sort of like a rich uncle who has a better credit rating than you do.

By Pepper Parr By Pepper Parr

March 5th, 2021

BURLINGTON, ON

It started out with;

Direct the Chief Financial Officer to implement a 2021 COVID-19 property tax deferral pre-authorized payment plan (by application) and report on the status as part of the ongoing monthly financial COVID-19 updates

Council approved property tax relief measures in 2020 in response to the COVID-19 pandemic. The assistance included extended property tax due dates, waived penalty and interest on outstanding property tax from April to August 31 and a pre-authorized payment plan to pay remaining 2020 taxes between the months of August and December 2020.

Most taxpayers continued to pay on time, while some had difficulties.

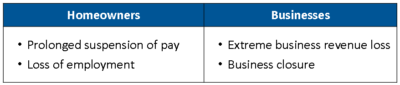

Provincial and Federal governments continue to provide residents and businesses financial assistance programs relating to COVID-19.

The Ontario government declared a Provincial COVID-19 state of emergency January 12, 2021 effective January 14, 2021, ending on February 14, 2021. The current Provincial and Public Health measures may produce a continued financial hardship for some Burlington residents and business in 2021.

Here is what Council decided to do.

They created an application-based deferral program consisting of pre-authorized monthly withdrawals to defer payment from our regularly scheduled due dates. It would apply to all property classes (residential and non-residential) to be fair and equitable. They created an application-based deferral program consisting of pre-authorized monthly withdrawals to defer payment from our regularly scheduled due dates. It would apply to all property classes (residential and non-residential) to be fair and equitable.

Balance can include any unpaid installments from March 1, 2020 and all of 2021 taxes

Taxes will be paid in full by December 1, 2021

Penalty/interest will be suspended for the duration of the deferral

Withdrawal start date chosen by the property owner.

Financial impact to the city is dependent on the number of applications and total tax payments deferred. It amounts to a shift in cash flow of property tax revenues to later in the year. The city will not collect penalty/interest revenue for months that taxes are deferred.

Taxes levied on behalf of the Region and school boards would still be paid on the normal schedule.

Eligibility criteria

Property taxes must be current prior to the pandemic (March 1, 2020)2 Property taxes must be current prior to the pandemic (March 1, 2020)2

Property owners would need to attest that they are experiencing financial hardship directly related to COVID-19

The expectation is that property owners with tenants should be passing on the deferral arrangement.

By Pepper Parr By Pepper Parr

March 4th, 2021

BURLINGTON, ON

OPINION

Once the decision is made to settle on just what the tax rate for a year is going to be the politicians get to justify it.

Each brings their own perspective and point of view to the decision that has been made and want to ensure that their constituents are aware of the work they did and why they deserve their vote at the next election.

Burlington has a seven member Council.

In this article I want to focus on the role Councillors Stolte, Nisan and Mayor Meed Ward played in producing the tax rate.

The 4.14% increase is the city’s portion of the taxes collected and used to pay the bills and ensure that there are reserves in place to protect when there is a financial failure. That number is what matters to the people who pay the taxes.

The tax payment you send the city happens to include the tax rate set by the Region for their expenses and the tax rate the Boards of education set to keep the schools operating. The city collects all the money and sends the Regional levy to the Region and the school board levies to the school boards.

Ward 3 Councillor Rory Nisan – served as Chair of the Committee that debated the city budget The debating and bickering that takes place to arrive at a tax rate takes place at a Standing Committee. This year that committee was chaired by ward 3 Councillor Rory Nisan. Mr. Nisan did not cover himself with glory while doing the task; he was difficult, less than fair to some of the Council members and tended to be authoritarian while doing the work.

He was acrimonious, discourteous and rude at times when the job of chair calls for a deft, mature understanding of the wishes of each Council member, drawing them out and letting a consensus come out of it all.

On far too many occasions it was clear that Nisan did not understand the numbers – he would say “that is nice to know” when it was actually essential that the Chair have a solid grip on what each number meant.

Chief Financial Officer Joan Ford; always ready willing and able to mentor members of Council Burlington has a Chief Financial Officer, Joan Ford, who bends over backwards to explain what can at times be arcane and difficult to understand. She is always ready, willing and able to mentor the Chair – Nisan didn’t appreciate or take advantage of what was available to him.

Mr. Nisan has shown a preference for aligning himself with the Mayor and championing her wishes and aspirations rather than creating a path of his own. It is hard to be certain just what Rory Nisan does stand for.

Like every other member of Council he will have to stand for re-election in 2022. He doesn’t have a lot of time to let his constituents know and see who he really is and what he wants to get done. Other than wanting to be the Mayor’s choice for Deputy Mayor – it is hard to point to something that has made a difference. There was a splash pad set up in his ward – but that idea was put in motion by his predecessor.

The Mayor said at the beginning of the budget proceedings that the 4.99% increase budget Staff brought in was not going to fly – her target was 3.99% and she fought hard to get that number.

She didn’t have the support of enough of her council members to make it happen – some found the drive for that 3.99% was misplaced and that the purpose of the budget was to serve the needs of the citizens and not the aspirations of a politician.

Meed Ward, to her credit, realized the 3.99% was not going to happen. “The goal is not going to be met,” she said; “let it go” and she did, adding that there is no shame in aiming high.

The Mayor said on numerous occasions that her objective was to “leave more money in the pockets of the tax payers”. The words had a populist tinge.

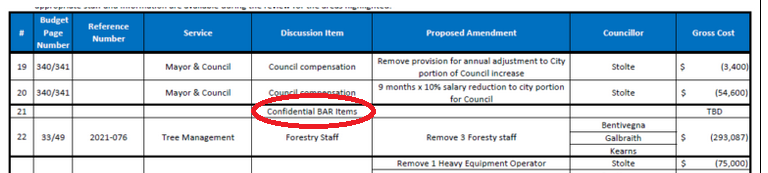

Took positions that challenged what others were advocating; kept pushing for more transparency. Councillor Stolte was the star of the budget debates – she consistently, but respectfully, challenged the views of her colleagues and questioned the Clerk on several of the decisions he made.

Saying:

“My comments in regard to whether or not to endorse the 2021 Operating Budget will be highlighted in two components today.

“In regard to the tax rate that we have landed on, I believe it is the result of a great deal of hard work by our Finance Department and this Council, and a great deal of effort to balance the needs of the community with solid financial stewardship and protection of City assets.

“There is still a great deal of work to be done within the City of Burlington to reduce unnecessary bureaucracy and the financial inefficiencies that are inherent in an overly bureaucratic organization, but we have begun to see some positive changes in this regard and I look forward to the citizens of Burlington reaping the financial savings from these improvements in the future.

“The second component of my comments is in regard to the PROCESS involved when staff and Council are tasked to determine the priorities, sacrifices and compromises necessary to manage a city budget.

“It was mentioned earlier today that I had brought forward a Staff direction in March of 2020 that was unanimously supported by Council. It stated to:

“Direct the Chief Financial Officer to plan a Council Workshop in June of 2020 with the subject matter of “Vision to Focus – Budget 2021”. The purpose being to allow staff and Council the opportunity to collaborate on high level priorities, values and vision leading into the 2021 budget process in an effort to concentrate the focus and priorities of Council.”

“Comments may be made that this plan was impacted due to COVID-19 but in hindsight, the 2021 budget still needed to be dealt with and the need to collaborate with Council on focus and priorities, at the start of that process, still should have happened.

“I am disappointed that another Budget cycle was completed without the benefit of a more collaborative Staff/Council process at the outset and I appeal to our City Manager to commit to ensuring that this process improvement is implemented for the next Budget cycle for 2022.

“Curiously, as we endeavored to land this Budget, further process and best practice challenges came to light.

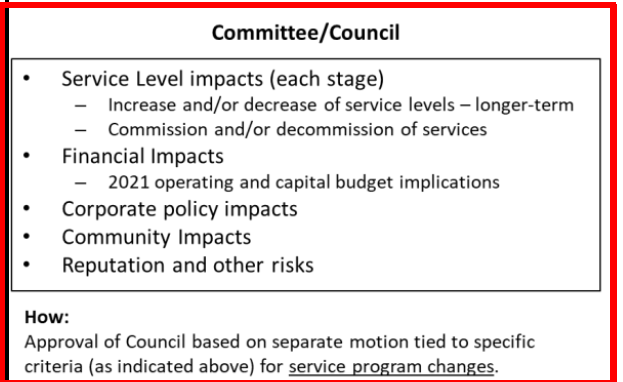

“When we began this term of Council in early 2019 we were oriented to understand that we would receive recommendations from staff in regard to agenda items that needed to be discussed in private, behind closed doors.

“Over the last two years the regular practice has been for Council to receive advice that we “need” to move into Closed Session and this recommendation is always accepted by Council without debate, as merely a point of procedure.

“During the 2021 Operating Budget process I presented an amendment which became the topic of much debate with the City Clerk and City Manager’s Office.

“It was recommended by staff that this amendment be discussed in private, behind closed doors.

“I challenged this recommendation and it quickly came to light that this was a very rare occurrence for a Closed Meeting recommendation to be questioned by Council and I was informed that it was inappropriate for a Councillor to question a staff recommendation of this nature.

“This is not how the municipal democratic process works … Staff’s role is to make their best professional recommendation and our role on Council is to assess this recommendation and concur or contest based on whether or not we believe the recommendation represents the best interests of the residents of Burlington.

“Ultimately, the decision on the Budget item was in the hands of Council, where it should be…but the process involved in this discussion was what was of concern.”

Stolte’s comments have the potential to bring about a change in the way council meetings are managed. The doors need to be open as much as possible.

This Council worked very hard to produce a budget that met the needs of the tax payers and at the same time underlined the goals they had when they sought election to city Council.

There are lessons in the budget experience for every member of Council; hopefully they will take the time to reflect on what took place and learn from both the mistakes and the successes.

This council was supported by a well-tuned finance department who met every challenge put to them and then some.

Salt with Pepper is the musings, reflections and opinions of the publisher of the Burlington Gazette, an online newspaper that was formed in 2010 and is a member of the National Newsmedia Council.

By Pepper Parr By Pepper Parr

March 3rd 2021

BURLINGTON, ON

It is now official.

Council voted for a tax levy of $182,276,388 which will mean a 4.14% increase in the 2020 city portion of the tax bill.

Ward 6 Councillor Angelo Bentivegna votes against the budget. Ward 6 Councillor Angelo Bentivegna votes against the budget.

That budget will mean an additional $18.99 per 100,000 of assessment value/

It was a tough budget; the toughest this council has had to deal with.

The COVID issues muddied up almost everything.

Mayor Mead Ward was gracious in her comments about the role each member of Council played in landing the budget.

By Pepper Parr By Pepper Parr

February 25th, 2021

BURLINGTON, ON

They wrapped it up.

We now know what the tax levy is going to be for the fiscal year: they are going to tax the public a total of $182,276,388.

We don’t know yet what that will translate into in terms of a percentage and what it will mean in terms of how much taxation for every $100,000 of property assessment.

Those details were not presented to the public during the meeting. It does not appear that the Mayor is going to be able to deliver on the promise of a tax increase over last year of not more than 3.99%

It looks like it will come in at about 4.05%

Before the lunch break the percentage over last year was 4.14%. Members of Council decided they would dive back into the budget and see if they could change their minds on some of the decisions they had made.

That’s when things got sticky. The rules of the game on a reconsideration of a vote call for a person who voted for the original motion to bring a motion that needs a 2/3rds majority to pass.

Ward 3 Councillor Rory Nisan chaired the committee that handled the budget review. He is said to have his eyes on the Office of the Mayor once Meed Ward has moved on to greener pastures. Chair of the meeting, Rory Nisan, did everything he could to get around that problem.

They went for lunch before they had a solution.

There is a contingency Reserve fund that had $1.8 million put into it – which was an increase over last year. Mayor Meed Ward wanted to decrease the increase by about 10% which would have allowed them to get to her much desired 3.99% tax increase.

Her colleagues were having none of it and went after the Mayor for raiding the Reserve Funds piggy bank. The account had something in the order of $9 million it.

Ward 1 Councillor Kelvin Galbraith listening to what his constituents have to say. Councillor Galbraith said he got far too many negative comments from his ward about the way reserve funds were being raised. He wasn’t on for more of that.

Councillor Bentivegna said raiding reserves was not what he wanted to do. If the increase was higher than the 3.99% – so be it.

City Manager Tim Commisso said that while there was some risk chipping away on what was going to be salted away the one before Council didn’t bother him that much.

Something had changed. Members of Council appeared to have stopped buying into the Mayor’s 3.99%. It took a bit for that change to sink in and while the Mayor never did say she would go with the will of her colleagues – it appears that she is going to have to find words to get her out of this one.

This is city council, Lisa Kearns is missing. City Manager, top left and Committee Clerk bottom right. Later this week there will be a carefully worded media release giving this budget that rosy red glow that the apple polishers can do to fruit that may have gone past its best before date.

It all goes to Council on March 3rd. Several Council members chose to withhold their comments on the budget until it gets to Council on the third.

This may not be over yet.

By Pepper Parr By Pepper Parr

February 25th, 2021

BURLINGTON, ON

Updated on February 25th: 11:07 am

A day off doesn’t seem to have changed a thing.

No sooner had Rory Nisan, Chair of the Corporate Services, Strategy, Risk and Accountability (CSSRA) committee, gotten through the Declarations of a Pecuniary Interest (there were none) and noting that there was nothing on the consent agenda – the meeting slid over to John Ford who said Tuesday had been a long day and then passed things along to Laurie Jivan who said that the tax rate for the city spending would amount to 4.18 % (that would be the increase over the 2020 budget) and that if they wanted to get it to 3.99% they would have to find $343,000 in savings.

The meeting returned to Nisan who said the Committee was going to look at items #4 and #24 on the Budget Action Requests (BAR) forms and in order to do that the Committee would have to go into CLOSED session.

Nisan asked Galbraith to so move, Galbraith did, everyone voted yes let’s do that and the screen went to the CLOSED image.

Not one member of Council asked for detail on why they were going into a CLOSED session.

Those who watch Council meeting webcasts would have seen this image often – too often? Item #4 on the BAR form was a provision to reduce the amount that was to go into the Contingency Reserve. Staff was recommending anything between $100,000 and $338,445. The Mayor wanted that amount to be $400,000 while Councillors Bentivegna, Kearns, Galbraith, Nisan, and Sharman wanted the amount to be $100,000

Item 24 on the Bar forms was to remove $154,470 from the spending – remove 1 legal staff who worked on Community Planning matter. Bentivegna, Galbraith and Sharman proposed this.

A former councillor at a Halton municipality pointed out to us in an email that:

A meeting or part of a meeting may be closed to the public if the subject matter being considered is:

• the security of the property of the municipality or local board

• personal matters about an identifiable individual, including municipal or local board employees

• a proposed or pending acquisition or disposition of land by the municipality or local board

• labour relations or employee negotiations

• litigation or potential litigation, including matters before administrative tribunals, affecting the municipality or local board

• advice that is subject to solicitor-client privilege, including communications necessary for that purpose

• a matter in respect of which a council, board, committee or other body may hold a closed meeting under another Act

• information explicitly supplied in confidence to the municipality or local board by Canada, a province or territory or a Crown agency of any of them

• a trade secret or scientific, technical, commercial, financial or labour relations information, supplied in confidence to the municipality or local board, which, if disclosed, could reasonably be expected to prejudice significantly the competitive position or interfere significantly with the contractual or other negotiations of a person, group of persons, or organization

• a trade secret or scientific, technical, commercial or financial information that belongs to the municipality or local board and has monetary value or potential monetary value

• a position, plan, procedure, criteria or instruction to be applied to any negotiations carried on or to be carried on by or on behalf of the municipality or local board.

In a memo to Council the Finance department provided the following comment on the Provision to Contingency Reserve – As stated in the budget reduction list provided to you on February 1st, the list included a $100,000 reduction to the provision that would flatline the amount to the 2020 budget. The note included that the uncommitted balance was approximately $9.5 million. A question was asked as to whether the amount of the provision could be reduced further given this balance. Legal staff are reviewing outstanding and potential future litigation matters. At this time, a range could be considered for Committee’s discussion. This range would be from $100,000 (results in a budget provision of $2,038,445) to $338,445 (results in a budget provision of $1,800,000).

Would item #4 and # 24 meet these conditions? At some point the provincial Ombudsman will be asked to investigate and determine if these two, along with the other multiple occasion Council went into CLOSED on this budget – which at this moment has yet to be agreed upon before it goes to Council on March 3rd – and when you will know how much of your money is going to slide out of your pocket.

By Pepper Parr By Pepper Parr

February 24th, 2021

BURLINGTON, ON

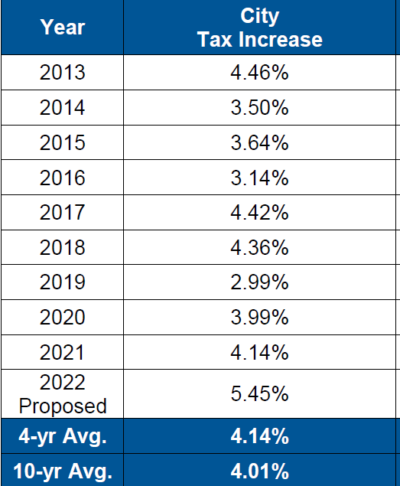

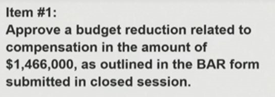

Just what was the hullabaloo all about? It was about a possible $1,466,000 savings that had something to do with city hall staff remuneration.

Ward 4 Councillor Shawna Stolte had some ideas on where savings could be found – wasn’t allowed to talk about them. They had to do with how much the city pays its staff. Details on just what was behind that idea were not made public because Ward 4 Councillor Shawna Stolte was not given the opportunity to talk about her proposal in a public session.

We are never really going to know the whole story but based on what is available we can say this: no one in the city knows the Municipal Act better than Clerk Kevin Arjoon who managed to find several sections on the Closed meeting provisions to keep Ward 4 Councillor Shawna Stolte from speaking publicly about her idea for reducing the size of the tax bite for the current year.

Stolte had an item on the BAR forms that didn’t have an amount next to it. It did have a note that it was to be discussed in a CLOSED session.

The items Stolte had in mind were broken out by Staff who created a list of four items.

Council then went into a CLOSED session to debate. We do not know what Stolte said, if anything, in the CLOSED session of a Standing Committee that lasted 12 hours.

There is a report that Stolte did not speak to her own motion while Council was in CLOSED.

Item 1 Defeated.

Item 2 – withdrawn

They then recessed until 6:30.

After the recess they then went back into Closed session to debate the other two items.

Based on what we have been able to piece together, we know that the proposal had to do with staffing.

City manager Tim Commisso appears to have out the interest of his staff ahead of the taxpayers. The city manager was adamant in wanting to get the discussion off the public table and have the views of Council members, particularly Stolte, away from the public.