By Staff By Staff

June 18th, 2025

BURLINGTON, ON

Exciting changes are underway at Alton Branch of the Burlington Library.

A Maker Station—a brand-new drop-in creative space—starting July 24.

Designed for curious creators of all ages, Maker Station is a self-guided space equipped with a 3D printer, sewing machine, Cricut® cutting machine, and button maker.

How It Works

- Prepare your ideas and design files before you visit. Review the design specifications for the equipment on our website and prepare your design file before you come to the branch.

- Starting July 24, drop in any time during open hours at our Alton Branch. The equipment is available on a first-come, first-served basis—no appointment necessary.

- Visit staff at the service desk to get started. You’ll need to sign a waiver, purchase any necessary materials, and receive instructional materials to review.

- Start creating! Print, sew, cut and create using one of the four pieces of equipment in the MakerStation.

The equipment is free to use, but you will need to purchase materials such as filament for the 3D printer, vinyl for the Cricut, and button materials for the button maker. We only charge for materials at cost. For the sewing machine, makers will need to bring their own suitable fabric.

You’re Invited to the Showcase

Want to see it in action? Join us for the MakerStation Showcase on Wednesday, July 23, from 6 to 8pm.

Check out live demos, explore the new equipment, get inspired by creative projects, and take home a small maker project

Whether you’re into crafting, designing, or just trying something new, MakerStation at Alton Branch is the place to make it happen!

By Staff By Staff

June 18th, 2025

BURLINGTON, ON

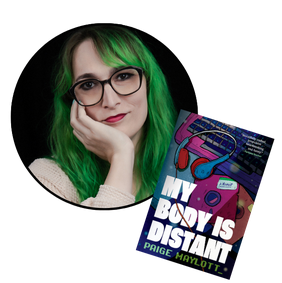

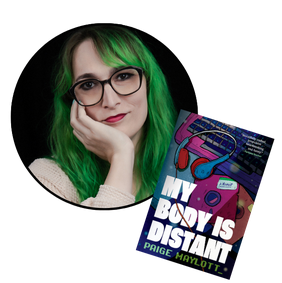

Paige Maylott’s award-winning book, My Body is Distant, is an electrifying and vulnerable memoir that invites readers into an intimate conversation about our digital and physical selves, gender, and belonging. Maylott writes about her life—both virtual and IRL—as she explores her authentic self and sexuality through dream-like virtual worlds. As she discovers the person she is meant to be, Paige contends with a cancer diagnosis and an imploding marriage while struggling to convert an online love story into reality. When a humiliation at work provides the necessary push to transition, Paige finds the freedom to explore her new self.

Part coming-out story of a trans woman and part heartfelt romance, My Body Is Distant follows Paige from a childhood obsession with the 1980s game Zork, through a health crisis and divorce, to an ultimately affirming experience and self-love. Part coming-out story of a trans woman and part heartfelt romance, My Body Is Distant follows Paige from a childhood obsession with the 1980s game Zork, through a health crisis and divorce, to an ultimately affirming experience and self-love.

Paige Maylott is a Hamiltonian author, gamer, and accessibility specialist. Her memoir, My Body is Distant examines gender transition, critical illness, and digital identity. This work earned the 2024 Hamilton Literary Award for Non-Fiction, the Gold IPPY Award for LGBTQ+ Non-Fiction, a spot on the Rakuten Kobo shortlist, and was one of Hamilton Review of Books’ Best Books of 2023. Praised by CBC Books, Publishers Weekly, Open Book, and the Whistler Writers Festival, among others. When not writing, Paige collects retro video games and blasts 80s hair metal—because sometimes the best plot twist is a guitar solo.

Takes place on June 30th, 7:00 to 8:00 pm at the Central Library on New Street

At publication, there were just 12 seats available for this event.

To REGISTER click HERE

Presented in partnership with ECW Press.

Borrow My Body is Distant from our collection

Accessibility

If you need an accessibility accommodation during this program, please register early so we can confirm arrangements a few days before your visit.

By Staff By Staff

June 18, 2025

BURLINGTON, ON

Halton Region Public Health was made aware of a confirmed case of measles that has led to a potential exposure in Halton on June 12.

Measles is a highly contagious disease that spreads easily through the air.

Individuals may have been exposed to the measles virus at the following location on the date listed below:

3075 Hospital Gate – Medical Building, Oakville (whole building) on Thursday June 12 from 2:10 p.m. to 7:30 p.m.

Extremely contagious – get vaccinated! Visitors to this location between the times noted should:

- Check your immunization records to make sure you and any people who accompanied you have up to date measles vaccinations (two doses are recommended for anyone born on or after January 1, 1970). Your immunization record (yellow card) or your doctor can provide you with this information. If you are not immune and were potentially exposed, please contact Halton Region Public Health as you may benefit from post-exposure prophylaxis.

- Infants under one year of age, pregnant women, and people with weakened immune systems can get very ill with measles and should contact Halton Region Public Health or their health care professional immediately for further assessment.

- If you think you may have measles and need to see a doctor, you must call ahead to the doctor’s office, walk-in clinic or emergency department. This will allow health care staff to take the necessary precautions to reduce the risk of infection and protect others visiting the office, clinic or hospital.

- Watch for symptoms of measles until 21 days after exposure.

Symptoms can appear 7 to 21 days after contact with someone with the measles virus. Measles symptoms may include:

- fever

- cough

- runny nose

- red eyes

- sleepiness

- irritability

- small, white spots on the inside of the mouth (Koplik Spots)

- a red blotchy rash that first starts on the face and spreads down the body, arms, and legs (this rash can last 4 to 7 days)

“Measles is a serious disease that can be prevented with a safe and effective vaccine. I encourage everyone to ensure their immunizations, including for measles, are up to date, particularly children who may have missed their routine shots during the COVID-19 pandemic,” said Dr. Deepika Lobo, Medical Officer of Health for Halton Region.

By Staff By Staff

June 18th, 2025

BURLINGTON, ON

Restoration work surpasses goal, reaching nearly 16 hectares—the equivalent of 30 football fields

A question that is asked of us frequently is who owns the 407 ETR?

407 International Inc. is the sole shareholder of 407 ETR and is owned by:

Cintra Global S.E. which is a wholly owned subsidiary of Ferrovial S.A. (48.29%);

Canada Pension Plan Investment Board (CPP Investments) and other institutional investors (44.20%); and

Public Sector Pension Investment Board (PSP Investments) (7.51%)

– In recognition of Pollinator Week, 407 ETR has announced that its pollinator conservation efforts with the Canadian Wildlife Federation (CWF) have surpassed the12-hectare goal of roadside restoration.

The initiative is on track to restore 15.8 hectares of habitat restoration—the equivalent of approximately 30 football fields. Today, there are 15 projects underway within local municipalities and conservation areas in the Greater Toronto Area (GTA). The restoration work includes Kingsford Gardens in Oakville; boulevard restorations in Toronto; roadside restorations in Halton Hills; and a roadside meadow plot in Keswick.

Photographs that tell part of the 407 ETR story on roadside vegetation management to support the recovery of monarchs, bees, hummingbirds and other pollinator species. In 2023, the Company signed onto a three-year, $500,000 sponsorship with CWF to support its Rights-of-Way as Habitat Program. In addition to supporting the planting of native wildflowers and grasses, 407 ETR’s funding is helping CWF educate rights-of-way managers about best practices in roadside vegetation management to support the recovery of monarchs, bees, hummingbirds and other pollinator species.

“Our collaboration with 407 ETR enables restoration of native meadow habitat along rights-of-way in the GTA,” says Carolyn Callaghan, Senior Conservation Biologist, Terrestrial Wildlife at CWF. “By establishing thriving meadow ecosystems, we’re helping native pollinator species, like the monarch butterfly, flourish while also enhancing the natural pollination of flowering plants and increasing biodiversity on the landscape.”

The Pollinator Pathway expansion by Oakville Green Conservation Association, located by a roadside at Kingsford Gardens, in the path of monarch migration, is flourishing thanks to the collaboration. With additional native plants added in 2024, the site became more welcoming to pollinators and monarch butterflies were spotted in the fall of 2024.

The next few years will be critical for other meadow projects that are in their “creep phase” as the native seeds develop roots to grow into successful plant communities, supporting the monarch butterfly and other pollinators around the GTA.

Access points to the 407 ETR “As stewards of a vital transportation corridor in the GTA, we recognize our responsibility to protect and enhance the biodiversity along our rights-of-way,” says Javier Tamargo, President & CEO, 407 ETR. “At 407 ETR, we want to be part of the solution by supporting land restoration efforts in the communities we serve, and it’s great to see these spaces turning into thriving ecosystems, contributing to a healthier environment for generations to come.”

There are over 200,000 kilometres of roadways in Ontario, representing tens of thousands of hectares of vegetated land.

Insect abundance has declined by 50 to 90% in North America and Europe.

Eight species of native bees are considered at risk in Canada and the population of the monarch butterfly has declined by 75% in North America.

GTA residents can support pollinators with native species for their gardens. Native plants have co-evolved with the wildlife of that area and are often their perfect food. They require less maintenance, are less susceptible to disease and pests, and many produce colourful blooms. Learn more at 407etr.com/biodiversity.

Since 2023, the Company has planted 30,000 native trees along Highway 407 ETR.

The Company is supporting Nature Conservancy of Canada’s Conservation Intern program with a three-year, $800,000 sponsorship. The program helps prepare the next generation of environmental leaders with real-world, skills-building opportunities to care for natural areas in Ontario.

Highway 407 ETR highway spans 108 kilometres from Burlington in the west to Pickering in the east.

By Pepper Parr By Pepper Parr

June 17th, 2025

BURLINGTON, ON

On that tariff stuff – word is that they are still talking.

Or at least they were right up until President Trump announced that he had to leave right after dinner on Monday – he was needed back in Washington, where control over the war between Israel and Iran was getting out of hand.

Everyone is mouthing the words used to say basically nothing.

“both countries have agreed to keep the details of those talks private and to reconvene before the end of the week.”

“we’re making progress in coming to a deal that would be in the economic interest of both countries, but we’re not there yet,”

“agreed to pursue negotiations toward a deal within the coming 30 days.”

President Trump with an illustration of the Golden Dome that is expected to protect North America from nuclear weapons. As he was leaving Kananaskis in Alberta, Trump said that Canada was going to pay for the Golden Dome – that is the stuff that is going to protect us from the nuclear warheads that might be coming our way from China, Russia or maybe the Iranians.

The price for the Golden Dome protection was $60 billion at first but that got ratcheted up to $71 billion. One had to notice that Trump did not say Canada had “agreed to pay” just that it was going to pay. He added that Canada wouldn’t have to pay a dime if it became the 51st state.

Trump does have a habit of rambling. Some suggest not bothering to listen to him.

On the tariff stuff, an American automotive research company said Ontario production of automobiles would be reduced by 56,000 this year.

Most of the 1.3 million cars manufactured in Ontario in 2024 went to the United States.

Ford Motor plant in Oakville. Auto Forecast Solutions said there are questions about the future of assembly plants in Oshawa, Oakville and Ingersoll in addition to expected production cuts in Alliston.

Early in May, President Trump levied 25% tariffs on automobiles made in Canada and sold in the United States.

With those tariffs in place, the Canadian economy is in serious peril. There have already been layoffs in the automotive sector.

Prime Minister Mark Carney and his government have been working very hard to have those tariffs removed.

By Pepper Parr By Pepper Parr

June 17th, 2025

BURLINGTON, ON

Ward 6 Councillor Angelo Bentivegna “This is now serious.”, said Ward 6 Councillor Angelo Bentivegna as Council prepared to vote on a bylaw that will request the Minister of Municipal Affairs and Housing through its zoning order framework process to issue a ministerial zoning order to restrict the uses permitted on the remainder of the Millcroft golf course to those currently permitted by the City of Burlington zoning by law, and be it further resolved that the clerk forward the resolution to the Honorable Doug Ford, Premier of Ontario, the Honorable Doug Downey, Attorney General, the Honorable Rob Flack, Minister of Municipal Affairs and Housing, and the Honorable Todd McCarthy, Minister of Environment Conservation and Parks.

Send the request to Halton, MPPs, Halton, local municipalities and the Association of Municipalities of Ontario for their information.

Millcroft – a community in the middle of a golf course.  Trees have been cut down as the developer gets ready to build the 98 new homes on what has been golf course property. At this point, some of the damage the community feared has already been done.

The matter has gone to the Ontario Land Tribunal where the city lost their argument.

The approval given by the Tribunal had a number of conditions that have to be met. They are complex and difficult to understand.

The provincial legislature is in recess until the fall.

The City Tree bylaw is in place – no one is certain that the developer, Millcroft Greens, will adhere to that by law.

Biggest community organization The two local community organizations, Millcroft Against Development (MAD) and the Millcroft Green Alliance may feel that the city is finally on their side.

Community organization that took part in the Tribunal hearing.  The developer The opportunity to get an MZO in place existed a number of years ago – at this stage the province would be looking at a serious civil suit from the developer.

Issuing an MZO before the matter went to the Land Tribunal is what should have been done.

It was always messy – city council failed the residents of the community and may have destroyed what has been a lovely place to live.

By Staff By Staff

June 17th, 2025

BURLINGTON, ON

Prime Minister Mark Carney and U.S. President Donald Trump failed to reach an agreement Monday that would see the U.S. drop billions of dollars in import taxes on Canadian products despite what Carney called their “fantastic” meeting on the sidelines of the G7 summit.

Instead, the two leaders instructed their negotiating teams to accelerate talks, and to meet again before the end of this week in an effort to land a deal within 30 days, according to the Prime Minister’s Office, which issued a late-day summary of the meeting.

Canadian officials held out hope they can still bridge the divide within that time, but Canada’s ambassador to the U.S., Kirsten Hillman, said, “we’re not there yet.”

From left to right, clockwise, Japan’s Prime Minister Shigeru Ishiba, Italy’s Prime Minister Giorgia Meloni, French President Emmanuel Macron, Prime Minister Mark Carney, U.S. President Donald Trump, British Prime Minister Keir Starmer, German Chancellor Friedrich Merz, European Commission President Ursula Von der Leyen and European Council President Antonio Costa attend a working session during the Group of Seven (G7) summit on June 16, 2025. Michael Kappeler/Pool/AFP TNS Meanwhile, the British and the Americans have signed a deal.

Carney appears to have thought it was a promising start to the G7 summit, but at this point it has not ended a promising note.

Trump abruptly left Kananaskis after the leaders’ dinner on global security to return to Washington. His press secretary Karoline Leavitt tweeted he’d “had a great day” but that “because of what’s going on in the Middle East,” the president would cut his Canadian trip short.

Ukraine President Volodymyr Zelensky expecting to take part in discussions on the war with Russia. Trump left the G7 meeting before Zelensky arrived. From Carney’s perspective, the summit loses its heavyweight player on the eve of sensitive talks about Ukraine with President Volodymyr Zelenskyy.

Whatever the Carney-Trump divide over a new deal is really about, only a handful of people know. It was clear however, that the question of tariffs — a foundational tool in Trump’s foreign and economic policy tool box — remains a sticking point. Carney has upped Canada’s defence spending, opened the door to Canadian participation in American-led missile defence, and underscored willingness to be a U.S. partner on energy security.

But it was all about tariffs — the import charges Trump is wielding as a weapon against all of America’s trading partners.

Trump suggested any new trade deal would include tariffs when he spoke to reporters after the two leaders met for about 30 minutes behind closed doors, before inviting their broader teams inside and letting the media catch a glimpse of their dynamics.

Trump said “it’s not so much holding up,” but that he and Carney have fundamentally “different concepts” about what an agreement should look like. Trump says Canada and the U.S. have “different concepts” about a potential trade deal.

“I have a tariff concept,” Trump replied. “Mark has a different concept, which is something that some people like, but we’re going to see if we can get to the bottom of it today. I’m a tariff person, I’ve always been a tariff (person) — it’s simple, it’s easy, it’s precise, and it just goes very quickly.

“And I think Mark has a more complex idea, but also very good. So we’re going to look at both, and we’re going to see what we’re going to come out with.” Trump said a deal is still within reach within days or weeks, “if both parties agree, sure.”

Trump with U.K. Prime Minister Keir Starmer and a new signed executive order on a U.S.-U.K. tariff deal. That point was underscored later in the day when Trump met U.K. Prime Minister Keir Starmer before he signed new executive orders on a U.S.-U.K. tariff deal. Trump’s papers spilled to the ground and nearly blew away in the warm afternoon wind, but they still retained a chilly 10 per cent baseline tariff on most British exports to the U.S. The “deal” includes future reductions in steel and aluminum tariffs if Starmer’s promise to open up other sectors like pharmaceuticals is kept.

The president said the U.K. is “very well protected” from tariffs. “You know why? Because I like him, that’s why. That’s their ultimate protection.”

A White House official declined the Star’s request to provide more details on the Carney-Trump meeting.

Dominic LeBlanc, the cabinet minister leading trade talks, and Hillman, Carney’s ambassador in Washington, portrayed it as productive. Hillman said “our goal is to get tariffs off,” but added, “we are not there yet” and acknowledged that getting to zero tariffs will be hard.

“We have a president who is very convinced of the policy that he has around tariffs in order to achieve some of his policy goals,” she said. “We are very convinced that applying that policy to Canada is actually detrimental to his overall goals, and we are trying to get there with him and his officials, so that they understand our perspective.”

Both sides said they have agreed not to talk publicly about the details of what they are discussing. The Canadians also refused to say if Trump at any point repeated his view that Canada should become his country’s 51st state.

“We’re not going to go into the private details of the conversation,” added LeBlanc. “Our focus was on the economic opportunity of working with the United States, and that was the conversation that the prime minister had.”

Trump reciprocated, saying he and Carney have “developed a very good relationship.” On trade, he added, “I’m sure we can work something out.”

“I have a tariff concept, Mark has a different concept, which is something that some people like, but we’re going to see if we can get to the bottom of it today. I’m a tariff person, I’ve always been a tariff (person) — it’s simple, it’s easy, it’s precise, and it just goes very quickly.” Flavio Volpe, head of Canada’s Auto Parts Manufacturers Association, said he believed their meeting telegraphed progress. Even the fact that few are talking, and none of Trump’s officials are “speaking out as a surrogate anymore,” suggests to Volpe “that means that the deal, whatever deal we think we’re going to get, is close.”

Trump, who has said he’s negotiating with 15 countries with which he hopes will reach agreements in the next few weeks, has long suggested tariffs are the new normal, with exemptions available for countries that want to grant the U.S. better access to their markets.

Carney has repeatedly said he is not interested in simply striking out one particular tariff or another. Instead, the prime minister wants to settle on a new comprehensive economic and security agreement to frame how Canada and the U.S. will move forward on defence co-operation, energy security and trade issues, as he seeks to diversify Canada’s alliances with other international partners. The Canadians believe broader trade talks should take place in the context of the 2026 review of the Canada-U.S.-Mexico trade deal.

By Jessica Bell By Jessica Bell

June 16th, 2025

BURLINGTON, ON

Donald Trump’s escalating trade war and threats to our economy should be a wake-up call for Ontario’s Conservative government to bring a robust economic plan that puts Ontario and Canada first. Doug Ford didn’t give us that.

Ontarians want to do their part and support our country and province, and we need to make it easy for them to do so. But instead of a real strategy, the Conservatives proposed to recognize the last Friday of each June as “Buy Ontario, Buy Canadian Day.”

Jessica Bell is the MPP for University–Rosedale and the NDP’s finance critic. Every day should be “Buy Ontario, Buy Canadian Day,” not just one day. That’s why the Ontario NDP introduced a law to mandate the labelling of Canadian-made products, including food, so Ontarians can visit the supermarket and choose to buy Canadian products, supporting local businesses and local job creation. The Conservatives put politics ahead of patriotism and voted our motion down.

The moment we are in calls for unity of purpose, to take good ideas from all sides of the political spectrum, so we can put our province first.

What a missed opportunity. According to Bank of Montreal economist Robert Kavcic, even a modest shift in consumer spending toward Canadian goods could add $10 billion in value to the economy alone.

This legislative session, Ontario should have flexed its hefty purchasing muscle and made firm commitments to buy, build and invest in local projects, products and services.

Ontario is investing $200 billion in infrastructure projects, including hospitals, highways, transit, schools and child-care spots. These investments should be allocated to public agencies, and Ontario and Canadian businesses first, not foreign companies. The government should also mandate conditions to maximize these investments, such as requiring projects to use resources from our most trade-impacted sectors, such as steel, aluminum and lumber.

Ensuring more government dollars go to Canadian and Ontario businesses and workers has huge economic value. Every year, the Ontario government buys $29 billion in goods and services, but only $3 billion goes to Ontario-based businesses. That number should be much higher.

Over the past few months, trade associations, unions and businesses have been providing examples to the government on how exactly Ontario can support specific workers, public institutions and business sectors.

The Ontario Federation of Agriculture recommended Ontario require institutions, like schools, hospitals and prisons, to prioritize buying locally grown food because it would help Ontario farms and strengthen local supply chains.

What the Conservatives have proposed instead is a new $35-million Ontario grape program to encourage wine producers to use Ontario-grown grapes. While support for our wine sector is welcome, our entire agricultural sector needs support to withstand the impact of the tariff war, not just the wine sector.

Canada’s largest private sector union, Unifor, joined our call for governments to harness our lumber resources and build affordable housing to fix our national housing crisis. This plan should include manufacturing housing in Ontario factories to create jobs, speed up housing construction and lower construction costs.

Unifor also called on Ontario to contract with Canadian companies to build new transit lines and increase the Canadian-content requirements for municipal and provincial purchases of streetcars, subway cars and buses, especially electric vehicles. Ontario has transit vehicle manufacturing plants in Thunder Bay and Kingston that are operating below capacity.

In Ontario, the standard requirement is that transit vehicles purchased with provincial funding must have at least 25 per cent Canadian content. The Conservatives relaxed this rule and allowed the massive Ontario Line subway project to be built by a U.S. company that was given the flexibility to meet a lower Canadian-content requirement of 10 per cent. That wasn’t a good move then, and it looks even worse now.

Ontarians want the Ontario government to have their back during this economically challenging time. Strong “buy local” and “build local” policies will help Ontario keep jobs in our province, keep small- and medium-sized businesses afloat, and help trade-impacted industries, like our manufacturing sector, weather Trump’s economic storm. What are we waiting for?

Jessica Bell is the MPP for University–Rosedale and the NDP’s finance critic.

By Staff By Staff

June 16th, 2025

BURLINGTON, ON

Students from the Halton District School Board (HDSB) achieved outstanding success at the 2025 Canada-Wide Science Fair (CWSF), held from June 1–6 in Fredericton, New Brunswick. The CWSF is Canada’s largest annual youth science, technology, engineering and mathematics (STEM) event. For more than 60 years, the CWSF has united young thinkers from across Canada to present their research and innovations, compete for prestigious awards and engage with like-minded peers who are passionate about discovery and innovation.

This year, 11 students from HDSB elementary and secondary schools earned 40 awards across a range of categories, recognizing excellence in innovation and research. The following are the Burlington students.

Evan Budz, Grade 9 student at Dr. Frank J. Hayden Secondary School for Development of an Autonomous Bionic Sea Turtle Robot for Ecological Monitoring using AI

- Best Project Award – Innovation

- The Beaty Centre for Species Discovery Award

- Excellence Award – Gold

- Challenge Award – Environment and Climate Change

- Youth Can Innovate Award

- European Union Contest for Young Scientists

- Mount Allison University Entrance Scholarship

- Western University Entrance Scholarship

Anish Rathod, Grade 12 student at Burlington Central High School for PIONEER: Pipe Inspection and Observation for Non-Destructive Evaluation and Environmental Review

- Engineering Innovation Award

- Excellence Award – Silver

- Dalhousie University Faculty of Science Entrance Scholarship

- Mount Allison University Entrance Scholarship

- University of New Brunswick Canada-Wide Science Fair Scholarship

- University of Ottawa Entrance Scholarship

- Western University Entrance Scholarship

Claire Marsh, Grade 11 student at M.M. Robinson High School for Autism Identification Tool: An AI Approach to Reducing Diagnostic Barriers

- Excellence Award – Bronze

- Mount Allison University Entrance Scholarship

- University of Ottawa Entrance Scholarship

- Western University Entrance Scholarship

The impressive results at the Canada-Wide Science Fair reflect the strength of science, technology, engineering and mathematics (STEM) learning across the HDSB. With students from a variety of schools represented, these achievements highlight how the HDSB fosters curiosity, encourages innovation and provides meaningful opportunities that help students develop their passions and deepen their learning.

By Staff By Staff

June 16th, 2025

BURLINGTON, ON

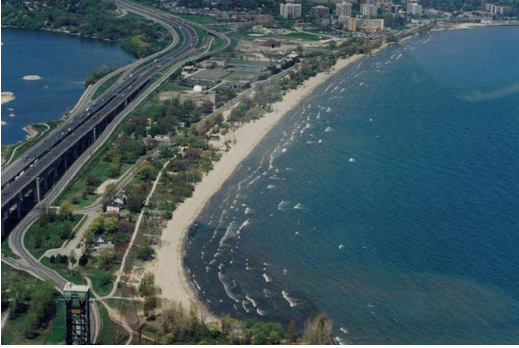

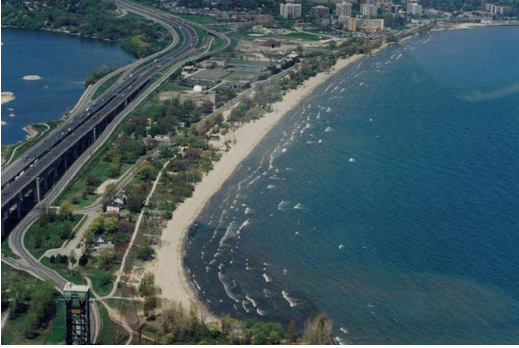

The Beachway and that little slip of a beach at the bottom of Brant Street are open for swimming.

Testing for E coli takes place regularly

Beachway Beach in Burlington (1094 Lakeshore Road) tested safe for swimming on June 11

Lake Ontario is still quite cold – it tends to warm up nicely in August. Brant Street Beach in Burlington (Lakeshore Road and Brant Street) tested safe for swimming on June 12

This mini-beach on the west shore side of the pier was created naturally by sands that came from as far away as the Scarborough bluffs. It was upgraded when Michelle Benoit, a local swimmer, attempted to swim from Port Dalhousie to Spencer Smith Park in 2012. Heavy waves brought the attempt to an early end.

By Staff By Staff

June 16, 2025

BURLINGTON, ON

Originally published by Logic,

Mark Carney wants to “build, baby, build” to fix Canada’s housing crisis—but supply alone can’t fix affordability. Decades of underinvestment have left the federal government devoid of expertise on how to effectively fund housing, creating major challenges for a housing boom.

The numbers are daunting. The government plans to create a new federal housing entity to help construct 500,000 homes per year by 2035, and will spend $10 billion to finance organizations that build affordable homes.

The federal government wants to build an unprecedented 500,000 homes per year, but decades absent from the business of building means that expertise now lies with provinces and cities

Canada’s housing supply is overwhelmingly owned by the private sector, with a lack of social housing pushing up prices and dragging down productivity. To change that, experts say Carney must be strategic about what type of home—not just how many—are built.

Carney says the government wants to get “back into the business of building affordable homes.” That business peaked in the 1970s, when the government poured money and resources into boosting Canada’s housing market. In 1976, construction began on a record 273,203 homes—a number the country has never reached since, despite the population tripling. Back then, almost half of those housing starts benefited from some form of public funding.

The building frenzy was overseen by the federal government’s housing Crown corporation, the Canada Mortgage and Housing Corporation (CMHC). The 1970s housing boom had two crucial factors that Carney is trying to revive: big federal funding and a lot of social housing developments.

The building frenzy was overseen by the federal government’s housing Crown corporation, the Canada Mortgage and Housing Corporation (CMHC). By the 1980s, its presence was vast, with about 90 offices across the country. Steve Pomeroy, executive advisor and industry professor at McMaster University’s Canadian Housing Evidence Collaborative adds that working relationships with social housing organizations also resulted in the construction of roughly 25,000 affordable homes per year from the late 1960s to the early 1980s.

Steve Pomeroy, executive advisor and industry professor at McMaster University’s Canadian Housing Evidence Collaborative. That changed in the mid-’80s when the federal government began shifting responsibility for housing to the provinces. In 1993, Canada’s federal budget removed all new funding for non-market homes—housing that’s not owned by the private sector, including co-ops and housing operated by non-profits or the government. Only B.C. and Quebec continued to provide funding for their non-market housing sectors.

CMHC staff either moved to the provincial level or out of the government-run housing business altogether. By the 1990s, there were 53 CMHC offices, and by the middle of the decade, federally funded affordable housing units dropped from roughly 43,000 per year in 1970 to under 5,000 units in 1995, where they stayed until 2016.

“The non-profit housing sector got quiet,” said Jill Atkey, CEO of the B.C. Non-Profit Housing Association. “Without investment from senior levels of government, affordability couldn’t be achieved.”

Atkey said expertise in the non-profit housing sector was eroded or outsourced because projects weren’t happening. As funding went down, so did the number of community housing units. Today, the CMHC has six offices—five regional ones and its headquarters in Ottawa.

Now, Carney wants to create a new federal entity: Build Canada Homes. The Liberals say it will act as both an affordable housing developer and financer, absorbing all relevant programs from the CMHC and building at least in part on public land.

But most of the expertise of how to finance affordable housing—and the local connections to do so—now lies with provinces and municipalities as the levels of government that have been responsible for housing for decades.

Alexandra Flynn, director of the Housing Research Collaborative. “Municipalities are the knowledge keepers of non-profit and deeply affordable housing in their communities,” said Alexandra Flynn, director of the Housing Research Collaborative, a research hub based in Vancouver, and an associate professor at the University of British Columbia’s Peter A. Allard School of Law. These relationships, she said, have been forged through decades of work on zoning, building and funding.

And Carney’s plan to reassert the federal government’s place in housebuilding will fall short if it takes the same approach as his predecessor. The National Housing Strategy, launched by then-prime minister Justin Trudeau in 2017, was, according to Pomeroy, the equivalent of the government jumping into the deep end of a pool with no life jacket and then realizing it had forgotten how to swim.

One of the problems with the strategy was that most of its funding was delivered through new federal initiatives, with developers often waiting almost a year and a half to hear back from the CMHC about their application, let alone start building.

If the Trudeau government had built on provincial expertise, it would have been fine, Pomeroy said. In trying to take everything over, Ottawa revealed itself to be incapable and incompetent.

“There was certainly a huge amount of frustration from the folks that were trying to access those programs,” Pomeroy said, and many projects didn’t go through. Atkey said non-profits had to stack funding from various programs that weren’t designed to work together.

Carney says building 500,000 homes a year will require “both the private and public sector,” and the prime minister has acknowledged the need to build more social housing. The government has yet to say much about how it will define and work with the “affordable home builders” set to receive billions of dollars of funding—whether they will be private sector, public or some kind of collaboration. Carney says building 500,000 homes a year will require “both the private and public sector,” and the prime minister has acknowledged the need to build more social housing. The government has yet to say much about how it will define and work with the “affordable home builders” set to receive billions of dollars of funding—whether they will be private sector, public or some kind of collaboration.

Right now, 95 per cent of Canada’s housing stock is built by the private sector, compared to just 3.5 per cent for social housing—less than the OECD average of 7 per cent. Ownership makes up a disproportionate share of the housing supply in Canada, with rental demand increasing as more and more people are priced out of buying a home.

Pomeroy’s research suggests that Canada spends huge sums subsidizing affordable home builds only to lose 11 low-rent units for every new one added. The cause, he said, is that rent hikes and demolitions remove affordable homes faster than they can be replaced.

“The model of investor-financed housing isn’t working, and I think we’re in a huge moment to change that,” said Cherise Burda, incoming director of the Ottawa Climate Action Fund and former executive director of Toronto Metropolitan University’s City Building Institute. Burda said there’s a role for private developers, but that, for too long, officials have been asking them to deliver affordable housing when it’s not their job to do so. “Let’s get shovels in the ground that aren’t dependent on that model,” she said.

Are prefabricated homes the answer? Scaling up not-for-profit housing can help make housing more affordable for moderate- and middle-income families, she added. A 2023 study from Deloitte and the Canadian Housing and Renewal Association (CHRA) found that building more community housing drives down real estate costs across the market and boosts productivity across the country.

The report found scaling Canada’s community housing sector to the size found in similar high-income countries would boost national productivity by 5.7 to 9.3 per cent and add $67 billion to $136 billion to Canada’s GDP. These economic boosts aren’t from one-off construction jobs, said CHRA executive director Ray Sullivan, but rather the effect of improved labour mobility, rises in disposable income and more. Sullivan said the analysis establishes that productivity goes up with the share of community homes, and vice versa—but only for non-profit housing, as the relationship “does not hold” for private-sector homes.

The report estimated it would take an additional 371,600 community housing units in Canada to reach that 7 per cent average. That number doesn’t have to be just new buildings—not-for-profit housing developers can purchase properties, and the Liberal plan has endorsed the “conversion of existing structures into affordable housing units.”

Cherise Burda: incoming director of the Ottawa Climate Action Fund and former executive director of Toronto Metropolitan University’s City Building Institute. Rebuilding the non-profit housing sector may also be crucial to weathering the cost of trade instability, Burda said, since it is not subject to the same speculation as the for-profit housing market, and project costs are somewhat lower without a profit margin. And the sector is financed, meaning the government will get its money back from non-profit housing providers.

Tim Ross, CEO of Co-operative Housing Federation of Canada, an organization representing more than 900 housing co-ops across the country, said the group’s research comparing private-sector rents and co-ops estimates upwards of $400 in savings on rent per month. He adds that his organization wants to get building sooner rather than later, as trade uncertainty complicates the business of importing building materials and components.

Carney has pledged to cut red tape to speed up building, including lowering municipal development fees and reducing zoning restrictions. Atkey said that whenever there is a non-profit element to a build, the applications are nearly 100 pages with strict oversight. She welcomes the scrutiny, but doesn’t see the same rigour applied to the private sector.

It’s not just a matter of supply, but what kind of people can actually access it. The 500,000 homes per year might help the upper rental market years down the line, Pomeroy said, “but it certainly wouldn’t get folks out of encampments, and it certainly wouldn’t help people in the middle.” Burda said big targets can result in big projects, but there’s a risk of ending up with a lot of housing that isn’t really affordable.

Case in point: Toronto. The closest Canada has come to its 1976 record for housing starts was in 2021, when the GTA’s investor-backed condo-building boom contributed to construction starting on 271,198 new projects across the country. Yet that boom was a mirage of sorts, with Canada’s condo financiers now fleeing as development charges surge and sales slump. The resulting condo ghost towns are a reminder of what can happen when “build, baby, build” goes wrong.

By Pepper Parr By Pepper Parr

June 16th, 2025

BURLINGTON, ON

OPINION

The criminal trial of the five hockey players accused of sexually assaulting a woman has ended.

The Crown has presented its case, and the Defence has put forward its arguments.

Justice Carroccia Justice Carroccia will deliver a verdict on July 24th.

The public has heard far more than they wanted about the antics of boys who were headed for fame, celebrity and annual incomes in the millions, driven by their gonads.

Whatever the decision, it may well be appealed.

We know far too much about what they are accused of doing. As described during the trial – this was disgusting behaviour.

As I followed the trial, I found myself wondering – what do the parents and grandparents of these boys say to their friends and associates about the behaviour?

We know that Hockey Canada, the national governing body for grassroots hockey in the country, used funds provided by parents to pay out hush money to women who filed complaints. We know that Hockey Canada, the national governing body for grassroots hockey in the country, used funds provided by parents to pay out hush money to women who filed complaints.

The outrage over that practice was so strong that the federal government cut off its Hockey Canada funding and sponsors walked away from the table.

Hockey Canada got a new board and cleaned up their act.

The remark that came from the National Hockey League about whether or not the five boys (now young men) would be able to play in the NHL even if they were found not guilty – reset what is acceptable behaviour and what isn’t.

The parties that took place were not something new. They had been going on for years – they were looked forward to as a sort of “coming out” in the hockey business. Young women were as involved as young men.

The question I found myself asking is – who is going to set the standards for the sport?

Could it be that the NHL will determine what the social values are determine what is acceptable?

In the Armed Services, there is a phrase: “prejudicial to good order and discipline” a catch-all provision, used to address misconduct not specifically covered by other offences.

Offences that are prejudicial to good order and discipline can result in disciplinary actions, including summary trials or courts-martial, and potentially lead to penalties such as dismissal with disgrace from Her Majesty’s service, fines, or imprisonment.

NHL Commissioner Gary Bettman In February of 2024 NHL Commissioner Gary Bettman said he does not believe the NHL players facing charges will return to their NHL teams this season.

It appears that Bettman might be prepared to rule that the players never return to the league.

By Nicolai Ryan Klausen By Nicolai Ryan Klausen

June 16th, 2025

BURLINGTON, ON

Progressive jackpot slots breathe new life into online gambling. And when it comes to places where you enjoy such jackpots, Wildrobin casino offers its own selection of progressive slots, each with fresh designs and fun gameplay. Today, these dynamic jackpots are no longer limited to traditional slot machines. They’re now found in online slots, and even some video poker games, with prize pools shared across networks.

What are progressive slots?

Progressive slots are machines where the main prize, or jackpot, grows with each bet. When someone places a bet, a portion of this money is added to the jackpot. And it gets bigger and bigger until someone wins it.

Sometimes the jackpot can automatically “fall” when it reaches a certain amount. But more often it simply grows without limits, and you can win it at any time if you’re lucky.

There are two types of such games: those where the jackpot is created specifically for this game; those that are connected to a common jackpot (the same prize for several slots). There are two types of such games: those where the jackpot is created specifically for this game; those that are connected to a common jackpot (the same prize for several slots).

Here’s what’s important to know about progressive slots before you go to play more than 50+ types of games in Wildrobin:

- Each bet has a small portion that goes into the common prize pool;

- This fund is visible on the screen: it is constantly updated so that everyone can see how big it is;

- When someone wins the jackpot, it starts over with a minimum amount;

- The jackpot itself is formed from the players’ money, not from the casino’s pocket. You all “collect” it together;

- Anyone can win, but usually it’s just one person, like in the lottery.

That’s it. A simple idea, but sometimes it brings someone a lot of money.

Different types of progressive slot

Progressive jackpots have changed in recent years. Previously, jackpots were only in one game, but now they are collected from many casinos around the world. The more people play, the bigger the jackpots become and the more often someone wins them. For example, there is the Jackpot King feature from Blueprint Gaming. It shows three large jackpots at once, collected from many games at once. Progressive jackpots have changed in recent years. Previously, jackpots were only in one game, but now they are collected from many casinos around the world. The more people play, the bigger the jackpots become and the more often someone wins them. For example, there is the Jackpot King feature from Blueprint Gaming. It shows three large jackpots at once, collected from many games at once.

Here are the common jackpots:

Game jackpot. Some games, like Ozwin’s Jackpots, have their own jackpot. It is also formed by players from different casinos. Game jackpot. Some games, like Ozwin’s Jackpots, have their own jackpot. It is also formed by players from different casinos.

Network jackpot. This is when the jackpot is the same for more than 30 different slots. That is, you can play different games, and the winnings will be from one large fund.

Multi-level jackpots. Many games have several jackpots: small, medium, and large. Small ones can be won more often, and large ones, less often, but they are very large. This makes the game more interesting because there is always a chance to win.

Time-limited jackpots. Red Tiger has come up with jackpots that are guaranteed to be paid out by a certain time of day. This means that the prizes cannot accumulate for very long; they are paid out daily.

Canadian players try out two primary categories of jackpots at Wildrobin: hot and new.

Almost all game manufacturers now make progressive slots. But the biggest jackpots are given by big gaming companies like Games Global, NetEnt, and IGT.

To cap it all, progressive jackpots are not just ordinary games; they grow in value with every spin players make. It means the more people play, the bigger the prize becomes. It’s a feature that keeps players coming back, all hoping to hit that growing jackpot.

By Staff By Staff

June 16th, 2025

BURLINGTON, ON

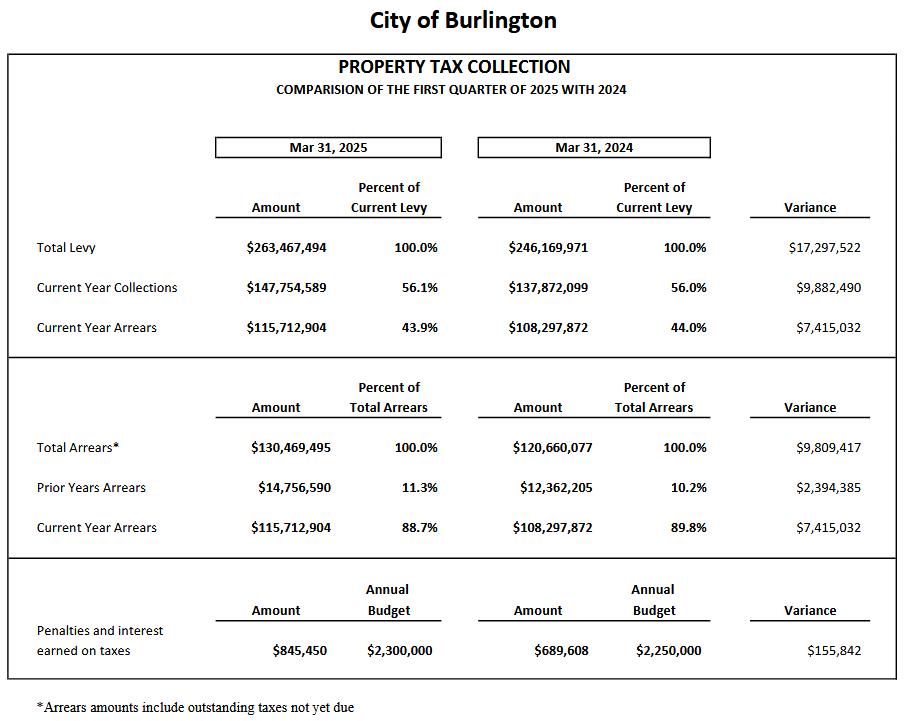

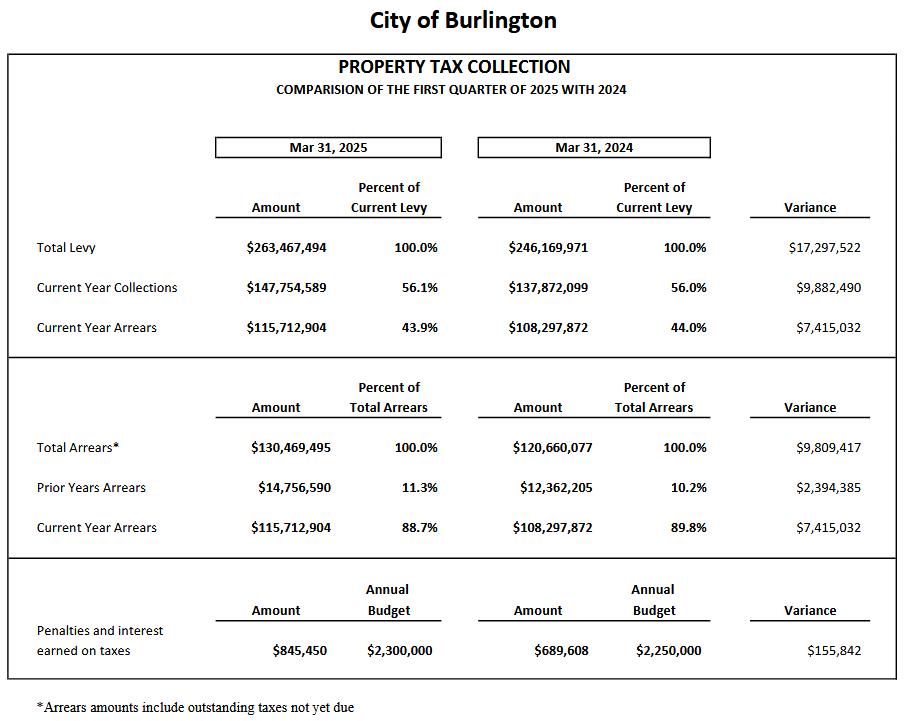

Tax arrears are an indicator of how healthy the economy of a city is at a particular period of time.

The data below shows taxes for the previous year not yet paid at $14,756,590. The city collects interest on those tax accounts that are overdue – $845,540 for 2025 – significantly higher than the previous year.

The data includes outstanding taxes not yet due.

The total tax levy increased by more than $17 million.

By Jeannie Løjstrup By Jeannie Løjstrup

June 16th, 2025

BURLINGTON, ON

Modern online casinos offer many slots that differ in theme, mechanics, and bonus options. Jackpot slots are especially popular among Canadian gamblers because they allow them to win a large prize. Many reputable online casinos, including Robocat, offer this format of gambling entertainment. In some of them, the jackpot sizes can reach millions of dollars.

What is the difference between fixed and progressive jackpot slots?

Top gambling sites, including Robocat online casino, offer slots with fixed and progressive jackpots. Below, we will explain the main differences between them.

Slots with fixed jackpots

A fixed jackpot is a specific amount of payouts you can receive in a particular slot. Usually, the limit on the win is set by the provider, but there are slots in which the online casino determines the prize amount. The size of the fixed jackpot does not depend on the number of rounds and the popularity of the slot. You need to collect a winning combination or pass levels to get the biggest win.

The most popular slots with a fixed jackpot, which are offered by a random online casino:

- Electro Coin Link. This slot from Fugaso allows players to win one of four fixed jackpots (Grand, Major, Minor, Mini), which are activated by the Running Wins bonus feature. Each of them has a fixed value, which depends on the size of your current bet. The maximum win in Electro Coin Link is up to 5000× of the bet.

- Immortal Ways Sweet Coin. You can win one of four fixed jackpots by launching this colorful and dynamic slot. To do this, you need to activate the Prize Wheel bonus feature. It is triggered by collecting six or more gold coins on the reels. RTP of the Immortal Ways Sweet Coin slot is 96.28%. Volatility: medium.

Juicy Win. This slot allows players to win one of four fixed jackpots (Bronze, Silver, Gold, Platinum) activated during the bonus game with the Hold the Spin mechanic. You must collect three coin symbols on the reels to launch the bonus game. The maximum win is up to 3600× of the initial bet. Juicy Win. This slot allows players to win one of four fixed jackpots (Bronze, Silver, Gold, Platinum) activated during the bonus game with the Hold the Spin mechanic. You must collect three coin symbols on the reels to launch the bonus game. The maximum win is up to 3600× of the initial bet.

In addition, reliable online casinos offer other slots with fixed jackpots. The most popular are Coins of Ra Power— Hold & Win, Power Coin: Trinity Series, and Eagle Strike.

Slots with progressive jackpots

A progressive jackpot is a cumulative prize, the size of which consists of deductions from each bet. With each game round, the size of the progressive jackpot increases. This means that the more bets gamblers make, the higher the maximum payout. Another feature of progressive jackpot slots is that winnings do not depend on the bet size. A player who has made the minimum bet can win. A progressive jackpot is a cumulative prize, the size of which consists of deductions from each bet. With each game round, the size of the progressive jackpot increases. This means that the more bets gamblers make, the higher the maximum payout. Another feature of progressive jackpot slots is that winnings do not depend on the bet size. A player who has made the minimum bet can win.

The most popular progressive jackpot slot on sites like Robocat online casino is Super Wolf from Skywind Group. It allows players to win a progressive jackpot, which is activated when five multi-colored gems fall on one active payline. The slot’s RTP is 95.34%, of which 0.4% goes to forming the jackpot. Super Wolf has medium volatility, which ensures frequent but moderate wins.

Try to perceive large prize payouts in online casinos as a way to get bright emotions and pleasure from the game, not as a source of income. Rationally manage your bankroll and adhere to the principles of responsible gaming.

By Pepper Parr By Pepper Parr

June 15th, 2025

BURLINGTON, ON

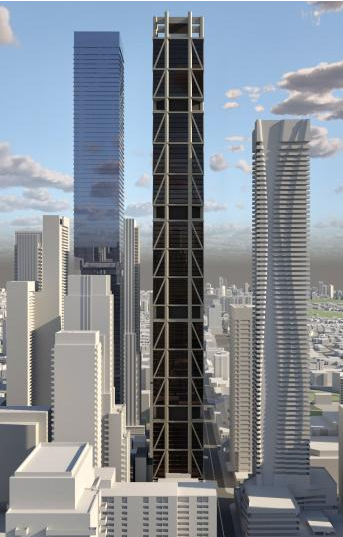

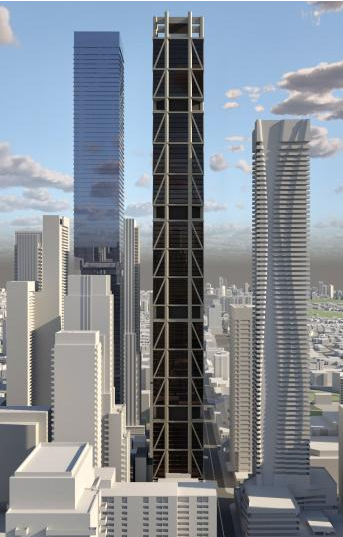

The structure on the right, 19 Bloor West, is the third-highest tower in Toronto. At the Bay Area Economic Summit held recently in Burlington Mike Moffatt said: “we need to get away from the mindset that a unit is a unit when we are counting. The 400 to 600 square foot condos that attracted investors are not housing for a family. We need three and four-bedroom units if families are to be accommodated.”

Moffatt is an assistant professor of business, economics and public policy at Ivey. In 2018, Moffatt was appointed director of policy and research at the progressive think-tank Canada 2020.

He is the Founding Director of the Missing Middle Initiative.

A news item out of Toronto made mention of the units in the tower being built at 19 Bloor Street West’ “The residential units themselves will range from studios to three-bedrooms, with some of them getting pretty tight, even by Toronto standards.

According to design plans, a number of the studios will measure as small as 287.8 sq. ft, with many of three-bedrooms being as snug as 863 sq. ft. The largest unit shown in the plans is a three-bedroom measuring 941.8 sq. ft.

One-beds will take the lion’s share of units (48%), followed by two-bedrooms (36%), three-bedrooms (10%), and studios (7%).

Related news story:

Mike Moffatt at the Bay Area Summit

By Pepper Parr By Pepper Parr

June 14th, 2025

BURLINGTON, ON

The story of the week has to be the announcement by the Art Gallery that they wanted to tear down the existing building and erect a new three-level structure – at a cost of at least $116 million.

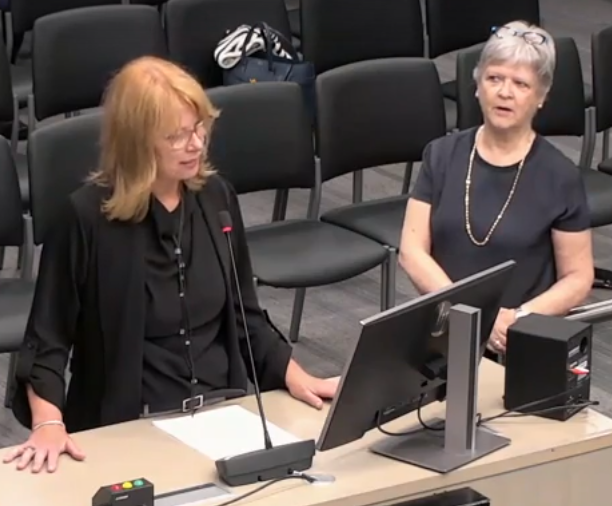

Art Gallery Chair Susan Busby on the right wanders where Executive Director Sankey is going with the presentation. While the gallery leadership did its best to assure council they had consulted far and wide on their plans, that wasn’t the feedback we have been getting.

Whatever changes are going to take place – it won’t happen overnight. Two things became very clear from the people we talked with – no one wanted their names used and every said they didn’t think the $116 million was a realistic number.

View from the parking lot at the rear of the property.  Intersection of Lakeshore Road and Brock There is a Strategic Plan out there somewhere that the Art Gallery has yet to produce. Two people we talked with said they had seen the document. Staff at the AGB have yet to find it.

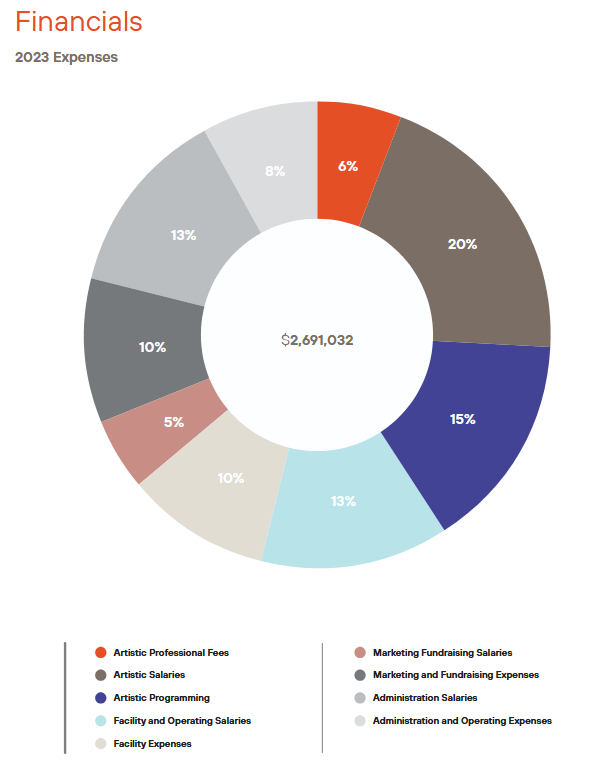

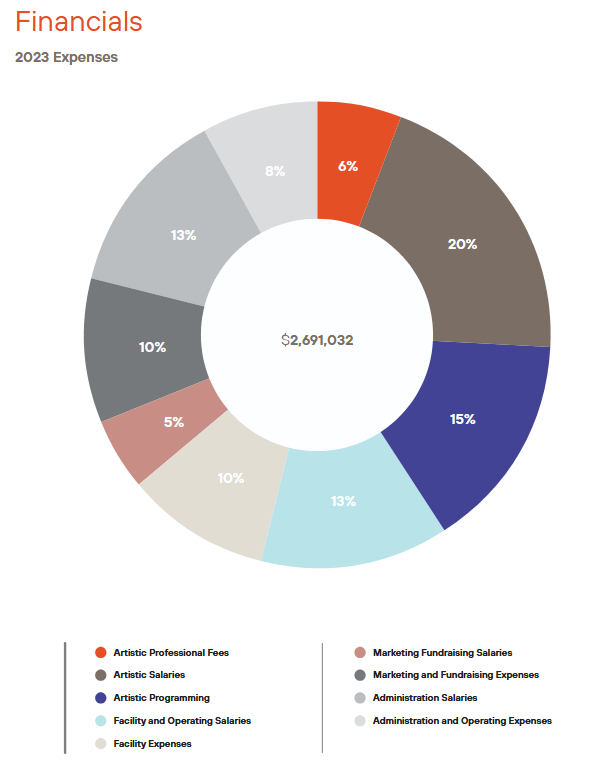

What we were able to get was the financial picture as it stood at the end of 2023.

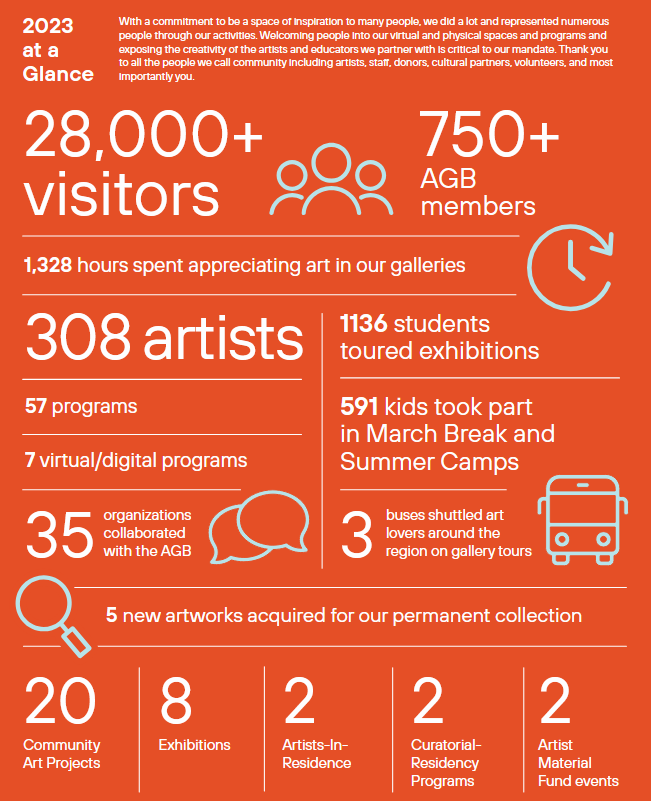

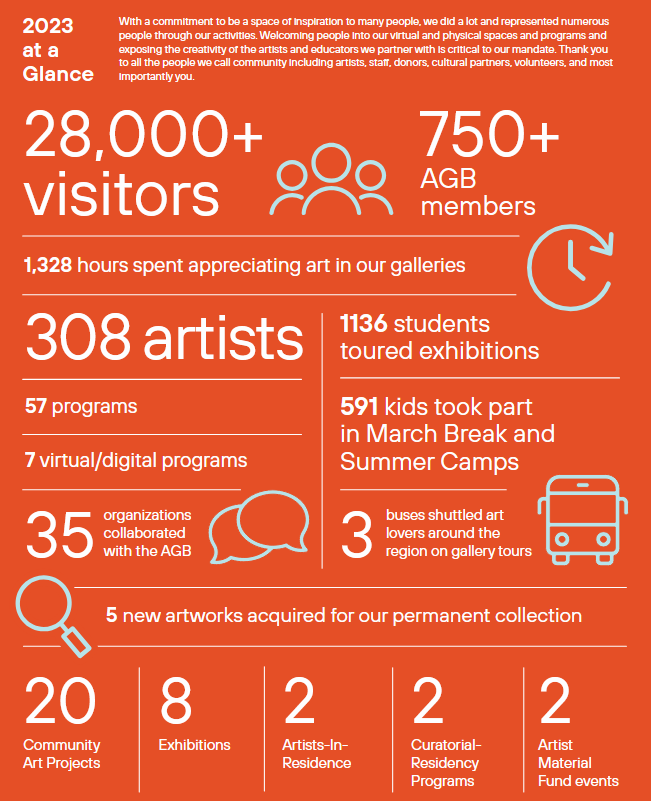

There was an infographic on what took place in 2023.

By Staff By Staff

June 13th, 2025

BURLINGTON, ON

The Burlington Downtown Business Association (BDBA) works to enhance the downtown experience for all its many residents and visitors, we are thrilled to introduce The Green Lanyard Project.

Green lanyard with badge holder This newly launched program works by freely issuing a green lanyard to business owners and staff, patrons and visitors of our downtown. The use of this lanyard is to signal to others that the wearer of the lanyard (or a member of their party) has an invisible atypical ability. This suggests they may need more time, more patience and more empathy as they navigate their environment.

So why a green lanyard? Green is often seen as the colour that most widely represents mental health. It also provides a gentle and comforting nod to neurodivergent community members as well.

What does neurodiversity mean?

Great question! As education is a great first step to breaking down barriers and building understanding, let’s talk about it! Neurodiversity is medical framework designed to consider and understand the human brain within sensory processing, motor abilities, social comfort, cognition, and focus as neurobiological differences. Autism Spectrum Disorder ADHD, Dyslexia, Tourette’s, Dyspraxia, Synesthesia, Dyscalculia, Down Syndrome, Epilepsy, and chronic mental health illnesses such as Bipolar Disorder, Obsessive-Compulsive Disorder, Borderline Personality Disorder, Anxiety, and Depression.

How does the program work? Starting June 20th, you will be able to submit a request to the BIA for a lanyard, for free, which will then be mailed to you, to use at your discretion. The lanyard can then be worn when visiting and exploring our downtown. Through a series of community and public education pieces, our downtown businesses will remain as they are, providing you with the incredible hospitality and warmth our community is known for – we’re just adding a touch of green! Lanyards also proudly feature a BDBA branded pin, complete with emergency release mechanism. Lanyards will take 7 to 10 business days from day of request to arrival.

The Green Lanyard Project was developed in partnership with Stefanie Peachey, Peachey Counselling and Family Support. Our dual commitment to this program, along with the support we have received from our small businesses, clearly demonstrates that your BIA is working to make our community more accessible, inclusive, and comfortable for those in need.

For more information, please visit https://burlingtondowntown.ca/thegreenlanyardproject/

By Pepper Parr By Pepper Parr

June 13th, 2025

BURLINGTON, ON

The Ontario Liberals put on their fanciest shoes and deepest pockets earlier this week for leader Bonnie Crombie’s banner fundraising dinner, where tickets topped out at a sizzling $3,400 a plate. Sources inside the room tell QPO it was equal parts schmooze-fest and war-chest flex, with a smattering of quiet leadership tension. And yes, I got my hands on the menu.

It looked like a walk to a Coronation when Bonnie Crombie walked to a Liberal Party meeting in Hamilton – the momentum stalled – not being able to win a seat in the Legislature hasn’t helped. The party’s comms team is touting a $5 million haul so far this year — a $500,000-chunk of it thanks to last night’s glitzy affair at the Metro Toronto Convention Centre. That number would put the Grits ahead of their usual pace — the party claims to have raked in $5.4 million last year — and is a not-so-subtle message to anyone still questioning Crombie’s pull with the party’s donor class. Case in point, the official line: It’s “a clear sign of a party on the rise.”

But while the cash was flowing, the vibes were…complicated. Crombie is staring down a leadership review in the fall, and not everyone in the red tent is convinced it’s going to be a coronation. As I previously scooped, her inner circle is now holding regular Monday meetings focused squarely on making sure the review doesn’t turn into a full-blown referendum on her rookie-ish leadership.

One insider described the mood as “strategic” but not “panicked” — though others were tittering about a shadowy group of grassroots Grits that has emerged, setting the bar (and the trap) for the leadership review.

The energy now goes into keeping the job instead of building the party. Crombie’s 66% problem: The anonymous group calling themselves the “New Leaf Liberals” says that unless Crombie gets 66 per cent of delegate support for the leadership, it’ll be time for her to pack it in.

In their words: They want “the resignation of the current party leader at the 2025 Annual General Meeting, should they not reach a two-thirds majority (66%) of the delegate vote.” Oh, and they want the party not to fill vacant delegate spots in the meantime — translation: no parachuting in last-minute Crombie loyalists. As of this morning, the petition had 75 signatures.

The party line? Everything’s fine. Some are brushing off the New Leaf Liberals as noise from the cheap seats. They’re quick to point out that Crombie still enjoys the public blessing of the entire caucus and party executive, and technically speaking, she only needs 51 per cent of delegate support to survive.

But insiders know all too well: 66 per cent is the quiet cutoff in Canadian politics. Fall short, and the knives tend to come out.

When the leader of a political party fails to win a seat, the tradition is for a sitting member in a very safe seat resigns and lets the party leader run for office. The Poilievre situation is an example. It is interesting to note that so far none of the 14 Liberals has stepped forward. Telling

By Staff By Staff

June 13th, 2025

BURLINGTON, ON

The news on the fund raiser that brought in xxx for the Ontario Liberals was less than a day old when word of a group, described as a “grassroots movement,” is planning to mount a push to defeat the Liberal leader at the party’s annual general meeting in September.

Bonnie Crombie: charged with an “inability to undertake the necessary steps to rebuild our party.”  They go by “New Leaf Liberals,” and they’re gearing up to challenge Bonnie Crombie’s leadership in the fall. They go by “New Leaf Liberals,” and they’re gearing up to challenge Bonnie Crombie’s leadership in the fall.

While organizers wouldn’t disclose the full strategy yet (“stay tuned,” we’re told), the group launched an online petition calling for “renewal” this morning.

Aiming to grow the rank-and-file, “win back” trust, expand the candidate and volunteer base and modernize campaign infrastructure, the group is calling for a ground-up overhaul — and new leadership to lead it.

They blame Crombie for her “inability to undertake the necessary steps to rebuild our party.”

“We believe that there needs to be some accountability from Bonnie Crombie and her team,” the organizers wrote in a document reviewed by this reporter.

What they want: The group is asking Crombie to quit if she is unable to clinch a two-thirds majority at the convention, and to pledge to freeze the delegate list and leave any vacancies as-is. They don’t want the Crombie crowd to pad the delegate list with their supporters..

|

|

By Staff

By Staff

Part coming-out story of a trans woman and part heartfelt romance, My Body Is Distant follows Paige from a childhood obsession with the 1980s game Zork, through a health crisis and divorce, to an ultimately affirming experience and self-love.

Part coming-out story of a trans woman and part heartfelt romance, My Body Is Distant follows Paige from a childhood obsession with the 1980s game Zork, through a health crisis and divorce, to an ultimately affirming experience and self-love.

By Staff

By Staff