By Staff By Staff

September 15th, 2023

BURLINGTON, ON

The federal Liberals met in London, Ontario for three days and came out with several bold statements.

They said they are going to do something about food prices and have told the supermarkets that if prices are not lower by Thanksgiving – “watch for consequences”.

Prime Minister Justin Trudeau credited his Liberal MPs for the government’s decision to summon the heads of major grocery companies to Ottawa next week to discuss how they will “stabilize” food prices on the same day one of the major supermarkets reported a profit increase of 40%

No good news on those shelves. Supermarket corporate leaders are being summoned to Ottawa to “stabilize” food prices.as they rake in record profits. “Those profits should not be made on the backs of people who are struggling to feed their families,” said Trudeau.

Did Burlington MP Karina Gould speak up for her constituents during the Liberal retreat in London? House of Commons returns on September 18th

Thanksgiving Day is October 9th this year.

There might be deals on turkeys.

By Pepper Parr By Pepper Parr

September 15th, 2023

BURLINGTON, ON

Craig Kowalchuk who operated Emmas Back Porch – very successfully for years has a new brand name on his T shirt. Something might be up with Emmas – is it the Emmas Back Porch or perhaps the Emmas Kitchen that Craig Kowalchuk had on a T-shirt he was seen wearing or could it be a “New Emmas” that is being floated?

The building on Old Lakeshore Road is still there – all gussied with fresh paint.

The owners were once advertising the space for rent for private parties. From time to time we get reports of a lot of traffic in and out of the place – but nothing recently.

People with an insurance background – lots of money in those pockets – are working at drumming up some interest.

Let’s see what comes of it.

By Pepper Parr By Pepper Parr

September 15th, 2023

BURLINGTON, ON’

An update on the preparations for the March Ontario Land Tribunal hearing on the development application to add close to 100 homes to the golf course site.

On Tuesday, September 26 at 9:30am, Burlington city council will consider a resolution to the Minister of Municipal Affairs and Housing to declare a provincial interest in preserving Millcroft’s greenspace. On Tuesday, September 26 at 9:30am, Burlington city council will consider a resolution to the Minister of Municipal Affairs and Housing to declare a provincial interest in preserving Millcroft’s greenspace.

If successful, such a resolution has the potential to halt the Ontario Land Tribunal hearing. However, we cannot rely on this option’s success exclusively.

In the event the resolution is passed, MAD will contact supporters to write to their local MPPs, the Minister of Municipal Affairs and Housing, and the Premier in support of the resolution.

The OLT hearing’s confirmed parties are Millcroft Against Bad Development, City of Burlington, Region of Halton, Halton Conservation Authority, Millcroft Greenspace Alliance, and Millcroft Greens. The OLT hearing’s confirmed parties are Millcroft Against Bad Development, City of Burlington, Region of Halton, Halton Conservation Authority, Millcroft Greenspace Alliance, and Millcroft Greens.

Each party has exchanged its witness list. Chantal Desereville of Weir Foulds (Legal Counsel) and Allan Ramsey (Land Use Planner) will represent MAD at the hearing.

The key dates for the OLT process are as follows:

October 13 – Meeting of party experts

October 27 – Statement of facts

November 24 – Exchange of witness statements, summoned witness outlines, expert reports

December 15 – Exchange of response to witness statements

March 5 – Hearing commences (expected to be 19 days)

Political opposition to the development

The City of Burlington, Region of Halton, and Halton Conservation all oppose the development application and will call several expert witnesses. MAD believes each of these parties will vigorously oppose the application and have the financial means to supply the appropriate experts. With close to 6,000 registered supporters, MAD has the political voice to make an impact at the OLT hearing.

MAD initiatives

Over the summer, MAD executives continued to engage with city Councilors and provincial MPPs to rally their support for our cause and explore pathways to halt the development prior to an OLT hearing. Due to our approximately 6,000 supporters, many Councilors, MPPs, and other politically significant people and groups now follow MAD on social media. We have also been working with our expert team, Allan Ramsey and Chantal Desereville, in preparing for the

OLT hearing.

MAD had a fundraising concert on Hadfield Court with the Torque classic rock band sponsored by Glen Bowker, which raised over $4,000. We have partnered with Small Change Fund to allow supporters to receive a charitable donation receipt for their contributions to our cause.

Mad’s participation at OLT – A Critical role

As the most directly impacted party at the hearing, it is critical that MAD present Allan Ramsey’s expert testimony on land use planning, with world-class legal counsel for opening statements and cross-examination. MAD, as the united community voice, is an indispensable party in ensuring any proposal reflects the best interests of the entire neighbourhood and city, should a negotiated solution be considered.

Funding the efforts

The projected cost of our participation at the OLT is $60,000. The majority of these costs will be related to our professional advisors, with the remainder to be spent on outreach and continued communication with our supporters. MAD has approximately $20,000 in reserve. Consequently, we need to raise $40,000. We believe this to be a realistic fundraising target. If we are unable to raise these funds, we will be unable to participate meaningfully at the OLT hearing.

Ways to donate

• Donate through our website

• E-transfer to admin@millcroftagainstdevelopment.ca

• Cheque

o Mail or drop off at 2067 Hadfield Court, Burlington, Ontario, L7M 3V5.

o For pickup, email admin@millcroftagainstdevelopment.ca

Tax Receipt Option – Small Change Fund

By Staff By Staff

September 14th, 2023

BURLINGTON, ON

City Council has conditionally accepted a revised proposal related to a development application at 1600 Kerns Rd. to rezone the site from ‘Neighbourhood Commercial’ to ‘Mixed-Use’. This zoning continues to allow commercial uses on the property, while also adding residential units.

The revised proposed redevelopment contemplates a four-storey retirement home of 115 units, with commercial uses at street level – the original proposal did not include commercial space.

Staff note in their planning justification report that providing an option for seniors housing in the area provides a greater mix of housing types and can provide an option for residents to age in place.

The recent changes to the proposal take into account concerns raised by the community, staff and council and include: The recent changes to the proposal take into account concerns raised by the community, staff and council and include:

• An increase in commercial area abutting Kerns Road and Four Seasons Drive from 278 m2 to 450 m2;

• An increase in landscape buffer abutting a residential zone to a minimum of 2.5 m along the loading space area and 3 m along the outdoor amenity area;

• An increase in amenity area 14.4 m2 per dwelling unit to 15.4 m2 per dwelling unit;

• A reduction from 5-storeys to 4-storeys with 115 units;

• A decrease in front yard setback (Kerns Road) from 6 m to 4.5 m to provide a greater setback from the erosion hazard area.

This project was appealed to the Ontario Land Tribunal (OLT) with a hearing date set for Oct. 2, 2023. There are still contested matters, such as setbacks from the creek and parts of the development still existing in the erosion hazard area. Expert evidence regarding the hazard will be provided by

Conservation Halton and depending on how the OLT rules, may require further refinements to the project.

Should the OLT prefer the technical evidence of Conservation Halton regarding erosion hazards, the City of Burlington would not support the approval of the revised development.

We want to thank the many residents who provided their input into the 1600 Kerns Rd. project. It has contributed to a better proposal, including a more appropriate height for the area, larger setbacks, and additional commercial space.

We have heard from many in the community about concerns related to a loss of the neighbourhood commercial feature with the proposed rezoning from commercial to mixed-use. Mixed-use allows both commercial and residential uses and provides more flexibility on the property.

As a result of community input, 450 m2 in commercial uses are preserved as part of the mixed-use proposal.

We also heard concerns from residents regarding the size of the building. It was reduced from 5-storeys to 4-storeys from the original proposal to adhere to our new Official Plan. The developer also accepted a request from the working group on this application to move the location of the building so the street corner would remain open.

The neighbours immediately backing onto the project have withdrawn their appeal after changes satisfied their concerns.

The OLT will still need to rule on the setbacks from the creek, so more changes may yet come on this project.

Thank you once again to everyone who participated in reviewing this proposed development. We believe your concerns and your input have been reflected in the revised proposal.

Marianne Meed Ward Kelvin Galbraith

Mayor, City of Burlington Ward 1 Councillor

—

By Pepper Parr By Pepper Parr

September 14th, 2023

BURLINGTON, ON

The Mayor’s Strut has become a topic for local conversation.

Mayor gets it all moving as she talks about her strut – to be seen live at the hospital fund raiser at the Art Gallery on Friday. Appearing on CHCH Morning Live the Mayor talked about her meeting with the Premier – we got her side of the story – how plans at the Bateman site were coming along, a development approved on the east side of Brant that met the kind of criteria the Mayor likes – 12 storeys – with a 26 story on the other side of the street.

She also said that the 7.82% budget increase was not what she had in mind – that she would work with Council to come up with something lower than that. Refreshing news

The big issue for many of those watching the TV broadcast was the Mayor’s Strut. She gave the viewing public a tease and a taste of what she can do.

The Strut was to promote the Red Carpet Charity and Runway Show taking place at the Art Gallery on Friday – a fund raiser for the Joseph Brant Hospital.

See what the Mayor can do when she wants to make a point. Scroll to minute 4:25

By Staff By Staff

September 14th, 2023

BURLINGTON, ON

Rock out at the library! We’re bringing back Library After Dark, with a touch of spooky this year! Rock out at the library! We’re bringing back Library After Dark, with a touch of spooky this year!

Join us after hours for an epic night featuring rip-roaring party band, The 99s. Think candy coloured neon lights and throwback tunes that will have you singing until your throat is raw.

Feeling Halloween-y? Costumes are encouraged but not required.

Tickets are a little on the pricey side: $55.66

Get your ticket before they sell out!

By Pepper Parr By Pepper Parr

September 14th, 2023

BURLINGTON, ON

OPINION

There has always been a concern with the thinking Mayor Marianne Meed Ward does when it comes to financial matters.

Many people sense that she does not have a firm grasp of balance sheets and profit and loss statements.

Hydro reserves were raided to pay for Marian upgrades. There is a tendency to spend, a habit of raiding reserve funds to pay for projects she wants to go forward with.

Frugal is not a word used by this Mayor.

Now that she has Strong Mayor Powers the Mayor can get away with almost anything – given the size of the city council it will be hard to defeat anything she comes forward with.

There was nothing wrong with the idea of rainbow crosswalks. But did they all have to be done in the one year and then add rainbow benches as well? There are some who think Councillor Sharman will serve as a modifying influence – not something we want to depend on.

Power is not equalizing; power corrupts; power reveals.

The people of Burlington have seen what this Mayor can do when she gets the bit in her teeth.

Will this be her finest hour? Stand By – this could be painful.

Salt with Pepper is the musings, reflections and opinions of the publisher of the Burlington Gazette, an online newspaper that was formed in 2010 and is a member of the National Newsmedia Council.

By Pepper Parr By Pepper Parr

September 14th, 2023

BURLINGTON, ON

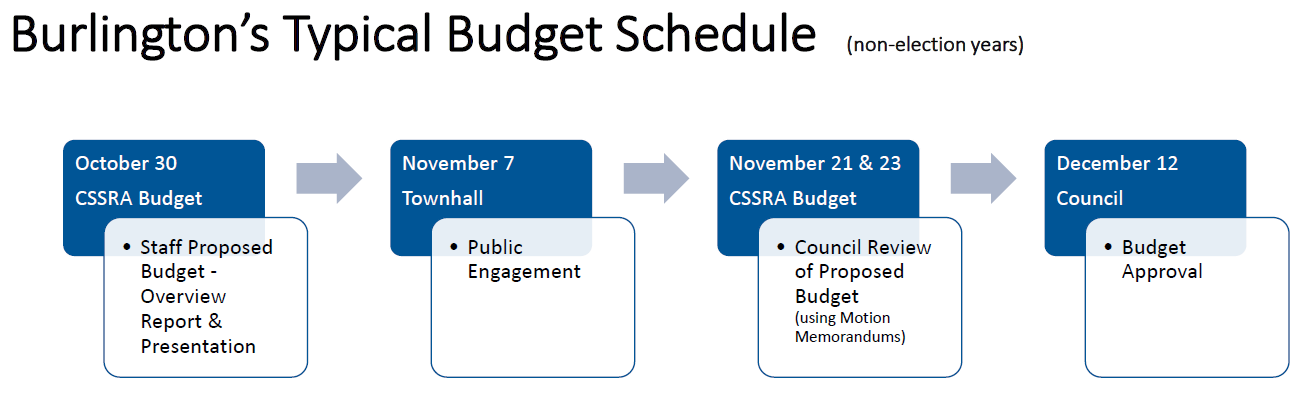

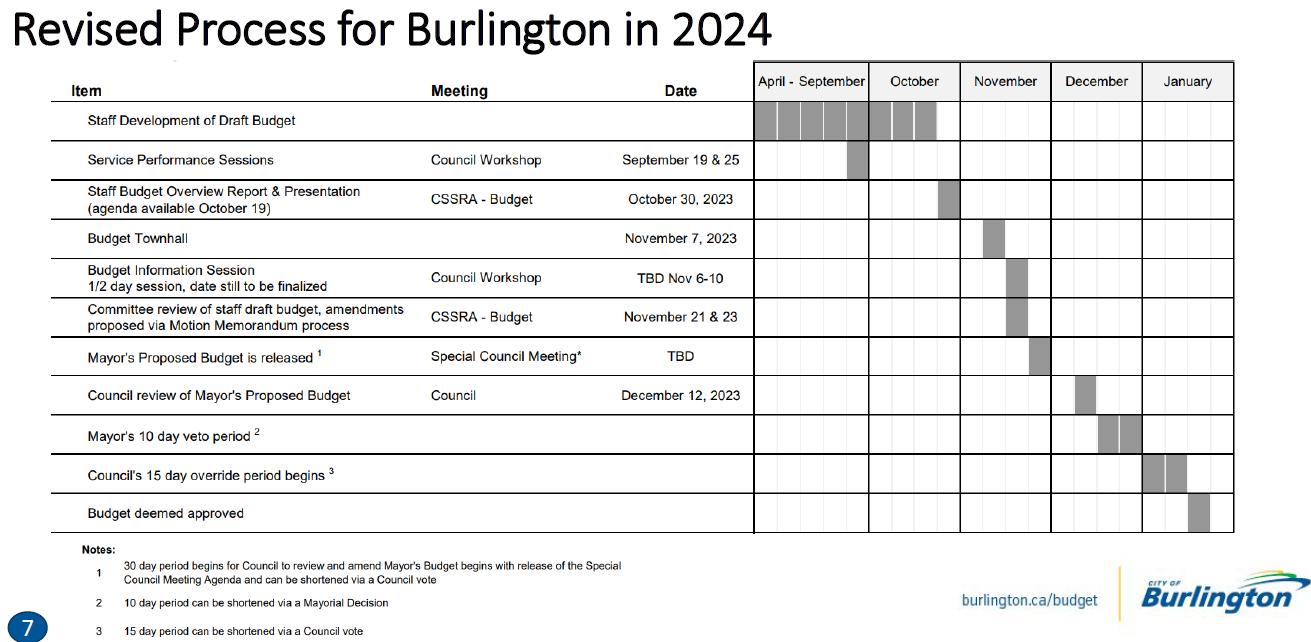

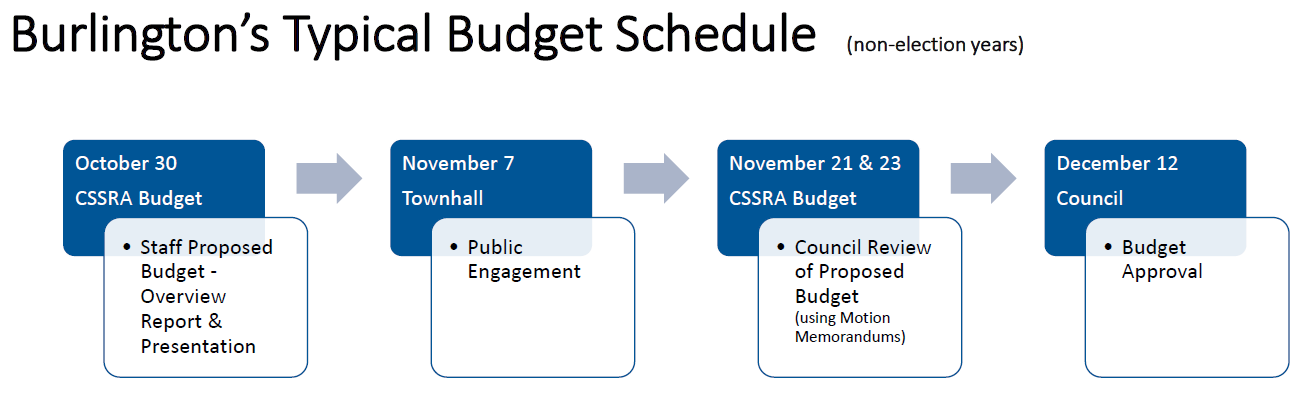

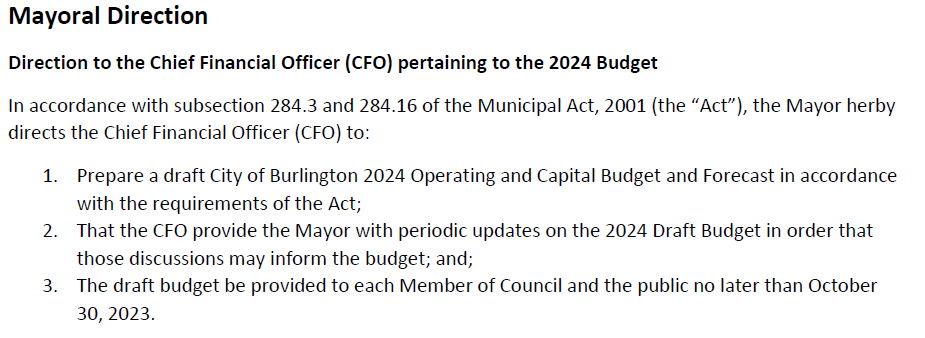

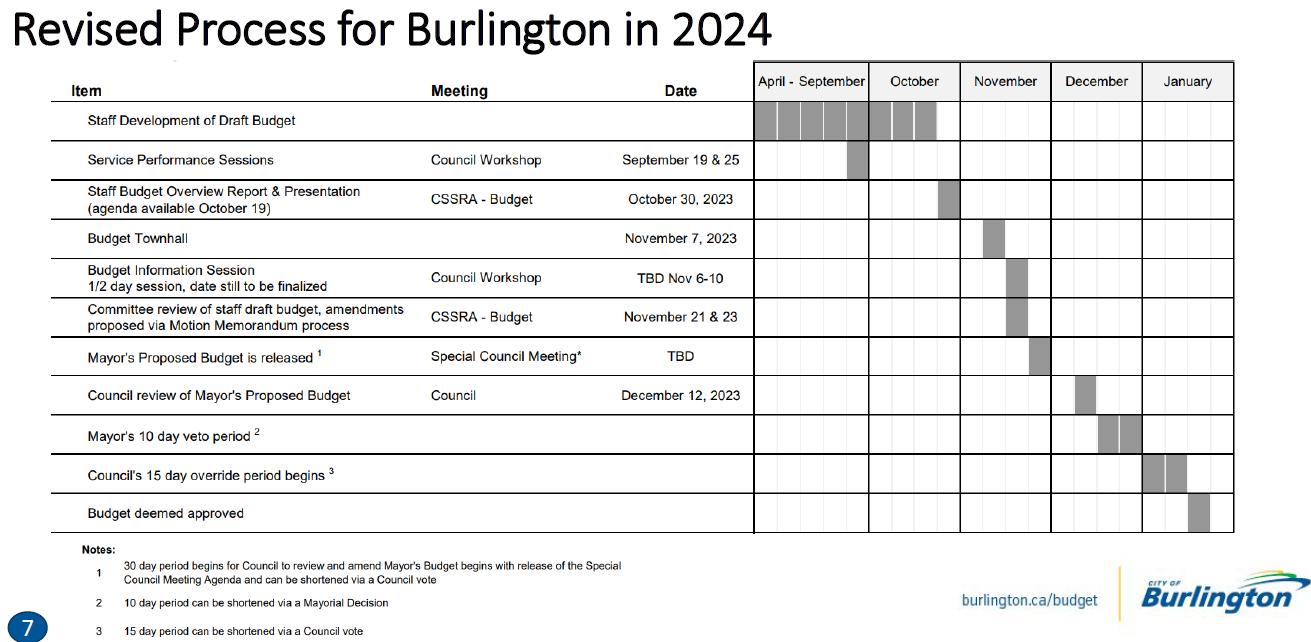

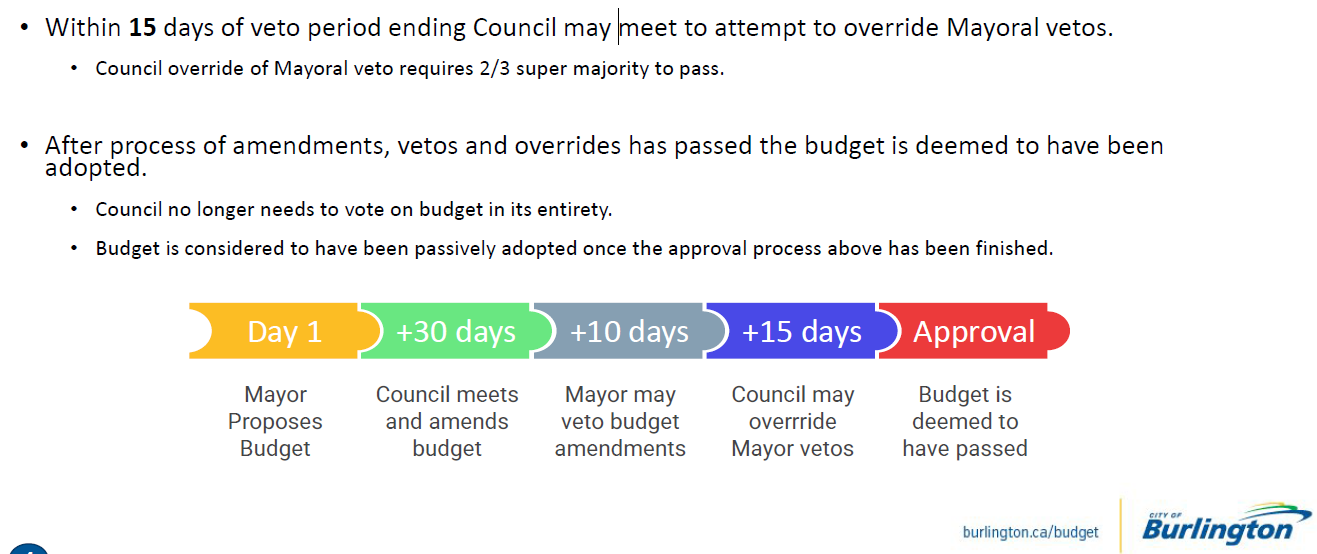

This is the process a city budget goes through each year.

It will be a different budget process this year. Why?

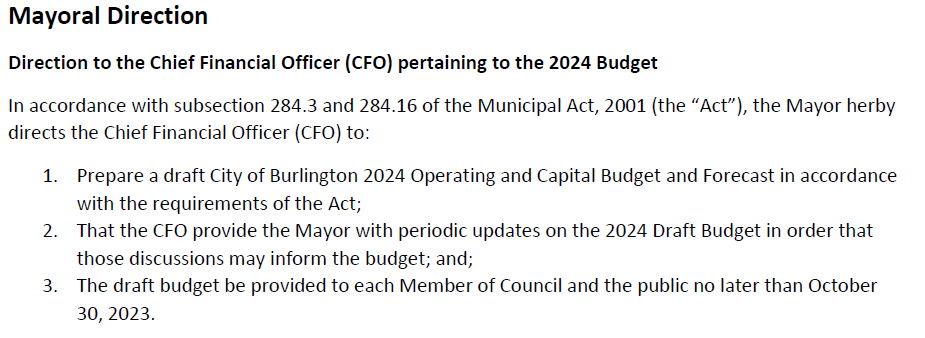

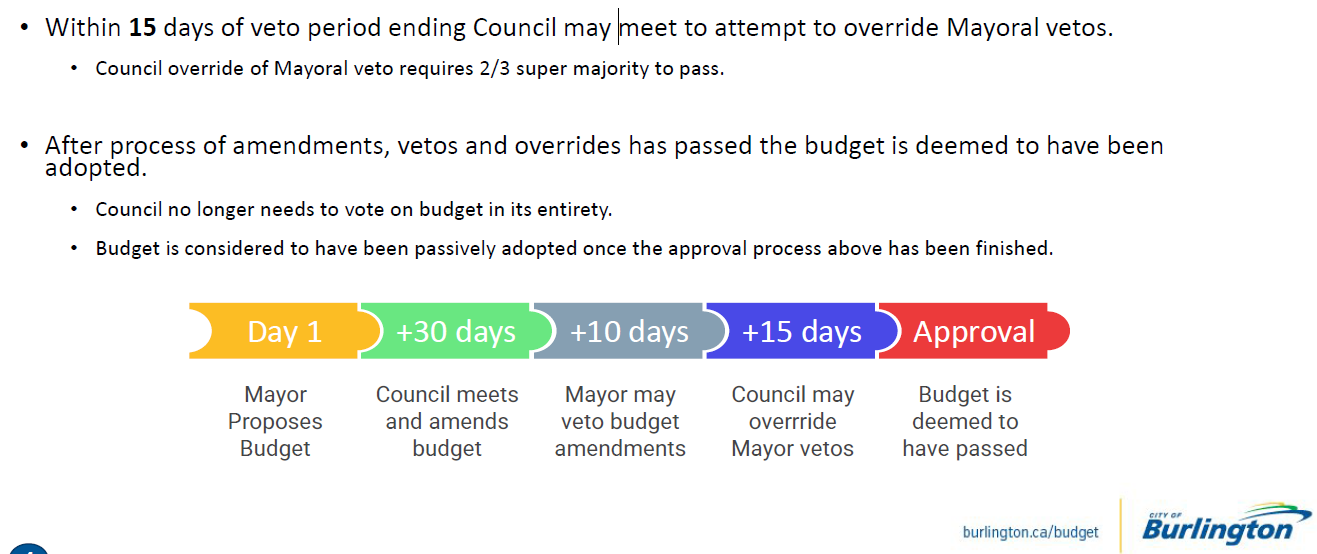

There is now legislation which gives the Mayor the power to direct the Chief Financial Officer to produce a budget that is delivered to members of Council not later than October 30th.

Then what? The schedule as set out in the Strong Mayor legislation.

Some staff members are already having difficulty with the process – it will be awkward, bumpy – but eventually there will be a budget.

A remark by the Mayor during a Standing Committee meeting left a glimmer of hope.

She told her colleagues that she was prepared to hear whatever council might have in mind in the way of a cap on just how high the budget increase could go.

Related editorial opinion:

Nothing frugal about this mayor

By Paul Hanson By Paul Hanson

September 13th, 2023

BURLINGTON, ON

Have you ever wondered why your money won’t just go as far as it did before the pandemic? We get told it’s due to massive, unforeseen events that are out of control of every day people: the war in Ukraine, COVID-19, Brexit; the list could go on and on. But once these large disruptions in the global order of things have occurred, how do the shockwaves propagate out through the rest of society?

The cost of living is hitting everyone – solutions are not clear yet. The truth is that each and every one of us, to a tiny, but not vanishingly small degree, are playing a part in this. Don’t mistake this analysis for an attempt to blame the victim, or to say that you should be doing more to support the economy; this is not what’s being said here at all. Rather, we talking about the small shifts in behaviour consumers are making as a result of the cost of living crisis, and how these seemingly small acts can have a profound affect on the wider economy.

Learning from a trip to the cinema

Let’s consider, for a moment, the prospect of asking your boss for a raise. Imagine you work at a cinema, you want your wages to go up to cover the increased cost of food and fuel. This is a perfectly reasonable thing to want, especially in the present situation, but your boss still declines your request. She tells you that her business is struggling because of more and people staying at home — they simply have less money to spend on leisure activities like sitting in front of the big screen for a couple of hours on a Sunday afternoon.

Cutting screening subscriptions is a choice many are making. She can’t afford to give you a pay rise until business picks up again, but business is unlikely to pick up unless people have more money to spend. Do you see how this quickly becomes a vicious circle? And that’s before we’ve even broached the fact that many people are reducing the number of streaming subscriptions they have, let alone considering spending precious disposable income on a 2-hour trip to the local cinema.

But the cinema is an outdated form of entertainment, you say. Think again, it goes far deeper than that…

Understanding the true cost of lunch out in town

As a whole, we’re spending less on food on days out with the family, as well as on evening meals on the weekends to enjoy a break from the kids. Again, in times where money in the household budget is constrained and wages drop in real terms, this is a perfectly prudent thing for everyone to do. The problem is it doesn’t help the cafes, bars and restaurants who have to pay the staff whose household bills and living expenses continue to rise.

Taking a packed lunch and enjoying a picnic, rather than stopping in at your favorite cafe, may feel like a smart thing to do because it saves you money in the immediate future. But what about the knock-on impact to the rest of the economy? If more and more people start doing it, there’ll be less work for the catering and hospitality sectors, which means less money for the people who rely on them for their livelihood.

Soaring food prices are hitting everyone. But my eating habits don’t really have any impact, you say. How about another key area many of us are cutting back on?

Seeing the impact of the staycation

Short weekends away nearby rather than lengthy foreign holidays are becoming more and more common during the cost of living crisis, and again, this is perfectly understandable. The problem is that while it keeps money in your pocket so you can cover your urgent expenses and outgoings, it will hit the tourist industry hard.

At the heart of it we’re not really talking about the abstract idea of an ‘industry’ making less money, we’re considering how consumer spending shifts result in less money to pay staff. Wages stay low, fewer people purchase products and services, running costs increase and the vicious cycle continues.

Final Thoughts

A summer picnic is a lot less than a familty dinner in a restaurant. Many of us are turning to more affordable, cost-effective ways to enjoy our free time. YouTube is a free alternative to Disney+ and Paramount, picnics in the park are kinder to the budget than a meal out, and things like free casino games or free online bingo are becoming increasingly popular ways to play instead of playing for real money.

While this helps us stretch our household budget further that week, the impact on the economy is far wider and longer lasting. This shouldn’t be pure doom and gloom though: these types of patterns in the economy are always cyclical. Opinion may be split on when the upturn will begin, but history shows it always does.

Be patient, prudent and kind and we will all get there.

By Pepper Parr By Pepper Parr

September 13th, 2023

BURLINGTON, ON

Will it be semi-detached house?

Maybe duplexes?

Albert Facenda – on a roll; chomping at the bit, looking for a way to get zoning changes in place. Triplexes don’t appear to be popular.

Take those three forms of housing and then add the letters MZO – Ministerial Zoning Order. That’s when the province tells a municipality what it has to do.

Sometime in the next few weeks – maybe the next few days, Burlington’s MPP Natalie Pierre will be getting a visit from one of the smaller developers – the guys who do small one off project – and taking through a situation that some believe has been a breach of responsibility on the part of the city when it comes to permitting zoning is low density parts of the city.

Albert Facenda has been itching to get at this one for more than seven years.

He delegated at council earlier this week – feels Chair Paul Sharman kept trying to shut him down explaining that what Albert wanted to talk about was not on the agenda.

That has never bothered Albert in the past.

Going forward – this should by fun.

Stand By

By Pepper Parr By Pepper Parr

September 12th, 2023

BURLINGTON, ON

The Boy Scout movement isn’t what it used to be

There was a time when a lot of boys were Scouts. Those who became what were then called Queen’s Scouts were seen is as a cut above the crowd. There was a time when a lot of boys were Scouts. Those who became what were then called Queen’s Scouts were seen is as a cut above the crowd.

Today they would be called King’s Scouts and they aren’t what

The 11th Burlington Scout troop is no longer active but in its day it was very active. There was some land donated to the Scouts and they carved a camp out of the wilderness just outside.

Kevin Jackson, one of five Cam Jackson brothers, reached out to us to advise that Paul Barbour is arranging a small reunion at Camp Speyside on Saturday September 23.

Anyone who was a member of the 11th Burlington scout troop is invited. You can bring along your kids, wives, parents.

The only condition is no alcohol and no smoking.

No doubt everyone has forgotten how to get there, so Paul is going to show us the way. Be at the Pineland Public School parking lot at 10 am on September 23.

Bring a lawn chair if you wish. If you prefer to drive direct to the camp, contact Paul and he can send you a map or give you the Finlay’s address to plug into your GPS.

If you have questions you can contact Paul at 905 639 3501 or email him at paul@barbourfinancial.com

We will be meeting the Finlays, sharing stories of Mr. Evans and Bill Orchard and walking through our past.

Afterwards we can go for lunch at a nearby bar/restaurant in Acton. It should be a fun day. Please let Paul know if you are planning to come so we know who to expect at Pineland Public School.

By Pepper Parr By Pepper Parr

September 12th, 2023

BURLINGTON, ON

Check this out.

The province is filled with people who have signed up to be able yo vote on who the new leader is going to be when the ballots are counted at the end of November

44,000 members were eligible to vote during the 2013 OLP Leadership,

38,000 members were eligible to vote during the 2020 OLP Leadership.

The deadline for registration to vote at the end of December was on Tuesday. The total number of memberships within the OLP eligible to cast ballots in the November leadership vote is estimated to be over 80,000.

John Fraser, Interim Leader of the Ontario Liberal Party John Fraser, Interim Leader of the OLP must have been wearing a huge smile when he said: “I want to thank all of the grassroots Ontarians who have joined our party in record numbers, and each of the leadership candidates and their teams for the hard work they are doing to engage with communities across our province”.

The news of record-breaking membership numbers follows the Ontario Liberal Party’s two by-election victories in Scarborough–Centre and Kanata–Carleton.

“Ontarians are fed up with Doug Ford’s billion-dollar backroom deals, and are finding a new home in the Ontario Liberal Party,” added Fraser. “Ontario Liberals will continue to fight for the brighter future that families deserve, and build on this momentum as we prepare for another by-election in Kitchener Centre, and success in 2026.”

Potential members of student clubs on post-secondary campuses have another two weeks, until Tuesday, September 26th, 2023 to register as a member.

Voting will take place via ranked ballots on Saturday, November 25, 2023, and Sunday, November 26, 2023, with ballot counting and the announcement of round-by-round results taking place on Saturday, December 2, 2023.

The first of five debates will take place on Thursday, September 14 at 7:00 PM in Thunder Bay. To learn more about the 2023 Leadership contest, and to watch Thursday’s live stream, visit https://ontarioliberal.ca/leadership/.

By Staff By Staff

September 12th, 2023

BURLINGTON, ON

Ok, so summer is officially coming to a close. But that doesn’t mean that all the fun has to end just yet. There are still lots of things that you can do in the neighbourhood and in your backyard to keep the family entertained and keep everyone going before the snow comes.

Fall colours – brilliant – to be enjoyed People dread the end of summer, but fall can actually be the most beautiful and fun-filled season of all. The leaves changing colours and falling into big, rainbow-filled piles. Pumpkins growing in pumpkin patches, waiting to be collected and made into jack-o-lanterns. Hot cocoa that you can sip by a bonfire as the nights grow nippier. There are plenty of things that you can do to take advantage of fall and savor all that it has to offer. Let’s take a look at some of the more popular fall activities that people are taking on this season.

Halloween backyard party

Why not transform your yard into a Halloween paradise? Even if it gets a bit nippy at night in the fall, you can have a bonfire and set up a couple of heat lamps. Think about your decor: You can decorate your outdoor patio doors with spider webs, and cut out cardboard witches to hang from the trees. Use some old sheets to make ghosts out of, and hang them around the yard.

You can make your catering part of the decor, as well. Halloween dishes can be some of the most fun and creative that you put together all year. Make some dishes covered in “blood” using ketchup, or use olives to create “eyeball” hors d’oeuvres.

And of course don’t forget the pumpkins! There are tons of things you can do with pumpkins. First of all, make a jack-o-lantern carving contest part of your main event. You can showcase all the entries after the carving is complete, and the most creative entrant can win a spooky prize in the end.

Skeletons have always been a part of Halloween – get creative and think of the many ways they can be used in your home If you’ve got a pool, why not bring it into the excitement? There are lots of ways that you can decorate your pool to give it a fall look. How about floating skeletons to add to your spooky theme? Maybe get a fog machine to provide a spiffed-up atmosphere?

All this will set the perfect stage for your guests. The array of costumes that fill the yard will provide photo-perfect moments. Just be sure you have your phone on the night setting!

Activities in the neighbourhood

Beyond your home, there are also plenty of ways to take advantage of fall around your neighbourhood. Collecting leaves, acorns, and other fall treasures is a favourite for many. Take the kids on a nature walk and see what you can collect. Once you’re done, there are some fun crafts that you can do to display your collections.

Gather pine cones in the fall and paint them to be used as decorations during Christmas. Have you ever painted acorns and pinecones? This can be a great way to immortalize fall and add to your home decor until it’s time for Christmas. Find some fun colors that will give your collection a special glow, and arrange your pieces in an artistic display to keep in a special place in the living room.

Another fall favourite is making leaf prints. Find some plain paper – perhaps you can use several sheets to create a montage of images – and glue your leaves on in different arrangements. Try to use a variety of colours and leaf types to give yourself a nice variety.

A related craft is making leaf presses. This can be a way to keep your leaves for a long time, even after they get old. You’ll want to choose leaves that are relatively flat so they don’t crumble and lose important parts. Find a big, heavy book and lay the leaves carefully between two sheets. It is recommended to add moisture to the leaves before you insert them. If you use wax paper, this is the best method to preserve your leaves for a long time.

Apple picking

No fall would be complete without apple picking. You can take the family to the nearest orchard and fill up on whatever type each of you prefers. Once you’ve assembled your choice pics, there are lots of things that you can do with them.

Bobbing for apples dates back to the 14th century, and it has ties to courting rituals. Part of your Halloween night can include bobbing for apples. This timeless tradition never gets old and is fun for all ages. You can also use apples to decorate other parts of your holiday scene, especially if you carve some of them to go with your jack-o-lantern display.

And, of course, there are countless dishes you can make with apples. Both apple and pumpkin pies will suit your hungry partygoers just perfectly. How about trying your hand at making your own apple cider? Hot or cold, it can be something that the whole family will love. Add a stick of cinnamon, and you’ve got the perfect complement to that evening party.

Don’t let fall slip by

Even though we all dread the end of summer, we shouldn’t let fall simply go by without taking advantage of all that it has to offer. There are countless activities, holiday traditions, and food ideas that you can take part in that will be fun for the whole family and give you happy times to remember.

So bundle up, if necessary, go out and pick your choice pumpkin, and think of the perfect Halloween costume!

By Staffer By Staffer

September 11th, 2023

BURLINGTON, ON

In today’s digital age, online casinos have gained immense popularity, providing players with the convenience and excitement of gambling from the comfort of their own homes. Ontario is Canada’s most populous province, but can you play slots canada online there?

Understanding the Regulatory Framework for Online Gambling in Ontario

Online casinos are regulated in Canada by the Alcohol Gaming Commission of Ontario. Online gambling in Ontario is regulated by the Alcohol and Gaming Commission of Ontario (AGCO). The AGCO oversees the province’s gaming industry and set guidelines to ensure fair play, player protection, and responsible gambling practices. Online gambling is legal in Ontario, allowing residents to partake in various casino games through licensed online platforms.

The AGCO ensures that online casinos operating in Ontario meet specific criteria, including secure and fair gaming systems, responsible gambling measures, and the protection of player funds. By adhering to these regulations, licensed online casinos provide a safe and trustworthy environment for players to enjoy their favourite games.

The Benefits of Playing in Legal Online Casinos in Ontario

Playing in legal online casinos in Ontario offers several advantages for players. Firstly, it provides a convenient and accessible way to enjoy casino games. With just a few clicks, players can access their preferred online casino platforms from the comfort of their homes, eliminating the need to travel to physical casino locations.

Bonuses reward long term players and add some excitement to the experience. Moreover, legal online casinos in Ontario often offer enticing bonuses and promotions to attract new players and reward loyal customers. These bonuses can enhance the gaming experience and provide additional opportunities to win. Additionally, licensed online casinos adhere to responsible gambling practices, providing tools and resources to help players maintain control over their gambling activities.

One of the other benefits is that you don’t need to comply with a vestiment-code, nor do you have to endure the cold weather in the Winter. So, even if playing in a land-based casino can be a very interesting and exciting experience, there are a few advantages about playing in online casinos that you have to keep in mind. But, if you want to have a safe experience, it’s very important that you play only in licensed casinos.

The Importance of Choosing Licensed Online Casinos

Do your homework and know who you are dealing with in the casino world. While online gambling is legal in Ontario, it is crucial for players to choose licensed online casinos to ensure a safe and secure gaming experience. Licensed online casinos operate under the regulatory oversight of the AGCO, guaranteeing fair play, the protection of personal information, and secure financial transactions. Players should always verify the licensing and certifications of an online casino before engaging in real money gambling to ensure they are playing on a reputable platform.

It is important for players to do their due diligence and select licensed online casinos to ensure they are engaging in legal and secure gambling activities. By making informed choices and adhering to responsible gambling practices, players can enjoy the excitement and entertainment of online casinos while maintaining control over their gaming experiences.

By Sheldon McGrath By Sheldon McGrath

September 12th, 2023

BURLINGTON, ON

Discover why playing at a Canadian-specific online casino like PinUp Casino offers a more tailored and enjoyable gaming experience. Explore optimized gameplay, necessary certifications, and exceptional customer support for Canadian players.

Why is it good to use a version of an online casino built specifically for the country you are living in?

Providing specific support services for people with different needs and requirements – language being an important one. No one is going to deny the fact that online casinos have shifted the gambling industry because they opened up a door for a whole new audience of players. Thanks to the brands, like Pin Up Casino , it has become much easier for gamblers to access their favourite games, no matter where they are. But it is important to admit that at first, people were frustrated with such websites because they were not adapted for a specific market. It means there were only international versions of online casinos, but now, Canadian players can play games with the local variant of their favourite brand. There are a lot of reasons why it is good to do so.

Reasons to use a local version of online casino

There are several good reasons why the Canadian version of the PinUp Casino is better for local players. Here they are:Well Optimized For A Region. One of the first things people will admit about the Canadian version of the site – it is well-optimized for a specific region. This means people will find games, payment methods, and special rewards that were selected according to the statistics of the country and there are going to be boundaries in terms of the way people are able to play online. All promotions and payment methods will work clockwise.

The Canadian version of the Pin Up, it is a Curaçao license. All The Necessary Certifications. For the online casino to operate in a specific country, it is very important to be regulated by the correct organizations. In the case of the Canadian version of the Pin Up, it is a Curaçao license. This is important for the best experience of players, as it means the website will work correctly, and it is an indicator that all games are fair and updated to the latest version of the software.

High-Quality Customer Support. Local online casinos often provide customer support services that are more attuned to the needs and preferences of local players. Players can expect to communicate with support agents who understand your language and are familiar with the specific challenges and inquiries you may have. Having access to dedicated customer support can be a game-changer when Canadian players encounter issues or have questions about the platform. Quick and effective support can enhance your overall experience and resolve any problems promptly.

These reasons alone should be motivational enough for people to register an account at PinUp and start playing without any restrictions. But it is important to admit that age restrictions are applied, depending on the specific province, where the player currently lives.

Pin-Up brand designed for the country you live and play in. The best way to experience online casinos

People who are looking for a decent way of playing games online should start with a local version of the Pin-Up brand. Such casinos are designed to cater to the specific needs of Canadian players. So, the next time people look for an online casino, they should consider choosing one that is built specifically for the country they are living in to enjoy a more personalized and enjoyable gaming experience.

By Pepper Parr By Pepper Parr

September 11th, 2023

BURLINGTON, ON

Minister of Municipal Affairs and Housing Paul Calandra The province may not move forward with a review of six regions with both upper- and lower-tier municipal governments. In a statement released earlier today Minister of Municipal Affairs and Housing said he will be reviewing the move announced by his predecessor to appoint facilitators to assess regional governments in Durham, Halton, Waterloo, York and Niagara regions and Simcoe County.

Minister of Municipal Affairs and Housing said today that he “wants to ensure the province’s approach supports the goal of getting homes built quickly in those fast-growing areas.

The previous minister, Steve Clark, said last month that the facilitators in the six regions would be appointed by today, but the change in plans comes a week after

Clark resigned amid the fallout of two scathing reports on Greenbelt land swaps.

Burlington City Council had an item on a Standing Committee agenda with considerable detail and how the process of determining if administrative efficiencies could be achieved.

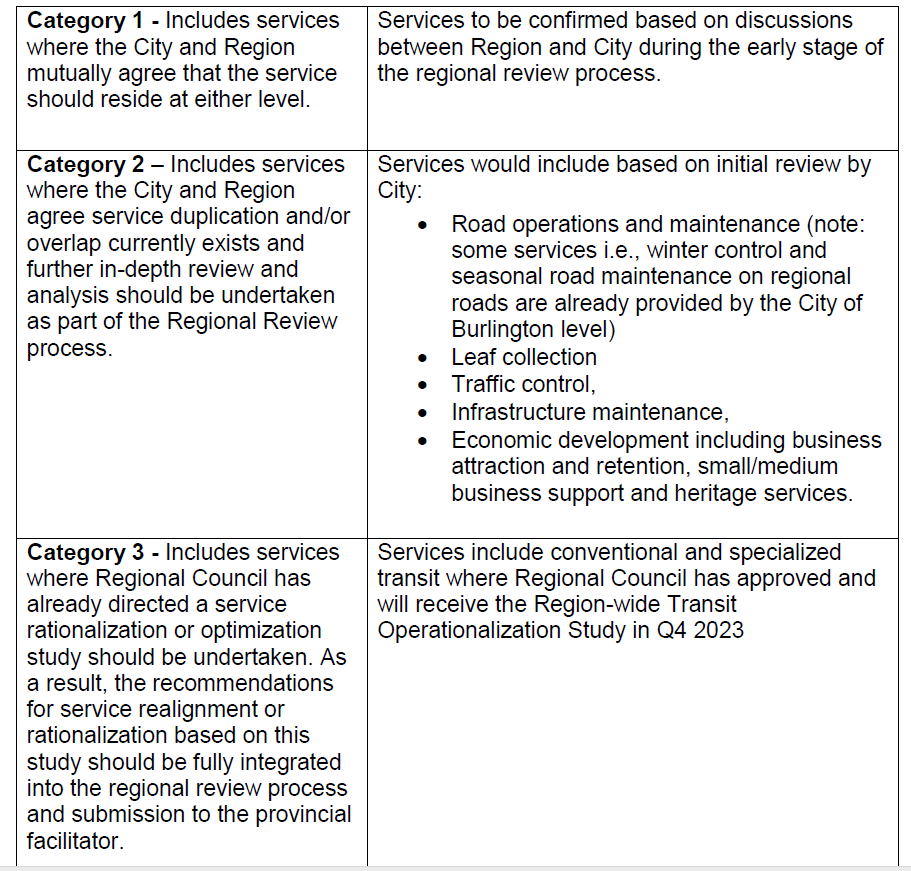

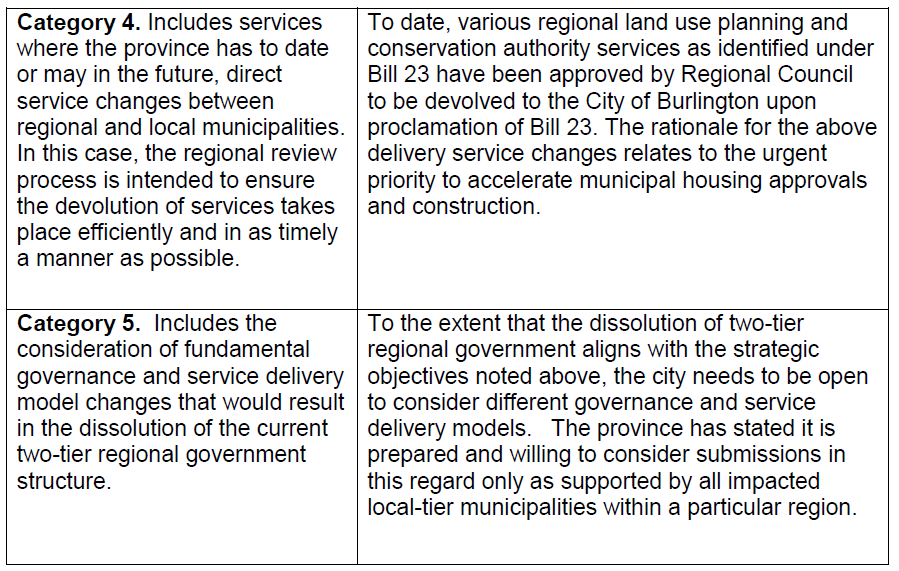

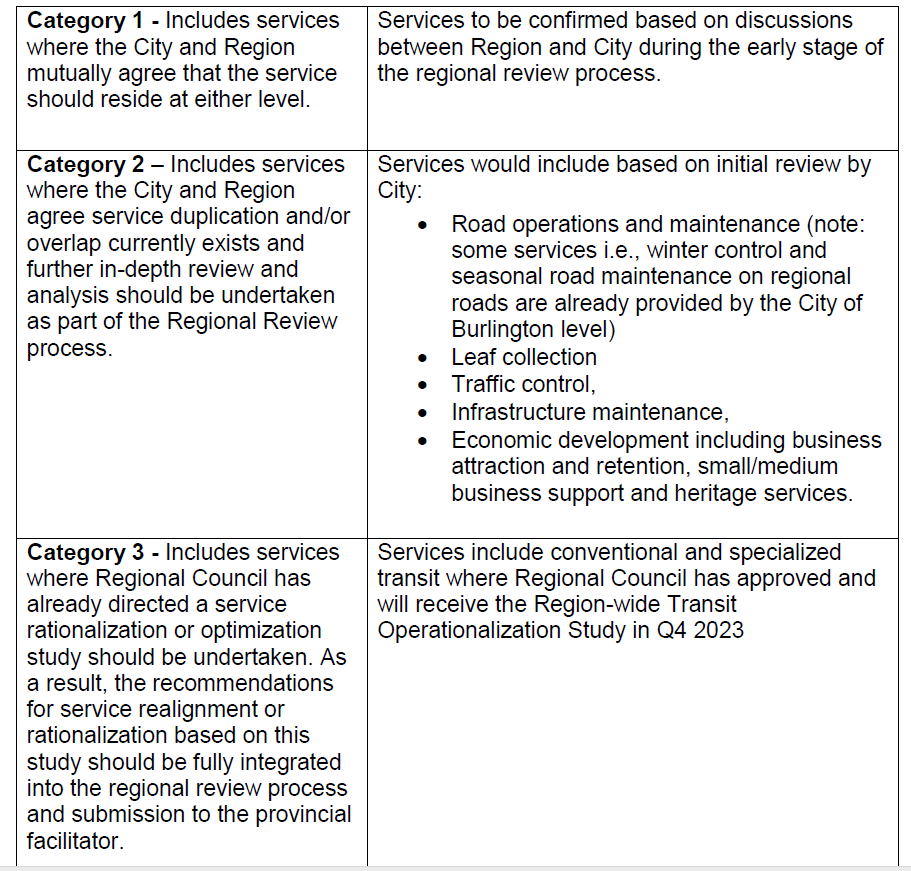

City Manager Tim Commisso – might not have to undergo a review of what his working relationship with the Region is going to be. The overall framework and approach being recommended for developing a regional review strategy and resultant City of Burlington submission to the regional facilitator is based on the consideration of service delivery options or categories.

This may never come to pass which would make the We Love Burlington group happy. They opposed the idea when it was before the public back in 2019

Related news story:

We Love Burlington

By Pepper Parr By Pepper Parr

September 11th, 2023

BURLINGTON, ON

Council Standing Committee news will be a little slower getting to the press room today. The city kept running into technical problems. The communications systems must have gone rusty while council had all of August without any council meetings.

They started late and weren’t really back on line with both voice and video until pretty close to 11:00 am.

We contact the City Clerk and advised him – twice – there was no response.

Councillor Paul Sharman We sent along a note to Councillor Sharman who is prompt just about all the time and he did get back to us.

The following is the email traffic between Sharman and the Gazette

10:14 Gazette to Sharman: There is no sound. I have confirmed it with two other people.

10:27 Sharman to the Gazette: The technical problem is a disappointment. The meeting needs to proceed because there is important work to be done. It is being recorded and that will be published with the minutes as soon as possible.

10:40: Gazette to Sharman: That’s not acceptable.

The back and forth is a critical part of understanding the debate. You were doing quite a bit of chatter with Laura Boyd

I will take a formal complaint to the City Ombudsman.

This borders on being recklessly irresponsible.

The meeting needs to be adjourned until the problem is resolved.

With the issues on this agenda – one would think there is something being hidden.

TIME Sharman back to the Gazette

As you wish Pepper.

Council chambers are open to the public and interested members are welcome to attend.

I appreciate that members of the public have become dependent on technology to listen in, however it was not regulated that technical difficulties should cause a meeting to be delayed. Schedules are already made and need to be maintained.

Personal attendance is more reliable. But, nothing is perfect.

At just after 9:30 the video portion was being broadcast – a nervous looking Chair kept glancing left and right. An unhappy looking city manager said nothing. The City Clerk was never seen until the very end.

During the difficult phase we would see messages on the screen:

It is our view that if voices cannot be heard then the City Clerk should have called for a recess until the technical problems had been resolved.

There have been consistent technical problems ever since the city moved to a hybrid format a the start of the pandemic.

The only way to describe the repeated technical problems is poor maintenance of the service being used by the city or just rank incompetence.

Quite why the City Manager has not ordered that the system be made fool proof – technical staff had all of August to repair, revise and test – is beyond any reason we can think of – he tends to delegate but this has become ridiculous.

Given the number of problems with the service one would think that the technical people would do a short test before the start of every meting.

During the meting there were a number of matters that are critical – the change in the way the budget is going to be debated and delivered now comes under the Mayor Strong Powers: it is no longer a council budget – it is the Mayor’s’ budget. And given the difficulty Meed Ward has with financial statements and the tendency to spend the clearest possible public understanding is vital.

City Clerk Kevin Arjoon When Councillor Sharman says “there is important work to be done” he is absolutely correct – which is all the more reason to ensure that the public is able to see and hear what is said.

When someone wants to take a complaint to the City level Ombudsman they must first put the concern before the City Clerk – we can then take the complaint to the Ombudsman.

We are waiting for a response from the City Clerk.

By Staff By Staff

September 11th, 2023

BURLINGTON, ON

Burlington provincial Liberals have now had an opportunity to listen to all five candidates for the leadership of the Ontario Liberal Party.

The final leadership candidate, Adil Shamji, spoke to the group on Sunday. His web site at HERE The final leadership candidate, Adil Shamji, spoke to the group on Sunday. His web site at HERE

Adil Shamji addressing Liberals in Burlington Getting to the point where the election of the new leader takes place moves now into the debate stage.

Today, Monday September the 11th at 6:00 pm is the final opportunity to become a member of the Ontario Liberal party and be able to vote in the ranked ballot that will take place late in November.

The Ontario Liberal Party has an open membership – there is no fee, you must be at least 14 years of age and reside in the province.

To register – use this link

Related news story:

Being part of making a difference.

By Staff By Staff

September 11th, 2023

BURLINGTON, ON

Mayor Marianne Meed Ward announces the appointment of Marie Nash as her new Chief of Staff.

Marie Nash: New Chief of Staff for Mayor Meed Ward Marie has been a leader of more than 12 years in communications, public policy, and community engagement. She brings with her a strong business background, extensive knowledge of the functions of municipal governments and experience working with government stakeholders. These skills will serve our goal of promoting Burlington as open for business and are especially needed at a time when collaboration between all government levels is crucially important.

Marie was most recently the Chief Operating Officer at the Hamilton Chamber of Commerce, where she worked to further elevate the institution’s operations, communications, advocacy efforts, value proposition and engagement with all members of the business community, large and small. Working directly with the CEO and Board of Directors in developing and executing the organization’s overall short- and long-term strategies, she ensured the relevancy and longevity of the 178-year-old institution.

During the pandemic, Marie successfully created and executed programs and policies that addressed critical issues, such as the creation of Hamilton’s COVID-19 Concierge program, Ontario’s Vaccine Support Council, and the Rapid Testing for Business program. She also led the creation of multiple research projects and reports that resulted in significant recommendations on issues — such as women in the workforce, labour shortages and childcare — leading to measurable improvements in the community’s quality of life.

Marie also chairs and sits on multiple boards and committees, including Tourism Hamilton’s Music Advisory Committee, the City of Hamilton’s Physician Recruitment and Retention Steering Committee,

By Pepper Parr By Pepper Parr

September 11th, 2023

BURLINGTON, ON

Premier Doug Ford has a promise for young people in Ontario: an affordable home for under $500,000.

He has certainly gone out on a limb: Speaking to a Kitchener crowd on Friday during his “carnival-style FordFest”, the premier finished his speech with a promise of building 1,600 square-foot houses across the province similar to the wartime homes — also known as the Strawberry box houses — built across Canada after the Second World War.

Built for veterans returning from WW II – thousands were built on large lots across the country. Beginning in 1941, a federal crown corporation called Wartime Housing Limited (WHL) built almost 26,000 rental housing units for war workers and veterans. It was a successful yet temporary phenomenon. Six years later, Central Mortgage and Housing Corporation (CHMC) absorbed and dismantled the wartime company. The houses will have finished basements that owners can rent out, backyards with fences, paved driveways, and will be built on land made available through partnerships with municipalities, Ford said

And the total sum: under $500,000.

One can only imagine the reaction within the developer sector – never mind the gulps heard in Planning departments across the province.

For continued: “You can’t find a home for under $500,000 anywhere in this province, but as sure as I am standing here, we’re going to make that available to young people, people that are renting right now that have a dream of home ownership,” he said.

The fifteen minute speech was about housing with some divisive comments on how young people choose to identify themselves. It was the Premier take a shot at the province’s school boards, deciding to wade into a national debate about parental involvement.

“Most important is the parents’ rights to listen and make sure they are informed when their children make a decision. It’s not up to the teachers, it’s not up to the school boards to indoctrinate our kids,” he said.

|

|

By Staff

By Staff

On Tuesday, September 26 at 9:30am, Burlington city council will consider a resolution to the Minister of Municipal Affairs and Housing to declare a provincial interest in preserving Millcroft’s greenspace.

On Tuesday, September 26 at 9:30am, Burlington city council will consider a resolution to the Minister of Municipal Affairs and Housing to declare a provincial interest in preserving Millcroft’s greenspace. The OLT hearing’s confirmed parties are Millcroft Against Bad Development, City of Burlington, Region of Halton, Halton Conservation Authority, Millcroft Greenspace Alliance, and Millcroft Greens.

The OLT hearing’s confirmed parties are Millcroft Against Bad Development, City of Burlington, Region of Halton, Halton Conservation Authority, Millcroft Greenspace Alliance, and Millcroft Greens.

The recent changes to the proposal take into account concerns raised by the community, staff and council and include:

The recent changes to the proposal take into account concerns raised by the community, staff and council and include:

Rock out at the library! We’re bringing back Library After Dark, with a touch of spooky this year!

Rock out at the library! We’re bringing back Library After Dark, with a touch of spooky this year!

There was a time when a lot of boys were Scouts. Those who became what were then called Queen’s Scouts were seen is as a cut above the crowd.

There was a time when a lot of boys were Scouts. Those who became what were then called Queen’s Scouts were seen is as a cut above the crowd.

The final leadership candidate, Adil Shamji, spoke to the group on Sunday. His web site at

The final leadership candidate, Adil Shamji, spoke to the group on Sunday. His web site at