By Pepper Parr By Pepper Parr

January 26th, 2016

BURLINGTON, ON

It was his first serious delegation, one at which he had a concern he wanted to put before city council.

Vince Fiorito, a candidate in the last federal election and a committed environmentalist who spends some of his weekends clearing out rubbish from the city’s creeks, had announced to friends that he was planning on running for city council in his home ward in 2018.

His intention was to spend the next couple of years attending meetings and networking like crazy.

Vince Fiorito was named the Watershed Steward for Sheldon creek. He now wants to become the member of city council for the ward he lives in – Sheldon Creek runs right through the middle of it. Fiorito is the Steward of Sheldon Creek, a title given him by the Conservation Authority, something he takes very seriously.

His delegation to city council was to focus on what he felt was very poor citizen engagement and he launched into his presentation. Less than 18% of the people in this city know about the ways they can be engaged in the civic process he said.

The city treasurer said she was going to inform citizens about the budget but would not be engaging them, advised Fiorito.

He explained that while he as new to the ways of city hall he expected more public participation.

It was at that point that Mayor Goldring interrupted Fiorito and explained that while he could talk about civic engagement he had to confine his remarks to how civic engagement related to the budget that council was considering.

We recall the Mayor interrupting delegations in the past but never on such a fine point,

Fiorito thought he was going to be able to talk about his concerns over the poor level of citizen engagement – the Mayor advised him that he could talk about his citizen engagement but only as it pertained to the budget – which was limiting what Fiorito had planned – but he recovered and went on to make his point – which was that the public really wasn’t in the room when the budget was being discussed

Fiorito was taken aback at first. His first comment was “Gee whiz” as he fumbled a bit to figure out how he was going to get back on track.

He did pretty well – pointing out to council that Seattle had held 38 neighbourhood meetings and involved 30,000 citizens.

This was the kind of thing he wanted to see happen in Burlington.

He also pointed out that there were no evening sessions in the committee meetings that went through the budget in detail.

The Clerk informed Fiorito that there was a planned evening session but no one asked to be a delegate.

Most of the council members hold meetings in their wards to get local input. A couple of Ward 4 residents discuss a previous budget. Councillor Dennison told Fiorito that he held a budget meeting for ward 4 residents and it attracted more people than the city meeting held at Tansley Woods. Dennison serves water and popcorn – that must be the attraction.

Councillor Meed Ward explained to Fiorito that many people send email to council members directly and questions are answered.

She and the Mayor asked for a link to the Seattle procedures.

There was to be a second delegation from Robert Lovell who had planned on talking about the need for the Free Monday transit for seniors – but he decided not to speak.

Was Lovell spooked by the way Fiorito was cut off by the Mayor?

Was it necessary for the Mayor to interrupt Fiorito? We have heard others go much further off track than Fiorito did without being interrupted.

What was most disappointing was while Fiorito had strayed – this was his first delegation and the Mayor could have cut him some slack. Mayor Goldring did approach Fiorito after the meeting and apologized for having to interrupt and did invite him to meet with the Mayor and discuss his concerns.

What was disappointing as well was that the Mayor could have said that Burlington had some distance to go to pull in stronger citizen participation.

Those that might have watched the live broadcast will probably have concluded that delegating and getting shot down was not something they needed to experience.

Vince Fiorito, delegating for the first time at a city council meeting brought back visions of the days when Councillor Meed Ward used to delegate and press council on better transparency and more accountability. Fiorito is cut from a different cloth. We saw traces of the original Marianne Meed Ward who delegated several dozen times pressing council to be more transparent and accountable before she was elected to office. And she began her climb to those august chambers several years before the 2010 election.

Fiorito seems to have decided to use the same approach. He will be worth watching. And don’t expect him to get tripped up again by the Mayor.

By Staff By Staff

January 25th, 2016

BURLINGTON, ON

The residential tax rate for 2016 is going to be $17.10 per $100,000 of home assessment value.

City council approved the 2016 budget this evening which came in at an increase of 3.19% more than 2015.

Additional details will be published early Tuesday.

By Pepper Parr By Pepper Parr

January 22, 2016

BURLINGTON, ON

It’s called being between a rock and a hard place, The rules will ‘get ya’ every time.

Your city council and the staff at city hall will say, whenever they get the chance, that they are always transparent and always accountable and that they are there to serve the people of the city.

The words “citizen engagement” are sprinkled throughout the Strategic Plan that is working its way through the bureaucracy.

Look at this situation and see if you can find the transparency or the accountability or even a smidgen of citizen engagement.

Director of Finance Joan Ford does a great job of providing the data. Burlington has a very good finance department; some of the most diligent people on the city payroll work in that department. They usually always have their fingers on whatever number a member of council might want. Whenever Treasurer Joan Ford doesn’t have a number at her finger tips or makes a small mistake she actually blushes with embarrassment and correct the error very quickly.

Our only beef is that the finance people are not particularly interested in engaging the citizens of the city – they are interested, and are very good at informing the public. These are two different approaches to civic government.

But that is not the current issue. The finance people set an aggressive agenda to get the 2016 budget completed. Debates on the budget take place within a Standing Committee.

Staff set out several days for the process of budget delegations and debate to take place.

Tuesday, January 19th: 10:30 to 6:30 – the meeting ended just after 4:30 pm

Wednesday January 20th: 10:00 am to 4:00 pm.

Thursday January 21st: 3:00 pm to 5:30 pm. This meeting did not take place; the Standing Committee was able to adjourn at 4:00 on the Wednesday when they set they recommended a tax increase of 3.16%

Delegations were held on the Tuesday during the day. For some reason they saw no reason to hold evening sessions- why not?

Why wasn’t there more in the way of public notices – the Gazette would have cheerfully run an advertisement for the city had they chosen to use our medium – which gives better value than any other media in the city – but I digress.

The delegations were strong, factual and well delivered and members of council certainly engaged those who were on hand to speak.

The Council debate took place the following day – the Gazette and the Spectator were the only media present.

It was a good debate – we saw some staff behave in a very disrespectful manner when a member of council put forward some data that was supplied by Oakville on their Free Monday for seniors program. A city Director came very close to saying he didn’t believe the numbers read out to him from the Oakville Director of transit. Our city manager, a former Canadian Armed Forces Captain, knows what insubordination is, quite why he didn’t intercede is a question he might want to answer.

When it came to a vote – those wanting the Free Monday transit for seniors lost on a 4 against – 3 for vote.

Councillor Craven is reported to have told an Aldershot resident that he liked the program – but he did not vote for it – that may have been because almost anything Councillor Meed Ward puts forward, Craven opposes. He didn’t speak at any length on the matter during the debate.

Councillor Paul Sharman voted no – he wanted more data. Councillor Sharman always wants more data before he makes a decision – there does come a point when a decision has to be made based on experience and wisdom. There was the sense that the asking for additional data was punting the ball off the field.

Councillor John Taylor – he voted no – saw free transit as social welfare which most people didn’t need. Councillor Taylor couldn’t help but see Free transit as some form of social welfare; his mind is still stuck in that old style thinking.

One wonders why Taylor does not label the $225,000 that is forgone in terms of parking fees for the free parking members of staff get every year. With that kind of money the city could make the transit service free to everyone.

Votes can be changed at city council; members can change their mind when they have new information.

But here is the rub. If council votes a second time on the budget matter of free transit for seniors on Monday’s and the vote is lost a second time – it cannot be brought back to council again for the balance of the term of office of this council – two and half years, unless the motion is brought by one of the people who originally voted against the motion – and that vote must pass with a 5-2 for vote just to get it on the table.

That is a high hill to have to climb and would make anyone who wanted to attempt to have the vote over turned at council think twice. Forcing the vote kills the opportunity for the balance of this term of office – which we suspect is exactly what some of the Councillors wanted.

A wiser mind would get into discussions with any member of Council they thought could be swayed – and if the votes were not there – then go to ground and wait for the right opportunity.

There is nothing to prevent council from asking the transit people to prepare the document that would set out what the metrics would be to measure a successful pilot program.

At one point Director of Transit said he could have the document done in a day – when pressed a bit he said he would need a couple of weeks.

Transit Director Mike Spicer, in the yellow shirt, shows Mayor Goldring what he wants in the way of new buses. The pilot program wasn’t due to start until April – so Mike Spicer, the Director of Transit has all kind of time to prepare a report – he might use some of that time to meet with his peer in Oakville and learn just how they made their program work.

There is a sliver of hope for the program. Mayor Goldring suggested that the transit people might want to use the pilot project as a marketing initiative – their response to that was they already had a number of marketing programs.

And how well are they working ? is a question the Mayor might have reasonably asked.

Rick Goldring doesn’t yet fully understand what it is to be a Mayor – as the Chief Magistrate he has a “bully pulpit” which he hasn’t learned to use. He could have and should have asked the Director of Transit to re-think his response and then invite the City Manager and the Director in for a cup of coffee and a chat.

Mayor Rick Goldring on one of the few occasions that he wore his chain of office during an interview. During the debate James Ridge, City Manager, wouldn’t touch the question. He said – and he right – “this is a political decision.”

That chain of Office the Mayor wears isn’t just a piece of bling. It is a symbol of the office he holds and the authority given him.

There was an opportunity to do something bold, something visionary and, in the words of Jim Young, a chance to show Burlington as a caring, conscientious community.

By Jim Young By Jim Young

January 21st, 2016

BURLINGTON, ON

I am speaking as a private citizen in support of Burlington Seniors Advisory Committee’s effort to reduce or eliminate Transit Fares for Burlington Senior Citizens. A proposal has been made that City Council and Burlington Transit consider Reduced Transit Fares for Seniors.

In support of, and in addition to the well-made case presented by Mr. Lovell on behalf of Burlington Seniors Advisory Committee, I would respectfully submit to Council and the Budget Committee that Seniors Transit is not just a senior’s issue but is one that affects the entire city, its residents and its reputation as a caring, conscientious community. An issue, which, if addressed effectively, will have beneficial impacts on Traffic Congestion, Road Safety, The Environment and will dovetail perfectly with many aspects of Burlington’s Strategic Plan Proposals currently under review.

As Burlington’s senior’s population approaches 30,000 and continues to grow, it is fair to say our impact on every facet of our city’s way of life is and will continue to be significant.

Jim Young Seniors Impact on Burlington’s Traffic Congestion:

There is universal agreement that traffic congestion is becoming a more serious issue in Burlington every year. As council strives to encourage continued growth and increasing population to ensure the economic well-being of our city this congestion will only become more troublesome and the economic and the environmental impact more acute. City Council recognizes this and addresses the issue in its Proposed New Strategic Plan (A City That Moves).

Seniors using affordable transit for one in five of their journeys would reduce traffic congestion by approximately 3%. While that may not sound like much, traffic flow science suggests such a reduction has a major impact on traffic flow and reduced commute times particularly at peak volumes. The more attractive any incentive to switch seniors from cars to transit, the greater that improvement will be. More seniors on transit allows working people, business transport and goods to move more efficiently, improving productivity, and supporting the vibrant business environment our city strives to encourage in that Strategic Plan.

Road Safety:

Studies indicate that as we age our cognitive abilities and response times deteriorate resulting in higher levels of traffic accidents, injuries and claims for senior drivers. The safety of senior drivers and their impact on accident rates is an emotionally charged subject we are loath to address for fear offending spouses, parents or potential voters.

Reduced transit costs for seniors would alleviate that burden by providing a dignified and affordable alternative to driving; thereby reducing the risks with all the human and monetary costs involved for their families, the city, traffic authorities and emergency services.

Reducing traffic accidents by moving seniors from automobiles to transit would also go a long way to meeting the city’s Age Friendly City and a Safe Place to Live objectives of its Proposed New Strategic Plan.

Jim Young The Environment:

Thirty Thousand Burlington Seniors driving an average of 15,000 Kilometers per year, even allowing for some spousal car sharing, emit 105,000 tons of CO2 into the atmosphere. Every car taken off the road by affordable transit for seniors reduces this annual amount by 3.5 tons.

Again, the Proposed New Strategic Plan aims to make Burlington a Greener Place to Live: an admirable objective for our city that we can help achieve by switching seniors from automobiles to transit and reducing our carbon footprint.

Jim Young has lived in Burlington for more than 30 years where he raised his family and involved himself in his community. He still has a pleasantly strong brogue accent. This opinion pice is a delegation he made during the budget deliberations at city hall.

By Pepper Parr By Pepper Parr

January 21st, 2016

BURLINGTON, ON

Robert Lovell doesn’t understand.

Robert Lovell He was interviewed for the job he has as a member of the Burlington Seniors Advisory Committee and thought he was expected to do just that – advise city council on things that mattered to seniors.

BSAC met on a number of occasions and went into the community to learn when people wanted in the way of transit services.

They researched what Oakville was doing and came to the conclusion that the Free Transit on Monday’s was a good idea and certainly worth trying in Burlington.

They then delegated to city council and made a strong case for trying the Free transit for seniors on Monday’s.

They argued that ridership would rise and the free service might convince people to try the bus. They argued it would also allow people with limited means to use the bus service more often.

Councillor Jack Dennison, Rick Craven and John Taylor voted not to proceed with a pilot project to learn how much additional ridership could be added to the transit service. All three voted for an allocation of $15,500 for the car free Sunday event that takes place in wards 4,5 and 6. A majority of city council didn’t see it that way and they voted (4-3) against the pilot program that was to run for six months.

Councillors Marianne Meed Ward, Blair Lancaster and Mayor Goldring voted for the pilot program.

Councillor Craven said very little during the debate. Councillor Taylor seemed to feel that the program was intended for those who could not afford transit – and he argued, if that was the case, there were Regional programs that gave financial support.

Taylor seemed quite prepared to have people submit to a financial means test to get support to buy a transit pass. He saw the pilot project as social welfare which he explained is handled by the Region.

Councillor Dennison has never been in favour of much in the way of support programs. Councillor Sharman said he didn’t have a problem with the program but he wanted to be sure everyone fully understood just what the outcomes and expectations were for the pilot project. He wanted the Director of transit to set out what would be measured so that a proper evaluation could be done when the six month pilot ended.

Lovell said he had been told by friends that the Advisory committees were just a sham – that they were put in place to let the public think the city wanted to hear what they had to say. “If that is the case: said Lovell, “then I am out of that committee. I am interested in working on committees that want to make a difference.”

Lovell was one of three people who delegated on the Free Transit for seniors on Monday – a program that Oakville has had in place since 2012 where it is reported to have increased transit ridership by as much as 14% in one period.

Burlington Transit has always had difficulty growing transit ridership. There have been significant price increases which has depressed ridership and route changes haven’t helped all that much either.

When the matter got to council for debate it was clear that some of the members of council didn’t hear what the delegations were saying the day before.

Jim Young was asking council to forget the cost but focus on service – he argued that it was taxpayer’s money and the seniors wanted this kind of service.

What council failed to see was the real opportunity that was being missed. Burlington has busses that travel the streets “more than half empty most of the time” if we understood what Councillor Sharman says.

A new bus is added to the fleet – city hall staff and area politicians drove over to the transit garage to give a round of applause. They get paid for this – don’t they? We own the buses, we pay a driver to be behind the steering wheel – if there was a chance to increase the ridership at no additional cost and at the same time provide a service and entice people to use the buses – why wouldn’t one at least try the pilot?

The city wasn’t going to lose any money – there would be passengers on the bus who would not pay a fare – they wouldn’t have been on the bus anyway

There is an additional benefit if ridership can be increased. The gas tax rebate the province gives a municipality is based on two measurements: the population of the municipality and the ridership.

There are currently 130 municipalities sharing $332 million dollars.

There was an addition to the 2016 budget that was estimated to cost $14,000 – they spent more than an hour

Burlington has had problems convincing people to use transit. Doug Brown maintains the city does not have a plan to increase ridership and that there really isn’t anyone within city hall who will advocate for improving transit. There is no one at city hall who fully understands transit – responsibility for transit get mentioned by the people responsible for transportation.

More than 17% of the population is over 65 and while many people are able to drive their cars well into their 90’s our aging population is likely to become subject to graduated drivers licenses.

We will get to the point where a doctor will be required to advise the department of transportation that the patient is no longer capable of driving a car. What do we do when we have a growing cohort of people who are either not allowed to drive or are no longer comfortable driving?

The transit free Monday was an opportunity to learn if people would take a bus if it were free. The driving factor behind the pilot project was to see if this was a way to increase ridership.

Old school thinking had Councillor Taylor seeing the request as a social welfare issue, while Councillor Sharman wanted a clear understanding of what the expectations of the pilot were going to be.

Ward 6 Councillor Blair Lancaster – voted for the Free Monday transit service for seniors  Ward 2 Councillor Marianne Meed Ward made her presence known to Council well before her election to office, the city knew what they were getting and she has delivered on that promise. Councillors Lancaster and Meed Ward were quite willing to let the Director of Transit take the time needed to prepare a report and if they had to move the start date of the pilot back a bit they could live with that as well. An amendment to the motion allowing for a report to be prepared didn’t pass either – the four opposed to the pilot project just didn’t want to see it take place.

When an item fails at the Standing Committee level there is always an opportunity to debate it again at a council meeting – these are usually held a couple of weeks later. However, budget meetings were slipped in and the normal rotation of meetings got jammed up. If there is going to be a change at city council – those who are behind this project will have to get a wiggle on.

The Gazette understands that the good folks in Aldershot are not at all pleased with the Councillor Craven vote against the pilot.

By Pepper Parr By Pepper Parr

January 21st, 2016

BURLINGTON, ON

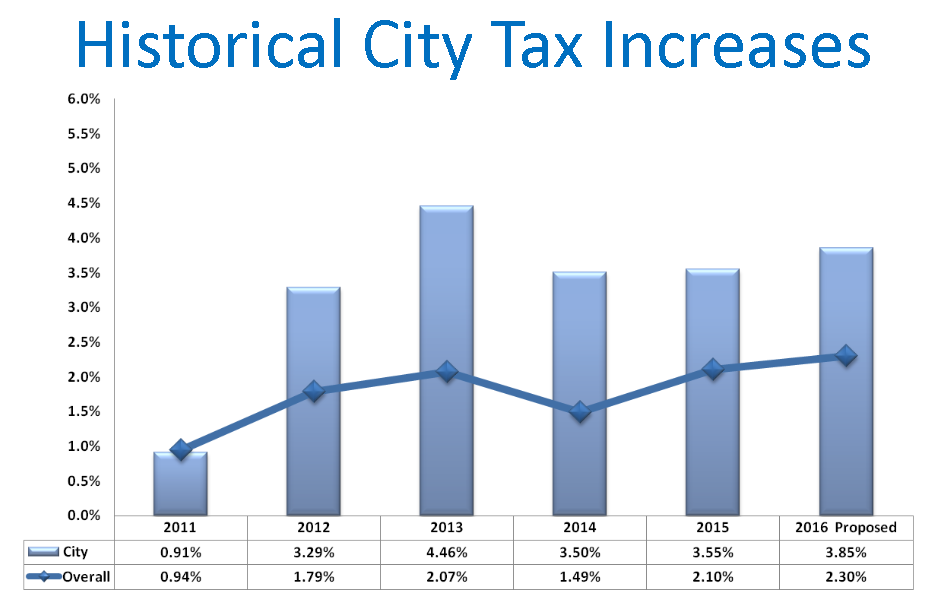

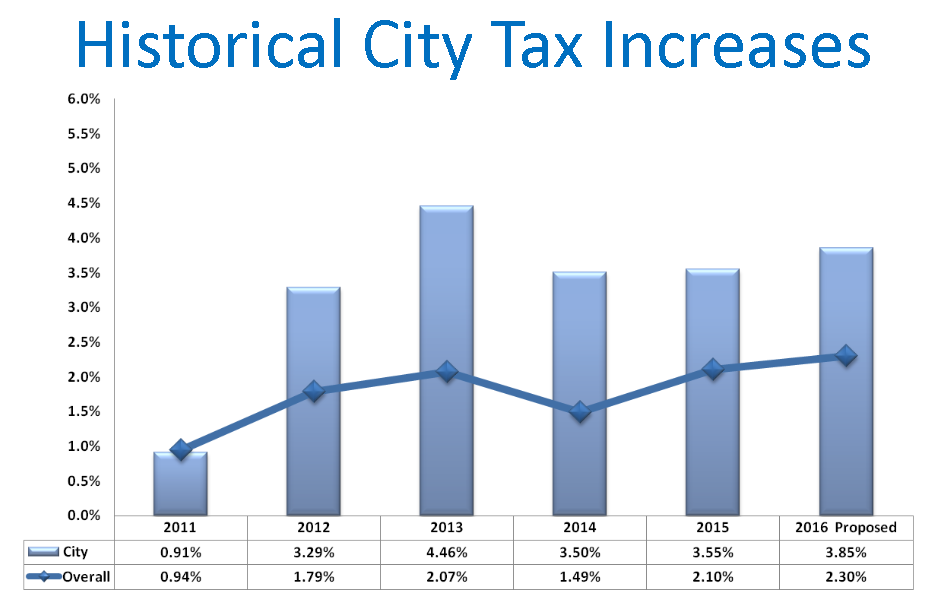

What started out as a 3.85% increase in the tax rate for 2016 got whittled down to 3.15% at the end of a five hour budget meeting held at city hall on Wednesday.

The Performing Arts Centre got what they wanted, the seniors didn’t succeed in convincing the Councillors that free transit Monday’s was a good idea.

For the first time the public got some sense as to where the city manager ants to take the city of the future.

The disposition of the 2015 surplus was hotly debated – but for the most part those dollars are getting tucked into different reserve funds.

The way city hall is staffed is going to get a hard look and the city manager is going to issue mandate letters to his Directors.

The number of bylaw officers is going to change.

Plans for a program to collect data on the state of commerce in the down ton core got the chop- The Burlington Downtown Business Association (BDBA) was told they could pay for that task themselves.

And Councillor Jack Dennison actually went along with spending some money.

Councillor Sharman continued to hammer away for more data.

The Gazette will report in detail on each of these.

Council met as a Standing Committee – the decisions they made get approved at Council on Monday where they can be changed.

By Pepper Parr By Pepper Parr

January 20th, 2015

BURLINGTON, ON

It was a different day for Rick Burgess who stood before the Community and Corporate Affairs Standing Committee explaining why funds were needed for two new positions at the Performing Arts Centre.

He got a decent hearing; the Mayor is onside – Burgess was heavily involved in the Mayor’s re-election campaign.

Rick Burgess, the Mayor’s man. Paul Sharman, who sits on the Performance Centre Board didn’t seem opposed to the addition of the two people but didn’t seem all that keen on adding the cost to the Centre’s base budget.

There was a bit of banter back and forth about a how a Centre board meeting went – Sharman seemed to think the Centre should improve their revenue and pay for the new jobs out of those funds.

Burgess didn’t want to take that kind of risk – he wanted the dollars put into the base budget now and keep them there.

From the right: Performing Arts Centre Executive Director Suzanne Haines, retiring Executive Director Brian McCurdy who did a great job; Brenda Heatherington who opened the Centre and was the first Executive Director and Ilene Elkaim chair of the board. Suzanne Haines, coming along nicely as the Executive Director, appears to have broadened her role and is more involved in fund raising – even though there is a close to full time fund raiser on staff.

The public has yet to hear anything about what the fall program is going to look like – there hasn’t even been a hint.

Two years ago Burgess was getting a solid dressing down from this same committee when he pleaded for funds to cover the cost over runs and deficits that kept mounting. Council gave him the funds he needed then but it wasn’t a day that Burgess wants to remember.

He got the funding he needed then but the Performing Arts centre lost its Executive Director

Two Executive Director’s later and Burgess is back asking for additional funding – he wants the cost of a technician and the cost of a person to handle community engagement added to the Centre’s base budget.

Getting that additional funding isn’t going to be a slam dunk – there is far from a consensus among Council members that the Centre has earned the right to ask for additional support.

Last year was a good year – but it was not something Haines did – the good year – and it was a good year was made to happen by former Executive Director Brian McCurdy who resigned for personal reasons.

Haines is out in the community doing the networking and learning how culture works in this city and where the clout exists. She has a language of her own and talks of “animating” the place and making it more active.

There have been some small interesting changes. Haines needs time to get her footing and show what she is capable of doing. She has a supportive board and has come off a season that worked very well.

In her delegation to council Haines pointed out that curated performances grew from 30 to more than 100 and that there were 600 uses of the Centre.

The Pat Methany performance was sold out – it was the day Suzanne Haines started her job as the new Executive Director. She said 100,000 people have bought tickets and added that in August the Centre will celebrate its 5th Anniversary.

There is a Culture Infrastructure Fund, either set up or being set up, that will have $100,000 put into it. The Gazette needs to dig into just what that fund is to be used for and which part of the cultural community will have access to it.

Royal Wood signing CD’s after the very first commercial event at the Burlington Performing Arts Centre. The Centre people along with its supporters seem to be saying that the first four years were a time when they learned what needed to be done – and that is part of the past.

McCurdy has shown that with strong management the Centre can get by on the close to half a million it needs in the way of ongoing support.

The Centre is always going to need financial support from the tax payers.

Whether they are going to get the support they need is something council will debate today and on Thursday.

By Pepper Parr By Pepper Parr

January 20, 2106

BURLINGTON, ON

Every chance Doug Brown gets to talk about transit – he shows up. Brown is part of Bfast (Burlington’s Friends and Supporters of Transit) an organization that advocates for improved transit.

Brown is one of those people who tirelessly make delegation after delegation – he speaks with authority because he does his homework and has a good grip on transit facts and figures. Brown is one of those people who tirelessly make delegation after delegation – he speaks with authority because he does his homework and has a good grip on transit facts and figures.

More often than not, Brown will complete his delegation and Council doesn’t ask a single question. Brown turns away from the podium quietly and returns to his seat.

He must have been pleased to listen to the delegation that Robert Lovell and James Young made supporting the proposal in the budget review document that transit be free to senior citizens on Monday’s.

Brown however was surprised and disappointed to see that the budget for transit in 2016 was the same as it was in 2015 – which from Brown’s vantage point meant they were getting less because there was no allowance for inflation.

Doug Brown and Susan Lewis look over a 1982 copy of the city’s bus schedule. It is worse than that according to Brown. The province gives municipalities a portion of the gas tax they collect. The funds the municipalities get is based on a formula that includes population and ridership. the municipalities get is based on a formula that includes population and ridership.

Burlington has a population that grew a bit – but transit ridership was less in 2015 than it was in 2014 which meant we got less in the way of that gas tax funding . .

Doug Brown, chair of Bfast, wants to see more funding for transit and the development of a long term transit plan. Brown has been toiling away as an advocate for better transit but quietly says: “We have a long way to go” and point to Waterloo which has a council that understands the need for good, reliable, affordable transit.

Waterloo has a population of 97,475 – Burlington has a population that is at the 173,000 level. They can develop a progressive transit system – why can’t we?

Brown points to the city’s Official Plan and the Strategic Plan that calls for a modal split that has 11% of the transportation choices being transit. We are currently at 2%.

Free student passes are also something Brown would like to see.

If the amount of gas tax Burlington gets from the province is based on ridership – would it not make sense to boost ridership?

By Pepper Parr By Pepper Parr

January 19th, 2016

BURLINGTON, ON

It was delegation time, the occasion when different community groups get their ten minutes to wrangle with council to advance their different causes.

This time it was transit for seniors, transit and the lack of a master plan and two positions the Performing Arts wanted to fill and have added to their ongoing budget.

The Performing arts matter will get covered in a separate story.

Two very effective speakers wanted to see the idea of free Monday transit for seniors make it into the 2016 budget.

Which seniors need the free transit was the question that occupied the minds of many of the council members.

Imagine a bus service that is free to senior’s on Monday’s – it just might happen. Every senior responded both Robert Lovell representing the Burlington Seniors’ Advisory committee and James Young, a word 1 resident who spoke to the plans for transit fares for seniors.

In Burlington delegations are usually a one way street – the delegations speaks but for the most part doesn’t often engage the members of council.

There are many occasions when a delegation doesn’t get asked questions.

When Councillor Craven is chairing the meeting – delegations are kept to very few words. Not that way when Councillor Lancaster is the chair.

Robert Lovell was asked questions and council got much more in the way of an answer than they expected when Lovell pushed right back. Lovell wanted to see Burlington adopt the free Monday transit for seniors that Oakville uses and he kept chiding Burlington’s council members for not doing what Oakville has been doing since 2012.

The two delegations were both seniors – they were there to see that the senior’s in the city got what they felt was needed. Lovell talked of people who were not able to get out of their homes because they couldn’t afford the cost of transit.

“These people get isolated and there mental health deteriorates”, he said.

Mayor Goldring and Councillor Dennison wanted to know what percentage of the senior population lived on the $12,000 a year Lovell had referred to; he wasn’t able to say but he had a petition with more than 500 signatures.

The short delegation session Tuesday afternoon was all that was needed to handle the delegations that were made. It isn’t clear if no one asked to delegate in the evening or if the city decided it was not going to hold an evening session. So much for an engaged city.

Councillor Lancaster said in her opening remarks there was lot of consultation. There was just the one public meeting held at Tansley Woods last week.

In contrast the Strategic Plan has been put before five different public meetings as well as a very detailed on line questionnaire.

For some reason people in Burlington just accept how much their council decides to tax them.

Parents at a hockey game while three people next door were listening to a budget presentation. It’s just who we are. In 2015 there was a public meeting that focused on the budget held at Mainway Recreation Centre; it was a winter night – less than three people showed up – next door at one of the skating rinks less than 20 yards away there were several hundred parents watching a hockey game . .

Did they know there was a public meeting to review and comment on the budget? The city does advertise the events – and the Gazette certainly spread the word.

In 2014 – an election year people showed up for the budget review. In 2015 it snowed and there were just three people in the room plus two people who had run in the last election and were keeping tabs on the council they were not part of – this time. There have been other public budget meetings that were very well attended – however the more active citizens complained that the budget decisions had already been made – all the city was doing was explaining what they had decided to do.

There are those who think the public should be at the table helping to decide what and where their tax dollars are to be spent. And that was certainly what Robert Lovell and James Young were suggesting council do – take a much different look at transit. Make it free for seniors every day of the week suggested Young. “That’s what they do in Europe” he said. “You are looking at transit as a cost when you should be looking at transit as a service that is paid for with money the taxpayers give you”, he added. the taxpayers give you”, he added.

Several members of council wanted to know how many really poor seniors there were in the city that needed financial support to be able to use the transit system. The figure was said to be 6%. support to be able to use the transit system. The figure was said to be 6%.

Mayor Goldring pointed out that 17% of the population is made up of seniors – he seemed to be worried that they all might want to get on a bus on the Monday’s when service would be free – which is exactly the point Lovell and Young were making.

There comes a time pointed our Lovell when you lose your license – what do you do then? The frequency of the bus service really limits how much you are going to be able to get around. If the service were free and frequent you would have people out of their homes spending money , going places and being active in the community, said Lovell , going places and being active in the community, said Lovell

The Mayor, who said he was a senior, one of the younger set – but he does hold a membership at the Seniors’ Centre, told the delegation that he was once carded and asked to prove he was a senior.

The Mayor’s concern was with how many seniors the city will have in 25 years and how a city would manage to deliver the services they will need. The challenge is to develop plans today that will provide the services needed.

One thing became very clear Tuesday afternoon at city hall – if Robert Lovell is representative of the baby boomers who are entering retirement city councils of the future had better be ready for some very local people who expect much more in the way of services And they are not going to be quiet or docile.

Joan Gallagher Bell spoke of a new vision for an age friendly city – for her the minimum was the free transit on Monday.

And that was what Councillor Meed Ward had put forward an adjustment to the budget to make the free service available this year.

Cost – no one was sure but $40,000 seemed to be the number. James Young pointed out that it wasn’t a real expense – it was just revenue the city wasn’t going to get.

Councillor Meed Ward just might deliver a real benefit to the senior citizens with this budget. There is a side bar to this event. More than a year ago – on a December 18th of 2014 when city council was deciding who was going to sit on which committee, Meed Ward represented the city on the hospital board and she very much wanted to retain that committee responsibility.

Her colleagues didn’t see it that way and gave that task to Councillor Sharman and gave the job of representing council on the Seniors Advisory Committee to Meed Ward. of representing council on the Seniors Advisory Committee to Meed Ward.

Meed Ward has delivered big time for the seniors – she will be rewarded when she decides to run for a different role on city council in 2018. when she decides to run for a different role on city council in 2018.

TO:  Burlington Community and Corporate Standing Committee Burlington Community and Corporate Standing Committee

FROM: Tom Muir

Subject: City Budget 2016

Tom Muir wasn’t able to get to the Standing committee and his schedule didn’t allow him to get to the one public meeting held to “inform” the public abouit the contents of the Operating budget. So he took to the media that is open to every opinion out there and sent the following to the Clerk of the Standing committee to have his comments put on the record. Council tends not to listen to Tom Muir.

Councillors;

Since residents did not enjoy city public engagement on the budget, but have just been informed of spending and taxing plans, I have had to spend significant time finding a focus of my concerns.

It’s far to much to cover all the details, however, the big picture over the 20 year forecast is of particular note and concern to me.

1. The compounded average tax rate increases will double the tax take before the forecast period of 20 years is elapsed. Use the rule of 72 to figure that out. The average tax rate increase over the entire period is 3.62% and this leads to the doubling over 20 years.

Using the example bungalow residence in the budget document, the city tax take will go from $1415 to $2854.

If the other tiers of the total tax burden go up as well, the total tax bill could go from $3410 to $6878.

I have to ask you to ask what residents and businessmen think about that exponential curve trend upwards of this tax burden?

Can business double the price for goods and services over the same time period?

I hope your net income is increasing by more than 4% a year for the next 20. Mine is not.

Is this really raising taxes in an affordable manner?

This is really inflationary, in fact, and is shifting income from residents and business to the city for them to spend.

It seems like Council isn’t really thinking about this cumulative trend, in and of itself, and the consequences, at all.

No comment or request in the budget papers that I saw.

And residents were not asked what they thought, they were not “engaged”, just “informed” – this is what we are doing and here’s the tax take.

I would like to see Council pay a lot of attention to this trend. We need Council to tell the Managers to find the cuts needed to shave this to the inflation rate. And don’t tell me there’s no fat to be found.

Tell them a doubling of city taxes over the next 20 years is not to be tolerated.

2. Regarding the 2015 surplus reported, this $4.75 million is 3.23% of the net tax levy of almost $147 million. Taking $3 million of this and subtracting it from the tax levy, would bring the increase down to about the 2% inflation the city claims.

From the of view of the residents and business people, adding all of this to reserves is akin to adding more fat to the city finances. We don’t need fat there, as the reserves look fat as they are.

I see no explanation of some disaster lurking.

The 20 year trend of exponential tax increases that double the tax take, also has fat, for sure, somewhere, but while there are certainly some Councilor requests for amendments and some cost cutting, overall Council doesn’t appear to have asked Management to go find sufficient cuts needed to stay within inflation.

Here’s another pot of money, paid last year by residents, but not spent, that I am sure residents would agree could help reduce this years increase to something more like the “affordable” the city says is the number 1 goal – inflation.

Let’s see some talk and action about this, please.

I’m retired, and I have to live within my income, which certainly doesn’t increase by this much. I’m told business taxes are already high, so we are all in the same boat.

Management makes do with what Council tells them. It’s their job to find cuts. Tell them to.

Aldershot resident Tom Muir is usually direct, at times abrasive and always looking for clear answers. When I worked in government, that’s how things were done, just find the cuts, and there were and are no sacred cows.

Certainly, not everything in the budget is needed in the time stated. What’s done is a function of input and time. The first can be reduced some and the time to completion can be extended. Put off spending now to save some. Elementary things we are supposed to teach children about money management.

If the city wants affordable tax rates for residents and business then get going on dealing with the exponential trend that will never deliver such a thing – only a crunch.

By Pepper Parr By Pepper Parr

JANUARY 19th, 2015

BURLINGTON, ON

The report to council set out how the treasurer thought the surplus from the 2015 budget should be used. A cool $4,750,000 that was not spent in 2015 will not get returned to the taxpayers – it will get tucked into various reserve funds and saved for those rainy days.

The surplus came from money budgeted but not spent on city services and significant improvements on revenue the city was able to pull in. We overspent on corporate expenditures. The numbers are in millions. Where were the savings experienced?

The city treasurer reports that expenses were closely monitored in 2015 to find ways to reduce operating costs; she reports the 2015 retained savings as follows:

• Human Resource Savings

City human resource costs (excluding winter control) are projected to have a favourable variance of $1,555,230. (The treasurer uses the term favourable and unfavourable balances which most of us know as a surplus and deficit.)

The city experienced a large number of vacancies throughout the year, some of them for senior positions. The favourable variance is primarily attributed to the period of time from when the position became vacant to being filled after the competition was complete.

• Earnings on Investments

Investment income is projected to exceed expectations by $1,327,017. This positive variance is attributed to $2,287,375 of realized capital gains, of which $960,358 will be used to meet the budget of $5.1 million. The proposed budget for Earnings on Investments for 2016 has been increased by $100,000 to $5.2 million.

• Supplementary Taxes

Supplementary tax revenues exceeded budget by $1,885,369. This is due to one property with three high rise buildings assessed as multi-residential for 3 years of taxes (2013-2015) totaling just over $2.0M in city revenues in 2015.

The city saved on the cost of fuel – but the projected bus ticket sales target was not reached. Transit is going to be an ongoing cost that the city does not seem to be really prepared for – where is the problem? • Transit Fare Revenues

Transit fare revenue is projected to have an unfavourable variance of $719,870 as a result of the 2015 budget not being in line with actual receipts. The proposed 2016 budget has been decreased by approximately $592K to $5.1 million to better reflect the actual trend.

• Diesel Fuel Costs

Diesel fuel costs are projected to have a favourable variance of $643,572. The majority of the variance is found in Transit.This variance is mainly attributed to lower than anticipated fuel prices.The proposed budget has been decreased by approximately $110K for 2016 to $2.9 million.

The remaining difference in the retained savings is comprised of favourable and unfavourable variances spread across numerous programs within the city. The 2015 Operating Budget Performance Report will provide more details on these program variances.

Consistent with past practice and recognizing the one-time nature of the retained savings, this report recommends a transfer to provide flexibility for addressing future one-time expenditures.

The retained savings is not to be used to directly reduce the proposed 2016 tax increase. As this is a one-time funding source, it is important that there is no reliance on retained savings built into the budget process on an ongoing basis.

2015 Recommended Retained Savings Disposition

• $738,361 Provision to Tax Rate Stabilization Reserve Fund

It is recommended that $738,361 be set aside to finance one-time expenditures included in the 2016 Proposed Operating Budget. This allows unique one-time needs to be addressed without affecting the tax rate and without being built into future budget years. These one-time expenditures will be addressed through the review of the 2016 Proposed Operating Budget.

• $750,000 Provision to Capital Purposes Reserve Fund

In order to meet future funding challenges and for the city to support its vision for implementing priority capital projects, staff recommend that $750,000 be allocated to the Capital Purposes reserve fund. This will provide funding for unforeseen requirements for approved projects, funding related to potential future federal/provincial programs and the accelerated road renewal program approved by Council. The 2015 balance for the Capital Purposes Reserve Fund is $9.5 million.

• $750,000 Provision to Strategic Land Acquisition Reserve Fund

The $750,000 provision will assist in replenishing the reserve fund for future strategic land needs. The 2015 uncommitted balance in the Strategic Land Acquisition Reserve Fund is $908K.

• $750,000 Provision to Information Technology Renewal Reserve Fund This provision will provide funding for life-cycle renewal of Information Technology infrastructure.

• $500,000 Provision to Insurance Reserve

In order to maintain a sufficient balance to cover both premium and deductible expenses, it is recommended that funding be allocated to this reserve. The 2015 balance is $663K.

• $500,000 Provision to Benefits Reserve Fund

It is recommended that $500,000 be transferred to the Benefits Reserve Fund to help replenish the balance which is currently $1.2 million.

• $500,000 Provision to Policy Initiatives Reserve Fund

In order to support resource requirements to finalize the Official Plan and other related studies.The balance is currently $100K.

• $250,000 Provision to Severe Weather Reserve Fund

This will help stabilize future budgets when major storms dramatically impact the operating budget.

The balance in the Severe Weather Reserve Fund is currently $2.8 million. It is recommended that the City target a one-year budget for the Winter Maintenance (which is approx. $4.6 million). .

• $11,639 Provision to Tax Rate Stabilization Reserve Fund

The remaining amount of $11,639 to the Tax Rate Stabilization Reserve Fund.

Prior to the calculation of the preliminary 2015 year-end retained savings, staff estimated any minor accounts payable, year-end accruals, and any year-end transfers for net zero activities that needed to be made as part of the year- end close process. The following are the estimated year end transfers for net zero activities.

DAAP Reserve Funds

In 2005, the Engineering Fee Stabilization Reserve Fund, the Building Permit Stabilization Reserve Fund and the Planning Fee Stabilization Reserve Fund were created to ease budget pressures should development revenues slow down due to economic and/or market conditions.

The table below shows the projected year-end transfers included in the the calculation of the 2015 preliminary year-end retained savings.

• Engineering Fee Stabilization Reserve Fund

The decrease in Subdivision Administration Fees has resulted in a draw of

$91,829 from the reserve fund. Residential development in Burlington has changed from large-scale Greenfield subdivision applications, to small-scale, infill and intensification sites requiring OPA, zoning, site plan and condominium approvals. The proposed 2016 Budget for Subdivision Administration revenues has been flatlined to $100,000 and will be gradually reduced to zero over time using the $275,000 in the Reserve Fund.

• Building Permit Stabilization Reserve Fund

The Building Permit revenues for 2015 are $3,479,851. These revenues are offset by expenditures (both direct and indirect as per the Bill 124 model), with the resulting draw from the reserve fund of $244,544.

The proposed 2016 Budget for building permit revenues have been increased by

$98,770 to be in line with the 3 year average 2012-2014.

• Planning Fee Stabilization Reserve Fund

Planning Fee revenues have a favourable variance of $566,144 mainly due to increases in official plan and rezoning revenues. A provision of $566,144 has been made to the Planning Fee Stabilization Reserve Fund.

The proposed 2016 Budget for planning revenues has been increased by $45,000 to $1,695,000 to be in line with the 3 year average 2012-2014.

Budgeting is part science and part dealing with the unknown. Set out below is what the city experienced between 2011 and 2015.

Top portion of the report shows where the surpluses came from – bottom shows what city council decided to do with the surplus.

By Pepper Parr By Pepper Parr

January 19th 2016

BURLINGTON, ON

The budget city council is debating this week and will make law next week adheres to the Long Term Financial plan created in 2012 which contained the following key strategic objectives for the city:

1. Competitive Property Taxes

2. Responsible Debt Management

3. Improved Reserves and Reserve Funds

4. Predictable Infrastructure Investment

5. Recognized Value for Services

City treasurer Joan Ford puts the numbers together – she does so at city council’s direction. Staff have shown a realistic scenario where assessment growth is slowing; no new legacy projects are forecasted; and infrastructure renewal funding is addressed over the 20 year time horizon.

The budget being debated recognizes budget drivers and includes the following assumptions within each item:

Maintaining Current Service Levels – Base Budget

Inflationary Impacts and User Fees

With the exception of human resources and commodities (hydro, water, fuel etc.), 2.0% inflation per year has been applied to all other expense categories (materials and supplies, purchased services and contributions to local boards and committees)

• The increases to User Rates and Fees assumed a 2.0% increase per annum, which is dependent on the nature of the revenues and external market conditions

• An annual increase of 3% to the Vehicle Depreciation Reserve Fund to sustain the City’s fleet and equipment inventory

Corporate Expenditures/Revenues

• An annual increase to the provisions for Insurance and Contingency Reserves of

$300,000 and $100,000 respectively

• An increase in Investment Income of $100,000 per year in 2019 and beyond given the current low interest rate environment

Long term tax increase projections – above current inflation every year. Other Expenditures

Infrastructure Renewal Funding and Joseph Brant Hospital

• An annual increase of 1.25% for Dedicated Infrastructure Renewal Funding from 2016-2022, reduced to 1.0% for 2023-2033 and 0.5% for 2034 and 2035. This provides funding for capital renewal, as per the Asset Management Financing Plan (approved 20 year scenario)

• An annual increase of 0.2% (2016-2019) in order to finance the repayment of additional tax supported debt for roadways. This will be repositioned in 2020 to fund renewal needs for new infrastructure

• Includes the repositioning of the hospital levy to infrastructure renewal in 2019 ($1.3 million), 2026 ($900,000) and 2027 ($2.6 million)

As with all forecasts, it is imperative to recognize that there are a vast number of unknown factors that will likely occur in the future that could impact the model. In order to address these unpredictable factors, an amount of $300,000 has been included in the 2018 forecast, increasing by $50,000 per year.

Assessment growth is stagnant – costs of running the city increasing – there is a crunch coming that is going to hit pocketbooks. Assessment Growth

Assessment growth is estimated to be 0.9% in 2017 and decreasing by 0.1% per year to 0.6% in 2020 and beyond. Over the last 5 years, weighted assessment growth has ranged from a low of 0.5% to just over 1.0%. The five year average is 0.9%.

Financial Matters:

The single largest portion of City funding comes from property taxes. As outlined in the Long Term Financial Plan, strategic objective 1 is Competitive Property Taxes; whereby, “the city must respond to the demand for programs, services, and the continued maintenance of our existing infrastructure in an affordable manner.

The city must strike a balance between conflicting goals, such as minimizing tax increases, while maintaining existing programs, services and infrastructure, and providing new services in a climate of increasing costs.”

The report then comes to this astounding conclusion: The 2017 -2035 forecast meets recommendation 1, whereby, “Base budget tax rate changes align closely with inflation”.

Inflation currently hovers at the 2% level and is expected to remain at that level for the next few years. The simulation forecasts the city tax impact from 2017 to 2035 to begin at 3.89% reducing to 2.96%.

Do they do mathematics differently at city hall?

And if they repeat the statement: “Base budget tax rate changes align closely with inflation”. often enough does that make it true?

By Pepper Parr By Pepper Parr

January 19, 2016

BURLINGTON, ON

The report going to the Community and Corporate Services Committee asks city council to approve the 2016 Operating Budget including any budget amendments.

The proposed net tax levy for 2016 is set at $146,883,341.

Members of Council have had the Operating Budget book since November and will now debate the operating budget and listen to public delegations at meetings on January 19, 20 and 21.

The budget goes to city council on January 25th where it gets approved.

The city held a just the one public meeting on January 14, 2016 at Tansley Woods Community Centre. The intent of the meeting was to provide residents with an overview of the 2016 proposed budget.

A disturbing comment was made when city council discussed the operating budget. Treasurer said her staff would inform the public about the operating budget but would not be “engaging” the public. No one corrected the treasurer – so this city might have to swallow a budget that asks for an increase of 3.85 % over the 2015 budget.

With inflation at the 2% level one would think the people paying the bills would want to have some say in why such a big difference between inflation and the increase in taxes. Perhaps city council feels the public had their say when they re-elected every member of this council in 2014.

Members of Council are given thick binders will details on the spending plans and are asked to submit Budget Action requests in which each council member sets out items they would like to see changed.

Some of the changes that have been put forward are set out below:

Members of city council were given the budget on a memory stick that allowed them to do simulations on what the budget total would look like if they added or deleted an expense items. This year they went through the budget line by line individually. Based on what the public has seen so far – it doesn’t look as if there is going to be much in the way of cuts. From the left are Councillors Jack Dennison, ward 4, Rick Craven ward 1 and John Taylor ward 3. Ward 1 Councillor Rick Craven wants to see the one time funding of $35,000 for the Downtown Data Collection Project pulled. He points out that the original staff recommendation in September 2015 included the following observation: “After considering the staff and funding resources that would be required to collect accurate and useful data to inform the performance indicators and headline measures, staff is of the opinion that the value of obtaining and maintaining such data as a means to evaluating the experience of the downtown may be limited” Remove project and one-time funding of $35,000

The Performing Arts Centre appears to be facing an uphill battle for the additional business case funding it is asking for; $72,500 for a technician and $115,800 for someone to work on community engagement.

Ward 4 Councillor Jack Dennison wants the Performing Arts centre to stay within their budget; Councillor Blair Lancaster (Ward 6) wants data to show the success of the previous contract position and indicate if the proposed permanent position could be self-sustaining.

He also wants to know: Why has the Human Resources budget been increased by 6.2%?

Why is the Arts and Culture – Human Resources year-end projection for 2015 $43,000 over the budget?

Why is the budget $1,009,140 for Human Resources?

Why has the Human Resources budget for Council and Citizen Committee been increased by $30,000?

Dennison has always been the Councillor with the best understanding of the budget and has consistently asked the toughest questions.

Ward 2 Councillor Marianne Meed Ward seems to have focused on transit and seniors in the changes she wants to see in the 2016 budget. Ward 2 Councillor Marianne Meed Ward has focused some of her energy on seniors and transit.

She wants to replace the existing business case with the following staff direction (Part 1): “Direct the Director of Transit to implement a pilot program for free transit on Mondays for seniors (65+) for the period April 1 – Sept 30 2016 and report back with results and a recommendation as part of the 2017 budget cycle.” The goal of the program is to increase ridership among seniors; among the Key Performance Indicators that will be tracked during the pilot are: change in ridership among seniors on Mondays; change in ridership among seniors Tuesday to Sunday; change in revenue from seniors Mondays and the rest of the week.

Replace the existing business case with the following staff direction (Part 2): “Direct the Director of Transit to implement a pilot program of a $30 monthly pass for seniors (65+) (about $1/day) for the period April 1 – Sept 30 2016 and report back with results and a recommendation as part of the 2017 budget cycle.” The goal of the program is to increase ridership among seniors and remove affordability concerns for people who may not qualify for the Regional SPLIT pass. Among the Key Performance Indicators that will be tracked during the pilot are: change in sales and revenue of monthly passes for seniors; change in ridership among seniors.

Ward 5 Councillor Paul Sharman has focused om both information technology and corporate management and is asking that staff be directed to prepare an assessment of each of the services with respect to their relative strategic importance. The objective is help determine where we might wish to reduce/cut spending and therefore be able to re-allocate funds to services which are strategically more important.

Councillors Sharman and Lancaster – both had changes they wanted to see in the 2016 budget. Staff be directed to conduct a series of Council Workshops to explain and seek agreement about each service: strategic positioning; service improvement goals; improvement actions: short/medium & long term resource/financial requirement projections.

The Strategic Plan has now gone through an extensive public review – when staff returns with its summary of what the public thought of the document it will be brought to Council for adoption. Some of what Councillor Sharman is asking for will then get matched up with what is included in the Strategic Plan.

Sharman is perhaps the Councillor with the best understanding of spending on Information technology. He suggests that a justification based on the 2 1/2 year old report is of questionable value today due the pace of change in technology. He points out that a report did correctly point out that City systems are aging and should be updated.

Rather than spend $209,350 in 2016 and $407,250 in 2017 Sharman proposes the following staff direction: Funding for IT Business Cases be approved but be refined by the City Manager relative to his assessment of the alignment of IT projects, in the context of the Strategic Plan, and the current strategic review of IT now underway, as well as the approach proposed in the subject Business Cases.

City manager James Ridge has some IT experience – but his desk is pretty full with managing the city – and he no longer has a management level between his office and the directors. Interesting that there has been no mention of just what the city is going to have in the way of a management structure going forward.

Mayor Rick Goldring didn’t ask for any cuts to the 2016 budget but did want the city manager to look for ways to increase revenue. Mayor Goldring didn’t seem to see anything he wanted to cut in the 2016 budget but did want the city manager to study approaches that the city can take in revenue generation and provide a report to committee with the presentation of the 2017 budget

By Staff By Staff

January 13th, 2016

BURLINGTON, ON

City Council will meet next week for two days to thrash out the 2016 budget which, at this point, looks like it will increase 3.85% over what they asked for last year.

The Bank of Canada set inflation at 2% and for the most part the country has been able to keep spending within the inflation range.

For some reason Burlington’s city council feels it has to spend more in 2016 than it did in 2015 (3.85% is the most recent budget increase projection) which has the people at Bfast (Burlington for Accessible, Sustainable Transit) upset because they don’t see any increase in the amount being sent on transit.

“Despite commitments in the City’s Strategic Plan, transit users in Burlington are again being shortchanged by the municipality‘s 2016 budget,” says a spokesperson for Burlington For Accessible, Sustainable Transit (BFAST).

Council is set to approve a budget for the system that provides no funding increase for 2016.

Doug Brown, chair of Bfast says the city is short changing transit users. “When inflation is considered, the 2016 transit budget is actually less than the budget in 2015,” commented BFAST spokesperson Doug Brown.

“Funding and service cuts, schedule changes and fare increases over the past four years have resulted in a 17% decline in ridership for Burlington’s chronically underfunded transit system. This is despite the requirement of the Ontario Municipal Board that the city increase transit ridership to 11% of all city trips by 2030.

“In contrast,” he ads ” Oakville has seen large increases in transit use as a result of higher funding and better service levels.”

“Burlington’s politicians like to point to the survey by MoneySense magazine that rates our community as the most livable mid-size city in Canada,” Brown said. “But that same magazine notes Burlington is well down the list when it comes to walkability and transit.”

Brown said adequate transit service is an investment, not an expense.

Bus drivers got a pay increase, some new buses arrived – but transit advocates say the city is still not spending enough on transit. “How much does it end up costing us when people without cars can’t get to their jobs? What’s the real cost of students not being able to take advantage of educational opportunities because Burlington Transit can’t get them to school on time? How much does it cost every taxpayer to own a second or even third car because they can’t rely on the transit system?”

Council is set to vote on the 2016 budget on Jan. 25..

BFAST is a citizen’s group formed in 2012 to advocate for better transit in Burlington.

By Staff By Staff

December 29, 2015

BURLINGTON, ON

The year in review – July, August and September – how did the city do?

July 2015

Union wage settlements of 4.25% and 6.95% negotiated by CUPE.

Burlington Transit asking its riders what they want

We get to use HOV lanes with two occupants in the vehicle – as we prepare for the day when we have to pay to use that lane with just a single occupant in the car. We get to use HOV lanes with two occupants in the vehicle – as we prepare for the day when we have to pay to use that lane with just a single occupant in the car.

Burlington’s federal Liberals launch their campaign; they sense a victory in the air.

Changing the culture at city hall; bringing in the department leadership needed – and getting a Code of Conduct in place for the politicians.

Federal government decides the CN Milton Logistics hub needs to benefit from the eyes of an independent panel. Truck traffic impact on Burlington roads worrisome.

Messy council debate refers the Code of Conduct to the city manager.

Community Foundation closes it books on the Disaster Relief Fund – $2.72 million distributed. Community Foundation closes it books on the Disaster Relief Fund – $2.72 million distributed.

Is the Food Truck a fad, a new phenomenon or the shape of things to come?

Is there a future for the oldest farmhouse in the downtown core? Could be if the city planners and the developer get creative.

Premier plans to make room for more politicians in the legislature.

An electric vehicle charging station will be installed in downtown Burlington at the parking garage on Locust Street.

The Flood – It was small in area and it hovered in the one place and just kept pouring – dropping almost as much rain as Hurricane Hazel in 1954.

August 2015

Can we pull it off? The potential is significant and it will certainly change the city in a rather positive way.

Premier tells Ontario Mayors they will get a better deal next time there is a localized disaster.

Burlington imports a new executive director for the Performing Arts Centre from Richmond BC; Susan Haines starts September 1st Burlington imports a new executive director for the Performing Arts Centre from Richmond BC; Susan Haines starts September 1st

Rebuild of the Freeman station is coming along nicely – they still need help with a lot of the work. Get in on it now – when this thing is done it will be something to be able to say you were a part of.

Where do we put 35,000 people in the next 25 years? And what will the city have in place in the way of roads and transit to move these people around?

September 2015

Hydro cuts the ribbon on a micro co-generation turbine that has the potential to contribute significantly to the city’s Community Energy Plan

Is there an Arts Council in the city’s future? Should there be one? Does anyone care?

Stuart Miller appointed Director of Education for the Halton District School Board Stuart Miller appointed Director of Education for the Halton District School Board

A fourth GO station for Burlington? It is in the works.

City Clerk opens the kimono just a little and lets you see how Council voted on recorded votes.

Most of the community and corporate affairs discussion at council was be behind closed doors – six confidential items on the list.

City challenges residents to Think Outside the Car – the process of changing the car culture has begun

Transportation Minister explains what the provincial government is going to do with rail transit – catch up and keep up!

Prime Minister in town with a promise to build an Advanced Manufacturing hub – if he is re-elected. Prime Minister in town with a promise to build an Advanced Manufacturing hub – if he is re-elected.

The full year:

Ist quarter – January, February and March

2nd quarter – April, May and June.

4th quarter – October November and December. To follow.

By Pepper Parr By Pepper Parr

December 2, 2015

BURLINGTON, ON

Part of the budget process Burlington uses is the presenting of business cases for new spending.

The Burlington Performing Arts Centre, which is working at branding itself as The Centre, has two cases that is will take to Council.

Former site of the Burlington police station The Centre is working it way towards a business model that keeps the taxpayer subsidy as low as possible The Centre is one of six boards and agencies that are not run out of city hall but receive significant funding from the city. Included in that list are the library, the Art Gallery of Burlington, the Museums of Burlington, Tourism Burlington and the Economic Development Corporation.

The total cost to the city for what are called Local Board and other agencies was $13,471,026 in 2015

To fully appreciate the cost of a service one has to look at the capital costs, any business cases put forward and the profit and loss situation for a board or agency.

The Centre has a strong revenue stream that consists of tickets sales, space rentals and sponsorships.

The Centre has been operational for four years – it had its problems during the first few years and found that it needed a change at the Executive Director level.

Once that change was made the flow of red ink was lessened and more seats were filled on a regular basis. Significantly more community based events were added to the program.

In 2013 city Council approved funding of $131,700 for two year contract positions as well as $225,250 for a “revenue shortfall”

City council did this under the assumption that after two additional seasons the city would have a clearer understanding of the true costs of operating the centre. Quite why this financial analysis was not done when The Centre was proposed as a benefit to the city is far from clear.

It was former Mayor Rob MacIsaac who put all the moving parts together and got the dream the city had had for many years to build a performing arts centre. The community certainly got behind when it came to raising funds to build. The centre came in on time and on budget.

Suzanne Haines recently appointed Executive Director of the Burlington Performing Arts Centre. What many, probably most of the city councillors, didn’t understand was that performing arts centres need consistent ongoing financial support. There was one city Councillor who actually thought The Centre would contribute to the city’s tax coffers. The Centre did manage to spread the one time “revenue shortfall” funding over a three seasons.

They report that past funding for the two positions is now exhausted

The two positions The Centre wants to fill are business cases that have been put forward and if approved they will bring the 2016 base budget contribution from the city to $763,861 plus an on-going program change of $188,300 for a total 2016 contribution of $952,161 – which is pretty close to $1 million each year.

City council gulped when the cost rose to $1.2 million a number of years ago. The community was led to believe that the city contribution was going to be in the $500,000 range and seemed to be comfortable with that.

The business cases are for a Venue Technician and Community Engagement. Lighting and sound equipment is complex and the technology keeps changing. In 2016 The Centre wants to add LED theatrical lighting fixtures and portable audio equipment. Canada 150 funding ( a federal government initiative that put funds into municipalities across the country) has been identified for this project.

One of the early complaints people had with The Centre was that there wasn’t enough time for community groups and that the cost for many was prohibitive.

Former Executive Director Brian McCurdy did a fabulous job of bringing in small groups and expanding the educational program. It is not unusual to see four or five school buses parked outside The Centre.

Those students are the theatre goers of the future – these programs are a large part of what performing arts centres are built to achieve.

The Centre created an annual membership program that had modest goals in its first year – the plan is to ramp this up.

Everyone is looking for sponsorship – the wonder is that there is any water left in that well.

The budget for 2016 is set at $3,470,871.

Based on the numbers available at this point – it is not clear if this budget has been approved by the Theatre board – the city is being asked to provide 27% of the cost of running The Centre.

Salaries wages and benefits make up 48% of the budget.

Calendar of performances at the Burlington Performing Arts Centre during August of 2015 Last years The Centre was close to closed during the month of August – there wasn’t much being offered.

The activity for December isn’t much better.

Calendar of event at the Burlington Performing Arts Centre during December of 2015 The Centre recently produced an Economic Impact report done by Natural Capital Resources that reported The Centre had $7.8 million to the local economy – that figure included the salaries and wages paid out.

“This impact” said the report “has grown steadily since 2011 as the number of events and associated attendance at The Centre has grown. The study further shows that The Centre has retained cultural expenditures and related economic impact, as Burlington residents stay here to consume their cultural product more often. This repatriation of the cultural spending in Burlington translates to roughly $1.3 million of economic activity annually.

“Patron expenditures flow through the local economy in the form of sales in local businesses, restaurants and stores and impact both prosperity of business and create jobs”, said Executive Director Suzanne Haines. “The Centre’s operations and the expenditures of its patrons are estimated to account for roughly one hundred full-time equivalents each year, sixty-six percent of these jobs are in the community”.

Pie chart indicates where the economic impact was felt. “Over fifteen thousand patrons were surveyed and approximately two thousand responses were completed, representing an outstanding thirteen percent return rate, which makes the study statistically significant. The survey found that fifty percent of The Centre’s patrons indicated they combine food as part of their performing arts experience and twenty-three percent of patrons shop as part of their performing arts experience.

This is probably not a statement the local restaurants would agree with.

The amount of money spent has climbed – has it climbed enough – what is the ideal economic benefit supposed to be? “Ninety percent of The Centre’s patrons rate overall performance quality as ‘excellent’ or ‘very good’ and seventy-five percent indicated performances to be ‘excellent’ or ‘very good’ value for the ticket price.”

During Culture week in September The Centre put on several Friday night Jazz events that were held out on the plaza – they were hugely successful – and they were free. The public got great value. The event is expected to be repeated in 2016.

The Centre is will announce its fifth season next May. It is at that time the public will have some sense as to what newly appointed Executive Director Susan Haines brings to the table.

By Pepper Parr By Pepper Parr

November 24th, 2015

BURLINGTON, ON

When a new tax is created more than one department at city hall gets involved.

The Finance department is gathering data to determine how a tax to cover the cost of managing storm water is justified; what the tax should amount to and how it should be administered.

The Capital Works department works at determining what has to be done to protect people and property from storm water damage in the future.

The Engineering department is costing out the work that has to be done and creating time lines for construction and repair.

Our flood – as seen on a radar screen. It is now understood that climate change is going to result in much different weather patterns. We are now paying the price for all the carbon we let into the atmosphere.